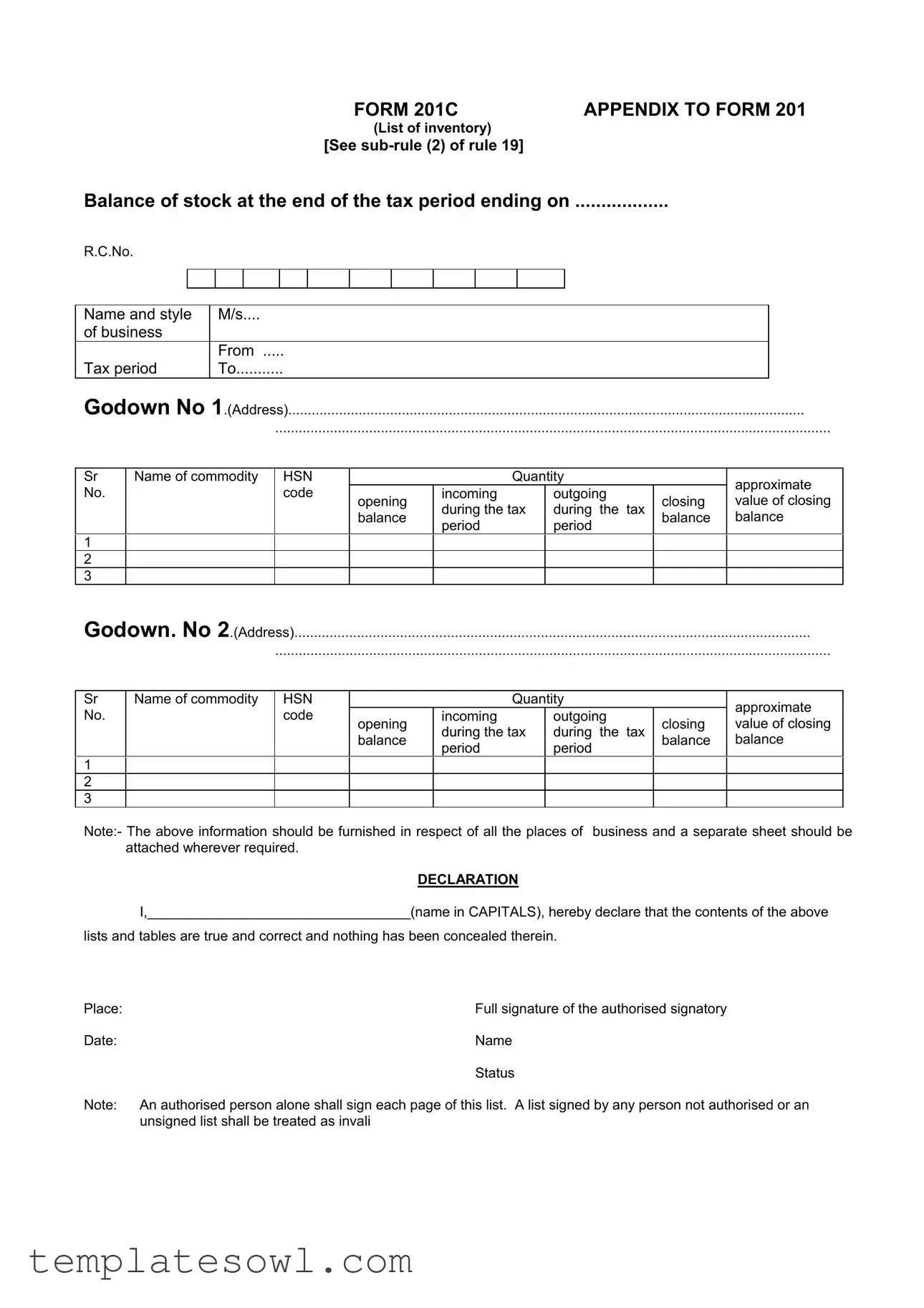

Fill Out Your 201C Form

The 201C form serves an essential function in inventory management for businesses, specifically regarding tax reporting. This form requires a detailed account of stock levels at the conclusion of a specified tax period. Businesses must identify crucial information, including the name, style, and registration number of the company, as well as the addresses of each godown where inventory is stored. The form is divided into sections that capture incoming and outgoing quantities of commodities, along with their respective HSN codes. It also demands accurate recordings of opening and closing balances to substantiate the financial statements of the business. It’s important to note that the form requires the declaration to be signed by an authorized representative, adding a layer of accountability. Failure to complete and sign the form correctly or to ensure all locations of business are accounted for can lead to significant issues, including invalid submissions. By understanding the intricacies of the 201C form, businesses can better prepare for audits, maintain compliance, and uphold transparency in their operations.

