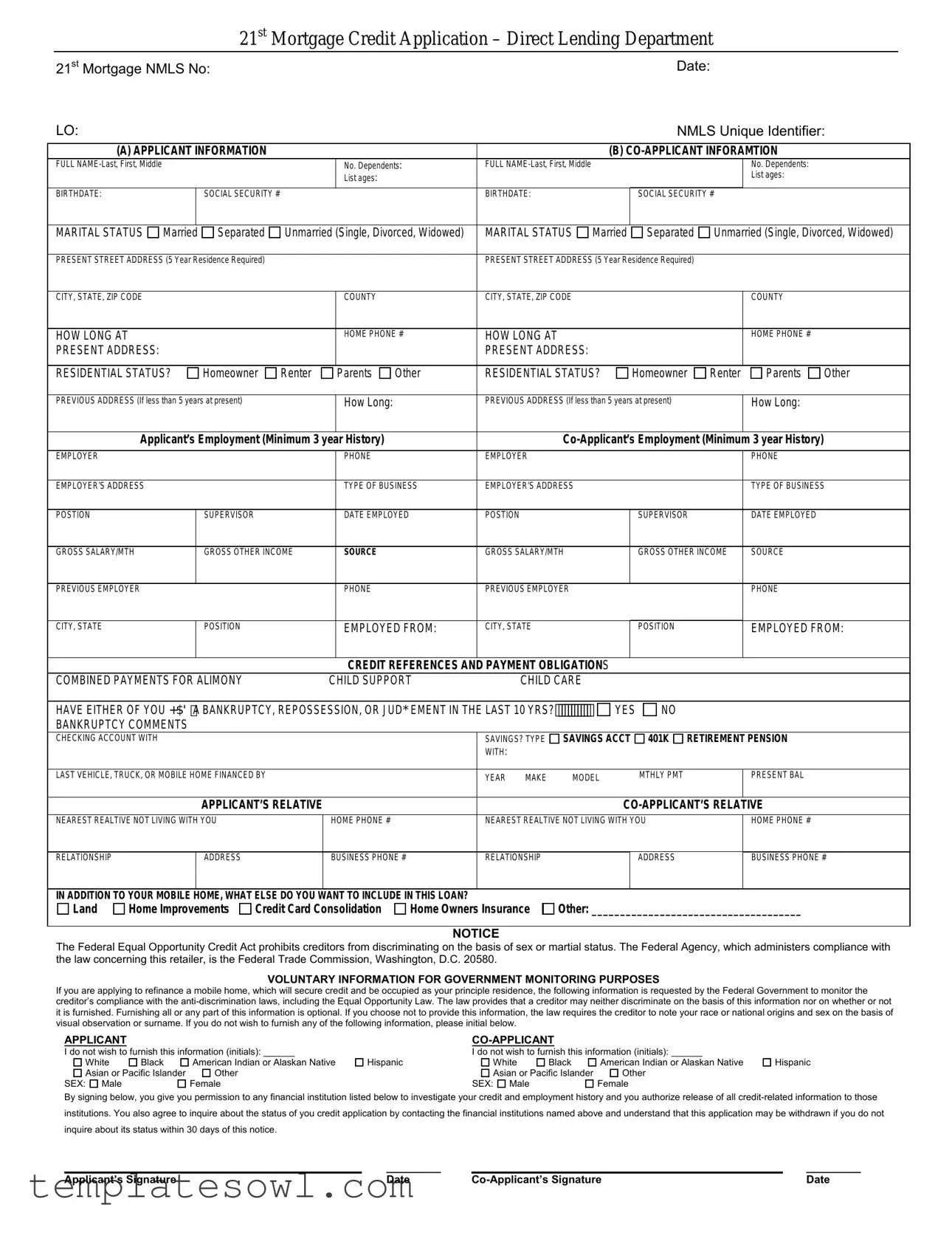

Fill Out Your 21St Mortgage Credit Application Form

The 21st Mortgage Credit Application form is a crucial document for individuals seeking financing for mobile homes or land. This form captures essential applicant information, including full names, Social Security numbers, birthdates, and marital statuses of both the primary applicant and co-applicant. It requires details about the applicant’s and co-applicant’s current and previous addresses, along with residential status. Employment history plays a significant role in the application, with sections designated for reporting at least three years of employment and income sources. Additional sections address credit obligations, including questions about bankruptcy and payment obligations, which help lenders assess financial risk. The form also includes a section for voluntary self-identification for government monitoring purposes, ensuring compliance with anti-discrimination laws. Moreover, it emphasizes the applicant's and co-applicant's authority to allow credit inquiries and outlines the rights and responsibilities associated with the application process. Understanding these components is vital for applicants to navigate the financing process effectively.

