Fill Out Your 1088 Tax Form

The 1088 Tax Form is a tool designed for lenders to assess the financial health of a self-employed borrower’s business over several years. It facilitates a comparative income analysis by allowing users to track key financial metrics such as gross income, expenses, and taxable income. Gross income is calculated by taking gross receipts or sales and deducting returns and allowances. Expenses include the cost of goods sold plus total deductions. Taxable income is derived from various IRS forms based on the type of business entity—whether a sole proprietorship, partnership, S corporation, or corporation. The form requires the borrower to enter figures for each year, calculate percentage changes year-over-year, and analyze trends in these financial categories. This information can be crucial for lenders in making informed decisions about a borrower’s creditworthiness and the viability of their business.

1088 Tax Example

@) Fannie Mae

Comparative Income Analysis

Borrower Name

Company Name

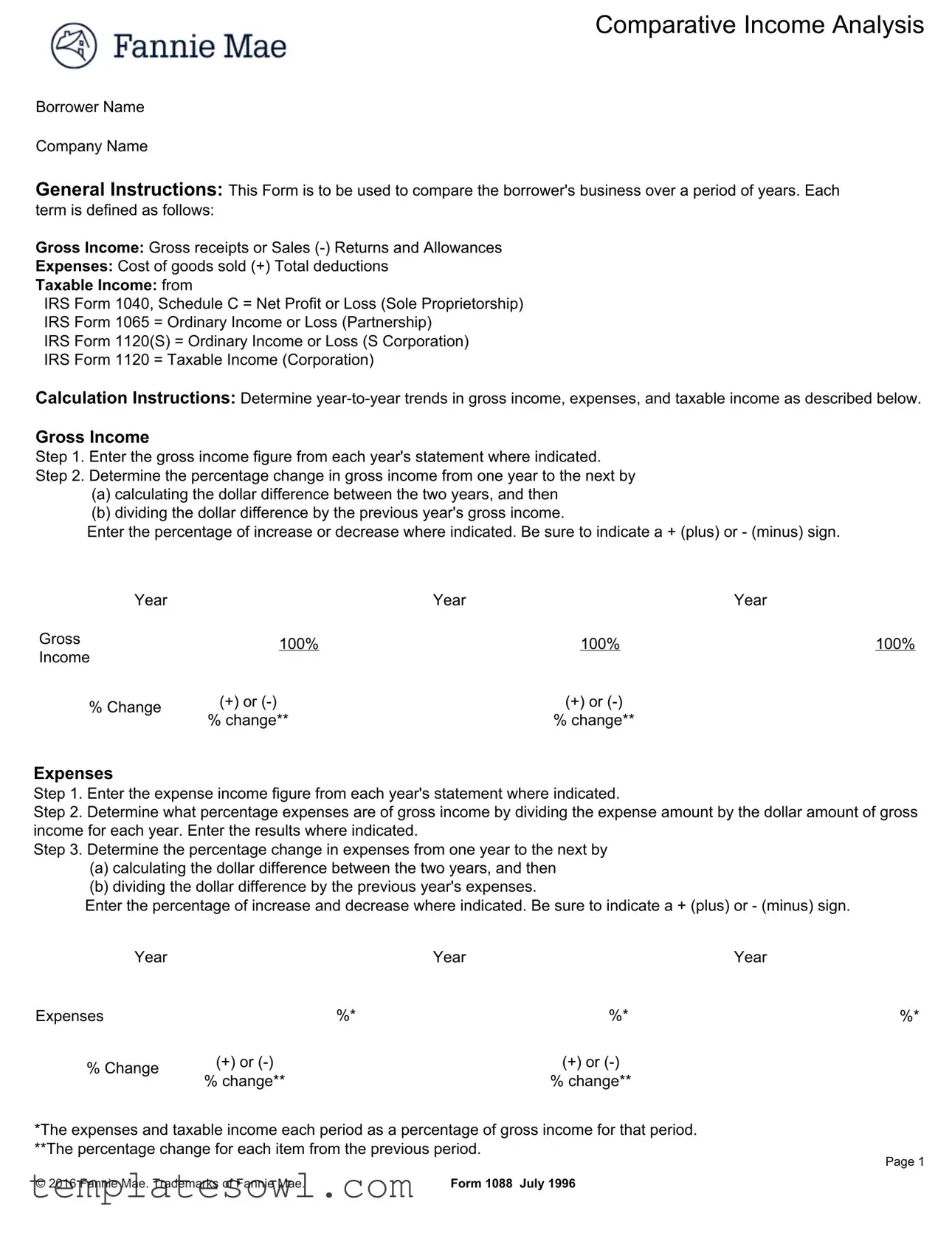

General Instructions: This Form is to be used to compare the borrower's business over a period of years. Each

term is defined as follows:

