Fill Out Your 3557 Llc Form

The 3557 LLC form is a critical document for any Limited Liability Company (LLC) in California seeking to revive its status after suspension or forfeiture. It serves as an application for a Certificate of Revivor and is addressed to the California Franchise Tax Board. This form requires specific information including entity identification numbers, the entity's name, and its address. A complete request demands full compliance, meaning that any necessary payments, returns, or accompanying documentation must either be enclosed or previously submitted. Signatures on this application can be made by various stakeholders associated with the entity—this includes stockholders, members, creditors, general partners, and officers—thereby ensuring that those directly impacted by the suspension can advocate for its revival. Additional provisions exist for domestic entities, allowing a majority of surviving trustees or directors to sign on behalf of the entity. Timely submission of the 3557 LLC form is essential to restore operational status and mitigate potential legal complications arising from a lapsed entity registration.

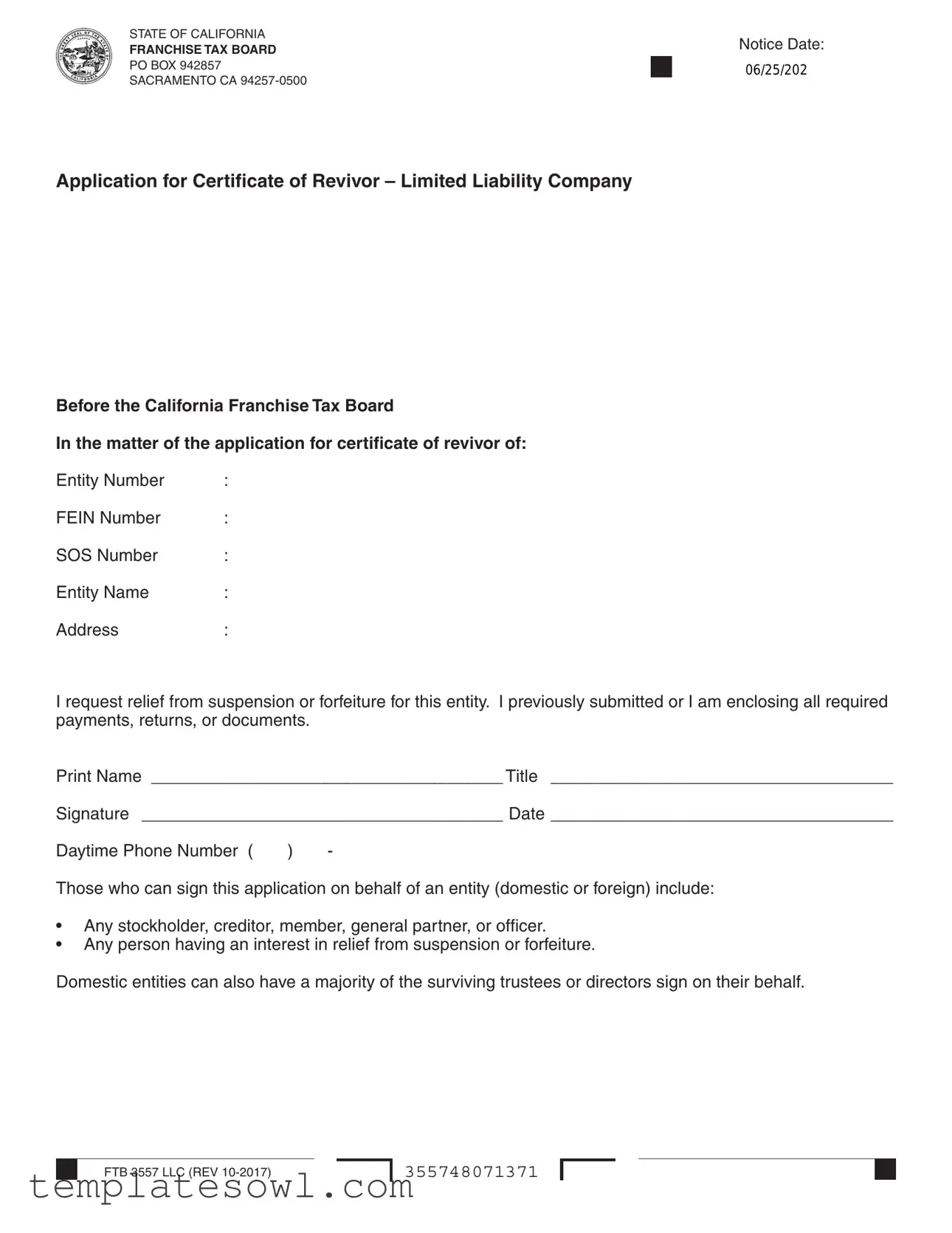

3557 Llc Example

STATE OF CALIFORNIA |

|

Notice Date: |

FRANCHISE TAX BOARD |

|

|

|

|

|

PO BOX 942857 |

|

06/25/202 |

SACRAMENTO CA |

|

|

|

|

Application for Certificate of Revivor – Limited Liability Company

Before the California Franchise Tax Board

In the matter of the application for certificate of revivor of:

Entity Number |

: |

FEIN Number |

: |

SOS Number |

: |

Entity Name |

: |

Address |

: |

I request relief from suspension or forfeiture for this entity. I previously submitted or I am enclosing all required payments, returns, or documents.

Print Name _____________________________________ Title ____________________________________

Signature ______________________________________ Date ____________________________________

Daytime Phone Number ( |

) |

- |

Those who can sign this application on behalf of an entity (domestic or foreign) include:

•Any stockholder, creditor, member, general partner, or officer.

•Any person having an interest in relief from suspension or forfeiture.

Domestic entities can also have a majority of the surviving trustees or directors sign on their behalf.

FTB 3557 LLC (REV

355748071371

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 3557 LLC form is used to apply for a certificate of revivor for limited liability companies in California. |

| Governing Authority | This form is governed by the laws of California under the California Revenue and Taxation Code. |

| Eligibility | Any stockholder, member, officer, or creditor can sign the form if they have an interest in the entity. |

| Required Submissions | Applicants need to ensure all necessary payments, returns, or documents are submitted alongside the application. |

| Contact Information | The form requires the applicant to provide their name, title, signature, date, and daytime phone number. |