21St Mortgage Credit Application Example

21st Mortgage Credit Application – Direct Lending Department

21st Mortgage NMLS No: |

|

|

|

|

|

Date: |

|

|

||||

LO: |

|

|

|

|

|

|

|

|

NMLS Unique Identifier: |

|||

|

|

|

|

|

|

|

|

INFORAMTION |

|

|||

(A) APPLICANT INFORMATION |

|

|

|

|

(B) |

|

||||||

FULL |

|

|

|

|

No. Dependents: |

FULL |

|

|

|

No. Dependents: |

|

|

|

|

|

|

|

List ages: |

|

|

|

|

|

List ages: |

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY # |

|

|

|

BIRTHDATE: |

|

|

SOCIAL SECURITY # |

|

|

|

BIRTHDATE: |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

MARITAL STATUS |

Married |

|

Separated |

Unmarried (Single, Divorced, Widowed) |

MARITAL STATUS |

Married |

Separated |

Unmarried (Single, Divorced, Widowed) |

||||

|

|

|

|

|

|

|

|

|||||

PRESENT STREET ADDRESS (5 Year Residence Required) |

|

|

|

PRESENT STREET ADDRESS (5 Year Residence Required) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY, STATE, ZIP CODE |

|

|

|

|

COUNTY |

|

CITY, STATE, ZIP CODE |

|

|

|

COUNTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOW LONG AT |

|

|

|

|

HOME PHONE # |

HOW LONG AT |

|

|

|

HOME PHONE # |

|

|

PRESENT ADDRESS: |

|

|

|

|

|

|

PRESENT ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

RESIDENTIAL STATUS? |

Homeowner |

Renter |

Parents |

Other |

RESIDENTIAL STATUS? |

Homeowner |

Renter |

Parents |

Other |

|||

|

|

|

|

|

|

|

|

|||||

PREVIOUS ADDRESS (If less than 5 years at present) |

|

How Long: |

|

PREVIOUS ADDRESS (If less than 5 years at present) |

|

How Long: |

|

|||||

|

|

|

|

|

|

|||||||

Applicant’s Employment (Minimum 3 year History) |

|

3 year History) |

|

|||||||||

EMPLOYER |

|

|

|

|

PHONE |

|

EMPLOYER |

|

|

|

PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

||

EMPLOYER’S ADDRESS |

|

|

|

|

TYPE OF BUSINESS |

EMPLOYER’S ADDRESS |

|

|

|

TYPE OF BUSINESS |

||

|

|

|

|

|

|

|

|

SUPERVISOR |

|

|

|

|

POSTION |

|

|

SUPERVISOR |

|

DATE EMPLOYED |

POSTION |

|

|

DATE EMPLOYED |

|

||

GROSS SALARY/MTH

GROSS OTHER INCOME

SOURCE

GROSS SALARY/MTH

GROSS OTHER INCOME

SOURCE

PREVIOUS EMPLOYER

PHONE

PREVIOUS EMPLOYER

PHONE

CITY, STATE

POSITION

EMPLOYED FROM:

CITY, STATE

POSITION

EMPLOYED FROM:

