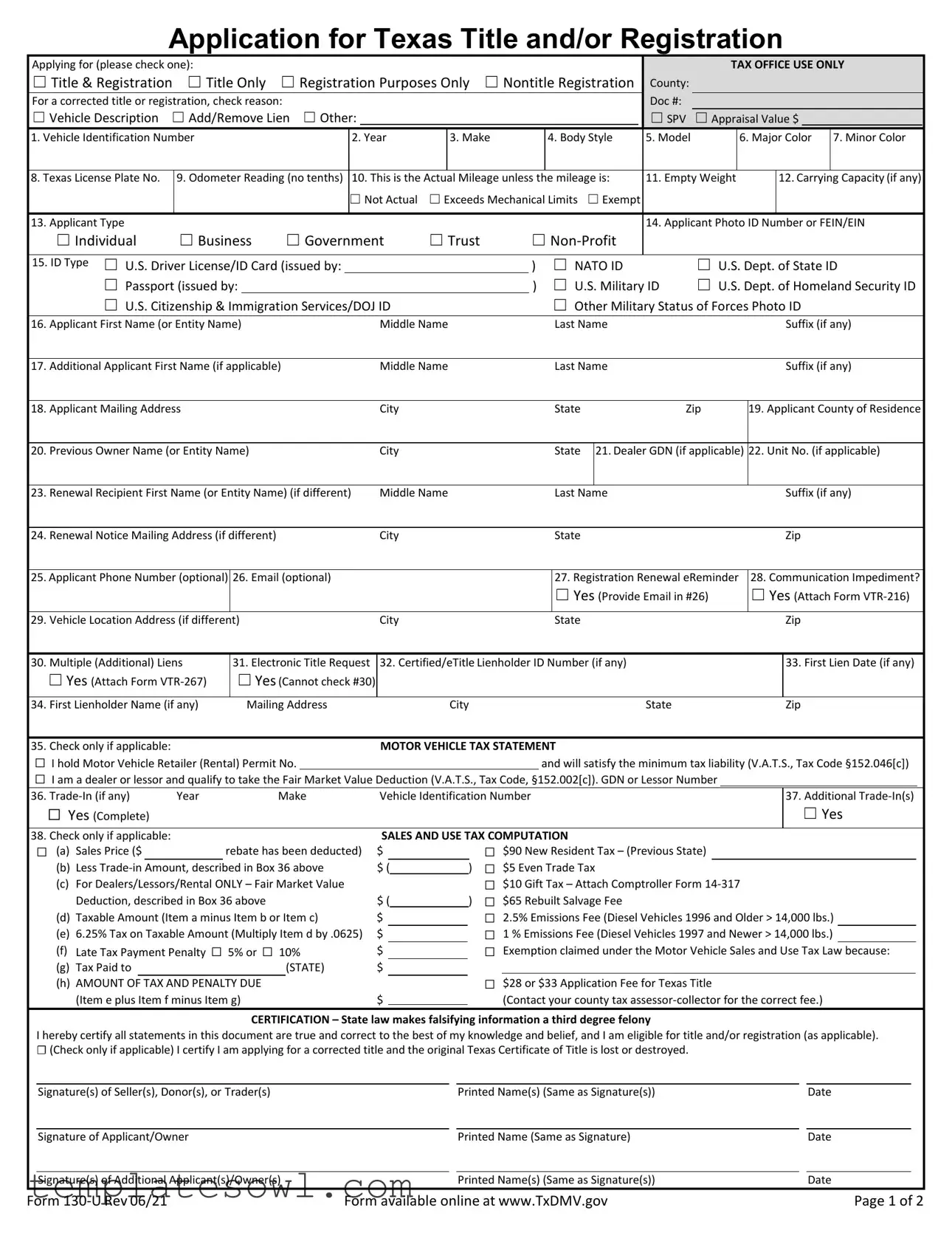

Fill Out Your 130U Form

The 130U form is an essential document for vehicle owners in Texas, as it serves as the application for a title and/or vehicle registration. This form must be filled out and submitted to your local county tax assessor-collector when making important changes to your vehicle’s title or registration status. In addition to initiating a new title and registration, the form can also be used for various purposes such as correcting an existing title, registering a vehicle without obtaining a title, or completing a transfer of ownership. Key aspects of the form include detailed sections for providing the vehicle’s information, such as its identification number, make, model, and odometer reading. Applicants are also required to share their personal information, including name, mailing address, and an identification type that will verify their identity. Further, the 130U form addresses tax liabilities that may arise from the title or registration process, outlining potential fees, including sales and use taxes, as well as penalties for late submissions. This comprehensive nature ensures that both vehicle owners and the state can accurately document the ownership and legal standing of vehicles, contributing to a more organized vehicle registration system in Texas.

