Fill Out Your 3 Star Discount State Farm Form

The 3 Star Discount form from State Farm provides significant benefits for drivers who maintain a clean record. Designed for private passenger cars, this form outlines the criteria for obtaining various discounts based on a driver's history of accidents and violations. Drivers can qualify for the prestigious 3-Star Discount, which requires that they remain free from at-fault accidents and minor violations for the past three years, as well as major violations for the past five years. This discount emphasizes the importance of responsible driving, rewarding those who have demonstrated good habits on the road. If the criteria are not met, drivers may still access the 2-Star Discount, although it comes with higher premiums in comparison. It’s vital to understand that surcharges can occur if any driver assigned to the vehicle has chargeable accidents or violations. The form also specifies the terms and conditions surrounding how these incidents are assessed, including how long surcharges may remain in effect. By rewarding safe driving, State Farm aims to foster a community where safety takes precedence, making roads safer for everyone. Knowing what is required for these discounts can help you make informed decisions about your auto insurance coverage.

3 Star Discount State Farm Example

ACCIDENT/VIOLATION DISCOUNTSANDSURCHARGES

StateFarmFireandCasualtyCompany

ApplicabletoVehiclesRated AsPrivatePassengerCars

EffectiveJuly15,2005NewBusiness EffectiveAugust15,2005Renewals

(continuedinside)

Likeagoodneighbor,StateFarmisthere.®

STATEFARMFIREAND

CASUALTYCOMPANY

HomeOffice:

7/05(C) |

|

|

Thefollowingdiscountsandsurchargesapply baseduponthedrivers’chargeableaccidentsand violations.

Anaccidentthatoccurredwithinthethreeyears priortothedateofapplicationwillbeconsidered

Amultiplevehicleaccidentwillnotbeconsidered

Foraccidentsthatoccurredpriortothedateof application,theaccidentwillnotbeconsidered

accidentwasconvictedofamovingtrafficviolation, or(7)theoperatorwasoperatingavehicleofatype noteligibleforratingunderthisPlan,or(8)the insurerrecovered80%ormoreoftheinsurer’sloss throughsubrogationwhenitwasacollisionloss, or(9)theaccidentresultedinapaymentunder PersonalInjuryProtectionorAdditionalPersonal InjuryProtectionCoverageandnopaymentis madeundertheLiabilityorCollisionCoverages, unlesstheaccidentisasinglevehicleaccidentin whichdamagetopropertyoccurs.

Majorviolationsinclude:(1)drivingamotor vehicleundertheinfluenceofintoxicantsordrugs,

(2)manslaughter(whetherornot“involuntary”), recklesshomicideorfeloniousassaultarisingout oftheuseofamotorvehicle,(3)recklessdriving whichresultsinaninjurytoaperson,(4)failureto stopandreportoridentifyoneselfwheninvolved inamotorvehicleaccident,(5)operatingamotor vehiclewithoutavalidoperator’slicenseorduring aperiodofrevocationorsuspensionofmotor vehicleregistrationoroperator’slicense,and(6) operatingamotorvehiclewithouttheowner’s authorityifsuchoperationresultsinafelony.

Minorviolationsincludetrafficlawoffenses forspeeding,stopsignandsignalinfractions, improperturns,failuretoyieldrightofway,and similaroffenses.Aminorviolationshallnotbe countedasaseparateincidentifitoccurredin connectionwithachargeableaccident.Ifany violationissubsequentlydismissed,itwillno longerbeconsideredachargeableviolation.

