Fill Out Your 3229 Form

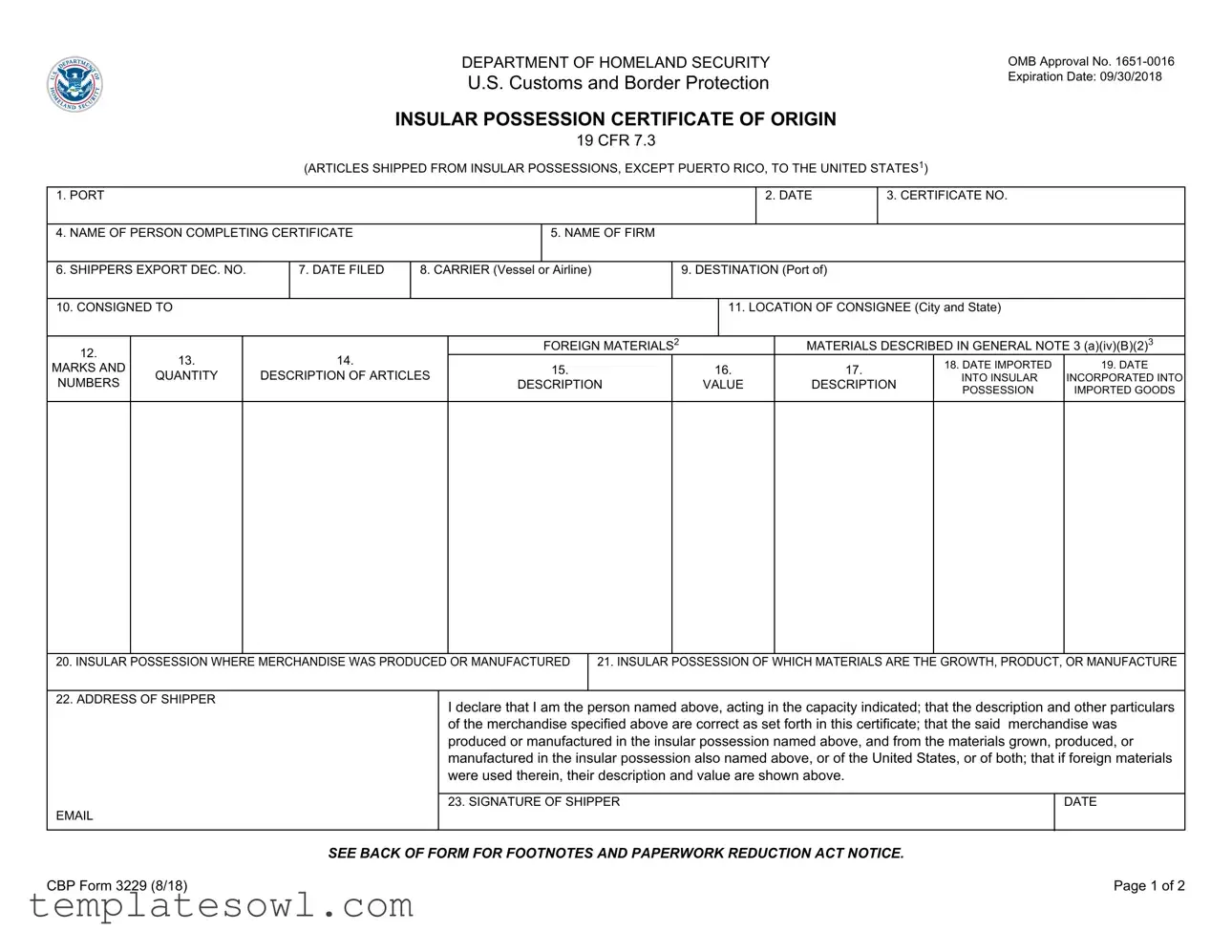

The 3229 Form, officially known as the Insular Possession Certificate of Origin, plays a crucial role in the importation process for goods shipped from U.S. insular possessions, excluding Puerto Rico, to the mainland United States. This form serves to verify that the merchandise being imported was either produced or manufactured in a specified insular possession or from materials that were sourced from the same location, thus ensuring compliance with U.S. customs regulations. Key details required on the form include information about the port of entry, the date of certification, and the identity of the person completing the certificate. Shipping specifics further highlight the path the goods will take, listing the carrier as well as the final destination and consignee information. Additionally, the form mandates a clear declaration of any foreign materials incorporated into the products, ensuring that importers accurately represent the origin of their goods. Understanding how to fill out the 3229 Form is essential for businesses aiming to navigate customs effectively and benefit from potential duty exemptions available for certain products from insular possessions. This document not only enhances transparency in international trade but also aids in maintaining the integrity of trade regulations.

3229 Example

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

INSULAR POSSESSION CERTIFICATE OF ORIGIN

19 CFR 7.3

OMB Approval No.

Expiration Date: 09/30/2018

|

|

|

|

(ARTICLES SHIPPED FROM INSULAR POSSESSIONS, EXCEPT PUERTO RICO, TO THE UNITED STATES1) |

|

|

|

||||||||||||

1. PORT |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. DATE |

3. CERTIFICATE NO. |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4. NAME OF PERSON COMPLETING CERTIFICATE |

|

|

|

