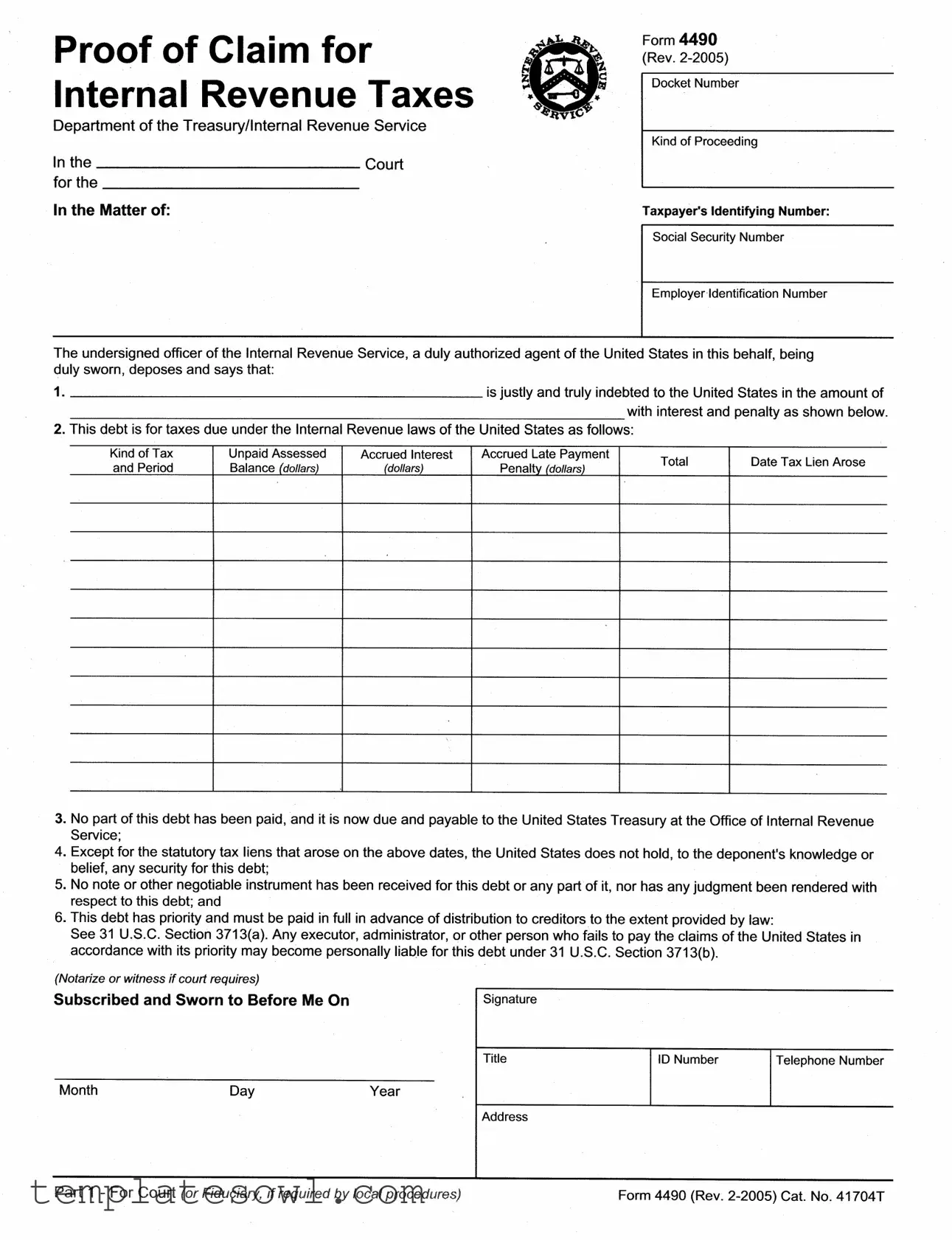

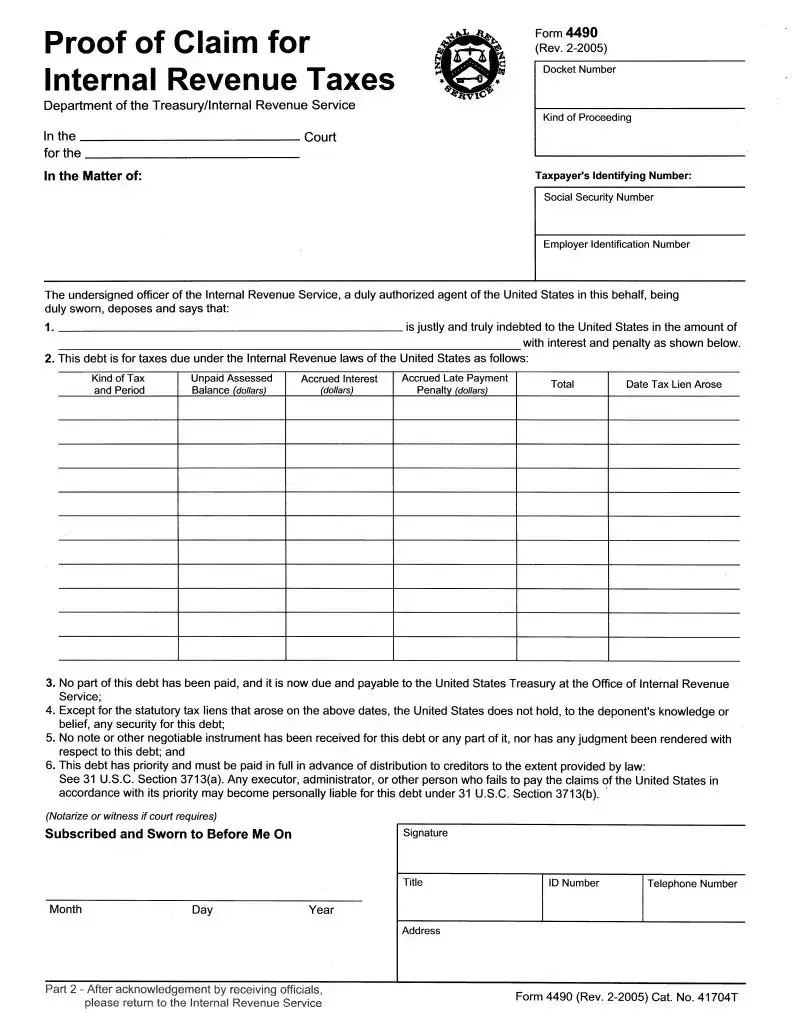

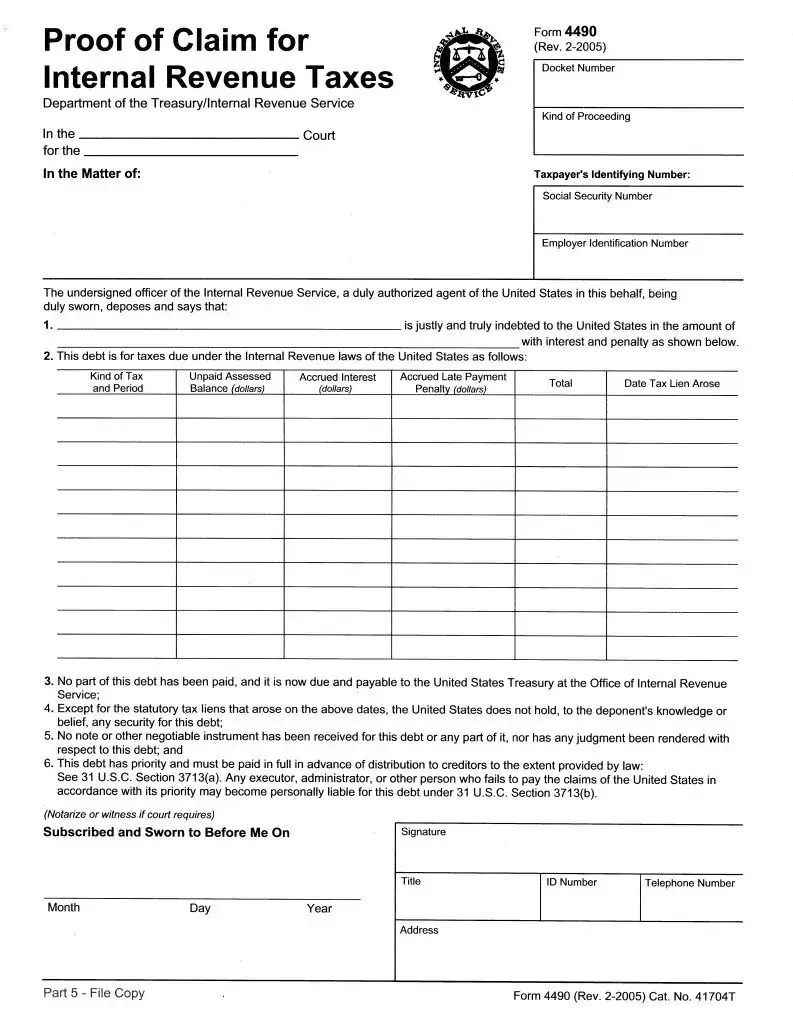

Fill Out Your 4490 Form

The Form 4490 serves as a Proof of Claim for Internal Revenue Taxes and plays a critical role in the legal processes surrounding tax debts owed to the United States. This form is utilized in court proceedings to formally declare the amount a taxpayer owes, along with any accrued interest and penalties. Information required includes identifying details like the taxpayer's Social Security Number or Employer Identification Number and specifics about the debt, including the type of tax and any related financial penalties. The form outlines provisions that establish the priority of this tax debt, indicating that it must be settled before other creditors receive payment. Moreover, it warns that failure to address these claims may result in personal liability for executors or administrators overseeing the estate. The entirety of the claim must be carefully sworn to and can require notarization, ensuring its validity within legal frameworks. Understanding the intricacies and requirements of Form 4490 is essential for both taxpayers and legal representatives who navigate these complex situations.

