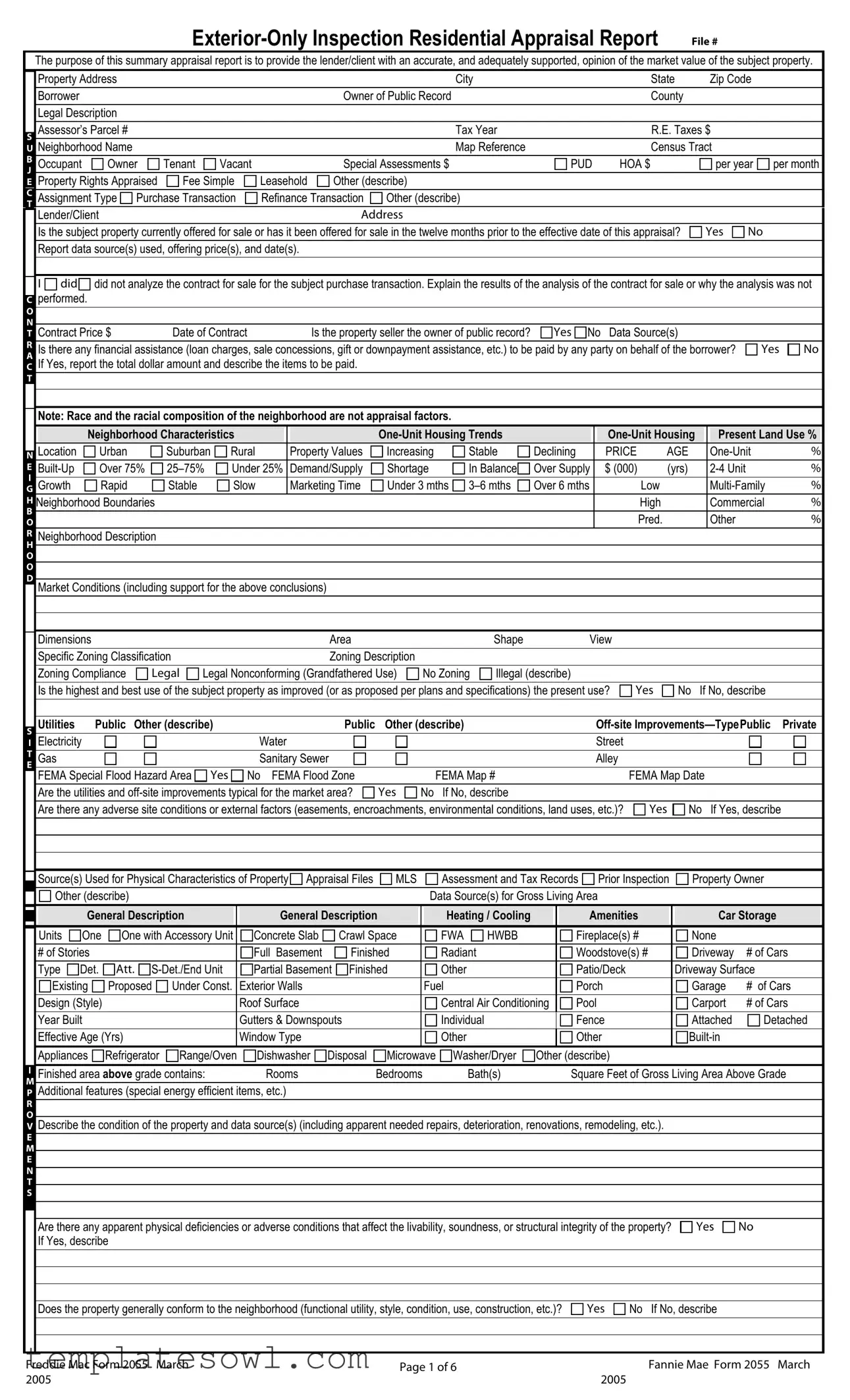

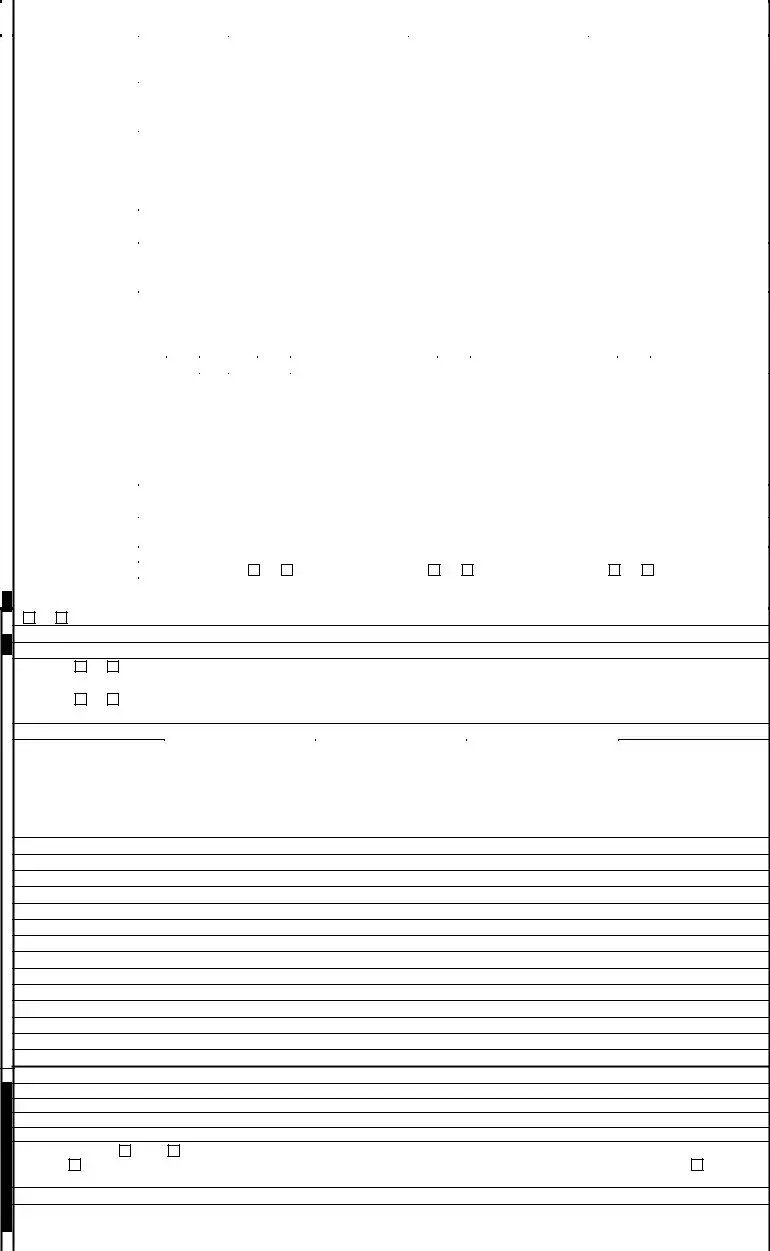

Fill Out Your 2055 Form

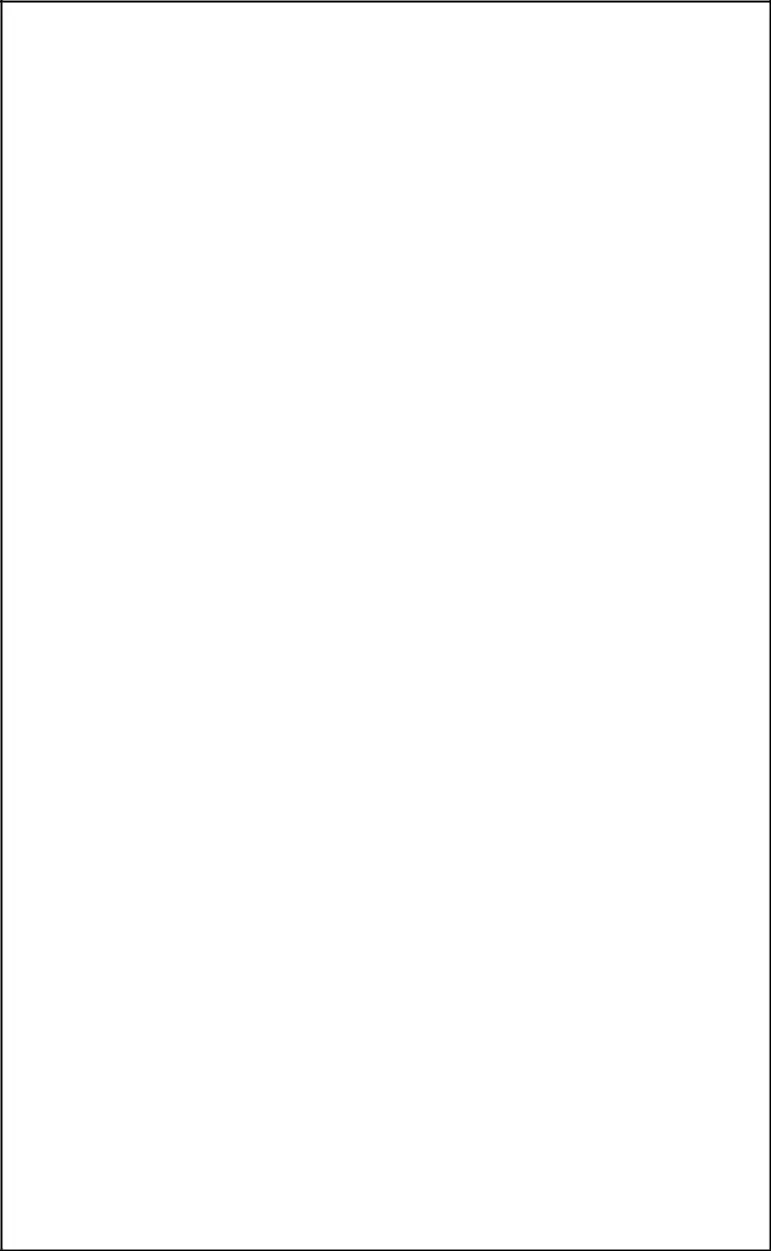

The 2055 form, also known as the Exterior-Only Inspection Residential Appraisal Report, plays a critical role in evaluating the market value of residential properties. It is designed primarily for lenders and clients seeking an appraisal for mortgage transactions, whether for a purchase or refinance. The report focuses on an exterior inspection of single-unit properties, including those within planned unit developments (PUDs). Key components of the form encompass property information such as address, legal description, and neighborhood characteristics. Additionally, it highlights the appraised property rights, details about the current market, and outlines any financial assistance related to the transaction. The appraiser must analyze comparable sales, evaluate market conditions, and assess any external factors impacting the property's value. A comprehensive section detailing physical characteristics—like building age, condition, and amenities—is included to provide a clear picture of the asset's overall quality. Finally, the report culminates in a value conclusion based on established appraisal methods, ensuring that all findings reflect an unbiased assessment of the property’s worth as of the date of inspection.

2055 Example

The purpose of this summary appraisal report is to provide the lender/client with an accurate, and adequately supported, opinion of the market value of the subject property.

|

Property Address |

|

|

