Fill Out Your 1845 0120 Form

The 1845 0120 form plays a crucial role in assisting borrowers who are seeking to rehabilitate their defaulted loans under the William D. Ford Federal Direct Loan Program or the Federal Family Education Loan Program. By filling out this form, borrowers provide essential details about their income and monthly expenses to their loan holders, who will then determine an alternative payment amount. This amount may vary from the original payment calculated using the 15% formula. The form requires applicants to supply personal information, including their Social Security number, contact details, and family size, while emphasizing the importance of accurate and truthful reporting. Additionally, signature verification is necessary to initiate the rehabilitation process, which mandates timely payments over ten consecutive months. To ensure clarity and compliance, borrowers must carefully review each section, provide supporting documentation when requested, and understand their commitments as outlined. Compliance with this form ultimately aids individuals in regaining eligibility for various benefits and support associated with their loans.

1845 0120 Example

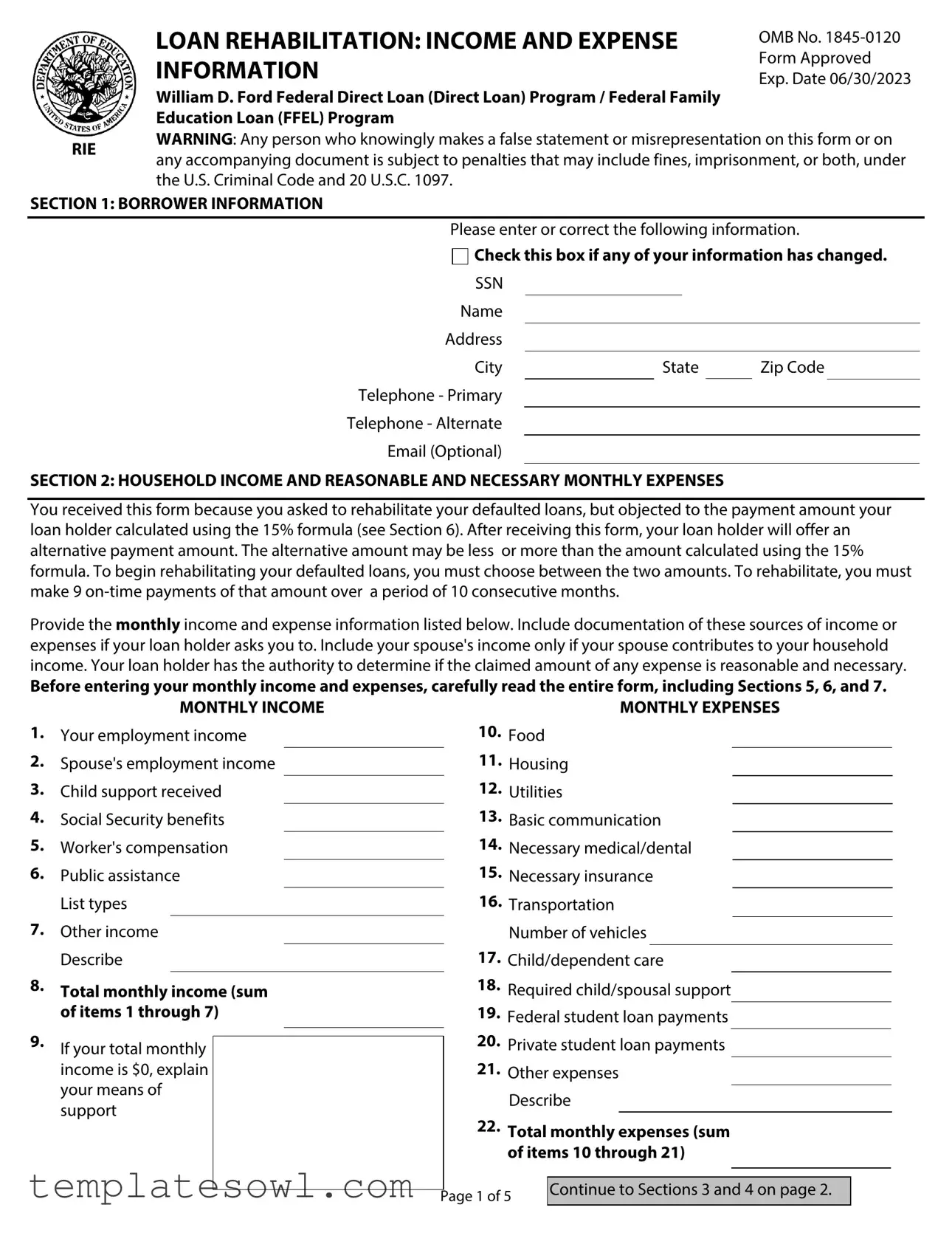

LOAN REHABILITATION: INCOME AND EXPENSE |

OMB No. |

INFORMATION |

Form Approved |

Exp. Date 06/30/2023 |

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family

Education Loan (FFEL) Program

RIE WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying document is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

SECTION 1: BORROWER INFORMATION

Please enter or correct the following information.

