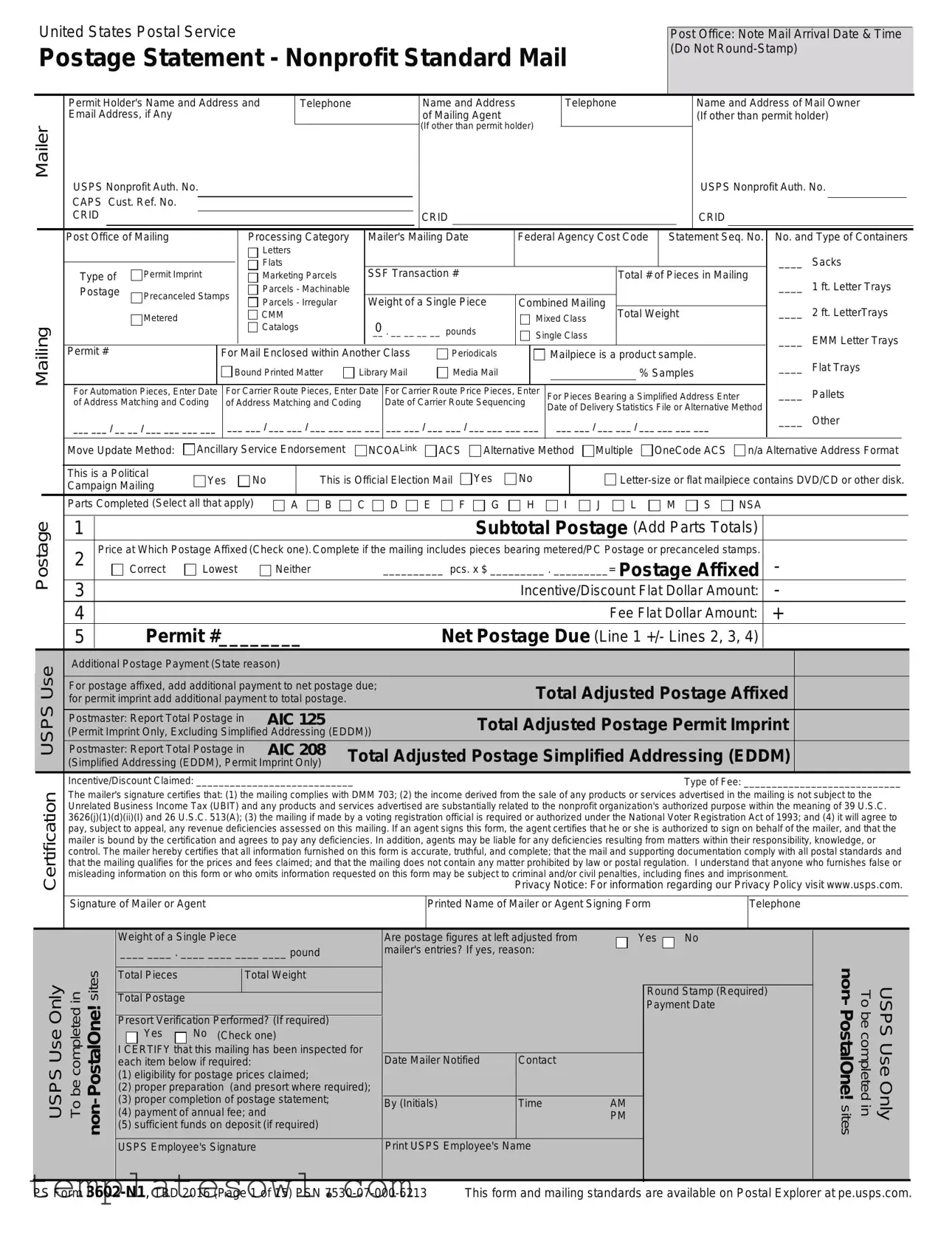

Fill Out Your 3602 N1 Form

The 3602 N1 form is an essential document for organizations wishing to take advantage of nonprofit pricing for mailing purposes through the United States Postal Service (USPS). This form serves several important functions in the mailing process. First, it collects pertinent information about the mailer, including their name, address, and contact details, as well as data about the mailing itself, such as the date of mailing and the type of mail being sent. By entering this information, organizations can certify that their mailing meets specific postal regulations and is eligible for nonprofit rates. The form also outlines different categories of mail, enabling users to calculate postage based on the size and type of their mailpieces, whether they are letters, flats, or parcels. To keep the process efficient, it breaks down detailed pricing tiers, identifies discounts, and includes calculations for any adjustments needed for postage. Crucially, the form requires a certification from the mailer affirming compliance with various legal obligations, including adherence to income-related regulations and the integrity of the mailing content. In sum, the 3602 N1 form plays a pivotal role in facilitating the cost-effective distribution of materials for nonprofit organizations, ensuring they can fulfill their communications needs while abiding by USPS standards.

3602 N1 Example

United States Postal Service

Postage Statement - Nonprofit Standard Mail

Post Office: Note Mail Arrival Date & Time (Do Not

|

|

|

Permit Holder's Name and Address and |

|

Telephone |

|

|

|

|

Name and Address |

|

|

|

|

Telephone |

|

|

|

|

Name and Address of Mail Owner |

|

||||||||||||||||||||||||||||||||||||

|

|

|

Email Address, if Any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Mailing Agent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If other than permit holder) |

|

||||||||||||||||||||

Mailer |

USPS Nonprofit Auth. No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

(If other than permit holder) |

|

|

|

|

|

|

|

|

|

|

|

|

USPS Nonprofit Auth. No. |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

CAPS Cust. Ref. No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

CRID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CRID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CRID |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post Office of Mailing |

|

|

|

|

|

|

|

Processing Category |

|

Mailer's Mailing Date |

|

Federal Agency Cost Code |

|

Statement Seq. No. |

|

No. and Type of Containers |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Letters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____ |

Sacks |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Flats |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

