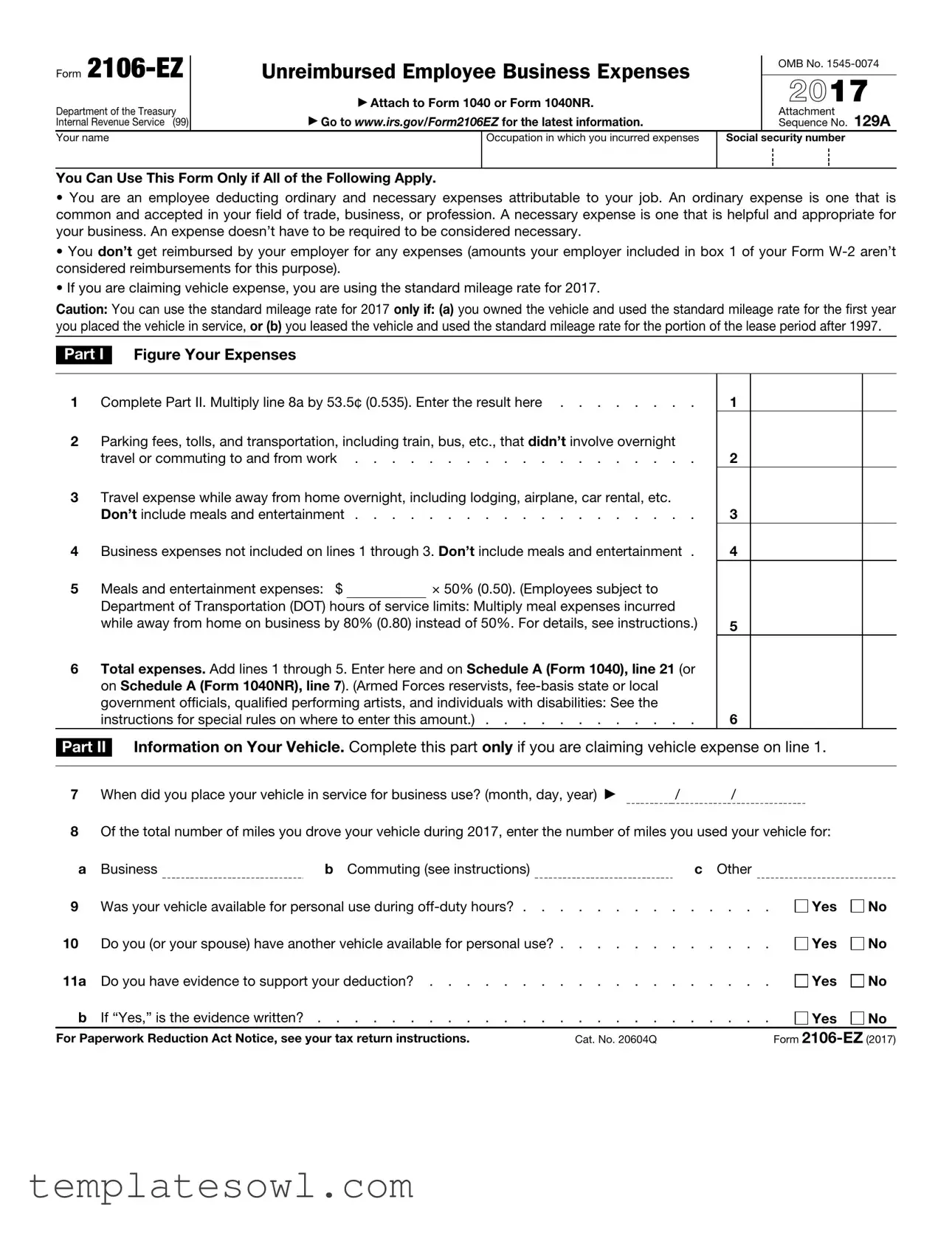

Fill Out Your 2106 Ez Form

The 2106-EZ form is a simplified tool for employees to claim unreimbursed business expenses directly related to their job. By using this form, individuals can deduct costs for ordinary and necessary expenses they incur while performing their work duties, especially when their employer has not provided reimbursement. Major expenses that can be claimed include transportation costs, travel expenses for overnight stays, and specific business-related costs, excluding meals and entertainment. Notably, the form provides the option to calculate vehicle expenses using the standard mileage rate, which for 2017 is set at 53.5 cents per mile. To qualify for the 2106-EZ, specific criteria must be met: employees must be deducting expenses that are common in their field, they must not receive reimbursement for those expenses, and, if claiming vehicle expenses, they need to follow the standard mileage rate guidelines. The form is designed to be straightforward, making it easier for eligible employees to navigate tax deductions related to their professional expenditures when filing their tax returns.