Gross Income: Gross receipts or Sales

Expenses: Cost of goods sold (+) Total deductions

Taxable Income: from

IRS Form 1040, Schedule C = Net Profit or Loss (Sole Proprietorship)

IRS Form 1065 = Ordinary Income or Loss (Partnership)

IRS Form 1120(S) = Ordinary Income or Loss (S Corporation)

IRS Form 1120 = Taxable Income (Corporation)

Calculation Instructions: Determine

Gross Income

Step 1. Enter the gross income figure from each year's statement where indicated.

Step 2. Determine the percentage change in gross income from one year to the next by

(a)calculating the dollar difference between the two years, and then

(b)dividing the dollar difference by the previous year's gross income.

Enter the percentage of increase or decrease where indicated. Be sure to indicate a + (plus) or - (minus) sign.

|

Year |

|

Year |

Year |

Gross |

|

100% |

100% |

100% |

|

|

|||

|

% Change |

(+) or |

(+) or |

. |

|

% change** I |

% change** |

|

|

|

|

|

||

Expenses

Step 1. Enter the expense income figure from each year's statement where indicated.

Step 2. Determine what percentage expenses are of gross income by dividing the expense amount by the dollar amount of gross income for each year. Enter the results where indicated.

Step 3. Determine the percentage change in expenses from one year to the next by

(a)calculating the dollar difference between the two years, and then

(b)dividing the dollar difference by the previous year's expenses.

Enter the percentage of increase and decrease where indicated. Be sure to indicate a + (plus) or - (minus) sign.

Year ~I |

Year |

I |

Year I I |

||

%* |

|||||

% Change |

(+) or |

(+) or |

|

||

% change** I |

% change** I |

I |

|||

|

|||||

*The expenses and taxable income each period as a percentage of gross income for that period. **The percentage change for each item from the previous period.

Page 1

© 2016 Fannie Mae. Trademarks of Fannie Mae. |

Form 1088 July 1996 |

Taxable Income

Step 1. Enter the taxable income figure from each year's statement where indicated.

Step 2. Determine what percentage taxable income is of gross income by dividing the dollar amount of taxable income by the dollar amount of gross income. Enter the results where indicated.

Step 3. Determine the percentage change in taxable income from one year to the next by

(a)calculating the dollar difference between the two years, and then

(b)dividing the dollar difference by the previous year's taxable income.

Enter the percentage of increase or decrease where indicated. Be sure to indicate a + (plus) or - (minus) sign.

Year ~I |

Year |

I

Year

Taxable |

|

~~I□ |

|

||||

Income |

|

|

|

%* |

|

%* |

%* |

|

|

|

~1- |

|

|

||

|

% Change |

(+) or |

(+) or |

|

|||

|

|

|

|

|

|

||

|

|

|

% change** |

|

|

% change** |

|

The Taxable Income Trend is

*The expenses and taxable income each period as a percentage of gross income for that period. **The percentage change for each item from the previous period.

Page 2

© 2016 Fannie Mae. Trademarks of Fannie Mae. |

Form 1088 July 1996 |

Instructions

Comparative Income Analysis

The lender uses this form to compare the performance of a

Copies

Original

Printing Instructions

This form must be printed on letter size paper, using portrait format. When printing this form, you may need to use the "shrink to fit" option in the Adobe Acrobat print dialogue box.

Instructions

The lender should calculate the percentage change for the borrower's gross income, expenses, and taxable income from one period to the next, covering at least a

Gross Income equals

Gross receipts (or sales) less Returns and allowances.

Expenses equal

Cost of goods sold plus Total deductions.

