Fill Out Your 1099 Charles Jones Reporting Form

The 1099 Charles Jones Reporting form is an essential document specifically designed for reporting real estate transactions to the Internal Revenue Service (IRS). With its origin stemming from the Tax Reform Act of 1986, this form facilitates the compliance of reporting requirements under Section 6045(e) of the Internal Revenue Code. It is critical for applicants to accurately collect and submit necessary information related to each transaction, ensuring adherence to IRS regulations. Signature Information Solutions LLC, as the reporting service provider, plays a vital role in this process by taking on the responsibilities of transmitting information returns electronically, verifying submission details, and maintaining records for a specific duration. It is important for applicants to be mindful of deadlines and requirements throughout the year to avoid any potential penalties. Moreover, while Signature provides necessary services, it is essential to understand that they do not offer tax or accounting advice; thus, applicants remain responsible for ensuring their compliance with all applicable laws. By maintaining open communication and familiarity with the reporting process, applicants can navigate the requirements effectively and fulfill their obligations with confidence.

1099 Charles Jones Reporting Example

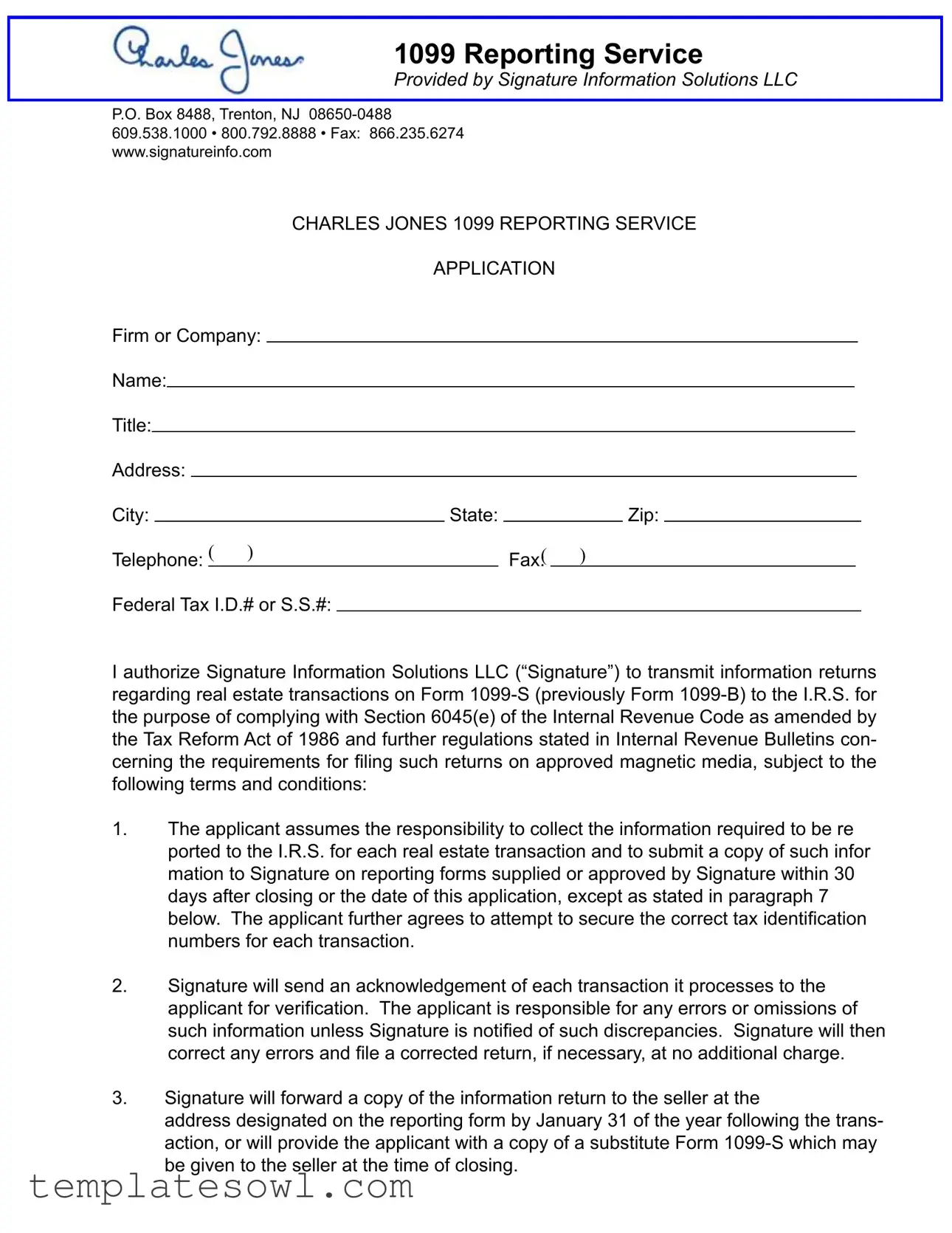

1099 Reporting Service

Provided by Signature Information Solutions LLC

P.O. Box 8488, Trenton, NJ

609.538.1000 • 800.792.8888 • Fax: 866.235.6274

www.signatureinfo.com

CHARLES JONES 1099 REPORTING SERVICE

APPLICATION

Firm or Company:

Name:

Title:

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

State: |

|

|

Zip: |

|

|

||

Telephone: |

( |

) |

|

|

Fax:( |

) |

|

|

|

||

Federal Tax I.D.# or S.S.#:

I authorize Signature Information Solutions LLC (“Signature”) to transmit information returns regarding real estate transactions on Form

the Tax Reform Act of 1986 and further regulations stated in Internal Revenue Bulletins con- cerning the requirements for iling such returns on approved magnetic media, subject to the

following terms and conditions:

1.The applicant assumes the responsibility to collect the information required to be re ported to the I.R.S. for each real estate transaction and to submit a copy of such infor

