Fill Out Your 2016 Rev 545 Form

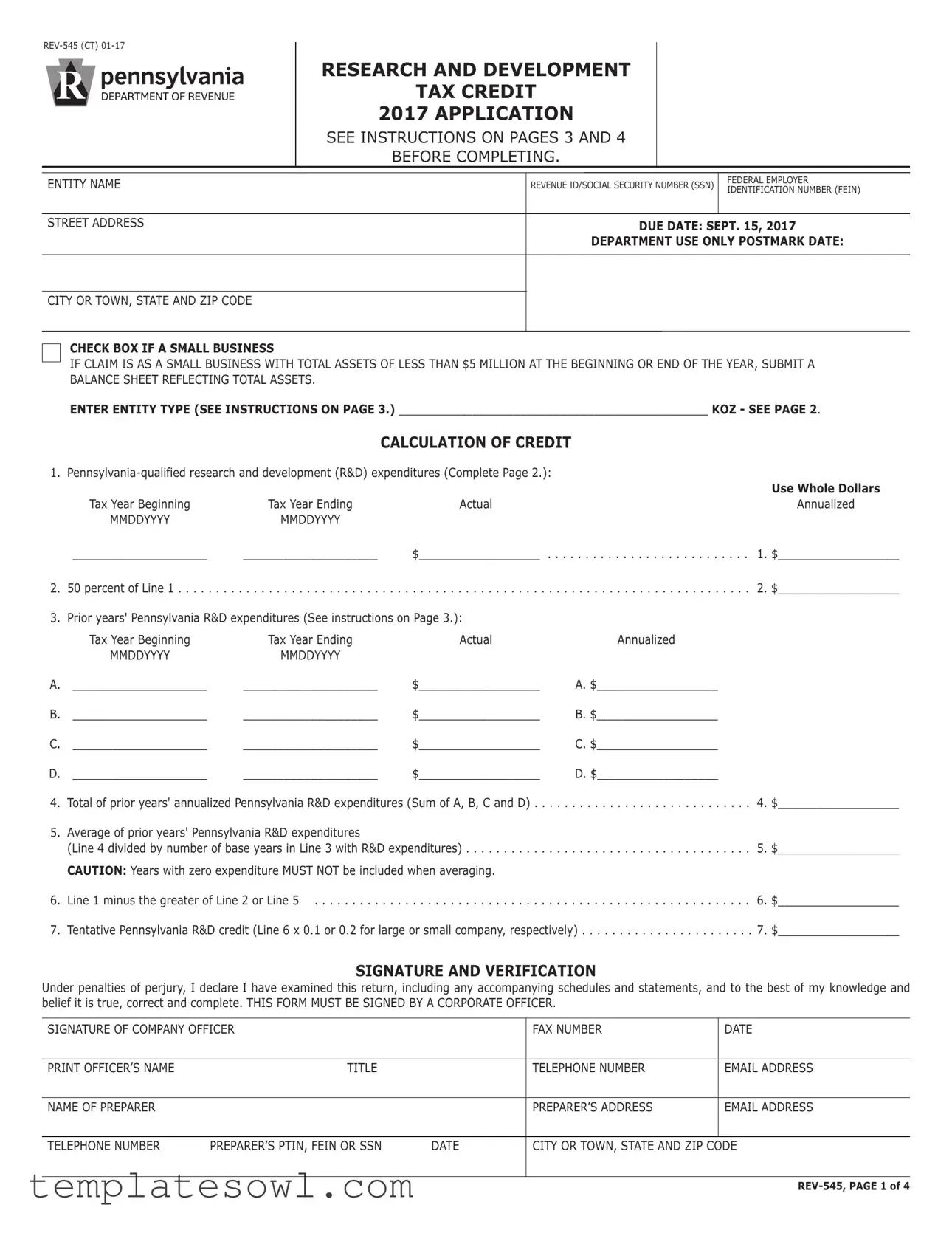

The 2016 Rev 545 form relates to Pennsylvania's Research and Development (R&D) Tax Credit application, which is designed to support businesses engaging in qualified R&D activities. This application is an essential tool for entities wishing to claim credits that can ultimately reduce their tax obligations. The form consists of several key sections, where businesses provide detailed information about their qualified R&D expenditures for the current tax year, as well as those from prior years. Importantly, the application requires a balance sheet for small businesses with total assets of less than $5 million. The calculations outlined in the form determine the eligible credits, influenced by the business's annual and prior Pennsylvania R&D expenditures. Additionally, the form includes a section for entity identification, requiring basic information such as the entity name, address, and identification numbers. Upon completion, the form must be signed by a corporate officer to confirm the accuracy of the information provided. Therefore, it is vital to ensure all necessary documentation and explanations accompany the application to prevent any delays in processing or potential denial of the claim.

