Fill Out Your 5 359 Texas Form

The 5 359 Texas form, officially titled the Request for Certificate of Account Status to Terminate a Taxable Entity’s Existence in Texas or Registration, serves as a critical document for businesses looking to formally dissolve or unregister in the state of Texas. Filing this form is essential when an entity wishes to ensure compliance with all tax obligations administered by the Texas Comptroller under Title 2 of the Texas Tax Code. Before you submit the 5 359, it's vital to check that all tax accounts have been appropriately closed and that the entity is current with its tax requirements. The form itself is structured to collect important information about the entity in question, including its legal name, taxpayer number, and the context of its dissolution—whether through termination, merger, or conversion. Businesses organized as part of an affiliated group must also provide details regarding reporting responsibilities. For non-Texas entities, the form requires additional information about the entity's business activities within Texas and its home state charter status, ensuring that all loose ends are tied before the dissolution process is finalized. Whether you are submitting via fax, email, or traditional mail, understanding the details of the 5 359 can facilitate a smoother termination process, paving the way for a compliant exit from the Texas business landscape.

5 359 Texas Example

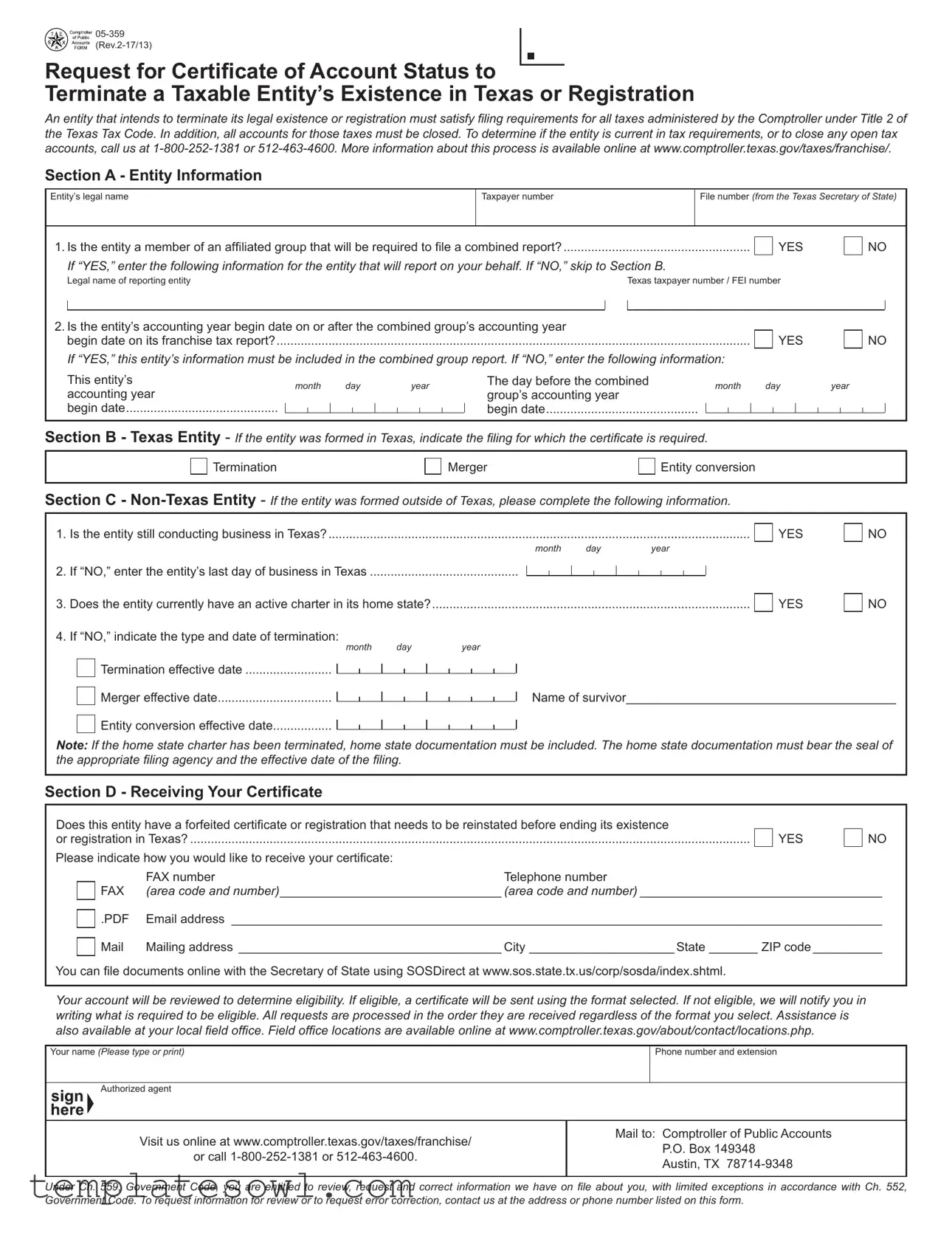

Request for Certificate of Account Status to

Terminate a Taxable Entity’s Existence in Texas or Registration

An entity that intends to terminate its legal existence or registration must satisfy filing requirements for all taxes administered by the Comptroller under Title 2 of the Texas Tax Code. In addition, all accounts for those taxes must be closed. To determine if the entity is current in tax requirements, or to close any open tax accounts, call us at

Section A - Entity Information

Entity’s legal name

Taxpayer number

File number (from the Texas Secretary of State)

1. Is the entity a member of an affiliated group that will be required to file a combined report? |

YES |

If “YES,” enter the following information for the entity that will report on your behalf. If “NO,” skip to Section B.

Legal name of reporting entityTexas taxpayer number / FEI number

2. Is the entity’s accounting year begin date on or after the combined group’s accounting year |

|

begin date on its franchise tax report? |

YES |

If “YES,” this entity’s information must be included in the combined group report. If “NO,” enter the following information:

NO

NO

This entity’s |

month |

day |

year |

|

accounting year |

||||

|

|

|

begin date............................................

The day before the combined |

month |

day |

year |

group’s accounting year |

|

|

|

begin date............................................

Section B - Texas Entity - If the entity was formed in Texas, indicate the filing for which the certificate is required.

Termination

Merger

Entity conversion

Section C -

1. Is the entity still conducting business in Texas? ..........................................................................................................................

month |

day |

year |

YES

NO

2.If “NO,” enter the entity’s last day of business in Texas ...........................................

