Fill Out Your 403B Loan Axa Hardship Form

The 403B Loan AXA Hardship Withdrawal Request form serves as a crucial tool for participants navigating challenging financial situations. It is designed for individuals looking to withdraw funds from their 403(b) plan due to immediate and heavy financial needs, as outlined under federal tax regulations. Before diving into the specifics of the application process, users must ensure they meet the criteria for hardship distributions. This involves demonstrating that the financial strain is genuine and that alternative resources have been exhausted. The form requires personal information, including the participant's name, social security number, and contract number, alongside a detailed description of the hardship circumstances. Additionally, applicants must clearly outline the requested withdrawal amount, which should not exceed the immediate financial need, while adhering to the stipulation that hardship distributions are limited to the employee's elective deferrals. Alongside disclosures of prior hardship applications with other companies, applicants must also attach supporting documentation to substantiate their claims. Given its complexity, prospective applicants are encouraged to familiarize themselves with the requirements detailed in the form to enhance their chances of a successful withdrawal request.

403B Loan Axa Hardship Example

Variable Annuity Series

Hardship Withdrawal Request for TSA Plans

Express Mail: |

|

|

|

AXA Equitable |

|

|

|

|

|

||

100 Madison St., Suite 1000 |

|

|

|

Syracuse, N.Y. 13202 |

|

|

|

Regular Mail: |

For Assistance: Call (800) |

||

Monday − Thursday 8:00 a.m. − 7:00 p.m. EST |

|||

|

Friday 8:00 a.m. − 5:00 p.m. EST |

||

P.O Box 4956 |

|

||

|

|

||

Syracuse, N.Y. 13221 |

|

|

|

Fax Number: |

|

|

|

(201) |

|

|

|

Requirements

Before completing this form, read ‘‘403(b) Contract Hardship Withdrawal Requirements’’ located at the back of this form. Please note that AXA Equitable will not process your request if the Employer sponsoring your 403(b) plan, or its designee, has specifically advised that hardship withdrawals are not permitted in its plan. You must demonstrate that your hardship situation meets the criteria for hardship distributions under federal tax regulations, and that there are no other resources available to meet the need. Supporting documentation must be provided with this request in order to be considered for approval.

1. Participant Information

(Certificate number must be provided to process this request.)

Participant/Employee Name |

|

|

|

Contract Number |

|||

|

|

|

|

|

|

|

|

Address |

|

|

|

Daytime Phone Number |

|||

|

|

|

|

|

|

|

|

City/State/Zip |

|

|

|

Social Security Number (Last 4 digits only) |

|||

Is this a change to your address on our records: |

Yes |

No |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Professional |

||

Employer – Name: |

|

|

|

|

Unit #: |

|

|

2. Withdrawal Amount Requested

(Please note: Check will be made payable to the Participant)

A hardship distribution may not exceed the amount necessary to satisfy the immediate and heavy financial need (which may include any amounts necessary to pay any federal, state, or local income taxes or penalties reasonably anticipated to result from the distribution). The total amount withdrawn will include any applicable withdrawal charges, which are deducted in addition to the requested withdrawal, from your total Annuity Account Value. Hardship distributions are limited to the amount of the employee’s elective deferrals.

I am requesting a hardship withdrawal from my 403(b) TSA Contract: |

|

A. Total of hardship withdrawal expense: |

Amount needed $ |

B. I request additional funds to cover taxes on this withdrawal: |

Amount needed $ |

Note: 10% federal income tax will be withheld from the withdrawal amount requested |

|

unless you elect not to have income tax withheld in Section 7. |

|

C. Total hardship withdrawal requested (add lines A & B) |

Total amount needed $ |

D. To satisfy this hardship need, I have also applied for a hardship withdrawal from the following companies:

• Company Name/Acct. #: |

|

Amount: $ |

• Company Name/Acct. #: |

|

Amount: $ |

3. Hardship Circumstances

In this list, understand that ‘‘employee’’ refers to me, ‘‘beneficiary’’ refers to the individual I designated as my beneficiary under the 403(b) Plan, and ‘‘dependent’’ is defined in Internal Revenue Code Section 152. I have reviewed the information on the ‘‘403(b) Contract Hardship Withdrawal Requirements’’ on the last page of this form. I will describe the circumstances further in Section 4, and attach supporting documentation for my need and the amount of my need. I understand that requests without adequate supporting documentation cannot be processed.

My hardship is due to the following immediate and heavy financial need:

Medical care expenses previously incurred by the employee, the employee’s spouse, any dependents of the employee, or the employee’s primary beneficiary under the 403(b) plan, necessary for these persons to obtain medical care (attach supporting documentation, e.g. doctor’s certification, hospital bills, explanation of benefits by insurance company);

Costs directly related to the purchase of a principal residence for the employee (excluding mortgage payments) (attach supporting documentation);

Payment of tuition, related educational fees, and room and board expenses, for the next 12 months of

Payment necessary to prevent eviction of the employee from the employee’s principal residence, or foreclosure on the mortgage on that residence (attach supporting documentation, e.g. bank’s foreclosure notice);

Payment of funeral expenses for the employee’s spouse, dependent, or primary beneficiary under the 403(b) plan (attach supporting documentation, e.g. death certificate, funeral home bill);

Certain expenses relating to the repair of damage to the employee’s principal residence (attach supporting documentation e.g. proof of loss, contractor’s estimates, insurance adjuster’s estimates).

