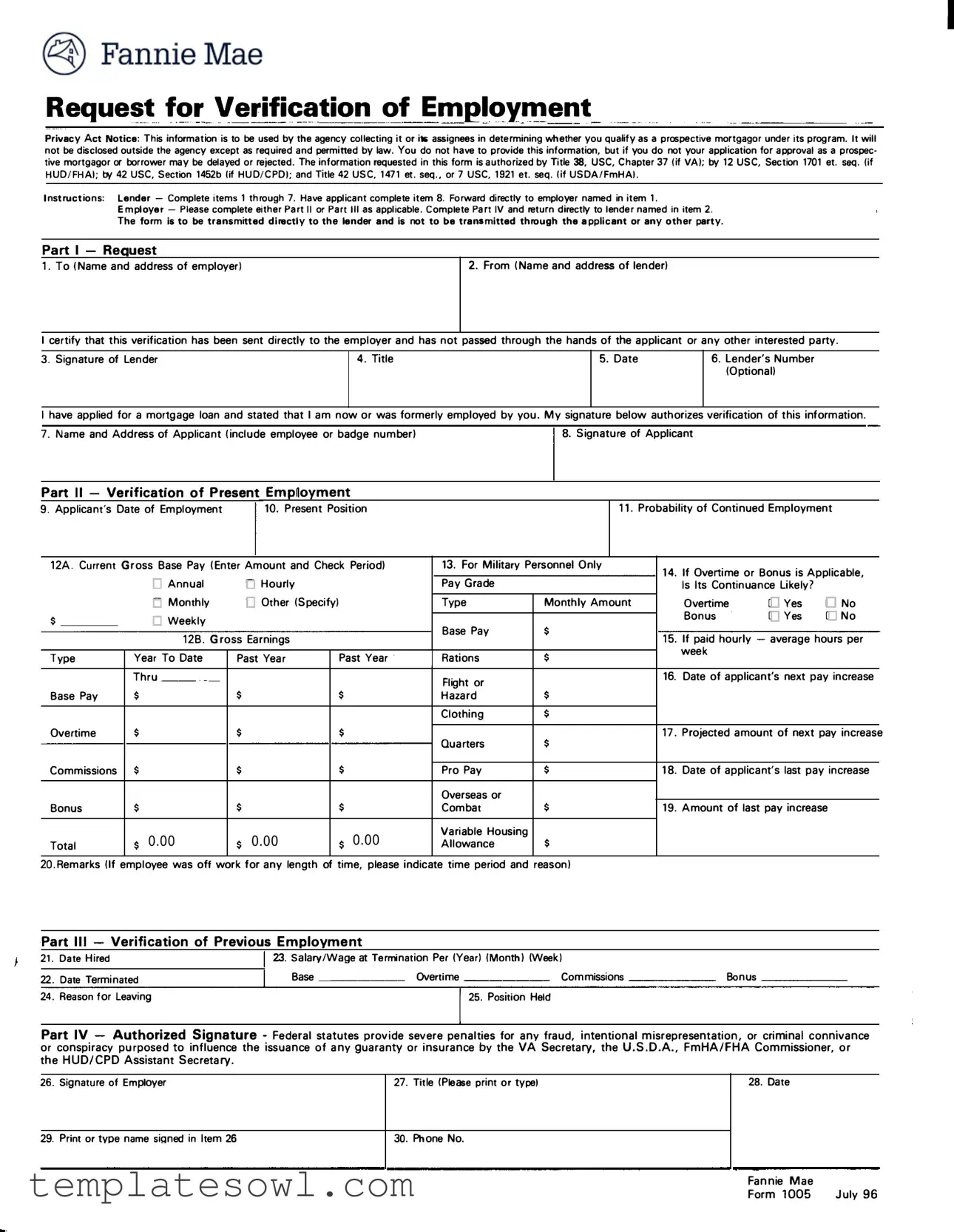

Fill Out Your 1005 Verification Of Employment Form

The 1005 Verification of Employment form is an essential document in the mortgage application process, specifically designed to ascertain an applicant’s employment history and current status. Lenders, including those operating under Fannie Mae guidelines, utilize this form to collect pertinent information about an applicant's job details, such as dates of employment, position held, salary, and the likelihood of continued employment. The form must be meticulously completed by the lender and subsequently forwarded directly to the applicant's current or previous employers. In such cases, the applicant's authorization is required, demonstrating consent for their employers to disclose the requested employment information. The form also complies with various federal regulations, ensuring that the collected data will be used solely for determining mortgage eligibility. It is critical for this verification to occur without any intermediary involvement from the applicant, thereby maintaining confidentiality and integrity throughout the process. Employers must provide accurate responses, including any remarks on employment gaps or other relevant notes. For applicants seeking first or second mortgages, understanding the importance and requirements of the 1005 Verification of Employment form can significantly impact the approval process and overall outcome of their mortgage application.

