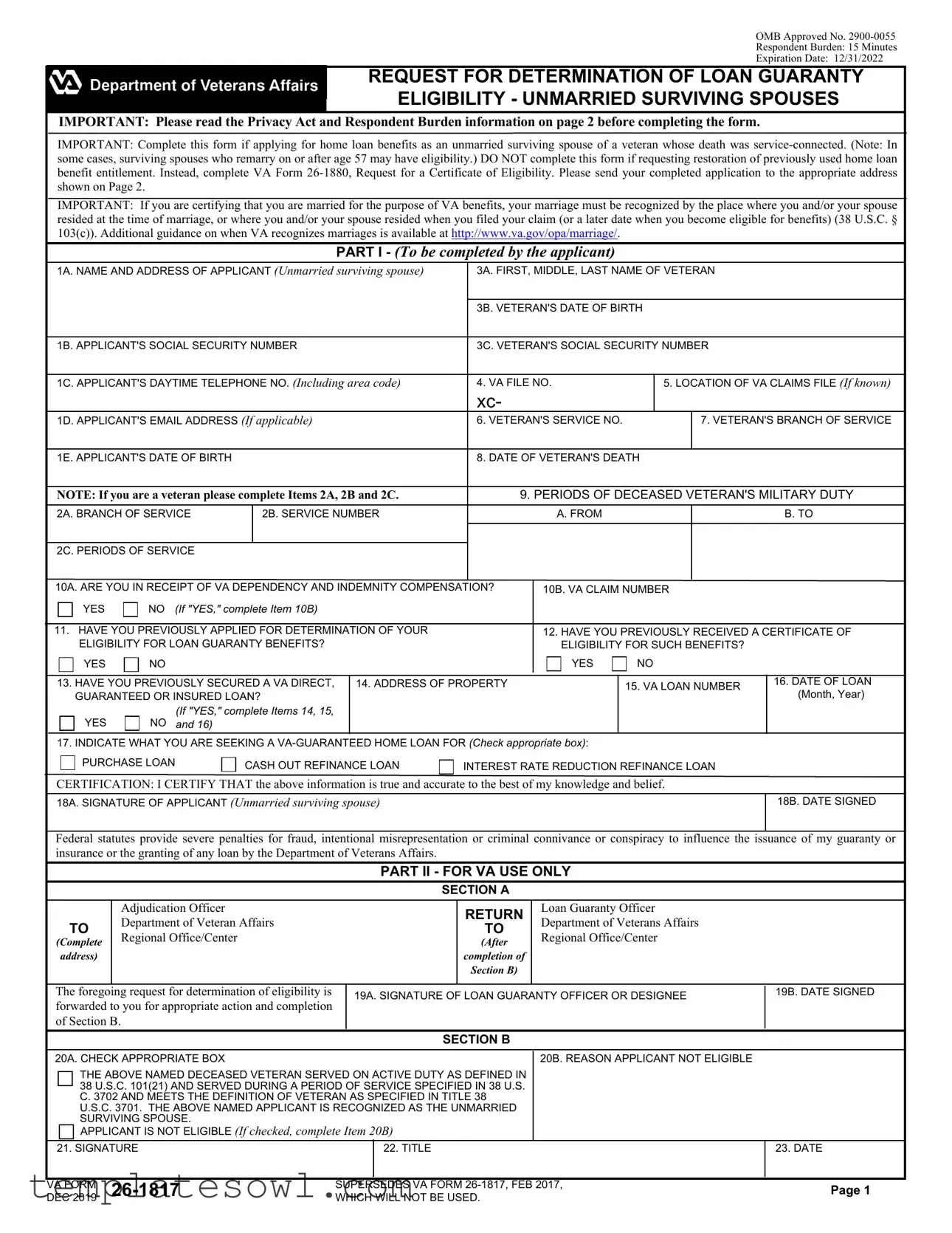

Fill Out Your 26 1817 Form

The VA Form 26-1817 serves a critical purpose for unmarried surviving spouses of veterans seeking financial assistance through loan guaranty eligibility. Designed to streamline the process, this form is primarily for those applying for home loan benefits related to the veteran's service connection. It’s important to emphasize that this application is not for those looking to restore previously used home loan benefits, as they must use a different form, VA Form 26-1880. The application requires detailed information about the applicant and the veteran, including names, social security numbers, and relevant dates. There’s a significant emphasis on accurately certifying marital status and ensuring that any marriage recognized is compliant with legal standards. The form also includes various sections, with specific inquiries regarding the veteran's military service and any existing claims for Dependency and Indemnity Compensation. The applicant must be aware of the guidelines about marital status and the impact it could have on eligibility, especially for those who may have remarried after the age of 57. Completing this form thoroughly and truthfully is essential, as discrepancies could lead to severe penalties under federal law. Once completed, the application should be sent to the appropriate VA regional office, ensuring it arrives at the correct location based on the applicant's state of residency.

26 1817 Example

OMB Approved No.

Respondent Burden: 15 Minutes

Expiration Date: 12/31/2022

REQUEST FOR DETERMINATION OF LOAN GUARANTY

ELIGIBILITY - UNMARRIED SURVIVING SPOUSES

IMPORTANT: Please read the Privacy Act and Respondent Burden information on page 2 before completing the form.

IMPORTANT: Complete this form if applying for home loan benefits as an unmarried surviving spouse of a veteran whose death was

IMPORTANT: If you are certifying that you are married for the purpose of VA benefits, your marriage must be recognized by the place where you and/or your spouse resided at the time of marriage, or where you and/or your spouse resided when you filed your claim (or a later date when you become eligible for benefits) (38 U.S.C. § 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

PART I - (To be completed by the applicant)

|

1A. NAME AND ADDRESS OF APPLICANT (Unmarried surviving spouse) |

