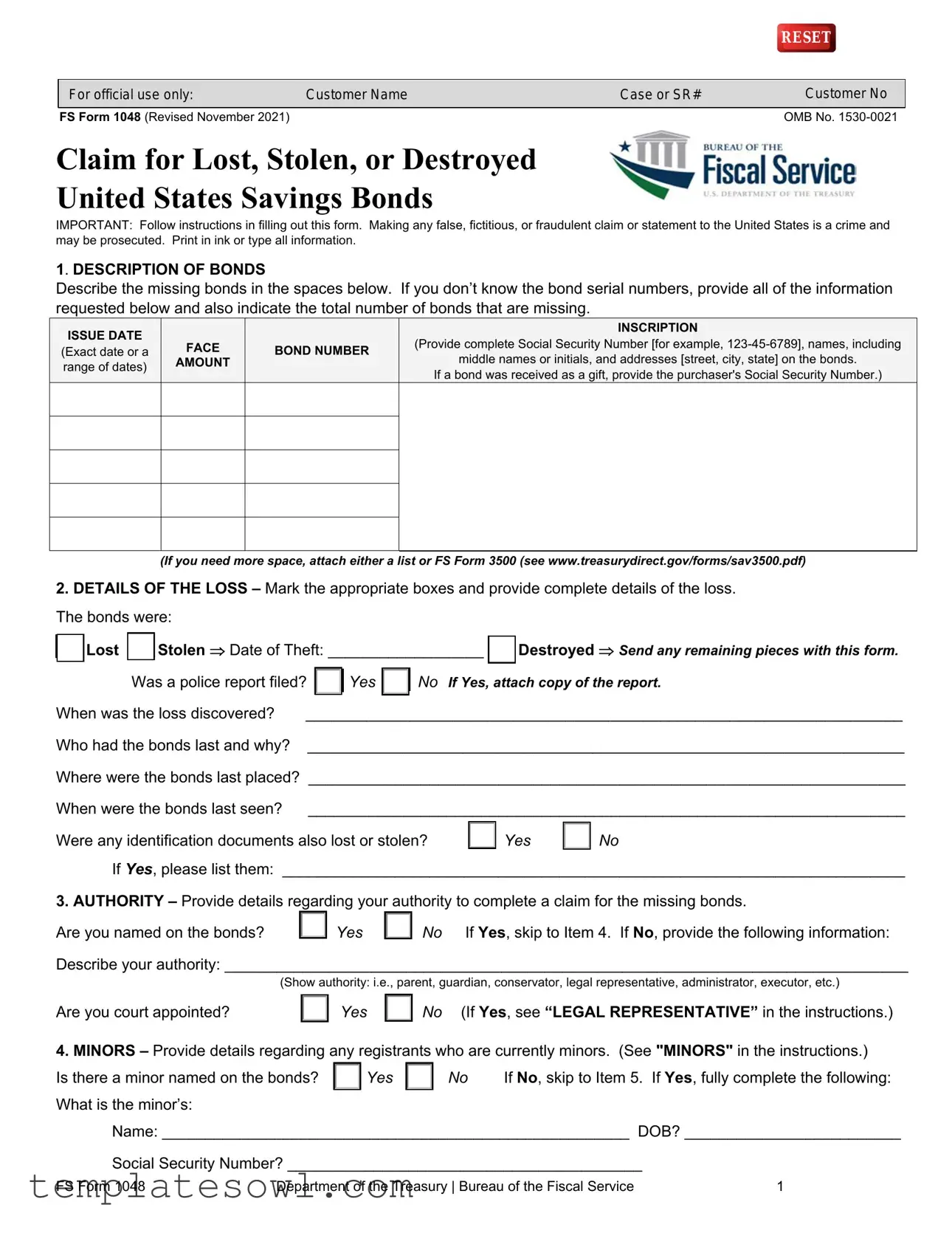

Fill Out Your 1048 Form

The FS Form 1048 serves a crucial function for those who need to claim lost, stolen, or destroyed United States Savings Bonds. This form is essential for initiating the process and must be completed with accurate details about the missing bonds, including descriptions, issue dates, and serial numbers. It requires users to specify the circumstances surrounding the loss, whether it was a simple misplacement, a theft, or destruction by fire or other means. Moreover, individuals seeking to file the claim must clarify their authority to act on behalf of the bond owner, which is particularly important in cases where the owner is deceased, a minor, or otherwise incapacitated. The form includes sections dedicated to minors, ensuring appropriate caregivers complete it on their behalf. When submitting the claim, it's essential to provide any necessary documentation, such as police reports, in cases of theft, to substantiate the claim. Choosing whether to request substitute bonds or direct payment is also a significant aspect of the process. This form assists in restoring financial security for those who have faced the anxiety of losing their investments in savings bonds, ensuring they can reclaim their rightful financial assets.

1048 Example

|

|

|

RESET |

|

|

|

|

For official use only: |

Customer Name |

Case or SR# |

Customer No |

|

|

|

|

FS Form 1048 (Revised November 2021) |

|

|

OMB No. |

Claim for Lost, Stolen, or Destroyed

United States Savings Bonds

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information.

1. DESCRIPTION OF BONDS

Describe the missing bonds in the spaces below. If you don’t know the bond serial numbers, provide all of the information requested below and also indicate the total number of bonds that are missing.

|

ISSUE DATE |

|

|

|

|

|

|

|

INSCRIPTION |

|

|

|

FACE |

|

|

BOND NUMBER |

|

(Provide complete Social Security Number [for example, |

|

|

(Exact date or a |

|

|

|

|

|

|||

|

range of dates) |

|

|

AMOUNT |

|

|

|

|

middle names or initials, and addresses [street, city, state] on the bonds. |

|

|

|

|

|

|

|

If a bond was received as a gift, provide the purchaser's Social Security Number.) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If you need more space, attach either a list or FS Form 3500 (see www.treasurydirect.gov/forms/sav3500.pdf)

2.DETAILS OF THE LOSS – Mark the appropriate boxes and provide complete details of the loss. The bonds were:

Lost

Stolen Date of Theft: __________________

Destroyed Send any remaining pieces with this form.

Was a police report filed? |

|

Yes |

|

No If Yes, attach copy of the report. |

|

When was the loss discovered? |

