Fill Out Your 1120 Schedule G Form

The 1120 Schedule G form serves a crucial role in reporting the ownership of voting stock in a corporation, requiring the disclosure of certain entities, individuals, and estates. Corporations subjected to this form must provide detailed information about any entity owning at least 20% of their voting stock or any entity that has control over 50% of the voting power, either directly or indirectly. This includes various types of organizations such as partnerships, corporations, trusts, and tax-exempt entities. The first part of the form requires corporations to disclose the names, Employer Identification Numbers (EINs), types of entities, countries of organization, and the precise percentage of voting stock held by each qualifying entity. The second part focuses on individuals and estates, capturing similar details, including the individual's or estate’s taxpayer identification number, country of citizenship, and the percentage of stock owned. Important rules regarding constructive ownership also apply, ensuring that the ownership stakes of family members and associated entities are factored into the calculations. Understanding this form is essential for compliance and accurate reporting within the U.S. tax system.

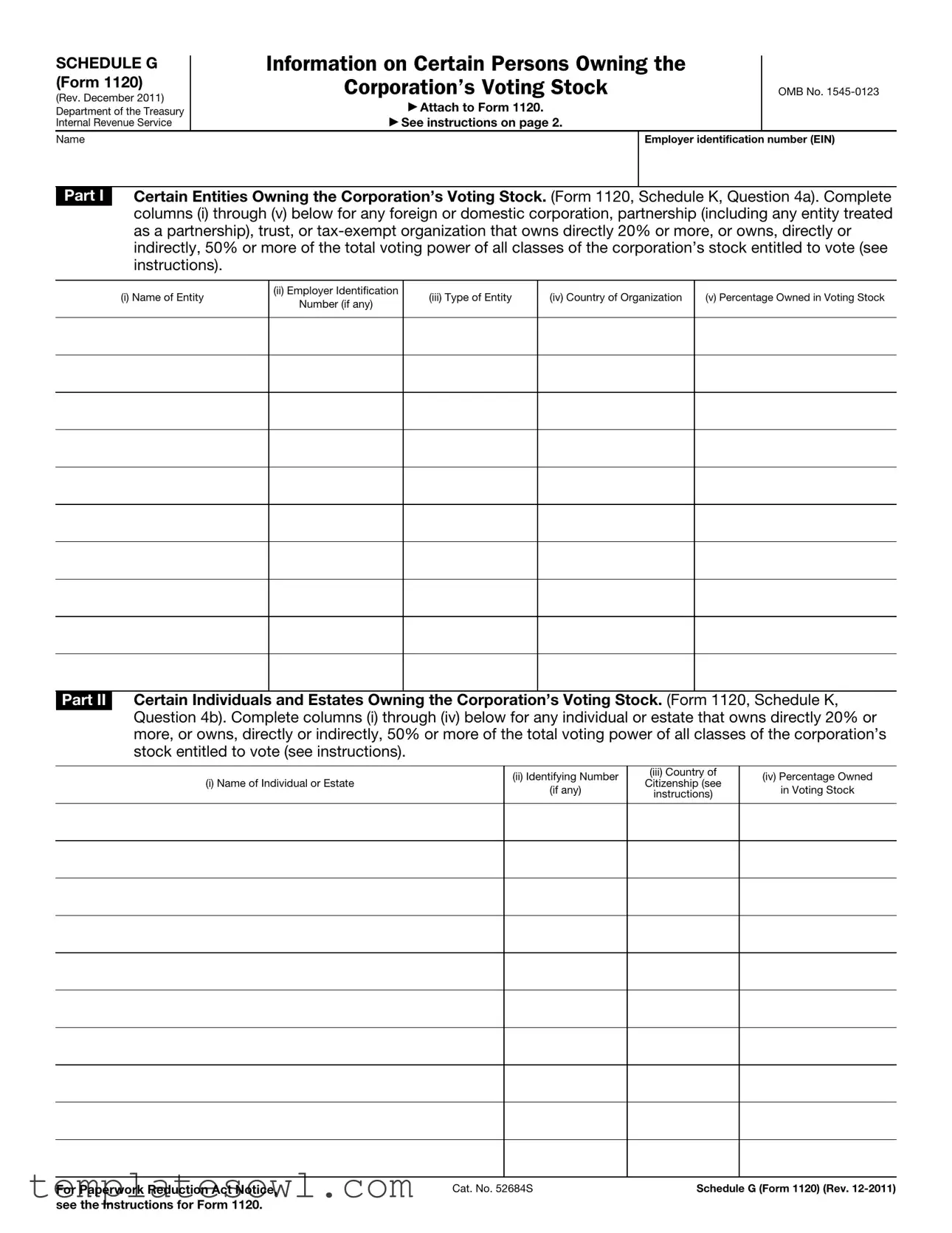

1120 Schedule G Example

SCHEDULE G |

Information on Certain Persons Owning the |

|

||

(Form 1120) |

Corporation’s Voting Stock |

|

OMB No. |

|

(Rev. December 2011) |

|

|||

▶ Attach to Form 1120. |

|

|

||

Department of the Treasury |

|

|

||

|

|

|

||

Internal Revenue Service |

▶ See instructions on page 2. |

|

|

|

Name |

|

Employer identification number (EIN) |

||

|

|

|

|

|

Part I Certain Entities Owning the Corporation’s Voting Stock. (Form 1120, Schedule K, Question 4a). Complete columns (i) through (v) below for any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or

(i) Name of Entity

(ii)Employer Identification Number (if any)

(iii) Type of Entity

(iv) Country of Organization

(v) Percentage Owned in Voting Stock

Part II Certain Individuals and Estates Owning the Corporation’s Voting Stock. (Form 1120, Schedule K, Question 4b). Complete columns (i) through (iv) below for any individual or estate that owns directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote (see instructions).

(i) Name of Individual or Estate

(ii)Identifying Number (if any)

(iii)Country of Citizenship (see

instructions)

(iv)Percentage Owned in Voting Stock

For Paperwork Reduction Act Notice, |

Cat. No. 52684S |

Schedule G (Form 1120) (Rev. |

see the Instructions for Form 1120. |