130U Example

Application for Texas Title and/or Registration

Applying for (please check one): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX OFFICE USE ONLY |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

☐ Title & Registration |

☐ Title Only |

☐ Registration Purposes Only |

☐ Nontitle Registration |

|

County |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

For a corrected title or registration, check reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Doc #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

☐ Vehicle Description ☐ Add/Remove Lien ☐ Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

☐ SPV |

☐ Appraisal Value $ |

|

|

|

|

|

|

||||||||||||||||||||||||

1. Vehicle Identification Number |

|

|

|

|

|

|

|

|

2. Year |

|

3. Make |

|

|

|

4. Body Style |

|

5. Model |

|

|

|

|

6. Major Color |

|

7. Minor Color |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

8. Texas License Plate No. |

9. Odometer Reading (no tenths) |

10. This is the Actual Mileage unless the mileage is: |

|

11. Empty Weight |

|

|

12. Carrying Capacity (if any) |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Not Actual ☐ Exceeds Mechanical Limits |

☐ Exempt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

13. Applicant Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. Applicant Photo ID Number or FEIN/EIN |

|

|||||||||||||||||||

|

☐ Individual |

☐ Business |

☐ Government |

☐ Trust |

|

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

15. ID Type ☐ U.S. Driver License/ID Card (issued by: |

|

|

|

|

|

|

|

|

|

|

) |

|

|

☐ NATO ID |

|

|

|

☐ U.S. Dept. of State ID |

|

|||||||||||||||||||||||||||||

|

|

☐ Passport (issued by: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

☐ U.S. Military ID |

☐ U.S. Dept. of Homeland Security ID |

|

||||||||||||||||||||||||

|

|

☐ U.S. Citizenship & Immigration Services/DOJ ID |

|

|

|

|

|

|

|

|

|

☐ Other Military Status of Forces Photo ID |

|

|

|

|

|

|||||||||||||||||||||||||||||||

16. |

Applicant First Name (or Entity Name) |

|

|

|

|

|

|

Middle Name |

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Suffix (if any) |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

17. |

Additional Applicant First Name (if applicable) |

Middle Name |

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Suffix (if any) |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

18. |

Applicant Mailing Address |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

Zip |

|

19. Applicant County of Residence |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

20. |

Previous Owner Name (or Entity Name) |

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

21. Dealer GDN (if applicable) |

22. Unit No. (if applicable) |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

23. |

Renewal Recipient First Name (or Entity Name) (if different) |

Middle Name |

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Suffix (if any) |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

24. |

Renewal Notice Mailing Address (if different) |

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

Zip |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

25. Applicant Phone Number (optional) |

26. Email (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

27. Registration Renewal eReminder |

|

28. Communication Impediment? |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Yes (Provide Email in #26) |

|

☐ Yes (Attach Form |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

29. |

Vehicle Location Address (if different) |

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

Zip |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

30. |

Multiple (Additional) Liens |

|

|

31. Electronic Title Request |

32. Certified/eTitle Lienholder ID Number (if any) |

|

|

|

|

|

|

|

|

|

|

33. First Lien Date (if any) |

|

|||||||||||||||||||||||||||||||

|

☐Yes (Attach Form |

|

|

☐Yes (Cannot check #30) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

34. |

First Lienholder Name (if any) |

|

|

|

Mailing Address |

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

Zip |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

35. |

Check only if applicable: |

|

|

|

|

|

|

|

|

|

|

|

MOTOR VEHICLE TAX STATEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

☐ |

I hold Motor Vehicle Retailer (Rental) Permit No. |

|

|

|

|

|

|

|

|

|

|

|

and will satisfy the minimum tax liability (V.A.T.S., Tax Code §152.046[c]) |

|

||||||||||||||||||||||||||||||||||

☐ |

I am a dealer or lessor and qualify to take the Fair Market Value Deduction (V.A.T.S., Tax Code, §152.002[c]). GDN or Lessor Number |