2016 Rev 545 Example

RESEARCHANDDEVELOPMENT

TAXCREDIT

2017APPLICATION

SEE INSTRUCTIONS ON PAGES 3 AND 4

BEFORE COMPLETING.

ENTITY NAME

STREET ADDRESS

REVENUE ID/SOCIAL SECURITY NUMBER (SSN) |

FEDERAL EMPLOYER |

|

IDENTIFICATION NUMBER (FEIN) |

||

|

||

|

|

DUEDATE:SEPT.15,2017

DEPARTMENTUSEONLYPOSTMARKDATE:

CITY OR TOWN, STATE AND ZIP CODE

CHECKBOXIFASMALLBUSINESS

IF CLAIM IS AS A SMALL BUSINESS WITH TOTAL ASSETS OF LESS THAN $5 MILLION AT THE BEGINNING OR END OF THE YEAR, SUBMIT A BALANCE SHEET REFLECTING TOTAL ASSETS.

ENTERENTITYTYPE(SEEINSTRUCTIONSONPAGE3.)______________________________________________

CALCULATIONOFCREDIT

1.

|

|

|

|

|

UseWholeDollars |

|

Tax Year Beginning |

Tax Year Ending |

Actual |

|

Annualized |

|

MMDDYYYY |

MMDDYYYY |

|

|

|

|

____________________ |

____________________ |

$__________________ . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

1. $__________________ |

2. |

50 percent of Line 1 |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2. $__________________ |

|

3. |

Prior years' Pennsylvania R&D expenditures (See instructions on Page 3.): |

|

|

||

|

Tax Year Beginning |

Tax Year Ending |

Actual |

Annualized |

|

|

MMDDYYYY |

MMDDYYYY |

|

|

|

A. |

____________________ |

____________________ |

$__________________ |

A. $__________________ |

|

B. |

____________________ |

____________________ |

$__________________ |

B. $__________________ |

|

C. |

____________________ |

____________________ |

$__________________ |

C. $__________________ |

|

D. |

____________________ |

____________________ |

$__________________ |

D. $__________________ |

|

4. |

Total of prior years' annualized Pennsylvania R&D expenditures (Sum of A, B, C and D) |

4. $__________________ |

|||

5. |

Average of prior years' Pennsylvania R&D expenditures |

|

|

|

|

|

(Line 4 divided by number of base years in Line 3 with R&D expenditures) |

5. $__________________ |

|||

|

CAUTION:Years with zero expenditure MUST NOT be included when averaging. |

|

|

||

6. |

Line 1 minus the greater of Line 2 or Line 5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

6. $__________________ |

||

7. |

Tentative Pennsylvania R&D credit (Line 6 x 0.1 or 0.2 for large or small company, respectively) |

7. $__________________ |

|||

SIGNATUREANDVERIFICATION

Under penalties of perjury, I declare I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. THIS FORM MUST BE SIGNED BY A CORPORATE OFFICER.