|

|

Schedule G (Form 1120) (Rev. |

Page 2 |

|

|

General Instructions

Purpose of Form

Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote.

Who Must File

Every corporation that answers “Yes” to Form 1120, Schedule K, Questions 4a or 4b, must file Schedule G to provide the additional information requested for certain entities, individuals, and estates owning the corporation’s voting stock.

Constructive Ownership of the Corporation

For purposes of Schedule G (Form 1120), the constructive ownership rules of section 267(c) (excluding section 267(c)(3)) apply to ownership of interests in corporate stock and ownership of interests in the profit, loss, or capital of a partnership. An interest in the corporation owned directly or indirectly by or for another entity (corporation, partnership, estate, or trust) is considered to be owned proportionately by the owners (shareholders, partners, or beneficiaries) of the owning entity. Also, under section 267(c), an individual is considered to own an interest owned directly or indirectly by or for his or her family. The family of an individual includes only that individual’s spouse, brothers, sisters, ancestors, and lineal descendants.

An interest will be attributed from an individual under the family attribution rules only if the person to whom the interest is attributed owns a direct or an indirect interest in the corporation under section 267(c)(1) or (5). However, for purposes of these instructions, an individual will not be considered to own, under section 267(c)(2), an interest in the corporation owned, directly or indirectly, by a family member unless the individual also owns an interest in the corporation either directly or indirectly through a corporation, partnership or trust.

Example 1. Corporation A owns, directly, a 50% interest in the profit, loss, or capital of Partnership B. Corporation A also owns, directly, a 15% interest in the profit, loss, or capital of Partnership C and owns, directly, 15% of the voting stock of Corporation D. Partnership B owns, directly, a 70% interest in the profit, loss, or capital of Partnership C and owns, directly, 70% of the voting stock of Corporation D. Corporation A owns, indirectly, through Partnership B, a 35% interest (50% of 70%) in the profit, loss, or capital of Partnership C and owns, indirectly, 35% of the voting stock of Corporation D. Corporation A owns, directly or indirectly, a 50% interest in the profit, loss, or capital of Partnership C

(15% directly and 35% indirectly), and owns, directly or indirectly, 50% of the voting stock of Corporation D (15% directly and 35% indirectly).

