Fill Out Your 1100 Form

The VA Form 1100 is an important document for individuals who have incurred a debt with the Department of Veterans Affairs (VA) as part of a benefits program. This form outlines the agreement to pay back the owed amount, detailing the total indebtedness, which may include principal, interest, and any associated costs. It allows the debtor to select their repayment method, whether through monthly payments or payroll deductions. For those choosing monthly payments, the form specifies the required minimum amount and due dates, ensuring the borrower remains accountable. Meanwhile, authorization for payroll deductions gives the VA the ability to automatically deduct the agreed amount from the individual's paycheck, simplifying the repayment process. Furthermore, the form warns that should payments not be made as agreed, the VA may withhold future benefit payments until the debt is fully repaid. Properly completing the VA Form 1100 is crucial for managing one's financial obligations to the VA, enabling veterans and beneficiaries to stay informed and in control of their debts.

1100 Example

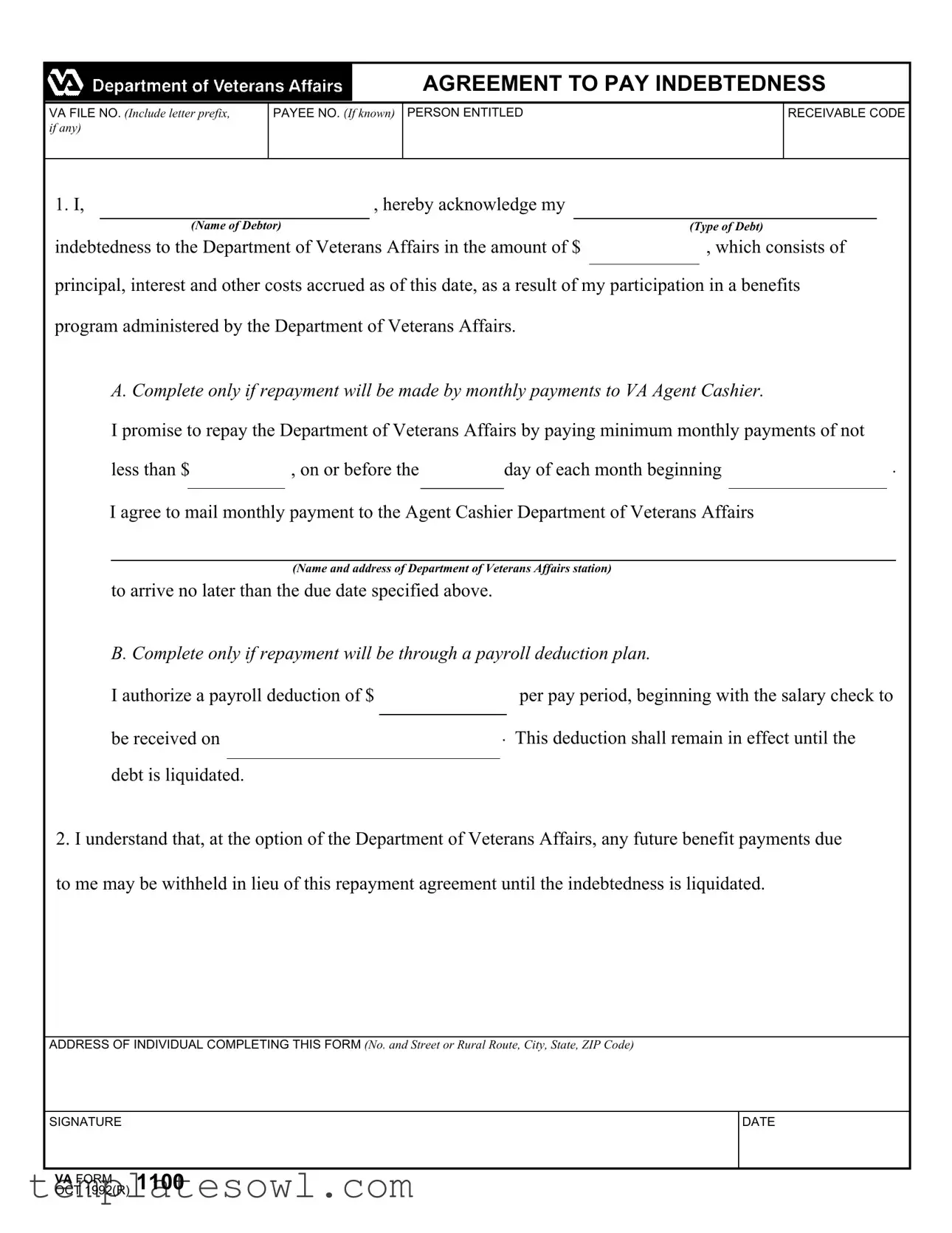

AGREEMENT TO PAY INDEBTEDNESS

VA FILE NO. (Include letter prefix, if any)

PAYEE NO. (If known) PERSON ENTITLED

RECEIVABLE CODE

1. I, |

|

, hereby acknowledge my |

|

|

|

|

|

|

|

|

(Name of Debtor) |

|

(Type of Debt) |

|

indebtedness to the Department of Veterans Affairs in the amount of $ |

, which consists of |

|||

principal, interest and other costs accrued as of this date, as a result of my participation in a benefits program administered by the Department of Veterans Affairs.