Check this box if any of your information has changed.

Check this box if any of your information has changed.

SSN

Name |

|

|

|

|

|

Address |

|

|

|

|

|

City |

|

State |

|

Zip Code |

|

Telephone - Primary |

|

|

|

|

|

Telephone - Alternate |

|

|

|

|

|

Email (Optional) |

|

|

|

|

|

SECTION 2: HOUSEHOLD INCOME AND REASONABLE AND NECESSARY MONTHLY EXPENSES

You received this form because you asked to rehabilitate your defaulted loans, but objected to the payment amount your loan holder calculated using the 15% formula (see Section 6). After receiving this form, your loan holder will offer an alternative payment amount. The alternative amount may be less or more than the amount calculated using the 15% formula. To begin rehabilitating your defaulted loans, you must choose between the two amounts. To rehabilitate, you must make 9

Provide the monthly income and expense information listed below. Include documentation of these sources of income or expenses if your loan holder asks you to. Include your spouse's income only if your spouse contributes to your household income. Your loan holder has the authority to determine if the claimed amount of any expense is reasonable and necessary.

Before entering your monthly income and expenses, carefully read the entire form, including Sections 5, 6, and 7.

MONTHLY INCOME |

MONTHLY EXPENSES |

1.Your employment income

2.Spouse's employment income

3.Child support received

4.Social Security benefits

5.Worker's compensation

6.Public assistance List types

7.Other income Describe

8.Total monthly income (sum of items 1 through 7)

9.If your total monthly income is $0, explain your means of support

10.Food

11.Housing

12.Utilities

13.Basic communication

14.Necessary medical/dental

15.Necessary insurance

16.Transportation Number of vehicles

17.Child/dependent care

18.Required child/spousal support

19.Federal student loan payments

20.Private student loan payments

21.Other expenses Describe

22.Total monthly expenses (sum of items 10 through 21)