2106 Ez Example

Form |

Unreimbursed Employee Business Expenses |

|

OMB No. |

|

|

|

|||

|

2017 |

|||

|

▶ Attach to Form 1040 or Form 1040NR. |

|

||

Department of the Treasury |

|

Attachment |

||

Internal Revenue Service (99) |

▶ Go to www.irs.gov/Form2106EZ for the latest information. |

|

Sequence No. 129A |

|

Your name |

|

Occupation in which you incurred expenses |

Social security number |

|

|

|

|

|

|

You Can Use This Form Only if All of the Following Apply.

•You are an employee deducting ordinary and necessary expenses attributable to your job. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business. An expense doesn’t have to be required to be considered necessary.

•You don’t get reimbursed by your employer for any expenses (amounts your employer included in box 1 of your Form

•If you are claiming vehicle expense, you are using the standard mileage rate for 2017.

Caution: You can use the standard mileage rate for 2017 only if: (a) you owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or (b) you leased the vehicle and used the standard mileage rate for the portion of the lease period after 1997.

Part I |

Figure Your Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Complete Part II. Multiply line 8a by 53.5¢ (0.535). Enter the result here |

1 |

|

|

|||

2 |

Parking fees, tolls, and transportation, including train, bus, etc., that didn’t involve overnight |

|

|

|

|||

|

travel or commuting to and from work |

2 |

|

|

|||

3 |

Travel expense while away from home overnight, including lodging, airplane, car rental, etc. |

|

|

|

|||

|

Don’t include meals and entertainment |

3 |

|

|

|||

4 |

Business expenses not included on lines 1 through 3. Don’t include meals and entertainment . |

4 |

|

|

|||

5 |

Meals and entertainment expenses: $ |

|

× 50% (0.50). (Employees subject to |

|

|

|

|

|

Department of Transportation (DOT) hours of service limits: Multiply meal expenses incurred |

|

|

|

|||

|

while away from home on business by 80% (0.80) instead of 50%. For details, see instructions.) |

5 |

|

|

|||

6 |

Total expenses. Add lines 1 through 5. Enter here and on Schedule A (Form 1040), line 21 (or |

|

|

|

|||

|

on Schedule A (Form 1040NR), line 7). (Armed Forces reservists, |

|

|

|

|||

|

government officials, qualified performing artists, and individuals with disabilities: See the |

|

|

|

|||

|

instructions for special rules on where to enter this amount.) |

6 |

|

|

|||

|

Information on Your Vehicle. Complete this part only if you are claiming vehicle expense on line 1. |

||||||

Part II |

|||||||

|

|

|

|

|

|

|

|

7 When did you place your vehicle in service for business use? (month, day, year) ▶ |

/ |

/ |

8Of the total number of miles you drove your vehicle during 2017, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c |

Other |

|

9 |

Was your vehicle available for personal use during |

. . . |

. . . . |

Yes |

|

10 |

Do you (or your spouse) have another vehicle available for personal use? |

. . . |

. . . . |

Yes |

|

11a |

Do you have evidence to support your deduction? |

. . . |

. . . . |

Yes |

|

b |

If “Yes,” is the evidence written? |

. . . |

. . . . |

Yes |

|

No

No

No

No

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 20604Q |

Form |

[This Page Left Intentionally Blank]

Form |

Page 3 |

|

|

Instructions for

Form

Section references are to the Internal Revenue Code.

Future Developments

For the latest information about developments related to Form

What’s New

Standard mileage rate. The 2017 rate for business use of your vehicle is 53.5 cents (0.535) a mile.

Purpose of Form

You can use Form

Recordkeeping

You can’t deduct expenses for travel (including meals, unless you used the standard meal allowance), entertainment, gifts, or use of a car or other listed property, unless you keep records to prove the time, place, business purpose, business relationship (for entertainment and gifts), and amounts of these expenses. Generally, you must also have receipts for all lodging expenses (regardless of the amount) and any other expense of $75 or more.

Additional Information

For more details about employee business expenses, see the following.