201C Example

|

|

|

|

|

|

|

|

|

|

|

FORM 201C |

|

APPENDIX TO FORM 201 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

(List of inventory) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

[See |

|

|

|

|

|

|

|||||

Balance of stock at the end of the tax period ending on |

|

|

|

||||||||||||||||||

R.C.No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name and style |

|

M/s.... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

From |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Tax period |

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Godown No 1.(Address) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

.............................................................................................................................................. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Sr |

|

Name of commodity |

|

HSN |

|

|

|

|

Quantity |

|

|

approximate |

|||||||||

No. |

|

|

|

|

|

|

|

code |

|

|

|

incoming |

outgoing |

|

|

||||||

|

|

|

|

|

|

|

|

opening |

|

closing |

value of closing |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

during the tax |

during the |

tax |

||||||||

|

|

|

|

|

|

|

|

|

|

|

balance |

balance |

balance |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

period |

period |

|

|

|

|

|||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Godown. No 2.(Address) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

.............................................................................................................................................. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Sr |

|

Name of commodity |

|

HSN |

|

|

|

|

Quantity |

|

|

approximate |

|||||||||

No. |

|

|

|

|

|

|

|

code |

|

|

|

incoming |

outgoing |

|

|

||||||

|

|

|

|

|

|

|

|

opening |

|

closing |

value of closing |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

during the tax |

during the |

tax |

||||||||

|

|

|

|

|

|

|

|

|

|

|

balance |

balance |

balance |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

period |

period |

|

|

|

|

|||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:- The above information should be furnished in respect of all the places of business and a separate sheet should be attached wherever required.

DECLARATION

I,__________________________________(name in CAPITALS), hereby declare that the contents of the above

lists and tables are true and correct and nothing has been concealed therein.

Place: |

Full signature of the authorised signatory |

Date: |

Name |

|

Status |

Note: |

An authorised person alone shall sign each page of this list. A list signed by any person not authorised or an |

|

unsigned list shall be treated as invali |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form 201C is an appendix to report the stock inventory at the end of a tax period, including a detailed list of commodities. |

| Governing Law | This form is governed by the specific tax laws outlined in Rule 19 of the applicable jurisdiction. |

| Content Requirements | It requires information such as the name of the business, the period of tax, commodity details, and storage locations. |

| Signature Requirement | The declaration must be signed by an authorised signatory; any unsigned or improperly signed document may be considered invalid. |

| Inventory Details | Users must report the quantity and value of commodities coming in and going out, as well as the opening and closing balances. |

| Separate Sheets | If the business has multiple locations, separate sheets should be attached to detail each location's inventory. |

Guidelines on Utilizing 201C

Filling out the 201C form requires attention to detail and accuracy. Follow these steps to ensure you provide the necessary information correctly.

- Begin by entering the name and style of the business at the top of the form.

- Provide the R.C. number for your business.

- Indicate the tax period by filling in the "From" and "To" dates.

- For each godown (storage location), fill in the address in the designated area.

- In the inventory section, list each commodity:

- Enter the serial number (Sr. No.) for each item.

- Input the name of the commodity.

- List the HSN (Harmonized System of Nomenclature) code.

- Fill in the quantity of items coming in during the tax period.

- Fill in the quantity of items going out during the tax period.

- Provide the opening balance at the beginning of the period.

- Provide the closing balance at the end of the period.

- Enter the approximate value of the closing balance.

- Repeat the inventory information for each additional godown, using separate sheets as necessary.

- In the declaration section, write your name in capital letters, and declare that the list is accurate.

- Sign the form, noting that only an authorized person can sign.

- Date the form in the provided space.

- Ensure each page is signed by the authorized signatory to avoid invalidation.

What You Should Know About This Form

What is Form 201C?

Form 201C is an appendix to Form 201 that provides a structured format for businesses to report their inventory. It is specifically designed to capture details about the balance of stock at the end of a tax period. The form includes sections for entering information such as commodity details, HSN codes, quantities, and values, all of which are vital for tax assessment and compliance purposes.