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 1 of 7 |

|

4. Describe the Hardship Need

(Required for all circumstances indicated above)

Please provide a description of your hardship need by answering parts A through D completely. Attach supporting documentation, and any additional details, necessary to validate your request. Please attach additional sheets of paper if necessary, and include your name and contract number on any additional attachments. If you answer ‘‘No’’ to any of the items in section

A.Enter date hardship (immediate and heavy financial need) first occurred:

B.• Based on the heavy inancial need selected in #3, explain your speciic need for this money.

• How did you arrive at the amount needed?

• Did you consider all other available assets and sources of funds including, but not limited to, those described in 4C and 4D? |

Yes |

No |

If ‘‘No’’, explain why not:

C. Please complete the following statements: |

|

|

|

1) |

I can alleviate this hardship by discontinuing contributions to my 403(b) plan |

Yes |

No |

2) |

I can receive reimbursement from insurance or other sources to pay these expenses |

Yes |

No |

3) |

I can secure a commercial loan to pay these expenses |

Yes |

No |

4) |

I can liquidate assets to pay these expenses |

Yes |

No |

If you checked ‘‘Yes’’ to any of the statements above, please provide an explanation why you still qualify for a hardship withdrawal.

D.• Please list all qualiied plans of this or any other employer that you (i) currently participate in, or (ii) do not participate in currently, but have past participation, and have not yet received full distribution of your interest.

• I have taken all available distributions or |

Yes |

No |

||

|

If ‘‘No’’, explain why not: |

|

|

|

|

|

|

|

|

• I have taken all available distributions or |

Yes |

No |

||

|

If ‘‘No’’, explain why not: |

|

|

|

|

|

|

|

|

• I have taken all available distributions or |

Yes |

No |

||

|

If ‘‘No’’, explain why not: |

|

|

|

|

|

|

|

|

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 2 of 7 |

|

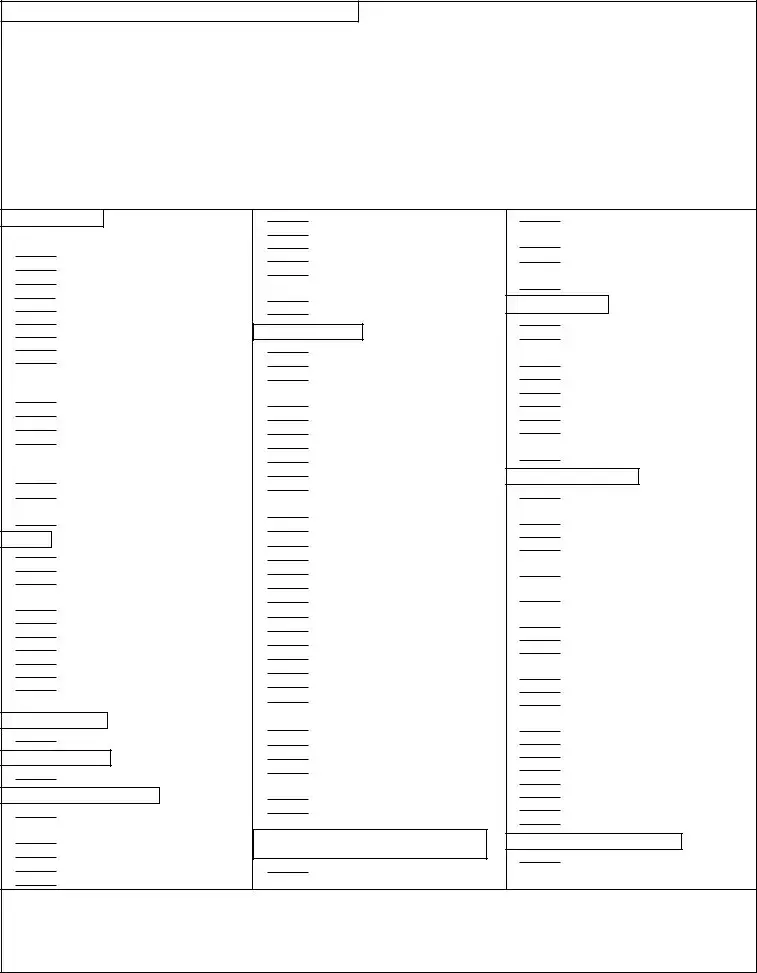

5. Withdrawal Instructions from the Investment Options

How you want your hardship withdrawal taken:

•For withdrawals only from the Guaranteed Interest Option (GIO) and/or the Variable Investment Options (excluding the Fixed Maturity Options (FMOs)), complete section 5A.

•For withdrawals only from the Fixed Maturity Option(s), complete section 5B.

•For withdrawals from both the GIO and/or the Variable Investment Options, and FMOs, complete Sections 5A and 5B.

A.Withdrawals from the GIO and/or Variable Investment Options only:

Please withdraw the total amount needed proportionately from the GIO and/or Variable Investment Options.

Please withdraw the total amount needed proportionately from the GIO and/or Variable Investment Options.

Please withdraw the specific dollar amount as designated below from the GIO and/or Variable Investment Options.

Please withdraw the specific dollar amount as designated below from the GIO and/or Variable Investment Options.

Specific dollar amounts should be taken from the GIO and/or Variable Investment Options. If you wish to withdraw the entire amount from your GIO or from a specific Variable Investment Option, you may enter ‘‘all’’ next to that option. The amount withdrawn will be the withdrawal amount plus any applicable withdrawal charges.