3A. FIRST, MIDDLE, LAST NAME OF VETERAN |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3B. VETERAN'S DATE OF BIRTH |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1B. APPLICANT'S SOCIAL SECURITY NUMBER |

3C. VETERAN'S SOCIAL SECURITY NUMBER |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

1C. APPLICANT'S DAYTIME TELEPHONE NO. (Including area code) |

4. VA FILE NO. |

|

5. LOCATION OF VA CLAIMS FILE (If known) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

xc- |

|

|

|

|

|

|

|

|

|

|

|

1D. APPLICANT'S EMAIL ADDRESS (If applicable) |

6. VETERAN'S SERVICE NO. |

|

|

7. VETERAN'S BRANCH OF SERVICE |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1E. APPLICANT'S DATE OF BIRTH |

|

|

8. DATE OF VETERAN'S DEATH |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

NOTE: If you are a veteran please complete Items 2A, 2B and 2C. |

|

9. PERIODS OF DECEASED VETERAN'S MILITARY DUTY |

|||||||||||||||||||||

|

2A. BRANCH OF SERVICE |

|

2B. SERVICE NUMBER |

|

|

|

A. FROM |

|

|

|

B. TO |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2C. PERIODS OF SERVICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

10A. ARE YOU IN RECEIPT OF VA DEPENDENCY AND INDEMNITY COMPENSATION? |

|

10B. VA CLAIM NUMBER |

|

|

|||||||||||||||||||

|

|

|

|

|

YES |

|

|

|

NO (If "YES," complete Item 10B) |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||||||||||||||

|

11. HAVE YOU PREVIOUSLY APPLIED FOR DETERMINATION OF YOUR |

|

|

12. HAVE YOU PREVIOUSLY RECEIVED A CERTIFICATE OF |

||||||||||||||||||||

|

|

|

|

|

ELIGIBILITY FOR LOAN GUARANTY BENEFITS? |

|

|

|

|

ELIGIBILITY FOR SUCH BENEFITS? |

|

|

||||||||||||

|

|

|

|

|

YES |

|

|

|

NO |

|

|

|

|

|

|

YES |

|

NO |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

13. HAVE YOU PREVIOUSLY SECURED A VA DIRECT, |

14. ADDRESS OF PROPERTY |

|

|

|

|

|

15. VA LOAN NUMBER |

16. DATE OF LOAN |

|

||||||||||||||

|

|

|

|

|

GUARANTEED OR INSURED LOAN? |

|

|

|

|

|

|

|

|

|

|

|

(Month, Year) |

|||||||

|

|

|

|

|

|

|

|

|

|

(If "YES," complete Items 14, 15, |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

YES |

|

|

NO and 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. INDICATE WHAT YOU ARE SEEKING A

PURCHASE LOAN

CASH OUT REFINANCE LOAN

INTEREST RATE REDUCTION REFINANCE LOAN

CERTIFICATION: I CERTIFY THAT the above information is true and accurate to the best of my knowledge and belief.