3.Does the entity currently have an active charter in its home state?............................................................................................

4.If “NO,” indicate the type and date of termination:

month |

day |

year |

Termination effective date .........................

YES

NO

Merger effective date.................................

Entity conversion effective date.................

Name of survivor_______________________________________

NOTE: If the home state charter has been terminated, home state documentation must be included. The home state documentation must bear the seal of the appropriate filing agency and the effective date of the filing.

Section D - Receiving Your Certificate

Does this entity have a forfeited certificate or registration that needs to be reinstated before ending its existence |

|

or registration in Texas? |

YES |

Please indicate how you would like to receive your certificate:

NO

|

FAX number |

Telephone number |

FAX |

(area code and number)________________________________ (area code and number) ___________________________________ |

|

Email address ______________________________________________________________________________________________ |

||

Mailing address ______________________________________ City _____________________ State _______ ZIP code __________ |

||

You can file documents online with the Secretary of State using SOSDirect at www.sos.state.tx.us/corp/sosda/index.shtml.

Your account will be reviewed to determine eligibility. If eligible, a certificate will be sent using the format selected. If not eligible, we will notify you in writing what is required to be eligible. All requests are processed in the order they are received regardless of the format you select. Assistance is also available at your local field office. Field office locations are available online at www.comptroller.texas.gov/about/contact/locations.php.

Your name (Please type or print)

Phone number and extension

Authorized agent

Visit us online at www.comptroller.texas.gov/taxes/franchise/

or call

Mail to: Comptroller of Public Accounts P.O. Box 149348

Austin, TX

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone number listed on this form.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The 05-359 form is used to request a Certificate of Account Status, allowing entities to terminate their legal existence or registration in Texas. |

| Compliance Requirement | Entities must meet all tax filing requirements under Title 2 of the Texas Tax Code to qualify for termination. |

| Entity Types | This form accommodates both Texas entities and non-Texas entities, requiring specific information based on the entity's formation location. |

| Filing Options | Certificates can be received via various methods, including fax, email, or traditional mail, based on the entity's preference. |

| Contact Information | For assistance, individuals can reach out to the Texas Comptroller's office by phone at 1-800-252-1381 or 512-463-4600. |

Guidelines on Utilizing 5 359 Texas

To successfully complete the Form 05-359 in Texas, you will need to provide detailed information about your entity. It’s vital to ensure that all accounts are closed before terminating your entity’s existence. Once you've collected the necessary information, you can follow these steps to complete the form accurately.