4490 Example

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The 4490 form serves as a Proof of Claim for Internal Revenue Taxes owed to the United States. |

| Governing Body | It is issued by the Department of the Treasury/Internal Revenue Service (IRS). |

| Revision Date | The current revision date of the form is February 2005. |

| Required Information | Taxpayer identification numbers, including Social Security Number (SSN) and Employer Identification Number (EIN), must be included. |

| Debt Acknowledgment | The form requires that the debtor acknowledges their indebtedness to the United States. |

| Tax Lien Details | It demands details about the kind of taxes owed, including any unpaid assessments, accrued interest, and penalties. |

| Debt Payment Status | The form asserts that no part of the debt has been paid and is now due. |

| Statutory Tax Liens | It notes that the U.S. does not hold security for the debt, except for statutory tax liens that may exist. |

| Legal References | The form refers to 31 U.S.C. Sections 3713(a) and 3713(b), outlining payment priority and potential personal liability for noncompliance. |

Guidelines on Utilizing 4490

Completing Form 4490 is an essential step for individuals or entities needing to assert a claim for tax owed to the Internal Revenue Service (IRS). Filling out this form requires careful attention to detail, ensuring all necessary information is provided accurately. The following steps will guide you through the process efficiently.

- Gather Required Information: Collect relevant details including your Taxpayer Identification Number, Social Security Number, or Employer Identification Number.

- Enter the Court Information: Write the name of the court where the proceeding is taking place and the docket number assigned to your case.

- Identify the Debtor: Clearly state the name of the individual or entity that is indebted to the United States.

- Specify the Amount Owed: Fill in the total amount of debt owed. Ensure to include any interest and penalty amounts with supporting calculations attached.