18A. SIGNATURE OF APPLICANT (Unmarried surviving spouse) |

18B. DATE SIGNED |

Federal statutes provide severe penalties for fraud, intentional misrepresentation or criminal connivance or conspiracy to influence the issuance of my guaranty or insurance or the granting of any loan by the Department of Veterans Affairs.

|

|

|

|

|

|

|

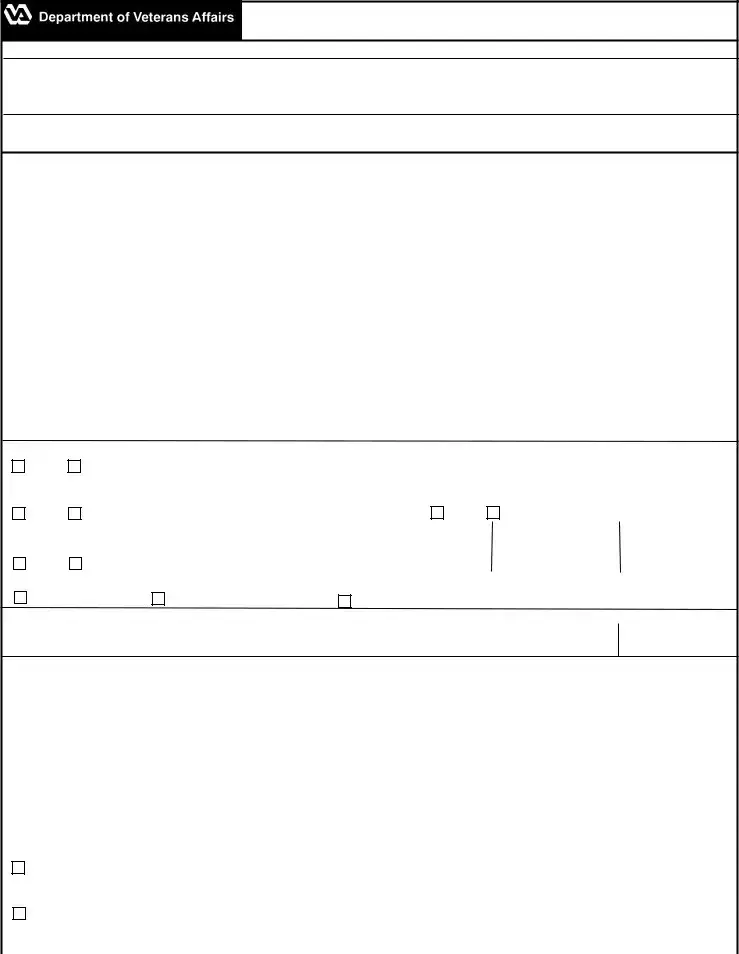

PART II - FOR VA USE ONLY |

|

|||

|

|

|

|

|

|

|

SECTION A |

|

|

||

|

|

|

|

Adjudication Officer |

|

|

|

RETURN |

|

Loan Guaranty Officer |

|

|

|

|

|

Department of Veteran Affairs |

|

|

|

|

Department of Veterans Affairs |

|

|

|

TO |

|

|

|

TO |

|

|

||||

|

Regional Office/Center |

|

|

|

|

Regional Office/Center |

|

||||

(Complete |

|

|

|

(After |

|

|

|||||

|

address) |

|

|

|

|

completion of |

|

|

|

||

|

|

|

|

|

|

|

|

Section B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

The foregoing request for determination of eligibility is |

|

19A. SIGNATURE OF LOAN GUARANTY OFFICER OR DESIGNEE |

19B. DATE SIGNED |

||||||||

forwarded to you for appropriate action and completion |

|

|

|

|

|

|

|

||||

of Section B. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

SECTION B |

|

|

||

20A. CHECK APPROPRIATE BOX |

|

|

|

|

|

20B. REASON APPLICANT NOT ELIGIBLE |

|

||||

|

|

|

THE ABOVE NAMED DECEASED VETERAN SERVED ON ACTIVE DUTY AS DEFINED IN |

|

|

||||||

|

|

|

|

||||||||

|

|

|

38 U.S.C. 101(21) AND SERVED DURING A PERIOD OF SERVICE SPECIFIED IN 38 U.S. |

|

|

||||||

|

|

|

|

||||||||

|

|

|

C. 3702 AND MEETS THE DEFINITION OF VETERAN AS SPECIFIED IN TITLE 38 |

|

|

||||||

|

|

|

U.S.C. 3701. THE ABOVE NAMED APPLICANT IS RECOGNIZED AS THE UNMARRIED |

|

|

||||||

|

|

|

SURVIVING SPOUSE. |

|

|

|

|

|

|

|

|

|

|

|

APPLICANT IS NOT ELIGIBLE (If checked, complete Item 20B) |

|

|

||||||

21. SIGNATURE |

|

|

22. TITLE |

|

23. DATE |

||||||

DEC 2019 |

|

|

|

|

|

|

Page 1 |

||||

WHICH WILL NOT BE USED. |

|

||||||||||

VA FORM |

|

SUPERSEDES VA FORM |

|

||||||||

If you live in: |

Please send your completed application to: |

|

|

Georgia, North Carolina, South |

Department of Veterans Affairs |

