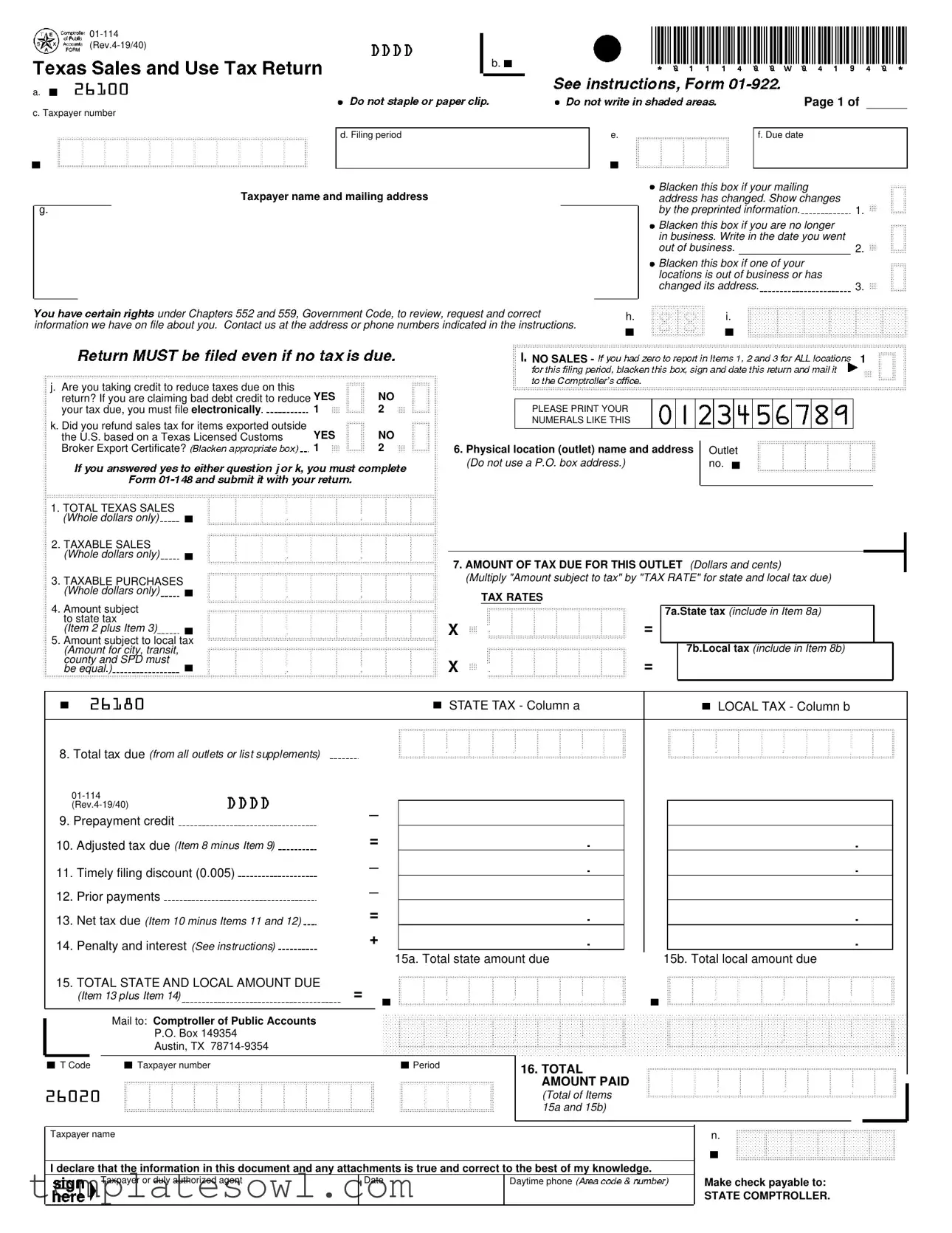

Fill Out Your 1 114 Texas Form

The 1-114 Texas form serves a critical function in the state's tax reporting process, specifically for businesses that engage in sales taxable operations. This form requires businesses to provide essential details such as the taxpayer number, the filing period, and the taxpayer's name along with their mailing address, ensuring accurate record-keeping and communication. It includes several checkboxes that allow taxpayers to indicate changes, such as alterations in business status or address. Moreover, the form prompts taxpayers to report both total Texas sales and taxable sales, alongside taxable purchases, which helps maintain clear visibility into revenue streams. Completing the 1-114 involves calculating tax amounts due, factoring in state and local tax rates, and applying any relevant prepayment credits or discounts. The final section of the form summarizes the total amount due, which includes penalties and interest if applicable. After filling out all necessary information, businesses must sign and date the document, confirming that the information provided is accurate and truthful. This form is essential for compliance with Texas tax obligations and plays a key role in the state's overall revenue collection system.