SIGNATURE OF COMPANY OFFICER |

|

FAX NUMBER |

DATE |

|

|

|

|

|

|

PRINT OFFICER’S NAME |

TITLE |

|

TELEPHONE NUMBER |

EMAIL ADDRESS |

|

|

|

|

|

NAME OF PREPARER |

|

|

PREPARER’S ADDRESS |

EMAIL ADDRESS |

|

|

|

|

|

TELEPHONE NUMBER |

PREPARER’S PTIN, FEIN OR SSN |

DATE |

CITY OR TOWN, STATE AND ZIP CODE |

|

|

|

|

|

|

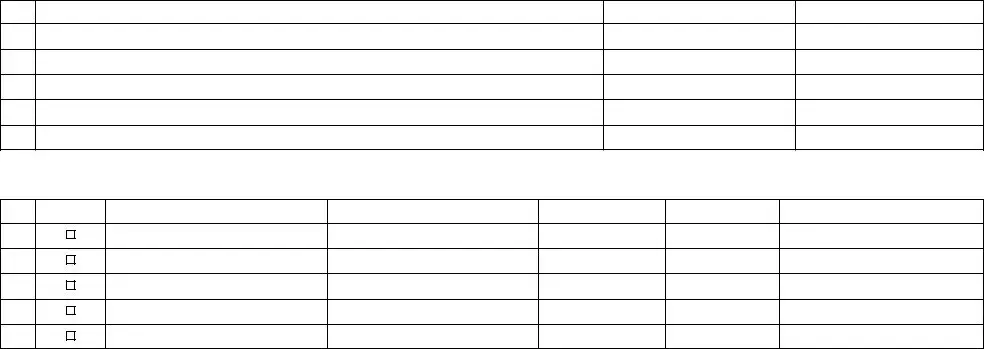

BREAKDOWNOFR&DEXPENDITURESBYLOCATION

PARTI

|

|

Column 1 |

Column 2 |

Column 3 |

Column 4 |

|

|

|

|

|

|

Line 1 |

Federal R&D Expense |

|

|

$ |

100% |

|

PA Location: |

PA Expenditure |

Total Expenditure |

Percent of Federal Expense |

|

|

Expenditure |

Located in KOZ |

(Percent of Line 1, Column 3) |

||

|

|

|

|||

|

|

|

|

|

|

Line 2 |

A |

$ |

$ |

$ |

% |

|

|

|

|

|

|

Line 3 |

B |

$ |

$ |

$ |

% |

|

|

|

|

|

|

Line 4 |

C |

$ |

$ |

$ |

% |

|

|

|

|

|

|

Line 5 |

D |

$ |

$ |

$ |

% |

|

|

|

|

|

|

Line 6 |

E |

$ |

$ |

$ |

% |

|

|

|

|

|

|

Line 7 |

|

|

$ |

% |

|

|

|

|

|

|

|

Line 8 |

Total |

$ |

|

$ |

100% |

|

|

|

|

|

|

PARTII

A.

B.

C.

D.

E.

Address

City

ZIP Code

PARTIII

3rd Party |

Contact Name |

Employer Name |

Telephone Number |

Fax Number |

Email Address |

A.

B.

C.

D.

E.

PENNSYLVANIARESEARCHANDDEVELOPMENTTAXCREDITAPPLICATIONINSTRUCTIONS

PERACT7of1997,ACT46of2003,ACT116of2006andAct84of2016

Requiredinformation: Completed and signed Page 1 of the 2016 Research and Development Tax Credit Application, completed Page 2 of the 2016 R&D application, completed Page 2 (all three sections) of

NOTE: Verify the address on Page 1; it will be used to mail the award letter.

Prior year expenses must be four taxable years immediately preceding the taxable year in which the expense is incurred.

To apply for a PA R&D tax credit, a taxpayer must have qualified PA R&D expenses in the current tax year (Line 1) and in at least one preceding tax year (Line 3). NOTE:IfPAR&DexpenditureswereincurredinaKeystoneOpportunityZone(KOZ),thetaxpayerisnotentitled

to an R&D credit. If you have questions regarding combining a Keystone Opportunity Zone (KOZ) tax credit and a Research and

For purposes of the PA R&D tax credit, a taxpayer is an entity subject to PA personal income tax or corporate net income tax.

Qualified R&D expenses include research expenses incurred for qualified research and development, as defined in Section 41 (b) of the Internal Revenue Code of 1986, conducted within PA.

A

The department will notify applicants of PA R&D tax credit approvals by mailing award letters by Dec. 15th. A taxpayer may apply the approved credit against his/her PA personal income tax or corporate net income tax liability for the tax year in which the credit is approved. Any unused credit may be carried over for up to 15 succeeding taxable years. A taxpayer is not entitled to carry back, obtain a refund of or assign unused PA R&D tax credits awarded on or prior to Dec. 15, 2002.