•Pub. 463, Travel, Entertainment, Gift, and Car Expenses.

•Pub. 529, Miscellaneous Deductions.

•Pub. 587, Business Use of Your Home.

•Pub. 946, How To Depreciate Property.

Specific Instructions

Part

Expenses

Line 2. See the line 8b instructions for the definition of commuting.

Line 3. Enter lodging and transportation expenses connected with overnight travel away from your tax home (defined on this page). You generally can’t deduct expenses for travel away from your tax home for any period of temporary employment of more than 1 year. Don’t include expenses for meals and entertainment on this line. For more details, including limits, see Pub. 463.

If you didn’t pay or incur meal expenses on a day you were traveling away from your tax home, you can use an optional method for deducting incidental expenses instead of keeping records of your actual incidental expenses. The amount of the deduction is $5 a day. The term “incidental expenses”

means fees and tips given to porters, baggage carriers, hotel staff, and staff on ships. It doesn’t include expenses for laundry, cleaning and pressing of clothing, lodging taxes, costs of telegrams or telephone calls, transportation between places of lodging or business and places where meals are taken, or the mailing cost of filing travel vouchers and paying

Tax home. Generally, your tax home is your regular or main place of business or post of duty regardless of where you maintain your family home. If you don’t have a regular or main place of business because of the nature of your work, then your tax home may be the place where you regularly live. If you don’t fit in either of these categories, you are considered an itinerant and your tax home is wherever you work. As an itinerant, you are never away from home and can’t claim a travel expense deduction. For more information about determining your tax home, see Pub. 463.

Line 4. Enter other

If you are deducting home office expenses, see Pub. 587 for special instructions on how to report these expenses.

If you are deducting depreciation or claiming a section 179 deduction, see Form 4562, Depreciation and Amortization, to figure the depreciation and section 179 deduction to enter on line 4.

Don’t include on line 4 any educator expenses you deducted on Form 1040, line 23, or Form 1040NR.

▲ |

At the time these instructions |

|

! |

||

went to print, the tuition and |

||

fees deduction formerly claimed |

||

CAUTION |

on line 34 had expired. To find |

|

|

out if legislation extended the |

deduction so you can claim it on your 2017 return, go to www.irs.gov/Extenders.

You may be able to take a credit for your educational

TIP expenses instead of a deduction. See Form 8863, Education Credits, for details.

Don’t include expenses for meals and entertainment, taxes, or interest on line 4. Deductible taxes are entered on Schedule A (Form 1040), lines 5 through 9; or Schedule A (Form 1040NR), line 1. Employees can’t deduct car loan interest.

Note: If line 4 is your only entry, don’t complete Form

•Expenses for performing your job as a

•

•

See the line 6 instructions below for definitions. If you aren’t required to file Form

Line 5. Generally, you can deduct only 50% of your business meal and entertainment expenses, including meals incurred while away from home on business. If you were an employee subject to the DOT hours of service limits, that percentage is 80% for business meals consumed during, or incident to, any period of duty for which those limits are in effect.

Employees subject to the DOT hours of service limits include certain air transportation employees, such as pilots, crew, dispatchers, mechanics, and control tower operators; interstate truck operators and interstate bus drivers; certain railroad employees, such as engineers, conductors, train crews, dispatchers, and control operations personnel; and certain merchant mariners.

Instead of actual cost, you may be able to claim the standard meal allowance for your daily meals and incidental expenses (M&IE) while away from your tax home overnight. Under this method, instead of keeping records of your actual meal expenses, you deduct a specified amount, depending on where you travel. However, you must still keep records to prove the time, place, and business purpose of your travel.

The standard meal allowance is the federal M&IE rate. For most small localities in the United States, this rate is $51 a day. Most major cities and many other localities in the United States qualify for higher rates. You can find these rates at www.gsa.gov/ perdiem.

For locations outside the continental United States, the applicable rates are published each month. You can find these rates at www.state.gov/travel/ and select “Travel Per Diem Allowances for Foreign Areas,” under “Foreign Per Diem Rates.”

See Pub. 463 for details on how to figure your deduction using the standard meal allowance, including special rules for partial days of travel and for transportation workers.

Line 6. If you are one of the individuals discussed below, special rules apply to deducting your employee business expenses.