mation to Signature on reporting forms supplied or approved by Signature within 30 days after closing or the date of this application, except as stated in paragraph 7 below. The applicant further agrees to attempt to secure the correct tax identiication numbers for each transaction.

2.Signature will send an acknowledgement of each transaction it processes to the applicant for veriication. The applicant is responsible for any errors or omissions of such information unless Signature is notiied of such discrepancies. Signature will then correct any errors and ile a corrected return, if necessary, at no additional charge.

3.Signature will forward a copy of the information return to the seller at the

address designated on the reporting form by January 31 of the year following the trans- action, or will provide the applicant with a copy of a substitute Form

4.Signature will transmit on behalf of the applicant information returns to the I.R.S. on approved electronic format and will be responsible for the timely reporting of such information.

5.Signature will retain a copy of the information returns iled with the I.R.S. or the ability to reconstruct the data for four (4) years.

6.All reporting forms must be submitted to Signature within 10 days of the end of each

calendar year. Reporting forms received after this deadline may not be processed or may be subject to late charges. Signature will not be responsible for penalties or iling requirements for reporting forms received after this deadline.

7.The applicant acknowledges that the services, instructions or forms provided by Sig

nature do not represent tax or accounting advice and that the applicant is solely responsible for compliance with applicable law, except as stated herein.

8.The applicant understands that the requirements for iling information returns with the I.R.S. may change and that Signature may issue new instructions, require additional information, or change the forms required to be used.

Signed:

Dated:

Revised 02/11/2011

1099 Application

Charles Jones and Signature Information Solutions are registered trademarks of Signature Information Solutions LLC. ©2011 Signature Information Solutions LLC. All rights reserved.