_____________________________________________________________________ |

||||

Who had the bonds last and why? _____________________________________________________________________

Where were the bonds last placed? _____________________________________________________________________

When were the bonds last seen? _____________________________________________________________________

Were any identification documents also lost or stolen? |

|

Yes |

|

No |

If Yes, please list them: ________________________________________________________________________

3.AUTHORITY – Provide details regarding your authority to complete a claim for the missing bonds.

Are you named on the bonds? |

|

Yes |

|

No If Yes, skip to Item 4. If No, provide the following information: |

Describe your authority: _______________________________________________________________________________

(Show authority: i.e., parent, guardian, conservator, legal representative, administrator, executor, etc.)

Are you court appointed?

Yes

No (If Yes, see “LEGAL REPRESENTATIVE” in the instructions.)

4.MINORS – Provide details regarding any registrants who are currently minors. (See "MINORS" in the instructions.)

Is there a minor named on the bonds? |

|

Yes |

|

No |

If No, skip to Item 5. If Yes, fully complete the following: |

What is the minor’s: |

|

|

|

|

|

Name: ______________________________________________________ DOB? _________________________

Social Security Number? _________________________________________

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

1 |

What is your relationship to the minor? ___________________________________________________________________

Does the minor live with you?

Yes

No

If No, with whom? _____________________________________________________________________________

(Name)(Relationship to Minor)

_____________________________________________________________________________

(Address)

Who provides the minor’s chief support?

_____________________________________________________________________________

(Name)(Relationship to Minor)

_____________________________________________________________________________

(Address)

Are both parents able to sign the application for relief?

If Yes, skip to Item 5. If No, fully complete the following:

Yes

No

Why are you unable to obtain the signature? ________________________________________________________

Did that parent have access to the bonds?

Could that parent have possession of the bonds?

Yes

Yes

No

No

5.RELIEF REQUESTED – Indicate whether you want substitute bonds or payment. NOTE: Substitute bonds can’t be issued in some cases, including if a bond is within one full calendar month of its final maturity.