Asset Allocation

AXA Allocation

$AXA Aggressive Allocation (18*)

$AXA Balanced Strategy (8Q*)

$AXA Conservative Allocation (15*)

$AXA Conservative Growth Strategy (8R*)

$AXA

$AXA Conservative Strategy (8S*)

$AXA Moderate Allocation (T4*)

$AXA Moderate Growth Strategy (8O*)

$AXA

Target Allocation

$Target 2015 Allocation (6G*)

$Target 2025 Allocation (6H*)

$Target 2035 Allocation (6I*)

$Target 2045 Allocation (6J*)

Other Asset Allocation

$All Asset Growth – Alt 20 (7H*)

$EQ/AllianceBernstein Dynamic Wealth Strategies (8P*)

$EQ/Franklin Templeton Allocation (6P*)

Bonds

$EQ/Core Bond Index (96*)

$EQ/Global Bond PLUS (47*)

$EQ/Intermediate Government Bond (TI*)1

$EQ/PIMCO Ultra Short Bond (28*)

$EQ/Quality Bond PLUS (TQ*)

$Invesco V.I. High Yield (8L*)5

$Ivy Funds VIP High Income (8G*)5

$Multimanager Core Bond (69*)

$Multimanager

$Templeton Global Bond Securities (8F*)2,5

Cash Equivalents

$EQ/Money Market (T3*)

$Guaranteed Interest Option (A1*)

International Stocks/Global

$AXA Tactical Manager International

(7N*)

$EQ/Global

$EQ/International Core PLUS (88*)

$EQ/International Equity Index (TN*)1

$EQ/International Value PLUS (73*)

$EQ/MFS International Growth (26*)

$EQ/Oppenheimer Global (6A*)

$EQ/Templeton Global Equity (6D*)

$Invesco V.I. International Growth (7Z*)5

$Lazard Retirement Emerging Markets Equity (8H*)5

$MFS® International Value (8A*)5

$Multimanager International Equity (65*)1

Large Cap Stocks

$AXA Tactical Manager 500 (7M*)

$EQ/BlackRock Basic Value Equity (81*)

$EQ/Boston Advisors Equity Income (33*)

$EQ/Calvert Socially Responsible (92*)

$EQ/Capital Guardian Research (86*)3

$EQ/Common Stock Index (T1*)

$EQ/Davis New York Venture (6Q*)

$EQ/Equity 500 Index (TE*)

$EQ/Equity Growth PLUS (94*)

$EQ/JPMorgan Value Opportunities (72*)

$EQ/Large Cap Core PLUS (85*)

$EQ/Large Cap Growth Index (82*)

$EQ/Large Cap Growth PLUS (77*)

$EQ/Large Cap Value Index (49*)

$EQ/Large Cap Value PLUS (89*)1

$EQ/Lord Abbett Large Cap Core (05*)

$EQ/Montag & Caldwell Growth (34*)1

$EQ/Mutual Large Cap Equity (6F*)

$EQ/T. Rowe Price Growth Stock (32*)

$EQ/UBS Growth and Income (35*)3

$EQ/Van Kampen Comstock (07*)1

$EQ/Wells Fargo Omega Growth (83*)3

$Fidelity® VIP Contrafund® (7R*)5

$Invesco V.I. Diversified Dividend (8B*)2,5

$MFS® Investors Growth Stock (8I*)5

$MFS® Investors Trust (7P*)5

$Multimanager Aggressive Equity (T2*)

$Multimanager Large Cap Core Equity (57*)3

$Multimanager Large Cap Value (58*)

$Oppenheimer Main Street Fund/VA (7Q*)2,5

Personal Income Benefit (PIB) Variable Investment Options

$PIB AXA Moderate Growth Strategy (Q1*)4

$PIB EQ/AllianceBernstein Dynamic Wealth Strategies (Q2*)4

$PIB AXA Balanced Strategy (Q3*)4

$PIB AXA Conservative Growth Strategy (Q4*)4

$PIB AXA Conservative Strategy (Q5*)4

Sector/Specialty

$EQ/Franklin Core Balanced (6C*)

$EQ/GAMCO Mergers and Acquisitions (25*)3

$Invesco V.I. Global Real Estate (8C*)5

$Ivy Funds VIP Energy (8D*)5

$MFS® Technology (8J*)5

$MFS® Utilities (8K*)5

$Multimanager Technology (67*)

$PIMCO VIT CommodityRealReturn® Strategy (8E*)2,5

$Van Eck VIP Global Hard Assets (8N*)5

Small/Mid Cap Stocks

$American Century VIP Mid Cap Value (7V*)2,5

$AXA Tactical Manager 400 (7L*)

$AXA Tactical Manager 2000 (7K*)

$EQ/AllianceBernstein Small Cap Growth (TP*)

$EQ/AXA Franklin Small Cap Value Core (6E*)

$EQ/GAMCO Small Company Value (37*)

$EQ/Mid Cap Index (55*)

$EQ/Mid Cap Value PLUS (79*)

$EQ/Morgan Stanley Mid Cap Growth (08*)

$EQ/Small Company Index (97*)

$Fidelity VIP Mid Cap (7U*)2,5

$Goldman Sachs VIT Mid Cap Value (7W*)5

$Invesco V.I. Mid Cap Core Equity (7T*)5

$Invesco V.I. Small Cap Equity (7X*)5

$Ivy Funds VIP Mid Cap Growth (8M*)5

$Ivy Funds VIP Small Cap Growth (7Y*)5

$Multimanager Mid Cap Growth (59*)1

$Multimanager Mid Cap Value (61*)1

$Multimanager Small Cap Growth (36*)1

$Multimanager Small Cap Value (91*)1

Structured Investment Option

$Segment Holding Account for S&P 500 1yr

*he number in parenthesis is shown for data input only.