1 114 Texas Example

01- 14

b.

a.

c. Taxp yer number

d. Filing period

Taxpayer name and mailing address

g.

under Chapt |

rs 552 and 559, G v rnment Cod , review, request and correct |

information we have n file about you. |

Contact us at the address or phone numbers indicated in the ins ruct ons. |

|

|

|

|

Page 1 of |

||

|

|

|

|

|

|

|

e. |

|

|

f. Due date |

|

|

|

|

|

|

|

|

|

|

|

Blacken this box if your mailing |

|

|

|||

|

address has ch nged. Sh w changes |

|

|

|||

|

by the preprinted information. |

1. |

|

|||

|

Blacken this box if you are no longer |

|

|

|||

|

in |

usiness. Write in the date you went |

|

|

||

|

out of busin ss. |

|

2. |

|

||

|

Blacken this box if one of your |

|

|

|||

|

locations is out of business or has |

|

|

|||

|

changed its ad ress. |

3. |

|

|||

|

|

|

|

|

|

|

. |

|

i. |

|

|

||

j. Are |

t king c |

it to reduce taxes due |

is |

|

|

return? If you are claiming |

d bt cred to reduce YES |

NO |

|||

your tax due, you |

ust file ele tronically. |

1 |

2 |

||

k. Did you refund sales tax f |

r items expor ed outside |

|

|||

the U.S. based |

a T xas Licen ed Cus oms |

YES |

NO |

||

Broker Export Certificate? |

|

1 |

2 |

||

1.TOTAL TEXAS SALES (Whole dollars only)

2.TAXABLE SALES (Whole dollars only)

3.TAXABLE PURCHASES (Whole dollars only)

|

l. NO SALES - |

1 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT YOUR |

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMERALS LIKE THIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Physical location (outlet) name and address |

|

Outlet |

|||||||||||

|

|||||||||||||

(Do not use a P.O. box address.) |

|

no. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.AMOUNT OF TAX DUE FOR THIS OUTLET (Dollars and cents)

(Multiply "Amount subject to tax" by "TAX RATE" for state and local tax due)

TAX RATES

4.Amount subject to state tax

(Item plus Item 3)

5.Amount subject to local tax (Amount for city, transit, county and SPD must

equal.)b

X |

= |

X |

= |

7a.State tax (include in Item 8a)

7b.Local tax (include in Item 8b)

be |

STATE TAX - Column a |

LOCAL TAX - Column b |

8.Total tax due (from all outlets or list supplements)

|

|

|

|

|

|

|

|

|

|

|

||

_ |

|

|

|

|

|

|

|

|

||||

9. Prepayment credit |

|

|

|

|

|

|

|

|

||||

= |

|

|

|

|

|

|

|

|

||||

10. Adjusted tax due (Item 8 minus Item 9) |

|

|

|

|

|

|

|

|

||||

11. Timely filing discount (0.005) |

_ |

|

|

|

|

|

|

|

|

|||

_ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

12. Prior payments |

|

|

|

|

|

|

|

|

||||

= |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

13. Net tax due (Item 10 minus Items 11 and 12) |

|

|

|

|

|

|

|

|

||||

+ |

|

|

|

|

|

|

|

|

||||

14. Penalty and interest (See instructions) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

15a. Total state amount due |

15b. Total local amount due |

|

|||||||||

|

|

|

|

|

||||||||

15. TOTAL STATE AND LOCAL AMOUNT DUE |

= |

|

|

|

|

|

|

|

|

|

||

(Item 13 plus Item 14) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail to: Comptroller of Public Accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 149354 |

|

|

|

|

|

|

|

|

|

|

|

|

Austin, TX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T Code |

Taxpayer number |

|

|

Period |

16. TOTAL |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

AMOUNT PAID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(Total of Items |

|

|

|

|

|

|

|

|

|

|

|

|

15a and 15b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name

I declare that the information in this document and any attachments is true and correct to the best of my kn wledge.