Corporation D reports in Part I that its voting stock is owned, directly or indirectly, 50% by Corporation A and is owned, directly, 70% by Partnership B.

Example 2. A owns, directly, 50% of the voting stock of Corporation X. B, the daughter of A, does not own, directly, any interest in Corporation X and does not own, indirectly, any interest in Corporation X through any entity (corporation, partnership, trust, or estate). Therefore, the family attribution rules do not apply and, for the purposes of Part II, the 50% interest of A in Corporation X is not attributed to B.

Example 3. A owns, directly, 50% of the voting stock of Corporation X. B, the daughter of A, does not own, directly, any interest in X but does own, indirectly, 10% of the voting stock of Corporation X through Trust T of which she is the sole beneficiary. No other family member of A or B owns, directly, any interest in Corporation X nor does any own, indirectly, any interest in Corporation X through any entity. Neither A nor B owns any other interest in Corporation X through any entity.

For the purposes of Part II, the 50% interest of A in the voting stock of Corporation X is attributed to B and the 10% interest of B in the voting stock of Corporation X is attributed to A. A owns, directly or indirectly, 60% of the voting stock of Corporation X, 50% directly and 10% indirectly through B. B owns, directly or indirectly, 60% of the voting stock of Corporation X (50% indirectly through A and 10% indirectly through Trust T).

Specific Instructions

Part I

Complete Part I if the corporation answered “Yes” to Form 1120, Schedule K, Question 4a. List each foreign or domestic corporation, partnership, trust, or tax- exempt organization that owns, at the end of the tax year, directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation’s stock entitled to vote. Indicate the name of the entity, employer identification number (if any), type of entity (corporation, partnership, trust, or tax- exempt organization), country of organization, and the percentage owned, directly or indirectly, of the voting stock of the corporation.

For an affiliated group filing a consolidated tax return, list the parent corporation rather than the subsidiary members. List the entity owner of a disregarded entity rather than the disregarded entity. If the owner of a disregarded entity is an individual rather than an entity, list the individual in Part II.

Part II

Complete Part II if the corporation answered “Yes” to Form 1120, Schedule K, Question 4b. List each individual or estate that owns, at the end of the tax year, directly 20% or more, or owns, directly or indirectly, 50% or more, of the total voting power of all classes of the corporation’s stock entitled to vote. Indicate the name of the individual or estate, taxpayer identification number (if any), country of citizenship (for an estate, the citizenship of the decedent), and the percentage owned, directly or indirectly, of the voting stock of the corporation.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Schedule G | Schedule G is used to disclose ownership information concerning entities, individuals, and estates that hold significant voting stock in a corporation. |

| Ownership Threshold | It must be completed if any entity, individual, or estate owns directly 20% or more, or indirectly 50% or more, of the corporation’s total voting power. |

| Who Must File | Every corporation that answers "Yes" to specific questions on Form 1120, Schedule K, is required to file Schedule G. |

| Filing Instructions | Schedule G should be attached to Form 1120. Detailed instructions are provided on its second page for accurate completion. |

| Constructive Ownership Rules | The rules from section 267(c) regarding constructive ownership apply. This means ownership can extend through family or corporate entities. |

| Part I vs. Part II | Part I is for entities such as corporations or partnerships, while Part II focuses on individuals and estates owning the voting stock. |

| Source of Legal Requirement | The provisions governing the filing of Schedule G are outlined in the Internal Revenue Code (IRC), particularly involving corporate ownership disclosures. |

Guidelines on Utilizing 1120 Schedule G

Completing Schedule G of Form 1120 is a necessary step for corporations that meet specific ownership criteria, especially those answering affirmatively to Form 1120 Schedule K questions 4a or 4b. The following steps will guide you through filling out this form accurately.

- Obtain the Form: Download Schedule G from the IRS website or access it through your tax software.

- Enter Basic Information: At the top of the form, input the corporation’s name and employer identification number (EIN).

- Complete Part I: This section is for entities owning the corporation's voting stock. If applicable, provide the following information for each qualifying entity:

- Name of Entity

- Employer Identification Number (if any)

- Type of Entity (corporation, partnership, trust, or tax-exempt organization)

- Country of Organization

- Percentage Owned in Voting Stock

- Complete Part II: Use this section if individual persons or estates own the corporation's voting stock. Fill in the following for each person or estate:

- Name of Individual or Estate

- Identifying Number (if any)

- Country of Citizenship (for estates, use the citizenship of the decedent)

- Percentage Owned in Voting Stock

- Proofread the Information: Double-check the entries for accuracy and completeness to avoid potential issues with processing.