Taxable Income

is taken from one of the following IRS Forms:

IRS Form 1040, Schedule C = for the Net Profit or Loss for a Sole Proprietorship IRS Form 1065 = for Ordinary Income or Loss for a Partnership

IRS Form 1120(S) = for Ordinary Income or Loss for an S Corporation (a small,

Page 3

© 2016 Fannie Mae. Trademarks of Fannie Mae. |

Form 1088 July 1996 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 1088 Tax Form is designed for lenders to compare a self-employed borrower's business performance over several years. |

| Gross Income Definition | Gross income is calculated as gross receipts or sales minus any returns and allowances. This figure is essential for understanding business revenue. |

| Net Profit Sources | Taxable income can be derived from various IRS forms, depending on the type of business structure, such as IRS Form 1040, Schedule C for sole proprietorships. |

| Expense Calculation | Expenses consist of the cost of goods sold plus total deductions. It's crucial to track these to assess business sustainability and profitability. |

| Print Instructions | This form should be printed on letter-sized paper in portrait format. If necessary, use the "shrink to fit" option in your printing software. |

| Governing Law | This form adheres to IRS regulations, specifically concerning tax reporting for businesses as outlined in IRS guidelines. |

Guidelines on Utilizing 1088 Tax

Filling out the 1088 Tax form involves careful attention to your business's financial data over multiple years. You will need to gather gross income, expenses, and taxable income from your financial statements. This information will help illustrate trends in your business performance. Below are the steps to complete the form accurately.

- Gross Income:

- Enter the gross income figure for each year where indicated on the form.

- Calculate the percentage change in gross income from one year to the next. First, find the dollar difference between the two years, and then divide that number by the previous year's gross income. Record the percentage of increase or decrease, ensuring to include a + or - sign.

- Expenses:

- Input the expenses for each year as indicated on the form.

- Determine what percentage of gross income the expenses represent by dividing the expense amount by the gross income for each year. Write these results on the form.

- Calculate the percentage change in expenses for consecutive years similarly to gross income. Find the dollar difference, then divide by the previous year's expenses. Document the percentage of increase or decrease with a + or - sign.

- Taxable Income:

- Enter the taxable income figure for each year accordingly.

- Calculate the percentage of gross income that taxable income represents by dividing taxable income by gross income for each year and noting the results on the form.

- Determine the percentage change in taxable income from one year to the next by calculating the dollar difference and dividing that by the previous year's taxable income. Mark the percentage change with a + or - sign.

By following these steps, you can ensure that your 1088 Tax form provides a clear and coherent picture of your business's financial trends over the years. Accurate data entry will help in the evaluation of your company's financial viability.

What You Should Know About This Form

What is Form 1088 and why is it used?

Form 1088 is a tax form utilized primarily by lenders to analyze and compare the financial performance of a self-employed borrower’s business over a span of several years. By examining trends in gross income, expenses, and taxable income, lenders can make informed decisions about the borrower’s ability to sustain and grow their business. This form is crucial for assessing the viability of a business for loan approval or refinancing purposes.

How do I calculate Gross Income using Form 1088?

To determine gross income on Form 1088, begin by recording the gross receipts or sales for each year as indicated on your financial statements. Then, subtract any returns and allowances, which adjust your gross sales. The gross income figure is then used to analyze year-to-year performance and calculate percentage changes. This process requires a careful entry of data from financial statements for accuracy.

What types of businesses need to use Form 1088?

Form 1088 is generally used by self-employed individuals, including sole proprietors, partnerships, and corporations, particularly those who need financing. Businesses classified under IRS regulations, such as Sole Proprietorships, Partnerships, S Corporations, and traditional Corporations, would benefit from utilizing this form to provide a clear comparative analysis of their income over time.

What information do I need to complete the expense section?

In the expenses section of Form 1088, you will input costs related to the goods sold and total deductions for each year under review. Calculate the percentage expenses comprise of gross income by dividing the expense amount by gross income for that year. This will help assess how expenses are impacting overall profitability and aid in calculating any increases or decreases in expenses year over year.

How is Taxable Income determined on Form 1088?

Taxable income is determined by referencing specific IRS forms based on the business structure. For a Sole Proprietorship, utilize IRS Form 1040, Schedule C; for Partnerships, use IRS Form 1065; for S Corporations, IRS Form 1120(S); and for Corporations, IRS Form 1120. Enter the taxable income from these forms into Form 1088 to analyze your overall business profitability and calculate percentage changes over the designated period.

What does percentage change indicate in Form 1088 analysis?

Percentage change is an essential analytical tool within Form 1088 that illustrates how business performance has fluctuated over the years. It involves calculating the dollar difference between two consecutive years and then dividing that difference by the previous year's figure. Indicating whether there has been an increase or decrease allows lenders to gauge the sustainability and growth potential of the borrower’s business.

How should I format Form 1088 when printing?

