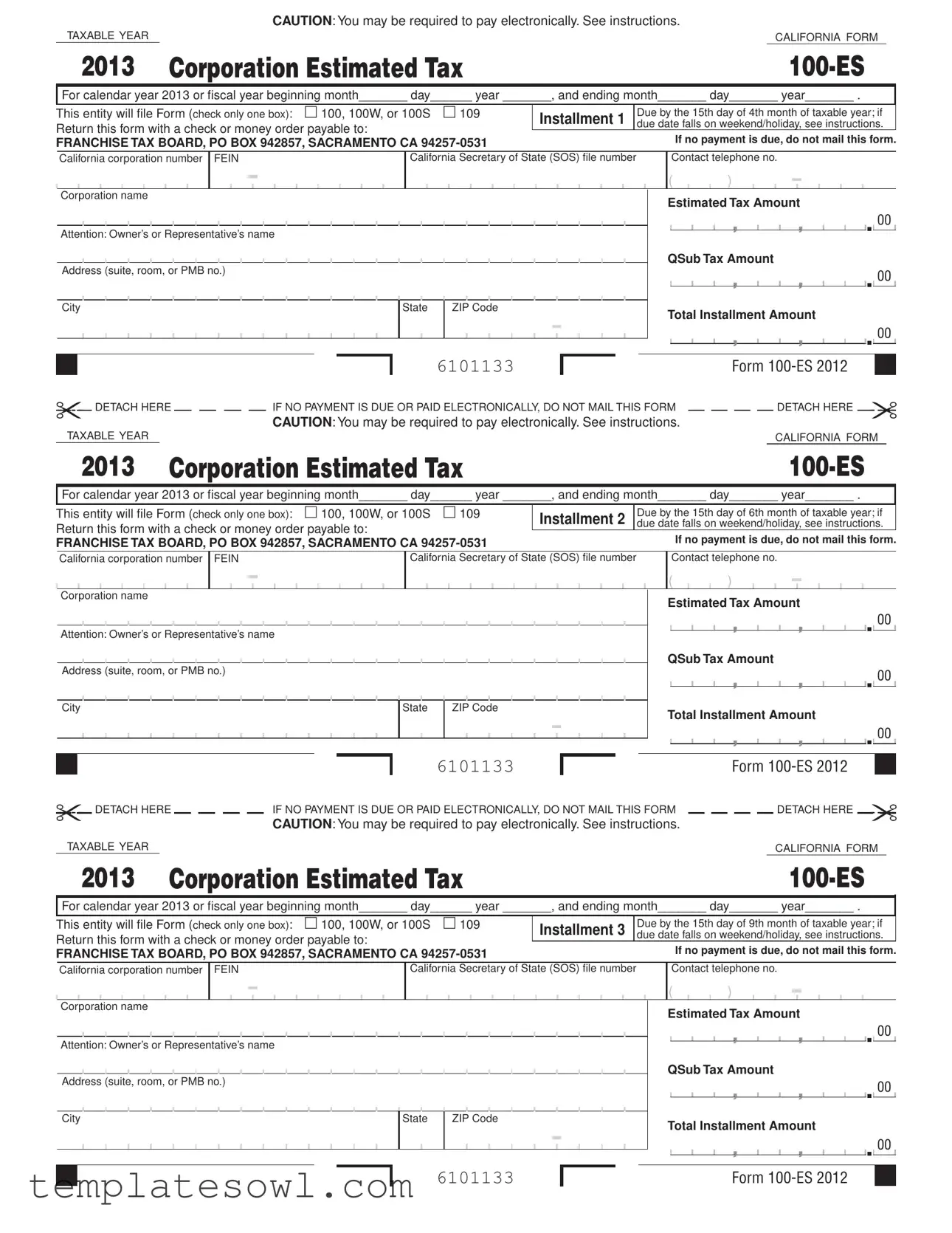

Fill Out Your 100 Es Form

The California Form 100-ES plays a crucial role in the estimated tax obligations for corporations operating within the state. Specifically designed for corporate income tax, this form serves both calendar year filers and those on a fiscal year schedule. Corporations must carefully complete this form by reporting their estimated tax amounts, including any applicable Qualified Subchapter S (QSub) amounts. Payments are structured into four installments, each with specific due dates that are defined in relation to the corporation's taxable year. Failure to adhere to these deadlines can lead to penalties. Notably, there is an electronic payment requirement for many corporations, which aims to streamline the payment process while enhancing efficiency. Companies must provide their identification details, such as the corporation number and Federal Employer Identification Number (FEIN), ensuring proper tracking and processing of their submissions. It is essential to understand that if no payment is due, mailing this form is unnecessary. Additionally, utilizing the online payment system available through the Franchise Tax Board (FTB) can offer a convenient alternative for corporations looking to schedule their payments in advance.

100 Es Example

CAUTION: You may be required to pay electronically. See instructions.

TAXABLE YEAR |

CALIFORNIA FORM |

|

|

|

|

2013 Corporation Estimated Tax |

||

For calendar year 2013 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

This entity will file Form (check only one box): m 100, 100W, or 100S m 109 Return this form with a check or money order payable to:

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA

Installment 1 |

Due by the 15th day of 4th month of taxable year; if |

due date falls on weekend/holiday, see instructions. |

If no payment is due, do not mail this form.

California corporation number

FEIN

California Secretary of State (SOS) file number

Contact telephone no.

()

Corporation name

Attention: Owner’s or Representative’s name

Address (suite, room, or PMB no.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax Amount

,

,

,

. 00

. 00

QSub Tax Amount

,

,

,

. 00

. 00

Total Installment Amount

,

,

,

. 00

. 00