- Attach the Form: Include Schedule G with your completed Form 1120 when filing with the IRS.

Once the form is filled out and attached, review it one last time to ensure everything is accurate. Next, submit the completed Form 1120 and all required schedules to the IRS by the filing deadline. Stay informed of any potential updates to forms or filing requirements in future years.

What You Should Know About This Form

What is Schedule G on Form 1120?

Schedule G is a form used by corporations to provide information about certain entities and individuals that own a significant portion of the corporation’s voting stock. It is part of the Form 1120, which is the U.S. Corporation Income Tax Return. Specifically, it captures details about those who own 20% or more, or directly or indirectly 50% or more, of the total voting power of the corporation.

Who needs to file Schedule G?

Every corporation that answers “Yes” to specific questions on Form 1120, Schedule K (Questions 4a or 4b), must file Schedule G. This requirement applies if certain entities, individuals, or estates own the voting stock in the corporation as described.

What information is required in Part I of Schedule G?

Part I focuses on entities such as corporations, partnerships, trusts, and tax-exempt organizations. Corporations must list each entity that owns at least 20% of their voting stock directly or at least 50% indirectly. The required information includes the entity’s name, the Employer Identification Number (EIN), type of entity, country of organization, and the percentage of voting stock owned.

What information is required in Part II of Schedule G?

Part II is dedicated to individuals and estates. Corporations must specify individuals or estates that own 20% or more of the voting stock directly or 50% or more indirectly. Essential details include the individual’s name or estate name, their taxpayer identification number, the country of citizenship, and the percentage of voting stock owned.

What are “constructive ownership” rules?

Constructive ownership rules refer to how ownership can be attributed through various familial or business structures. For example, if a person owns stock indirectly through a family member or entity, that stock may still count as ownership under these rules. The specifics are outlined in section 267(c), with certain exceptions depending on relationship and ownership structure.

What if a corporation is part of an affiliated group?

When filing, if a corporation is part of an affiliated group and is using a consolidated tax return, it should only list the parent corporation in Part I instead of including its subsidiary members. This focuses the reporting on the controlling entity rather than the smaller parts of the group.

Can an individual’s family ownership affect how they report their interests?

Yes, an individual’s family relationships can affect how ownership is reported. Under the family attribution rules, an individual can be considered to own shares owned by their family members if certain conditions are met. This means, if one family member has a significant ownership stake, it could potentially impact the reporting for the whole family.

What happens if there are changes in ownership during the tax year?

If there are changes in ownership during the tax year, corporations must reflect these in their reporting. It is important to report the ownership as it stands at the end of the tax year, ensuring accurate and up-to-date information is provided on Schedule G.

Is there a deadline for filing Schedule G?

Schedule G must be filed along with Form 1120 by the tax deadline for the corporation. Generally, this means the filing is due on the 15th day of the 4th month after the end of the corporation’s tax year. If there are any extensions or changes in deadlines, corporations should account for those when preparing their tax forms.

Where can one find the instructions for completing Schedule G?

The instructions for Schedule G can typically be found on the IRS website or within the Form 1120 instructions booklet. It is essential to review these instructions carefully to ensure all reporting requirements are met properly.

Common mistakes

When completing the 1120 Schedule G form, certain mistakes frequently occur that can lead to complications. One common error is failing to identify all relevant entities and individuals. If a corporation has foreign or domestic partners or shareholders owning 20% or more, this information must be accurately reported. Not listing such entities can trigger questions from the IRS and potentially lead to fines.

Another significant mistake is neglecting to include the Employer Identification Numbers (EIN) of the identified entities. Providing this information helps verify ownership and ensures smooth processing. Omitting the EIN can cause delays and may result in requests for additional documentation.

Providing incorrect ownership percentages is also a prevalent issue. Individuals and entities must disclose their exact ownership stake in a corporation’s voting stock. Miscalculating these percentages can lead to inaccuracies in reporting and potential compliance issues with tax authorities.