1 Not available for

2 Available for

3 Not available for

4 Available for

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 3 of 7 |

|

5.Withdrawal Instructions from the Investment Options (continued) B.  Withdrawals from Fixed Maturity Option (FMO) Only

Withdrawals from Fixed Maturity Option (FMO) Only

The amount withdrawn from your FMO will be at the Market Adjusted Amount.

Specific Dollar Amount(s) or Percent(s)

Complete below if you wish specific dollar amounts or percents to be taken from your FMO. If you wish to withdraw the entire amount from any one Period, you may enter ‘‘all’’ next to that Period. Be sure to insert the maturity year for each Period selection. The amount withdrawn will be the amount requested plus any applicable withdrawal charges.

Note: Amounts in this section cannot be withdrawn in both dollars and percents. Amounts must be made either in dollars or percents only.

FMO − Period |

|

$ |

|

or % |

|

FMO − Period |

|

$ |

|

or % |

|

maturity year |

|

|

|

|

maturity year |

|

|

||

FMO − Period |

|

$ |

|

or % |

|

FMO − Period |

|

$ |

|

or % |

|

maturity year |

|

|

|

|

maturity year |

|

|

||

6. Spousal Consent Requirement

For TSA plans subject to the Employee Retirement Income Security Act of 1974 (ERISA): If you are a current or former Annuitant in this type of plan, your spouse’s consent is required for a hardship withdrawal, as your spouse is entitled to benefits under your retirement plan according to the Retirement Equity Act of 1984 (REA).

One of the following two statements must be completed and witnessed by a Notary Public or Plan Administrator.

1.I am the current spouse of the above named Participant, and I hereby consent, by my signature appearing below, to a hardship withdrawal from the contract by the Participant. I also acknowledge that I understand I have the right to receive a benefit under the terms of the plan in which my spouse is a current or former Participant and that I hereby waive such right to the requested distribution.

I acknowledge that I understand the consequences of this consent: x

2.I am the

Notary Public/Plan Administrator

(Needs to be completed)

State of |

|

|

|

|

|

, County of |

|

|

. |

|

On the |

|

|

day of |

|

|

year before me personally |

||||

appeared |

|

|

to me known to be the person described in |

|||||||

and who executed the foregoing instrument, and acknowledged that (s)he executed the same.

Notary Public – Stamp Here

Title & Signature of Notary Public or Plan Administrator

7. Important Tax Notification

We will automatically withhold 10% federal income tax from the taxable portion of your hardship withdrawal unless you check the box below. Some states require us to withhold state income tax if federal income tax is withheld. Please consult your tax advisor for rules that apply to you. AXA Equitable is required to withhold federal income tax on payments from 403(b) annuity contracts, which may be included in gross income. If we withhold income tax, any income tax withheld is a credit against your income tax liability.

I do not want federal income taxes (and state, if applicable) withheld from my hardship withdrawal. I have provided my U.S. residence address and Social Security number in Section 1 of this form. I understand that I am responsible for the payment of any estimated taxes, and that I may incur penalties if my payments are not enough.

I do not want federal income taxes (and state, if applicable) withheld from my hardship withdrawal. I have provided my U.S. residence address and Social Security number in Section 1 of this form. I understand that I am responsible for the payment of any estimated taxes, and that I may incur penalties if my payments are not enough.

Under penalty of perjury, I certify that the following Social Security number is correct:

If your address of record is not a U.S. residence address, complete the following statement:

(Check one): |

I am a U.S. citizen. I am not a U.S. citizen. I reside in |

|

(name of country). |

|

If you are foreign, you may need to complete additional tax forms before your transaction can be processed.