1005 Verification Of Employment Example

I

�FannieMae

Request fc,r Verification of Em�le>y_111ent

Privacy Act Notice: This information is to be used by the agency collecting it or its assignees in determining whether you qualify as a prospective mortgagor under its program. It will not be disclosed outside the agency except as required and permitted by law. You do not have to provide this information, but if you do not your application for approval as a prospec tive mortgagor or borrower may be delayed or rejected. The information requested in this form is authorized by Title 38, USC, Chapter 37 (if VA); by 12 USC, Section 1701 et. seq. (if HUD/FHA); by 42 USC, Section 1452b (if HUD/CPD); and Title 42 USC, 1471 et. seq., or 7 USC, 1921 et. seq. (if USDA/FmHA).

Instructions: Lender - Complete items 1 through 7. Have applicant complete item 8. Forward directly to employer named in item 1.

Employer Please complete either Part II or Part Ill as applicable. Complete Part IV and return directly to lender named in item 2.

The form is- to be transmitted directly to the lender and is not to be transmitted through the applicant or any other party.

Part I - Re uest

1. To (Name and address of employer)

I certify that this verification has been sent directly to the employer and has not passed through the hands of the applicant or any other interested party.

3. Signature of Lender4. Title5. Date 6. Lender's Number (Optional)

|

|

I have applied for a mortgage loan and stated that I am now or was formerly employed by you. My signature below authorizes verification of this information. |

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

7. Name and Address of Applicant (include employee or badge number) |

|

|

|

|

|

|

8. Signature of Applicant |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Part II - |

VenT1cat1on ofPresent |

|

Emp1oyment |

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Probability of Continued Employment |

|

|

|

|

|

|||||||||||||||||||||||||||

|

9. Applicant's Date of Employment |

|

|

|

10. Present Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

12A. Current Gross Base Pay (Enter Amount and Check Period) |

|

|

|

|

|

13. For Military Personnel Only |

14. If Overtime or Bonus is Applicable, |

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

D |

Annual |

|

□ |

Hourly |

|

|

|

|

|

|

|

Pay Grade |

|

|

|

|

|

|

Is Its Continuance Likely? |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

D |

Monthly |

|

D |

Other (Specify) |

|

|

|

|

|

|

Type |

|

Monthly Amount |

Overtime |

|

D |

Yes |

D |

No |

||||||||||||||||||||||

$ |

|

|

|

|

|

C |

Weekly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonus |

|

□ |

Yes |

□ |

No |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Pay |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

128. Gross Earnings |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

15. If paid hourly - average hours per |

||||||||||||||||||||||||

|

|

Type |

|

|

|

Year To Date |

|

Past Year |

|

|

Past Year |

19__ |

Rations |

|

$ |

|

|

|

|

|

week |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

19_ _ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Pay |

|

|

|

Thru __19_ |

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Flight or |

|

$ |

|

|

|

|

|

16. Date of applicant's next pay increase |

|||||||||||||||||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hazard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Overtime |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clothing |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Quarters |

|

$ |

|

|

|

|

|

17. Projected amount of next pay increase |

|

|||||||||||||||||

|

|

Commissions |

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Pay |

|

$ |

|

|

|

|

|

18. Date of applicant's last pay increase |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overseas or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Bonus |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Combat |

|

$ |

|

|

|

|

|

19. Amount of last pay increase |

|

|

|

|

|

|||||||||||

|

|

Total |

|

|

|

$ |

0.00 |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

|

|

|

Variable Housing |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

20.Remarks (If employee was off work for any length of time, please indicate time period and reason) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Part Ill - Verification ofPrevious Em lo ment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