A. Series EE or Series I Bonds: I/We hereby request

*Substitute Electronic Bonds  Payment by Direct Deposit

Payment by Direct Deposit

*When we reissue a Series EE or Series I savings bond, we no longer provide a paper bond. The reissued bond is in electronic form, in our online system TreasuryDirect. For information on opening an account in TreasuryDirect, go to www.treasurydirect.gov.

B. Series HH Bonds: I/We hereby request |

|

Substitute Paper Bonds |

6. DELIVERY INSTRUCTIONS |

|

|

Payment by Direct Deposit

A. For Electronic Substitute Bonds – Series EE or Series I

TreasuryDirect account number ________________________________

Account name ________________________________________________________________

Social Security Number or Employer Identification Number _______________________________

NOTE: You may add a secondary owner or beneficiary once bonds have been replaced in electronic form within your TreasuryDirect account. For more information, access your account and click on “How do I” at the top of the page to find instructions on how to add a secondary owner or beneficiary.

TAX LIABILITY: If the name of a living owner or principal coowner of the bonds is eliminated from the registration, the owner or principal coowner must include the interest earned and previously unreported on the bonds to the date of the transaction on his or her Federal income tax return for the year of the reissue. (Both registrants are considered to be coowners when bonds are registered in the form: "A" or "B.") The principal coowner is the coowner who (1) purchased the bonds with his or her own funds, or (2) received them as a gift, inheritance, or legacy, or as a result of judicial proceedings, and had them reissued in coownership form, provided he or she has received no contribution in money or money's worth for designating the other coowner on the bonds. If the reissue is a reportable event, the interest earned on the bonds to the date of the reissue will be reported to the Internal Revenue Service (IRS) by a Federal Reserve Bank or Branch or the Bureau of the Fiscal Service under the Tax Equity and Fiscal Responsibility Act of 1982. THE OBLIGATION TO REPORT THE INTEREST CANNOT BE TRANSFERRED TO SOMEONE ELSE THROUGH A REISSUE TRANSACTION. If you have questions concerning the tax consequences, consult the IRS, or write to the Commissioner of Internal Revenue, Washington, DC 20224. Unless we are otherwise informed, the

B. For Substitute Paper

Mail Bonds To: _________________________________________________________________________

(Name)

____________________________________________________________________________________________

(Number and Street, Rural Route, or P O Box) |

(City) |

(State) |

(ZIP Code) |

|

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

|

2 |

|

C. For Direct Deposit

Payee must provide a Social Security Number or Employer Identification Number:

______________________________________ OR |

__________________________________________ |

(Social Security Number of Payee) |

(Employer Identification Number of Payee) |

________________________________________________________________________________________

(Name/Names on the Account)

Bank Routing No. (nine digits and begins with 0, 1, 2, or 3): _______________________________

_________________________________________ |

Type of Account |

(Depositor’s Account No.)

Checking

Savings

___________________________________________________ |

______________________________ |

(Financial Institution’s Name) |

(Financial Institution’s Phone No.) |

7. Signatures and Certification

I/We severally petition the Secretary of the Treasury for relief as authorized by law and, if relief is granted, acknowledge that the original securities will become the property of the United States. Upon the granting of relief, I/we assign all our right, title, and interest in the original securities to the United States and hereby bind myself/ourselves, my/our heirs, executors, administrators, successors and assigns, jointly and severally: (1) to surrender the original securities to the Department of the Treasury should they come into my/our possession; (2) to hold the United States harmless on account of any claim by any other parties having, or claiming to have, interests in these securities; and (3) upon demand by the Department of the Treasury, to indemnify unconditionally the United States and repay to the Department of the Treasury all sums of money which the Department may pay due to the redemption of these original securities, including any interest, administrative costs and penalties, and any other liability or losses incurred as a result of such redemption. I/We consent to the release of any information in this form or regarding the securities described to any party having an ownership or entitlement interest in these securities.

I/We certify, under penalty of perjury, and severally affirm and say that the securities described on this form have been lost, stolen, or destroyed, and that the information given is true to the best of my/our knowledge and belief.