Taxpayer or duly authorized agent |

Date |

Daytime phone |

|

|

|

n.

Make check payable to:

STATE COMPTROLLER.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Number | This form is officially designated as 1-114. |

| Revision Date | The current revision date is April 2019. |

| Governing Law | This form is governed by Chapters 552 and 559 of the Texas Government Code. |

| Filing Requirement | Taxpayers must file electronically if claiming a debt credit to reduce taxes due. |

| Sales Tax Information | The form requires reporting of total Texas sales, taxable sales, and taxable purchases in whole dollars only. |

| Contact Information | Taxpayers can contact the Comptroller of Public Accounts for information about their files. |

| Addresses | Physical locations must be provided; P.O. box addresses are not accepted. |

| Payment Details | Payments must be made to the STATE COMPTROLLER as indicated at the end of the form. |

Guidelines on Utilizing 1 114 Texas

Completing the 1-114 Texas form involves gathering necessary information about your business and financial activities for the specified filing period. Follow these instructions carefully to ensure accurate submission.

- Obtain the form. You can find the 1-114 Texas form online or request a physical copy from the local authorities.

- Fill in your Taxpayer number in the appropriate box. Make sure it matches the number assigned to your business.

- Enter the Filing period. Indicate the time frame for which the form is being filed.

- Provide your Taxpayer name and mailing address. Use the most current information.

- If your mailing address has changed, blacken the designated box and write the updated information next to it.

- If you are no longer in business, mark that box and enter the date you went out of business.

- Mark the box if any of your business locations are out of business or have a changed address.

- If claiming a credit to reduce taxes on this return, answer "YES" or "NO" accordingly. Remember, electronic filing is mandatory if claiming a debt credit.

- Indicate whether you refunded sales tax for items exported outside the U.S. based on a Texas Licensed Customs Broker Export Certificate by answering "YES" or "NO."

- Fill in Total Texas Sales in whole dollars.

- Fill in Taxable Sales in whole dollars.

- Fill in Taxable Purchases in whole dollars.

- If applicable, write the Physical location (outlet) name and address without using a P.O. box.

- Calculate and enter the amount of tax due for the outlet. This is done by multiplying the "Amount subject to tax" by the "TAX RATE" for both state and local taxes.

- Complete the section on Amount subject to state tax by adding Item 4 and Item 3.

- Complete the section on Amount subject to local tax; ensure that amounts for city, transit, county, and SPD total correctly.

- Complete the total tax due for all outlets or list supplements.

- Fill in any prepayment credit applicable to your business.

- Calculate the Adjusted tax due by subtracting the prepayment credit from the total tax due.

- If you qualify, include any timely filing discount.

- Add prior payments and provide the net tax due by subtracting any discounts from the adjusted tax due.

- Calculate any penalties and interest, if relevant.

- Fill in the total state and local amounts due by adding the net tax due and any penalties or interest.

- Calculate the total amount paid by summing Items 15a and 15b.

- Sign the form, certifying that the information provided is accurate to the best of your knowledge.

- Provide your daytime phone number for contact purposes.

- Prepare a check payable to the STATE COMPTROLLER if a payment is necessary.

- Mail the completed form to: Comptroller of Public Accounts, P.O. Box 149354, Austin, TX 78714-9354.

What You Should Know About This Form

What is the 1 114 Texas form used for?

The 1 114 Texas form is used for filing sales and use tax returns in the state of Texas. It allows taxpayers to report their total sales, taxable sales, and any tax due to the state or local jurisdictions. This form assists the Texas Comptroller’s office in collecting the appropriate taxes based on the taxpayer's sales activities.

Who needs to file the 1 114 Texas form?

Any business or individual engaged in selling taxable goods or services in Texas is required to file this form. This includes companies with physical locations, as well as those soliciting sales in Texas through other means, such as online sales.

When is the 1 114 Texas form due?

The due date for filing the 1 114 Texas form typically aligns with the end of each month for monthly filers. It is essential to check your filing frequency, as some businesses may have quarterly or annual filing requirements. Ensure that your form is postmarked or submitted electronically by the due date to avoid late fees.

What information is required on the 1 114 Texas form?

The form requires various details, including your taxpayer number, name, and address, along with information regarding sales, taxable purchases, tax amounts, and the outlet's address. It's critical to fill out these sections accurately to avoid processing delays.