Ministers. Before entering your total expenses on line 6, you must reduce them by the amount allocable to your

Armed Forces reservist (member of a reserve component). You are a member of a reserve component of the Armed Forces of the United States if you are in the Army, Navy, Marine Corps, Air Force, or Coast Guard Reserve; the Army National Guard of the United States; the Air National Guard of the United States; or the Reserve Corps of the Public Health Service.

Form |

Page 4 |

|

|

If you qualify, complete Form

If you qualify, include the part of the line

6 amount attributable to expenses you incurred for services performed in that job in the total on Form 1040, line 24, and attach Form

Qualified performing artist. You are a qualified performing artist if you:

1.Performed services in the performing arts as an employee for at least two employers during the tax year,

2.Received at least $200 each from any two of these employers,

3.Had allowable business expenses attributable to the performing arts of more than 10% of gross income from the performing arts, and

4.Had adjusted gross income of $16,000 or less before deducting expenses as a performing artist.

In addition, if you are married, you must file a joint return unless you lived apart from your spouse for all of 2017. If you file a joint return, you must figure requirements (1), (2), and (3) separately for both you and your spouse. However, requirement (4) applies to the combined adjusted gross income of both you and your spouse.

If you meet all of the above requirements, include the part of the line 6 amount attributable to

Disabled employee with impairment- related work expenses. Impairment- related work expenses are the allowable expenses of an individual with physical or mental disabilities for attendant care at his or her place of employment. They also include other expenses in connection with the place of employment that enable the employee to work. See Pub. 463 for details.

If you qualify, enter the part of the line 6 amount attributable to

Part

If you claim vehicle expense, you must provide certain information on the use of your vehicle by completing Part II. Include an attachment listing the information requested in Part II for any additional vehicles you used for business during the year.

Line 7. The date placed in service is generally the date you first start using your vehicle. However, if you first start using your vehicle for personal use and later convert it to business use, the vehicle is treated as placed in service on the date you started using it for business.

Line 8a. Don’t include commuting miles on this line; commuting miles aren’t considered business miles. See the definition of commuting under Line 8b next.

Line 8b. If you don’t know the total actual miles you used your vehicle for commuting during the year, figure the amount to enter on line 8b by multiplying the number of days during the year that you used your vehicle for commuting by the average daily roundtrip commuting distance in miles. However, if you converted your vehicle during the year from personal to business use (or vice versa), enter your commuting miles only for the period you drove your vehicle for business.

Generally, commuting is travel between your home and a work location. However, travel that meets any of the following conditions isn’t commuting.

•You have at least one regular work location away from your home and the travel is to a temporary work location in the same trade or business, regardless of the distance. Generally, a temporary work location is one where your employment is expected to last 1 year or less. See Pub. 463 for details.

•The travel is to a temporary work location outside the metropolitan area where you live and normally work.

•Your home is your principal place of business under section 280A(c)(1)(A) (for purposes of deducting expenses for business use of your home) and the travel is to another work location in the same trade or business, regardless of whether that location is regular or temporary and regardless of distance.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | Form 2106-EZ is used to claim unreimbursed employee business expenses. It is a simpler version of Form 2106. |

| Eligibility Criteria | Taxpayers must be employees not reimbursed by their employer and must incur ordinary and necessary expenses related to their job. |

| Standard Mileage Rate | The standard mileage rate for business use of a vehicle in 2017 is 53.5 cents per mile. |

| Claiming Vehicle Expenses | Taxpayers claiming vehicle expenses must either own the vehicle and have used it for business during the first year or lease the vehicle and apply the standard mileage rate after 1997. |

| Filing Requirements | Form 2106-EZ must be attached to Form 1040 or Form 1040NR. It cannot be used for certain specified exceptions like performing artists or military reservists. |

Guidelines on Utilizing 2106 Ez

Completing the Form 2106-EZ can help you claim unreimbursed employee business expenses. Start by gathering the necessary information about your expenses. Follow these steps to fill out the form accurately.

- Write your name at the top of the form.

- Indicate your occupation in which you incurred expenses.

- Provide your social security number.

- In Part I, proceed to calculate your expenses beginning with line 1. Multiply line 8a by 0.535 and enter the result on line 1.

- For line 2, list parking fees, tolls, and transportation costs that did not involve overnight travel.

- On line 3, enter travel expenses incurred while away from home overnight that include lodging and transportation. Do not include meals or entertainment.

- Line 4 is for other business expenses not listed before. Do not list meals and entertainment costs here.