Guidelines on Utilizing 3557 Llc

Once you have obtained the 3557 LLC form, carefully fill it out to request the revivor of your limited liability company. This process involves providing information about your entity and confirming that you have addressed any outstanding obligations.

- Obtain the 3557 LLC form from the California Franchise Tax Board website or a local office.

- Enter the Notice Date that appears on the top of the form.

- Provide the Entity Number, which is assigned to your LLC.

- Fill in your FEIN Number (Federal Employer Identification Number).

- Write down the SOS Number (Secretary of State Number) for your entity.

- Clearly state the Entity Name on the next line.

- Complete the Address section with the registered address of the entity.

- Tick the option requesting relief from suspension or forfeiture.

- Indicate that you have submitted or enclosed all required payments, returns, or documents.

- Print your name in the space provided for Print Name.

- In the title section, specify your relationship to the entity (e.g., member, officer).

- Sign the form in the designated area for Signature.

- Date the application in the Date field.

- Provide your Daytime Phone Number for any follow-up communication.

What You Should Know About This Form

What is the purpose of the 3557 LLC form?

The 3557 LLC form is used to apply for a Certificate of Revivor for a Limited Liability Company (LLC) in California. This application allows a company that has been suspended or forfeited by the California Franchise Tax Board (FTB) to regain its status as an active entity. Completing this form is vital for businesses looking to reinstate their operations legally.

Who is eligible to sign the 3557 LLC form?

Eligible individuals who can sign the 3557 LLC form include stockholders, creditors, members, general partners, or officers of the LLC. Anyone with an interest in regaining the entity's rights can also sign. For domestic entities, a majority of surviving trustees or directors may sign on behalf of the LLC, providing flexibility in the application process.

What information is required when completing the 3557 LLC form?

To successfully fill out the 3557 LLC form, specific information must be provided. This includes the Entity Number, FEIN (Federal Employer Identification Number), SOS (Secretary of State) Number, Entity Name, and the business address. Additionally, the form requires the print name, title, signature, date, and daytime phone number of the individual signing the application.

What is the significance of submitting this form timely?

Timely submission of the 3557 LLC form is crucial for businesses seeking to restore their active status. Delays may result in continued suspension, which can affect the company’s operations and ability to conduct business. It is advisable to address any outstanding payments, returns, or documents before applying, ensuring a smooth reinstatement process.