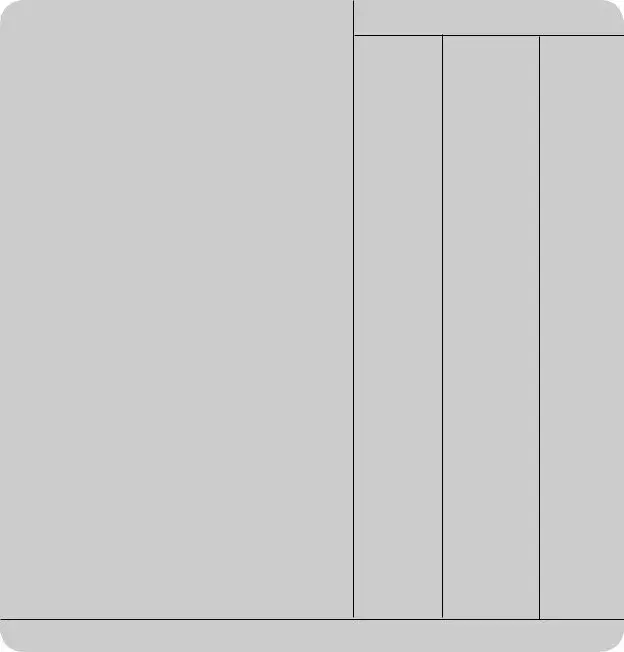

EachdriverisassignedaDriverRecordLevel(DRL)basedontheirchargeableaccidentsandviolationsduring thepastthreeyears.Iftherewerenochargeableaccidentsorviolations,theDriverRecordLevelisLevel1. Otherwise,theDRLisincreasedasshownbelowforeachchargeableaccidentandviolation:

Incident |

InitialYear |

SecondYear |

ThirdYear |

|

|

|

|

MinorViolation |

+2levels |

+1level |

+0levels |

|

|

|

|

ChargeableAccident |

+3levels |

+2levels |

+1level |

|

|

|

|

MajorViolation |

+5levels |

+4levels |

+3levels |

|

|

|

|

Iftheincidentoccurredpriortothedateofapplication,theDRLwillbeadjustedasiftheincidenthad occurredwithinoneyearpriortothedateofapplication,andwilldecreaseforeachyeartheincidentis surcharged.However,theDRLwillnotbeaffectedbyanincidentwhentheincidentoccurredatleastthree yearspriortotheeffectivedateofthecurrentrenewal.

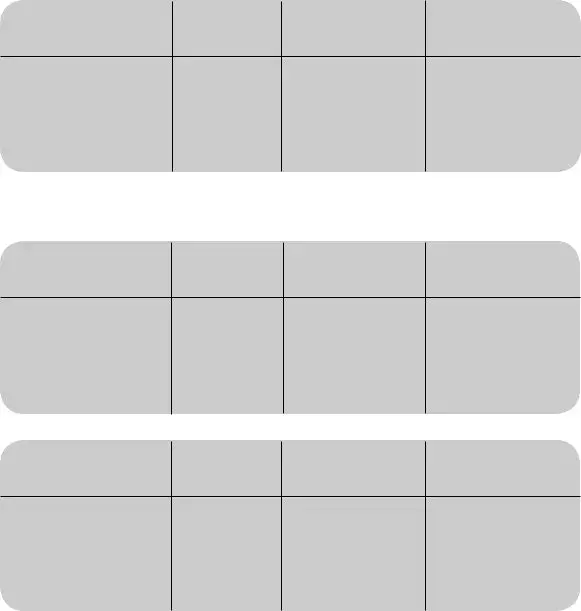

TheDriverRecordSurchargeforeachindividualdriverisbasedontheirDriverRecordLevel,asshowninthe followingtable:

|

DriverRecordLevel |

DriverRecordSurcharge |

|

|

|

|

1 |

0% |

|

|

|

|

2 |

0% |

|

|

|

|

3 |

0% |

|

|

|

|

4 |

15% |

|

|

|

|

5 |

50% |

|

|

|

|

6 |

60% |

|

|

|

|

7 |

70% |

|

|

|

|

8 |

90% |

|

|

|

|

9 |

110% |

|

|

|

|

10* |

140% |

|

|

|

*Plus50%foreachadditionallevelabove10

Theaccidentsurchargesapplytothevehiclethedriverisassignedtoratherthanthevehicleinvolvedinthe accident.