- For meals and entertainment expenses, enter the amount on line 5 and multiply it by 50% (or 80% if applicable). Only take this number if it meets the requirements mentioned on the form.

- Line 6 is where you total all calculated expenses from lines 1 to 5. Enter this total on the specified line of your tax return.

- Proceed to Part II only if claiming vehicle expenses. For line 7, provide the date you began using the vehicle for business purposes.

- On line 8, list the total miles driven for business, commuting, and other purposes. Remember to only include business miles for line 8a.

- Answer the Yes or No questions in lines 9, 10, and 11 based on your vehicle and evidence for deductions.

After completing the form, review it for accuracy. Attach the Form 2106-EZ to your Form 1040 or Form 1040NR when filing your taxes. Make sure to keep records of your expenses for future reference, as they may be required if questions arise about your deductions.

What You Should Know About This Form

What is Form 2106-EZ?

Form 2106-EZ is a simplified tax form used by employees in the United States to claim unreimbursed business expenses. It is generally used when the individual has ordinary and necessary expenses related to their work but has not been reimbursed by their employer. This form can be submitted along with Form 1040 or Form 1040NR when filing taxes.

Who is eligible to use Form 2106-EZ?

The form can be utilized only by employees who meet specific criteria. You must be claiming expenses that are ordinary and necessary for your job and not reimbursed by your employer. Additionally, if you are claiming vehicle expenses, you must also use the standard mileage rate for the year in which you incurred those expenses. Remember, the vehicle must have been owned for business purposes or leased in a qualifying manner.

What types of expenses can I claim using Form 2106-EZ?

You can claim various categories of unreimbursed business expenses. These include vehicle expenses calculated using the standard mileage rate, parking fees, tolls, travel expenses incurred while away from home overnight (excluding meals), and other business expenses. Be mindful, however, that meals and entertainment expenses can only be claimed partially, at a reduced deductibility rate.

How do I calculate vehicle expenses on Form 2106-EZ?

Calculating vehicle expenses involves a few straightforward steps. First, you'll need to complete Part II of the form, providing the necessary details about your vehicle use. To determine your deduction, multiply your business miles driven by the standard mileage rate, which was set at 53.5 cents per mile in 2017. Be careful to ensure that you distinguish between commuting miles, which do not qualify as business expenses, and actual business miles driven.

Are there specific recordkeeping requirements for Form 2106-EZ?

Yes, proper recordkeeping is crucial. You must maintain records to substantiate all claimed expenses, including receipts for lodging over $75, details about business purposes of travel, and proof of the time and place of travel. If you are claiming car expenses, documentation regarding your vehicle's business use is also necessary. Failure to keep adequate records can jeopardize your deductions.

What limitations exist for claiming meals and entertainment on Form 2106-EZ?

When it comes to meals and entertainment expenses, generally only 50% is deductible. However, if you are subject to hours of service limits as defined by the Department of Transportation, that percentage can increase to 80%. To substantiate these expenses, you must provide a clear business purpose and documentation to support the claims.

What should I do if I have additional expenses not covered by Form 2106-EZ?

If you have other business-related expenses that do not fit within the scope of Form 2106-EZ, it may be necessary to use Form 2106 instead. Additionally, some specific categories of expenses such as educator expenses or those for home office deductions need to be reported separately on their respective forms or schedules. Be sure to review your specific situation and consider seeking professional guidance if needed.

Where can I find more information about Form 2106-EZ?

For the latest updates and more detailed instructions on completing Form 2106-EZ, visit the official IRS website at www.irs.gov/Form2106EZ. This resource provides comprehensive guidance, including any recent changes to deductions, regulations, or eligibility criteria, ensuring you have the most current information available for a successful filing.

Common mistakes

Completing Form 2106-EZ accurately is essential for reporting unreimbursed employee business expenses. However, many individuals make mistakes that can lead to complications or lost deductions. Here are nine common errors made while filling out this form.

One significant mistake occurs when employees fail to confirm their eligibility to use the 2106-EZ. This form is specifically for employees who have not been reimbursed by their employer for work-related expenses. If expenses have been reimbursed or if the filer does not meet the requirements outlined by the IRS, they should instead use Form 2106. This point can easily be overlooked, resulting in an incorrect filing.

Another common error is improper mileage tracking. When completing Part II of the form, filers must provide specific mileage details related to business use. Many forget to exclude commuting miles from the calculation, mistakenly including them as business miles. This oversight can inflate deductions and lead to potential audits by the IRS.