- Gather your entity's legal name, taxpayer number, and file number from the Texas Secretary of State.

- In Section A, indicate whether your entity is part of an affiliated group that must file a combined report. If "YES," provide the legal name and taxpayer number of the reporting entity.

- If you answered "NO" to the previous question, move to the next part of Section A. Provide your entity's accounting year begin date.

- If applicable, indicate if your accounting year begin date is on or after the combined group's accounting year begin date. If "NO," provide the date of the combined group's accounting year begin date.

- Move to Section B if your entity was formed in Texas and specify whether the certification is for termination, merger, or entity conversion.

- If your entity was formed outside Texas, complete Section C. Answer the questions about whether the entity is still conducting business in Texas and provide the last day of business date if applicable.

- Confirm whether the entity has an active charter in its home state. If "NO," indicate the type and date of termination.

- When you've filled out the necessary sections, proceed to Section D. Indicate how you would like to receive your certificate and provide your contact information.

- Lastly, review all your entries carefully to ensure everything is accurate and complete.

- Mail the completed form to the address provided for the Comptroller of Public Accounts or submit it through the online portal if preferred.

After submitting the form, be prepared to respond to any follow-up inquiries or provide additional documentation if needed. Your application will be processed in the order it’s received. Once eligibility is confirmed, you will receive your certificate in the selected format.

What You Should Know About This Form

1. What is the purpose of the 5 359 Texas form?

The 5 359 Texas form, known as the Request for Certificate of Account Status, is used by entities that wish to terminate their legal existence or registration in Texas. This form ensures that all tax obligations are met and that there are no outstanding accounts before the entity is officially dissolved or removed from registration records.

2. Who should fill out this form?

This form is intended for individuals and organizations, including corporations and limited liability companies, that have completed all necessary tax filings and are looking to formally end their status in Texas. It's crucial that all affiliated businesses are accounted for if the entity is part of a larger group.

3. What information is required in Section A?

Section A requires basic information about the entity, such as its legal name, taxpayer number, and file number from the Texas Secretary of State. It also includes questions about whether the entity is part of a combined group for franchise tax reporting, which helps determine the correct tax reporting method.

4. What if the entity has not conducted business in Texas recently?

If the entity was formed outside Texas and has not conducted business there in some time, the form asks for the last day of business and whether the entity still has an active charter in its home state. This information is essential for processing the termination appropriately.

5. How does a forfeited certificate affect the termination process?

If the entity has a forfeited certificate or registration, this must be reinstated before ending the existence in Texas. The form provides options for how to receive the certificate once it has been issued, including by fax, email, or standard mail.

6. What documentation is required if the home state charter has been terminated?

In cases where the entity's home state charter has been terminated, it is necessary to include documentation from the home state. This documentation must have the official seal from the appropriate filing agency and indicate the effective date of filing. This requirement helps verify the entity's status in its home state.

7. How can I submit this form or get assistance?

The 5 359 form can be submitted by mailing it to the Comptroller of Public Accounts at the provided address. For online submissions or assistance, individuals can use the SOSDirect website for Texas Secretary of State filings. Local field offices are also available for help and can be located online.

8. How long does it take to receive the certificate after submission?

Requests for the certificate are processed in the order they are received. The time frame for receiving the certificate may vary based on demand and the specific details of the request. If the entity is not eligible for termination, a written notification outlining the necessary steps will be sent.

9. Where can I find additional information about the process?

Additional information about terminating an entity's existence or registration can be found on the Texas Comptroller's website. This site provides guidance on tax responsibilities and additional resources to help in the process, ensuring that all requirements are met before filing the termination request.

Common mistakes

Filling out the 5 359 Texas form can be a straightforward process, but many people make mistakes that can delay their requests. One common error is not providing the entity's legal name or the correct taxpayer number. These details must match official records precisely. Double-checking this information is crucial to prevent processing delays.

Another frequent mistake is related to Section A's questions about affiliated groups. Individuals often overlook the requirement to answer whether the entity is a member of such a group. If the answer is YES, additional reporting details are necessary. Failing to provide the name and taxpayer number of the reporting entity can lead to confusion and a request for further information.