- Detail the Tax Information: In the designated area, specify the type of tax, unpaid balance, assessed amounts, accrued interest, and any penalties. Include precise dates and total amounts.

- Indicate Payment Status: Confirm that no part of this debt has been paid, and acknowledge that it is due to the U.S. Treasury.

- Submit Acknowledgments: Include a statement regarding statutory tax liens and other security associated with the debt.

- Notarization: If required, ensure to have the form notarized or witnessed as specified by the court.

- Finalize and Review: Double-check all entries for accuracy and completeness before signing the form at the bottom.

- File the Form: Make a copy for your records, and submit the completed form to the appropriate court or fiduciary as required.

After completing the form, ensure all supporting documentation is attached. Follow the submission instructions carefully to avoid delays. Should any questions arise during this process, consulting with a tax professional or legal advisor may provide valuable assistance.

What You Should Know About This Form

What is Form 4490?

Form 4490 is a document used as proof of claim for internal revenue taxes owed to the United States. It is completed by an officer of the Internal Revenue Service (IRS) and submitted in bankruptcy or other court proceedings. This form details the amount owed, including any interest and penalties, and serves as a formal notice of the debt to the relevant court.

Who uses Form 4490?

The form is utilized primarily by authorized agents of the IRS. These agents complete the form to establish a claim against individuals or entities that owe federal taxes. The claim is noted in court proceedings to ensure that the debt is acknowledged and prioritized in accordance with federal law.

What information is required to complete Form 4490?

To complete Form 4490, the following details are required: the taxpayer's identifying number (either a Social Security Number or Employer Identification Number), the amount owed to the United States, types of taxes and their respective amounts (including assessed and late payment balances), accrued interest, and penalties. Additionally, the dates on which tax liens arose and the circumstances surrounding the debt must be included.

What is the significance of the debt priority mentioned in Form 4490?

The debt outlined in Form 4490 holds a priority status, meaning it must be paid before any other creditor claims are addressed. This is mandated by federal law, specifically 31 U.S.C. Section 3713(a). If individuals acting as executors or administrators fail to pay this debt in compliance with its priority, they may face personal liability for the amount owed under 31 U.S.C. Section 3713(b).

What happens after submitting Form 4490?

After the completion and submission of Form 4490, it is presented to the appropriate court or fiduciary. The court acknowledges receipt of the form, and it may be used in proceedings to determine the distribution of assets, taking into account the priority of the United States' claim. A copy of the form is typically returned to the IRS for their records.

Is notarization required for Form 4490?

Yes, notarization or witnessing may be required for Form 4490, depending on local court procedures. The signature of the IRS officer is necessary to authenticate the submission, ensuring that the information provided is accurate and duly sworn.

Common mistakes

Filling out the 4490 form, known as the Proof of Claim for Internal Revenue Taxes, can be a complex process for many individuals. Mistakes are frequent, particularly for those unfamiliar with tax-related paperwork. One common error involves incomplete information. Individuals may neglect to fill in critical sections, such as the amount owed or the specifics of the tax liability. Each blank represents an essential piece of information that the court or the IRS requires to process the claim appropriately.

Another mistake often occurs when providing identifying numbers. People sometimes confuse Social Security Numbers with Employer Identification Numbers, leading to incorrect or delayed processing. Accuracy in these numbers is crucial, as any discrepancies can hinder the credibility of the claim.

Many individuals also fail to provide adequate supporting documentation. It is not enough to simply claim a debt exists; proofs of tax assessments and other relevant details must accompany the form. Without this documentation, the claim may be dismissed or delayed significantly.

Another frequent oversight relates to the signature requirement. Submitting the form without a proper signature can invalidate the entire claim. Individuals must ensure that all signatures are in place and align with the official titles of the signatories.

Moreover, missing deadlines is a significant concern. Each legal proceeding has specific timelines, and failing to submit the form within these periods can result in losing one’s right to make a claim. Keeping track of all relevant dates is vital for maintaining one's standing in the matter.