What should I do if my mailing address has changed?

If your mailing address has changed, you should check the applicable box on the form and provide the updated information. This ensures that all correspondence regarding your account reaches you promptly.

Can I submit the form electronically?

Yes, you can file the 1 114 Texas form electronically. If you are claiming a debt credit to reduce taxes due, electronic submission is mandatory. Submitting online can streamline the process and provide immediate confirmation of your submission.

What happens if I am no longer in business?

If you are no longer in business, you should check the box indicating your cessation of business on the form. Then, provide the date you went out of business. This will help the Comptroller’s office update their records accordingly.

How do I calculate the amount of tax due?

The amount of tax due is calculated by multiplying the amount subject to tax by the applicable tax rate. Ensure you separate state and local tax amounts and include those in their respective sections on the form.

What should I do if I have further questions about the form?

If you have additional questions, you can contact the Texas Comptroller's office using the phone numbers or addresses provided in the instructions accompanying the 1 114 Texas form. They are available to assist with any uncertainties you may have regarding the filing process.

How do I make my payment?

Payments for the tax due should be made payable to the "STATE COMPTROLLER." You can include your payment with the form when mailing it to the address provided. Ensure that all payment information is accurate to avoid any processing issues.

Common mistakes

Completing the 1-114 Texas form can be intimidating, and mistakes are common. One significant error is not providing an accurate taxpayer number. This number is essential for identifying the business and ensuring proper processing. If the number is wrong or missing, it could lead to rejected filings or delays in tax refunds.

Another frequent mistake involves the filing period. It's crucial to select the correct period for which you are reporting. Inaccurate dates can create confusion and may result in penalties. Always verify the filing period before submitting the form to avoid this pitfall.

Additionally, many individuals forget to update their mailing address. If there has been a change, it’s important to blacken the box indicating a change of address and provide the new information. Failing to do so may cause important correspondence to be sent to the wrong address, disrupting communication with the Texas Comptroller's Office.

Claiming credits incorrectly is another common issue. If you're taking credit to reduce taxes due, it's essential to file electronically. Ignoring this requirement can lead to rejection of the filing. Always double-check your eligibility for credits before submitting the form.

Using improper numerical formatting is also a prevalent mistake when filling out the 1-114 form. For instance, only whole dollar amounts should be entered in certain fields. Inaccuracies in how numbers are presented can lead to miscalculations and further complications in the tax process.

Lastly, neglecting to answer all the required questions can be detrimental. Each section of the form serves a purpose, and omitting any part can result in delays or additional requests for information. Taking the time to carefully read and complete each section ensures a smoother filing process.

Documents used along the form

Filing the 1-114 Texas form is an important step for businesses participating in sales in Texas. To support the completion of this form, there are several other documents that may be required or beneficial. Below are some relevant forms that accompany the 1-114 Texas form, each serving a unique purpose.

- Texas Sales Tax Permit Application (01-114): This document is necessary for businesses planning to sell taxable items in Texas. Applying for this permit grants authorization to collect sales tax from customers, ensuring compliance with state tax laws.

- Sales Tax Exemption Certificate (01-339): If your business is making tax-exempt purchases, you will need this certificate. It allows you to buy certain items without paying sales tax, provided they qualify under state exemption rules.

- Texas Franchise Tax Report: While not directly related to sales tax, this report is essential for Texas businesses. It ensures that all franchise tax obligations are met and is due annually for businesses operating under the Texas tax code.

- Monthly or Quarterly Sales Tax Reports: Depending on your filing frequency, these forms compile sales and tax collections over a set period, detailing amounts collected before remitting to the state. Timely filings help in avoiding penalties and maintaining good standing.

Each of these forms plays a critical role in maintaining compliance with Texas tax regulations. Be sure to keep accurate records and consult these documents as you navigate your business responsibilities.

Similar forms

- Form 1040: Similar to the Texas 1 114 form, the Form 1040 is used for individual income tax returns. Both forms require taxpayer information and detail amounts due or owed.

- Form 941: This form is used for quarterly federal tax returns. Like the 1 114, it requires reporting of taxes collected and due, as well as taxpayer identification numbers.

- Sales Tax Return (various states): Many states have their own sales tax return forms. They function similarly to the Texas 1 114 by documenting sales and calculating amounts due based on taxable sales.

- Form W-2: This form reports wages and withholdings to employees. It also requires accuracy in reporting income, much like the details found in the 1 114 Texas form.