Type of |

Permit Imprint |

|

|

|

|

|

Marketing Parcels |

|

SSF Transaction # |

|

|

|

|

|

|

|

|

|

Total # of Pieces in Mailing |

____ |

1 ft. Letter Trays |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

Postage |

Precanceled Stamps |

|

|

|

Parcels - Machinable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parcels - Irregular |

|

Weight of a Single Piece |

Combined Mailing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____ |

2 ft. LetterTrays |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Weight |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

Metered |

|

|

|

|

|

|

|

|

|

CMM |

|

|

0 |

|

|

|

|

|

|

|

|

Mixed Class |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Mailing |

|

|

|

|

|

|

|

|

|

|

|

|

Catalogs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__ . __ __ __ __ pounds |

|

Single Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____ |

EMM Letter Trays |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

Permit # |

|

|

|

|

|

For Mail Enclosed within Another Class |

|

|

Periodicals |

|

|

Mailpiece is a product sample. |

|

|

|

|

|

|

|

____ |

Flat Trays |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Bound Printed Matter |

|

Library Mail |

|

|

|

Media Mail |

|

|

|

|

|

|

|

|

|

% Samples |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Automation Pieces, Enter Date |

For Carrier Route Pieces, Enter Date |

For Carrier Route Price Pieces, Enter |

For Pieces Bearing a Simplified Address Enter |

|

|

|

|

|

____ |

Pallets |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

of Address Matching and Coding |

of Address Matching and Coding |

Date of Carrier Route Sequencing |

Date of Delivery Statistics File or Alternative Method |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

___ ___ / __ __ / ___ ___ ___ ___ |

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

___ ___ / ___ ___ / ___ ___ ___ ___ |

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|

|

|

|

____ |

Other |

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

Move Update Method: |

Ancillary Service Endorsement |

|

NCOALink |

|

|

ACS |

Alternative Method |

Multiple |

OneCode ACS |

|

|

|

n/a Alternative Address Format |

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

This is a Political |

|

|

Yes |

|

|

No |

|

This is Official Election Mail |

Yes |

No |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

Campaign Mailing |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Parts Completed (Select all that apply) |

A |

B |

C |

D |

E |

|

F |

G |

H |

|

|

I |

J |

|

L |

|

M |

S |

NSA |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Postage |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Postage (Add Parts Totals) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