Surchargeswillberemovedifsatisfactoryevidenceisfurnishedthatthedriverinvolvedisnolongeramember ofthehouseholdorwillnotbedrivingthecarinthefuture.IfthatdriverisinsuredonanotherStateFarm policy,theaccidentorviolationwillbeconsideredintheratingofthatpolicy.

Thefollowingchartillustratesthesurchargesthatapplyifonedriverhadthelisteddrivingrecords.Whenmore thanonedriverisassignedtoavehicle,theDriverRecordSurchargeforeachdriverisaddedtogethertodetermine thetotalsurcharge.Forexample,ifonedriverofthevehiclehadanaccidentinthepastyearandanotherdriverof thevehiclehadaminorviolationthesurchargefortheinitialyearwouldbe15%(=15%+0%).

|

|

|

|

|

|

|

Surcharges |

DrivingRecord

|

|

InitialYear SecondYear |

ThirdYear |

|

|

|

|

|

|

1minorviolation |

0% |

0% |

0% |

|

|

|

|

|

|

1chargeableaccident |

15% |

0% |

0% |

|

|

|

|

|

|

1majorviolation |

60% |

50% |

15% |

|

|

|

|

|

|

2minorviolations |

|

|

|

|

Bothoccurredwithinpastyear |

50% |

0% |

0% |

|

Onewithinpastyear&otherone1yearago |

15% |

0% |

0% |

|

Onewithinpastyear&otherone2yearsago |

0% |

0% |

0% |

|

|

|

|

|

|

2chargeableaccidents |

|

|

|

|

Bothoccurredwithinpastyear |

70% |

50% |

0% |

|

Onewithinpastyear&otherone1yearago |

60% |

15% |

0% |

|

Onewithinpastyear&otherone2yearsago |

50% |

0% |

0% |

|

|

|

|

|

|

1chargeableaccident,1minorviolation |

|

|

|

|

Bothoccurredwithinpastyear |

60% |

15% |

0% |

|

Onewithinpastyear&otherone1yearago |

50% |

0% |

0% |

|

Onewithinpastyear&otherone2yearsago |

15% |

0% |

0% |

|

|

|

|

|

|

1chargeableaccident,1majorviolation |

|

|

|

|

Bothoccurredwithinpastyear |

110% |

70% |

50% |

|

Majorviolationwithinpastyear&accident1yearago |

90% |

60% |

15% |

|

Majorviolationwithinpastyear&accident2yearsago |

70% |

50% |

15% |

|

Accidentwithinpastyear&majorviolation1yearago |

90% |

60% |

0% |

|

Accidentwithinpastyear&majorviolation2yearsago |

70% |

0% |

0% |

|

|

|

|

|

|

1minorand1majorviolation |

|

|

|

|

Bothoccurredwithinpastyear |

90% |

60% |

15% |

|

Majorviolationwithinpastyear&minor1yearago |

70% |

50% |

15% |

|

Majorviolationwithinpastyear&minor2yearsago |

60% |

50% |

15% |

|

Minorviolationwithinpastyear&major1yearago |

70% |

50% |

0% |

|

Minorviolationwithinpastyear&major2yearsago |

60% |

0% |

0% |

|

Additionalsurchargesapplyforahighernumberofincidents.

Thefollowingtableshowssomeexamplesofhowtheaccidentsurchargeworks.Theseexamplesarenotbased onactualpremiumamountsandconsideronlytheeffectofaccidentsurcharges.Wehaveassumedthatthe

