Fill Out Your 4905 Ftb Form

The FTB 4905 form, also known as the Offer in Compromise application, is an important tool for individuals facing challenges in settling their California income tax liabilities. Designed for those who may not have the financial means to pay their full tax obligations, this form allows taxpayers to propose a settlement for less than they owe. It guides applicants through a structured process that requires detailed personal and financial information, including employment income, asset and liability assessments, and an evaluation of monthly expenses. To ensure completeness and accuracy, the form includes a checklist of necessary documentation that must accompany the application. Key factors affect eligibility, such as the taxpayer's ability to pay, the equity they hold in their assets, and their current and projected income. Moreover, the form emphasizes the need for transparency, requiring all necessary tax returns to be filed before submitting an OIC. As individuals navigate this process, understanding the implications of a successful offer—including the potential for collateral agreements—can lead to a significantly manageable resolution of their tax debts.

4905 Ftb Example

FTB 4905 PIT BOOKLET

Offer in Compromise

for Individuals

Table of Contents

What You Need to Know Before You Prepare an Offer in Compromise . . . . . . . . . . . . . . . . . . . . . . . . 1 Offer in Compromise Application Form – Checklist of Required Items. . . . . . . . . . . . . . . . . . . . . . . . . 2 Section 1 – Personal Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Section 2 – Employment or Business Income Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Section 3 – General Financial Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Section 4 – Asset and Liability Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Section 5 – Monthly Household Income and Expense Analysis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Section 6 – Three Year Income Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Section 7 – Basis for the Offer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Section 8 – Source of Funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Section 9 – Offer Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Section 10 – Statement of Agreement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Frequently Asked Questions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

An Offer in Compromise (OIC) provides an alternative for individuals who are unable to pay their outstanding California income tax liabilities, and who won’t be able to in the foreseeable future.

What You Need to Know Before Preparing an Offer in Compromise

Eligibility: If you are an individual without the income, assets, or means to pay your tax liability now or in the foreseeable future, you may be eligible for an OIC. The OIC Program allows you to offer a lesser amount for payment of a nondisputed final tax liability.

Generally, we approve an OIC when the amount offered represents the most we can expect to collect within a reasonable period of time.

Although each case is evaluated based on its own unique set of facts and circumstances, we give the following factors strong consideration in the evaluation:

•Your ability to pay.

•Your equity in assets.

•Your present and future income.

•Your present and future expenses.

•The potential for changed circumstances.

•The offer is in the best interest of the state.

Your |

We will only process your OIC application once you: |

Application: |

|

•File all required tax returns. If you have no filing requirement, note it on the application.

•Fully complete the OIC application and provide all supporting documentation.

•You agree with the Franchise Tax Board (FTB) on the amount of tax you owe.

Collateral |

Upon approval of your offer, we may require you to enter into a collateral agreement. If you |

Agreement: |

have a significant potential for increased earnings, we may require that you pay a greater |

|

portion or all of your original tax liability if you earn more than anticipated during the five |

|

year period following FTB’s approval of your OIC. |

Collection |

Submitting an offer does not automatically suspend collection activity. If delaying collection |

Activity: |

activity jeopardizes our ability to collect the tax, we may continue collection efforts. Interest, |

|

fees, and penalties continue to accrue as prescribed by law. |

When to pay: |

Do not submit the offer amount until we request it. When we ask for the funds, submit them |