|

|

|

|

|

|

|

|

|

|

. |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

36. |

Year |

|

|

|

|

Make |

Vehicle Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37. Additional |

|

||||||||||||||||||||||||

|

☐ Yes (Complete) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Yes |

|

||||||||

38. |

Check only if applicable: |

|

|

|

|

|

|

|

|

|

|

|

SALES AND USE TAX COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

☐ |

(a) Sales Price ($ |

|

|

|

rebate has been deducted) |

$ |

|

|

|

|

|

|

☐ |

$90 New Resident Tax – (Previous State) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

(b) Less |

Amount, described in Box 36 above |

$ ( |

|

|

) |

☐ |

$5 Even Trade Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

(c) For Dealers/Lessors/Rental ONLY – Fair Market Value |

|

|

|

|

|

|

|

☐ |

$10 Gift Tax – Attach Comptroller Form |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Deduction, described in Box 36 above |

|

|

|

|

|

|

$ ( |

) |

☐ |

$65 Rebuilt Salvage Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

(d) Taxable Amount (Item a minus Item b or Item c) |

$ |

|

|

|

|

|

|

☐ |

2.5% Emissions Fee (Diesel Vehicles 1996 and Older > 14,000 lbs.) |

|

|||||||||||||||||||||||||||||||||||||

|

(e) |

6.25% Tax on Taxable Amount (Multiply Item d by .0625) |

$ |

|

|

|

|

|

|

☐ |

1 % Emissions Fee (Diesel Vehicles 1997 and Newer > 14,000 lbs.) |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

(f) |

|

|

☐ 5% or ☐ |

|

|

|

|

|

$ |

|

|

|

|

|

|

☐ |

Exemption claimed under the Motor Vehicle Sales and Use Tax Law |

|

|

|

|||||||||||||||||||||||||||

|

Late Tax Payment Penalty |

10% |

|

|

|

|

|

|

|

|

|

because: |

|

|

||||||||||||||||||||||||||||||||||

|

(g) |

Tax Paid to |

|

|

|

|

|

|

(STATE) |

$ |

|

|

|

|

|

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(h) AMOUNT OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$28 or $33 Application Fee for Texas Title |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

TAX AND PENALTY DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

(Item e plus Item f minus Item g) |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

(Contact your county tax |

|

|

|

|

|

||||||||||||||||||||||||||

CERTIFICATION – State law makes falsifying information a third degree felony

I hereby certify all statements in this document are true and correct to the best of my knowledge and belief, and I am eligible for title and/or registration (as applicable).

☐(Check only if applicable) I certify I am applying for a corrected title and the original Texas Certificate of Title is lost or destroyed.

Signature(s) of Seller(s), Donor(s), or Trader(s) |

Printed Name(s) (Same as Signature(s)) |

Date |

Signature of Applicant/Owner |

Printed Name (Same as Signature) |

Date |

Signature(s) of Additional Applicant(s)/Owner(s) |

Printed Name(s) (Same as Signature(s)) |

Date |

Form |

Form available online at www.TxDMV.gov |

Page 1 of 2 |

Application for Texas Title and/or Registration

General Instructions

With a few exceptions, you are entitled to be informed about the information the department collects about you. The Texas Government Code entitles you to receive and review the information and to request that the department correct any information about you that is incorrect. Please contact the Texas Department of Motor Vehicles at

This form must be completed and submitted to your county tax

AVAILABLE HELP

•For assistance in completing this form, contact your county tax

•For information about motor vehicle sales and use tax or emission fees, contact the Texas Comptroller of Public Accounts, Tax Assistance Section, at

•For title or registration information, contact your county tax

Additional Details

Title Only: License plates and registration insignia previously issued for this motor vehicle must be surrendered in accordance with Transportation Code §501.0275, if applicable, unless this vehicle displays a license plate under an applicable status of forces agreement. The following types of vehicles are not eligible for Title Only: construction machinery (unconventional vehicles), water well drilling units, machinery used exclusively for drilling water wells, construction machinery not designed to transport persons or property, implements of husbandry, farm equipment (including combines), golf carts, slow moving vehicles, or any vehicle with a suspended or revoked title. Registration Purposes Only: Do not surrender an original out of state title with this application. A Texas title will NOT be issued for a vehicle applying for Registration Purposes Only. The receipt issued upon filing this application will serve as the registration receipt and proof of application for Registration Purposes Only.