A. Complete only if repayment will be made by monthly payments to VA Agent Cashier.

I promise to repay the Department of Veterans Affairs by paying minimum monthly payments of not

less than $ , on or before the day of each month beginning. I agree to mail monthly payment to the Agent Cashier Department of Veterans Affairs

(Name and address of Department of Veterans Affairs station)

to arrive no later than the due date specified above.

B. Complete only if repayment will be through a payroll deduction plan.

I authorize a payroll deduction of $ |

|

|

per pay period, beginning with the salary check to |

|

|

|

|

|

|

be received on |

|

. This deduction shall remain in effect until the |

||

|

|

|

|

|

debt is liquidated. |

|

|

|

|

2.I understand that, at the option of the Department of Veterans Affairs, any future benefit payments due to me may be withheld in lieu of this repayment agreement until the indebtedness is liquidated.

ADDRESS OF INDIVIDUAL COMPLETING THIS FORM (No. and Street or Rural Route, City, State, ZIP Code)

SIGNATURE

VA FORM 1100 OCT 1992(R)

DATE

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The VA Form 1100 is used for acknowledging and repaying debts to the Department of Veterans Affairs. |

| Governing Law | This form is governed by federal law pertaining to the Department of Veterans Affairs. |

| Debt Acknowledgment | Debtors must acknowledge their total indebtedness, including principal and interest. |

| Payment Method | Payments can be made via monthly installments or payroll deductions, depending on the debtor's choice. |

| Monthly Payment | Debtors must specify a minimum monthly payment amount that will be made on or before a specific date. |

| Address Requirement | Individuals completing the form must provide their mailing address, including city, state, and ZIP code. |

| Authorization for Deductions | Debtors can authorize payroll deductions to repay the debt starting from their next salary payment. |

| Withholding of Benefits | The VA may withhold future benefit payments until the debt is fully repaid, as stated in the form. |

| Signature and Date | The debtor must sign and date the form to validate the agreement to repay the indebtedness. |

Guidelines on Utilizing 1100

Filling out the 1100 form is a straightforward process. This form is used to formalize an agreement with the Department of Veterans Affairs regarding repayment of a debt. After gathering the necessary information, follow these steps to complete the form accurately.

- Begin with the VA File Number. Enter any letter prefix followed by the appropriate number.

- If known, provide the Payee Number.

- Next, identify the Person Entitled and include the appropriate Receivable Code.

- In the section for Indebtedness, write your name in the designated space.

- Specify the Type of Debt you are acknowledging.

- Indicate the total amount of your debt (principal, interest, and other costs) in the provided space.

- If you are opting for monthly repayments, fill out the minimum monthly payment amount and the due date for these payments.

- Provide the name and address of the VA station where the payments should be mailed.

- If repaying through a payroll deduction plan, enter the amount per pay period and the start date for these deductions.

- Write your current address, including the street, city, state, and ZIP code.

- Sign and date the form at the bottom.

Once you complete the form, verify all information for accuracy before submitting it. Making sure that all details are correctly filled out will help prevent delays in processing your repayment agreement.

What You Should Know About This Form

What is the 1100 form?

The 1100 form, officially known as the "Agreement to Pay Indebtedness," is used by individuals who owe money to the Department of Veterans Affairs (VA). This form is crucial for acknowledging a debt, which could arise from various benefits programs that the VA administers. It outlines the terms of repayment, whether through monthly payments or payroll deductions.

Who needs to fill out the 1100 form?

This form is typically required for veterans, dependents, or beneficiaries who have accrued a debt to the VA. If you receive a notice of indebtedness from the VA, completing this form is an important step in managing your financial obligation.

What information do I need to provide on the 1100 form?

You will need to enter your name, information about the type of debt, the amount owed, and your address. Additionally, you must specify your repayment plan, whether it will involve monthly payments or payroll deductions, and provide details on the payment amount and schedule.

Can I choose how to repay the debt?

Yes, the 1100 form allows you to choose between two repayment methods. You can either schedule monthly payments sent directly to the VA or set up a payroll deduction from your paycheck. Both options offer flexibility depending on your financial situation.