- Form 1099: Used for reporting various types of income, the 1099 shares similarities with the 1 114, particularly in terms of summarizing financial activities over a certain period.

- Form 990: This form is for nonprofit organizations to report their financial information and activities. Both forms share the need for transparency and accurate reporting to the respective authorities.

- Form 1120: Corporations use this form to report their income. Like the 1 114, it requires an accounting of revenue and taxes owed to be filed with the government.

- FR-100: This form is often used for franchise tax reporting and is akin to the 1 114 in that both track business income and deductions specific to state tax laws.

- Property Tax Return: Similar in purpose to the 1 114, property tax forms outline values and taxes owed for real estate properties, requiring detailed information about the taxpayer and property.

- Form 8829: This form is for deducting expenses for business use of your home. It requires accurate reporting of business-related expenses, resembling the detail needed in the Texas 1 114 form.

Dos and Don'ts

When filling out the 1 114 Texas form, it's essential to follow specific dos and don’ts to ensure your application is processed correctly. Here’s a handy list:

- Do double-check the taxpayer number for accuracy before submission.

- Do ensure that all monetary amounts are whole dollars and clearly printed.

- Do blacken the box if your mailing address has changed.

- Do provide the correct physical location and address for your outlet — avoid using a P.O. box.

- Do claim any sales tax refunds for items exported correctly, using the Texas Licensed Customs Broker Export Certificate if necessary.

- Don't forget to sign the form; without your signature, the form may be considered incomplete.

- Don't underestimate the importance of deadlines; be aware of the due date for submission.

- Don't neglect to report any changes in business status or location accurately.

- Don't leave any sections blank; all applicable fields must be filled out to avoid delays.

Following these guidelines can help you navigate the filing process more smoothly and avoid unnecessary complications.

Misconceptions

-

Misconception 1: The 1-114 form is only for businesses operating in Texas.

This form is applicable for anyone conducting taxable sales in Texas, including out-of-state businesses that have nexus in the state.

-

Misconception 2: You cannot change your mailing address on the 1-114 form.

You can indicate a change in your mailing address by blackening the appropriate box and providing updated information in the space provided.

-

Misconception 3: All sales are taxable and must be reported.

Only taxable sales should be included. Therefore, if you have no taxable sales, you can select the "No Sales" option.

-

Misconception 4: It is unnecessary to file the 1-114 form if there is no tax due.

Even if no taxes are due, filing may still be required to maintain compliance with state regulations.

-

Misconception 5: The form can be submitted anytime without consequence.

The 1-114 form has a specific due date, and late submissions may incur penalties and interest.

-

Misconception 6: You don’t need to report sales tax if you refund customers.

Refunds for sales tax must still be included on the form to ensure accurate reporting and compliance.

-

Misconception 7: Filing electronically is optional for all taxpayers.

For those claiming a debt credit to reduce taxes due, electronic filing is mandatory.

Key takeaways

Completing the 1-114 Texas form requires careful attention to detail. Here are key takeaways to ensure a smooth process:

- Taxpayer Identification: Always enter your taxpayer number accurately. This is crucial for identification and processing.

- Filing Period: Clearly specify the filing period. Any mistakes may delay your return.

- Mailing Address: Provide your current mailing address. If it has changed, remember to blacken the appropriate box and show any corrections on the preprinted section.

- Business Status: Indicate if you are no longer in business. This requires you to provide the closure date.

- Sales Tax Refunds: If claiming a refund for items exported outside the U.S., confirm eligibility under Texas Licensed Customs Broker Export Certificate.

- Numerical Clarity: Print all numerals clearly. Use whole dollars only, avoiding cents to minimize confusion.

- Tax Amount Calculation: Carefully calculate the amount of tax due for each outlet. Ensure that local and state tax totals match the required calculations.

- Timely Filing Discounts: Apply any timely filing discounts available. This can positively impact your total amount due.

- Submission Details: Mail the completed form to the Comptroller of Public Accounts at the specified address to ensure proper processing.

Failure to adhere to these guidelines can lead to complications or delays in your filing. Take action now to avoid potential problems.

Browse Other Templates

What Is an Apportioned Tag - The IRP registration form is necessary for apportioned registration of commercial vehicles in Oklahoma.

2407 - Unpaid loans on existing policies may reduce total insurance benefits upon death.