A. Onevehicleinsured.

PremiumincludingPremiumincluding

|

CoveragePremiumwithsurchargeforone |

surchargefortwo |

||

|

|

noaccidents |

chargeableaccident* |

chargeableaccidents* |

BodilyInjury,

|

PropertyDamage |

$80 |

$96 |

$110 |

$96 |

$163 |

||

|

UninsuredMotorist |

5 |

7 |

7 |

7 |

7 |

||

|

PersonalInjuryProtection |

40 |

48 |

55 |

48 |

82 |

||

|

|

|

|

|

|

|

|

|

Comprehensive |

25 |

30 |

30 |

30 |

30 |

|||

|

Collision |

50 |

60 |

69 |

60 |

102 |

||

|

TOTALPREMIUM |

$200 |

$241 |

$271 |

$241 |

$384 |

B. Twovehiclesinsured.Accidentschargeabletotheprincipaloperatorofvehiclenumberone,while operatingvehiclenumberone.

1.VEHICLENUMBERONE

PremiumincludingPremiumincluding

|

CoveragePremiumwithsurchargeforone |

surchargefortwo |

||

|

|

noaccidents |

chargeableaccident* |

chargeableaccidents* |

BodilyInjury,

|

PropertyDamage |

$80 |

$96 |

$110 |

$96 |

$163 |

|||

|

UninsuredMotorist |

5 |

7 |

7 |

7 |

7 |

|||

|

|

PersonalInjuryProtection |

40 |

48 |

55 |

48 |

82 |

||

|

Comprehensive |

25 |

30 |

30 |

30 |

30 |

|||

|

|

Collision |

50 |

60 |

69 |

60 |

102 |

||

|

TOTALPREMIUM |

$200 |

$241 |

$271 |

$241 |

$384 |

|||

2.VEHICLENUMBERTWO

|

|

|

|

|

|

|

PremiumincludingPremiumincluding |

|

|

Coverage |

Premiumwithsurchargeforonesurchargefortwo |

||||||

|

|

noaccidentschargeableaccident |

chargeableaccidents |

|||||

BodilyInjury,

|

PropertyDamage |

$120 |

$120 |

$120 |

|

UninsuredMotorist |

5 |

5 |

5 |

|

PersonalInjuryProtection |

60 |

60 |

60 |

|

Comprehensive |

40 |

40 |

40 |

|

Collision |

75 |

75 |

75 |

|

TOTALPREMIUM |

$300 |

$300 |

$300 |

* Thesurchargedecreaseseachyear.Forthetwoaccidentexample,thesurchargedependsonthetimingoftheaccidents.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Name | 3 Star Discount State Farm Form |

| Effective Date | The form became effective on July 15, 2005. |

| Applicable Vehicles | Applies to private passenger cars rated by State Farm. |

| 3-Star Discount Criteria | Available for drivers with no at-fault accidents in three years and no major violations in five years. |

| 2-Star Discount | Offered if the 3-Star Discount doesn’t apply, with 20% higher premiums than the 3-Star level. |

| Surcharges | Major and minor violations, as well as chargeable accidents, may lead to additional surcharges. |

| Driver Record Level | DRL is assigned based on chargeable incidents, impacting the overall surcharge. |

| Driver Record Adjustments | DRL may decrease after the incident's surcharge period, provided it was over three years ago. |

| Governing Law | This form is subject to regulations by the Indiana Department of Insurance. |

Guidelines on Utilizing 3 Star Discount State Farm

When filling out the 3-Star Discount form, it’s essential to ensure that all information is accurate and complete. This form helps to evaluate whether you qualify for certain discounts based on your driving history. Careful attention to detail will assist in a smooth review process.

- Begin by providing your personal information at the top of the form. Include your full name, address, and contact details.

- List all drivers in the household. Be sure to include their names, dates of birth, and license numbers.

- Check the box indicating whether you have had any at-fault accidents or major violations in the past three years. Use the guidelines provided on the form to determine your answers.

- Indicate if there’s at least one driver licensed for three years. This is a requirement for the 3-Star Discount.

- Confirm that none of the household vehicles have been driven without liability insurance in the past year. This information is crucial for eligibility.

- Review the details entered for accuracy. Ensure spelling is correct and dates are accurate.

- Sign and date the form to certify that the information provided is true to the best of your knowledge.