Carolina, Tennessee |

Atlanta Regional Loan Center |

|

P.O. Box 100023 |

|

Decatur, GA |

Connecticut, Delaware, Indiana, |

Department of Veterans Affairs |

Maine, Massachusetts, Michigan, |

Cleveland Regional Loan Center |

New Hampshire, New Jersey, |

1240 East Ninth Street |

New York, Ohio, Pennsylvania, |

Cleveland, OH 44199 |

Rhode Island, Vermont |

|

|

|

Alaska, Colorado, Idaho, |

Department of Veterans Affairs |

Montana, Oregon, Utah, |

Denver Regional Loan Center |

Washington, Wyoming |

P.O. Box 25126 |

|

Denver, CO 80225 |

Hawaii, Guam, American Samoa |

Department of Veterans Affairs |

Commonwealth of the Northern |

VA Regional Office |

Marianas |

Loan Guaranty Division (26) |

|

459 Patterson Road |

|

Honolulu, HI 96819 |

Arkansas, Louisiana, Oklahoma, |

Department of Veterans Affairs |

Texas |

Houston Regional Loan Center |

|

6900 Almeda Road |

|

Houston, TX |

|

|

Arizona, California, New |

Department of Veterans Affairs |

Mexico, Nevada |

Phoenix Regional Loan Center |

|

3333 N. Central Avenue |

|

Phoenix, AZ |

District of Columbia, Kentucky, |

Department of Veterans Affairs |

Maryland,Virginia, |

Roanoke Regional Loan Center |

West Virginia |

210 Franklin Road, S.W. |

|

Roanoke, VA 24011 |

Illinois, Iowa, Kansas, |

Department of Veterans Affairs |

Minnesota, Missouri, Nebraska, |

St. Paul Regional Loan Center |

North Dakota, South Dakota, |

1 Federal Drive, Ft. Snelling |

Wisconsin |

St. Paul, MN |

|

|

Alabama, Florida, Mississippi, |

Department of Veterans Affairs |

Puerto Rico, U.S. Virgin Islands |

St. Petersburg Regional Loan Center |

|

9500 Bay Pines Boulevard |

|

St. Petersburg, FL 33744 |

PRIVACY ACT INFORMATION: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 38, Code of Federal Regulations 1.576 for routine uses (e.g., to a member of Congress inquiring on behalf of a veteran) as identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan Applicant Records - VA, published in the Federal Register. Your obligation to respond is required in order to determine the surviving spouse's qualifications for a loan. Giving us your SSN account information is voluntary. VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January 1, 1975, and still in effect.