Sign in ink in the presence of a notary or certifying officer and provide the requested information.

Sign

Here:___________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Sign

Here:___________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

3 |

Sign

Here:___________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. Original signature is required if a Medallion stamp is used. 3. Person(s) must sign in your presence.

I CERTIFY that _________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

|

|

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

|

(City, State) |

|

|

________________________________________________________ |

|

|

(Signature and Title of Notary or Certifying Officer) |

|

|

________________________________________________________ |

|

|

(Name of Financial Institution) |

|

|

________________________________________________________ |

|

|

(Address) |

|

|

________________________________________________________ |

|

|

(City, State, ZIP code) |

|

|

________________________________________________________ |

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION |

|

(Telephone) |

|

|

|

I CERTIFY that _________________________________________________________________________ , whose identity(ies) |

|||

|

|

(Names of Persons Who Appeared) |

|

|

|

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

||

|

|

|

(Month) |

(Year) |

|

at ___________________________________________________ and signed this form. |

|

||

|

|

(City, State) |

|

|

|

________________________________________________________ |

|

|

|

|

|

(Signature and Title of Notary or Certifying Officer) |

|

|

|

________________________________________________________ |

|

|

|

|

|

(Name of Financial Institution) |

|

|

|

________________________________________________________ |

|

|

|

|

|

(Address) |

|

|

|

________________________________________________________ |

|

|

|

|

|

(City, State, ZIP code) |

|

|

|

________________________________________________________ |

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION |

||

|

|

(Telephone) |

|

|

|

|

|

|

|

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

4 |

||

I CERTIFY that _________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

|

|

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

|

(City, State) |

|

|

________________________________________________________ |

|

|

(Signature and Title of Notary or Certifying Officer) |

|

|

________________________________________________________ |

|

|

(Name of Financial Institution) |

|

|

________________________________________________________ |

|

|

(Address) |

|

|

________________________________________________________ |

|

|

(City, State, ZIP code) |

|

|

________________________________________________________ |

SEE INSTRUCTIONS FOR ACCEPTABLE CERTIFICATION |

|

(Telephone) |

|

|

INSTRUCTIONS

IF YOU LIVE IN A DECLARED DISASTER AREA: You need to complete only parts 1, 5, 6.B. and 7. Write the word “DISASTER” on the top of the first page of the form and on the front of the envelope.

PURPOSE OF FORM – Use this form to apply for relief on account of the loss, theft, or destruction of United States Savings Bonds. "Bonds," as used on this form, refers to Savings Bonds, Savings Notes, Retirement Plan Bonds, or Individual Retirement Bonds.

WHO MAY APPLY – This form must be completed and signed by all persons named on the bonds, or by an authorized representative.

PROOF OF DEATH – If a registrant is deceased, you must submit a certified copy of his or her official death certificate with this form.

LEGAL REPRESENTATIVE – If you were appointed as legal representative because:

the owner is deceased (with no surviving coowner or beneficiary named on the bonds), or

the owner or coowner is a minor, or

the owner or coowner is incapacitated,

complete the form and submit a court certificate or certified copy of your letters of appointment, under court seal and dated within one year of submission, showing the appointment is still in full force. If your name and official capacity are shown in the registration of the bonds, evidence of your appointment is not necessary.

If no legal representative has been appointed for a deceased or incompetent owner, advise the Bureau of the Fiscal Service and additional instructions will be provided.

AMOUNT OF BONDS EXCEEDS $5,000 – If the amount of the bonds involved exceeds $5,000 and an investigation was made by a law enforcement agency or an insurance, transportation, or similar business organization, provide a copy of the report.

COMPLETION OF FORM – Print clearly in ink or type all information requested.

ITEM 1. Describe the missing bonds by bond serial number. If you don't know the bond serial numbers, you must provide the exact issue date or a range of dates, and the Social Security Number, name (including middle name or initial), and complete address (street, city, state) that appear on the bonds. Also state the total number of missing bonds. If you need more space, attach either a “Continuation Sheet for Listing Securities” (FS Form 3500), available at http://www.treasurydirect.gov/forms/sav3500.pdf or a plain sheet of paper.