Page 1 of 5 |

Continue to Sections 3 and 4 on page 2. |

|

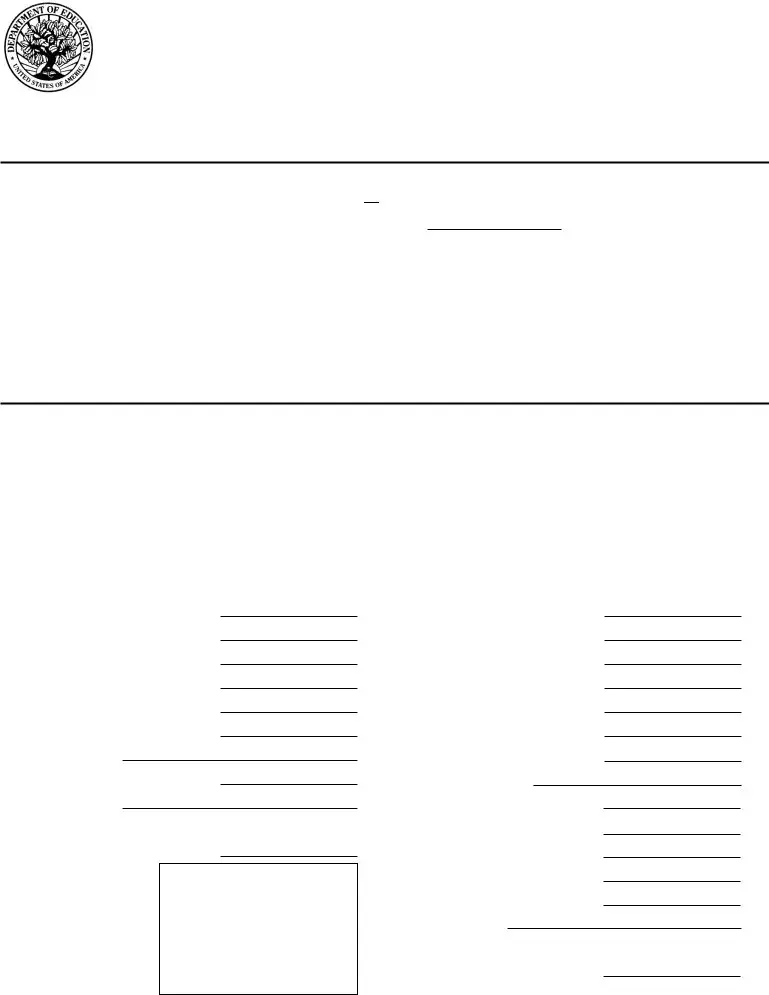

Borrower Name |

|

Borrower SSN |

SECTION 3: FAMILY SIZE AND SPOUSE IDENTIFICATION |

|

|

Your family size includes you, your spouse, and your children (including unborn children who will be born before the end of the current calendar year), if the children will receive more than half of their support from you. Your family size includes other people only if they live with you now, receive more than half of their support from you now, and will continue to receive this support from you for the year for which you are certifying your family size. Support includes money, gifts, loans, housing, food, clothes, car, medical and dental care, and payment of college costs.

23.Family size

24.Are you requesting rehabilitation of a Direct Consolidation Loan or a Federal Consolidation Loan that was made jointly to you and your spouse?

Yes. Enter your spouse's name and SSN:

Yes. Enter your spouse's name and SSN:

Spouse's Name

No. Continue to Section 4.

SECTION 4: UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION

I understand that:

1.I have received this form because I requested the opportunity to rehabilitate my defaulted loans and objected to the reasonable and affordable monthly payment amount calculated using the 15% formula.

2.My loan holder will calculate an alternative reasonable and affordable monthly payment amount that will be based solely on the information I provide on this form and, if requested, supporting documentation.

3.If I do not accept either the 15% formula payment amount or the payment amount determined by my loan holder based on information from this form, the loan rehabilitation process will not proceed and I will be required to repay my defaulted loans in accordance with the terms of the loan and applicable law.

4.If I do not provide any supporting documentation requested by my loan holder by the deadline specified by my loan holder, my request for loan rehabilitation will not be considered.

5.If I want to rehabilitate a defaulted Direct Consolidation Loan or Federal Consolidation Loan that was made jointly to me and my spouse and am requesting an alternative payment amount, my spouse and I must each sign below.

6.If I rehabilitate a loan and default on the same loan again in the future, I may not rehabilitate that loan a second time.

7.I must notify my loan holder immediately if my address changes.

8.If my loan is rehabilitated, my loan will be sold or transferred to a new loan holder or loan servicer. After the sale or transfer, I will be asked to select a repayment plan. If I do not select a repayment plan, my loans will be placed on the standard repayment plan, which will likely require me to make a much higher monthly payment amount than the payment I made to rehabilitate my loan.

9.After my loan is rehabilitated, I may be eligible to repay my loans under an

10.I can learn more about the eligibility requirements and application process for

I certify that (1) the information that I have provided on this form is true and correct and (2) upon request, I will provide additional documentation to my loan holder to support the information I have provided in this form.

I authorize the loan holder to which I submit this request (and its agents or contractors) to contact me regarding my request or my loans, including the repayment of my loans, at any number that I provide on this form or any future number that I provide for my cellular telephone or other wireless device using automated dialing equipment or artificial or prerecorded voice or text messages.

Borrower's Signature |

Date |

|

|

|

Date |

Spouse's Signature |

||

Your spouse must sign this form only if you entered your spouse's name and SSN in Section 3.

Page 2 of 5

SECTION 5: INSTRUCTIONS

If you are not completing this form electronically, type or |

Basic communication: Include the amount spent on |

print using dark ink. Enter dates as |

basic communication expenses, such as basic telephone, |

yyyy). Use only numbers. Example: March 14, 2017 = |

internet, and cable TV. |

Medical and dental: Include the amount spent on |

|

your defaulted loans on any documentation that you are |

|

required to submit with this form. If you need help |

necessary medical and dental expenses and procedures not |

completing this form, contact your loan holder. |

covered by insurance, such as medically necessary |

Return the completed form to the address shown in |

prescription and nonprescription medications, and |

medically necessary nutritional supplements. Do not include |

|

Section 8 |

any costs relating to medical or dental insurance premium |

MONTHLY INCOME IN SECTION 2 (ITEMS |

payments. |

|

Your loan holder may request supporting documentation for any income items.

Employment income documentation may include a pay stub or a letter from the employer stating the income paid to you by that employer.

Child support, Social Security benefits, worker’s compensation, or public assistance documentation may include copies of benefits checks or a benefits statement, a letter from a court, a governmental body, or the individual paying child support, specifying the amount of the benefit.

Public assistance: Identify the type of public assistance received (see definition of “public assistance” in Section 6).

Other income: Include any other income not covered in items

If you report that your Total Monthly Income is zero, explain your means of support in Item 9.