|

|

|

|

|

|

6101133 |

|

|

|

FORM |

|

||

DETACH HERE |

IF NO PAYMENT IS DUE OR PAID ELECTRONICALLY, DO NOT MAIL THIS FORM |

|

DETACH HERE |

||||||||||

|

|

|

CAUTION: You may be required to pay electronically. See instructions. |

|

|

|

|

||||||

TAXABLE YEAR |

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 Corporation Estimated Tax |

|

|||||||||||

For calendar year 2013 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

This entity will file Form (check only one box): m 100, 100W, or 100S m 109 Return this form with a check or money order payable to:

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA

Installment 2 |

Due by the 15th day of 6th month of taxable year; if |

due date falls on weekend/holiday, see instructions. |

If no payment is due, do not mail this form.

California corporation number

FEIN

California Secretary of State (SOS) file number

Contact telephone no.

()

Corporation name

Attention: Owner’s or Representative’s name

Address (suite, room, or PMB no.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax Amount

,

,

,

. 00

. 00

QSub Tax Amount

,

,

,

. 00

. 00

Total Installment Amount

,

,

,

. 00

. 00

|

|

|

|

|

|

6101133 |

|

|

|

FORM |

|

||

DETACH HERE |

IF NO PAYMENT IS DUE OR PAID ELECTRONICALLY, DO NOT MAIL THIS FORM |

|

DETACH HERE |

||||||||||

|

|

|

CAUTION: You may be required to pay electronically. See instructions. |

|

|

|

|

||||||

TAXABLE YEAR |

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 Corporation Estimated Tax |

|

|||||||||||

For calendar year 2013 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

This entity will file Form (check only one box): m 100, 100W, or 100S m 109 Return this form with a check or money order payable to:

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA

Installment 3 |

Due by the 15th day of 9th month of taxable year; if |

due date falls on weekend/holiday, see instructions. |

If no payment is due, do not mail this form.

California corporation number

FEIN

California Secretary of State (SOS) file number

Contact telephone no.

()

Corporation name

Attention: Owner’s or Representative’s name

Address (suite, room, or PMB no.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax Amount