People often misinterpret the requirements for listing individuals and estates. Many fail to recognize that any individual owning 20% or more, either directly or indirectly, needs to be listed in Part II. Skipping this step creates a misleading picture of ownership and could attract scrutiny.

Some filers confuse where to list entities versus individuals on the form. Part I is explicitly for entities like corporations and partnerships, while Part II is designated for individuals and estates. Mixing these up results in an incomplete and incorrect form submission.

Failure to correctly identify the type of entity can occur as well. Each entity must be classified accurately—whether it’s a corporation, partnership, trust, or tax-exempt organization. Incorrect classifications can lead to misinterpretations of ownership structures and regulatory obligations.

Another common mistake involves not providing the country of organization or citizenship for the individuals listed. This information is mandatory for compliance and lack of attention to this detail can hinder processing and accuracy checks.

Many filers overlook the implications of constructive ownership rules. Understanding how ownership can be attributed among family members and through business entities is vital. Not applying these rules correctly can distort reported ownership structures.

Lastly, some filers forget to check the integrity of the information before submission. Mistakes or inaccuracies, no matter how minor, can lead to significant delays or issues with the IRS. Taking the time to review and confirm every detail can prevent unnecessary complications in the future.

Documents used along the form

The Schedule G form is an important component of the corporate tax filing process. Alongside this form, several other documents may be required to ensure a comprehensive submission of the corporation's tax information. Below are some common forms and documents that are frequently associated with Form 1120 Schedule G.

- Form 1120: This is the U.S. Corporation Income Tax Return. Corporations must file this form annually to report income, gains, losses, deductions, and credits, ultimately calculating their tax liability.

- Schedule K (Form 1120): This schedule requires corporations to report information about their shareholders, including ownership percentages. It is essential for ensuring compliance with ownership disclosure requirements.

- Form 5472: This form is required for reporting transactions between a foreign corporation and a U.S. corporation that is 25% foreign-owned. It helps the IRS track international investments and income.

- Form 4562: This form provides information on depreciation and amortization of assets. Corporations use it to claim deduction for the decrease in value of their assets over time, impacting their taxable income.

- Form 941: This form reports employment taxes. Corporations that have employees must file it quarterly to report wages paid and taxes withheld from employees' paychecks.

- Schedule M-1 (Form 1120): This schedule reconciles book income and taxable income. It explains the differences between financial accounting income and tax income, aiding in a clear understanding of tax obligations.

Being aware of these documents can streamline the tax filing process. Having all necessary forms prepared and accurately completed will facilitate compliance and help avoid complications with the IRS. Consider consulting with a tax professional if you have questions or need assistance with your filings.

Similar forms

The 1120 Schedule G form is designed to provide important information about certain individuals and entities that own voting stock in a corporation. Its function resembles several other tax-related documents, each serving a unique yet similar purpose. Below is a list of ten documents that share characteristics with the 1120 Schedule G, explaining how they are similar.

- Form 1120 - The primary corporate income tax return form that requires corporations to report their income, gains, losses, deductions, and credits. Schedule G supplements this form by detailing who owns the voting stock.

- Schedule K (Form 1120) - This schedule provides a summary of shareholders' and partners' ownership interests. Schedule G expands on this by focusing specifically on those with significant ownership, enhancing transparency.

- Form 1065 - Partnership tax return form that reports income, deductions, and credits. Just as Schedule G lists owners of stock, Form 1065 identifies partners in a partnership, emphasizing ownership structure.

- Schedule K-1 (Form 1065) - A document that reports each partner's share of income and ownership. Like Schedule G, it details ownership interests, though specific to partnerships rather than corporations.

- Form 5471 - This form provides information on foreign corporations owned by U.S. taxpayers. It contains detailed ownership information similar to Schedule G but focuses on foreign entities.

- Form 1120S - The income tax return for S corporations, which also includes information on shareholders. Schedule G parallels this by identifying significant stakeholders in a corporate structure.

- Form 990 - This is used by tax-exempt organizations to report their information. Schedule G serves a similar purpose for corporations by disclosing ownership information, ensuring accountability.

- Form 1040, Schedule C - This form allows sole proprietors to report their business income. Both documents emphasize ownership interests, though Schedule C focuses on individual business operations rather than corporate stock.