2 |

Price at Which Postage Affixed (Check one). Complete if the mailing includes pieces bearing metered/PC Postage or precanceled stamps. |

|

- |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Correct |

|

Lowest |

|

|

|

Neither |

|

|

|

__________ pcs. x $ _________ . _________= Postage Affixed |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incentive/Discount Flat Dollar Amount: |

|

- |

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee Flat Dollar Amount: |

|

+ |

|

|

|

|

|

|

|||||||||||||

|

|

|

5 |

|

|

Permit #________ |

|

|

|

|

|

|

|

Net Postage Due (Line 1 +/- Lines 2, 3, 4) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

Additional Postage Payment (State reason) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Use |

For postage affixed, add additional payment to net postage due; |

|

|

|

|

|

|

|

|

Total Adjusted Postage |

|

|

Affixed |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

for permit imprint add additional payment to total postage. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

USPS |

Postmaster: Report Total Postage in |

|

|

|

AIC 125 |

|

|

|

|

|

|

|

|

|

Total Adjusted Postage Permit |

|

Imprint |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

(Permit Imprint Only, Excluding Simplified Addressing (EDDM)) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

Postmaster: Report Total Postage in |

|

|

|

AIC 208 |

Total Adjusted Postage Simplified Addressing |

(EDDM) |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

(Simplified Addressing (EDDM), Permit Imprint Only) |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Certification |

Incentive/Discount Claimed: ____________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Fee: ____________________________ |

|

|||||||||||||||||||||||||||||||

|

|

The mailer's signature certifies that: (1) the mailing complies with DMM 703; (2) the income derived from the sale of any products or services advertised in the mailing is not subject to the |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Privacy Notice: |

For information regarding our Privacy Policy visit www.usps.com. |

|

|||||||||||||||||||||||||||

|

|

|

Unrelated Business Income Tax (UBIT) and any products and services advertised are substantially related to the nonprofit organization's authorized purpose within the meaning of 39 U.S.C. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

3626(j)(1)(d)(ii)(I) and 26 U.S.C. 513(A); (3) the mailing if made by a voting registration official is required or authorized under the National Voter Registration Act of 1993; and (4) it will agree to |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

pay, subject to appeal, any revenue deficiencies assessed on this mailing. If an agent signs this form, the agent certifies that he or she is authorized to sign on behalf of the mailer, and that the |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

mailer is bound by the certification and agrees to pay any deficiencies. In addition, agents may be liable for any deficiencies resulting from matters within their responsibility, knowledge, or |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

control. The mailer hereby certifies that all information furnished on this form is accurate, truthful, and complete; that the mail and supporting documentation comply with all postal standards and |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

that the mailing qualifies for the prices and fees claimed; and that the mailing does not contain any matter prohibited by law or postal regulation. I understand that anyone who furnishes false or |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

misleading information on this form or who omits information requested on this form may be subject to criminal and/or civil penalties, including fines and imprisonment. |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Signature of Mailer or Agent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed Name of Mailer or Agent Signing Form |

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USPS Use Only To be completed in non- PostalOne! sites

Weight of a Single Piece

____ ____ . ____ ____ ____ ____ pound

Total Pieces |

Total Weight |

|

|

Total Postage |

|

Presort Verification Performed? (If required)

Yes |

|

No (Check one) |

|

I CERTIFY that this mailing has been inspected for each item below if required:

(1)eligibility for postage prices claimed;

(2)proper preparation (and presort where required);

(3)proper completion of postage statement;

(4)payment of annual fee; and

(5)sufficient funds on deposit (if required)

USPS Employee's Signature

Are postage figures at left adjusted from mailer's entries? If yes, reason:

Date Mailer Notified |

Contact |

|

By (Initials) |

Time |

AM |

|

|

PM |

|

|

|

Print USPS Employee's Name |

|

|

Yes

No

No

Round Stamp (Required) Payment Date

USPS Use Only To be completed in non- PostalOne! sites

PS Form

Nonprofit Standard Mail

Part A

Check box at left if prices are populated in this section.