CREDIT REFERENCES AND PAYMENT OBLIGATIONS

COMBINED PAYMENTS FOR ALIMONY |

CHILD SUPPORT |

CHILD CARE |

|

|

|

|

|

|

|

|

|||

HAVE EITHER OF YOU +$'A BANKRUPTCY, REPOSSESSION, OR JUD*EMENT IN THE LAST 10 YRS? |

YES |

NO |

|

|||

BANKRUPTCY COMMENTS |

|

|

|

|

|

|

CHECKING ACCOUNT WITH |

|

SAVINGS? TYPE |

SAVINGS ACCT |

401K |

RETIREMENT PENSION |

|

|

|

WITH: |

|

|

|

|

|

|

|

|

|

|

|

LAST VEHICLE, TRUCK, OR MOBILE HOME FINANCED BY |

|

YEAR MAKE |

MODEL |

|

MTHLY PMT |

PRESENT BAL |

|

|

APPLICANT’S RELATIVE |

|

|||||

NEAREST REALTIVE NOT LIVING WITH YOU |

|

HOME PHONE # |

NEAREST REALTIVE NOT LIVING WITH YOU |

HOME PHONE # |

||||

|

|

|

|

|

|

|

ADDRESS |

|

RELATIONSHIP |

|

ADDRESS |

|

BUSINESS PHONE # |

RELATIONSHIP |

|

BUSINESS PHONE # |

|

|

|

|

|

|

|

|||

IN ADDITION TO YOUR MOBILE |

HOME, WHAT ELSE DO YOU |

WANT TO INCLUDE IN THIS LOAN? |

|

|

|

|||

Land |

Home Improvements |

Credit Card Consolidation |

Home Owners Insurance |

Other: _____________________________________ |

||||

NOTICE

The Federal Equal Opportunity Credit Act prohibits creditors from discriminating on the basis of sex or martial status. The Federal Agency, which administers compliance with the law concerning this retailer, is the Federal Trade Commission, Washington, D.C. 20580.

VOLUNTARY INFORMATION FOR GOVERNMENT MONITORING PURPOSES

If you are applying to refinance a mobile home, which will secure credit and be occupied as your principle residence, the following information is requested by the Federal Government to monitor the creditor’s compliance with the

APPLICANT |

|

|

|

|

|

||||

I do not wish to furnish this information (initials): ______ |

|

I do not wish to furnish this information (initials): ______ |

|

||||||

White |

Black |

American Indian or Alaskan Native |

Hispanic |

White |

Black |

American Indian or Alaskan Native |

Hispanic |

||

Asian or Pacific Islander |

Other |

|

|

Asian or Pacific Islander |

Other |

|

|||

SEX: |

Male |

|

Female |

|

SEX: |

Male |

|

Female |

|

By signing below, you give you permission to any financial institution listed below to investigate your credit and employment history and you authorize release of all

___________________________________________ |

_________ |

_____________________________________________ |

_________ |

Applicant’s Signature |

Date |

Date |

LOAN SUBMISSION WORKSHEET – DIRECT LENDING DEPARTMENT

Lead Source: |

|

|

|

|

Referred by: |

|

|

|

Application Taker: |

|

|

|

Originator: |

|

|

Key #: |

|

Customer Names: |

|

|

|

Spoke w/: |

Best time to call: |

|

|

|

Year: |

Width: |

|

Length: |

Mfgr: |

Model: |

|

|

|

NADA Base x130% = |

|

|

|

|

|

|

||

|

|

|

|

|

REFINANCE LOAN INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

Original Sale Price of Home: |

|

|

Amount Financed: |

|

Estimated Payoff: |

|||

Where Purchased: |

|

|

|

When Purchased: |

|

|

|

|

Who lives in the home: |

|

|

Original Investment: |

|

|

|

||

Original Lienholder: |

|

|

|

Current Lienholder: |

|

|

|

|

Current Interest Rate: |

Original Term: |

months Remaining Term: |

months |

Monthly Pmt: |

||||

|

Is insurance included in the home payment? |

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

HOME PURCHASE INFORMATION |

|

|

|

|

|

|

|

||||||

|

Who are you buying the home from? |

|

Name: |

|

|

|

|

|

|

|

|

City & State: |

|

|

|

|||

|

|

|

|

|

Salesman: |

|

|

|

|

|

|

|

|

Phone: ( |

) |

|

– |

|

|

|

|

|

|

HOME LOCATION INFORMATION |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Where is the home currently located – or – Where will it be located? |

|

|

|

|

|

|

|

|

|

|

|||||||

|

Does the customer own the land? |

Yes |

No |

|

Tax Appraisal Value: |

|

|

|

|

|

|

|

||||||

|

Land Pmt/ Lot Rent: |

per month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When was the land purchased? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Is the Land financed? |

Yes, with mobile home |

Yes, separate loan |

No |

|

|

|

|

|

|

|

|||||||

|

Whose name(s) is/are on the customer’s deed? |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

What was the land purchase price? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Who is the lender for the land loan? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Will the customer consider a Land/Home combination? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