,

,

,

. 00

. 00

QSub Tax Amount

,

,

,

. 00

. 00

Total Installment Amount

,

,

,

. 00

. 00

6101133

FORM

Form at bottom of page

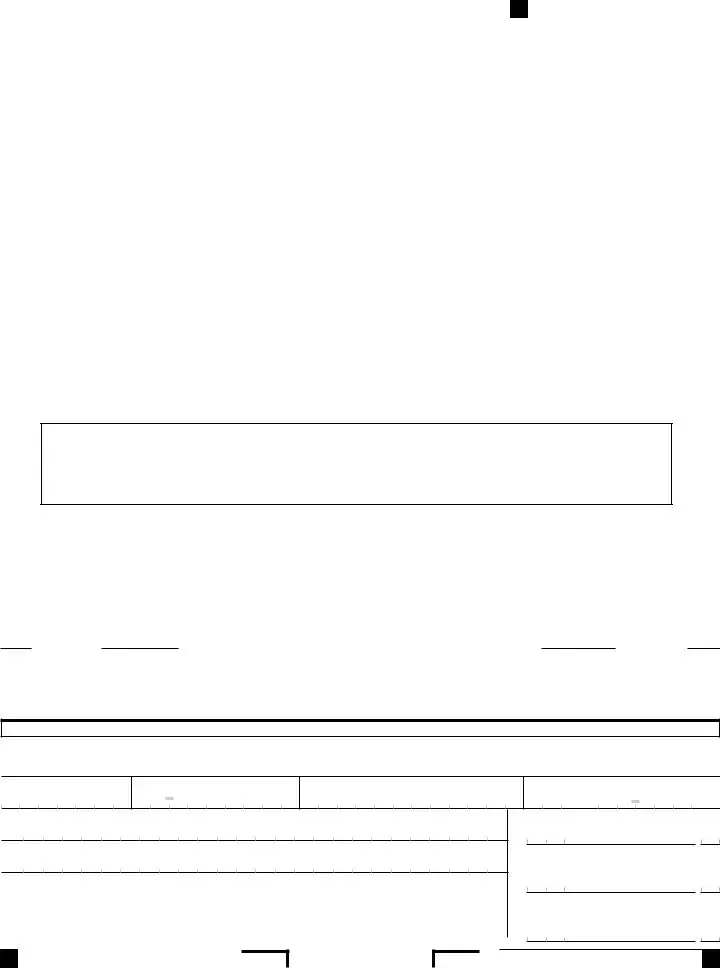

Pay Online: Use Web Pay for Business and enjoy the ease of our free online payment service. Go to ftb.ca.gov for more information. You can schedule your payments up to one year in advance. Do not mail this form if you use Web Pay.