5. NAME OF FIRM |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. SHIPPERS EXPORT DEC. NO. |

|

7. DATE FILED |

8. CARRIER (Vessel or Airline) |

|

|

9. DESTINATION (Port of) |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. CONSIGNED TO |

|

|

|

|

|

|

|

|

|

|

11. LOCATION OF CONSIGNEE (City and State) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

13. |

|

14. |

|

|

|

FOREIGN MATERIALS2 |

|

|

|

MATERIALS DESCRIBED IN GENERAL NOTE 3 (a)(iv)(B)(2)3 |

||||||||

MARKS AND |

|

|

|

15. |

|

|

|

16. |

|

17. |

|

18. DATE IMPORTED |

19. DATE |

||||||

QUANTITY |

|

DESCRIPTION OF ARTICLES |

|

|

|

|

|

||||||||||||

NUMBERS |

|

DESCRIPTION |

|

VALUE |

|

DESCRIPTION |

INTO INSULAR |

INCORPORATED INTO |

|||||||||||

|

|

|

|

|

|

|

|

POSSESSION |

IMPORTED GOODS |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

20. INSULAR POSSESSION WHERE MERCHANDISE WAS PRODUCED OR MANUFACTURED |

|

21. INSULAR POSSESSION OF WHICH MATERIALS ARE THE GROWTH, PRODUCT, OR MANUFACTURE |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. ADDRESS OF SHIPPER |

|

|

|

|

I declare that I am the person named above, acting in the capacity indicated; that the description and other particulars |

||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

of the merchandise specified above are correct as set forth in this certificate; that the said merchandise was |

||||||||||||

|

|

|

|

|

|

|

produced or manufactured in the insular possession named above, and from the materials grown, produced, or |

||||||||||||

|

|

|

|

|

|

|

manufactured in the insular possession also named above, or of the United States, or of both; that if foreign materials |

||||||||||||

|

|

|

|

|

|

|

were used therein, their description and value are shown above. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