What happens after submitting the 3557 LLC form?

After you submit the 3557 LLC form, the Franchise Tax Board will review the application. If all requirements are met, and any outstanding obligations are resolved, the FTB will grant the Certificate of Revivor. This reinstatement allows the LLC to continue operating and maintaining compliance with state regulations. Remember, staying proactive in managing your business's legal status is a key part of maintaining good standing.

Common mistakes

Filling out the 3557 LLC form can be a straightforward process, but many people make common mistakes that can lead to delays or rejections. One frequent error is neglecting to provide all required information. Every field must be completed accurately. Leaving out even one detail, such as the entity number or address, can halt the application process.

Another common mistake is using incorrect entity or tax identification numbers. The form requires specific numbers, such as the FEIN and SOS numbers. Double-checking these entries is essential. Transposing numbers or inputting the wrong digits can cause significant complications. Verify these numbers against official documents before submission.

Many applicants fail to sign the form. A signature is a crucial part of the application. Without it, the Franchise Tax Board will not process the submission. Additionally, it's important to ensure that the person signing the form has the authority to do so. Misunderstanding who is eligible to sign can lead to unnecessary obstacles.

Some also overlook the necessity of including associated payment documentation. The application requests proof of any required payments or documents related to prior filings. Incomplete submissions may result in rejection or delays. It’s vital to double-check that all necessary attachments are included with the application.

Inaccurate phone numbers are another common misstep. It’s important to provide a valid daytime phone number where you can be reached. If the FTB has questions or needs clarifications about your application, they rely heavily on this contact information.

Applicants sometimes submit outdated forms. Always ensure that you are using the most current version of the form. Submitting an older version may lead to rejection based on insufficient or non-compliance with current requirements.

Another error is failing to review the application before pressing send. Taking a few extra moments to proofread can catch mistakes that may have been overlooked during the initial filling process. This review can save time and prevent frustration later.

Misunderstanding the purpose of the application is also a pitfall. The 3557 LLC form serves a specific function: it requests a certificate of revivor. Knowing this can prevent applicants from mistakenly applying for other types of relief or permits.

Some applicants incorrectly assume that submission guarantees approval. Understanding that a successful application still relies on meeting established criteria and providing full and accurate information is essential. Approval is never automatic.

Lastly, ignoring deadlines can drastically impact an application. Each form must be submitted within specific time frames to remain valid. Keeping track of these deadlines and submitting promptly helps avoid complications.

Documents used along the form

The 3557 LLC form is specifically designed for entities looking to obtain a certificate of revivor from the California Franchise Tax Board. However, additional documents are often required or advisable to accompany this form, depending on the unique circumstances of the entity in question. Below is a list of commonly used forms and documents that may be necessary in scenarios involving the 3557 LLC form.

- Certificate of Good Standing: This document proves that the LLC is compliant with state regulations and has fulfilled all necessary tax obligations. It often serves as a prerequisite for various business dealings.

- Statement of Information (Form LLC-12): Required for California LLCs, this form provides updated information regarding the business, including the addresses of the business, members, and managers. It ensures transparency and may be required for compliance verification.

- Application for Limited Liability Company Name Reservation (Form LLC-1): If a business is changing its name or needs to reserve a name before the revivor process, this application secures the desired name for the LLC before it's officially registered.

- Franchise Tax Payment Receipt: Proof of payment for any outstanding franchise taxes can expedite the revivor process. This receipt serves as evidence that the LLC is in good standing with the Franchise Tax Board.

- Operating Agreement: While not always required, an operating agreement outlines the management structure and operational guidelines for the LLC. It can be necessary for demonstrating the legitimacy of the business in case of audits or legal inquiries.

- Tax Returns: Providing recent tax returns can demonstrate that the LLC has maintained compliance with federal and state tax obligations, supporting the request for revivor.

Carefully preparing the necessary documentation alongside the 3557 LLC form can streamline the revivor process and enhance the likelihood of a favorable outcome. Ensuring all forms and documents are completed accurately is crucial for maintaining compliance and supporting the continued operation of the LLC.

Similar forms

-

Articles of Organization – This document is filed to officially create a Limited Liability Company (LLC) with the appropriate state authority. Like the 3557 LLC form, it helps establish an entity's status and may involve similar information about the entity’s name and address.