Effective for awards made Dec. 15, 2003, and after, the taxpayer can apply to the PA Department of Community and Economic Development, DCED, to sell or assign a PA R&D credit if there has been no claim of allowance filed within one year from the date the Department of Revenue approved the credit. Effective for awards made Dec. 15, 2009, and after, the taxpayer no longer has to wait one year before selling or assigning the credit. However, the taxpayer cannot sell or assign credit until the tax return covering the period including the Dec. 15 award date has been filed.

To apply to sell or assign R&D credit, visit www.dced.pa.gov or contact DCED at

Effective for awards made Dec. 15, 2006, and after,

ENTITY TYPE: Complete the Entity Type on Page 1 by selecting one of the following categories:

Individual,LLC,LLP,Scorporation,Ccorporation,Soleproprietorship

If any tax years on Line 1 or Lines 3A, 3B, 3C or 3D of Page 1 represent a period of less than a full year, (other than for full year

Example: Tax year beginning Jan. 1, 2016, and ending July 31, 2016

Annualized amount = $1,000,000 x 365* = $1,721,698 212

*Use 366 for leap years that include 29 days in February.

If the taxpayer has two or more consecutive short periods that equal one full tax year, the short periods should be combined as a single tax year on Line 1 and Line 3,

InstructionsforPage2,BreakdownofR&DExpendituresbyLocation

PARTI,Page2

Line 1:

Column 3 – List the Total Qualified Research Expenses from Section A, Section B or Section C of federal Form 6765.

Line 2: Location A

Column 1 – List

Column 2 – List PA expenditures located in a KOZ.

Column 3 – List total PA expenditures (sum of Columns 1 and 2).

Column 4 – List percent of federal expense (Line 1, Column 3).

Lines 3 through 6 should be completed for additional PA locations (if more than five locations, make a clean copy of Page 2 to report additional locations).

Line 7:

Column 3 – List total

Column 4 – List percent of federal expense (Line 1, Column 3).

Line 8:

Column 1 – Total

PARTII

List address for each location (A, B, etc.).

PARTIII

List contact’s name, employer’s name, telephone number, fax number and email address for each location (A, B, etc.). Check the box if the research was performed by a third party.

NOTE: Complete Page 2 of the R&D application even if all expenses were incurred in PA.

Please carry all totals to the bottom of each column, Part I, Page 2 of the R&D application.

Forinformationonthisandothersaleablerestrictedtaxcreditprograms,pleasevisittheDepartmentofRevenue’sOnlineCustomer Service Center and/or review Corporation Tax Bulletin

CAUTION:You MUST email your

CAUTION: When emailing, your application with any supporting documentation must be one document in PDF format to ensure timely and accurate processing.

If submitting more than one application, each application must be a separate attachment in your email.

CHECKLIST:

Before submitting your application, please review the items below and put an X next to each item after you have verified it is complete. This will help to avoid a delay or denial of your application.

_____1. Page 1 and Page 2 (all three parts) of the

_____2. Included is a copy of federal Form 6765 or a pro forma copy of federal Form 6765 for each year listed with expenditures. Expenditures

are listed under Line 1 and Line 3 on Page 1 of

_____3. Included is a completed Page 2 of

Page 1 of

_____4. Included is a written explanation of the difference(s) in R&D expenditures between this year’s expenditures and prior filings of

if applicable. Supporting documentation is also included.

_____5. If filing as a small business, included is a copy of the balance sheet showing total assets less than $5 million at the beginning or end of

the year.

*NOTE: Only provide items 2 and 3 above for years that had changes in expenditures or years for which this information was not already provided in prior filings of

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The REV-545 form is an application used to claim the Pennsylvania Research and Development Tax Credit for qualifying expenditures. |

| Entity Types | Eligible entities include individuals, LLCs, LLPs, S corporations, C corporations, and sole proprietorships. |

| Filing Deadline | The deadline to submit the REV-545 form for the 2017 tax year is September 15, 2017. |

| Governing Laws | This form is governed by Act 7 of 1997, Act 46 of 2003, Act 116 of 2006, and Act 84 of 2016. |

| Small Business Criteria | The form includes a checkbox for small businesses, which are defined as those with total assets less than $5 million. |

| Credit Calculation | The tentative Pennsylvania R&D credit is calculated based on eligible expenses, with specific percentages depending on whether the applicant is a large or small company. |

Guidelines on Utilizing 2016 Rev 545

Filling out the 2016 Rev 545 form requires collecting specific information about your research and development expenditures and ensuring that all sections of the form are accurately completed. Follow the steps carefully to ensure your application is processed smoothly.