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 4 of 7 |

|

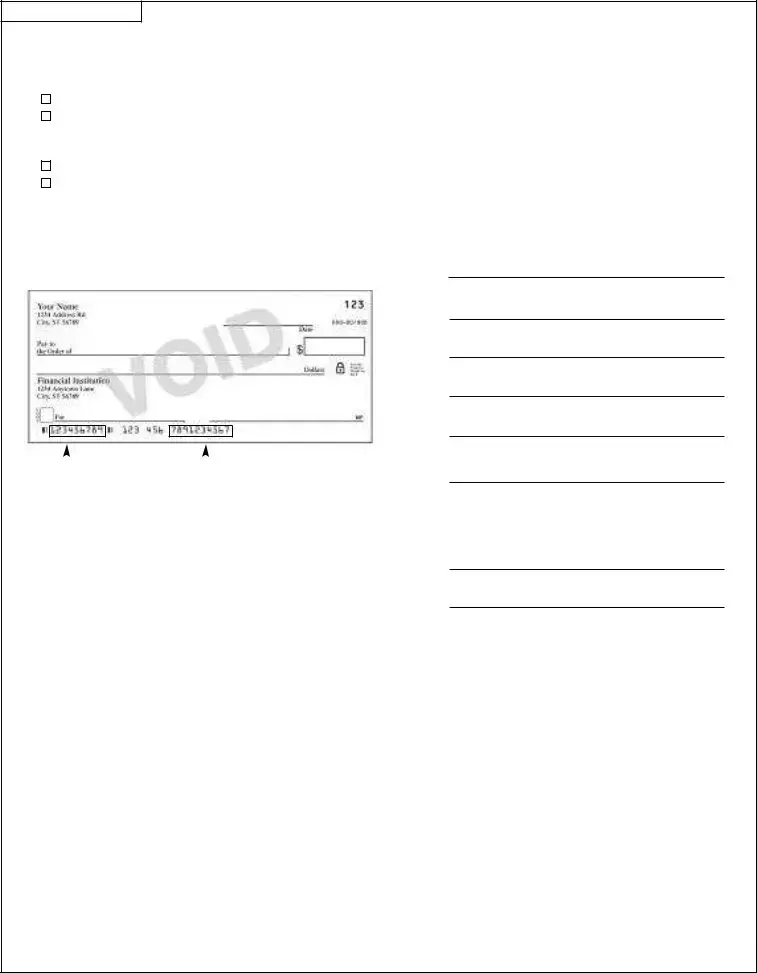

8. Delivery Options

PLEASE SELECT ONLY ONE OPTION FOR WHERE YOU WOULD LIKE YOUR PAYMENT SENT. IF YOU DO NOT COMPLETE THIS SECTION, WE WILL DEFAULT TO THE ADDRESS OF RECORD AND SEND YOU A CHECK VIA FIRST CLASS MAIL.

First Class Mail No Fee — Please allow

Direct Deposit No Fee — Please enter your bank account information on lines

Express Delivery $35 fee — Allow 4 business days for delivery of your check.

Wire Transfer $90 fee — Only available for net wire amounts of $10,000 or more. Please enter your bank account information on lines

IF YOU ELECTED DIRECT DEPOSIT OR WIRE TRANSFER YOU MUST COMPLETE THIS SECTION OR YOUR REQUEST WILL BE DELAYED.

Enter your bank account information on lines

➀

|

➁ |

|

|

➂ |

|

➃ |

|

|

|

|

|

|

|

|

|

Routing Number |

Account Number |

||

Additional Information

•The Owner’s name on the contract must be the same as the owner of the bank/financial institution account.

•Your bank or inancial institution may take 2 or more business days to deposit the funds into your account.

•Keep in mind that in order to take advantage of direct deposit, your financial institution MUST be a participating member of the AUTOMATED CLEARING HOUSE (ACH) Association.

•Please check with your bank to make sure they participate before completing this form.

Direct Deposit Agreement

By my signature in Section 9 I consent to the following:

➀Name as it appears on bank account

➁Name of Bank / Financial Institution

Bank Address

Bank − City, State & Zip Code

➂Bank ABA / Routing # (9 digits)

➃Account #

For Wire Transfers only: For Further Credit To:

Name of Client

Account Number

•By submitting and signing below you are certifying that the bank routing number and bank account number provided are accurate. You should confirm these with your bank or financial institution prior to submitting the form to ensure that you have the correct information for direct deposit. Incorrect information may misdirect and/or delay receipt of your funds.

•I certify that the above account(s) bears my name, that I am an unrestricted and authorized signor for each account and that the funds are being deposited to a financial institution within the US and will remain in a US Bank. The funds will not be credited further to an international bank.

•I hereby authorize AXA Equitable Life Insurance to directly deposit the amount of my withdrawal in the account listed above at the

•In the event that AXA Equitable notiies the inancial institution that funds to which I am not entitled have been deposited to my account, in error, I hereby authorize and direct the financial institution to return said funds to AXA Equitable as soon as possible. If the funds erroneously deposited to my account have been drawn from that account so that return of those funds by the bank to AXA Equitable is not possible, I authorize AXA Equitable to recover those funds by

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 5 of 7 |

|

9. Participant Certification

I request a hardship withdrawal to be made in accordance with federal tax rules. I understand that federal income tax of 10% will be withheld from the amount approved unless I am eligible to, and elect, not to have withholding. I understand that if my request is approved, I am required to immediately suspend for a period of six months any salary deferral contributions under the 403(b) plan sponsored by my Employer, as well as to any other

I am aware this withdrawal will increase my taxable income for the year. I further certify that this withdrawal is necessary to satisfy the immediate and heavy financial need documented, that the amount requested is not in excess of the amount necessary to relieve the financial need, and the financial need cannot be satisfied from other resources reasonably available. I have read all the information provided on this form, including the 403(b) Contract Hardship Withdrawal Requirements.

The information on this form is correct and complete to the best of my knowledge. I acknowledge that in the processing of my request, AXA Equitable may have questions about my request or need additional documentation and I agree to provide such information or additional documentation as is necessary to support my request. I authorize AXA Equitable to make a hardship withdrawal from my 403(b) Contract. I understand that the withdrawal will be effective on the date that this form, properly completed and signed, is received at AXA Equitable’s

Financial transactions processed will be verified by a confirmation notice. If you do not receive the notice within 14 days of the transaction, please notify us immediately.

Participant Signature |

Date |

Notary Public/Plan Administrator

(Needs to be completed)

State of |

|

|

|

|

|

, County of |

|

|

. |

|

On the |

|

|

day of |

|

|

year before me personally |

||||

appeared |

|

|

to me known to be the person described in |

|||||||

and who executed the foregoing instrument, and acknowledged that (s)he executed the same.