ITEM 2. Mark the appropriate boxes and provide complete details of the loss, theft, or destruction.

ITEM 3. Provide details regarding your authority to complete a claim for the missing bonds. If you have been

ITEM 4. A minor (who does not have a

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

5 |

ITEM 5. Indicate whether you want substitute bonds or payment by direct deposit.

For Series EE and Series I bonds, we no longer issue substitute bonds in paper form. We issue those substitute bonds in electronic form, in our online system TreasuryDirect.

If you want substitute Series EE bonds or substitute Series I bonds, provide the TreasuryDirect account number. If you don’t have an account, you may open one at www.treasurydirect.gov.

Series EE and Series I bonds issued February 2003 and later are not eligible for payment until one full year after issue; if payment is requested and such bonds are less than one year old, substitute bonds will be issued instead.

If substitute bonds are requested and a bond is within less than one full calendar month of reaching its final maturity, or has reached final maturity, payment will be made instead.

ITEM 6. Complete either section A, B, or C. Which section is appropriate for you depends on which series of bonds you have and whether you want payment or substitute bonds.

CERTIFICATION – Each person whose signature is required must appear before and establish identification to the satisfaction of a notary or authorized certifying officer. The signatures to the form must be signed in the presence of the notary or officer. The notary or certifying officer must affix the seal or stamp which is used when certifying requests for payment. Authorized certifying officers are available at financial institutions, including credit unions, in the United States. Examples of acceptable seals and stamps:

The seal or stamp of a notary

A financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying agent seal or stamp (including name, location, and

The seal or stamp of

WHERE TO SEND – Send this form and any additional information to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN

NOTICE UNDER PRIVACY ACT AND PAPERWORK REDUCTION ACT

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 20 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV

address; send to the address shown in "WHERE TO SEND" in the Instructions.

FS Form 1048 |

Department of the Treasury | Bureau of the Fiscal Service |

6 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The form is used to claim relief for lost, stolen, or destroyed United States Savings Bonds. |

| Applicable Laws | This form operates under federal regulations governed by the Department of the Treasury. |

| Completion Requirements | All information must be printed clearly or typed. Inaccuracies can lead to prosecution. |

| Signatures | Every claimant must sign the form in the presence of a notary or certifying officer. |

| Delivery Options | Claimants can request either substitute electronic bonds or direct deposit payments. |

Guidelines on Utilizing 1048

Completing the 1048 form is straightforward if you follow a series of well-defined steps. Ensure that you have all necessary information at hand, as accuracy is crucial when claiming lost, stolen, or destroyed United States Savings Bonds. Once the form is submitted, it will be reviewed by the relevant authorities, and notification of the outcome will typically be provided afterward.

- Gather Required Information: Collect details about the missing bonds, including issue date, inscription, face amount, and bond number. If these are unknown, prepare to provide the total number of missing bonds and related personal identification details.

- Details of Loss: Indicate how the bonds were lost, stolen, or destroyed. Mark the appropriate box on the form and record any additional details such as when and where the loss occurred.

- Authority Verification: Confirm if you are named on the bonds. If not, provide a description of your authority (e.g., guardian or legal representative) to make this claim.

- Details About Minors: If any minors are named on the bonds, complete the specific section with their personal details, including name, date of birth, relationship, and living arrangements.

- Relief Requested: Specify whether you want substitute bonds or direct payment. Follow the instructions given for each type. For example, if opting for electronic bonds, provide your TreasuryDirect account information.

- Delivery Instructions: Enter delivery details, particularly if you are requesting direct deposit or paper bonds. Be ready to provide necessary banking information and ensure that names on the account match those on the form.

- Signatures and Certification: Each claimant must sign the form in front of a notary or certifying officer, who will need to complete their section to certify your identity and the date of signing.

What You Should Know About This Form

What is the purpose of Form 1048?

Form 1048 is used to apply for relief in the event that your United States Savings Bonds have been lost, stolen, or destroyed. This form ensures that you have a pathway to replace these securities and recover their value. It’s essential for anyone who needs to address issues regarding missing bonds to complete this form accurately, as it captures vital information about the missing securities and the circumstances surrounding their loss.