RESPONDENT BURDEN: We need this information to determine a surviving spouse's qualifications for a

VA FORM |

Page 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| OMB Approval | This form is approved by the Office of Management and Budget with approval number 2900-0055. |

| Completion Time | Applicants should expect to spend about 15 minutes filling out this form. |

| Expiration Date | The form expired on 12/31/2022, and it is important to use the most current version. |

| Eligibility Criteria | Unmarried surviving spouses of veterans whose deaths were service-connected can apply for benefits using this form. |

| Marriage Clause | Surviving spouses who remarry after age 57 may retain eligibility for benefits under certain conditions. |

| Alternative Form | If you need to restore previously used home loan benefits, use VA Form 26-1880 instead. |

| Privacy Notice | Applicants are advised to read the Privacy Act information included on page 2 of the form. |

| State-Specific Submissions | The completed application must be sent to a specific Regional Loan Center based on the applicant’s state of residence. |

| Fraud Warning | There are serious penalties for fraud or misrepresentation when seeking VA benefits. |

| Governing Law | Eligibility is governed under 38 U.S.C. § 3702, determining VA-guaranteed loan benefits. |

Guidelines on Utilizing 26 1817

Completing the VA Form 26-1817 is an important step in applying for loan guaranty eligibility as the unmarried surviving spouse of a veteran. This process requires accurate information regarding both the applicant and the veteran. After ensuring that you have all necessary documentation, follow these steps to complete the form properly.

- In Part I of the form, provide your personal details as the applicant. This includes your name, address, and Social Security number.

- Fill out the veteran's information. Enter their full name, date of birth, and Social Security number.

- Include your daytime telephone number and email address if applicable.

- If you know it, write down the VA file number and the location of the VA claims file.

- Provide the deceased veteran's service number, branch of service, and the date of death.

- Fill in the period of military duty for the veteran, from start to end dates, noting all relevant periods of service.

- Indicate if you are receiving VA Dependency and Indemnity Compensation by checking yes or no.

- Answer whether you have previously applied for a determination of eligibility. Check the appropriate box for yes or no.

- Indicate if you have received a certificate of eligibility for loan guaranty benefits before by again checking yes or no.

- If applicable, provide information about any previously secured VA direct loan, including property address and loan number.

- Select what type of loan you are seeking by checking the appropriate box (purchase loan, cash-out refinance loan, etc.).

- Finally, certify the information by providing your signature and the date signed.

Once completed, ensure that the form is reviewed for any errors. Submit the form to the appropriate address listed on the second page of the application. Each state has a specific VA regional loan center to which applications should be sent. It is crucial to choose the correct address to avoid any delays in processing your application.

What You Should Know About This Form

What is VA Form 26-1817 used for?

VA Form 26-1817 is a request form specifically designed for unmarried surviving spouses of veterans. It is used to determine eligibility for VA loan guaranty benefits. This form helps to establish whether the applicant qualifies for home loan benefits as the surviving spouse of a veteran whose death was connected to their service. It’s important that applicants complete this form if they have not remarried and their spouse’s death qualifies them for such benefits.

Who should complete Form 26-1817?

This form should be completed by the unmarried surviving spouse of a veteran. If you are applying for home loan benefits related to a veteran’s death that was service-connected, you will need to fill out this form. However, if you are seeking to restore previously used home loan benefits, you would need to use VA Form 26-1880 instead.

What information is required to fill out the form?

The form requires various pieces of personal information. You will need to provide your name, contact information, and Social Security number. In addition, you'll need details about the veteran, such as their name, Social Security number, date of birth, and details about their military service. It's crucial to have accurate information at hand to ensure smooth processing.

Where do I send my completed Form 26-1817?

After you complete the form, you must send it to the appropriate Regional Loan Center based on your state of residence. Each regional office serves different states, so it is important to verify the correct address. This information is typically provided on the second page of the form. Sending your application to the correct location will help avoid delays in processing.

What happens after I submit the form?

Once you submit VA Form 26-1817, your application will be reviewed by a loan guaranty officer at the VA. They will assess your eligibility for benefits. If you are determined eligible, you will receive a certificate of eligibility. If not, you will be provided with the reasons why within the VA's response. It's important to keep track of your application status and follow up if necessary.

Common mistakes

Completing the VA Form 26-1817 is crucial for unmarried surviving spouses seeking loan guaranty eligibility. However, many applicants make common mistakes that can delay or derail the approval process. Awareness of these potential pitfalls can make a significant difference.

One frequent error is skipping the Privacy Act and Respondent Burden information. Not reading this section can lead to misunderstandings about how personal information will be used and the importance of providing complete details. Taking a moment to familiarize oneself with this information is essential.