DETACH HERE |

IF NO PAYMENT IS DUE OR PAID ELECTRONICALLY, DO NOT MAIL THIS FORM |

DETACH HERE |

||

|

|

CAUTION: You may be required to pay electronically. See instructions. |

|

|

TAXABLE YEAR |

|

CALIFORNIA FORM |

||

|

|

|

|

|

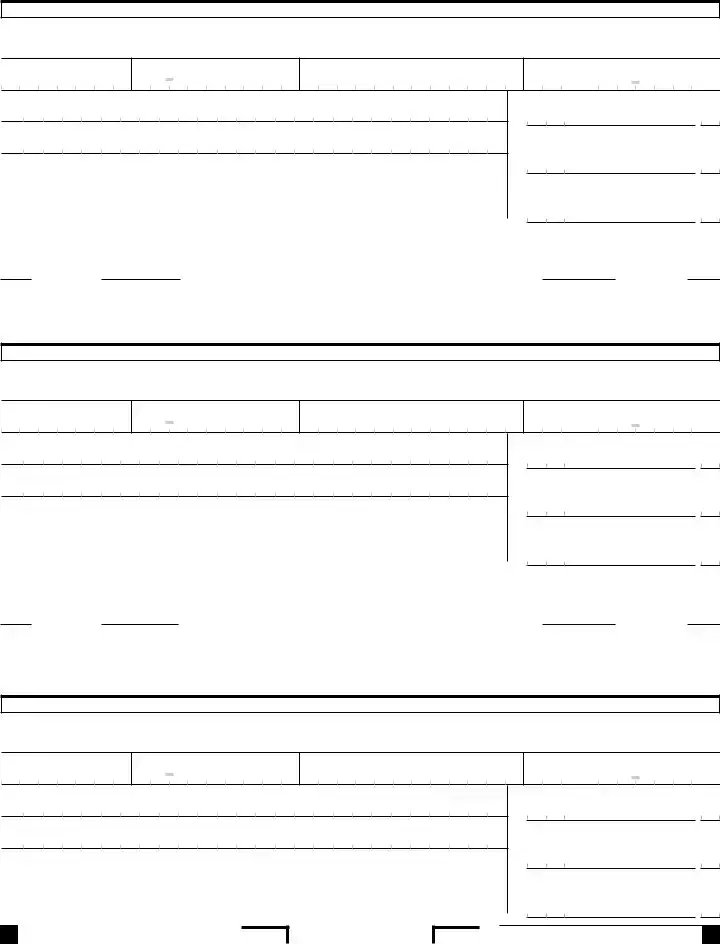

2013 Corporation Estimated Tax |

||||

For calendar year 2013 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

This entity will file Form (check only one box): m 100, 100W, or 100S m 109 Return this form with a check or money order payable to:

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA

Installment 4 |

Due by the 15th day of 12th month of taxable year; if |

due date falls on weekend/holiday, see instructions. |

If no payment is due, do not mail this form.

California corporation number

FEIN

California Secretary of State (SOS) file number

Contact telephone no.

()

Corporation name

Attention: Owner’s or Representative’s name

Address (suite, room, or PMB no.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Tax Amount

,

,

,

. 00

. 00

QSub Tax Amount

,

,

,

. 00

. 00

Total Installment Amount

,

,

,

. 00

. 00

6101133

FORM

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The form 100-ES is used for making estimated tax payments for corporations in California. |

| Tax Year | This version of the form is specifically designed for the tax year 2013. |

| Payment Methods | Payments can be made by check or money order. Electronic payment options are also available. |

| Installment Deadlines | There are four installments due on specific dates: 15th day of the 4th month, 6th month, 9th month, and 12th month of the taxable year. |

| Form Options | Corporations must indicate which form they will file—options include 100, 100W, 100S, or 109. |

| Governing Law | The form is governed by California tax law, specifically regulations from the California Franchise Tax Board. |

Guidelines on Utilizing 100 Es

Completing the California Corporation Estimated Tax Form 100-ES is essential for timely tax payments, especially if you're looking to avoid penalties. Here’s how to proceed efficiently to ensure your form is filled out correctly and submitted on time.

- Identify the taxable year. Specify whether it’s for the calendar year 2013 or your fiscal year by entering the start and end months, days, and years in the designated fields.

- Determine the entity type. Check the appropriate box for the form you'll be filing: 100, 100W, 100S, or 109.

- Complete entity information. Input your California corporation number, FEIN (Federal Employer Identification Number), and Secretary of State (SOS) file number.

- Provide contact details. Fill in the contact telephone number, corporation name, owner's or representative’s name, and address (including suite, room, or PMB number, city, state, and ZIP code).

- Estimate your tax amounts. Write in the estimated tax amount, QSub tax amount (if applicable), and the total installment amount, paying attention to include cents.

- Review due dates. Ensure that each installment is due on the correct date as outlined, noting that if the due date falls on a weekend or holiday, special instructions apply.

- Prepare for payment. Organize a check or money order payable to the Franchise Tax Board, and ensure it is included with the form if payment is due. If paying electronically, do not mail the form.

After completing these steps, double-check all information for accuracy. Timely submission is crucial; ensure that it reaches the specified address by the appropriate due date to prevent any issues.

What You Should Know About This Form

What is California Form 100-ES used for?

The California Form 100-ES is a tax form for corporations required to make estimated tax payments. This form is applicable for taxable years that align with either the calendar year or a specified fiscal year. Corporations use it to report and pay estimated taxes in installments throughout the taxable year. Proper submission of this form ensures compliance with California tax regulations and helps businesses avoid penalties for underpayment.

When are estimated tax payments due?

Estimated tax payments follow a specific schedule. Generally, the due dates align with certain milestones in the taxable year. For a calendar year corporation, these dates are as follows: the first installment is due by the 15th day of the fourth month, the second installment by the 15th day of the sixth month, the third installment by the 15th day of the ninth month, and the fourth installment by the 15th day of the twelfth month. If any due date falls on a weekend or holiday, the taxpayer should refer to the specific instructions for adjustments.

How should I submit Form 100-ES?