21. Date Hired |

|

|

|

|

|

|

|

|

|

23. Salary/Wage at Termination Per (Year) (Month) (Week) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base |

Overtime |

Commissions |

|

|

|

|

|

Bonus |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

22. Date Terminated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

24. Reason for Leaving |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

125. Position Held |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IV - |

Authorized Signature - Federal statutes provide severe penalties for any fraud, intentional misrepresentation, or criminal connivance |

||||||||||||||||||||||||||||||||||||||||||||||||

or conspiracy purposed to influence the issuance of any guaranty or insurance by the VA Secretary, the U.S.D.A., FmHA/FHA Commissioner, or |

|||||||||||||||||||||||||||||||||||||||||||||||||

the HUD/CPD Assistant Secretary. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. Date |

|

|

|

|

|

|

|||||||||||||

|

|

26. Signature of Employer |

|

|

|

|

|

|

|

|

|

|

|

|

27. Title (Please print or type) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. Print or type name signed in Item 26 |

|

|

|

|

|

|

|

|

30. Phone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae |

|

July 96 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 1005 |

|

|||||||

Instructions

Verification of Employment

The lender uses this form for applications for conventional first or second mortgages to verify the applicant's past and present employment status.

Copies

Original only.

Printing Instructions

This form must be printed on letter size paper, using portrait format.

Instructions

The applicant must sign this form to authorize his or her employer(s) to release the requested information. Separate forms should be sent to each firm that employed the applicant in the past two years. However, rather than having an applicant sign multiple forms, the lender may have the applicant sign a borrower's signature authorization form, which gives the lender blanket authorization to request the information it needs to evaluate the applicant's creditworthiness. When the lender uses this type of blanket authorization, it must attach a copy of the authorization form to each Form 1005 it sends to the applicant's employer(s).

For First Mortgages:

The lender must send the request directly to the employers. We will not permit the borrower to

For Second Mortgages:

The borrower may

Instructions Page

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The 1005 Verification of Employment form is utilized by lenders to confirm an applicant's current and past employment status when applying for a mortgage loan. |

| Signature Requirement | The applicant's signature is necessary to authorize employers to disclose the requested employment information. |

| Direct Submission Requirement | The completed form must be submitted directly from the employer to the lender, without passing through the applicant. |

| Governing Laws | This form is authorized under various laws including Title 38 USC, Chapter 37 for VA loans, 12 USC, Section 1701 et. seq. for HUD/FHA loans, and 42 USC, Section 1471 et. seq. for USDA/FmHA loans. |

Guidelines on Utilizing 1005 Verification Of Employment

Filling out the 1005 Verification of Employment form requires careful attention to specific details. After completing this form, it will be forwarded directly to the applicant's employer for verification of employment status. The lender will use this information to assess eligibility for mortgage approval. Here are the steps to complete the form properly:

- Gather information: Collect necessary personal and employment details, including the applicant's name, address, current and previous employers, dates of employment, and salary information.

- Complete Part I: Fill out items 1 to 7, including your name and address as the lender, the name and address of the employer, and the applicant's information. Ensure that all fields are accurately completed.

- Obtain applicant's signature: Have the applicant sign at item 8, authorizing the verification of their employment and confirming their employment details.

- Choose the correct part: Depending on the applicant's status, complete either Part II for current employment verification or Part III for previous employment verification.

- Fill out employment details: In Part II, provide the applicant's date of employment, present position, current gross base pay, and other required information. If completing Part III, include dates hired and terminated, as well as salary details.

- Document any remarks: If there were any significant employment gaps or reasons for leaving notable enough to mention, indicate them in the remarks section.

- Sign and date: Ensure that the employer's authorized representative signs and dates the form in Part IV. Include their title and printed name.

- Return the form: Send the completed form directly to the lender, adhering to the instructions that the form should not pass through the applicant or any other third party.

What You Should Know About This Form

What is the purpose of the 1005 Verification of Employment form?

The 1005 Verification of Employment form is used by lenders to verify the employment history of individuals applying for a mortgage loan. This information helps lenders assess the applicant's financial stability and creditworthiness. Accurate verification plays a crucial role in determining whether the applicant qualifies for a mortgage under the lender’s program.

Who completes the 1005 Verification of Employment form?

The form is primarily completed by both the lender and the employer. The lender fills out items 1 through 7, specifying the applicant’s details and sending the request directly to the employer. The employer then completes the relevant parts, providing information about the applicant's employment status, salary, and other pertinent details, before returning the form directly to the lender.

Why is the form transmitted directly to the lender?