Form 1088 should be printed on letter-sized paper in portrait format. While printing, it may be necessary to select the "shrink to fit" option in your print settings to ensure that all content fits appropriately on the page. Proper formatting is essential to maintain the integrity of the data entered and to facilitate its review by lenders.

What other instructions should I be aware of when using Form 1088?

It’s crucial to ensure all calculations are accurate and well-documented, as lenders will rely on the data for making financial decisions. The form demands a minimum time frame of two years for analysis to provide a productive overview of income trends. Additionally, it’s recommended to retain copies of all underlying documents for verification purposes.

Common mistakes

Filling out the 1088 Tax form can be daunting, and it’s easy to make mistakes that could affect your business evaluation. One common error is not providing consistent income figures. When looking at multiple years, ensure that the numbers you enter for gross income, expenses, and taxable income are correctly aligned by year. A mismatch can lead to an inaccurate comparison of financial performance.

Another mistake occurs when individuals fail to calculate the percentage change correctly. It’s crucial to know how to find the dollar difference between two years and then divide that by the previous year's amount. Neglecting to show a + or - sign can mislead the lender regarding your business’s financial trends. Accurate reporting is essential to present a true picture of your business's health.

Many people also overlook the importance of entering evidence of expenses. Ensure all expense figures are precise and each category is clearly labeled. The 1088 form requires you to assess expenses as a percentage of gross income. This requires careful calculations. Not doing so can create confusion about your business’s operating costs and profitability.

Additionally, entering incorrect taxable income is a frequent oversight. Use the right IRS forms as specified in the instructions. If you fail to pull the correct numbers from IRS Form 1040, 1065, 1120(S), or 1120, you risk misstating your taxable income. This mistake could affect your eligibility for loans or other financial assistance.

People may also neglect the “shrink to fit” printing option. It is important to follow the original printing instructions to ensure no information gets cut off. Printing errors can lead to incomplete submissions, which will certainly complicate things when lenders review your form.

Another common issue is not analyzing the data over the required period. The 1088 Tax form calls for at least two years of financial performance. Failing to provide comparative data over this span means lenders miss important trends in your gross income, expenses, and taxable income. They might not receive the complete picture of your business viability.

Lastly, be wary of not double-checking all entries before submission. Simple typographical errors can result in significant misunderstandings about your financial status. Take the time to review your numbers, calculations, and the overall accuracy of the provided information. Your diligence during the data entry process can offer peace of mind and clarity in evaluating your business’s financial health.

Documents used along the form

The 1088 Tax form serves as a crucial tool in assessing a business's financial health over multiple years, mainly utilized by lenders when evaluating self-employed borrowers. However, various other documents complement this form, enhancing understanding of a business's performance. Below is a list of related forms often used in conjunction with the 1088.

- IRS Form 1040, Schedule C: This form reports income or loss from a sole proprietorship. It provides insights into the net profit or loss of the business, which is essential for completing the 1088.

- IRS Form 1065: Used by partnerships, this form details the ordinary income or loss of the business. Understanding this income helps provide a clearer picture when analyzing business trends against the 1088 data.

- IRS Form 1120(S): This form is for S Corporations and reports ordinary income or loss. It aids in contextualizing the financial performance of a business structured as an S Corp, important for lenders assessing risk.

- IRS Form 1120: Corporations use this form to report taxable income. It gives vital insights into corporate earnings and tax obligations, which can impact broader financing decisions.

- Profit and Loss Statement: This internal document outlines revenues and expenses over a specific period, allowing businesses to track profitability and guide financial decisions, complementing the comparative analysis of the 1088.

- Balance Sheet: A snapshot of a company's assets, liabilities, and equity at a given time. It helps lenders assess a company's financial position alongside the income analysis from the 1088.

- Cash Flow Statement: This document tracks cash inflows and outflows, indicating a business's liquidity situation. Solid cash flow is critical for sustainability and complements the income trends shown in the 1088.

- Business Tax Returns: These may include various forms filed by the company and provide a comprehensive overview of its tax obligations, essential for understanding financial trends alongside the 1088.

- Interim Financial Statements: Often prepared between annual statements, these provide updated financial data, offering insights into recent trends that can affect the long-term analysis found in the 1088.

- Loan Application Documents: These typically include personal financial statements and business details that help lenders assess borrower eligibility and overall financial health, complementing the analysis from the 1088.

Understanding these documents is vital, as they collectively provide a fuller picture of a business’s financial health. When analyzed together, they assist both lenders and borrowers in making well-informed decisions regarding financing and business viability.