•Foreign Vehicles: Foreign vehicles applying for Registration Purposes Only must attach DOT Form

indicate the vehicle is: 1) over 25 years old, or 2) complies with Federal Motor Vehicle Safety Standards, or 3) is being imported in the United States for a temporary period by a nonresident or a member of the armed forces of a foreign country on assignment in the U.S., and does not conform to the Federal Motor Vehicle Standards and cannot be sold in the U.S.

Nontitle Registration: Certain trailers, farm equipment, construction machinery, oil well servicing machinery, water well drilling units, etc. are either exempt from, or not eligible for title, but are eligible for, or required to, obtain registration or a specialty plate in order to operate on the highway. Applicants should mark this box only when applicable. Note: A lien cannot be recorded on this type of application.

Out of State Vehicles: If the applicant certifies the vehicle is located out of state,

Notice

•The sales and use tax must be paid to the county tax

•A $2.50 transfer fee is paid to transfer current registration to the new owner in addition to the title application fee and other applicable fees. If the registration is not current, full registration fees are due unless applying for Title Only.

•A 6.25 percent motor vehicle sales and use tax is imposed on the sales price (less

•Standard Presumptive Value (SPV) applies to

•New Texas residents are subject to a $90 use tax on a vehicle brought into this state that was previously registered to the new resident in another state or foreign country. This is in lieu of the 6.25 percent use tax imposed on a Texas resident.

•A $10 gift tax is due when a person receives a motor vehicle as a gift from an immediate family member, guardian, or a decedent's estate. A vehicle donated to, or given by, a

•A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift described above is a sale and will be subject to tax calculated on the vehicle's standard presumptive value.

•A late penalty equal to 5 percent of the tax will be charged if the tax or surcharge is paid from 1 to 30 calendar days late. If more than 30 calendar days late, the penalty will be 10 percent of the tax; minimum penalty is $1.

•In addition to the late tax payment penalty, Texas Transportation Code provides for an escalating delinquent transfer penalty of up to $250 for failure to apply for title within 30 days from the date of title assignment. Submit this application along with proper evidence of ownership and appropriate valid proof of financial responsibility such as a liability insurance card or policy.

•All new residents applying for a Texas title and registration for a motor vehicle must file at the county tax

Form |

Form available online at www.TxDMV.gov |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The 130U form is used to apply for a Texas title and/or vehicle registration. |

| Governing Law | This form is governed by the Texas Transportation Code, specifically Chapters 501 and 152. |

| Required Information | Applicants must provide vehicle details, identification, and a signed certification of truthfulness. |

| Submission Location | The completed form must be submitted to the county tax assessor-collector in the applicant's county of residence. |

| Additional Fees | Applicants may need to pay fees for registration, title transfer, and any applicable taxes or penalties. |

| Deadline for Submission | The application must be submitted within 30 days of purchasing the vehicle or establishing residency in Texas. |

Guidelines on Utilizing 130U

Completing the Form 130-U is a critical step in ensuring that your vehicle is legally titled and registered in Texas. Be thorough and accurate while filling it out, as errors or omissions may delay the process. Ensure you have all required documents and fees ready for submission to the county tax assessor-collector.

- Determine the purpose of your application. Check the appropriate box for Title & Registration, Title Only, Registration Purposes Only, or Nontitle Registration.

- If applicable, indicate the reason for a corrected title or registration by checking the appropriate box.

- Enter the county in which you are applying.

- Provide the vehicle's identification number (VIN) in the first section.

- Fill in the vehicle's year, make, body style, model, major color, minor color, and Texas license plate number.

- Record the odometer reading (whole numbers only). Specify whether this is the actual mileage or if any exceptions apply.