- Submit the completed form to your State Farm representative or appropriate department, as indicated in the form instructions.

What You Should Know About This Form

What is the 3-Star Discount?

The 3-Star Discount is available to drivers who have not experienced any at-fault accidents or minor violations in the past three years, nor major violations in the past five years. Additionally, at least one driver in the household must have held a valid driver's license for at least three years, and all vehicles must have been insured in compliance with relevant state laws. This discount remains applicable as long as the driving record continues to meet these criteria.

How does one qualify for the 3-Star Discount?

To qualify for the 3-Star Discount, no at-fault accidents or minor violations should have occurred over the last three years, and no major violations should have occurred in the last five years. It's crucial that one driver in the household has maintained a valid driver's license for at least three years. Additionally, the household vehicles must not have been driven without proper liability insurance, as per state requirements.

What happens if a driver has a violation after qualifying for the discount?

If a driver who is eligible for the 3-Star Discount subsequently incurs a violation or at-fault accident, the discount will change. The household will then qualify for a smaller 2-Star Discount. Depending on the severity and nature of the incidents, additional surcharges may also be applied to the insurance premiums.

What is the difference between the 2-Star Discount and the 3-Star Discount?

The 2-Star Discount applies when drivers do not qualify for the 3-Star Discount, typically due to a recent at-fault accident or minor violation. The 2-Star Discount is associated with higher premiums—20% more for liability and comprehensive coverages when compared to the 3-Star Discount. Moreover, the 2-Star Discount indicates a less favorable driving history.

What are the surcharges related to driver records?

Driver record surcharges are additional costs added to premiums based on a driver's history of accidents and violations. Major violations and chargeable accidents may lead to significant increases in premiums. These surcharges can remain in effect for up to three years, depending on when the incidents occurred and their nature. The specific surcharge percentage varies with the severity and frequency of violations or accidents.

How long does the 3-Star Discount last?

The 3-Star Discount lasts as long as the qualifying drivers maintain a clean driving record, with no at-fault accidents or minor violations over the last three years and no major violations in the last five years. Should any qualifying conditions change, the discount may be reevaluated, potentially dropping to the 2-Star Discount level.

Can surcharges be removed after they have been applied?

Yes, surcharges can be removed if it is shown that the driver responsible for the incidents is no longer a member of the household or will not be operating the car going forward. In cases where the driver is insured under another State Farm policy, the incidents will be considered in that policy's rating, but they won't affect the current policy's rates.

Common mistakes

Filling out the 3-Star Discount State Farm form may seem straightforward at first glance, but many individuals fall into common pitfalls that can jeopardize their eligibility for discounts. One significant mistake is failing to accurately report the driving history of all household members. It's essential to include all drivers, even if they don’t regularly operate the insured vehicle. Omitting a driver who has a less-than-perfect record could result in unexpected charges or a loss of discounts.

Another frequent error involves misunderstanding the time frames associated with accidents and violations. Individuals often overlook the requirement that no at-fault accidents or minor violations can have occurred in the past three years to qualify for the 3-Star Discount. A simple miscalculation of dates or a failure to remember a minor infraction can change a person's discount level significantly.

Many applicants also mistakenly assume that their driving record won't change after submitting the form. A lack of ongoing awareness regarding one’s own driving history can lead to surprises at renewal time. Regularly reviewing your driving record helps ensure that everyone on the policy is aware of any recent incidents, whether that’s a speeding ticket or a minor fender bender.

In addition, failing to disclose previous insurance lapses can be detrimental. The form specifically mentions that household vehicles should not have been driven without liability insurance. Neglecting to check this detail can lead to an automatic disqualification from the 3-Star Discount, even if the rest of the driving record is exemplary.

Sometimes applicants misinterpret the section about major and minor violations. They might think minor violations won’t impact their eligibility as long as they haven’t had any serious offenses. However, just one minor infraction can have ramifications on the discount level, especially if it occurred recently. Understanding the definitions and implications of different violation types is crucial.