|

|

|

City |

|

State |

Zip Code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower |

|

|

|

|

|

Owner of Public Record |

|

County |

|

|

|

|

|

Legal Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

Assessor’s Parcel # |

|

|

|

|

|

Tax Year |

|

R.E. Taxes $ |

|

|

||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Neighborhood Name |

|

|

|

|

|

Map Reference |

|

Census Tract |

|

|

||

|

|

|

|

|

|

|

|

|

|||||

|

Occupant |

Owner |

Tenant |

Vacant |

|

Special Assessments $ |

PUD |

HOA $ |

per year |

per month |

|||

|

|

||||||||||||

|

Property Rights Appraised |

Fee Simple |

Leasehold |

Other (describe) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assignment Type |

Purchase Transaction |

Refinance Transaction |

Other (describe) |

|

|

|

|

|

||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lender/Client |

|

|

|

|

|

Address |

|

|

|

|

|

|

|

Is the subject property currently offered for sale or has it been offered for sale in the twelve months prior to the effective date of this appraisal? |

Yes |

No |

|

|||||||||

|

Report data source(s) used, offering price(s), and date(s). |

|

|

|

|

|

|

|

|||||

I  did

did did not analyze the contract for sale for the subject purchase transaction. Explain the results of the analysis of the contract for sale or why the analysis was not performed.

did not analyze the contract for sale for the subject purchase transaction. Explain the results of the analysis of the contract for sale or why the analysis was not performed.