MONTHLY EXPENSES IN SECTION 2 (ITEMS

For each monthly expense, provide the amount you usually spend each month. Your loan holder may request supporting documentation for any of these items. Do not include a single expense in more than one category. If you have no expenses under a category, enter 0 for that category.

Food: Include the amount spent on food, even if purchased using the Supplemental Nutrition Assistance Program (SNAP) (food stamps).

Housing: Include the amount spent on housing and shelter, such as rent, required security deposits, mortgage payments (including principal, interest, taxes, and homeowner’s insurance), maintenance, and repairs.

Utilities: Include the amount spent on

Insurance: Include the amount spent on insurance, such as necessary renter’s, auto, medical, dental, or life insurance. Include any amounts paid toward insurance premiums.

However, if the income amount you listed under Monthly Income already reflects deductions from your pay for insurance premiums, do not list the amount of these deductions as an Insurance expense. Include homeowner’s insurance under Item 11 (Housing).

Transportation: Include the amount spent on basic transportation expenses such as fuel, car payments, basic vehicle maintenance, public transportation, tolls, and parking. Also list the number of vehicles for which you are claiming related transportation expenses.

Child/dependent care: Include the amount spent on care for children or other dependents in the household and other

Legally required child /spousal support: Include the amount spent on legally required child support and spousal support.

Federal student loan payments: Include the total monthly amount you pay on any federal student loans except for the defaulted loans you are trying to rehabilitate, unless you are subject to mandatory withholding such as wage garnishment or Treasury offset (e.g., your Social Security is being garnished). If you are subject to wage garnishment or Treasury offset include the amount that is collected from you each month.

Private student loan payments: Include the total monthly amount you pay on any private student loans. Include any type of payment, voluntary or otherwise.

Other expenses: Include the amount spent on any other necessary expenses not covered in items 10 - 20 and explain these expenses. These other expenses will be considered only if the Department of Education determines that they should be considered. If more space is needed to list other expenses, attach a separate piece of paper and include your name and Social Security Number at the top.

Page 3 of 5

SECTION 6: DEFINITIONS

The William D. Ford Federal Direct Loan (Direct Loan) |

Reasonable and affordable payment amount means a |

|

Program includes Federal Direct Stafford/Ford (Direct |

||

monthly payment determined by the loan holder based |

||

Subsidized) Loans, Federal Direct Unsubsidized Stafford/ |

||

either on the 15% formula or on information provided in this |

||

Ford (Direct Unsubsidized) Loans, Federal Direct PLUS |

||

form and supporting documentation. It cannot be a |

||

(Direct PLUS) Loans, and Federal Direct Consolidation (Direct |

||

percentage of your total loan balance or based on |

||

Consolidation) Loans. |

||

information unrelated to your total financial circumstances. |

||

|

||

The Federal Family Education Loan (FFEL) Program |

The 15% formula means 15% of the amount by which |

|

includes Federal Stafford Loans (both subsidized and |

||

your Adjusted Gross Income exceeds 150% of the poverty |

||

unsubsidized), Federal PLUS Loans, Federal Consolidation |

||

guideline amount that is applicable to your family size and |

||

Loans, and Federal Supplemental Loans for Students (SLS). |

||

state, divided by 12. Your minimum payment may not be |

||

Rehabilitation of your defaulted loan occurs only after |

||

less than $5.00. |

||

you have made 9 voluntary, reasonable and affordable |

|

|

monthly payments within 20 days of the due date during 10 |

The loan holder of a defaulted Direct Loan Program |

|

consecutive months and, for FFEL loans held by a guaranty |

loan is the Department. The loan holder of a defaulted FFEL |

|

agency, when the loan has been sold to an eligible lender or |

Program loan may be a guaranty agency or the Department. |

|

assigned to the U.S. Department of Education (the |

Public assistance means payments you receive under a |

|

Department). When you rehabilitate your loans, you will |

||

regain all the benefits of the Direct Loan Program or FFEL |

federal or state program. These assistance programs include, |

|

Program, including eligibility for deferments or forbearances |

but are not limited to, Temporary Assistance for Needy |

|

and for a repayment plan with a monthly payment amount |

Families (TANF), Supplemental Security Income (SSI), Food |

|

based on your income. You will also regain eligibility to |

Stamps/Supplemental Nutritional Assistance Program |

|

receive additional federal student aid, including additional |

(SNAP), or state general public assistance. |

|

federal student loans. After a defaulted loan is rehabilitated, |

|

|

your loan holder will instruct any consumer reporting |

|

|

agency (credit bureau) to which the default was reported to |

|

|

remove the default from your credit history. |

|

|

SECTION 7: LOAN REHABILITATION AGREEMENT |

|

To rehabilitate your loan, you must accept either the monthly rehabilitation payment amount determined using the 15% formula, or the payment amount determined based on the monthly income, monthly expenses, and family size information that you provide on this form and on any requested supporting documentation.