Automation Letters

Letters 3.3 oz. (0.2063 lbs.) or less |

|

|

|

|

|

|

||

|

Entry |

Price Category |

Price |

No. of Pieces |

Subtotal |

Discount Total* Fee Total |

Total Postage |

|

|

Postage |

|||||||

|

|

|

|

|

|

|

|

|

A1 |

None |

$0.140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A2 |

None |

0.159 |

|

|

|

|

|

|

A3 |

None |

AADC |

0.159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A4 |

None |

Mixed AADC |

0.176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A5 |

DNDC |

0.105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A6 |

DNDC |

0.124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A7 |

DNDC |

AADC |

0.124 |

|

|

|

|

|

A8 |

DNDC |

Mixed AADC |

0.141 |

|

|

|

|

|

A9 |

DSCF |

0.096 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A10 |

DSCF |

0.115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A11 |

DSCF |

AADC |

0.115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Letters Over 3.3 oz. up to 3.5 oz.

|

|

Price |

Piece |

Or |

No. of |

Pieces |

Pound |

|

Pounds |

Subtotal |

Discount |

Fee |

Total |

|

Entry |

Amount |

Pounds |

||||||||||

|

Category |

Price |

Pieces |

Subtotal |

Price |

Subtotal |

Postage |

Total* |

Total |

Postage |

|||

|

|

|

|

Affixed |

|

|

|

|

|

|

|

|

|

A12 |

None |

$0.140 |

|

|

|

$0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A13 |

None |

0.159 |

|

|

|

0.00 |

|

|

|

|

|

|

|

A14 |

None |

AADC |

0.159 |

|

|

|

0.00 |

|

|

|

|

|

|

A15 |

None |

Mixed |

0.176 |

|

|

|

0.00 |

|

|

|

|

|

|

AADC |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A16 |

DNDC |

0.105 |

|

|

|

0.00 |

|

|

|

|

|

|

|

A17 |

DNDC |

0.124 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A18 |

DNDC |

AADC |

0.124 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A19 |

DNDC |

Mixed |

0.141 |

|

|

|

0.00 |

|

|

|

|

|

|

AADC |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A20 |

DSCF |

0.096 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A21 |

DSCF |

0.115 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A22 |

DSCF |

AADC |

0.115 |

|

|

|

0.00 |

|

|

|

|

|

|

For affixed postage mailings as described in DMM 243, compute and enter the price for each piece in the Amount Affixed column, multiply by No. of Pieces and total in the Total column.

A23

Part A Total (Add Lines

Full Service Intelligent Mail Option

A24 |

DISPLAY ONLY |

Letters - Number of Pieces that Comply_________ x $0.001 = |

|

|

|

|

|

*May contain both Full Service Intelligent Mail and other discount - see Instructions page for additional information PS Form

Nonprofit Standard Mail |

|

|

|

Check box at left if prices are populated in this section. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Nonautomation Letters |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinable Letters 3.3 oz. (0.2063 lbs.) or less |

|

Subtotal |

|

|

|

|

|

|

||||

|

|

|

Entry |

Price Category |

Price |

No. of Pieces |

|

Discount Total |

|

Fee Total |

|

Total Postage |

|

|

|

|

Postage |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B1 |

None |

AADC |

$0.175 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B2 |

None |

Mixed AADC |

0.192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B3 |

DNDC |

AADC |

0.140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B4 |

DNDC |

Mixed AADC |

0.157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B5 |

DSCF |

AADC |

0.131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonmachinable Letters 3.3 oz. (0.2063 lbs.) or less |

|

|

|

|

|

|

|

|

||||

|

|

|

Entry |

Price Category |

Price |

No. of Pieces |

Subtotal |

|

Discount Total |

|

Fee Total |

|

Total Postage |

|

|

|

Postage |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B6 |

None |

$0.349 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B7 |

None |

0.438 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B8 |

None |

ADC |

0.464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B9 |

None |

Mixed ADC |

0.538 |

|

|

|

|

|

|

|

|

|

|

B10 |

DNDC |

0.314 |

|

|

|

|

|

|

|

|

||

|

B11 |

DNDC |

0.403 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B12 |

DNDC |

ADC |

0.429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B13 |

DNDC |

Mixed ADC |

0.503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B14 |

DSCF |

0.305 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B15 |

DSCF |

0.394 |

|

|

|

|

|

|

|

|

||

|

B16 |

DSCF |

ADC |

0.420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonmachinable Letters Over 3.3 oz. but less than 16 oz. |