|

Contract Price $ |

Date of Contract |

Is the property seller the owner of public record? |

Yes No Data Source(s) |

|

|

|

|

|

||||

|

Is there any financial assistance (loan charges, sale concessions, gift or downpayment assistance, etc.) to be paid by any party on behalf of the borrower? |

Yes |

No |

|||

|

||||||

|

If Yes, report the total dollar amount and describe the items to be paid. |

|

|

|

||

|

|

|

|

|

|

|

Note: Race and the racial composition of the neighborhood are not appraisal factors.

|

|

|

|

Neighborhood Characteristics |

|

|

|

|

|

|

|

|

Present Land Use % |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Location |

Urban |

Suburban |

Rural |

|

Property Values |

Increasing |

Stable |

Declining |

|

|

PRICE |

AGE |

|

% |

|

|||||

|

|

|

|

|

|

|

||||||||||||||||

|

|

Over 75% |

Under 25% |

|

Demand/Supply |

Shortage |

In Balance |

Over Supply |

|

$ (000) |

(yrs) |

|

% |

|

||||||||

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Growth |

Rapid |

Stable |

Slow |

|

|

Marketing Time |

Under 3 mths |

Over 6 mths |

|

|

|

Low |

|

% |

|

|||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Neighborhood Boundaries |

|

|

|

|

|

|

|

|

|

|

|

High |

|

Commercial |

% |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pred. |

|

|

Other |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Neighborhood Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Conditions (including support for the above conclusions)

|

Dimensions |

|

|

|

Area |

|

|

Shape |

View |

|

|

|

Specific Zoning Classification |

|

Zoning Description |

|

|

|

|

|

|||

|

Zoning Compliance |

Legal |

Legal Nonconforming (Grandfathered Use) |

No Zoning |

Illegal (describe) |

|

|

|

|||

|

|

|

|

||||||||

|

Is the highest and best use of the subject property as improved (or as proposed per plans and specifications) the present use? |

Yes |

No If No, describe |

||||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

|

Utilities |

Public |

Other (describe) |

Public |

Other (describe) |

|

|||||

|

|

||||||||||

|

Electricity |

|

|

|

Water |

|

|

|

Street |

|

|

|

Gas |

|

|

|

Sanitary Sewer |

|

|

|

Alley |

|

|

|

FEMA Special Flood Hazard Area |

Yes |

No FEMA Flood Zone |

|

FEMA Map # |

|

FEMA Map Date |

||||

|

Are the utilities and |

Yes |

No If No, describe |

|

|

|

|||||

|

|

|

|

||||||||

|

Are there any adverse site conditions or external factors (easements, encroachments, environmental conditions, land uses, etc.)? |

Yes |

No If Yes, describe |

||||||||

|

|

|

Source(s) Used for Physical Characteristics of Property |

Appraisal Files |

MLS |

Assessment and Tax Records |

Prior Inspection |

|

Property Owner |

||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Other (describe) |

|

|

|

|

|

|

|

|

|

Data Source(s) for Gross Living Area |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

General Description |

|

|

General Description |

|

|

Heating / Cooling |

|

|

Amenities |

|

|

Car Storage |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Units |

One |

One with Accessory Unit |

|

Concrete Slab |

Crawl Space |

|

FWA |

HWBB |

|

|

Fireplace(s) # |

|

None |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

# of Stories |

|

|

|

|

Full Basement |

Finished |

|

Radiant |

|

|

|

Woodstove(s) # |

|

Driveway |

# of Cars |

|||||||||

|

|

|

Type |

Det. |

Att. |

|

Partial Basement |

Finished |

|

Other |

|

|

|

Patio/Deck |

Driveway Surface |

||||||||||||

|

|

|

|

Existing |

Proposed |

Under Const. |

Exterior Walls |

|

|

|

|

|

Fuel |

|

|

|

Porch |

|

Garage |

# of Cars |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Design (Style) |

|

|

|

Roof Surface |

|

|

|

|

|

Central Air Conditioning |

|

Pool |

|

|

|

Carport |

# of Cars |

|||||||

|

|

|

Year Built |

|

|

|

|

Gutters & Downspouts |

|

|

|

Individual |

|

|

|

Fence |

|

Attached |

Detached |

||||||||

|

|

|

Effective Age (Yrs) |

|

|

Window Type |

|

|

|

|

|

Other |

|

|

|

Other |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Appliances |

Refrigerator |

Range/Oven |

|

Dishwasher Disposal |

Microwave Washer/Dryer |

Other (describe) |

|

|

|

|

|

|||||||||||||

|

|

|

Finished area above grade contains: |

|

Rooms |

|

|

Bedrooms |

Bath(s) |

|

|

Square Feet of Gross Living Area Above Grade |

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

Additional features (special energy efficient items, etc.)

Describe the condition of the property and data source(s) (including apparent needed repairs, deterioration, renovations, remodeling, etc.).

Are there any apparent physical deficiencies or adverse conditions that affect the livability, soundness, or structural integrity of the property? If Yes, describe

Yes

No

Does the property generally conform to the neighborhood (functional utility, style, condition, use, construction, etc.)?

Yes  No If No, describe

No If No, describe

Freddie Mac Form 2055 March |

Page 1 of 6 |

Fannie Mae Form 2055 March |

2005 |

|

2005 |

|

|

|

|

File # |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

There are |

comparable properties currently offered for sale in the subject neighborhood ranging in price from $ |

|

|

to |

$ |

|

|

. |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

There are |

comparable sales in the subject neighborhood within the past twelve months ranging in sale price from $ |

|

|

|

to $ |

. |

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEATURE |

|

SUBJECT |

|

|

COMPARABLE SALE # 1 |

|

|

COMPARABLE SALE # 2 |

|

|

COMPARABLE SALE # 3 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale Price |

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Sale Price/Gross Liv. Area |

$ |

|

sq. ft. |

$ |

sq. ft. |

|

|

|

$ |

|

sq. ft. |

|

|

|

$ |

|

|

sq. ft. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data Source(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Source(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