- Enter your entity name in the designated field on Page 1.

- Fill in your complete street address, including city or town, state, and ZIP code.

- Provide your Revenue ID or Social Security Number (SSN) and Federal Employer Identification Number (FEIN).

- Note the due date, which is September 15, 2017.

- If applicable, check the box to indicate if you are a small business with total assets of less than $5 million at the beginning or end of the year. Include a balance sheet reflecting total assets.

- State your entity type by selecting from the listed options.

- Complete Page 2 for the calculation of your Pennsylvania-qualified research and development (R&D) expenditures. Make sure to use whole dollars.

- Fill out the appropriate tax year starting and ending dates in the provided fields.

- Report your actual annualized R&D expenditures on Line 1, ensuring accuracy.

- Calculate 50 percent of Line 1 and enter that amount on Line 2.

- List any prior years' Pennsylvania R&D expenditures, providing tax year details and actual annualized amounts for each relevant year on Line 3 (A-D).

- Total the prior years' annualized Pennsylvania R&D expenditures and enter the amount on Line 4.

- Calculate the average of prior years' Pennsylvania R&D expenditures and write that figure on Line 5.

- Subtract the greater of Line 2 or Line 5 from Line 1, and record the result on Line 6.

- Determine the tentative Pennsylvania R&D credit by multiplying Line 6 by 0.1 for large companies or 0.2 for small companies, and enter the credit amount on Line 7.

- Sign the form where indicated. A corporate officer must sign to verify the form's accuracy.

- Provide the officer’s contact information, including title, telephone number, and email address.

- Fill in the preparer’s details if someone else prepared the form, including a signature if applicable.

- Ensure that all pages are completed and ready for submission by reviewing your entries.

- Email your completed form and any required attachments as one PDF document to ra-rvpacorprd@pa.gov.

What You Should Know About This Form

What is the purpose of the 2016 Rev 545 form?

The 2016 Rev 545 form is used to apply for the Pennsylvania Research and Development (R&D) Tax Credit. This tax credit is available to entities that have incurred qualified R&D expenditures in Pennsylvania, and it aims to encourage innovation and investment in research activities within the state.

Who is eligible to submit the Rev 545 form?

Entities subject to Pennsylvania personal income tax or corporate net income tax can submit the Rev 545 form. This includes corporations, partnerships, limited liability companies, and sole proprietorships. A qualifying entity must demonstrate that it has qualified R&D expenditures both in the current tax year and in at least one prior year.

What information is needed to complete the Rev 545 form?

You will need to provide details such as the entity's name, address, revenue ID or Social Security number (SSN), Federal Employer Identification Number (FEIN), and a summary of R&D expenditures. This includes both current year expenses and any prior year expenses. Additionally, a balance sheet is required for small businesses claiming the credit if total assets are less than $5 million.

How are R&D expenditures calculated on the form?

R&D expenditures are listed on the form as the total qualified expenditures made in Pennsylvania. To determine your credit, you first identify the current year's expenditures and compare them against prior years’ expenditures. The form includes various lines to facilitate this calculation, such as averaging prior year expenditures and determining the tentative credit amount based on total eligible R&D expenses.

What happens after submitting the Rev 545 form?

Once the form is submitted, you will receive an award letter by December 15th if your application is approved. The approved tax credit can then be applied against your Pennsylvania personal income tax or corporate net income tax liability for the assigned tax year. Any unused credit can be carried over for up to 15 succeeding taxable years.

Can the tax credit be transferred or sold?

Yes, the Pennsylvania R&D tax credit can be transferred or sold, but specific conditions must be met. After the credit has been approved, a taxpayer can apply to sell or assign it if they have not filed a claim within one year of the approval date. The buyer can use the credit in the taxable year of the purchase but cannot carry it over, back, or obtain a refund for it.

Common mistakes

Filling out the 2016 Rev 545 form correctly is essential for claiming the Pennsylvania Research and Development Tax Credit. Unfortunately, many applicants make mistakes that can hinder their chances of approval. One common error is not using whole dollars when reporting expenditures. This can lead to miscalculations and potential delays in processing.