23. SIGNATURE OF SHIPPER |

|

|

|

|

|

|

|

DATE |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

SEE BACK OF FORM FOR FOOTNOTES AND PAPERWORK REDUCTION ACT NOTICE. |

|

|

|

||||||||||||

CBP Form 3229 (8/18) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

||

Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is

FOOTNOTES

1 General Note 3(a)(iv), Harmonized Tariff Schedule of the United States (HTSUS). |

cost of transporting those materials to the insular possession, but excluding any |

||

2 Each "foreign material" (i.e., a material which originated in sources other than an insular |

duties or taxes assessed by the insular possession and any charges which may |

||

accrue after landing; |

|||

possession or the United States) shall be listed on a separate line under columns 15 and |

|||

If the materials used in an article originated only in an insular possession or the |

|||

16. |

Columns 15 and 16 do not apply to materials which are not considered "foreign" |

||

under General Note 3(a)(iv)(B)(1), (2), HTSUS. |

United States, state "none" in column 15 and leave column 16 blank. |

||

"VALUE" as used in this certificate, refers to the sum of (a) the actual purchase price of |

3 Columns 17, 18, and 19 shall be completed if the article incorporates any material |

||

each foreign material used, or where a material is provided to the manufacturer without |

described in General Note 3(a)(iv)(B)(2), HTSUS, which is not considered "foreign |

||

charge, or at less than fair market value, the total of all expenses incurred in the growth, |

material" under General Note 3(a)(iv). Each such material shall be listed on a |

||

production, or manufacture of the material, including general expenses, plus an amount |

separate line. If no such materials are used, state "none" in column 17 and leave |

||

for profit; and (b) the |

columns 18 and 19 blank. |

||

|

|

|

|

|

EXCERPT FROM GENERAL NOTES, HARMONIZED TARIFF |

and all goods previously imported into the customs territory of the United States with |

|

|

SCHEDULE OF THE UNITED STATES |

payment of all applicable duties and taxes imposed upon or by reason of importation |

|

|

General Note 3(a)(iv) |

which were shipped from the United States, without remission, refund, or drawback of |

|

|

such duties or taxes, directly to the possession from which they are being returned |

||

(iv) |

Products of Insular Possessions |

by direct shipment, are exempt from duty. |

|

|

|||

|

(A) Except as provided in additional U.S. note 5 of chapter 91and except as |

(B) in determining whether goods produced or manufactured in any such insular |

|

|

possession contain foreign materials to the value of more than 70 percent, no |

||

|

provided in additional U.S. note 2 of chapter 96, and except as provided in |

||

|

material shall be considered foreign which either - |

||

|

section 423 of the Tax Reform Act of 1986, goods imported from insular |

||

|

|

||

|

possessions of the United States which are outside the customs territory of the |

(1) at the time such goods are entered, or |

|

|

United States are subject to the rates of duty set forth in column 1 of the tariff |

|

|

|

schedule, except that all such goods the growth or product of any such |

(2) at the time such material is imported into the insular possession. |

|

|

possession, or manufactured or produced in any such possession from |

may be imported into the customs territory from a foreign country, and entered |

|

|

materials the growth, product or manufacture of any such possession or of the |

||

|

customs territory of the United States, or of both, which do not contain foreign |

free of duty; except that no goods containing material to which (2) of this |

|

|

materials to the value of more than 70 percent of their total value (or more |

subparagraph applies shall be exempt from duty under subparagraph (A) unless |

|

|

than 50 percent of their total value with respect to goods described in section |

adequate documentation is supplied to show that the material has been |

|

|

213(b) of the Caribbean Basin Economic Recovery Act), coming to the |

incorporated into such goods during the |

|

|

customs territory of the United States directly from any such possession, |

such material is imported into the insular possession. |

|

|

|

|

|

CBP Form 3229 (8/18) |

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form certifies that articles shipped from insular possessions (excluding Puerto Rico) to the United States meet origin requirements. |

| Governing Law | The form operates under 19 CFR 7.3 and is influenced by General Note 3 of the Harmonized Tariff Schedule of the United States (HTSUS). |

| OMB Control Number | The OMB approval number for this form is 1651-0016, indicating compliance with federal regulations. |

| Expiration Date | The current expiration date for the form was September 30, 2018. It may need to be updated or checked for validity. |

| Estimated Completion Time | On average, completing this form takes approximately 22 minutes. This includes gathering necessary information. |

| Key Information Required | Important details include the shipper's certification, description of the merchandise, and the production information of the items involved. |

| Signature Requirement | The form requires the signature of the shipper, confirming that all provided information is accurate and compliant with regulations. |

Guidelines on Utilizing 3229

Completing Form 3229 is essential for ensuring proper documentation when shipping articles from insular possessions to the United States. Following the steps outlined will facilitate a clear and accurate submission.