Form Characteristics

| Fact Name | Description |

|---|---|

| Service Provider | Charles Jones 1099 Reporting is offered by Signature Information Solutions LLC. |

| Address | The company is located at P.O. Box 8488, Trenton, NJ 08650-0488. |

| Federal Compliance | This service complies with Section 6045(e) of the Internal Revenue Code. |

| Information Responsibility | The applicant must collect and submit necessary information within 30 days after closing. |

| Acknowledgment of Transactions | Signature will acknowledge each processed transaction for the applicant's review. |

| Annual Filing Deadline | All forms must be submitted within 10 days after the end of the calendar year. |

| Retention Period | Signature will keep copies of filed returns for four years. |

| No Tax Advice | The services provided are not considered tax or accounting advice. |

Guidelines on Utilizing 1099 Charles Jones Reporting

After you gather all the necessary information for the 1099 Charles Jones Reporting form, you’re ready to begin filling it out. Accurate completion of this form is crucial for ensuring compliance with IRS requirements. This guide will help you navigate the steps needed to complete it successfully.

- Obtain the Form: Download the 1099 Charles Jones Reporting form from the Signature Information Solutions LLC website or request a physical copy by calling their office.

- Fill in Your Information: In the designated fields, write down your firm or company's name, title, and complete address, including city, state, and zip code.

- Input Contact Details: Enter your telephone number and fax number, ensuring all digits are accurate.

- Provide Identification Numbers: Fill in your Federal Tax Identification Number or Social Security Number as applicable.

- Authorization Statement: Review the authorization statement that allows Signature to transmit information returns to the IRS. Confirm your understanding and agreement to the terms outlined.

- Sign and Date the Form: Make sure to sign and date the form at the bottom. This is crucial for confirming that you have read and accept the responsibilities stated in the document.

- Submit the Form: Send the completed form to Signature Information Solutions LLC using the provided contact information. Ensure it is sent within 30 days after closing or the date of your application, as stipulated in the agreement.

Once submitted, wait for an acknowledgment from Signature regarding the processing of your transaction. Their confirmation will help you verify that everything has been filed accurately. Always keep a copy for your records!

What You Should Know About This Form

What is the 1099 Charles Jones Reporting form?

The 1099 Charles Jones Reporting form is used to report real estate transactions to the Internal Revenue Service (IRS). Signature Information Solutions LLC manages this reporting service and ensures compliance with IRS regulations regarding these transactions.

Who needs to complete this form?

This form is typically completed by individuals or companies involved in real estate transactions. This includes real estate agents, closing agents, and sellers who must report information regarding the sale of real property to the IRS.

What information is required to complete the form?

To complete the form, applicants need to gather necessary information related to each real estate transaction. This includes identifying information for the parties involved, the details of the transaction, and the correct tax identification numbers. Applicants are responsible for collecting this data and submitting it to Signature Information Solutions LLC.

What are the deadlines for submitting information?

The applicant must submit the required information to Signature within 30 days of the transaction closing. Additionally, all reporting forms must be submitted by January 10 of the following calendar year to ensure timely processing. Late submissions may incur additional charges and may not be processed by Signature.

What happens if there is an error in the form?

If there is an error or omission in the information provided, the applicant is responsible for notifying Signature about it. Upon notification, Signature will correct the error at no additional charge and file a corrected return if necessary. Failure to inform Signature may lead to the applicant being held liable for inaccuracies.

Will Signature provide a copy of the filed form to the seller?

Yes, Signature will forward a copy of the information return to the seller by January 31 of the year following the transaction. Alternatively, Signature may provide a substitute Form 1099-S to the applicant for distribution to the seller at the time of closing.

How long will Signature keep the records?

Signature Information Solutions LLC will retain a copy of the information returns filed with the IRS or will maintain the ability to reconstruct the data for a period of four years. This retention is important for any potential audits or follow-up inquiries from the IRS.

Is the service provided by Signature considered tax advice?

No, the services, instructions, or forms provided by Signature do not constitute tax or accounting advice. The applicant remains responsible for ensuring compliance with applicable tax laws and regulations in connection with real estate transactions.

Common mistakes

Filling out the 1099 Charles Jones Reporting form can be straightforward, but several common mistakes often lead to complications. One frequent error is failing to collect correct information. Tax identification numbers or Social Security numbers must be accurate. If these numbers are incorrect, it can delay tax processing and lead to potential penalties for both the filer and the recipient.