Your loan holder will provide you with a written loan rehabilitation agreement confirming your monthly rehabilitation payment amount.

To accept the loan rehabilitation agreement, you must sign the agreement and return it to your loan holder.

During the loan rehabilitation period, the loan holder will limit contact with you on the loan being rehabilitated to collection activities that are required by law or regulation, and to communication that supports the rehabilitation.

If you do not accept either monthly payment amount, your rehabilitation request will not be considered any further.

SECTION 8: WHERE TO SEND THE COMPLETED FORM

Return the completed form and any documentation to: (If no address is shown, return to your loan holder.)

If you need help completing this form, call:

(If no telephone number is shown, call your loan holder.)

Page 4 of 5

SECTION 9: IMPORTANT NOTICES

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. |

To assist program administrators with tracking |

|

552a) requires that the following notice be provided to you: |

refunds and cancellations, disclosures may be made to |

|

The authorities for collecting the requested |

guaranty agencies, to financial and educational institutions, |

|

or to federal or state agencies. To provide a standardized |

||

information from and about you are §421 et seq. and §451 |

||

method for educational institutions to efficiently submit |

||

et seq. of the Higher Education Act of 1965, as amended (20 |

||

student enrollment statuses, disclosures may be made to |

||

U.S.C. 1071 et seq. and 20 U.S.C. 1087a et seq.) and the |

||

guaranty agencies or to financial and educational |

||

authorities for collecting and using your Social Security |

||

institutions. To counsel you in repayment efforts, disclosures |

||

Number (SSN) are §§428B(f) and 484(a)(4) of the HEA (20 |

||

may be made to guaranty agencies, to financial and |

||

U.S.C. |

||

educational institutions, or to federal, state, or local |

||

Participating in the William D. Ford Federal Direct Loan |

||

agencies. |

||

(Direct Loan) Program or the Federal Family Education Loan |

||

|

||

(FFEL) Program and giving us your SSN are voluntary, but |

In the event of litigation, we may send records to the |

|

you must provide the requested information, including your |

Department of Justice, a court, adjudicative body, counsel, |

|

SSN, to participate. |

party, or witness if the disclosure is relevant and necessary |

|

The principal purposes for collecting the |

to the litigation. If this information, either alone or with |

|

other information, indicates a potential violation of law, we |

||

information on this form, including your SSN, are to verify |

||

may send it to the appropriate authority for action. We may |

||

your identity, to determine your eligibility to receive a loan |

||

send information to members of Congress if you ask them |

||

or a benefit on a loan (such as a deferment, forbearance, |

||

to help you with federal student aid questions. In |

||

discharge, or forgiveness) under the Direct Loan and/or |

||

circumstances involving employment complaints, |

||

FFEL Programs, to permit the servicing of your loans, and, if |

||

grievances, or disciplinary actions, we may disclose relevant |

||

it becomes necessary, to locate you and to collect and |

||

records to adjudicate or investigate the issues. If provided |

||

report on your loans if your loans become delinquent or |

||

for by a collective bargaining agreement, we may disclose |

||

default. We also use your SSN as an account identifier and to |

||

records to a labor organization recognized under 5 U.S.C. |

||

permit you to access your account information |

||

Chapter 71. Disclosures may be made to our contractors for |

||

electronically. |

||

the purpose of performing any programmatic function that |

||

The information in your file may be disclosed, on a |

||

requires disclosure of records. Before making any such |

||

disclosure, we will require the contractor to maintain Privacy |

||

to third parties as authorized under routine uses in the |

||

Act safeguards. Disclosures may also be made to qualified |

||

appropriate systems of records notices. The routine uses of |

||

researchers under Privacy Act safeguards. |

||

this information include, but are not limited to, its disclosure |

||

Paperwork Reduction Notice. According to the |

||

to federal, state, or local agencies, to private parties such as |

||

Paperwork Reduction Act of 1995, no persons are required |

||

relatives, present and former employers, business and |

||

to respond to a collection of information unless such |

||

personal associates, to consumer reporting agencies, to |

||

collection displays a valid OMB control number. The valid |

||

financial and educational institutions, and to guaranty |

||

OMB control number for this information collection is |

||

agencies in order to verify your identity, to determine your |

||

eligibility to receive a loan or a benefit on a loan, to permit |

||

information is estimated to average 60 minutes per |

||

the servicing or collection of your loans, to enforce the |

||

response, including time for reviewing instructions, |

||

terms of the loans, to investigate possible fraud and to verify |

||

searching existing data sources, gathering and maintaining |

||

compliance with federal student financial aid program |

||

the data needed, and completing and reviewing the |

||

regulations, or to locate you if you become delinquent in |

||

collection of information. The obligation to respond to this |

||

your loan payments or if you default. To provide default rate |