What happens if I do not follow the repayment agreement?

If the repayment agreement is not honored, the VA has the option to withhold future benefit payments until the debt is fully repaid. This means it is critical to adhere to the terms outlined in the form to avoid additional financial consequences.

How do I submit the 1100 form?

The completed 1100 form should be mailed to the appropriate VA office, which is specified in the instructions on the form. Ensure that you send it to the correct address and that it is sent well before any payment due dates.

Is there a deadline for submitting the 1100 form?

While a specific deadline may not always be explicitly stated in a notice of indebtedness, it is advisable to submit the form as soon as you receive the debt notice. Timely submission ensures that you can start negotiating your repayment plan without delays.

Can I modify my repayment plan after submitting the 1100 form?

Yes, if your financial situation changes, you can reach out to the VA to request a modification of your repayment plan. It's important to communicate openly with the VA to prevent misunderstandings and ensure compliance with your repayment obligations.

What should I do if I have questions about the form or the debt?

If you have questions regarding the 1100 form or your specific debt situation, you should contact the VA directly. They have resources available to assist you and can provide guidance tailored to your needs.

Where can I find a copy of the 1100 form?

The 1100 form can typically be found on the VA’s official website or obtained from VA offices. Make sure to use the most current version to ensure your submission meets all required standards.

Common mistakes

Filling out the VA Form 1100 can be straightforward, but many people make common mistakes that can delay processing or cause complications. Understanding these mistakes can help ensure that the form is completed correctly.

One frequent error is neglecting to include the full VA file number. This number is essential for identifying your account and linking your repayment agreement to your existing records. Omitting this number may lead to confusion and significant delays.

Another mistake often seen is failing to write the full name of the debtor or leaving the debt type blank. It's crucial to provide complete information in both sections. Incomplete or incorrect entries can lead to misunderstandings about the nature of the debt.

Individuals sometimes miscalculate the total amount owed. The form requires the total of principal, interest, and other costs. Double-checking numbers to ensure accuracy can prevent complications later.

People often overlook signing the form. A signature is a vital component of the agreement. Submitting an unsigned form can result in rejection, necessitating another submission and further delays in your repayment plan.

Another common issue is not providing a specified date for the first payment. Clearly stating the payment date helps set expectations for both the debtor and the Department of Veterans Affairs. Missing this can lead to confusion regarding payment schedules.

Those opting for payroll deductions need to ensure they indicate the correct amount and start date. Incorrectly stated amounts or future dates can complicate the automatic deduction process. Always confirm with your employer to avoid any issues.

Individuals often forget to include their current address on the form. Providing accurate contact information ensures that the Department of Veterans Affairs can reach you if they need to discuss your repayment plan. A missing or incorrect address can cause delays in communication.

Finally, many people do not keep a copy of the completed form for their records. Retaining a copy can help track payments and provide necessary information if questions arise in the future. Keeping thorough records is important for managing debts effectively.

Documents used along the form

The VA Form 1100 is a crucial document outlining an agreement between a debtor and the Department of Veterans Affairs for the repayment of indebtedness. It details the terms of repayment, including the amount owed and the schedule for payments. Along with the 1100 form, there are several other important documents that may be used to clarify and support the repayment process. Below is a list of these documents.

- VA Form 28-1900: This document is used to apply for vocational rehabilitation services. It can provide essential context regarding the veteran's status and their eligibility for benefits, which may influence repayment terms.

- VA Form 555: Known as the "Authorization to Release Information," this form allows the Department of Veterans Affairs to obtain necessary financial details from other institutions that may assist in evaluating the debtor’s repayment ability.

- Credit Agreement: This document outlines the specific terms of a loan or credit line, detailing repayment obligations, interest rates, and other conditions that may impact how the debt is managed.

- Financial Statement Form: This form gathers comprehensive financial information about the debtor, including income, expenses, and assets, to assess their ability to meet payment obligations.

- Direct Deposit Authorization Form: This document allows the debtor to set up automatic payments to the Department of Veterans Affairs, streamlining the repayment process and ensuring timely payments.

Each of these forms and documents serves a unique purpose and provides valuable information that can facilitate the repayment agreement outlined in the VA Form 1100. Understanding these documents will help you manage your financial obligations more effectively.

Similar forms

The VA Form 1100, also known as the Agreement to Pay Indebtedness, shares similarities with several other documents commonly used in financial agreements and debt management. Below is a list of seven documents that have comparable purposes or structures:

- Promissory Note: This document establishes a borrower's promise to repay a specified sum of money to a lender under agreed-upon terms, including interest rates and payment schedules.

- Installment Agreement: Often used in tax situations, this document allows taxpayers to repay their debts in monthly installments, similar to the payment plan in the VA Form 1100.