A lack of clarity in detailing the debts also poses a substantial risk. When individuals do not clearly outline each debt, along with its accumulation of interest and penalties, it can lead to misunderstandings or misinterpretations by the court or the IRS. A detailed and transparent representation of financial obligations is essential to avoid complications.

Some individuals neglect to notarize the form when necessary. If the court or local procedures require notarization, failing to do so can invalidate the claim, leading to significant setbacks in resolving tax issues.

It is also important to be aware of the consequences of ignoring notifications. If the IRS or the court sends notifications regarding the claim, individuals must respond promptly. Ignoring such communications can result in adverse decisions that are difficult to reverse.

Lastly, individuals tend to overlook the importance of maintaining copies of the completed form and any accompanying documents. Keeping a record of what has been submitted plays a crucial role in tracking claims and addressing future inquiries or disputes. Being meticulous in maintaining documentation can save considerable stress down the line.

Documents used along the form

When filing a proof of claim for internal revenue taxes using Form 4490, several other forms and documents may accompany it. Each of these documents serves a unique purpose and can streamline the process, ensuring that every necessary detail is accurately reported. Here’s a list of commonly used forms.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return from the IRS. It is useful for verifying income and tax-related information when applying for loans or disputing a claim.

- Form 940: Employers use this annual tax form to report their Federal Unemployment Tax Act (FUTA) taxes. Understanding FUTA obligations can help in managing overall tax liabilities and avoid penalties.

- Form 941: This quarterly form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Maintaining accurate records ensures compliance with employer tax responsibilities.

- Form 1040: The standard form for individual income tax returns. This document provides a complete overview of a taxpayer's income, deductions, and credits, informing any outstanding obligations or claims on Form 4490.

- Form 12039: This is a claim for refund or request for abatement form. It can be filed to recover funds previously paid to the IRS when taxpayers believe they have been overcharged or that a penalty should be abated.

- Form 8821: Taxpayers use this form to authorize the IRS to disclose their tax information to specific individuals. It can be critical for allowing representatives to handle tax matters on behalf of the taxpayer.

- Form 4506: This form requests a copy of a previously filed tax return. It may be vital for individuals wanting to substantiate their tax filings or correct discrepancies.

- Form 656: Used for submitting an offer in compromise, which allows taxpayers to settle their tax liabilities for less than the total owed. This document can greatly impact the resolution of tax debts.

- Form 8822: This form allows taxpayers to notify the IRS of a change in address. Keeping contact information current is essential to receiving important tax information and notices.

- Schedule C: For sole proprietors, this schedule details income and expenses related to business activities. It connects directly to Form 1040 and can affect the overall tax situation of the individual.

Utilizing the appropriate forms in conjunction with Form 4490 not only helps to ensure compliance with IRS regulations but also aids in an organized approach to managing tax-related documentation. Each form plays a specific role and contributes to a clear financial picture and streamlined resolution of tax claims.

Similar forms

The Form 4490, known as the Proof of Claim for Internal Revenue Taxes, has several similarities to other documents used in legal and tax proceedings. Below is a list of these similar forms, highlighting their common features.

- Proof of Claim (Form 410) - This form is used in bankruptcy proceedings to assert a creditor's claim against the debtor's estate, much like how Form 4490 asserts a tax claim against the taxpayer's obligations.

- Federal Tax Lien (Form 668-Y) - Used to formally establish a federal tax lien against a taxpayer's property, this document parallels Form 4490's function of detailing tax debts owed to the government.

- IRS Collection Due Process Request (Form 12153) - This form allows taxpayers to appeal certain IRS collection actions, similar to how Form 4490 communicates tax obligations to the court.

- Notice of Federal Tax Lien - Issued by the IRS, this document informs taxpayers of a tax lien on their assets, akin to the claims made on Form 4490 regarding unpaid taxes.