VALUE ADJUSTMENTS |

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

|

DESCRIPTION |

|

|||||||||||||||||||||

|

|

Sale or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Sale/Time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Site |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design (Style) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual Age |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

|

Total |

Bdrms. |

Baths |

|

Total |

Bdrms. |

Baths |

|

|

|

|

Total |

Bdrms. |

Baths |

|

|

|

|

Total |

Bdrms. |

Baths |

|

|

|

|

|||||

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

sq. ft. |

|

|

|

sq. ft. |

|

|

|

|

|

|

sq. ft. |

|

|

|

|

|

|

|

sq. ft. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Porch/Patio/Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adjustment (Total) |

|

|

|

|

+ |

- |

|

$ |

|

+ |

- |

|

$ |

|

+ |

- |

|

$ |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Adjusted Sale Price |

|

|

|

|

Net Adj. |

% |

|

|

|

|

Net Adj. |

% |

|

|

|

|

Net Adj. |

% |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

of Comparables |

|

|

|

|

|

Gross Adj. |

% |

|

$ |

|

Gross Adj. |

% |

|

$ |

|

Gross Adj. |

% |

$ |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

I

I

did

did not research the sale or transfer history of the subject property and comparable sales. If not, explain

|

My research |

did |

did not reveal any prior sales or transfers of the subject property for the three years prior to the effective date of this appraisal. |

|

|||

|

Data source(s) |

|

|

|

My research |

did |

did not reveal any prior sales or transfers of the comparable sales for the year prior to the date of sale of the comparable sale. |

|

|

|

|

|

Data source(s) |

|

|

Report the results of the research and analysis of the prior sale or transfer history of the subject property and comparable sales (report additional prior sales on page 3).

ITEM |

SUBJECT |

COMPARABLE SALE # 1 |

COMPARABLE SALE # 2 |

COMPARABLE SALE # 3 |

|

|

|

|

|

Date of Prior Sale/Transfer |

|

|

|

|

|

|

|

|

|

Price of Prior Sale/Transfer |

|

|

|

|

DataSource(s) |

|

|

|

|

Effective Date of Data Source(s) |

|

|

|

|

|

|

|

|

|

Analysis of prior sale or transfer history of the subject property and comparable sales

Summary of Sales Comparison Approach

Indicated Value by Sales Comparison Approach $

Indicated Value by: Sales Comparison Approach $ |

Cost Approach (if developed) $ |

Income Approach (if developed) $ |

This appraisal is made |

“as is”, |

subject to completion per plans and specifications on the basis of a hypothetical condition that the improvements have been |

||

completed, |

subject to the following repairs or alterations on the basis of a hypothetical condition that the repairs or alterations have been completed, or |

subject to the |

||

following required inspection based on the extraordinary assumption that the condition or deficiency does not require alteration or repair: |

|

|||

Based on a visual inspection of the exterior areas of the subject property from at least the street, defined scope of work, statement of assumptions and limiting conditions, and appraiser’s certification, my (our) opinion of the market value, as defined, of the real property that is the subject of this report is

$ |

, as of |

, which is the date of the inspection and the effective date of this appraisal. |

|

|

|

|

|

Freddie Mac Form 2055 |

March |

Page 2 of 6 |

Fannie Mae Form 2055 March |

2005 |

|

|

2005 |

File # |

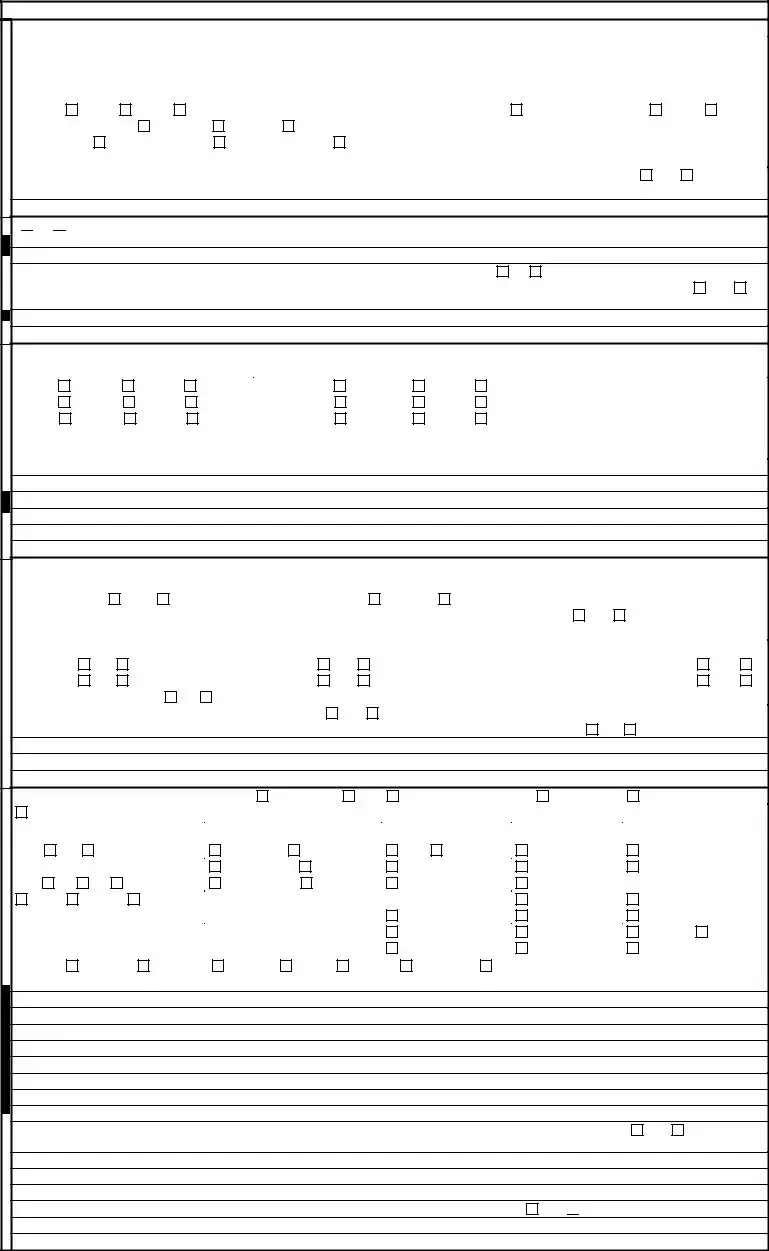

COST APPROACH TO VALUE (not required by Fannie Mae)

Provide adequate information for the lender/client to replicate the below cost figures and calculations.