Who is eligible to complete Form 1048?

Anyone named on the bonds can complete and sign Form 1048. If you are not named on the bonds, you may still submit the form if you hold legal authority over the bonds, such as being a parent, guardian, or legal representative. In these cases, you will need to provide evidence of your authority, especially if there is a legal requirement to do so.

What information do I need to provide about the lost bonds?

When filling out Form 1048, you must provide as much information as possible about the missing bonds. This includes the issue date, the face amount, and bond numbers if known. If you don’t know the bond serial numbers, you should provide the names, Social Security Numbers, and addresses that appear on the bonds. Additionally, indicating the total number of missing bonds is necessary for processing your claim.

What steps should I take if the bonds were stolen?

If your bonds were stolen, you should mark the appropriate box on the form and provide detailed information about the theft. This includes the date of the theft, whether a police report was filed, and any relevant details surrounding the theft. Typically, the police report is required to support your claim for stolen bonds, so be sure to attach a copy when you submit the form.

Do I need to provide proof of death when applying for a deceased registrant's bonds?

If you are applying for the bonds of a deceased registrant, you must submit a certified copy of the official death certificate along with your application. This document serves as proof of the registrant’s death, and is crucial for the legal process of replacing the bonds, especially if there are no surviving coowners or beneficiaries.

How does Form 1048 handle cases involving minors?

When minors are involved, Form 1048 requires you to provide additional information about the minor, including their name, date of birth, and Social Security Number. If a minor is named on the bonds and is not competent to fill out the form, the custodial parent or guardian must complete the necessary sections. The minor can sign the form on their own if deemed competent by a notary public.

What options do I have for relief requested on Form 1048?

You can request either substitute bonds or payment through Form 1048. For Series EE or Series I bonds, you will receive electronic substitute bonds that will be stored in a TreasuryDirect account. If you have Series HH bonds, you may request substitute paper bonds instead. It is important to indicate your preference clearly in the relief requested section of the form.

Is there a specific process for submitting Form 1048?

When you have completed Form 1048, follow the instructions carefully for submission. If the application involves multiple individuals, each person must sign the form. In cases where the applicant lives in a declared disaster area, special instructions apply, allowing for a simpler submission process. Make sure to include any necessary attachments and the required signatures to avoid delays.

What are the potential tax implications of using Form 1048?

There are tax implications to consider when replacing lost or stolen bonds. If the name of a living co-owner is removed from the bond registration, that person must report any previously unreported interest earned on the bonds. This interest must be included in their Federal income tax return for the year the bonds are reissued. It’s advisable to consult with a tax professional if you have concerns about tax liability stemming from bond replacements.

Common mistakes

Filling out Form 1048, which is used to claim lost, stolen, or destroyed United States Savings Bonds, can be tricky. Many people unintentionally make mistakes that delay their claims or even result in denial. Understanding these common pitfalls can make the process smoother and less stressful. Here are nine common mistakes to avoid:

First and foremost, failing to provide complete and accurate information is a leading cause of issues. The form requires specific details about the bonds, including serial numbers, issue dates, and the amount. If you do not know the serial numbers, you must still provide other relevant information. Omitting any requested details can lead to significant delays.

Another frequent error is not marking the correct boxes in the loss details section. The form includes options for lost, stolen, or destroyed bonds. It's essential to clearly indicate which applies to your situation. Misunderstanding your circumstances could lead to inappropriate categorizations that complicate the claim process.

Not attaching necessary documentation also proves to be a common misstep. If the bonds were stolen, for example, including a copy of the police report can substantiate your claim. If you fail to provide this critical piece of evidence when required, your application may face delays or rejection.

Additionally, many claimants overlook the importance of signing the form in the presence of a notary. This requirement helps verify your identity and the authenticity of your claim. Neglecting this step could lead to the necessity of resubmitting the entire form.

Another mistake involves misunderstanding your authority regarding the bonds. You must clearly state if you are a co-owner or an authorized representative. If this section is incomplete, it may raise questions about your right to make a claim on behalf of the bond owner.