Finally, many people forget to update their information if there are changes in household drivers or vehicle usage. Life circumstances change, and if more drivers or vehicles enter the picture, this must be reflected in the form to maintain accurate coverage and discount eligibility. Keeping information up to date ensures that discounts are applied correctly and helps prevent potential coverage disputes in the future.

Documents used along the form

When dealing with the 3-Star Discount State Farm form, several other documents are commonly needed. These documents help provide a complete picture of the driver’s insurance eligibility and driving history. Below is a summary of relevant forms that may accompany the 3-Star Discount application.

- Driver License History Report: This report shows the driving history of the applicant, including any violations or accidents. It helps ensure that the assessment for discounts and surcharges is accurate based on the driver's overall record.

- Proof of Insurance: Evidence that vehicles have been continuously insured is crucial. This document helps confirm that the household has complied with mandatory insurance requirements, qualifying for the discounts.

- Declaration Page: The declaration page from the current insurance policy outlines coverage details and limits. It serves as a reference to verify existing coverages and discounts applicable before applying for the new policy.

- Accident Reports: If there have been accidents in the prior years, these reports provide detailed accounts of each incident. They assist in determining whether they are chargeable and how they impact discount eligibility.

- Violation Citation Copies: Any tickets or citations received by the driver must be included. These documents allow State Farm to assess any minor or major violations that could affect the discount levels.

- Letter of Satisfactory Resolution: If any past violations have been dismissed or resolved satisfactorily, a letter confirming this status can be submitted. It helps clarify the driver’s current standing and may influence discount eligibility.

These documents collectively enhance the accuracy of the assessment process concerning the 3-Star Discount and other applicable ratings. Being organized and thorough can lead to a smooth application experience, ensuring that eligible discounts are properly applied.

Similar forms

Driver History Report - Similar to the 3 Star Discount form, a Driver History Report outlines an individual's driving record, including any accidents or violations. It provides companies with information used to determine premiums and discounts based on driving behavior.

Insurance Policy Underwriting Questionnaire - This form gathers information about the potential insured's risk factors, including driving history and previous claims. The gathered data helps insurers assess the risk and determine eligibility for discounts like the 3 Star Discount.

Accident Claim Form - This document is filed when a policyholder wants to report an accident. It details the circumstances and parties involved. Like the 3 Star Discount form, it influences an individual's insurance standing, particularly regarding potential surcharges.

Annual Mileage Declaration - Similar to the 3 Star Discount form’s requirements for driving behavior, this document requests information about the annual mileage driven. Lower mileage can contribute to safer driving assessments and may enhance discount qualifications.

Proof of Insurance Certificate - Required to ensure compliance with financial responsibility laws, this document must confirm that the vehicle has been insured. The 3 Star Discount form indicates that policies must conform to similar requirements regarding coverage.

Driver’s License Renewal Application - When renewing a driver’s license, individuals may need to disclose their accident history. Like the 3 Star Discount, it tracks whether drivers maintain a safe driving record over a specified period.

Unsafe Driving Record Reports - These reports detail a driver’s infractions and accidents. Correspondingly, the 3 Star Discount evaluates driving records to classify eligible drivers into discount tiers based on their level of safety.

Vehicle Safety Inspection Report - This document assesses a vehicle's operational safety. While focused on vehicle conditions, it complements the 3 Star Discount by promoting safe driving practices that contribute to lowered accident rates.

Dos and Don'ts

When filling out the 3 Star Discount State Farm form, there are some important dos and don'ts to keep in mind.

- Do review your driving history carefully. It’s essential to accurately report any chargeable accidents or violations.

- Do ensure that all assigned drivers to the vehicle meet the necessary qualifications for the 3-Star Discount, particularly regarding their accident and violation records.

- Do read the instructions thoroughly to understand the requirements for the 3-Star Discount, including the duration during which drivers must be incident-free.

- Do provide truthful information. Misleading or inaccurate data can lead to penalties or denial of discounts.