Another frequent oversight involves failure to annualize R&D expenditures when the reporting period is less than a full year. This mistake can result in inaccuracies that may affect the claimed amount. If a taxpayer has two or more short periods that together cover one full tax year, combining these periods is necessary; otherwise, separate filings may misrepresent the total expenditures.

In addition, applicants sometimes neglect to submit the required federal Form 6765 or its pro forma for each relevant year. This documentation is crucial for verifying the claimed expenditures. Each year with reported R&D expenditures must be accompanied by completed Page 2 of the Rev 545 application, which many applicants overlook.

Another significant error is failing to provide an explanation for changes in R&D expenditures from prior filings. If there are discrepancies, a detailed explanation and supporting documentation must accompany the application. This omission can lead to rejection or requests for further clarification, causing delays in the approval process.

Some individuals incorrectly indicate their entity type without confirming it matches the business structure. Choosing the wrong category may not automatically disqualify the application, but it can lead to complications during the review process. It is crucial to identify the correct entity type, such as an S corporation or LLC, to ensure proper classification.

Additionally, applicants might misunderstand the requirements when claiming status as a small business. For those eligible, providing a balance sheet to demonstrate total assets under $5 million is mandatory. Failing to include this document can swiftly derail an otherwise valid claim.

An incomplete submission is another prevalent mistake. Each part of the application must be filled out completely. Sometimes applicants assume that minor sections can be left blank, but doing so can cause significant processing issues. A thorough review is imperative before submission.

The address verification error also contributes to misunderstandings. The address on Page 1 is used for mailing award letters and other correspondence. If this address is incorrect, communications can be delayed or misdirected.

Lastly, applicants often misread submission instructions, particularly regarding the email process. It is vital that all documents are consolidated into one PDF file to avoid processing delays. Incorrect or multiple attachment formats can lead to immediate rejection.

Documents used along the form

When applying for the Pennsylvania Research and Development Tax Credit using the 2016 Rev 545 form, there are several other documents and forms that may be necessary or helpful to include. These documents help create a comprehensive application, ensuring all required information is presented clearly. Here’s a summary of some important forms often used alongside the Rev 545.

- Federal Form 6765: This form is essential for claiming the federal Research and Experimentation Tax Credit. It outlines R&D expenses and must be submitted each year to provide context for the state-level claim.

- Pro Forma 6765: If a company does not have the actual federal Form 6765 for some years, it can submit a pro forma version. This serves as an estimate of qualifying expenses and helps support the tax credit application.

- Balance Sheet: Small businesses claiming credit must provide a balance sheet for the year in question. This document ensures the business meets the criteria of having total assets under $5 million.

- Page 2 of REV-545: Every application must include completed sections from this page, detailing R&D expenditures and their locations. This helps clarify the basis for the tax credit calculated.

- Written Explanation of Changes: If a business has revised its R&D expenditures compared to previous applications, a detailed written explanation, along with supporting documentation, should be included to justify the changes.

- Partnership Information: For entities that are partnerships, any relevant details regarding ownership stakes and partners’ shares should be reported to ensure compliance and accuracy.

- Third Party Contact Information: If research was conducted by an outside party, including a third-party contact name, employer, and other relevant details can help validate the claimed R&D activities.

Collectively, these forms and documents not only support the Rev 545 but also enhance the clarity and completeness of the tax credit application. Submitting a well-organized application can significantly affect the outcome, ensuring that all qualifying expenses are considered favorably.

Similar forms

- Federal Form 6765: Both documents involve the application for claiming research and development tax credits. They require similar financial data and calculations related to R&D expenditures.

- Form 8883: This form is used for claiming a tax credit when acquiring a qualified business. Like the REV-545, it necessitates precise details about expenditures and eligibility requirements for claiming the benefit.

- State Research & Development Tax Credit Applications: Many states offer R&D tax credits with their forms reflecting similar structures. Applicants must provide data on eligible expenses, just as required in the REV-545.

- Tax Credit Transfer Forms: Documents used to transfer or sell tax credits have a parallel in the REV-545. Both require documentation detailing the credit amount and identification of the parties involved.

- Partnership Tax Returns (Form 1065): While primarily for reporting income, these returns also contain information about eligible credits and deductions that mirror the process seen in the REV-545.