- Begin by entering the Port where the shipment will be processed in the first field.

- Fill in the Date on which you are completing the form.

- Provide the Certificate No. assigned to this specific shipment.

- Include the Name of Person Completing Certificate.

- Write the Name of Firm involved in this transaction.

- Input the Shipper's Export Dec. No. to identify the export documentation.

- Specify the Date Filed for this certificate.

- Indicate the Carrier, either the vessel name or airline used for transportation.

- List the Destination by entering the port name where the articles will arrive.

- Provide the details for Consigned To, indicating the receiving party.

- State the Location of Consignee by mentioning the city and state.

- In columns 15 and 16, detail any Foreign Materials used in the shipment.

- Describe the items in the field for Materials Described in General Note 3(a)(iv)(B)(2).

- Fill out columns 17-19 for the Description, Value, and Quantity of the articles imported.

- Provide details about the Insular Possession Where Merchandise Was Produced or Manufactured.

- Mention the Insular Possession of Which Materials Are The Growth, Product, or Manufacture.

- Enter the Address of Shipper to ensure proper identification.

- Confirm your declaration by signing and dating the Signature of Shipper section.

- Ensure that the Email is also provided for any necessary communication.

What You Should Know About This Form

What is the purpose of Form 3229?

Form 3229, also known as the Insular Possession Certificate of Origin, is used to certify the origin of goods that are shipped from insular possessions, such as Guam or the U.S. Virgin Islands, to the United States (excluding Puerto Rico). This form is essential in demonstrating that the products were manufactured or produced in these territories and may qualify for special trade treatment under U.S. customs regulations.

Who needs to complete the 3229 form?

The form should be completed by the shipper or exporter of the goods. This individual is responsible for providing details regarding the articles being shipped, including their origin, description, and the foreign materials used in their production. Accurate completion is crucial to ensure compliance with customs regulations and to avoid any delays in processing shipments.

What information is required on Form 3229?

Form 3229 requires several pieces of information. It includes the shipping details like the port, date, certificate number, shipper's name and firm, export declaration number, and carrier information. Additionally, it requires a detailed description of the articles shipped, their value, and specifics about any foreign materials used in their production. The form also necessitates a declaration by the shipper confirming the accuracy of the provided information.

What are the consequences of providing inaccurate information on the form?

Providing inaccurate information on Form 3229 can lead to serious consequences, including potential fines and penalties imposed by U.S. Customs and Border Protection. Misrepresentation of the origin of goods can also result in the denial of entry into the United States or the imposition of additional duties or taxes on the shipment. It is crucial to ensure that all information is accurate and truthful to comply with customs regulations.

How long does it take to complete Form 3229?

On average, it takes about 22 minutes to complete Form 3229. This estimated time may vary depending on the complexity of the shipment and the availability of required information. It is advisable to gather all necessary documentation beforehand to streamline the process and avoid any delays in submission.

Does Form 3229 have an expiration date?

Yes, Form 3229 does have an expiration date. As indicated on the form, the current version is valid until September 30, 2018. However, it is essential to use the most up-to-date form version that is being used by U.S. Customs and Border Protection to ensure compliance with the latest regulations.

Common mistakes

When filling out the 3229 form, many individuals make critical errors that can delay processing and create complications. One common mistake is skipping required fields. Each section of the form is pertinent to verifying the origin of goods. If a person does not fill in all relevant areas, such as the description of articles or the name of the firm, it may lead to unnecessary questions from the customs officials.