|

|

|

|

|

|

|

|

|||||

|

|

Price |

Piece |

Or |

No. of |

Pieces |

Pound |

|

Pounds |

Subtotal |

Discount |

Fee |

Total |

|

Entry |

Amount |

Pounds |

||||||||||

|

Category |

Price |

Pieces |

Subtotal |

Price |

Subtotal |

Postage |

Total |

Total |

Postage |

|||

|

|

Affixed |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B17 |

None |

$0.150 |

|

|

|

$0.660 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B18 |

None |

0.219 |

|

|

|

0.660 |

|

|

|

|

|

|

|

B19 |

None |

ADC |

0.271 |

|

|

|

0.660 |

|

|

|

|

|

|

B20 |

None |

Mixed |

0.305 |

|

|

|

0.660 |

|

|

|

|

|

|

ADC |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B21 |

DNDC |

0.150 |

|

|

|

0.499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B22 |

DNDC |

0.219 |

|

|

|

0.499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B23 |

DNDC |

ADC |

0.271 |

|

|

|

0.499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B24 |

DNDC |

Mixed |

0.305 |

|

|

|

0.499 |

|

|

|

|

|

|

ADC |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B25 |

DSCF |

0.150 |

|

|

|

0.451 |

|

|

|

|

|

|

|

B26 |

DSCF |

0.219 |

|

|

|

0.451 |

|

|

|

|

|

|

|

B27 |

DSCF |

ADC |

0.271 |

|

|

|

0.451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For affixed postage mailings as described in DMM 243, compute and enter the price for each piece in the Amount Affixed column, multiply by No. of Pieces and total in the Total column.

Part B Total (Add lines

PS Form

Nonprofit Standard Mail

Part C

Check box at left if prices are populated in this section.