REQUESTED LOAN TERMS |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Only |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Home and Land Only |

|

|

|

|

|

|

|

|

|||

|

A. Purchase of Home |

|

|

|

|

|

|

|

|

I. Consolidation Request(s) |

|

|

|

|||||

|

B. Refinance Home |

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

C. Land Purchase |

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

D. Land Refinance |

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

E. Land/Home Purchase |

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

F. Land/Home Refinance |

|

|

|

|

|

|

|

|

J. Cash Out Request |

|

|

|

|

|

|

||

|

G. Improvement Request(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. |

|

|

|

|

|

|

|

|

K. Total Down Payment: |

|

|

down pmt |

||||||

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Total Loan Amount |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Less |

Down Pmt. & Fees) |

||

|

Did you request Purchase Agreement or Installment Contract + 30 day written payoff? |

Yes |

No |

|

|

|

||||||||||||

In the spaces below, provide your credit manager with any additional information that will be helpful in understanding this transaction:

Form Characteristics

| Fact Name | Description |

|---|---|

| Application Purpose | The 21st Mortgage Credit Application form is used to assess an applicant's financial status and creditworthiness for loans related to mobile homes. |

| Required Information | The form collects essential information from both the applicant and co-applicant, such as social security numbers, income details, and residential addresses, among others. |

| Federal Compliance | This application adheres to the Federal Equal Opportunity Credit Act, ensuring that applicants are not discriminated against based on sex or marital status. |

| State-Specific Forms | For submissions in specific states, compliance with respective state laws regarding consumer credit and financing is required, such as the California Finance Lenders Law. |

Guidelines on Utilizing 21St Mortgage Credit Application

Completing the 21St Mortgage Credit Application form requires careful attention to detail. You will need to provide personal, financial, and employment information for yourself and any co-applicant. After filling out the form, the next step involves gathering necessary documents and possibly contacting the lender for further inquiries. Here are the steps to ensure accurate and efficient completion of the application.

- Date: Fill in the date of the application at the top of the form.

- Loan Officer Information: Include the name of your loan officer and their unique identifier.

- Applicant Information: Write your full name, Social Security number, birthdate, and marital status. Record the number of dependents and their ages.

- Co-Applicant Information: Provide the same details for your co-applicant.

- Present Address: Enter your current street address, city, state, ZIP code, and county. Note how long you have lived there, and provide your home phone number.

- Residential Status: Select whether you are a homeowner, renter, or living with parents.

- Previous Address: Fill in your previous address if you have not lived at your current address for five years. State how long you lived there.

- Employment Information: For both yourself and your co-applicant, list your current employers, their phone numbers, addresses, type of business, and each person's position and start date. Include gross monthly salary and other income sources.

- Previous Employment: Provide the same details for your previous employers, covering the last three years.

- Credit References: Fill in your payment obligations, including any alimony, child support, or child care payments.

- Bankruptcy Information: Indicate if either of you has experienced bankruptcy, repossession, or judgment in the last ten years.

- Account Information: Include any checking or savings accounts, retirement accounts, and vehicle details.

- Relatives: Provide information about your nearest relatives who do not live with you, including their contact details.

- Loan Request: Indicate what is included in the loan (like land, improvements, etc.) and select the type of loan terms desired.

- Voluntary Information: If you wish to provide demographic information, please fill in the relevant sections, or indicate if you prefer not to share.

- Signatures: Both you and your co-applicant should sign and date the application at the bottom.

Once the application form is filled out, double-check to ensure all information is accurate. Collect any supporting documentation that may be required, as this will help expedite your credit application process.

What You Should Know About This Form

What is the purpose of the 21st Mortgage Credit Application form?

The 21st Mortgage Credit Application form is used to gather necessary information from applicants and co-applicants seeking a loan for purchasing or refinancing a mobile home. This information helps the lending department assess the applicant's creditworthiness and eligibility for the loan they are requesting.

What information do I need to provide in the applicant section?

In the applicant section, you will need to provide your full name, social security number, birthdate, marital status, and current residential address. Additionally, you should list your dependents and their ages, along with your employment details, including employer information and income sources. If you’ve lived at your current address for less than five years, you’ll also need to include your previous address details.

How will my credit history be checked?

By signing the application, you are granting permission for financial institutions to investigate your credit and employment history. This process typically involves contacting credit bureaus and reviewing your past financial behavior. The findings will play a crucial role in the approval process of your loan application.