|

by cashier’s check or money order. |

FTB 4905 PIT CI (REV

STATE OF CALIFORNIA

OIC GROUP MS A453

FRANCHISE TAX BOARD

PO BOX 2966

RANCHO CORDOVA CA

OFFER IN COMPROMISE APPLICATION FORM

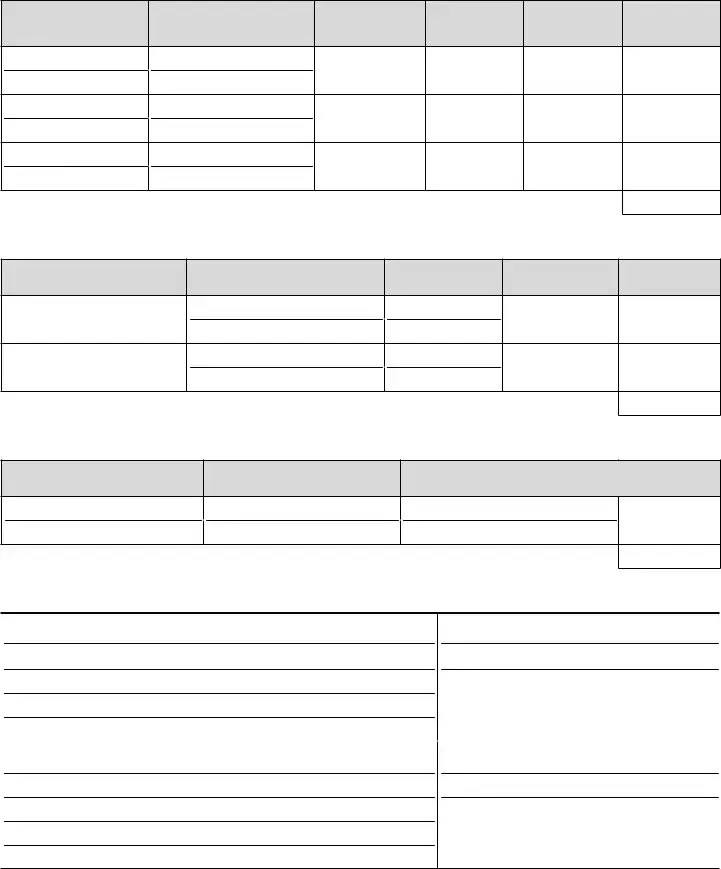

Checklist of Required Items

You must submit the following documentation with your Offer in Compromise Application Form or we will return your application as incomplete. You must include the information for you and your spouse/Registered Domestic Partner (RDP). Please submit copies only. Indicate if any of the items below are not applicable (N/A). We may request additional documentation.

N/A Included

mm Veriication of Income

Complete pay stubs for the past three months, or financial statements for the past two years if

mm Veriication of Expenses

Billing statements for the last three months. (Include copies of revolving charge card statements, bills from other creditors, and personal loan statements.)

mm Bank Information

Complete bank statements for savings and checking accounts for the last six months. If

mm Securities

Investment account statements showing the value of stocks, bonds, mutual funds, and/or retirement or profit sharing plans, e.g., IRA, 401(k), Keogh, or Annuity.

mm Current Lease or Rental Agreements

mm Real Property Information

Mortgage statements and escrow statements for property you currently own, sold, or gave away in the last five years.

mm Internal Revenue Service (IRS) Information

IRS OIC application and acceptance letter or other IRS arrangements.

mm Legal Documents

Marital settlement agreements, divorce decrees, marital property settlements, trust documents, and bankruptcy documents.

mm Medical Information

Physician’s letter including diagnosis and prognosis and/or other documents to show any medical condition that should be considered.

mm Power of Attorney

Power of Attorney if a designated representative submits this offer.

Mail your completed and signed application to the address listed above.

If you have any questions, contact the OIC group at 916.845.4787 (not

FTB 4905 PIT C1 (REV

Note: Complete all areas that are not shaded. Write “n/a” in those blocks that do not apply. For Privacy Notice information, please read the enclosed FTB 1131. To get additional copies of this notice, call us at 800.338.0505; from outside the United States call 916.845.6600 (not

Section 1 – Personal Information

First name |

MI |

Last name |

|

|

|

Social security number |

Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other names and aliases ever used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First name of spouse or Registered Domestic |

MI |

Last name of spouse or RDP |

|

Social security number |

Date of birth |

|||

Partner (RDP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other names and aliases ever used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s driver’s license number |

|

State |

Spouse or RDP driver’s license number |

|

State |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Dependent’s names |

|

|

|

Date of birth |

Social security number |

Relationship |

||

|

|

|

|

|

|

|

|

|

Current mailing address

Phone number

()

Cell phone number

()

Current physical address

Previous address if at current address less than two years

Name and address of your tax representative (attach a Power of Attorney)

Phone number

()

Cell phone number

()

Fax phone number

()