Another issue arises when filling out the applicant's information. It's vital to ensure that the name, address, and Social Security number are accurate and match the documentation provided. A simple typo can lead to unnecessary complications and further requests for clarification.

Additionally, many forget to include all necessary information about the veteran. Items like the veteran's full name, date of birth, and Social Security number are mandatory. Omitting these can lead to a rejection of the application.

Some applicants also overlook the requirement to indicate whether they are receiving VA Dependency and Indemnity Compensation. Ignoring this section may raise red flags during the review process. Ensuring this information is accurately provided can streamline the approval process.

Moreover, answering questions regarding previous applications requires careful attention. Many individuals might not recall their prior submissions or may confuse details, resulting in inaccurate information. Review previous applications to avoid contradictions.

It's also essential to provide relevant property details correctly. Applicants may either skip filling in the property address or make errors in the property description. Thoroughly reviewing this information ensures that the intent of the loan is clear.

Furthermore, the certification at the end of the form must not be overlooked. Applicants often forget to sign and date the document, leading to immediate denial of the application. A signature serves as a declaration that all provided information is truthful, and it is vital to complete this step.

Lastly, many submissions are held up due to improper submission methods. Following the submission instructions is critical. Ensure that the form is sent to the correct regional office, as indicated on the last page. Misaddressing the application can result in delays that are easily preventable.

By being aware of these common mistakes, applicants can enhance their chances of a smooth and successful process. Taking the time to double-check details, read instructions, and provide complete and accurate information will greatly facilitate obtaining the benefits deserved.

Documents used along the form

The VA Form 26-1817 is used by unmarried surviving spouses of veterans to request a determination of eligibility for loan guaranty benefits. Along with this form, several other documents may be relevant in the application process for home loan benefits. Here’s an overview of some commonly used forms and documents:

- VA Form 26-1880: This form is used to request a Certificate of Eligibility. It’s essential for determining if you qualify for a VA-backed home loan. If you've previously used your loan benefit, this is the form to use to restore your eligibility.

- VA Form 21-534: This application for Dependency and Indemnity Compensation (DIC) is designed for surviving spouses seeking benefits based on a service member's death. It’s crucial for those who want to access compensation after losing a veteran.

- VA Form 21P-534EZ: This is a simplified form for applying for DIC, Death Pension, and Accrued Benefits. It's streamlined for efficiency, making it quicker for applicants to receive essential support.

- VA Form 21-4180: When applying for certain benefit adjustments, this form is used to provide information on the status of a deceased veteran's service and family situation, which may help clarify eligibility.

- VA Form 26-4555: This document is the Application for a Certificate of Eligibility for Special Adapted Housing Grant for veterans with certain service-connected disabilities who need modifications in their living space.

- VA Form 26-0592: Known as the Loan Analysis Worksheet, this form assists in evaluating a loan application and determining the financial eligibility of the borrower.

- VA Form 27-8820: This form is used for establishing entitlement for veterans applying for a VA home loan. It provides information regarding prior use of benefits and other pertinent data.

- VA Form 26-1812: This form applies to individuals wishing to request a change or correction to their loan guaranty eligibility, ensuring that all records are accurate and up to date.

Gathering the correct forms and understanding their purposes is vital for a smooth application process. Be sure to check each document’s requirements and complete them accurately to avoid delays in processing your benefits.

Similar forms

-

VA Form 26-1880: This form is used to request a Certificate of Eligibility for veterans who have not previously used their home loan benefits. Like Form 26-1817, it assesses eligibility for VA loan benefits but focuses on those who are not surviving spouses and have existing entitlement.

-

VA Form 22-5490: Used to apply for pension benefits as a surviving spouse. This form collects similar personal and service-related information, ensuring that applicants meet the criteria for the benefits offered by the VA, much like the process for obtaining loan guaranty benefits.

-

VA Form 21-534EZ: This application is for Dependency and Indemnity Compensation (DIC) benefits. The purpose is to provide survivors of veterans with monthly benefits, similar to how Form 26-1817 establishes eligibility for a loan guaranty as a surviving spouse.

-

VA Form 21-527EZ: This form is designed for veterans applying for pension benefits and includes sections for service information and personal details. It is akin to Form 26-1817 in that both forms ascertain eligibility based on the veteran's service record.