The accounting year start date is another area where errors occur. Many filers do not confirm whether the entity’s accounting year begin date is on or after the combined group’s year begin date. This detail is essential because it dictates whether the entity must be included in the combined group report. Misunderstanding this requirement can lead to incorrect submissions.

For non-Texas entities, the section asking if the entity is still conducting business in Texas often invites errors. Filers sometimes mistakenly answer YES when they should mark NO. If the business has ceased operations, providing the correct last day of business is necessary to avoid complications.

Next, some filers forget to include important documentation when their home state charter has been terminated. The form explicitly states that documentation bearing the appropriate seal must accompany the application. Neglecting this step will result in delays as the request cannot be processed without proper verification.

Lastly, when selecting how to receive the certificate, individuals might neglect to fill in all contact details, such as the telephone number or email address. Incomplete information can lead to difficulties in further communication. Always ensure all sections are filled in carefully to facilitate smooth processing of your request.

Documents used along the form

When navigating the process of terminating a taxable entity’s existence or registration in Texas, various forms and documents may complement the 05-359 Texas form. Below is a brief overview of these essential documents, which are crucial for ensuring compliance with the state's tax regulations.

- Form 05-358 - This document is the Application for Extension of Time to file franchise tax reports. It allows entities extra time to prepare their tax filings while remaining compliant with Texas laws.

- Form 05-164 - Known as the Franchise Tax Report, this is the primary tax reporting form required for most businesses operating in Texas. It must be filed in conjunction with your tax obligations.

- Form 05-153 - This is the Texas Franchise Tax Public Information Report. It provides necessary details about the entity's operations and is often submitted alongside the Franchise Tax Report to maintain transparency.

- Form 05-167 - This form is for the Franchise Tax No Tax Due Report. It is used by entities that do not owe any tax, confirming that they are in good standing with the state.

- Form 01-114 - Known as the Certificate of Formation, this document establishes the existence of a corporation or limited liability company in Texas and may be necessary for merging or terminating entities.

- Form 50-284 - This is the Application for Renewal of Registered Agent. Keeping a registered agent updated is critical for any entity looking to terminate or merge its status.

- Home State Documentation - If an entity was formed outside Texas, it must provide its state documentation for termination, including the effective date of the termination and any associated filings in its home state.

These documents play a significant role in the overall process of terminating an entity's existence in Texas. Ensuring that each form is accurately completed and submitted will aid in avoiding potential complications down the road. Compliance with these requirements is essential not only for adhering to state regulations but also for safeguarding the interests of all parties involved.

Similar forms

- Form 05-356: Application for Franchise Tax Status. This form allows entities to request franchise tax status and receive confirmation regarding their tax obligations before termination, similar to the way Form 05-359 checks tax compliance prior to dissolution.

- Form 05-358: Texas Franchise Tax Report. This document requires entities to report their financial information annually. Both forms ensure that tax obligations are fulfilled before any termination or dissolution process.

- Form 05-356-1: Consent to Use of Texas Franchise Tax Report. This form can be submitted alongside a request for a certificate, similar to the 05-359, which also requires details about the entity's tax standing.

- Form 05-359M: Affidavit of Compliance with Franchise Tax. This affidavit serves to declare that the entity has complied with all franchise taxes, paralleling the compliance checks conducted in the 05-359.

- Form 05-357: Request for Letters of Good Standing. This form verifies whether an entity is in good standing before conducting business in Texas, akin to the verification process that Form 05-359 establishes for entities looking to terminate.

- Form 05-355: Texas Franchise Tax Cancellation Form. This document streamlines the cancellation process for franchises and is similar to Form 05-359 as both deal with the legal termination processes for Texas entities.

- Form 07-860: Application for Certificate of Account Status. This application confirms the status of an entity’s tax accounts, much like the 05-359, which confirms tax account status prior to cessation of existence.

- Form 05-348: Amended Franchise Tax Report. This report allows entities to amend previous tax reports. Both forms require an assessment of tax compliance before any dissolution or termination can proceed.

- Form 05-351: Statement of Change of Registered Agent or Office. This form updates official records and can affect an entity's standing, similar to how Form 05-359 processes changes before terminating an entity’s status.