To ensure the integrity of the verification process, the 1005 form must be sent directly from the employer to the lender. This protocol prevents any potential manipulation of the employment information by the applicant or any third parties and helps maintain the confidentiality of the applicant's employment data.

What happens if I do not provide the information requested in the form?

It is important to understand that providing information via the 1005 form is not optional. If you choose not to submit the requested information, your mortgage application may experience delays or may even be rejected. Your cooperation is essential for a smooth and timely approval process.

Can I hand-carry the verification form to my employer?

For first mortgage applications, you cannot hand-carry the verification form to your employer. The lender must send the request directly. However, if you are applying for a second mortgage, you are permitted to take the form to your employer, but they must mail it directly back to the lender. This maintains the verification's proper chain of custody.

What should I do if there are inaccuracies in my employment verification?

If you notice inaccuracies after your employer completes the 1005 form, it is crucial to address them immediately. Contact your employer directly to discuss the discrepancies and request corrections. Once updated, ensure that the corrected verification is sent back to the lender as soon as possible to avoid any issues with your mortgage application.

Is my personal information protected when I complete this form?

Yes, your personal information is protected. The 1005 form's design includes a privacy notice, indicating that the information collected will only be used to evaluate your eligibility as a prospective borrower. It will not be disclosed to unauthorized third parties except as required by law, ensuring your data remains confidential throughout the mortgage application process.

Common mistakes

When filling out the 1005 Verification of Employment form, people often make errors that can delay their mortgage applications. One common mistake is not providing complete information in the applicant section. For example, if the full name or correct address of the applicant is missing, it can hinder the lender's ability to verify the employment accurately.

Another mistake frequently seen is failing to sign the form. The applicant's signature is essential for authorizing the employer to release information. Without this, the form is incomplete and cannot be processed. Similarly, individuals might overlook including the employee or badge number. This number helps to uniquely identify the applicant's records, making it easier for the employer to locate the necessary information.

Completing the wrong section of the form is yet another issue. The instructions clearly outline which parts the lender and the employer should fill out. Sometimes, applicants mistakenly fill in the employer’s section, which leads to confusion and delays in processing.

Inaccurate reporting of employment details is also a significant pitfall. When noting the date of employment or salary, ensure that the information is precise. An error in these areas can jeopardize the applicant's chances for approval.

Applicants often neglect to include their current position and details regarding gross base pay. This oversight can cause the lender to question the applicant’s employment stability or income. Similarly, inaccurately reported pay grades or salary figures can raise red flags for lenders and prolong the evaluation process.

Another common error is mishandling the transmission of the form. The instructions specify that the form must be sent directly to the employer and should not pass through the applicant's hands. If this protocol is not followed, the integrity of the verification process is compromised.

People also sometimes forget to send separate forms for different employers. If the applicant has worked for multiple companies in the past two years, it is crucial to use separate forms for each employer to ensure all information is accurately verified.

Finally, individuals may not review the completed form for clarity and accuracy before submission. Even minor typos or unclear handwriting can lead to misunderstandings, delaying the verification process.

Documents used along the form

The Verification of Employment form 1005 is an essential document in the mortgage application process. It helps lenders confirm an applicant's employment status, which is critical for assessing qualification for a mortgage. Alongside this form, several other documents may also be required to provide a comprehensive view of the applicant's financial situation and employment history. Below is a list of these documents, each briefly described for clarity.

- Borrower's Signature Authorization Form: This form allows the applicant to grant the lender permission to request employment information from all past employers, facilitating a streamlined verification process.

- Pay Stubs: Recent pay stubs are used to verify the applicant's income and assess stability in their current job.

- W-2 Forms: These documents summarize an employee's annual earnings and tax withholding from their employer, providing insight into the applicant's income history.

- Tax Returns: Personal tax returns, ideally for the last two years, offer a broader perspective on the applicant's overall financial situation and income consistency.

- Employment Offer Letter: If applicable, a letter confirming a job offer may help verify future employment, enhancing the lender's understanding of the applicant’s job security.

- Employment Contract: For those in specialized fields, an employment contract can provide additional context regarding job stability and salary commitments.

- Credit Report: A comprehensive credit report reflects the applicant's creditworthiness, helping to contextualize their financial reliability alongside employment verification.

- Bank Statements: Recent bank statements offer insight into the applicant's financial health and regular income deposits, further supporting employment and income claims.