Another significant mistake is submitting forms after the deadline. According to the guidelines, all reporting forms should be sent to Signature Information Solutions within 10 days of the year’s end. Late submissions may result in processing issues or extra fees. Staying on top of these deadlines helps avoid unnecessary complications.

Providing incomplete information also causes problems. Each field on the form is essential for accuracy and compliance. Incomplete sections can lead to incomplete filings, which can necessitate corrections and additional paperwork. Double-checking that all required information is filled in can save time and frustration later.

Additionally, misunderstanding the role of Signature Information Solutions can lead to confusion. Although Signature processes the forms, the applicant remains responsible for collecting and submitting accurate information. Always assume this responsibility, as failing to do so can lead to errors that are the applicant's liability.

Lastly, many people overlook the acknowledgment process. Signature sends a confirmation for each processed transaction. If discrepancies arise and the applicant has not reviewed these acknowledgments, errors may go unnoticed until tax time. Regularly checking for and verifying these acknowledgments is a crucial step in maintaining accurate records.

Documents used along the form

When using the 1099 Charles Jones Reporting form, there are several other forms and documents that are frequently required to complete the reporting process accurately. Below is a list of these associated documents, along with brief descriptions to provide clarity on their purposes.

- Form W-9: This form is used to request the correct name and Taxpayer Identification Number (TIN) of a vendor or contractor. It ensures that the information provided on 1099 forms is accurate and matches IRS records.

- Form 1099-S: This form reports proceeds from real estate transactions. It is essential for disclosing the sale or exchange of real property to the IRS, ensuring compliance with reporting requirements.

- Form 1040: This is the individual income tax return form. Recipients of 1099 forms must report the income received on their annual tax returns using this form.

- Form 1096: This is a summary form that accompanies certain 1099 forms when filing with the IRS. It acts as a cover sheet and summarizes the information reported on the 1099s and provides the total number of forms submitted.

These forms and documents are crucial in ensuring that both payers and payees comply with federal tax regulations. Proper completion and submission of these forms can help avoid potential penalties and ensure accurate reporting of income.

Similar forms

When considering the 1099 Charles Jones Reporting form, it's important to recognize its similarity to several other tax documents. Each of these forms serves a unique purpose in tax reporting but follows similar principles. Here is a breakdown of six documents that share similarities with the 1099 form:

- Form 1099-MISC: This form is used for reporting various types of income received other than wages, salaries, or tips. Both the 1099-MISC and the 1099 Charles Jones form require the reporting of payments made to independent contractors or service providers.

- Form 1099-K: The 1099-K is utilized for reporting payment card transactions and third-party network transactions. Similar to the 1099 Charles Jones form, it helps the IRS track income generated through payment processing methods.

- Form 1099-INT: Used for reporting interest income, the 1099-INT shares the key function of income disclosure. Both forms aim to ensure that taxpayers accurately report their income to the IRS.

- Form 1099-DIV: This form reports dividends and distributions received by investors. Like the 1099 Charles Jones form, it plays a critical role in providing the IRS with necessary taxpayer income data.

- Form 1099-R: This form is issued for distributions from retirement plans, IRAs, and pensions. It is similar to the 1099 Charles Jones form in that both require the reporting of financial transactions involving significant amounts of money.

- Form W-2: While meant for reporting wages paid to employees, the W-2 is similar in that it documents income and tax withholding, requiring submission to both the employee and the IRS, much like the 1099 forms.

In summary, while these forms cater to different transactions and income types, they collectively contribute to a comprehensive understanding of an individual or entity's financial situation, ensuring all income is reported and taxed appropriately.

Dos and Don'ts

When filling out the 1099 Charles Jones Reporting form, it is important to follow certain guidelines to ensure compliance and accuracy. Here is a list of things you should and shouldn't do:

- Do collect all necessary information for each real estate transaction.

- Do submit the reporting forms to Signature within 30 days after closing or the date of application.