Similar forms

- IRS Form 1040, Schedule C: This form is used by sole proprietors to report income or loss from their business. Like Form 1088, it details gross income and expenses, allowing for a thorough analysis of taxable income.

- IRS Form 1065: Partnerships file this form to report ordinary income or loss. It provides similar insights into income trends and expenses, making it a valuable comparative tool like Form 1088.

- IRS Form 1120: Corporations use this form to report their taxable income. It offers a comprehensive view of a corporation's financial performance and expense management, paralleling the analysis in Form 1088.

- IRS Form 1120(S): This form is designed for S Corporations, reporting ordinary income or loss. Its structure mirrors Form 1088, focusing on income analysis over time.

- Profit and Loss Statement: Businesses prepare this document to summarize revenues and expenses. Similar to Form 1088, it helps identify trends in financial performance.

- Cash Flow Statement: This financial report details incoming and outgoing cash flows. Like Form 1088, it assesses financial health over a period of time.

- Balance Sheet: This document presents a snapshot of a business’s assets, liabilities, and equity. While it differs in function, it still contributes to a broader understanding of financial stability, akin to the analysis conducted in Form 1088.

- Financial Ratios Analysis: This process involves evaluating ratios derived from financial statements. Like Form 1088, it helps assess performance trends, offering insights into financial health.

- Business Plan Financial Projections: This document outlines forecasted income, expenses, and cash flow for future periods. Similar to Form 1088, it helps in evaluating potential business performance and viability over time.

Dos and Don'ts

Things to Do When Filling Out the 1088 Tax Form:

- Gather financial statements for the years being analyzed.

- Carefully enter gross income figures for each year.

- Calculate the percentage change in gross income accurately.

- Clearly indicate whether changes in income or expenses are increases or decreases.

- Ensure all information is printed on letter-sized paper in portrait format.

Things Not to Do When Filling Out the 1088 Tax Form:

- Do not omit any years of financial data from your analysis.

- Avoid using small print that may be difficult to read.

- Do not forget to double-check calculations for accuracy.

- Never leave percentage change fields blank.

- Avoid using the form without proper documentation to support your entries.

Misconceptions

- It's only for tax filing purposes: While the 1088 Tax form is related to income and taxes, its primary purpose is to analyze a self-employed borrower's business income over several years to assess its viability for loan approval. It’s not merely for filing taxes.

- Only corporations need to use it: This form isn't exclusive to corporations. Sole proprietorships and partnerships also utilize it. The 1088 Tax form is designed for any self-employed individual seeking a loan.

- You can skip calculating percentages: Calculating percentage changes in gross income, expenses, and taxable income is crucial. This information helps lenders understand financial trends, which influences the risk assessment of lending to the borrower.

- All years must be included on one form: It's a common misconception that all years of data must fit on a single 1088 form. In reality, the lender examines the financial data across multiple years, but not necessarily all in one place on one form.

Key takeaways

The 1088 Tax form is an essential tool for self-employed individuals and lenders alike. Below are key takeaways that highlight its importance and the process for using it effectively.

- Purpose: This form is designed to compare a borrower's business financial performance over multiple years.

- Gross Income Definition: It consists of total sales receipts minus returns and allowances.

- Expenses Clarification: These are calculated as the cost of goods sold plus total deductions.

- Taxable Income Sources: This figure is taken from IRS forms specific to the type of business, such as Form 1040, 1065, or 1120.

- Data Entry: Fill in the gross income, expenses, and taxable income figures for each relevant year.

- Percentage Changes: It is crucial to calculate and record the percentage changes in gross income, expenses, and taxable income from one year to the next.

- Clear Indication: Always note the percentage change with a plus (+) or minus (-) sign to clarify whether the figure increased or decreased.

- Two-Year Comparison: The analysis should cover a minimum of two years to spot trends effectively.

- Printer Settings: To print the form, use letter-sized paper in portrait format and consider the "shrink to fit" option.

- Financial Viability: Lenders utilize this comparative analysis to assess the borrower's business viability before making decisions.

Understanding these key points is not just beneficial but necessary for accurately filling out and utilizing the 1088 Tax form effectively. This form is a gateway to assessing a self-employed borrower's financial health, which is critical in lending decisions.

Browse Other Templates

Mls Listing Meaning - Highlight any homeowner association benefits that come with the property.

New Connection - A photograph needs to be pasted on the application form.