What information is required on Form 201C?

The form requires several pieces of information, including the name and style of the business, addresses of the godowns (warehouses), and details about each commodity held in stock. This includes the name of the commodity, HSN code, quantities of incoming and outgoing stock during the tax period, as well as the opening and closing balances for that period. Businesses must include all relevant sites of operation and attach separate sheets as necessary for additional locations.

Who is responsible for signing Form 201C?

The form must be signed by an authorized signatory of the business, whose full name should be clearly stated in capital letters. It is important to note that each page of the form must be signed to validate the information presented. If the signature is missing or provided by unauthorized personnel, the submission will be deemed invalid, potentially leading to compliance issues.

What happens if the information on Form 201C is incorrect?

If the information submitted on Form 201C is found to be incorrect or misleading, this may result in penalties or fines from the relevant tax authorities. Accuracy is crucial, as the contents are subject to verification. Businesses should take care to ensure that all reported figures are true and complete, and it is recommended to conduct a thorough review before submission.

Common mistakes

Completing Form 201C can be straightforward, but many people make common mistakes that can lead to complications. Here are nine mistakes to avoid when filling out this important document.

One common error is failure to provide complete information. Each section of the form demands specific details, including the name of commodities and their corresponding HSN codes. Omitting these details can delay processing and lead to misunderstandings.

Another issue arises from incorrect entries in the quantity fields. Be sure to double-check incoming and outgoing quantities. Mistakes in these numbers can significantly skew the reported inventory levels, resulting in potential compliance problems.

People often forget to list all places of business. If your business operates in multiple locations, ensure you complete a separate sheet for each one. Incomplete submissions will be flagged and require additional time to rectify.

Signing the form poses another challenge. Some individuals neglect to have the authorized signatory sign each page. Without the proper signature, the form can be deemed invalid, leading to further complications.

Another mistake is inaccurate dates. Ensure that the tax period dates are correctly filled out. Incorrect dates might cause mismatches with tax records, resulting in confusion or delays.

Some people also struggle with calculating balances. Make sure to verify both the opening and closing balances for accuracy. Errors in these calculations can lead to larger issues down the line.

Additionally, not adhering to formatting requirements can lead to rejection of the form. Pay attention to how the information needs to be structured, particularly regarding the accompanying lists and tables. Following the guidelines closely is crucial.

Lastly, failing to declare the information truthfully can have serious consequences. The declaration section is vital, and any inaccuracies can result in legal ramifications. It's essential to fill out this section honestly and ensure that all data is correct.

Avoiding these common mistakes will help ensure a smooth filing process. Taking the time to review each section thoroughly can prevent delays and complications down the line.

Documents used along the form

The 201C form is often accompanied by several other forms and documents. These documents help provide additional information required for tax and regulatory compliance. Below is a list of commonly used documents along with brief descriptions.

- Form 201A: This form is used to report the details of the business activities during a specific tax period. It includes information such as income generated and expenses incurred.

- Form 201B: This form details the assets and liabilities of the business. It provides a snapshot of the financial position of the business at the end of the tax period.

- Form GST ANX-1: This is a return that businesses must submit containing details of outward supplies. It includes sales information and is critical for calculating Goods and Services Tax (GST).

- Form GST ANX-2: This return captures the details of inward supplies. It helps businesses track their purchases and claim input tax credits.

- Form TDS Certificate: This document certifies the amount of tax deducted at source. It must be provided to the payee and is vital for tax reporting.

- Profit and Loss Statement: This financial statement summarizes revenues, costs, and expenses during a specified time. It is essential for evaluating business performance.

- Balance Sheet: This document presents the company's financial position at a specific point in time. It summarizes assets, liabilities, and equity.

Using the 201C form in conjunction with these documents ensures that all necessary information is reported accurately. Each document plays a crucial role in providing a comprehensive view of the business's financial standing and operational activities.

Similar forms

-

Form 1040 - Similar to Form 201C, this document allows individuals to report their income, deductions, and taxes owed. Both require accurate reporting of financial data for tax purposes, ensuring compliance with IRS regulations.

-

Schedule C - Used by sole proprietors, this form details income and expenses from self-employment. Like Form 201C, it requires detailed information about business activities and inventory.