Carrier Route Letters

(Automation) Letters 3.3 oz. (0.2063 lbs.) or less |

|

|

|

|

|

|

|||||

|

|

Entry |

Price Category |

Price |

No. of Pieces |

Subtotal |

Discount Total* |

Fee Total |

Total Postage |

|

|

|

|

Postage |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

C1 |

None |

Saturation |

|

$0.120 |

|

|

|

|

|

|

|

C2 |

None |

High Density Plus |

|

0.130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C3 |

None |

High Density |

|

0.133 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C4 |

None |

Basic |

|

0.214 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C5 |

DNDC |

Saturation |

|

0.088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C6 |

DNDC |

High Density Plus |

|

0.098 |

|

|

|

|

|

|

|

C7 |

DNDC |

High Density |

|

0.101 |

|

|

|

|

|

|

|

C8 |

DNDC |

Basic |

|

0.182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C9 |

DSCF |

Saturation |

|

0.077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C10 |

DSCF |

High Density Plus |

|

0.087 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C11 |

DSCF |

High Density |

|

0.090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C12 |

DSCF |

Basic |

|

0.171 |

|

|

|

|

|

|

|

Letters EDDM 3.3 oz. (0.2063 lbs.) or less |

|

No. of |

Subtotal |

|

|

|

|

||||

|

|

Entry |

Price Category |

|

Discount Total |

Fee Total |

Total Postage |

|

|||

|

|

Price |

Pieces |

Postage |

|

||||||

C13 |

|

None |

Saturation |

|

$0.120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C14 |

|

None |

High Density Plus |

|

|

|

|

|

|

|

|

C15 |

|

None |

High Density |

|

|

|

|

|

|

|

|

C16 |

|

None |

Basic |

|

|

|

|

|

|

|

|

C17 |

|

DNDC |

Saturation |

|

0.088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C18 |

|

DNDC |

High Density Plus |

|

|

|

|

|

|

|

|

C19 |

|

DNDC |

High Density |

|

|

|

|

|

|

|

|

C20 |

|

DNDC |

Basic |

|

|

|

|

|

|

|

|

C21 |

|

DSCF |

Saturation |

|

0.077 |

|

|

|

|

|

|

C22 |

|

DSCF |

High Density Plus |

|

|

|

|

|

|

|

|

C23 |

|

DSCF |

High Density |

|

|

|

|

|

|

|

|

C24 |

|

DSCF |

Basic |

|

|

|

|

|

|

|

|

Nonautomation Letters 3.3 oz. (0.2063 lbs.) or less |

|

Subtotal |

|

|

|

|

|||||

|

|

Entry |

Price Category |

Price |

No. of Pieces |

Discount Total |

Fee Total |

Total Postage |

|

||

|

|

Postage |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C25 |

None |

Saturation |

|

$0.131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C26 |

None |

High Density Plus |

|

0.156 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C27 |

None |

High Density |

|

0.161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C28 |

None |

Basic |

|

0.214 |

|

|

|

|

|

|

|

C29 |

DNDC |

Saturation |

|

0.098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C30 |

DNDC |

High Density Plus |

|

0.123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C31 |

DNDC |

High Density |

|

0.128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C32 |

DNDC |

Basic |

|

0.182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C33 |

DSCF |

Saturation |

|

0.088 |

|

|

|

|

|

|

|

C34 |

DSCF |

High Density Plus |

|

0.113 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C35 |

DSCF |

High Density |

|

0.118 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C36 |

DSCF |

Basic |

|

0.171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*May contain both Full Service Intelligent Mail and other discount - see Instructions page for additional information.

Part C continued on next page

PS Form

Nonprofit Standard Mail

Part C - Continued

Check box at left if prices are populated in this section.

Carrier Route Letters

(Automation) Letters Over 3.3 oz. up to 3.5 oz. |

|

|

|

|

|

|

|

|

|

|||||

|

|

Price |

Piece |

Or |

No. of |

Pieces |

Pound |

|

Pounds |

Subtotal |

Discount |

Fee |

Total |

|

|

Entry |

Amount |

Pounds |

|||||||||||

|

Category |

Price |

Pieces |

Subtotal |

Price |

Subtotal |

Postage |

Total* |

Total |

Postage |

||||

|

|

Affixed |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C37 |

None |

Saturation |

$0.120 |

|

|

|

|

$0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

C38 |

None |

Density |

0.130 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

C39 |

None |

High |

0.133 |

|

|

|

|

0.00 |

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C40 |

None |

Basic |

0.214 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C41 |

DNDC |

Saturation |

0.088 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

C42 |

DNDC |

Density |

0.098 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

C43 |

DNDC |

High |

0.101 |

|

|

|

|

0.00 |

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C44 |

DNDC |

Basic |

0.182 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C45 |

DSCF |

Saturation |

0.077 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

C46 |

DSCF |

Density |

0.087 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

C47 |

DSCF |

High |

0.090 |

|

|

|

|

0.00 |

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C48 |

DSCF |

Basic |

0.171 |

|

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Letters EDDM Over 3.3 oz. up to 3.5 oz.

|

|

Price |

Piece |

Or |

No. of |

Pieces |

Pound |

|

Pounds |

Subtotal |

Discount |

Fee |

Total |

|

Entry |

Amount |

Pounds |

||||||||||

|

Category |

Price |

Pieces |

Subtotal |

Price |

Subtotal |

Postage |

Total |

Total |

Postage |

|||

|

|

Affixed |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C49 |

None |

Saturation |

$0.120 |

|

|

|

$0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

C50 |

None |

Density |

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

C51 |

None |

High |

|

|

|

|

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C52 |

None |

Basic |

|

|

|

|

|

|

|

|

|

|

|

C53 |

DNDC |

Saturation |

0.088 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

C54 |

DNDC |

Density |

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

C55 |

DNDC |

High |

|

|

|

|

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C56 |

DNDC |

Basic |

|

|

|

|

|

|

|

|

|

|

|

C57 |

DSCF |

Saturation |

0.077 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

C58 |

DSCF |

Density |

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

C59 |

DSCF |

High |

|

|

|

|

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C60 |

DSCF |

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*May contain both Full Service Intelligent Mail and other discount - see Instructions page for additional information.

Part C continued on next page

PS Form

Nonprofit Standard Mail

Part C - Continued

Check box at left if prices are populated in this section.