Notary Public – Stamp Here

Title & Signature of Notary Public or Plan Administrator

10. EMPLOYER AUTHORIZATION – Note: Authorized Signature needed ONLY if required by the provisions of the Employer’s Plan

The Employer sponsoring this Plan or other authorized signatory authorizes the Participant’s request for a hardship withdrawal, as permitted under the employer’s 403(b) Plan.

Signature and Title of Employer or Authorized Signatory |

Date |

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 6 of 7 |

|

403(b) CONTRACT HARDSHIP WITHDRAWAL REQUIREMENTS

Please review the following information before completing this form. Federal tax rules allow for ‘‘hardship withdrawals’’ from elective deferrals only under certain circumstances.

1.Federal tax regulations describe a hardship need as:

•an immediate and heavy inancial need of the employee. The need of the employee may include amounts necessary to satisfy speciied expenses of the employee’s spouse or dependent. Under the provisions of the Pension Protection Act of 2006, the need of the employee also may include amounts necessary to satisfy specified expenses of the employee’s primary beneficiary under the 403(b) plan, who need not be a spouse or dependent; (Treas. Reg.

•Whether a need is immediate and heavy depends on the facts and circumstances. The Regulations provide a “safe harbor” in which certain categories of expenses are deemed to be “on account of an immediate and heavy financial need’, including: (1) certain medical expenses; (2) costs relating

to the purchase of a principal residence; (3) tuition and related educational fees and expenses; (4) payments necessary to prevent eviction from, or foreclosure on, a principal residence; (5) burial or funeral expenses; and (6) certain expenses for the repair of damage to the employee’s principal residence; (Treas. Reg.

2.The hardship distribution is deemed necessary to satisfy an immediate and heavy financial need of the employee if:

•(1) the employee has obtained all other currently available distributions and loans under the plan and all other plans maintained by the employer; and

(2) the employee is prohibited, under the terms of the plan or an otherwise legally enforceable agreement, from making elective contributions and employee contributions to the plan and all other plans maintained by the employer for at least 6 months after receipt of the hardship distribution; (Treas. Reg.

3.The hardship distribution is not considered necessary to satisfy an immediate and heavy financial need of the employee if:

•the employee has other resources available to meet the need, including assets of the employee’s spouse and minor children. Whether other resources are available is determined based on facts and circumstances. Thus, for example, a vacation home owned by the employee and the employee’s spouse generally is considered a resource of the employee, while property held for the employee’s child under an irrevocable trust or under the Uniform Gifts to Minors Act is not considered a resource of the employee; (Treas. Reg.

•the employee’s need can be relieved: (1) through reimbursement or compensation by insurance; (2) by liquidation of the employee’s assets; (3) by stopping elective contributions or employee contributions under the plan; (4) by other currently available distributions (such as

4.A hardship distribution may not exceed the amount of the employee’s need. However, the amount required to satisfy the financial need may include amounts necessary to pay any taxes or penalties that may result from the distribution; (Treas. Reg.

5.Hardship distributions are includible in gross income unless they consist of designated Roth contributions. They also may be subject to an additional tax on early distributions of elective contributions. Hardship distributions are not repaid to the plan, thus permanently reducing the employee’s account balance under the plan. A hardship distribution cannot be rolled over into an IRA or another qualified plan.

Hardship Withdrawal Request |

X02105_core_f |

Cat # 141050 (07/12) |

|

Page 7 of 7 |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The 403(b) Hardship Withdrawal is governed by federal tax regulations and may also be subject to specific state laws. |

| Eligibility Confirmation | Participants must confirm that their employer allows hardship withdrawals as part of their 403(b) plan. |

| Document Submission | Supporting documents are required with the request form to validate the hardship situation for approval. |

| Approved Hardship Reasons | Hardship can be due to medical expenses, purchase of a primary residence, tuition costs, eviction, funeral expenses, or home repairs. |

| Withdrawal Limits | The withdrawal amount cannot exceed the necessary funds for the immediate financial need, including taxes. |

| Participant Information | Basic information such as name, contract number, and a day-time phone are required on the application. |

| Spousal Consent | If subject to ERISA, spousal consent is required for hardship withdrawals to comply with the Retirement Equity Act. |

| Tax Withholding | A mandatory 10% federal income tax will be withheld unless the participant opts out of withholding in the form. |

| Delivery Options | Participants can choose between several delivery methods including First Class Mail, Direct Deposit, or express delivery options. |

Guidelines on Utilizing 403B Loan Axa Hardship

Completing the 403B Loan Axa Hardship form is an essential step in accessing funds during a financial emergency. Properly filling it out can help expedite your withdrawal request. Here's a direct approach to guide you through the form efficiently. Make sure to gather any necessary documents as you proceed.

- **Participant Information:** Fill in your name, contract number, and address. Include your daytime phone number, city, state, zip code, and the last four digits of your Social Security number. Indicate if this is a change of address.

- **Withdrawal Amount Requested:** Calculate your hardship amount. Specify the total hardship withdrawal requested, including funds for taxes. If you've applied for hardship withdrawal from other companies, note their names and amounts.

- **Hardship Circumstances:** Clearly indicate your immediate financial need. The form requires you to select the reasons for your request and to attach supporting documentation.

- **Describe the Hardship Need:** Provide detailed information about your hardship. Describe when it began and how you calculated your needed amount. Include explanations regarding any other resources you considered.