Support for the opinion of site value (summary of comparable land sales or other methods for estimating site value)

|

|

ESTIMATED |

REPRODUCTION OR |

REPLACEMENT COST NEW |

|

|

OPINION OF SITE VALUE |

|

= $ |

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

Source of cost data |

|

|

|

|

|

|

|

Dwelling |

Sq. Ft. @ $ |

=$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality rating from cost service |

|

Effective date of cost data |

|

|

|

|

|

|

Sq. Ft. @ $ |

=$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Comments on Cost Approach (gross living area calculations, depreciation, etc.) |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

Sq. Ft. @ $ |

=$ |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Total Estimate of |

= $ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less |

Physical |

Functional |

External |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

=$( |

) |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Depreciated Cost of Improvements |

=$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

=$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Estimated Remaining Economic Life (HUD and VA only) |

|

|

Years |

Indicated Value By Cost Approach |

|

|

|

||||||||||

|

|

|

|

|

|

|

INCOME APPROACH TO VALUE |

(not required by Fannie Mae) .=$ |

|

|

|

|

|||||||

|

|

Estimated Monthly Market Rent $ |

|

X Gross Rent Multiplier |

|

= |

$ |

Indicated Value by Income Approach |

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

Summary of Income Approach (including support for market rent and GRM) |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

PROJECT INFORMATION FOR PUDs (if applicable) |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Is the developer/builder in control of the Homeowners’ Association (HOA)? |

Yes |

No |

Unit type(s) |

Detached |

Attached |

|

|

|

|||||||||

|

|

Provide the following information for PUDs ONLY if the developer/builder is in control of the HOA and the subject property is an attached dwelling unit. |

|

|

|

||||||||||||||

|

|

|

|

|

|||||||||||||||

|

|

Legal name of project |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Total number of phases |

Total number of units |

|

|

|

Total number of units sold |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Total number of units rented |

Total number of units for sale |

|

|

Data source(s) |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Was the project created by the conversion of an existing building(s) into a PUD? |

Yes |

No If Yes, date of conversion |

|

|

|

|

|||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Does the project contain any |

Yes |

No |

Data source(s) |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Are the units, common elements, and recreation facilities complete? |

Yes |

|

No |

If No, describe the status of completion. |

|

|

|

|

|||||||||

Are the common elements leased to or by the Homeowners’ Association?

Yes

No If Yes, describe the rental terms and options.

Describe common elements and recreational facilities

Freddie Mac Form 2055 March |

Page 3 of 6 |

Fannie Mae Form 2055 March |

2005 |

|

2005 |

File # |

This report form is designed to report an appraisal of a

This appraisal report is subject to the following scope of work, intended use, intended user, definition of market value, statement of assumptions and limiting conditions, and certifications. Modifications, additions, or deletions to the intended use, intended user, definition of market value, or assumptions and limiting conditions are not permitted. The appraiser may expand the scope of work to include any additional research or analysis necessary based on the complexity of this appraisal assignment. Modifications or deletions to the certifications are also not permitted. However, additional certifications that do not constitute material alterations to this appraisal report, such as those required by law or those related to the appraiser’s continuing education or membership in an appraisal organization, are permitted.

SCOPE OF WORK:The scope of work for this appraisal is defined by the complexity of this appraisal assignment and the reporting requirements of this appraisal report form, including the following definition of market value, statement of assumptions and limiting conditions, and certifications. The appraiser must, at a minimum: (1) perform a visual inspection of the exterior areas of the subject property from at least the street, (2) inspect the neighborhood, (3) inspect each of the comparable sales from at least the street, (4) research, verify, and analyze data from reliable public and/or private sources, and (5) report his or her analysis, opinions, and conclusions in this appraisal report.

The appraiser must be able to obtain adequate information about the physical characteristics (including, but not limited to, condition, room count, gross living area, etc.) of the subject property from the

INTENDED USE: The intended use of this appraisal report is for the lender/client to evaluate the property that is the subject of this appraisal for a mortgage finance transaction.

INTENDED USER: The intended user of this appraisal report is the lender/client.

DEFINITION MARKET VALUE: The most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby: (1) buyer and seller are typically motivated; (2) both parties are well informed or well advised, and each acting in what he or she considers his or her own best interest; (3) a reasonable time is allowed for exposure in the open market; (4) payment is made in terms of cash in U. S. dollars or in terms of financial arrangements comparable thereto; and (5) the price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions* granted by anyone associated with the sale.

*Adjustments to the comparables must be made for special or creative financing or sales concessions. No adjustments are necessary for those costs which are normally paid by sellers as a result of tradition or law in a market area; these costs are readily identifiable since the seller pays these costs in virtually all sales transactions. Special or creative financing adjustments can be made to the comparable property by comparisons to financing terms offered by a third party institutional lender that is not already involved in the property or transaction. Any adjustment should not be calculated on a mechanical dollar for dollar cost of the financing or concession but the dollar amount of any adjustment should approximate the market’s reaction to the financing or concessions based on the appraiser’s judgment.

STATEMENT OF ASSUMPTIONS AND LIMITING CONDITIONS: The appraiser’s certification in this report is subject to the following assumptions and limiting conditions:

1.The appraiser will not be responsible for matters of a legal nature that affect either the property being appraised or the title to it, except for information that he or she became aware of during the research involved in performing this appraisal. The appraiser assumes that the title is good and marketable and will not render any opinions about the title.

2.The appraiser has examined the available flood maps that are provided by the Federal Emergency Management Agency (or other data sources) and has noted in this appraisal report whether any portion of the subject site is located in an identified Special Flood Hazard Area. Because the appraiser is not a surveyor, he or she makes no guarantees, express or implied, regarding this determination.

3.The appraiser will not give testimony or appear in court because he or she made an appraisal of the property in question, unless specific arrangements to do so have been made beforehand, or as otherwise required by law.

4.The appraiser has noted in this appraisal report any adverse conditions (such as needed repairs, deterioration, the presence of hazardous wastes, toxic substances, etc.) observed during the inspection of the subject property or that he or she became aware of during the research involved in performing this appraisal. Unless otherwise stated in this appraisal report, the appraiser has no knowledge of any hidden or unapparent physical deficiencies or adverse conditions of the property (such as, but not limited to, needed repairs, deterioration, the presence of hazardous wastes, toxic substances, adverse environmental conditions, etc.) that would make the property less valuable, and has assumed that there are no such conditions and makes no guarantees or warranties, express or implied. The appraiser will not be responsible for any such conditions that do exist or for any engineering or testing that might be required to discover whether such conditions exist. Because the appraiser is not an expert in the field of environmental hazards, this appraisal report must not be considered as an environmental assessment of the property.