- Form 8865 - This form is for U.S. taxpayers reporting on controlled foreign partnerships. Like Schedule G, it provides clarity regarding ownership stakes in complex ownership situations.

- Schedule A (Form 990) - Part of the 990 form that reports on contributions and grants. It similarly seeks to clarify financial relationships within organizations, akin to the ownership details required in Schedule G.

Each of these forms and schedules helps paint a broader picture of ownership and financial structure within various entities, enhancing the understanding of tax compliance and governance.

Dos and Don'ts

When filling out the 1120 Schedule G form, attention to detail is crucial. Here’s a straightforward guide to the dos and don’ts.

- Do ensure you attach the form to your main tax return, Form 1120.

- Do complete all required columns for entities and individuals owning the corporation’s voting stock.

- Do accurately report the percentage ownership of each entity listed.

- Do verify that the information provided matches your own records and any previous filings.

- Do include each entity and individual that meets the ownership criteria outlined in the instructions.

- Don't leave any required fields blank; incomplete submissions can lead to processing delays.

- Don't use outdated information from previous tax years; always update to reflect the current tax year.

- Don't mix up entities and individuals; keep their information distinct and correctly categorized.

- Don't ignore the country of organization or citizenship; this detail is necessary for proper reporting.

- Don't forget to review the instructions for specific guidelines on how to report certain ownership structures.

Misconceptions

Misconceptions about the Schedule G form for Form 1120 can lead to confusion and errors during tax filing. Here are ten common misconceptions along with their clarifications.

- Only large corporations need to file Schedule G. This is incorrect. Any corporation answering “Yes” to Schedule K, Questions 4a or 4b, must file Schedule G, regardless of size.

- Schedule G is only about foreign entities. In fact, Schedule G requires disclosure of both foreign and domestic entities or individuals owning significant shares of the corporation.

- You do not need to report subsidiaries. When filing, do include any foreign or domestic corporations that own a significant percentage of voting stock, even if they are subsidiaries.

- Only stockholders must be listed. Schedule G requires information about both entities and individuals who meet the ownership criteria, including estates.

- It is enough to report only direct owners. Schedule G requires reporting both direct and indirect ownership when it meets the specified thresholds.

- You can ignore family relationships in ownership disclosures. Family members may have their ownership attributed to one another under the constructive ownership rules, impacting who should be reported.

- Once filed, Schedule G does not need to be updated. Schedule G must be updated annually to reflect any changes in ownership percentages or entities.

- Schedule G information is only important for tax liability. This form also plays a critical role in compliance with various regulatory requirements concerning ownership disclosures.

- Tax-exempt organizations do not need to be reported. Any tax-exempt organization that owns a significant portion of the corporation’s stock must be disclosed on Schedule G.

- Filing Schedule G is optional. If a corporation is required to answer “Yes” to the relevant questions on Form 1120, failing to file Schedule G can result in penalties.

Understanding and addressing these misconceptions is essential for ensuring accurate and compliant tax filings. Proper disclosure on Schedule G helps maintain transparency and meet regulatory obligations.

Key takeaways

Understanding the 1120 Schedule G form is crucial for corporations reporting specific ownership information. Here are five key takeaways:

- Filing Requirement: Corporations must file Schedule G if they answer "Yes" to Schedule K questions 4a or 4b on Form 1120. This is necessary for those with certain entities or individuals holding significant voting power.

- Ownership Thresholds: You will need to report any entity or individual that owns 20% or more directly, or 50% or more directly or indirectly, of the corporation's voting stock. Be thorough in your ownership assessments.

- Detailing Entities: In Part I, you must provide details for entities, including name, employer identification number, type, country of organization, and voting percentage. Make sure this information is complete and accurate.

- Reporting Individuals: Part II focuses on individuals and estates. You have to list significant individuals or estates, their identification numbers if available, their country of citizenship, and the percentage of voting stock owned.

- Constructive Ownership Rules: The form follows specific constructive ownership rules. Learn how interests can be attributed within families or entities. This may affect reporting and must be factored into your ownership calculations.

Browse Other Templates

Af Imt 2519 - Documentation rituals like this form support overall operational security.

Fake Insurance Cards - This card supports your compliance with state insurance laws.