What happens if I have a bankruptcy or repossession in my past?

If you or your co-applicant have experienced a bankruptcy or repossession in the last ten years, you must disclose this information on the application. This disclosure will not automatically disqualify you, but it can impact the decision-making process as it provides insights into your credit history and financial management.

Can I apply for a loan with a co-applicant?

Yes, you can apply for a loan with a co-applicant. Including a co-applicant may strengthen your application by combining income and credit histories, which can enhance your overall eligibility for a loan. Both applicants will need to fill out their respective sections of the credit application, sharing information about income, debts, and personal details.

What additional information should I consider providing?

While the application form captures essential details, it’s beneficial to provide any additional information that could help the credit manager understand your financial situation better. This may include specific circumstances affecting your credit, reasons for applying for a loan, or future financial goals that may influence your loan needs.

Common mistakes

When individuals fill out the 21st Mortgage Credit Application form, they often encounter several common mistakes that can delay the approval process or lead to complications. Understanding these errors can enhance the accuracy of the application, increasing the likelihood of successful financing.

One common mistake is omitting essential personal information. Applicants frequently leave out their social security numbers or birth dates, which are critical for verifying identity. Incomplete addresses can also create confusion and hinder processing. All applicants must ensure they provide complete and accurate personal information.

Another significant error involves the marital status section. Applicants may misstate their marital status as "married," "unmarried," or "separated" without fully understanding the implications. Providing incorrect marital information can notably impact the application, as financial obligations differ significantly based on marital status.

Some applicants fail to provide a comprehensive employment history. The form asks for a minimum of three years of employment data for both the applicant and co-applicant. Neglecting to include previous employers or specific employment details can lead to an incomplete picture of financial stability, potentially raising red flags for lenders.

Additionally, individuals often overlook their credit obligations. List all credit references and payment obligations accurately, including any child support or alimony payments. Failure to do so can create discrepancies and may appear as an attempt to hide financial obligations, which could adversely affect the application outcome.

Missing signatures or initials in crucial sections frequently occurs as well. It is vital that both the applicant and co-applicant sign and date the document correctly. Not doing so may render the application invalid, adding unnecessary delays to the approval process.

Moreover, applicants sometimes misunderstand the section that requests voluntary information for government monitoring purposes. Many individuals may choose not to provide this information, which is optional. However, it’s important to clearly initial this choice to ensure that it is documented properly.

Finally, applicants may neglect to review their application for accuracy before submission. Small errors, such as typos or miscalculations in income or expenses, can lead to significant issues. Taking the time to thoroughly review the application can prevent unnecessary complications in the loan approval process.

Documents used along the form

The 21st Mortgage Credit Application form is essential for individuals seeking financing for a mobile home. However, several additional documents often accompany this application to provide comprehensive information about the applicant's financial background and situation. Below is a list of common forms and documents used along with the credit application, each briefly described for clarity.

- W-2 Forms: These documents provide a summary of an applicant's annual wages and taxes withheld. They help lenders verify income over the past couple of years.

- Pay Stubs: Recent pay stubs are usually required to confirm current income levels and employment status. Typically, lenders ask for the last few months' worth.

- Bank Statements: Copies of recent bank statements show an applicant's financial health. Lenders often review the last two to three months of transactions for income verification and assessment of spending habits.

- Tax Returns: Complete copies of the previous two years’ tax returns help lenders assess an individual’s overall income and any additional sources of revenue.

- Credit Report: A credit report provides a summary of an applicant's credit history, including scores, debts, and payment history. Lenders often obtain this directly from credit bureaus.

- Property Documents: If the applicant is buying property, purchase agreements or land deeds may be needed to confirm ownership details or terms of sale.

- Identification Documents: Valid photo identification, such as a driver's license or passport, is often required to verify the identity of the applicant and any co-applicants.

- Loan Term Sheet: This document outlines the details of the requested loan, including interest rates, payment terms, and amounts being financed. It is useful for ensuring that both the lender and applicant have a clear understanding of the loan structure.

- Debt Verification Letters: If applicable, letters confirming any existing debts, such as alimony or child support, may be required for accurate financial assessment and planning.

These documents collectively help lenders assess the creditworthiness of an applicant while ensuring transparency during the loan approval process. It is essential for applicants to gather these documents in advance, as this can facilitate a smoother and more efficient application experience.