Each of these forms serves a specific purpose, yet they all intersect through the theme of maintaining compliance with Texas tax laws and regulations before an entity can legally terminate its existence or registration. Proper filing and compliance are crucial steps in the process and ensure that all obligations are settled before dissolution.

Dos and Don'ts

Filling out the 5-359 Texas form requires careful attention to detail. Here is a list of things you should and shouldn't do to help ensure a smooth process.

- Do ensure that the entity’s legal name is entered exactly as it appears in the official records.

- Do verify that the taxpayer number and file number are accurate and up to date.

- Do check whether the entity is part of an affiliated group that must file a combined report.

- Do confirm whether the entity’s accounting year aligns with that of the combined group, if applicable.

- Do select the appropriate category of termination, whether it is for termination, merger, or entity conversion.

- Don’t rush through the form; take your time to ensure all information is correct before submission.

- Don’t forget to provide your preferred method for receiving the certificate, whether by mail, fax, or email.

- Don’t leave any sections blank; if a question does not apply, indicate that clearly.

- Don’t submit the form without double-checking all entries for errors or missing information.

By following these guidelines, you can help ensure that the certification process proceeds as smoothly as possible.

Misconceptions

Understanding the 5-359 Texas form can be challenging due to various misconceptions. It’s essential for entities looking to terminate their existence or registration in Texas to have accurate information. Below are some common misconceptions about this form, along with clarifications on each point.

- Misconception 1: The form is optional for all entities.

- Misconception 2: All entities can immediately terminate their registration.

- Misconception 3: There are no consequences for failing to close tax accounts.

- Misconception 4: The form does not require input from members of an affiliated group.

- Misconception 5: You can submit the form in any format.

- Misconception 6: Only Texas entities need to complete the form.

- Misconception 7: You can receive the certificate without confirming your tax status.

- Misconception 8: It’s unnecessary to provide the last day of business if no longer conducting business in Texas.

- Misconception 9: Assistance is unavailable if issues arise during the process.

This is not true. The form must be completed by entities that wish to officially terminate their legal existence or registration in Texas. Failing to submit this form could lead to ongoing tax liabilities.

Not all entities are eligible to terminate their registration immediately. They must first satisfy all filing requirements for taxes administered by the Comptroller.

In reality, if an entity does not close its tax accounts before termination, it may face penalties or ongoing tax obligations.

It actually does. If the entity belongs to an affiliated group, it must provide information about the reporting entity in Section A.

The form must be submitted in the specific format outlined on the form itself. Electronic submissions can be made using SOSDirect, but all guidelines should be followed carefully.

This is incorrect. Non-Texas entities that wish to terminate their business in Texas must also complete the form and provide relevant information about their operations.

This is false. A certificate will only be granted after the entity’s eligibility has been assessed, confirming that there are no outstanding tax obligations.

This is a misconception. The last day of business must be indicated for proper record-keeping and to confirm the entity's status.

In fact, assistance is readily available through local field offices or by calling the provided numbers. Entities can seek help if they have questions or need clarification.

Addressing these misconceptions can help ensure a smoother process when completing the 5-359 Texas form. Understanding the requirements thoroughly can prevent delays or issues related to tax compliance and entity status.

Key takeaways

When filling out the 5 359 Texas form, understanding the requirements and process can streamline your experience. Here are five key takeaways to consider:

- The form is essential for any entity wishing to terminate its existence or registration in Texas, and all tax obligations must be current before submitting it.

- Precise information about the entity, including legal name, taxpayer number, and file number, is required in Section A. It's crucial to fill this out accurately to avoid delays.

- If your entity is part of a combined group, the reporting entity’s information needs to be included in the applicable sections. This inclusion is mandatory based on the status of your accounting year.

- For entities formed outside Texas, you must indicate whether the business is still active in the state and provide details about the last day of business if it's no longer operating.

- Don't forget to check the preferred method of receiving your certificate. Options include email, fax, or standard mail, and your selection will affect how quickly you receive confirmation of the termination.

Reviewing each section carefully and ensuring that all required information is provided will help facilitate a smoother process in terminating your entity's registration in Texas.

Browse Other Templates

Gift Deed Form - This deed format helps streamline the property gifting process between family members.

Certificate of Origin Online - Exporters should ensure that all goods listed originate from the territories specified in the agreement.

Register Car in Illinois - The Secretary of State's office maintains the authority to approve all requests submitted.