-

Form 941 - Employers use this form to report payroll taxes. Similar to Form 201C, it requires precise tracking of financial activity within a specified period.

-

Form 1120 - Corporations file this form to report income, gains, and losses. It parallels Form 201C in that both document financial performance during a tax period.

-

Form 1120S - S corporations use this form, similar to corporations, but it maintains unique criteria for tax purposes. Both forms require meticulous financial tracking.

-

Form 1065 - This form is for partnerships and requires disclosure of income and expenditures, much like the inventory detail required in Form 201C.

-

Schedule A - Used for itemizing deductions, this form shares similarities with Form 201C in its detailed reporting aspect, capturing various financial details relevant for tax calculations.

-

Form W-2 - Employers give this form to employees to report wages and taxes withheld. Its structured format reflects the organized reporting required in Form 201C.

-

Form 1099 - This is used to report various types of income other than wages. Similar to Form 201C, it presents pertinent financial data that must be accurate for compliance.

-

Form 4562 - This form is used to claim depreciation and amortization. It requires detailed financial records, akin to the meticulous data collection in Form 201C.

Dos and Don'ts

When filling out the 201C form, it's essential to be thorough and accurate. Here’s a guide on what to do and what to avoid:

- Do ensure that all required fields are accurately filled in. Missing information can lead to processing delays.

- Do maintain clarity in your entries, especially with the quantities and values. This will help prevent misunderstandings.

- Do have an authorized person sign the document to validate its contents. An unsigned or improperly signed form can be rejected.

- Do attach additional sheets if necessary to provide complete information regarding all business locations.

- Don't provide false or misleading information. Doing so can lead to penalties or legal issues.

- Don't submit the form without reviewing it for errors—such mistakes can create complications.

- Don't forget to use the appropriate HSN codes for your commodities, as inaccuracies here can affect tax calculations.

- Don't leave any sections of the form blank unless explicitly instructed. Incomplete forms are often deemed invalid.

Misconceptions

Understanding the 201C form is crucial for many businesses, yet several misconceptions may lead to confusion. Here’s a breakdown of six common misunderstandings surrounding this important document.

- The 201C form is only necessary for large businesses. Many believe that only large companies need to submit this form. In reality, all businesses with inventory must present this information accurately, regardless of size.

- The form can be completed without detailed records. Some think they can fill out the 201C form without precise tracking of stock. Accurate records of all incoming and outgoing inventory are essential for completing the form correctly.

- Only the owner can sign the declaration. Many assume that only the owner has the authority to sign the form. However, an authorized person can sign it, as long as their authority is clear and documented.

- Each page of the form does not need a signature. It is often misunderstood that a single signature is sufficient. In fact, the form explicitly states that an authorized person must sign each page to validate the submission.

- The closing balance can be estimated. Some individuals believe they can round off figures or make estimations. This is incorrect; every amount reported must be correct and based on actual data to ensure compliance.

- Failure to submit the form has no consequences. There is a misconception that missing the submission deadline is a minor issue. In truth, neglecting to submit the 201C form can lead to penalties and complications during audits.

Clarifying these misconceptions can help ensure that businesses are better prepared when completing the 201C form, ultimately leading to smoother compliance with regulations.

Key takeaways

Here are some key takeaways about filling out and using the 201C form:

- Understand the Purpose: The 201C form is used to report inventory details at the end of a tax period. It's essential for compliance with tax regulations and helps ensure accurate reporting of your business's financial status.

- Accurate Information is Crucial: Fill in the form with precise details. Provide the name of each commodity, the HSN code, and the quantities for incoming and outgoing stock. Any inaccuracies can lead to complications or penalties.

- Complete All Necessary Sections: Ensure you fill out all sections related to your places of business. If you have multiple locations, attach an additional sheet when necessary to provide full disclosure.

- Authorized Signatory Requirement: The form must be signed by an authorized person. Make sure that the signature appears on every page to ensure that the form is valid and recognized by tax authorities.

- Declaration of Accuracy: At the end of the form, you must declare that the information is true and correct. This is a formal statement and should not be taken lightly, as any false information could have legal implications.

Browse Other Templates

Qr7 Online - The QR7 is an essential tool for maintaining accurate eligibility for benefits.

Genealogy Research Forms - Religious affiliation can be noted, reflecting the family's cultural heritage and values.