5.The appraiser has based his or her appraisal report and valuation conclusion for an appraisal that is subject to satisfactory completion, repairs, or alterations on the assumption that the completion, repairs, or alterations of the subject property will be performed in a professional manner.

Freddie Mac Form 2055 March |

Page 4 of 6 |

Fannie Mae Form 2055 March |

2005 |

|

2005 |

File # |

APPRAISER’S CERTIFICATION: The Appraiser certifies and agrees that:

1.I have, at a minimum, developed and reported this appraisal in accordance with the scope of work requirements stated in this appraisal report.

2.I performed a visual inspection of the exterior areas of the subject property from at least the street. I reported the condition of the improvements in factual, specific terms. I identified and reported the physical deficiencies that could affect the livability, soundness, or structural integrity of the property.

3.I performed this appraisal in accordance with the requirements of the Uniform Standards of Professional Appraisal Practice that were adopted and promulgated by the Appraisal Standards Board of The Appraisal Foundation and that were in place at the time this appraisal report was prepared.

4.I developed my opinion of the market value of the real property that is the subject of this report based on the sales comparison approach to value. I have adequate comparable market data to develop a reliable sales comparison approach for this appraisal assignment. I further certify that I considered the cost and income approaches to value but did not develop them, unless otherwise indicated in this report.

5.I researched, verified, analyzed, and reported on any current agreement for sale for the subject property, any offering for sale of the subject property in the twelve months prior to the effective date of this appraisal, and the prior sales of the subject property for a minimum of three years prior to the effective date of this appraisal, unless otherwise indicated in this report.

6.I researched, verified, analyzed, and reported on the prior sales of the comparable sales for a minimum of one year prior to the date of sale of the comparable sale, unless otherwise indicated in this report.

7.I selected and used comparable sales that are locationally, physically, and functionally the most similar to the subject property.

8.I have not used comparable sales that were the result of combining a land sale with the contract purchase price of a home that has been built or will be built on the land.

9.I have reported adjustments to the comparable sales that reflect the market's reaction to the differences between the subject property and the comparable sales.

10.I verified, from a disinterested source, all information in this report that was provided by parties who have a financial interest in the sale or financing of the subject property.

11.I have knowledge and experience in appraising this type of property in this market area.

12.I am aware of, and have access to, the necessary and appropriate public and private data sources, such as multiple listing services, tax assessment records, public land records and other such data sources for the area in which the property is located.

13.I obtained the information, estimates, and opinions furnished by other parties and expressed in this appraisal report from reliable sources that I believe to be true and correct.

14.I have taken into consideration the factors that have an impact on value with respect to the subject neighborhood, subject property, and the proximity of the subject property to adverse influences in the development of my opinion of market value. I have noted in this appraisal report any adverse conditions (such as, but not limited to, needed repairs, deterioration, the presence of hazardous wastes, toxic substances, adverse environmental conditions, etc.) observed during the inspection of the subject property or that I became aware of during the research involved in performing this appraisal. I have considered these adverse conditions in my analysis of the property value, and have reported on the effect of the conditions on the value and marketability of the subject property.

15.I have not knowingly withheld any significant information from this appraisal report and, to the best of my knowledge, all statements and information in this appraisal report are true and correct.

16.I stated in this appraisal report my own personal, unbiased, and professional analysis, opinions, and conclusions, which are subject only to the assumptions and limiting conditions in this appraisal report.

17.I have no present or prospective interest in the property that is the subject of this report, and I have no present or prospective personal interest or bias with respect to the participants in the transaction. I did not base, either partially or completely, my analysis and/or opinion of market value in this appraisal report on the race, color, religion, sex, age, marital status, handicap, familial status, or national origin of either the prospective owners or occupants of the subject property or of the present owners or occupants of the properties in the vicinity of the subject property or on any other basis prohibited by law.

18.My employment and/or compensation for performing this appraisal or any future or anticipated appraisals was not conditioned on any agreement or understanding, written or otherwise, that I would report (or present analysis supporting) a predetermined specific value, a predetermined minimum value, a range or direction in value, a value that favors the cause of any party, or the attainment of a specific result or occurrence of a specific subsequent event (such as approval of a pending mortgage loan application).

19.I personally prepared all conclusions and opinions about the real estate that were set forth in this appraisal report. If I

relied on significant real property appraisal assistance from any individual or individuals in the performance of this appraisal or the preparation of this appraisal report, I have named such individual(s) and disclosed the specific tasks performed in this appraisal report. I certify that any individual so named is qualified to perform the tasks. I have not authorized anyone to make a change to any item in this appraisal report; therefore, any change made to this appraisal is unauthorized and I will take no responsibility for it.

Freddie Mac Form 2055 March |

Page 5 of 6 |

Fannie Mae Form 2055 March |

2005 |

|

2005 |

File # |

20.I identified the lender/client in this appraisal report who is the individual, organization, or agent for the organization that ordered and will receive this appraisal report.

21.The lender/client may disclose or distribute this appraisal report to: the borrower; another lender at the request of the borrower; the mortgagee or its successors and assigns; mortgage insurers; government sponsored enterprises; other secondary market participants; data collection or reporting services; professional appraisal organizations; any department, agency, or instrumentality of the United States; and any state, the District of Columbia, or other jurisdictions; without having to obtain the appraiser’s or supervisory appraiser’s (if applicable) consent. Such consent must be obtained before this appraisal report may be disclosed or distributed to any other party (including, but not limited to, the public through advertising, public relations, news, sales, or other media).

22.I am aware that any disclosure or distribution of this appraisal report by me or the lender/client may be subject to certain laws and regulations. Further, I am also subject to the provisions of the Uniform Standards of Professional Appraisal Practice that pertain to disclosure or distribution by me.

23.The borrower, another lender at the request of the borrower, the mortgagee or its successors and assigns, mortgage of any mortgage finance transaction that involves any one or more of these parties. insurers, government sponsored enterprises, and other secondary market participants may rely on this appraisal report as part

24.If this appraisal report was transmitted as an “electronic record” containing my “electronic signature,” as those terms are defined in applicable federal and/or state laws (excluding audio and video recordings), or a facsimile transmission of this appraisal report containing a copy or representation of my signature, the appraisal report shall be as effective, enforceable and valid as if a paper version of this appraisal report were delivered containing my original hand written signature.

25.Any intentional or negligent misrepresentation(s) contained in this appraisal report may result in civil liability and/or criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United States Code, Section 1001, et seq., or similar state laws.