- Loan Agreement: A formal contract between a borrower and a lender that outlines the terms of a loan, including repayment schedules, interest rates, and penalties for late payment.

- Debt Repayment Plan: This provides a structured approach for individuals to repay their debts over a specified period, detailing amounts due and frequency of payments.

- Consumer Credit Agreement: This agreement specifies the terms of credit extended to a consumer, including the total amount borrowed, repayment terms, and any applicable fees.

- Payroll Deduction Authorization Form: This form allows an employer to deduct specific amounts from an employee's paycheck, often used for debt repayment or other financial obligations.

- Forbearance Agreement: This document temporarily postpones the repayment of a debt, outlining the conditions under which payments will resume, thus similar to hardship considerations in debt agreements.

Dos and Don'ts

When completing the VA Form 1100, it's important to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do fill in all required fields accurately. Ensure that your information reflects your current situation.

- Do read the instructions carefully. Understanding the requirements will help you avoid mistakes.

- Do use clear and legible handwriting or type your responses. This prevents confusion and ensures readability.

- Do ensure that your payments are completed on time. Meeting deadlines is crucial for maintaining good standing.

- Do keep a copy of the completed form for your records. This serves as proof of your submission.

- Don't leave any sections blank, unless specified. Incomplete information could lead to delays in processing.

- Don't make assumptions about what is required. If unsure, seek clarification before submitting.

- Don't provide inaccurate or misleading information. This can jeopardize your agreement with the Department of Veterans Affairs.

- Don't forget to sign and date the form. An unsigned form is typically considered invalid.

Misconceptions

Many people harbor misconceptions about the VA Form 1100, an important document related to repayment agreements for debts owed to the Department of Veterans Affairs. Understanding the truth behind these misconceptions can help individuals navigate financial responsibilities more effectively. Below are some common misunderstandings regarding this form.

- The form is only for veterans. Many believe that only veterans should fill out this form. However, it can also be utilized by dependents or others eligible for benefits associated with veterans.

- Completing the form is not necessary. Some think they can skip this form if they know they owe money. In reality, submitting the VA Form 1100 is crucial for establishing a formal repayment agreement.

- Monthly payments can be arbitrary. People often think they can choose any amount to repay each month. The form requires setting a minimum monthly payment, which must be adhered to.

- Paying off the debt cancels my benefits permanently. There is a misconception that repaying the debt means losing all associated benefits. In truth, fulfilling repayment obligations often allows for continued access to benefits.

- Payroll deductions are the only payment option. Many assume that they can only repay through payroll deductions. In fact, individuals have the option to make monthly payments through various methods, including mailing checks.

- The form only impacts future benefit payments. There is a belief that only future benefits are affected by establishing this agreement. However, it can also impact current eligibility until debts are resolved.

- It’s a complicated process. Some people feel overwhelmed by the thought of filling out the form. However, it is straightforward and meant to simplify the repayment process.

- Once submitted, the payment plan cannot change. Lastly, many think that once the form is submitted, they are locked into that payment plan. Changes can be made, but they must be communicated to the VA appropriately.

Understanding these misconceptions can empower individuals to take informed steps in managing their debts responsibly. Clarifying these points ensures that those engaged with the Department of Veterans Affairs can navigate their financial obligations with confidence.

Key takeaways

Here are some important points to keep in mind about filling out and using the 1100 form related to repayment of indebtedness to the Department of Veterans Affairs:

- Identify the debt: Begin by clearly stating the type of debt and the total amount owed. Include any relevant details to avoid confusion later.

- Choose your repayment method: Decide whether you will repay the debt through monthly payments or payroll deductions. Your choice will determine the sections you need to complete.

- Complete payment details: If opting for monthly payments, specify the minimum amount and the schedule by which payments will be made. This ensures clarity and helps you stay on track.

- Keep the VA informed: Provide the correct address of the Department of Veterans Affairs where payments should be sent. Errors in this information could lead to delays.

- Understand the consequences: Recognize that the VA can withhold future benefit payments until your debt is cleared. This is crucial to understanding your obligations.

- Sign and date the form: Remember to sign the form to confirm your agreement and date it for reference. This step is vital for the documentation process.

- Submit the form promptly: After completing all sections, submit the form without delay to avoid any potential issues with your repayments.

By keeping these takeaways in mind, you can effectively manage your repayment agreement and stay informed about your obligations. If you have any questions during the process, don’t hesitate to seek guidance.

Browse Other Templates

Hyundai Mpg Reimbursement - Make sure to attach any necessary proof documents when submitting the form.

Free Salon Chemical Release Form - Potential risks are documented to ensure full client awareness.