A third mistake involves not maintaining adequate documentation. Regulations require that taxpayers keep thorough records of their business expenses. Without receipts or records of the time, place, and business purpose for each expense, deductions may be disallowed. Individuals should ensure they have all necessary documentation before submitting the form.

Additionally, some filers neglect to calculate their meal deductions correctly. The form stipulates that only 50% of meal expenses can be deducted, yet some filers may inadvertently claim the entire amount. Employees under Department of Transportation regulations may qualify for an 80% deduction, but it is essential to understand and apply the correct percentage based on the filing circumstances.

Another frequent error is misreporting total expenses in Part I. When tallying expenses, failing to include all relevant costs from the various lines or miscalculating totals can result in lost deductions. This error often arises from a rushed review process before submission.

Employees sometimes fail to answer questions about vehicle use thoroughly, particularly in Part II, which can lead to incomplete information. Questions such as whether the vehicle was available for personal use or if another vehicle was available should be addressed accurately. Omitting details about vehicle usage can result in a denial of vehicle-related deductions.

Another mistake involves missing the filing deadline. Form 2106-EZ should be attached to the individual’s tax return and filed on time. Late submissions may result in penalties, and missing a deduction due to tardiness can be financially detrimental.

Some individuals mistakenly assume they can include personal expenses under business expenses. Deductions are only meant for expenses that are ordinary and necessary for one’s job; personal expenses should never be included on this form. Confusion between personal and allowable expenses can lead to significant tax issues.

Finally, filers sometimes overlook specific instructions based on their employment category. Special rules apply for ministers, reservists, and performing artists, necessitating a proper understanding of how these specifics impact deductions. A lack of knowledge in this area can lead to missed opportunities for valid deductions.

In summary, individuals filling out Form 2106-EZ should pay close attention to eligibility, accurate mileage tracking, proper documentation, and meal deduction calculations. Being mindful of these common mistakes can help ensure that taxpayers maximize their deductions while remaining in compliance with IRS regulations.

Documents used along the form

Form 2106-EZ is typically used by employees to claim unreimbursed business expenses. When submitting this form, several other documents may also be required or helpful. Below is a brief list of some commonly used forms and documents that complement Form 2106-EZ.

- Schedule A (Form 1040): This form is utilized for itemizing deductions, allowing taxpayers to list individual expenses, including those reported on Form 2106-EZ. It’s essential if you choose to itemize your deductions instead of taking the standard deduction.

- Form W-2: Employers provide this form to employees, detailing their annual earnings and the taxes withheld. It is necessary to have this to ensure that your reported income matches what is shown on your tax return and may also be required to verify deductions claimed on Form 2106-EZ.

- Publication 463: This IRS publication offers guidance on travel, entertainment, gift, and car expenses. It explains deductible expenses, record-keeping requirements, and provides essential information for filling out Form 2106-EZ.

- Form 4562: If you are claiming depreciation or a section 179 deduction related to your business use of property, you would use this form. It helps report property depreciation and can be relevant when calculating deductions reported on Form 2106-EZ.

Each of these documents plays a crucial role in accurately reporting your business expenses and ensuring tax compliance. Having them in order can simplify the tax preparation process and potentially maximize deductions.

Similar forms

- Form 2106: The standard version of the 2106 form allows employees to claim unreimbursed business expenses but has additional requirements for recordkeeping and detail compared to the 2106-EZ, which is simpler and streamlined for qualifying taxpayers.

- Schedule A (Form 1040): This schedule is used to itemize deductions, including unreimbursed employee expenses, but does not accommodate the simplified rules of the 2106-EZ for certain eligible taxpayers.

- Form 4562: This form is primarily for claiming depreciation of business property, which can also be a component of expenses reported on the 2106 forms if the taxpayer is claiming related expenses.

- Form 8829: Used for business use of a home, it intersects with business expense deductions but focuses specifically on expenses related to a home office, which can play a part in deductions entered on the 2106-EZ.

- Form 8880: This form applies to the Credit for Qualified Retirement Savings Contributions and provides an avenue for taxpayers to report contributions but does not directly relate to the employee expenses reported on 2106-EZ.

- Form 8889: This form is related to Health Savings Accounts and is not directly related to the 2106-EZ but reflects another type of deduction some employees may consider.