||

collection is required to obtain a benefit in accordance with |

||

calculations, disclosures may be made to guaranty agencies, |

||

34 CFR 682.405 or 685.211. If you have questions regarding |

||

to financial and educational institutions, or to state |

||

the status of your individual submission of this form, contact |

||

agencies. To provide financial aid history information, |

||

your loan holder (see Section 8). |

||

disclosures may be made to educational institutions. |

||

|

Page 5 of 5

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The 1845 0120 form is used for loan rehabilitation to help borrowers rectify defaulted student loans. It allows borrowers to provide their income and expense information for a reassessment of their monthly payments. |

| Governing Laws | The form is governed by the William D. Ford Federal Direct Loan Program and the Federal Family Education Loan (FFEL) Program under U.S. law, particularly specified under 20 U.S.C. 1097. |

| Required Information | Borrowers must provide personal information, including their Social Security Number, income details, and monthly expenses. Accurate documentation is necessary for supporting the claims made in this form. |

| Penalties for Misrepresentation | According to federal law, making false statements on this form can result in serious penalties, including fines and imprisonment. Borrowers should ensure that all provided information is truthful and complete. |

| Submission Guidelines | Users must complete the form carefully, following all instructions and ensuring that it is sent to the appropriate loan holder. If filling out a paper version, clarity and legibility are essential for processing. |

Guidelines on Utilizing 1845 0120

Completing the 1845 0120 form is an essential step for those looking to rehabilitate defaulted student loans. The information you provide will help your loan holder assess your financial situation and determine an appropriate payment plan. Here’s how to fill out the form accurately and efficiently.

- Section 1: Borrower Information - Enter your Social Security Number (SSN), name, address, city, state, zip code, and both primary and alternate telephone numbers. You also have the option to provide an email address, though it’s not mandatory. Remember to check the box if any of your information has changed.

- Section 2: Household Income and Expenses - Fill in your monthly income from various sources such as employment, child support, Social Security benefits, and any other income sources. Then, list your monthly expenses, including food, housing, utilities, and any other necessary costs. Always ensure to include documentation if requested by your loan holder.

- Section 3: Family Size and Spouse Identification - Indicate your family size, including yourself, your spouse, and any dependent children. If you are rehabilitating a loan taken jointly, provide your spouse’s name and SSN.

- Section 4: Understandings, Certifications, and Authorization - Carefully read the statements and confirm your understanding. Both you and your spouse (if applicable) must sign and date this section to authorize the information provided.

- Section 5: Instructions - Pay close attention to the instructions for completing the form. Ensure that you are typing or writing legibly and use only numbers for any entries.

- Section 8: Where to Send the Completed Form - After completing the form, send it along with any required documentation to the specified address. If no address is provided, contact your loan holder for further guidance.

After you submit the 1845 0120 form, your loan holder will review the information provided to calculate an alternative monthly payment amount. You will receive further instructions on how to proceed with your loan rehabilitation. It’s important to maintain communication with your loan holder throughout the process, as this will facilitate any necessary clarifications or additional documentation they may require.

What You Should Know About This Form

What is the purpose of the 1845 0120 form?

The 1845 0120 form, also known as the Loan Rehabilitation: Income and Expense form, is primarily used by borrowers seeking to rehabilitate their defaulted federal student loans. When an individual has defaulted on their loans, this form allows them to provide updated financial information that can help determine a more affordable monthly payment. Borrowers can choose between the calculated payment amount based on the 15% income formula or an alternative payment determined by the loan holder based on the borrower's financial information submitted in this form.

How do I fill out the income and expense sections of the form?

To accurately fill out the income and expense sections, gather all relevant documentation to support your claims. List all sources of income, which may include wages, child support, and public assistance. Follow the prompts to indicate the amount for each source. For monthly expenses, document necessary expenses including food, housing, utilities, transportation, and medical costs. Provide a clear picture of your financial situation, as your loan holder will verify the claimed amounts. If a section does not apply to you, simply enter '0'.

What happens if I do not submit supporting documentation?

If you fail to submit any requested supporting documentation by the deadline specified by your loan holder, your request for loan rehabilitation may not be considered. It’s essential to provide all necessary information to facilitate the processing of your rehabilitation request. The loan holder relies on this documentation to determine the appropriate monthly payment amount and to verify the details provided in the 1845 0120 form.