Another frequent issue is incorrect data entry. Mistakes in essential details, such as the date filed or the address of the shipper, can result in significant delays. Customs may require clarification, causing shipments to be held. It is vital to double-check that all information aligns accurately with company records.

Inaccurate descriptions of the materials used is yet another error that can occur. It's imperative to carefully assess where the materials originated. Misclassifying these materials, especially when indicating foreign materials, can have lasting effects on compliance and may incur penalties. Ensuring that the correct foreign materials are listed in columns 15 and 16 is essential.

People sometimes overlook the importance of the declaration section. By neglecting to sign and date the form, submissions can be rejected outright. The purpose of this declaration is to affirm the accuracy of the provided information. It’s a necessary step that solidifies accountability.

Finally, many individuals misinterpret the instructions regarding value calculations. The form requires a clear understanding of how to compute the value of foreign materials. If calculations are inaccurate or not properly documented, it may lead to assumptions by customs officials about the nature of the goods. Clarity and transparency in this section are vital to ensuring a smooth process.

Documents used along the form

The 3229 form, officially known as the Insular Possession Certificate of Origin, is an important document used during the importation process for goods shipped from insular possessions to the United States. Alongside this form, several other documents may be required to ensure compliance with customs regulations. Below is a list of frequently used documents in conjunction with the 3229 form.

- Bill of Lading: This is a document issued by a carrier detailing the type, quantity, and destination of the goods being shipped. It serves as a receipt for the cargo and a contract for transportation.

- Commercial Invoice: This document outlines the transaction between the buyer and seller, including the price of the goods, terms of sale, and any applicable discounts. It is essential for determining the value of the imported goods.

- Customs Declaration Form: This form is submitted to U.S. Customs and Border Protection, detailing the nature of the goods and their intended use. It serves to declare the items being imported and to assess relevant duties and taxes.

- Importer Security Filing (ISF): Also known as the 10+2 filing, this document provides detailed information about the shipment before arrival in the U.S. It typically includes data about the importer, supplier, and cargo, among other things.

- Food and Drug Administration (FDA) Filings: For certain food, drug, and cosmetic products, these filings ensure compliance with U.S. health and safety regulations. The documentation may involve premarket notifications and product listings.

- Certificate of Origin: This document certifies that the goods are manufactured in a specific country or region. It can affect duty rates and trade agreements, thus is crucial for determining eligibility for certain trade benefits.

- Import License: While not always required, some specific products may necessitate an import license. This document permits the import of certain goods into the U.S. and ensures that all regulations are followed.

- Duty Drawback Claims: If applicable, these claims allow importers to recover some of the duties paid on imported goods that are subsequently exported. Proper documentation supports these claims and helps ensure compliance with customs regulations.

- Proof of Payment: Documentation showing that payment has been made for goods, usually in the form of bank statements or receipts, may also be required to demonstrate that the transaction occurred legally.

Accurate completion and submission of these documents alongside the 3229 form can help facilitate a smooth import process. Understanding each document's role emphasizes the importance of compliance with customs regulations to avoid delays or additional scrutiny. Familiarity with these forms ultimately assists importers in navigating the complexities of international trade.

Similar forms

Form 7501 - Entry Summary: Similar to the 3229 form, this document is used for reporting the importation of goods into the United States. The 7501 requires details about the shipment, including the description and value of the goods, which mirrors the certificate of origin's aim to verify the origin and specifics of imported articles.

Form 3300 - Customs Bond: This document ensures compliance with U.S. Customs regulations. Like the 3229, it plays a crucial role in the importation process, requiring information about the shipper and the goods being imported, thereby establishing a formal link between the customs process and the items involved.

Form 3461 - Entry/Immediate Delivery: Used for expedited clearance of certain merchandise, the 3461 provides preliminary import information. It shares similarities with the 3229 by requiring specific details about the shipment's origin, thus facilitating smoother customs processing.