- Enter the empty weight and carrying capacity of the vehicle, if applicable.

- Select your applicant type: Individual, Business, Government, Trust, or Non-Profit.

- Input your photo ID number or FEIN/EIN, and identify the type of ID submitted.

- Provide your name, including first, middle, last, and suffix if applicable.

- If applicable, enter the additional applicant's name with the same details required above.

- Fill in the mailing address, city, state, and zip code where you can receive correspondence.

- Indicate your county of residence.

- Provide the previous owner's name or entity and their city and state.

- If applicable, include the dealer GDN and unit number.

- Enter the renewal recipient's name and mailing address if different from the applicant.

- Input your optional phone number and email address.

- Indicate if you want to receive a registration renewal eReminder.

- If applicable, mark if there is a communication impediment and provide additional information as requested.

- Enter the vehicle location address if different from the mailing address.

- List any additional liens if necessary.

- Request an electronic title if appropriate.

- If applicable, provide the certified/eTitle lienholder ID number and first lien date.

- Fill in the first lienholder's name and mailing address if applicable.

- Check applicable boxes regarding the Motor Vehicle Tax Statement and provide necessary numbers or fees.

- List any trade-ins, including year, make, and VIN.

- Complete the section for sales and use tax computation, detailing sales price and any deductions.

- Calculate the total due in the Tax and Penalty Due section, ensuring all numbers are accurate.

- Certify the accuracy of the information by signing and dating where indicated. Include the printed names of all signers.

What You Should Know About This Form

What is the purpose of the 130U form?

The 130U form, also known as the Application for Texas Title and/or Registration, is designed for individuals and entities in Texas who need to apply for a vehicle title and/or registration. It can be used for various purposes, including obtaining a title, renewing a registration, or registering a vehicle that is not eligible for a title.

Who needs to fill out the 130U form?

Anyone who has recently purchased a vehicle, relocated to Texas with a vehicle, or needs to change the details associated with their vehicle's title or registration should complete the 130U form. This includes individuals, businesses, government entities, and non-profits. Specific situations like correcting a title or registering a nontitle vehicle also require this form.

What information is required to complete the 130U form?

To successfully fill out the 130U form, you'll need several pieces of information. Key details include the vehicle identification number (VIN), year, make, model, color, and the current odometer reading. Additionally, the form requires personal information such as the applicant's name, address, and identification type. If applicable, you must also provide details about any previous owners and lienholders.

What should I do if my title or registration is lost or destroyed?

If your title or registration is lost or has been destroyed, you can indicate this on the form by checking the appropriate box. You will need to certify that you are applying for a corrected title. It’s important to provide accurate information and submit any necessary fees to process this request. Your county tax assessor-collector can assist you with any additional requirements.

Are there any fees associated with submitting the 130U form?

Yes, there are several fees that may accompany your application. These can include an application fee, registration fee, and potential taxes such as the motor vehicle sales and use tax. The specific amount varies depending on your situation. Always verify the correct fee with your county tax assessor-collector prior to submission, as it can differ by county.

What happens if I don't submit the 130U form promptly?

Texas law requires that you submit your 130U form within 30 days of purchasing your vehicle or moving to Texas. If you fail to do so, you may incur late penalties that can accumulate over time. Specifically, late payment penalties can range from 5% to 10% of the tax owed, in addition to potential penalties for failing to apply for the title timely.

Can I submit the 130U form online?

The 130U form cannot generally be submitted online; it must be completed and submitted to your local county tax assessor-collector office in person or by mail. However, you can fill out the form electronically and print it for submission. Always check if your local office offers specific online services or additional options for submission.

How can I get assistance with completing the 130U form?

If you need help with the 130U form, several resources are available. Your county tax assessor-collector's office can provide guidance on filling out the application correctly. Additionally, the Texas Department of Motor Vehicles (TxDMV) has a wealth of information on their website and can be reached by phone for specific questions related to motor vehicle title and registration.

Common mistakes

When completing the 130U form for Texas Title and/or Registration, several common mistakes can lead to delays or complications in processing. One of the most prevalent errors is not providing the Vehicle Identification Number (VIN). This critical piece of information uniquely identifies the vehicle and is essential for any application. Omitting the VIN can result in the application being returned or rejected altogether.