Can I rehabilitate my loan more than once?

Each loan can typically be rehabilitated only once. If you successfully rehabilitate a defaulted loan but default again in the future, you will not be eligible to rehabilitate that loan a second time. It’s crucial to maintain consistent payments after rehabilitation to avoid falling back into default status. Make sure to stay in touch with your loan holder so that you can choose a repayment plan that fits your financial situation post-rehabilitation.

Common mistakes

Filling out the OMB No. 1845-0120 form, essential for loan rehabilitation, can be daunting. Many borrowers make critical mistakes that can delay or derail their rehabilitation process. Recognizing these common errors can save time and frustration.

First, many individuals fail to update their borrower information correctly. Even small mistakes in the name, address, or Social Security Number can lead to issues. It's crucial to double-check that all provided information matches official documents.

Second, underestimating income is a frequent pitfall. Some borrowers inadvertently leave out additional income sources or fail to include their spouse's income when applicable. It’s vital to account for all forms of income, as this can influence the payment amount calculated by the loan holder.

Another common error involves misunderstanding the family size section. Some borrowers do not accurately include all dependents who receive support. There are specific criteria for counting individuals, and failing to follow them can result in a miscalculation of necessary expenses.

Additionally, borrowers often overlook the documentation requirement. Many assume that completing the form is sufficient without providing proof of income and expenses. Missing documentation can halt the process entirely. Be prepared to show evidence for all financial claims.

Another mistake is the misclassification of expenses. Borrowers sometimes confuse necessary expenses with discretionary spending. Each category need not include non-essential items, and mixing these can mislead loan holders about genuine financial needs.

Completing the section on monthly expenses can also pose challenges. Some individuals provide estimates rather than accurate figures from recent bills. Loan holders expect current and precise data to determine a reasonable payment amount.

Moreover, not reading the full instructions is a frequent oversight. Failing to understand the requirements in the entire form leads to incomplete sections. Each section and instruction is there for a reason, and misunderstanding one can impact the overall submission.

Individuals often also neglect to sign the form. A missing signature invalidates the submission, halting the entire process until it is resolved. A quick check before mailing can prevent unnecessary delays.

Lastly, many borrowers forget to send the completed form to the correct address. Always verify that you are sending it where indicated. Misdirected forms can get lost in the shuffle and lead to additional waiting time.

Avoiding these mistakes can streamline the loan rehabilitation process. Review each section carefully, double-check your information, and ensure all necessary documentation is gathered. Taking these steps can lead to a smoother and more efficient experience.

Documents used along the form

When submitting the 1845-0120 form for loan rehabilitation, you may encounter several other important documents. Each of these forms plays a significant role in helping to assess your financial situation and determine an appropriate payment plan for rehabilitating your loans. Here’s a list of some commonly used forms and documents associated with this process:

- Loan Rehabilitation Agreement: This document details the terms and conditions of your loan rehabilitation, including the payment amount you must adhere to and any implications if you default again.

- Income Verification Documents: These can include pay stubs, tax returns, or benefits statements, which help prove your monthly income as reported on the 1845-0120 form.

- Expense Documentation: Receipts or statements to support the monthly expenses listed in your form, showing your financial obligations and helping determine your affordability.

- Family Size Verification: Any necessary documents such as birth certificates or court orders that can provide proof of household size, important for assessing eligibility for income-driven repayment plans.

- Application for Income-Driven Repayment Plan: If applicable, this separate application allows you to switch to a repayment plan considering your income, particularly after your loan is rehabilitated.

- Notice of Your Rights: A document reinforcing your rights as a borrower, including information on harassment practices and your entitlement to seek assistance.

- Credit Report: A copy of your credit report may be required to assess how loan rehabilitation may affect your credit score and history.

- Authorization to Release Information: If applicable, this document allows the loan holder to share your information with relevant parties, typically necessary for the loan rehabilitation process.

Understanding these additional forms can simplify the loan rehabilitation process. Keeping thorough documentation ready can help ensure that your claim is processed efficiently. Take time to prepare these documents to support your financial stability as you work towards rehabilitating your loans.

Similar forms

- Form 1040. This is the standard U.S. individual income tax return form. Like the 1845 0120 form, it requires personal financial information, including income sources and deductions. Both forms aim to assess an individual’s financial situation to determine eligibility for financial programs or repayment plans.

- Form W-4. This form is used by employees to inform their employers about how much federal income tax to withhold from their paychecks. Similar to the 1845 0120 form, it requires personal details and provides insight into the individual’s financial circumstances, helping in adjusting withholdings based on income levels.