- Schedule C (Form 1040): This schedule is utilized by self-employed individuals or freelancers to report income and expenses. Although it covers business expenses, it differs from the employee-focused deductions of the 2106 forms.

- Form W-2: While this document reports income and taxes withheld, it also shows whether any reimbursements were made by the employer, which is crucial for determining eligibility to use the 2106-EZ.

Dos and Don'ts

- Do: Ensure you are eligible to use Form 2106-EZ, confirming you are an employee and have unreimbursed expenses.

- Do: Keep thorough records of your expenses, including receipts and documentation to support your claims.

- Do: Fill out each section of the form carefully, verifying that all calculations are accurate.

- Do: Report only ordinary and necessary expenses that relate directly to your job duties.

- Do: Review the specific instructions for vehicle expenses if you are claiming mileage or vehicle-related costs.

- Don't: Claim expenses that have been reimbursed by your employer.

- Don't: Include commuting miles in your business mileage calculations.

- Don't: Forget to reduce your total expenses by any tax-free allowances if applicable.

- Don't: Ignore the requirement for written evidence to support your deductions.

- Don't: Submit the form without checking for completeness and accuracy, as this may delay your refund or lead to an audit.

Misconceptions

Misconceptions can lead to confusion when it comes to tax forms, especially for Form 2106-EZ. Here are six common misconceptions about this form, along with clarifications to help you better understand it.

- You can claim all your business expenses without receipts. Many believe that they can deduct expenses without documenting them. In reality, you must keep records that prove the time, place, and purpose of your expenses, especially if you are claiming vehicle and travel costs.

- Anyone can use Form 2106-EZ. It's a misconception that this form is available to all employees. You can only use it if you are an employee deducting unreimbursed expenses and meet specific criteria, such as using the standard mileage rate for vehicle expenses.

- Meals and entertainment expenses are fully deductible. A common misunderstanding is that you can deduct the full amount of meals and entertainment costs. However, only 50% of these expenses is usually deductible, though this may increase to 80% for certain transportation workers under specific conditions.

- You can claim commuting expenses. Many people mistakenly think that they can deduct commuting costs from their home to work. Commuting expenses are not deductible under any circumstances, as they are considered a personal expense.

- It doesn't matter if you are reimbursed by your employer. There is a belief that you can still claim deductions even if you received reimbursements. If your employer reimburses you for any expenses, you cannot claim those amounts on Form 2106-EZ.

- Once you're on the standard mileage rate, you can't switch methods. Some believe that you can’t change your deduction method once you start using the standard mileage rate. In truth, if you owned the vehicle, you can choose to switch to actual expenses in future years, but certain rules apply.

Understanding these misconceptions can help you navigate the intricacies of Form 2106-EZ with greater confidence. Always consider consulting a qualified tax professional if you have questions specific to your situation.

Key takeaways

Filling out and using Form 2106-EZ requires attention to detail and understanding of your employee business expenses. Here are key takeaways that provide a comprehensive overview:

- You can only use Form 2106-EZ if you are an employee who incurs unreimbursed business expenses.

- This form is applicable for claiming ordinary and necessary expenses related to your job, which means they are standard in your field.

- Ensure you haven't been reimbursed by your employer for any expenses before using this form.

- If claiming vehicle expenses, you must use the standard mileage rate, which for 2017 is set at 53.5 cents per mile.

- Recordkeeping is crucial; you need documentation for all expenses, including time, place, and business purpose.

- For travel expenses, only those incurred during overnight stays away from home qualify, excluding meals.

- Keep in mind that you can only deduct 50% of your meal and entertainment expenses, or 80% if you meet specific criteria related to transportation employment.

- It is advisable to check IRS resources often for any updates or changes to tax laws that could impact your deductions.

- Eligible employees include armed forces reservists and qualified performing artists, each with specific rules for deducing expenses.

- Form 2106-EZ simplifies the process of reporting unreimbursed expenses, but proper completion is essential to maximize your deductions and avoid common pitfalls.

By understanding these key points, you can navigate the process of filling out Form 2106-EZ more effectively. Ensure you follow the guidelines closely to accurately report your expenses.

Browse Other Templates

Good Faith Estimate for Insured Patients - Understanding the potential for balloon payments through this GFE can safeguard you against sudden financial strains.

Can I Get a Vehicle Moving Permit Online - DMV field offices are the official locations for obtaining the REG 172 permit.