Form 7512 - In-Bond Application: This form is employed when transferring cargo from one port to another without paying duties. Like the 3229, it necessitates detailed information about the cargo and its origin, ensuring that proper oversight occurs while the goods are in transit.

Form 7042 - Special Foreign Trade Zone (FTZ) Declaration: This document supports the import process by identifying goods entering special trade areas. The 7042, like the 3229, requires detailed descriptions and valuation of products, emphasizing the importance of documentation to link the origin and legality of the goods.

Dos and Don'ts

When completing the 3229 form, it is vital to ensure that the information provided is accurate and complete. Mistakes can lead to delays or complications in processing your certificate. Below is a list of important do's and don'ts to consider.

- Do ensure that all required fields are filled out completely.

- Do double-check for accuracy in all numbers and names provided.

- Do sign and date the form where indicated.

- Do use clear, legible handwriting or type the information if possible.

- Don't leave any mandatory fields blank.

- Don't use abbreviations that might confuse the reader.

- Don't submit the form after the expiration date listed without checking for updates.

Misconceptions

When it comes to the 3229 Form, there are several misconceptions that may confuse individuals regarding its use and requirements. Let’s clarify these misunderstandings to ensure proper compliance and understanding.

- Misconception 1: The 3229 Form is only necessary for goods shipped from Puerto Rico.

- Misconception 2: You do not need to declare foreign materials used in the goods.

- Misconception 3: The 3229 Form is a simple form that can be filled out in minutes.

- Misconception 4: All articles shipped from insular possessions are exempt from duties.

This is incorrect. The 3229 Form is specifically for articles being shipped from insular possessions, excluding Puerto Rico, to the United States. Other insular areas, such as Guam or the U.S. Virgin Islands, also require this form.

In reality, if foreign materials were incorporated into the goods, you must declare them. Columns 15 and 16 on the form require details about foreign materials. Failing to provide this information can lead to compliance issues.

While it may seem straightforward, gathering the necessary information and ensuring accuracy can take time. It is estimated that completing this form can take around 22 minutes. Rushing through the process may lead to mistakes that complicate shipping.

This belief is not entirely accurate. While many products from insular possessions can be exempt from duties, this exemption applies only if they meet specific criteria. If goods contain a significant amount of foreign materials, they may be subject to duties. Therefore, it is crucial to understand the regulations and document appropriately.

Understanding these misconceptions helps ensure that you handle the 3229 Form correctly. Proper documentation is essential in international shipping, and clarity in your information can save you from potential complications down the line.

Key takeaways

Filling out the CBP Form 3229, known as the Insular Possession Certificate of Origin, is an important process for businesses shipping goods from insular possessions, excluding Puerto Rico, to the United States. Here are some key takeaways to keep in mind:

- Accurate Completion is Essential: Ensure that all fields are filled out thoroughly and accurately. This includes details such as the port, date, and description of articles. Inaccurate information can delay processing or lead to complications.

- Include All Required Information: Make sure to provide crucial identifiers, such as the certificate number and export declaration number. Omitting any information may result in delays.

- Specify Foreign Materials: If any foreign materials were used in the production of the articles, list them clearly under the designated columns. Foreign materials must be accounted for, even if their contribution is minimal.

- Timely Submission: Be mindful of deadlines. The form should be filed in a timely manner to avoid potential penalties or disruptions in your shipping process.

- Retention of Records: Keep a copy of the submitted form and any attached documents. This is a good practice in case of future inquiries or audits by customs.

Understanding and following these key points will help streamline the process and avoid potential issues when shipping goods from insular possessions to the U.S.

Browse Other Templates

Crsc - Contact the VA for assistance if you have questions about this form.

How to Get Scholarship for International Students in Usa - Applications are available through chapter presidents or may be requested directly from the International Office.

Where Does Bail Money Go - Questions about prior criminal convictions help assess the integrity of the applicant for bail bonding.