Form 100-ES can be submitted electronically or by mail, depending on the payment method chosen. If paying by check or money order, the completed form should be sent to the Franchise Tax Board at the designated P.O. box address in Sacramento. Alternatively, corporations may opt to pay online through the Web Pay for Business service available on the Franchise Tax Board’s website. This online option allows users to schedule payments in advance, providing additional convenience and efficiency.

What should I do if no payment is due?

If no estimated tax payment is required for a particular installment, you do not need to mail the form. It is advisable to only submit Form 100-ES when there is a payment due. Failure to adhere to this guideline helps reduce unnecessary paperwork and keeps the process streamlined. Always consult the instructions provided for further clarification regarding specific circumstances.

Common mistakes

When completing the California Corporation Estimated Tax Form 100-ES, there are common mistakes that can lead to complications. One significant error involves the failure to check the correct filing option. The form requires the filer to indicate which entity type they are using by checking only one box: either 100, 100W, or 100S, or 109. Not making this selection can result in delays or misdirected payments, as the Franchise Tax Board needs to know which tax return applies to your corporation.

Another frequent mistake occurs with the inaccurate reporting of estimated tax amounts. It is crucial to ensure that the estimated tax amounts entered are correct and complete. Double-check figures for each installment to avoid errors. Missing a decimal point or entering the wrong figures can lead to underpayment penalties or overpayment of taxes, complicating future filings or leading to potential refunds that are unnecessary.

Additionally, failing to provide complete information may hinder the processing of your form. Essential details such as the California corporation number, FEIN, Secretary of State file number, contact information, and the corporation’s name must be filled out entirely. Incomplete submissions may result in follow-up inquiries from the Franchise Tax Board, delaying your processing time and potentially incurring late fees.

Lastly, the misunderstanding of payment requirements can lead to significant issues. The instructions clearly state that you may be required to pay electronically. If this is applicable and you choose not to comply, you must not mail the form. Ignoring this guidance can result in rejected payments or unnecessary fees. Staying informed about payment options and deadlines is essential for compliance.

Documents used along the form

The 100-ES form, a crucial document for California corporations, helps manage estimated tax payments for the taxable year. Along with this form, several other documents may be necessary to ensure compliance with state tax laws. Below is a list of forms and documents that are commonly used together with the 100-ES form. Each entry provides a brief overview of its purpose.

- Form 100: This is the standard corporate tax return form for California corporations. It reports income, deductions, and tax credits, ultimately determining the tax liability for the corporation.

- Form 100W: Specifically for banks and financial corporations, this form is similar to Form 100 but tailored to the unique requirements of financial entities.

- Form 100S: S corporations use this form to report income, losses, and other tax-related information, electing to be taxed under Subchapter S of the Internal Revenue Code.

- Form 109: This form is for corporations that have chosen to be taxed as an S corporation, allowing them to report their income, deductions, and credits for the specified taxable year.

- Form 592: This document is used for withholding on payments to non-residents. It reports the tax withheld and must be filed separately from the corporate tax return.

- Form 592-B: This is a notifiable form for individual beneficiaries of a pass-through entity that reflects the amount of California source income distributed and the respective withholding amounts.

- Form 3519: This document applies to corporations that need to make an estimated tax payment based on the adjustments shown in their final tax returns from prior years.

- Form FTB 3500: Nonprofit corporations use this form to apply for tax-exempt status and must submit it alongside other necessary documentation to the Franchise Tax Board.

- Form 1120: This federal form is utilized by corporations to report their income and calculate federal corporate income tax, independent of state requirements.

- Form 4562: Corporations utilize this form to report depreciation and amortization information, which can affect overall tax calculations and liabilities.

Utilizing the 100-ES form and its accompanying documents ensures that corporations stay compliant with California taxation requirements. Proper completion and timely submission help prevent potential penalties and streamline the tax process.

Similar forms

- Form 100: This is the annual California corporation income tax return. Like Form 100-ES, it is used to report income, deductions, and tax liability. Both forms require similar entity information and payment details, but Form 100 summarizes the year's finances instead of estimating payments.

- Form 100W: This is the California corporation tax return specifically for "Water's Edge" filers. Similar to Form 100-ES, it aims to report annual income. Both forms require the corporation's information and have payment obligations, but Form 100W focuses on specific apportionment rules.