-

Application for Certificate of Good Standing – This application verifies that an LLC has met all state requirements. Both documents support an entity's lawful status and may require submission of previous filings or tax payments.

-

Certificate of Amendment – When an LLC needs to change its registered name or structure, it files this certificate. Similar to the 3557 LLC form, it aims to update the official records and often requires existing information on the entity.

-

Annual Statement of Information – This document provides current information about an LLC, including its management structure. The goals of this statement and the 3557 LLC form overlap in maintaining the state's records accurately.

-

Application for Reinstatement – This application is filed when an LLC has been suspended or forfeited and seeks to regain its status. Both forms address similar issues of reinstating the entity's legal standing.

-

Bylaws – Bylaws govern the operations of an LLC and are similar to the 3557 LLC form in that they outline the structure and specific actions related to the entity's governance, although they do so at a more detailed level.

-

Employment Identification Number (EIN) Application – An EIN is essential for tax purposes and is comparable to the 3557 LLC form because it establishes the entity's identity to the IRS, facilitating its legal operations.

-

Consent to Use of a Business Name – This document allows an LLC to operate under a name different from its legal name. Like the 3557 LLC form, it plays a crucial role in the entity’s public representation and compliance.

-

Statement of Domestic/Foreign Entity Status – This statement declares whether an LLC is domestic or foreign. The purpose aligns with the 3557 LLC form, ensuring clear identification of the entity's operational jurisdiction.

-

Tax Returns – LLCs must file tax returns each year, and these forms parallel the 3557 LLC form in providing a record of compliance with tax obligations, essential for maintaining the entity’s good standing.

Dos and Don'ts

When filling out the 3557 LLC form, careful attention to detail is essential. Here are important guidelines to follow:

- Do ensure that all required payments, returns, and documents are submitted with your application.

- Do provide accurate information for the Entity Number, FEIN Number, SOS Number, and Entity Name.

- Do include the appropriate signatures from those authorized to act on behalf of the entity.

- Do include a current daytime phone number for any follow-up communications.

- Don't leave any sections of the form blank, as this may delay the processing of your application.

- Don't use abbreviations or informal language; clarity is crucial for effective communication.

Misconceptions

There are several misconceptions surrounding the use of the 3557 LLC form, which is associated with the application for a Certificate of Revivor for Limited Liability Companies in California. Understanding these misconceptions can help businesses and individuals navigate the application process more effectively. Below are five common misconceptions:

- Only members of the LLC can file the form. In fact, the form can be signed by stockholders, creditors, members, general partners, or officers. Any person with a vested interest in relief from suspension or forfeiture can submit the application.

- The form is only needed for domestic LLCs. This is not true. The 3557 LLC form can be used by both domestic and foreign entities requesting relief from suspension in California.

- All payments must be made at once to submit the form. While it is important to submit required payments, returns, or documents, applicants may be able to submit their application and enclose the necessary payments separately, provided they have met all other requirements.

- The application guarantees approval. Submitting the 3557 LLC form does not guarantee that the request for a Certificate of Revivor will be approved. Approval depends on meeting all regulatory requirements set forth by the California Franchise Tax Board.

- Digital signatures are not accepted. This is a misconception. The application can be signed electronically, but it is advisable to check the latest guidelines from the Franchise Tax Board regarding signature requirements.

Addressing these misconceptions can lead to a smoother application process and better outcomes for those seeking a Certificate of Revivor for their LLCs.

Key takeaways

Here are some important points to consider when filling out and using the 3557 LLC form:

- Understand the Purpose: This form is used to request a certificate of revivor for a Limited Liability Company (LLC) in California. It helps restore a suspended or forfeited entity.

- Required Information: Make sure to fill in the entity number, FEIN number, SOS number, entity name, and address. This information is crucial for processing your application.

- Signatures: The application must be signed by an authorized individual. This could be a stockholder, creditor, member, general partner, or officer of the organization.

- Supporting Documents: Attach any necessary documents, such as previously submitted payments or returns. Ensure all required paperwork is enclosed to avoid delays.

- Stay Informed: Keep a copy of the completed form and any related documents for your records. This will help you track the application status and reference any correspondence.

Browse Other Templates

Parent Sample Letter to Judge for Child Custody - Filing this declaration is a responsible action within the justice system.

Dwc Forms California - Details about the injury, including date, time, and nature, are crucial for claims.