Similar forms

-

Uniform Residential Loan Application (Form 1003): Similar to the 21st Mortgage Credit Application, this form collects detailed information about the applicant, co-applicant, and their financial history to assess eligibility for a mortgage loan.

-

FHA Loan Application: Like the 21st Mortgage application, this application is utilized for assessing creditworthiness and includes similar sections on income, employment history, and property details.

-

VA Loan Application: This document mirrors the 21st Mortgage application by requiring personal information, employment history, and income verification for veterans applying for home loans backed by the U.S. Department of Veterans Affairs.

-

Conventional Loan Application: It serves a similar purpose, gathering comprehensive information about the borrower’s financial situation, credit history, and the property being financed, akin to the structure of the 21st Mortgage application.

-

Home Equity Line of Credit (HELOC) Application: This document often shares similar requirements regarding personal and financial details, as well as collateral information related to the property.

-

Rural Development Loan Application: Similar to the 21st form, it focuses on providing personal and financial background to help determine eligibility for loans aimed at rural homebuyers.

-

Chattel Mortgage Application: This form is used when applying for loans to finance mobile homes. It is similar in layout and purpose, requesting details about both the borrower and the collateral.

-

Credit Application for Mobile Home Insurance: Like the 21st Mortgage application, this insurance document collects similar personal and financial details to assess risk and determine coverage eligibility.

-

Loan Modification Application: This document shares the objective of assessing a borrower’s financial status, asking for similar income details and housing costs as the 21st Mortgage application.

Dos and Don'ts

When filling out the 21st Mortgage Credit Application form, attention to detail is crucial. Here are some guidelines to keep in mind:

- DO: Ensure all personal information is accurate, including your name, address, and social security number.

- DO: Provide complete employment history for both the applicant and co-applicant, including all previous employers from the last three years.

- DO: Include all forms of income, such as salaries, bonuses, and other sources. Transparency is key.

- DO: Review the application for any missing sections before submission. Make sure all required fields are filled out.

- DON'T: Forget to disclose any past financial issues like bankruptcies or repossessions, as this information is crucial.

- DON'T: Use shorthand or abbreviations when filling out the form; clarity is important for accurate processing.

- DON'T: Leave out co-applicant information. If applying with someone else, include their details thoroughly.

- DON'T: Submit the application without signing it. Signatures are necessary for authorization and processing.

Misconceptions

Here are four common misconceptions about the 21st Mortgage Credit Application form, along with clarifications:

- Misconception 1: The application is only for first-time homebuyers.

- Misconception 2: You need perfect credit to qualify.

- Misconception 3: All requested information must be provided even if it’s not applicable.

- Misconception 4: Providing personal demographic information is mandatory.

This form is not limited to new buyers. It is for anyone seeking financing, including those refinancing an existing home. Whether you are purchasing a new mobile home or refinancing an old one, this application applies.

While good credit can help, it’s not the only factor considered. Lenders look at your overall financial situation, including income, employment history, and payment obligations. Even with less-than-perfect credit, many can still qualify for a loan.

It’s essential to provide accurate information. However, if a question does not apply to your situation, you can simply indicate that. For example, if you don’t have a co-applicant, you may leave that section blank.

Furnishing demographic data is optional. While this information helps the lender comply with government regulations on fair lending, you can choose not to provide it. Your decision will not affect your application negatively.

Key takeaways

Key Takeaways for Completing the 21st Mortgage Credit Application

- Provide complete applicant and co-applicant information, including full names, Social Security numbers, birthdates, marital status, and current and previous addresses.

- Document both applicants' employment history for at least the past three years, including employer names, positions, and gross income.

- Before submitting, review your credit references and payment obligations. This includes any ongoing payments related to alimony, child support, or child care.

- Be truthful regarding bankruptcy or repossession history. Disclosures related to these can significantly impact loan eligibility.

- Understand that providing voluntary information regarding race and sex is optional and is used for monitoring compliance with anti-discrimination laws. It will not affect your application.

- Check for the loan submission worksheet at the end of the form. Fill it out carefully as it summarizes essential details about the loan request, including the purchase price and any existing liens on the property.

Browse Other Templates

Baltimore Permits - Separate fees apply for minor and major occupancy applications.

Goodwill Vouchers Near Me - Applicants need to select their preferred Goodwill store location for shopping.