Failing to provide correct banking information for any direct deposit requests can lead to complications as well. Double-checking account numbers and other banking details is crucial. Providing incorrect information may result in funds being sent to the wrong account or payment delays.

Moreover, many people neglect to address any minors associated with the bonds properly. If a minor is named on the bonds, there are additional requirements to verify their relationship to you. This step often trip people up, so ensure you read the instructions thoroughly.

Another common oversight is not filing within the appropriate timeline. While it might not be explicit in the application, prompt reporting is encouraged to facilitate your claim. Delays in notifying the appropriate authorities or completing the form can complicate the claims process.

Finally, be sure to keep a copy of everything you submit. This will aid in resolving any issues that may arise as they occur. Many claimants find themselves needing proof of submission or details they have already provided, and having copies on hand can be incredibly beneficial.

Avoiding these common mistakes can make the process of claiming lost, stolen, or destroyed savings bonds far less daunting. By being meticulous and thorough, you set yourself up for a smoother and potentially quicker resolution.

Documents used along the form

The FS Form 1048 is a critical document used to claim relief for lost, stolen, or destroyed United States Savings Bonds. While this form is central to the process, several other forms and documents are often required to support the claim. Each document serves a unique purpose and helps streamline the process of recovering the value of the missing bonds.

- FS Form 3500: This form is used when additional space is needed to list the details of missing bonds. It's crucial for providing complete information, especially when the bond serial numbers are unknown.

- Police Report: If the bonds were stolen, it’s essential to file a police report. A copy must be included with the claim to substantiate that theft occurred and to demonstrate the seriousness of the loss.

- Death Certificate: In instances where the registrant of the bonds has passed away, a certified copy of the death certificate must accompany the claim. This document confirms the death and is necessary for processing claims by legal representatives.

- Authority Documentation: If someone other than the bondholder submits the claim, they must provide documents proving their authority. This can include court-appointed letters for guardianship or power of attorney documentation.

- Continuation Sheet for Listing Securities: Similar to FS Form 3500, this sheet allows users to detail multiple bonds. It ensures that all relevant information is recorded, making it easier to process the claim.

- Tax Liability Documentation: If a bondholder’s name is being removed from the bond registration, it’s important to provide IRS documentation. This helps indicate any tax implications associated with the change in ownership.

Having these forms and documents ready can significantly enhance the efficiency of your claim process. It is always advisable to read through the requirements carefully, as presenting all necessary paperwork can avoid delays and complications.

Similar forms

The FS Form 1048 is essential for individuals seeking relief for lost, stolen, or destroyed United States Savings Bonds. Several other documents serve similar purposes or share common elements in their function. Below is a list of these documents, outlining how each one is similar to the 1048 form.

- FS Form 3500: This continuation sheet is used to provide additional details when the space on the 1048 form is insufficient. Both forms request similar information about the bonds and require a clear description of the securities involved.

- FS Form 1850: This form is used for requesting a payment on matured U.S. Savings Bonds. Like the 1048, it requires personal details of the bondholder and specifics about the bonds.

- FS Form 1522: Intended for beneficiaries, this form facilitates the payment of U.S. Savings Bonds upon a bondholder's death. It shares the need to provide identification and describes the bonds in question.

- Form W-9: Used to request taxpayer identification information, this form is often required in conjunction with claims made on bond forms. It aligns with the 1048 in terms of ensuring accurate identification of the claimant.

- Form 4506-T: This form allows individuals to request a transcript of their tax records, which can be necessary when verifying identities in financial transactions, including bond claims like the 1048.

- Form 21-526EZ: This is a claim form for veterans’ benefits, including compensation for lost property. Both this and the 1048 require information validation for claims made.

- FS Form 5336: This document is for reporting the loss of a U.S. Treasury check and requires similar identification and contextual details as the 1048 form.

- IRS Form 1040: The standard federal income tax form, where individuals often report income generated from savings bonds. It parallels the 1048 in the collection of identifying details about individuals involved.

- FS Form 1379: This form pertains to the transfer of ownership of U.S. Savings Bonds. Information on both forms includes details about the parties involved and the securities in question.