- Do secure the correct tax identification numbers for each party involved in the transaction.

- Do verify the acknowledgment sent by Signature for each transaction processed.

- Do ensure all reporting forms are submitted by January 10 of the year following the transaction.

- Don't forget to provide a copy of the information return to the seller by January 31.

- Don't submit reporting forms late; doing so may incur penalties.

- Don't rely exclusively on Signature's provided materials for tax or accounting advice.

- Don't ignore any changes in filing requirements that may arise.

- Don't overlook the responsibility for correcting any inaccuracies unless Signature is notified.

By adhering to these guidelines, you can help ensure a smoother reporting process and avoid potential issues with the IRS.

Misconceptions

Understanding the 1099 Charles Jones Reporting form can pose challenges, often leading to misconceptions. Here are six common misunderstandings regarding this form:

- All real estate transactions require a 1099-S form. This is not true. Only certain types of transactions, particularly those involving the sale or exchange of real estate, need to be reported on this form. Consult the guidelines to determine applicability.

- Signature Information Solutions will automatically handle all tax errors. While Signature will correct errors when notified, the responsibility largely falls on the applicant to ensure that accurate information is provided. Failing to check details can lead to complications.

- The 1099-S form is only for property sales. This is a misconception. The form can also be applicable to certain other transactions involving real estate, depending on the specific circumstances. Always verify the criteria that necessitate its use.

- Submission deadlines can be flexible. In reality, timely submission is crucial. To avoid potential penalties or processing issues, forms must be submitted within 10 days of the end of each calendar year.

- Once submitted, the information is permanent and cannot be changed. This is incorrect. If errors are identified, Signature can file corrections without any extra charge, as long as they are notified promptly.

- Using Signature's services guarantees compliance with all tax laws. This is not the case. The applicant must understand that Signature's services do not equate to tax advice. The individual remains accountable for meeting all legal requirements.

By clearing up these misconceptions, individuals can engage with the 1099 Charles Jones Reporting form more confidently and accurately.

Key takeaways

Filling out and using the 1099 Charles Jones Reporting form is essential for compliance with tax regulations. Here are some key takeaways to keep in mind:

- Understanding Responsibility: As the applicant, you must collect the necessary information for each real estate transaction. This includes submitting all relevant data to Signature within 30 days after closing or the date of application.

- Tax Identification Numbers: Attempt to secure the correct tax identification numbers for each transaction, as this is crucial for accurate reporting.

- Verification Process: Signature will provide an acknowledgment of each transaction processed. It's your responsibility to verify this information for any errors or omissions.

- Timely Reporting: Signature is responsible for submitting the information returns to the IRS in an approved electronic format, ensuring timely reporting.

- Copies for Sellers: A copy of the information return will be sent to the seller by January 31 of the year following the transaction. Alternatively, a substitute Form 1099-S may be provided to you at closing.

- Retention of Records: Signature will retain a copy of the filed information returns or maintain the ability to reconstruct the data for four years, which can be important for future reference.

- Deadlines Matter: All reporting forms must be submitted to Signature within 10 days of the end of each calendar year. Late submissions may lead to processing issues and potential fees.

- No Tax Advice: It's important to note that the services and forms provided do not constitute tax or accounting advice. You remain solely responsible for ensuring compliance with applicable laws.

- Stay Updated: Be aware that the requirements for filing information returns may change. Signature may issue new instructions or forms, so keep yourself informed.

Browse Other Templates

Placer County Dba - Business must adhere to state and federal naming regulations.

Monthly Expenditure Tracker,Living Expense Outline,Household Financial Planner,Cost Management Worksheet,Financial Planning Spreadsheet,Monthly Spending Assessment,Home Budget Overview,Expense Reduction Checklist,Comprehensive Monthly Finance Form,Fa - This section helps evaluate spending on nourishment and dining habits.

How to Write a Treatment Plan - This resource focuses on DSM-IV™ diagnoses, aligning treatment with recognized standards in mental health care.