SUPERVISORY APPRAISER’S CERTIFICATION: The Supervisory Appraiser certifies and agrees that:

1.I directly supervised the appraiser for this appraisal assignment, have read the appraisal report, and agree with the appraiser’s analysis, opinions, statements, conclusions, and the appraiser’s certification.

2.I accept full responsibility for the contents of this appraisal report including, but not limited to, the appraiser’s analysis, opinions, statements, conclusions, and the appraiser’s certification.

3.The appraiser identified in this appraisal report is either a

4.This appraisal report complies with the Uniform Standards of Professional Appraisal Practice that were adopted and promulgated by the Appraisal Standards Board of The Appraisal Foundation and that were in place at the time this appraisal report was prepared.

5.If this appraisal report was transmitted as an “electronic record” containing my “electronic signature,” as those terms are defined in applicable federal and/or state laws (excluding audio and video recordings), or a facsimile transmission of this appraisal report containing a copy or representation of my signature, the appraisal report shall be as effective, enforceable and valid as if a paper version of this appraisal report were delivered containing my original hand written signature.

APPRAISER |

|

SUPERVISORY APPRAISER (ONLY IF REQUIRED) |

|

Signature _____________________________________________ |

Signature ___________________________________________ |

||

Name ________________________________________________ |

Name ______________________________________________ |

||

Company Name ________________________________________ |

Company Name______________________________________ |

||

Company Address ______________________________________ |

Company Address ____________________________________ |

||

_____________________________________________________ |

___________________________________________________ |

||

Telephone Number ______________________________________ |

Telephone Number ___________________________________ |

||

Email Address__________________________________________ |

Email Address _______________________________________ |

||

Date of Signature and Report______________________________ |

Date of Signature_____________________________________ |

||

Effective Date of Appraisal ________________________________ |

State Certification # ___________________________________ |

||

State Certification # _____________________________________ |

or State License # ____________________________________ |

||

or State License #_______________________________________ |

State_______________________________________________ |

||

or Other (describe) ___________________State #_____________ |

Expiration Date of Certification or License _________________ |

||

State _________________________________________________ |

|

|

|

Expiration Date of Certification or License ____________________ |

SUBJECT PROPERTY |

||

ADDRESS OF PROPERTY APPRAISED |

|

|

Did not inspect exterior of subject property |

_____________________________________________________ |

|

Did inspect exterior of subject property from street |

|

_____________________________________________________ |

|

Date of Inspection _________________________________ |

|

APPRAISED VALUE OF SUBJECT PROPERTY $ _____________ |

|

|

|

LENDER/CLIENT |

|

COMPARABLE SALES |

|

Name ________________________________________________ |

|

Did not inspect exterior of comparable sales from street |

|

Company Name ________________________________________ |

|

Did inspect exterior of comparable sales from street |

|

Company Address ______________________________________ |

|

Date of Inspection _________________________________ |

|

_____________________________________________________ |

|

|

|

Email Address__________________________________________ |

|

|

|

|

|

|

|

Freddie Mac Form 2055 March |

Page 6 of 6 |

Fannie Mae Form 2055 March |

|

2005 |

|

|

2005 |

Instructions

This report form is designed to report an appraisal of a

Learn How to Use the New Market Conditions Addendum

Gain an understanding of and recognize the sources of market information necessary to analyze market conditions. Our new recorded training is organized to address the Market Conditions Addendum (Form 1004MC), effective April 1, 2009, section by section.

View Recorded Training

Modifications, Additions, or Deletions

This appraisal report is subject to the scope of work, intended use, intended user, definition of market value, statement of assumptions and limiting conditions, and certifications contained in the report form. Modifications, additions, or deletions to the intended use, intended user, definition of market value, or assumptions and limiting conditions are not permitted. The appraiser may expand the scope of work to include any additional research or analysis necessary based on the complexity of this appraisal assignment. Modifications or deletions to the certifications are also not permitted. However, additional certifications that do not constitute material alterations to this appraisal report, such as those required by law or those related to the appraiser's continuing education or membership in an appraisal organization are permitted.

Scope of Work

The scope of work for this appraisal is defined by the complexity of this appraisal assignment and the reporting requirements of this appraisal report form, including the following definition of market value, statement of assumptions and limiting conditions, and certifications. The appraiser must, at a minimum: (1) perform a visual inspection of the exterior areas of the subject property from at least the street, (2) inspect the neighborhood, (3) inspect each of the comparable sales from at least the street, (4) research, verify, and analyze data from reliable public and/or private sources, and (5) report his or her analysis, opinions, and conclusions in this appraisal report.

The appraiser must be able to obtain adequate information about the physical characteristics (including, but not limited to, condition, room count, gross living area, etc.) of the subject property from the

Required Exhibits

•A street map that shows the location of the subject property and of all comparables that the appraiser used;

•Clear, descriptive photographs (either in black and white or color) that show the front of the subject property, and that are appropriately identified. (Photographs must be originals that are produced either by photography or electronic imaging);

•Any other

Instructions Page

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The form provides a summary appraisal report, offering the lender or client a supported opinion on the market value of the subject property. |

| Property Types | This report is intended for a one-unit property or one-unit property with an accessory unit, including those in planned unit developments. |

| Inspection Method | Appraisers perform visual inspections of the property's exterior from at least the street to gather necessary information. |

| Use of Data | Data from sources such as Multiple Listing Services, tax and assessment records, and prior inspections are utilized for analysis. |

| Flood Zone Considerations | The appraiser notes if any part of the site is located in a Special Flood Hazard Area based on available flood maps. |

| Compliance with Standards | The appraisal is conducted in compliance with the Uniform Standards of Professional Appraisal Practice, ensuring adherence to industry guidelines. |

Guidelines on Utilizing 2055

Filling out the 2055 form is crucial for appraising a property accurately. Completing the form requires specific information about the property and its surrounding neighborhood, as well as any financial arrangements related to the purchase. Following the steps below will facilitate a smooth and accurate filling process.

- Start with Basic Information: Fill in the File number, Property Address, City, State, and Zip Code.

- Borrower Information: Include the Borrower’s name, Owner of Public Record details, County, and Legal Description.

- Property Details: Specify Assessor’s Parcel #, Tax Year, and Real Estate Taxes. Take note of the Neighborhood Name and Map Reference.

- Occupant Status: Indicate whether the property is Owner-Occupied, Tenant-Occupied, or Vacant.