- Form 100S: This form is for S corporations in California. Like the 100-ES, it deals with taxation but differs in its treatment of corporate income and tax rates. Both forms include basic corporate information and deadlines for payment.

- Form 109: This is for an annual information return filed by certain California entities. Similar to Form 100-ES, it requires entity details and addresses tax-related data. However, Form 109 is primarily for reporting purposes rather than estimating tax due.

Dos and Don'ts

Things to Do:

- Read the instructions carefully to understand any payment requirements.

- Fill in all the necessary information completely and accurately.

- Mail the form along with your payment if required, especially if you're not paying electronically.

- Keep a copy of the completed form and any payment for your records.

Things Not to Do:

- Do not submit the form if no payment is due; there’s no need to mail it.

- Avoid using the wrong form type; make sure to check the appropriate box for the form you are filing.

- Do not delay in sending your payment before the due date.

- Don’t forget to verify that the payment method accepted matches your submission method.

Misconceptions

Here are some common misconceptions about the California Form 100-ES that you might come across:

- It's only for large corporations. Many small businesses need to use this form too. If your corporation expects to owe tax, you should file it.

- I don’t need to file if I have no tax due. If there’s no payment, you are not required to mail this form. Just keep it in mind for next time.

- Electronic payments are optional. In some cases, paying electronically is a requirement. This could save you time and guarantee on-time payments.

- Filing late doesn't matter. It's important to meet the deadlines for estimated taxes. Late payments can lead to penalties.

- Only the owner should fill it out. A representative or an accountant can also fill out the form on behalf of the corporation.

- All corporations use Form 100-ES. Only corporations that expect to owe tax need to file this form. S corporations and LLCs might use different forms.

- I can send cash to pay my taxes. You should use a check or money order only. Sending cash is not a secure option.

- Using Web Pay means I don’t need to worry about the form. While you don’t need to mail the form if you pay online, you still need to keep track of your estimated tax obligations.

- Estimated tax payments are always the same. Your estimated payments can change based on your corporation's income each year.

Understanding these misconceptions will help you navigate the process more smoothly. Always double-check the current instructions as they can change yearly.

Key takeaways

When dealing with the California Corporation Estimated Tax Form 100-ES, understanding the process can simplify your tax payment experience. Here are some key takeaways:

- Know Your Due Dates: Payments are due in four installments throughout the year. Each installment has a specific due date, usually the 15th of the month corresponding to the end of each quarter.

- Filing Options: Ensure you check the correct box on the form that corresponds to your entity type: either a 100, 100W, 100S, or 109.

- Electronic Payments: You might be required to pay electronically. Familiarize yourself with options like the Web Pay for Business, which allows you to make online payments easily.

- Do Not Mail If No Payment is Due: If you do not owe any payment for that installment, do not send the form in. Only submit it with a payment.

- Keep Track of Your Information: Fill in all necessary details, including your corporation’s California number, FEIN, and Secretary of State file number. Accurate info helps avoid processing delays.

- Payment Amounts: Clearly state the estimated tax amount and any specific QSub tax amounts if applicable. Ensure the totals are calculated correctly to prevent issues.

- Use the Right Mailing Address: Send your payment to the correct address: Franchise Tax Board, PO Box 942857, Sacramento, CA 94257-0531, to make sure it gets processed efficiently.

By keeping these points in mind, you can navigate the 100-ES form process with ease. Proper preparation and attention to details will help ensure compliance and reduce stress during tax season.

Browse Other Templates

New Hire Reporting Kansas - The Kansas K-BEN 3211 form is designed for employers to provide a reasonable assurance statement regarding a claimant's eligibility for unemployment benefits.

Real Property Tax Credit Claim Form,Homeowners and Renters Tax Credit Application,New York Tax Credit Claim,IT-214 Tax Credit Application,Residential Property Tax Rebate Form,New York Homeowner and Renter Credit Form,Tax Savings Application for Homeo - Applicants will compare calculated credit amounts to determine eligibility based on their financial situation.

Broward Animal Care and Adoption - Veterinarians must use USDA licensed vaccines for safe vaccinations.