- **Withdrawal Instructions from Investment Options:** Specify how to withdraw the funds - whether from Guaranteed Interest Options, Variable Investment Options, or both. List specific amounts or percentages as needed.

- **Spousal Consent Requirement:** If applicable, your spouse must either consent to the withdrawal or certify that you are not married. This part requires a notarized signature.

- **Important Tax Notification:** Decide if you want federal income tax withheld from your withdrawal. Remember, you are responsible for your tax obligations.

- **Delivery Options:** Choose how you want to receive your payment. Options include First Class Mail, Direct Deposit, Express Delivery, or Wire Transfer. Fill in the necessary banking details if you select Direct Deposit or Wire Transfer.

- **Signature Section:** Finally, sign and date the form, certifying the information you provided is correct.

Once the form is completed and necessary documentation is attached, send it via the appropriate mail options listed at the top of the form. Remember to keep a copy for your records and follow up as needed to ensure timely processing of your request.

What You Should Know About This Form

What is the purpose of the 403B Loan Axa Hardship form?

This form is designed for participants in 403(b) plans, allowing them to request a hardship withdrawal. It outlines the requirements for proving a financial need and the necessary supporting documentation to accompany the request.

What types of hardship can I claim for a withdrawal?

You can claim hardship withdrawals for specific financial needs such as medical care expenses, tuition, eviction prevention, funeral expenses, and repairs to your principal residence. Each type must be documented, so be sure to gather supporting materials like bills or notices before submitting your form.

What documentation do I need to provide?

Supporting documentation is crucial for your request to be processed. You need to attach proof related to your claimed hardship. For example, if the hardship is medical expenses, include bills or a doctor’s statement. Each circumstance listed on the form requires corresponding proof to support your financial need.

How much can I withdraw from my 403(b) plan?

The amount you can withdraw is limited to what is necessary to meet your immediate and heavy financial need. This includes covering any applicable taxes or penalties. You must ensure that your request does not exceed the total amount of your own elective deferrals.

Is my spouse’s consent required for withdrawal?

If your 403(b) plan falls under the Employee Retirement Income Security Act (ERISA), you will need your spouse's consent to proceed with a hardship withdrawal. This is due to the rights spouses have under the Retirement Equity Act of 1984. Consent must be signed and notarized to validate the request.

What are the options for receiving my funds?

You have several delivery options for receiving your withdrawal. These include direct deposit, first-class mail, express delivery, and wire transfer. Each option has different fees and processing times. Be sure to indicate your preferred method clearly on the form to avoid delays.

Common mistakes

When completing the 403B Loan Axa Hardship form, individuals often make common mistakes that can delay or even derail their application. One frequent mistake is failing to provide all required personal information accurately. Participants must ensure that their name, contract number, and contact details are complete and correctly spelled. A single typo in your Social Security number or an omission can lead to processing delays, which could potentially affect your access to necessary funds.

Another issue arises when individuals do not attach the necessary supporting documentation with their request. The form clearly states that requests lacking adequate documentation cannot be processed. For example, if you are requesting funds for medical expenses, you should include relevant bills or a doctor’s note. Omitting these documents can result in denial of the application.

Many users also misunderstand the withdrawal amount limit. A hardship distribution cannot exceed what is necessary to cover the immediate financial need. This means accurately calculating how much money you truly require is crucial. People sometimes inflate the amount requested, including costs that don't fit the criteria or ignoring other available resources they might have, which can lead to denial of the request.

Additionally, applicants sometimes overlook the spousal consent requirement. If applicable, the form demands that a spouse’s signature be included, confirming agreement to the withdrawal. Without this consent, the request may be rejected. It's wise to ensure this step is completed if the plan is subject to the Employee Retirement Income Security Act.

Furthermore, it is important to read the tax implications regarding the withdrawal. Many people fail to check if they want federal taxes withheld from their distribution which can surprise them later on tax day. Understanding these tax requirements is essential to prevent any unexpected liabilities or penalties.

Finally, miscommunication regarding the delivery method can lead to further complications. Individuals often neglect to select a payment method or provide incorrect bank details for direct deposit. It's vital to follow up on the chosen method and verify that all provided account information is accurate. This attention to detail ensures that funds are delivered promptly and without issues.

Documents used along the form

When applying for a 403B Loan and specifically using the AXA Hardship Withdrawal form, it is essential to gather various documents to support your request. These accompanying documents can help clarify your financial need and ensure that your application is processed smoothly. Here is a list of commonly required forms and documents.

- Hardship Documentation: This includes any paperwork that demonstrates your qualifying hardship, such as medical bills, eviction notices, or funeral expenses. This documentation substantiates your claims regarding immediate financial needs.

- Tax Documents: Submitting previous years’ tax returns may provide insight into your financial situation. These documents can help support your claims about income or unexpected financial difficulties.

- Employer Confirmation Letter: A letter from your employer confirming your participation in the 403(b) plan can be necessary. This document proves that you are eligible to make a hardship withdrawal.

- Proof of Income: Pay stubs or bank statements can serve to demonstrate your current financial condition and the extent of your need for hardship withdrawal.

- Spousal Consent Form: If applicable, this form verifies consent from your spouse regarding the hardship withdrawal. It's particularly important for plans governed by ERISA regulations.

- Loan Application Form: If you are seeking a loan against your 403(b), this specific application form is essential. Ensure that all required information is completed and accurate.