-

VA Form 40-0247: This application is used for veterans interested in obtaining a military headstone or marker. Like Form 26-1817, it gathers essential details regarding the veteran’s service and the surviving spouse's relationship to the veteran, ensuring the appropriate benefits are granted for memorial purposes.

Dos and Don'ts

Do's:

- Read the Privacy Act and Respondent Burden information carefully before starting.

- Ensure that personal information, such as Social Security numbers, is accurate and complete.

- Provide a valid daytime telephone number and email address, if applicable.

- Apply only if you are the unmarried surviving spouse of a veteran whose death was service-connected.

- Double-check the application for any errors or missing information before submission.

Don'ts:

- Do not complete this form if you are seeking to restore previously used home loan entitlement.

- Never falsify any information or misrepresent any facts on the application.

- Do not submit your application without reviewing all instructions thoroughly.

- Avoid sending the completed form to the wrong VA address. Verify the correct address before mailing.

Misconceptions

- Misinformation about who should complete the form: Some believe that anyone can complete the VA Form 26-1817. In reality, this form is specifically for unmarried surviving spouses of veterans whose deaths were service-connected.

- Eligibility after remarriage: There is a common misconception that remarriage automatically disqualifies an individual from applying for benefits. However, unmarried surviving spouses who remarry on or after the age of 57 may still retain their eligibility.

- Restoration of entitlement: Many assume that this form can be used to restore home loan benefit entitlement. The correct procedure for that is to use VA Form 26-1880 instead.

- Importance of marriage recognition: Some applicants overlook that their marriage must be recognized by the jurisdiction where they lived at the time of marriage or where they filed their claim. This detail is crucial for certification of benefits.

- Misunderstanding of the application burden: A belief exists that completing this form requires extensive time and effort. Nonetheless, it is estimated that the average time to review instructions, gather information, and complete the form is about 15 minutes.

- Assuming prior applications hinder reapplication: There is a misconception that previously applying for benefits means they cannot apply again. Each application is assessed individually, and previous applications do not automatically disqualify an applicant.

- Age restrictions: Some individuals think that age limits prevent them from applying. While age is a factor for remarriage considerations, it does not limit the ability to apply overall.

- Inaccurate assumptions about VA acknowledgment: Many believe that simply submitting the form guarantees quick approval. Approval is contingent on meeting specific eligibility requirements, which the VA must assess thoroughly.

- Confusion surrounding dependent compensation: Individuals may think that receiving VA Dependency and Indemnity Compensation (DIC) automatically secures loan eligibility. In fact, these are separate benefits, and loan eligibility requires specific qualifications.

Key takeaways

Understanding the nuances of the VA Form 26-1817 is essential for unmarried surviving spouses seeking loan guaranty eligibility. Here are some key takeaways to keep in mind:

- Eligibility Requirements: This form is specifically for unmarried surviving spouses of veterans whose death was service-connected. It’s not applicable for spouses who have remarried, except those who remarried after age 57.

- Application Purpose: Use this form solely if you are applying for home loan benefits. If you have already used your benefit entitlement, consider VA Form 26-1880 instead.

- Provide Accurate Information: Double-check the information provided, including social security numbers and dates of birth, as inaccuracies can delay processing.

- Submission Process: After completing the form, send it to the correct regional loan center as indicated in the form’s instructions. This address varies depending on your state of residence.

- Privacy Notice: Review the Privacy Act information carefully. The VA is committed to ensuring that your personal information remains confidential.

- Signature Requirement: The form requires your signature to certify the accuracy of the information provided. Missing this signature may lead to rejection.

- Respondent Burden: Expect to spend approximately 15 minutes filling out this form. Use this time wisely to ensure completeness and correctness.

- Revision Notice: The form periodically undergoes updates. Always ensure you are using the correct version, as indicated by the expiration date.

- Help is Available: If you have questions while filling out the form, assistance is available through VA resources, including their customer service hotline.

Filling out the VA Form 26-1817 thoroughly and accurately can streamline the process of accessing much-deserved benefits. Familiarity with these key points will aid in navigating the requirements with confidence and clarity.

Browse Other Templates

Communication With Staff - Be mindful to express all relevant information in your submission.

Indian Bank Nomination Form - Marital status needs to be specified on the form.

Daf Form 594 - Failure to provide required information may lead to the suspension of housing allowance payments.