- Claim for Refund (Form 843) - This form allows taxpayers to request refunds from the IRS, sharing an underlying theme of addressing tax-related issues as seen in Form 4490.

- Request for Relief from Joint and Several Liability (Form 8857) - Used by one spouse seeking relief from tax liabilities incurred during marriage, it similarly addresses tax debts and relief obligations.

- Application for Tentative Refund (Form 1045) - It enables taxpayers to apply for a quick refund based on certain tax losses, maintaining a connection to the overarching issue of tax recovery.

- Certificate of Assessments and Payments (Form 4340) - This form provides proof of tax liabilities and payments, resonating with Form 4490's role in documenting tax debts.

- Court Petition for Judicial Review - This document initiates a request for court intervention on tax disputes, much like how Form 4490 is used in court proceedings regarding tax claims and debts.

Dos and Don'ts

When filling out the 4490 form, here are essential do's and don'ts to keep in mind:

- Do provide accurate taxpayer information, including Social Security and Employer Identification numbers.

- Do clearly list all applicable taxes due, including any interest and penalties.

- Do ensure the total amount due is calculated correctly.

- Do sign and date the form where required to validate your claim.

- Don't leave any sections blank unless explicitly instructed to do so.

- Don't submit the form without verification of all calculations and data.

- Don't ignore any notarization requirements, if applicable, as this could invalidate your claim.

Misconceptions

Understanding the Form 4490 requires some clarity, as there are several misconceptions surrounding it. Here’s a breakdown of eight common misunderstandings:

- Form 4490 is only for individuals. Many believe this form is solely for personal tax issues, but it applies to both individuals and entities with tax debts to the IRS.

- Filing Form 4490 guarantees debt forgiveness. Submitting this form does not mean the IRS will forgive your tax debt; it’s a formal claim process.

- Only the IRS can file Form 4490. While the IRS uses this form, creditors can also file it to assert their claims against the tax debtor.

- The form is optional and can be ignored. Ignoring Form 4490 can lead to serious consequences, including loss of rights to contest the IRS claim.

- Form 4490 is unnecessary if you pay your taxes. Even if you pay your taxes on time, filing may still be required to ensure your payments are recorded correctly.

- You need a lawyer to file Form 4490. While legal counsel can help, individuals can file the form without an attorney.

- Form 4490 will automatically stop tax liens. Simply filling out this form does not halt IRS collection actions or liens from being imposed.

- Once filed, the form cannot be amended. You can amend Form 4490 to correct any errors, but it must be done following the IRS guidelines.

Addressing these misconceptions can help you better navigate the process related to tax claims and obligations. Understanding how Form 4490 works is essential for ensuring accurate management of tax responsibilities.

Key takeaways

The 4490 form is a crucial document for those dealing with claims for internal revenue taxes. Here are some key takeaways to consider:

- The form is specifically used to file a proof of claim with the Internal Revenue Service (IRS), acknowledging a debt to the United States.

- Accurate completion of the form is essential. Any errors could delay processing or result in rejection.

- Include all relevant taxpayer identification numbers: the Social Security Number and Employer Identification Number, if applicable.

- The form requires the petitioner to disclose the amount owed, including any assessed interest and penalties.

- Verification of the debt is critical. The form states that no part of the debt has been paid and must include supporting details.

- It is important to understand that debts documented on the form have a high priority in judicial proceedings.

- The form should be notarized or witnessed if required by the court, which necessitates proper acknowledgment of the signature.

- Once filled, a copy of the form should be retained for personal records after submission to the IRS.

- Individuals filing the form may face personal liability if they fail to pay the claims of the IRS in accordance with its priority.

Browse Other Templates

Vital Sign Log Sheet - Healthcare providers can document peak flow readings here.

Ca Repo Affidavit - Records of repossession must be maintained for future reference, as needed.

How to Fill Out Affidavit for Collection of Personal Property California - Proper use of the affidavit can lead to a quicker resolution of estate matters.