- FFEL Consolidation Application. This form is used to consolidate multiple federal loans into one single loan. Similar to the 1845 0120 form, it evaluates the borrower’s financial situation and repayment capacity, focusing on their overall income and expense information to determine affordability.

- Income-Driven Repayment Plan Request. This application is for borrowers seeking a repayment plan based on their income. The document requires comprehensive income and expense details, much like the 1845 0120 form, to calculate a suitable monthly payment amount reflective of the borrower's financial ability.

- Public Assistance Application. This form is used to apply for government assistance for low-income individuals. It requires income and household expense details and aims to evaluate financial need, paralleling the purpose of the 1845 0120 form in assessing financial capacity for loan rehabilitation.

- Budget Worksheet. This is often used by individuals to track their monthly income and expenses. It serves a similar purpose to the 1845 0120 form, in that it helps individuals assess their financial health and make informed decisions regarding repayments, budgeting, or loan rehabilitation.

- Hardship Waiver Application. This form is utilized for requesting a waiver of requirements due to financial hardship. Like the 1845 0120 form, it reviews personal financial conditions, including income and expenses, to determine eligibility for relief from certain financial obligations.

Dos and Don'ts

When filling out the 1845 0120 form, there are several important considerations to keep in mind. The following lists outline what you should and shouldn’t do to ensure that your submission is complete and accurate.

- Double-check all personal information for accuracy.

- Be honest about your income and expenses.

- Include supporting documentation when requested.

- Ensure your spouse’s information is correct if applicable.

- Follow the specific instructions for entering dates and numbers.

- Consult your loan holder if you need assistance with the form.

- Submit the completed form before any deadlines specified by your loan holder.

- Keep a copy of the form for your records.

- Sign the form and, if required, obtain your spouse’s signature.

- Don’t leave any sections blank; fill in “0” for any non-applicable items.

- Do not misrepresent your financial situation.

- Avoid providing unnecessary information that is not requested.

- Do not ignore instructions regarding the type of ink or formatting.

- Do not forget to check all boxes that apply to your situation.

- Never submit the form late.

- Do not submit without proof of income if your loan holder asks for it.

- Avoid using abbreviations or unclear language.

- Don’t hesitate to ask questions if you are uncertain about any part of the form.

By adhering to these guidelines, the process of rehabilitating your defaulted loans can be more efficient and effective.

Misconceptions

- Misconception 1: The 1845 0120 form is only necessary for those who want to lower their monthly payments.

- Misconception 2: Submitting the form guarantees loan rehabilitation.

- Misconception 3: Only those with high incomes can successfully rehabilitate their loans.

- Misconception 4: Family size does not affect loan rehabilitation eligibility.

- Misconception 5: The information on the form is not verified, so one can provide inaccurate data.

This form is specifically designed for individuals who are rehabilitating their defaulted loans. While it may lead to a lower payment amount, its primary purpose is to address the defaulted status of the loans.

While submitting the 1845 0120 form is an important step in the rehabilitation process, it does not guarantee success. If the information provided is insufficient or if the required payment terms aren’t met, rehabilitation may not occur.

Everyone has the opportunity to rehabilitate their loans, regardless of income level. The form allows for the submission of income and expenses, which helps set a feasible payment amount based on one’s financial situation.

Family size is a factor in determining the reasonable and affordable payment amount. This consideration is crucial in ensuring that the borrower is set up with a payment plan that matches their overall financial obligations.

Providing false information can lead to serious consequences, including fines and potential legal action. Therefore, accuracy is essential when filling out the form. Loan holders have the authority to request supporting documentation to verify the information provided.

Key takeaways

- Ensure all personal details are accurate in Section 1, including your Social Security Number and contact information.

- Provide detailed income and expense information in Section 2. Document any sources of income or expenses if requested by your loan holder.

- Understand that your family size influences loan rehabilitation eligibility and payment amounts as documented in Section 3.

- Read and acknowledge all conditions in Section 4 before signing. Failure to comply may result in the rejection of your rehabilitation request.

- Return the completed form, along with any supporting documentation, to the address specified in Section 8 to ensure proper processing.

Browse Other Templates

Daily Work Log,Employee Attendance Record,Time and Attendance Sheet,Monthly Time Tracking Form,Work Hours Verification Document,Office Attendance Register,Daily Hours Summary,Monthly Attendance Report,Staff Time Record,Work Schedule and Attendance Fo - Employers can rely on the form for accurate payroll calculations.

New York State Workers Compensation - Review your submission for completeness before sending the C-3 form.

Florida Divorce Financial Affidavit - Be aware of the filing deadlines to ensure compliance with all court requirements.