These documents work together with the Verification of Employment form to help lenders make informed decisions about an applicant's mortgage eligibility. Providing accurate and complete documents can streamline the process, avoiding unnecessary delays in obtaining mortgage approval.

Similar forms

Verification of Income Form: This document confirms an applicant's income details, similar to the 1005 Verification of Employment form, which validates employment status. Both aim to assess financial stability for loan applications.

W-2 Forms: These are tax documents received from employers that report annual wages and tax withholdings. Like the 1005 form, W-2s provide necessary information about an individual's employment and income history for lenders.

Pay Stubs: Pay stubs detail an employee's earnings for a specific period, often used alongside the 1005 form to ensure accurate income verification for mortgage applications.

Employment Verification Letter: Typically provided by an employer, this letter confirms an employee's job title and duration of employment, which parallels the intent of the 1005 form to verify job status.

Borrower's Signature Authorization Form: This form allows lenders to request employment and income information on behalf of the borrower. It serves a similar purpose as the 1005, facilitating employment data collection for credit evaluation.

360 Form (Verification of Employment and Income): This form is specifically designed for verifying both employment and income for borrowers. It resembles the 1005 form in its objective to assist lenders in assessing a borrower's financial situation.

Dos and Don'ts

When filling out the 1005 Verification of Employment form, it's important to ensure accuracy and completeness. Here are five dos and don'ts to keep in mind:

- DO ensure that all requested information is provided and correctly filled out.

- DO sign the form to authorize your employer to release your employment information.

- DO separate forms for each employer if you've had multiple jobs in the past two years.

- DO verify that the form is sent directly to the employer and not passed through you.

- DO keep a copy of all forms for your own records.

- DON'T leave any sections blank; incomplete information can delay processing.

- DON'T provide false information; this can lead to severe penalties.

- DON'T allow anyone else to handle the verification form aside from the lender and the employer.

- DON'T forget to double-check the details before submitting the form.

- DON'T assume that the lender will notify you of any issues with your submission; stay proactive.

Misconceptions

Here are some common misconceptions about the 1005 Verification of Employment form.

- It's optional to fill out. Many think this form is optional, but submitting it is often crucial for mortgage approval. If you don’t provide it, your application could be delayed or rejected.

- Only current employment needs to be verified. Some believe only current positions matter, but lenders typically want to verify employment history for the past two years as well.

- The borrower can give the form to their employer. A common misconception is that borrowers can hand over the form to their employer. Instead, lenders must send the form directly to the employer.

- All lenders follow the same rules for the form. Different lenders may have varying procedures relating to this form. Always check with your lender for their specific requirements.

- The employer must respond immediately. Some people think that there is an immediate timeline for employers to complete and return the form. However, response times can vary based on the employer’s policies and workload.

- The form can include false information without consequences. There is a serious legal implication for providing false information. Employers and employees can face penalties for inaccuracies or misrepresentations.

- It only helps with mortgage approvals. This form can also be needed for other types of loans or financing that may require verification of income and employment.

- Filling out the form guarantees loan approval. While providing accurate information is necessary, submitting the form does not automatically mean you will be approved for a loan.

Key takeaways

Completing and using the 1005 Verification of Employment form is an important step in the mortgage application process. Here are some key takeaways to keep in mind:

- The form is used to verify both past and present employment status of mortgage applicants.

- It is essential that the lender completes items 1 through 7 before sending the form to the employer.

- Applicants need to fill out item 8, which provides their authorization for the employer to share employment information.

- The completed form must be sent directly from the employer to the lender and should not go through the applicant.

- Employers have two parts to complete: either Part II (for current employment) or Part III (for previous employment).

- It’s critical for applicants to ensure that their employers fill out the form accurately to avoid any delays in the loan process.

- If the applicant has worked for multiple employers in the last two years, separate forms must be sent to each one.

- Use of a blanket authorization form can simplify the process by allowing the lender to request employment verification without needing multiple individual authorizations from the applicant.

- For first mortgages, the lender must directly send the request to employers, while, for second mortgages, applicants may hand-carry the form to the employer.

Understanding these points will help streamline the verification process and assist in a smoother mortgage application experience.

Browse Other Templates

Hvcc Appraisal - Employing this form leads to a more reliable and objective assessment of property values.

Flashcard Maker Free - Time management improves as students can prioritize their study topics more effectively.