Another frequent issue is failing to check the appropriate boxes that indicate what the applicant is applying for, such as Title & Registration, Title Only, or Registration Purposes Only. Misunderstanding the categories can lead to an application being processed incorrectly. Ensuring the correct selection aligns with the applicant's intention is vital.

Incorrectly listing the odometer reading is another common mistake. This reading should reflect the actual mileage, which is a standard requirement. The form also asks whether the mileage is actual or not. Providing inaccurate information in this section can raise questions and potentially lead to unintended legal consequences.

Many applicants also overlook the need for supporting documentation. Along with the completed form, applicants must attach the required documents, which may include identification or proof of ownership. Missing documentation can significantly postpone the processing of the application.

Finally, a signature is mandatory. If an applicant neglects to sign the form, the application will not be processed. This seemingly small oversight can have considerable repercussions, as it could delay the issuance of the title or registration until the discrepancy is rectified.

Documents used along the form

When applying for a Texas title and/or registration using the Form 130-U, several additional documents might also be required or recommended. Each of these forms serves to facilitate the registration process and verify important information regarding the vehicle, ownership, or tax obligations. Below is a list of commonly used forms and their functions.

- Form VTR-216: This form is utilized to communicate any communication impediments experienced by the applicant, such as a hearing impairment. It is attached to the 130-U form to ensure proper assistance.

- Form VTR-270: This Vehicle Identification Number Certification form is essential for applicants certifying that the vehicle is located out of state. It helps in verifying the VIN when a state-approved inspection is not available.

- Form 14-317: Known as the Affidavit of Motor Vehicle Gift Transfer, this form is filled out when a vehicle is given as a gift. Both the donor and recipient must sign and submit this document along with the title application.

- DOT Form HS-7: Required for foreign vehicles, this form provides proof that the vehicle is either over 25 years old, compliant with safety standards, or temporarily imported into the U.S. by specific individuals.

- U.S. Customs Form CF-7501: Similar to the DOT Form HS-7, this document is needed for cars that don't conform to federal standards. It details the vehicle’s status during its temporary importation into the U.S.

- Form VTR-267: This form is necessary for filing a lien on a vehicle. It is completed when a first lien is recorded, ensuring that financial interests are legally recognized.

- Texas Vehicle Inspection Report: This report is required for new residents bringing vehicles from other states. It confirms that the vehicle has passed a state-approved safety inspection and verifies the VIN.

- Motor Vehicle Tax Statement: Used by individuals or dealers with a retail permit, this statement affirms that the applicant will meet minimum tax requirements related to vehicles sold or transferred.

- Trade-in Documentation: If applicable, details of any trade-ins, including make, model, and VIN, are needed. This documentation is essential for tax calculations involving the trade-in value.

- Proof of Insurance: A valid proof of financial responsibility, such as an insurance card or policy, is necessary at the time of application to show compliance with Texas insurance laws.

These documents aid in clarifying the circumstances surrounding vehicle ownership and ensure compliance with state regulations. It is always a good idea to gather all necessary forms ahead of time to facilitate a smoother application experience.

Similar forms

The Application for Texas Title and/or Registration, commonly known as the 130U form, shares similarities with various other important documents needed for vehicle registration and titling. Here’s a list of six documents that serve comparable purposes:

- Form VTR-130-UIF: This document provides detailed instructions for completing the 130U form. It ensures that all necessary information is included and helps applicants understand the requirements for title and registration in Texas.

- Form VTR-270: Known as the Vehicle Identification Number Certification, this form is used to confirm the VIN for vehicles being registered in Texas. Like the 130U form, it is important for verifying ownership and enabling the registration process.

- Form VTR-267: This is the application for a corrected title. If an applicant is seeking to correct mistakes on their current title, this form is needed, similar to how the 130U form is used for applications for title and registration.

- Form 14-317: This is the Affidavit of Motor Vehicle Gift Transfer. When a vehicle is gifted from one person to another, this document must be completed alongside the 130U form to ensure proper titling under Texas laws.

- Form VTR-221: This document is used for reporting the sale of a vehicle. It supplements the information on the 130U form by providing a record of the transaction, which is essential for both the seller and the buyer for legal ownership transfer.