- Special Assessments: List any applicable amounts related to special assessments, PUDs, or HOA fees.

- Appraised Rights: Choose the type of property rights appraised (Fee Simple, Leasehold, or Other) and explain if needed.

- Assignment Type: Select the type of transaction (Purchase Transaction, Refinance Transaction, or Other). Include the Lender/Client’s address.

- Sale Status: Answer whether the property is currently offered for sale or has been in the past twelve months. Explain the findings.

- Contract Analysis: State the Contract Price and date of contract. Indicate if you analyzed the contract for the subject purchase transaction.

- Seller Information: Confirm if the property seller is the owner of public record.

- Financial Assistance: Specify if there are any financial assistance items on behalf of the borrower, including the total dollar amount and descriptions.

- Neighborhood Characteristics: Describe the neighborhood's housing trends, property values, and any other relevant details.

- Physical Inspection Data: Report on dimensions, area, shape, view, and zoning classification. Include utility information if applicable.

- Off-Site Improvements: Provide information on utilities and describe whether they are typical for the area.

- Adverse Conditions: Answer whether there are any adverse site conditions or external factors affecting the property.

- Comparable Properties: Document data about comparable properties, including their sale prices and other relevant details.

- Previous Sales: Research and disclose any sales or transfer history of the subject property and comparable sales.

- Conclusions: Summarize the sales comparison approach, including the indicated value by the sales comparison, cost, or income approach if applicable.

- Final Thoughts: Review the document for accuracy and completeness before final submission.

What You Should Know About This Form

What is the purpose of the 2055 form?

The 2055 form, formally referred to as the Exterior-Only Inspection Residential Appraisal Report, serves a critical role in the home appraisal process. Its primary purpose is to offer lenders and clients a reliable and adequately supported opinion of a property's market value. It focuses on the exterior characteristics of a property, allowing the appraiser to assess various factors influencing its value without needing a comprehensive interior evaluation. This can be particularly beneficial in mortgage finance transactions where timely insights on property value are essential.

What types of properties can be appraised using the 2055 form?

This appraisal form is specifically designed for one-unit properties, including those with an accessory unit. It is also applicable to properties located within planned unit developments (PUDs). However, it's important to note that the 2055 form is not intended for manufactured homes or units within condominiums or cooperatives. By limiting its scope, the form ensures that appraisers can focus on the unique characteristics and market conditions related to single-family residences.

What information does the appraiser need to complete the 2055 form?

To complete the 2055 form, the appraiser must gather detailed information about the property, including its physical characteristics, condition, and neighborhood context. Key data points include the property address, legal description, zoning classification, and utilities. The appraiser also needs to conduct a visual inspection from the street, analyze market data for comparable properties, and report any adverse conditions that might impact the property's value. This comprehensive data collection informs the appraiser's valuation conclusions, ensuring they are grounded in reliable information.

Can the 2055 form accommodate special assessments or financial assistance notes?

Yes, the 2055 form includes sections where appraisers can report any special assessments or financial assistance related to the property. This might encompass loan charges, sale concessions, or down payment assistance provided by parties on behalf of the borrower. Including these details is crucial, as they can significantly impact the buyer's net cost and the overall appraisal value. Appraisers are encouraged to provide specific dollar amounts and explanations for such items to enhance the report’s clarity and utility for lenders.

What is the significance of the "highest and best use" analysis in the 2055 form?

The "highest and best use" analysis is an essential evaluation component of the 2055 form. It assesses whether the current use of the property is the most advantageous, taking into account market demand, zoning regulations, and economic feasibility. If the appraiser determines that the property is not being utilized to its fullest potential, they must describe this alternative use within the report. Identifying the highest and best use can provide vital insights for lenders and clients, influencing property investment decisions and financial strategies.

Common mistakes

Filling out the 2055 form might seem straightforward, but there are several common pitfalls that people encounter. Understanding these mistakes can help ensure that your appraisal report is accurate and complete.

Firstly, one prevalent error is failing to accurately report the property address. Many individuals mistakenly transcribe the address, which can lead to confusion in the appraisal process. It may seem insignificant, but a minor slip in digits or characters can result in delays or complications during property evaluations.

Secondly, neglecting to provide all necessary financial information is another common mistake. Whether it’s the tax year, property tax amount, or specific assessments, missing details can lead to an incomplete picture of the property’s financial standing. This oversight may hinder the appraisal’s accuracy and affect the buyer and lender's decisions.

Another issue arises with the “highest and best use” question. Many people answer “Yes” without considering whether the property could be used more profitably. If the appraisal indicates that the current use isn’t optimal, it could lead to lower property values. Thoughtful consideration of this section is crucial.

Missing the neighborhood characteristics can also be detrimental. Failing to analyze and report on the neighborhood's trends, values, or demographics can strip the report of essential context. An appraiser needs this information to compare the property effectively with others in the market.

The next mistake involves underestimating the importance of the condition description of the property. Some individuals either oversell or downplay issues with the property. An accurate and clear description is vital in determining the property’s value and ensuring all parties have a realistic understanding of what is being appraised.

Additionally, many people overlook the significance of comparable sales data. Ignoring or inadequately researching the sale history of comparable properties can misrepresent the market value of the subject property. Ensuring that the data is comprehensive and recent is essential for an accurate appraisal.

Lastly, many individuals make mistakes by assuming that the appraiser will understand the property and its condition without detailed explanations. It's easy to think that your words will be interpreted perfectly, but providing comprehensive context and descriptions is key to ensuring clarity throughout the appraisal report.

By being aware of these common errors and taking extra care when completing your 2055 form, you can help ensure a smoother appraisal process, benefiting all parties involved.

Documents used along the form

When dealing with a 2055 form, there are several other documents that often accompany it in the appraisal process. Each of these documents plays a vital role in providing a comprehensive assessment of the property. Below is a brief overview of four significant forms that commonly work hand-in-hand with the 2055 appraisal form.

- Real Estate Sale Agreement: This document outlines the terms of the property sale between the buyer and seller. It includes key details like the purchase price, contingencies, and any stipulated repairs or credits. Analyzing this agreement helps the appraiser assess the property's market condition and influences the valuation process.

- Comparative Market Analysis (CMA): A CMA provides an overview of recent sales in the area for properties similar to the one being appraised. It includes sales prices and pertinent details such as square footage and features. This analysis is essential for aligning the property’s value with current market trends.