Carrier Route Letters

Nonautomation Letters Over 3.3 oz. but less than 16 oz. |

|

|

|

|

|

|

|

|

|||||||

|

|

Entry |

Price |

Piece |

Or Amount |

No. of |

Pieces |

Pound |

Pounds |

Pounds |

Subtotal |

Discount |

Fee |

Total |

|

|

|

Category |

Price |

Affixed |

Pieces |

Subtotal |

Price |

Subtotal |

Postage |

Total |

Total |

Postage |

|||

|

|

|

|

||||||||||||

|

C61 |

None |

Saturation |

$0.039 |

|

|

|

|

$0.445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

C62 |

None |

Density |

0.045 |

|

|

|

|

0.445 |

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

C63 |

None |

High |

0.069 |

|

|

|

|

0.445 |

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C64 |

None |

Basic |

0.106 |

|

|

|

|

0.531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C65 |

DNDC |

Saturation |

0.039 |

|

|

|

|

0.284 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

C66 |

DNDC |

Density |

0.045 |

|

|

|

|

0.284 |

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

C67 |

DNDC |

High |

0.069 |

|

|

|

|

0.284 |

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C68 |

DNDC |

Basic |

0.106 |

|

|

|

|

0.370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C69 |

DSCF |

Saturation |

0.039 |

|

|

|

|

0.236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

C70 |

DSCF |

Density |

0.045 |

|

|

|

|

0.236 |

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

C71 |

DSCF |

High |

0.069 |

|

|

|

|

0.236 |

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C72 |

DSCF |

Basic |

0.106 |

|

|

|

|

0.322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Letters EDDM Over 3.5 oz. but less than 16 oz. |

|

|

|

|

|

|

|

|

|

|||||

|

|

Entry |

Price |

Piece |

Or Amount |

No. of |

Pieces |

Pound |

Pounds |

Pounds |

Subtotal |

Discount |

Fee |

Total |

|

|

|

Category |

Price |

Affixed |

Pieces |

Subtotal |

Price |

Subtotal |

Postage |

Total |

Total |

Postage |

|||

|

|

|

|

||||||||||||

|

C73 |

None |

Saturation |

$0.039 |

|

|

|

|

$0.445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

C74 |

None |

Density |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

C75 |

None |

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C76 |

None |

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

C77 |

DNDC |

Saturation |

0.039 |

|

|

|

|

0.284 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

C78 |

DNDC |

Density |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

C79 |

DNDC |

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C80 |

DNDC |

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

C81 |

DSCF |

Saturation |

0.039 |

|

|

|

|

0.236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

C82 |

DSCF |

Density |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus |

|

|

|

|

|

|

|

|

|

|

|

|

|

C83 |

DSCF |

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

Density |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C84 |

DSCF |

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For affixed postage mailings as described in DMM 243, compute and enter the price for each piece in the Amount Affixed column, multiply by No. of Pieces and total in the Total column.

C85 |

|

Part C Total (Add Lines |

|

|

|

|

|

|

|

|

|

|

|

Full Service Intelligent Mail Option |

|

|

|

|

||

C86 |

DISPLAY ONLY |

Letters - Number of Pieces that Comply_________ x $0.001 = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PS Form |

|

|

|

|

|

Nonprofit Standard Mail

Part D

Check box at left if prices are populated in this section.

Automation Flats

Flats 3.3 oz. (0.2063 lbs.) or less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Entry |

|

Price Category |

|

Price |

|

No. of Pieces |

Subtotal Postage |

Discount Total** |

Fee Total |

|

Total Postage |

||||||||||

|

D1 |

None |

|

FSS Sch Pallet |

$0.162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D2 |

None |

|

FSS Other |

0.192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D3 |

None |

|

0.237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D4 |

None |

|

0.328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

D5 |

None |

|

ADC |

0.383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

D6 |

None |

|

Mixed ADC |

0.400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D7 |

DNDC |

|

FSS Sch Pallet |

0.129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D8 |

DNDC |

|

FSS Other |

0.159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D9 |

DNDC |

|

0.204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

D10 |

DNDC |

|

0.295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

D11 |

DNDC |

|

ADC |

0.350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D12 |

DNDC |

|

Mixed ADC |

0.367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

D13 |

DSCF |

|

FSS Sch Pallet |

0.119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|