Dos and Don'ts

When filling out Form 1048, which is used to claim lost, stolen, or destroyed United States Savings Bonds, there are some important dos and don’ts to keep in mind to ensure a smooth process.

- Do print clearly in ink or type all required information.

- Do provide complete and accurate descriptions of the missing bonds, including serial numbers if available.

- Do mark the appropriate boxes regarding the details of the loss, such as if the bonds were lost, stolen, or destroyed.

- Do attach copies of any relevant police reports if available, especially if bonds were stolen.

- Don't leave any sections of the form blank unless instructed to skip them.

- Don't forget to provide your authority if you are not named on the bonds, such as being a guardian or legal representative.

- Don't submit the form without signing it in the presence of a notary or certifying officer.

- Don't make false or misleading statements, as this could be treated as fraud and have serious consequences.

Following these guidelines will help you complete Form 1048 efficiently and accurately, assisting you in claiming your bonds without unnecessary delays.

Misconceptions

- Misconception 1: The 1048 form is only for lost bonds. Many people believe that the form is exclusively for bonds that have been lost. In fact, it is also used for bonds that are stolen or destroyed, addressing a range of situations.

- Misconception 2: Completing the form is simple and doesn’t require much information. Some individuals think they can fill out the form quickly without noting details. However, the process demands specific information about the bonds, including issue dates and inscriptions, making thoroughness essential.

- Misconception 3: Only the original owner can submit Form 1048. This form can be completed by a legal representative, guardian, or conservator if the original owner is unavailable or deceased, as long as they provide evidence of their authority.

- Misconception 4: Substituted bonds are automatically paper bonds. Applicants often assume that when they request substitute bonds, they will receive physical copies. However, many Series EE and Series I bonds are reissued electronically in TreasuryDirect accounts.

- Misconception 5: The loss must be reported to law enforcement. While submitting a police report can strengthen a claim for stolen bonds, it is not a strict requirement unless the loss exceeds a specific dollar amount over $5,000.

- Misconception 6: You cannot request emergency relief if living in a disaster area. Despite concerns, those in declared disaster areas are allowed to submit a simplified version of the form. It requires marking the application with the word “DISASTER” and completing only certain sections.

- Misconception 7: There’s no need to provide Social Security Numbers. Applicants may think they can avoid personal identifiers. However, social security numbers are crucial for establishing ownership and preventing fraud during the claims process.

- Misconception 8: All bonds always have the same processing rules. Many assume a one-size-fits-all approach. Different types of bonds may have unique restrictions on reissuance or payment, varying procedures that applicants need to heed.

Key takeaways

Understanding the 1048 Form: The 1048 form is used to claim lost, stolen, or destroyed United States Savings Bonds. Accurate completion of this form is essential to ensure eligibility for any relief or substitute bonds.

- Provide a detailed description of the missing bonds. Include the issue date, bond amount, and other details to facilitate processing.

- If you don't know the bond serial numbers, state all requested information and indicate how many bonds are missing.

- Specify the circumstances around the loss. Mark the appropriate boxes for lost, stolen, or destroyed, and provide details about the incident.

- Indicate whether a police report was filed. If so, include a copy of that report with your submission.

- Clarify your authority to file the claim if you are not the bondholder. This includes being a guardian, legal representative, or other authorized individual.

- Minor bondholders require special attention. If a minor is listed on the bond, provide all necessary details about the minor and the assumptions of care or guardianship.

- Clearly state your preferences for relief, whether you want substitute bonds or payment by direct deposit; ensure all relevant banking information is provided for financial transactions.

Browse Other Templates

Shoreline Transcript Order Form,Official Transcript Application,Transcript Request Form,Shoreline College Transcript Request,Official Academic Record Request,SHC Transcript Request Form,Student Transcript Order Sheet,Shoreline College Academic Transc - This form is updated periodically, so review the current version before use.

Social Security Earnings Request Form,Earnings Information Request F4,Form for Earning Details,SSA Earnings Statement Application,Request for Earnings Record,Social Security Earnings Inquiry Form,SSA Earnings Certification Application,Earnings Inform - The requester must provide their Social Security number and date of birth.