- Withdrawal Instructions: Guidelines on how you want your funds distributed, specifying whether you prefer direct deposit or a check, should be clearly stated to avoid any delays.

- Notarized Signature: In some cases, a notarized signature may be required on certain forms to authenticate your identity and the legitimacy of your claims.

- Financial Plan Documentation: If you’re considering other financial options, including loans or liquidating assets, providing documentation regarding these plans can help paint a full picture of your financial situation.

Gathering these documents will not only aid in the smooth processing of your hardship withdrawal but also offer a clearer understanding of your financial needs during a challenging time. Take the time to ensure each form is complete and accurate, as this attention to detail can help prevent delays and make your experience less stressful.

Similar forms

Hardship Withdrawal Request Form: This document outlines the process for individuals requesting a withdrawal from their retirement plans due to financial hardship. Similar to the 403B Loan AXA Hardship form, it requires participants to provide detailed information regarding their financial situation and to submit supporting documentation to justify their need for funds.

Emergency Loan Request Form: Both forms demand personal information, such as social security number and contact details. The Emergency Loan Request Form also necessitates a description of the emergency and evidence of financial need, paralleling the requirements established in the AXA Hardship document.

Financial Assistance Application: This form serves a similar purpose, as it allows individuals to apply for monetary assistance during times of need. Like the AXA Hardship form, it requests a comprehensive explanation of the financial hardship involved and requires appropriate documentation to support the request.

Retirement Plan Withdrawal Request Form: This document functions to initiate the withdrawal process from retirement accounts, echoing the structure of the 403B Loan AXA form. It asks for the withdrawal amount and requires the participant to describe their financial emergency, ensuring a clear pathway for processing the request.

Dos and Don'ts

- Do read the "403(b) Contract Hardship Withdrawal Requirements" before starting.

- Don't forget to provide your certificate number; it is mandatory.

- Do attach all necessary supporting documents to validate your hardship claim.

- Don't submit the form without checking for accuracy and completeness.

- Do specify the amount you need clearly, including any additional funds for taxes.

- Don't overlook the potential tax implications; consult your tax advisor if needed.

- Do reach out to AXA Equitable if you have questions or need assistance at any stage.

Misconceptions

- Misconception 1: You can receive a 403(b) loan regardless of your employer’s rules.

- Misconception 2: You don’t need documentation for a hardship withdrawal.

- Misconception 3: The entire amount in your account can be withdrawn as hardship distribution.

- Misconception 4: You must withdraw the total amount requested immediately.

- Misconception 5: Hardship withdrawals can only be used for medical expenses.

- Misconception 6: Once you apply for a hardship withdrawal, you can’t change your mind.

- Misconception 7: There are no tax implications for hardship withdrawals.

- Misconception 8: You can use funds from any investment option for a hardship withdrawal.

- Misconception 9: Any spouse’s consent is required for all hardship withdrawals.

- Misconception 10: You can apply for a hardship withdrawal without considering other financial resources.

The truth is, some employers have specific policies regarding hardship withdrawals. If your employer does not allow for hardship withdrawals, your request will not be processed.

In reality, proper supporting documentation is crucial. Without adequate proof of your financial need, your request cannot be processed.

This is incorrect. A hardship withdrawal may only include the amount necessary to cover immediate and heavy financial needs, which means you cannot withdraw more than is actually needed.

You can specify the exact amount needed. There is no requirement to take out the full value if your needs are less.

This is not true. While medical expenses are one category, other qualifying events also include purchasing a principal residence or paying tuition, among others.

Actually, you can choose to withdraw your application before it is processed. Just be sure to communicate your decision promptly.

This is misleading. Hardship distributions are typically subject to federal income tax, and you may also incur penalties unless certain conditions are met.

Not all investment options may be available for withdrawals. Your selection will depend on the specifics of your 403(b) plan and your investment allocations.

This only applies to certain plans under the Employee Retirement Income Security Act (ERISA). You will need spousal consent only if your plan is governed by ERISA.

In fact, you must show that you have exhausted other resources before a hardship withdrawal can be approved. This may include loans or other assets.

Key takeaways

1. Before filling out the form, read the "403(b) Contract Hardship Withdrawal Requirements" as it lays out essential criteria for hardship withdrawals.

2. Confirm that your employer allows hardship withdrawals. If they don’t, AXA Equitable will not process your request.

3. Clearly state your hardship situation and ensure it aligns with federal tax regulations, demonstrating that no other financial resources are available.

4. Complete all participant information accurately. You will need your certificate number and the last four digits of your Social Security number.

5. Specify the amount you need. Remember, it cannot exceed what's necessary to address your immediate financial need, including any applicable taxes.

6. Provide supporting documentation with your request. Insufficient documentation might lead to delays or rejection of your application.

7. Consider discussing your situation with a financial professional to understand your withdrawal options and any implications involved.

8. Make sure to select how you want your funds delivered, whether by mail, direct deposit, or another option. Ensure bank details are accurate if applicable.

9. Spousal consent is required for participants in ERISA plans. If married, your spouse must consent to the withdrawal, which must be notarized.

Browse Other Templates

Step Mom in Kitchen - The report checks for fan accessibility and tippable conditions.

Does Hospice Pay for Cremation - It ensures that all parties involved in the cremation are properly documented and authorized.

Lost Title Application - This application replaces the original title and any previously issued copies.