- Form 14-318: The Motor Vehicle Sales and Use Tax Exemption Certification is relevant when exemptions from sales tax are applicable. This certification may accompany the 130U form to ensure proper assessment of any taxes owed during vehicle registration or title issuance.

Each of these documents plays a vital role in the vehicle registration process in Texas and works closely with the 130U form to facilitate accurate and efficient handling of vehicle titles and registrations.

Dos and Don'ts

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information for all required fields.

- Do ensure you include the original signature of the buyer on the form.

- Do attach any necessary supporting documents to your application.

- Do check the appropriate boxes for the type of application you are submitting.

- Don't neglect to include your vehicle identification number (VIN).

- Don't forget to list all applicable fees and taxes due.

- Don't leave out the mailing address or contact information.

- Don't submit an incomplete form; it may delay the processing of your application.

- Don't misrepresent information; it is a felony to provide false statements on the application.

Misconceptions

Understanding the 130U Form is essential for any vehicle owner in Texas. However, several misconceptions persist, leading to confusion and potential delays in the registration process. Here are six common misconceptions about the 130U form:

- It is only for title applications. Many believe the 130U form is solely for obtaining a vehicle title. In reality, it serves multiple purposes, including registration and corrections. Depending on your needs, you can apply for title, registration, or both using this form.

- I can submit my application without supporting documents. Some think they can simply fill out the form and send it off. However, the 130U must be accompanied by necessary documents, including proof of ownership and, in some cases, proof of financial responsibility. Missing these can delay your application.

- Only individuals can use this form. A common error is assuming the form is only for individual applicants. In fact, businesses, government entities, and trusts can also utilize the 130U form for their vehicle registration and title needs.

- The form can be faxed without original signatures. Although it's permissible to fax seller signatures, your application must include the original signature of the buyer. Submitting a form without this can render it invalid.

- Registration Purposes Only means I will get a title. Some people mistakenly believe that applying for Registration Purposes Only also grants them a Texas title. This is false. A title will not be issued for vehicles applying solely for registration.

- Late penalties aren’t significant. Many think that minor delays in filing won’t have serious repercussions. In reality, the Texas Transportation Code imposes significant penalties for late applications, including a 10% penalty for delays over 30 days. It’s crucial to act promptly to avoid unwanted charges.

Being informed about these misconceptions can save applicants time and money. If uncertain about any aspect of the 130U form, reach out to your county tax assessor-collector for guidance.

Key takeaways

When filling out and using the 130U form for the application of Texas Title and/or Registration, keep these key takeaways in mind:

- The form can be used for different purposes including title and registration, title only, or registration purposes only. Ensure you select the appropriate option at the top of the form.

- Provide accurate vehicle details such as the Vehicle Identification Number (VIN), year, make, model, color, and odometer reading. Accuracy is crucial to avoid delays.

- Include your photo ID information from the list provided, such as a U.S. driver’s license or passport. The form will require this for identification verification.

- If applying for a corrected title, be ready to specify the reason. This may include vehicle description changes or adding/removing a lien.

- Make sure to submit the application along with any required fees, supporting documents, and additional signatures where necessary. An incomplete application can lead to processing delays.

- Be aware of tax implications. There’s a 6.25% motor vehicle sales tax on the purchase price, and a fee may apply for registration transfers.

- Submit your application within 30 days of vehicle purchase or residency establishment to avoid penalties. Failing to do so may incur fees.

- For vehicles coming from out of state, a verification of the Vehicle Identification Number (VIN) is necessary through a Texas state-approved safety inspection station.

- If you encounter challenges while completing the form, contact your county's tax assessor-collector for assistance. They’re there to help you navigate the process.

Browse Other Templates

Mysuu Portal - Payment can only be accepted after all holds have been cleared.

California Corporation Tax Estimate,Corporate Tax Payment Form,California Estimated Tax Submission,Corporation Tax Installment Notice,Estimated Tax Payment Coupon,CA Corporation Tax Estimate 2013,Corporate Estimated Tax Schedule,Form 100-ES Payment N - Form 100-ES helps ensure estimated taxes are filed correctly.