- Don't omit any minor violations from your record. Even small infractions can affect eligibility for the discount.

- Don't wait until the last minute to submit your form. Allow ample time to gather documents and complete the application fully.

- Don't forget to inform State Farm if any driver listed no longer resides in your household. This information is necessary to reassess coverage correctly.

- Don't assume that past incidents won’t matter. Even older accidents could impact your current rating if they are chargeable.

Misconceptions

- Misconception 1: The 3-Star Discount guarantees lower premiums forever.

- Misconception 2: All minor violations affect the 3-Star Discount status.

- Misconception 3: Once a driver reaches the 3-Star Discount, they can ignore their driving record.

- Misconception 4: Major violations are always chargeable.

- Misconception 5: The form only considers accidents that result in significant damage.

- Misconception 6: Drivers with accidents in different vehicles are unaffected.

- Misconception 7: Surcharges remain indefinitely after an accident.

Many people believe that obtaining the 3-Star Discount means they will always enjoy lower premiums. However, this discount can change. If a driver incurs any violations or chargeable accidents, the discount can drop to a 2-Star Discount, which comes with higher premiums.

It is a common belief that any minor violation immediately harms one's 3-Star Discount status. This is not entirely accurate. Minor violations will not impact the discount if they occurred in connection with a chargeable accident, which means the context matters significantly.

Some individuals think that achieving the 3-Star Discount allows them to neglect their driving behavior. In reality, maintaining the discount requires continuous good driving. Any infractions will affect the status of the discount.

There is confusion surrounding major violations. Not all major violations will necessarily be deemed chargeable, especially if they occurred under specific conditions. Understanding these nuances is key to accurately assessing one's driving record.

Some people believe that only accidents causing substantial property damage will count against their record. However, even minor accidents that involve injuries or any damage exceeding a threshold can be considered chargeable, impacting insurance premiums.

It is often assumed that incidents occurring in different vehicles will not influence insurance rates. On the contrary, accidents affect the driver rather than the specific vehicle involved. All chargeable incidents contribute to the driver's overall record, regardless of the vehicle.

There is a belief that surcharges stay on a driver’s record for life. In fact, surcharges can decrease over time, and if satisfactory evidence is provided showing a driver is no longer part of the household, the surcharges may be removed altogether.

Key takeaways

When filling out and using the 3 Star Discount State Farm form, keep in mind the following key takeaways:

- The 3-Star Discount is available if assigned drivers have had no at-fault accidents or minor violations in the past three years, and no major violations in the last five years.

- At least one driver must be licensed for three years for the 3-Star Discount to apply.

- Household vehicles must not have been driven without liability insurance to qualify for the 3-Star Discount.

- If an active driver incurs a violation or chargeable accident, the 3-Star Discount will downgrade to the 2-Star Discount, which has higher premiums.

- The premiums for the 2-Star Discount are 20% higher than those for the 3-Star Discount across several coverage types.

- Driver record surcharges may apply for major violations, minor violations, and chargeable accidents, impacting basic coverage premiums.

- Chargeable accidents are defined as those resulting in payments by State Farm under Property Damage Liability or Collision Coverage of $750 or more.

- Each driver's history contributes to their Driver Record Level (DRL), impacting surcharge percentages.

- Evidence that a driver is no longer in the household can remove surcharges, provided appropriate documentation is submitted.

- Multiple drivers assigned to a vehicle will have their surcharges combined, affecting the total insurance premium due.

Browse Other Templates

Policy Loans Life Insurance - Delays in submitting the required signatures may halt your loan request process.

Illinois Employment Income Confirmation,Illinois Financial Eligibility Verification,Illinois Worker Income Statement,Illinois Client Income Declaration,Illinois Job Income Certification,Illinois Wage Verification Form,Illinois Income Information Rele - Regular updates to this form may be needed if employment changes.

Chabot College Transcript - All transcripts are sent via first-class mail.