- Corporate Tax Returns (Form 1120): Similar to the REV-545, these returns handle a corporation’s revenue and expenses, including tax credits and their calculations.

- Employment Tax Forms: Forms like the IRS Form 941 show eligible expenses and credits available for employment-related costs. Both outlines focus on expense reporting to claim allowances.

- State Incentive Application Forms: Various states have incentive applications for businesses which often include sections on R&D expenditures. These require comparative financial data as seen in the REV-545.

Dos and Don'ts

When filling out the 2016 Rev 545 form for the Pennsylvania Research and Development Tax Credit, following some basic guidelines can help ensure your application is complete and accurate. Here are five important dos and don'ts:

- Do carefully read and follow the instructions provided on pages 3 and 4 of the form.

- Do ensure that all required information is completed, including federal Form 6765 or a pro forma version for each year listed.

- Do include a written explanation for any discrepancies in R&D expenditures compared to previous filings.

- Do list the entity type clearly on Page 1 of the form.

- Do double-check the mailing address provided on the form, as it will be used for all future correspondence.

- Don't forget to sign the form; it must be signed by a corporate officer.

- Don't include this application with your RCT-101 corporate net income tax report.

- Don't submit more than one application in a single PDF file, as each must be an individual attachment.

- Don't forget to include a balance sheet if claiming as a small business, showing total assets under $5 million.

- Don't exclude any required pages, as all pages must be completed for a thorough review.

Misconceptions

Misconceptions can often cloud understanding of tax forms and their requirements, leading to confusion and frustration. The 2016 Rev 545 form, used for claiming the Pennsylvania Research and Development Tax Credit, is no exception. Here are some common misconceptions:

- The form is only for large businesses. Many people believe that the Rev 545 form is only applicable to large corporations with substantial R&D budgets. In reality, small businesses can benefit as well. The form includes specific provisions for small businesses, especially those with total assets under $5 million.

- R&D expenses must occur in Pennsylvania to qualify. While the intent of the credit is to stimulate in-state research and development, some taxpayers mistakenly think that expenses incurred out-of-state disqualify them entirely. However, it’s essential to report both in-state and non-Pennsylvania R&D expenditures accurately, as they may still impact total credit calculation.

- Previous applications have no bearing on future submissions. A common belief is that each tax year is an isolated event. This isn’t true. If there are changes in R&D expenditures from prior years, an explanation and supporting documentation must be included with each new application to clarify discrepancies.

- Incorporating a Keystone Opportunity Zone (KOZ) region eliminates all credits. Some assume that conducting research in a KOZ disqualifies an entity from receiving any R&D credits. While it is true that expenses incurred directly in a KOZ may not benefit from the R&D credit, taxpayers can still qualify for credits based on prior expenses, provided they meet the overall requirements.

- The application doesn’t need to be signed by a corporate officer. Many entrepreneurs think that it’s enough to fill out the form, but the Rev 545 application explicitly requires a corporate officer's signature. This added verification requirement is essential for ensuring the accuracy and completeness of the information submitted.

Understanding these misconceptions can help streamline the application process and enable businesses, both large and small, to take full advantage of the tax credits available to them.

Key takeaways

Ensure all sections of the 2016 Rev 545 form are filled out completely and accurately. This includes Pages 1 and 2.

Provide a signed application to avoid delays in processing. This is required for all submissions.

Include federal Form 6765 or a pro forma version for each year listed with R&D expenditures. This applies not only to the current year but also to prior years.

Small businesses claiming the credit must submit a balance sheet demonstrating total assets of less than $5 million.

Prior year Pennsylvania R&D expenditures must be reported. They should be from the four taxable years immediately before the current taxable year.

Document any changes in R&D expenditures between the current and previous filings. Include a detailed explanation and relevant supporting documents.

When emailing your application, consolidate all documents into one PDF. This will help ensure timely processing.

Double-check your entity information on Page 1 to ensure the accuracy of the address and type of entity.

Use whole dollar amounts for all expenditures. Make sure calculations are accurate and clear.

Understand that unused credits can be carried forward for up to 15 succeeding taxable years, but cannot be carried back.

Browse Other Templates

Wildlife Removal Hammond La - The completed application should be sent to the designated address for final processing.

Property Tax Write Off - Expenses must be directly related to your real estate activities to qualify.