FTB 4905 PIT CI (REV

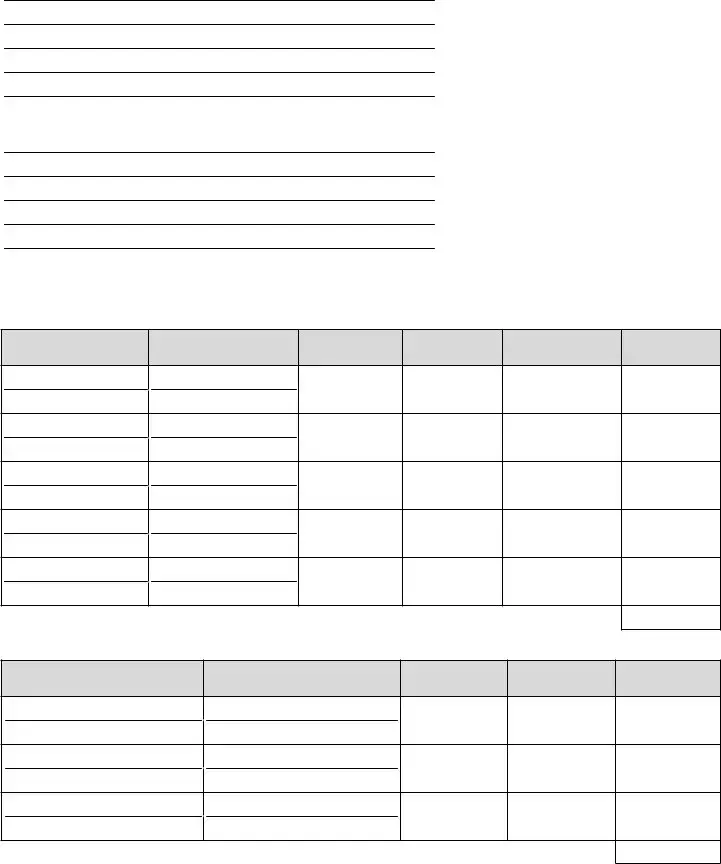

Section 2 – Employment or Business Income Information

Taxpayer’s employer or business (name and address): |

|

|

|

|

|

|

How long employed: _______ Years |

_______ Months |

|

|

|

Occupation: __________________________________ |

||

|

|

m Wage earner |

mSole proprietor |

|

|

|

mPartner |

mOfficer |

|

|

|

Paid: |

mBiweekly |

|

|

|

m Weekly |

||

Business phone number: ( |

) |

mMonthly |

mSemimonthly |

|

|

|

|

||

|

|

|

|

|

Spouse’s or RDP’s employer or business (name and address): |

|

|

|

|

|

|

How long employed: _______ Years |

_______ Months |

|

|

|

Occupation: __________________________________ |

||

|

|

m Wage earner |

mSole proprietor |

|

|

|

mPartner |

mOfficer |

|

|

|

Paid: |

mBiweekly |

|

|

|

m Weekly |

||

Business phone number: ( |

) |

mMonthly |

mSemimonthly |

|

|

|

|

||

Section 3 – General Financial Information

Bank accounts: (include IRA and retirement plans, certificates of deposit, etc.). Attach additional pages if needed.

Name of Institution

Address

Type

Date

Opened

Account Number

Balance

Total. Enter this amount on line 2, Section 4 (Asset and Liability Analysis) of this application . . .

Vehicles: Attach additional pages if needed.

Year, Make, Model,

License Number

Lender/Pink Slip

Holder

Current Market

Value

Current Payoff

Available Equity

Total. Enter this amount on line 3, Section 4 (Asset and Liability Analysis) of this application . . .

FTB 4905 PIT C1 (REV

Section 3 – General Financial Information (continued)

Life insurance. Attach additional pages if needed.

Name of Insurance

Agent’s Name

and Phone Number

Policy Number

Type

Face Amount

Loan/Cash

Surrender

Value

Total. Enter this amount on line 4, Section 4 (Asset and Liability Analysis) of this application . . .

Securities. (Stocks, bonds, mutual funds, money market funds, etc.) Attach additional pages if needed.

Type

Where Located

Owner of Record

Quantity or

Denomination

Current Value

Total. Enter this amount on line 5, Section 4 (Asset and Liability Analysis) of this application . .

Safe deposit boxes rented or accessed locations, box numbers, and contents. Attach additional pages if needed.

Name of Institution

Address

Box Identification

Current Value

of Assets

Total. Enter this amount on line 6, Section 4 (Asset and Liability Analysis) of this application . .

Real property. Attach additional pages if needed.

A) Physical address and description: (Single family dwelling,

|

How is title held: _________________________________ |

|

Purchase Price: _______________ |

Parcel Number: |

Purchase Date: _______________ |

|

|

B) Physical address and description: (Single family dwelling, |

Mortgage lender’s name and address: |

|

How is title held: _________________________________ |

|

Purchase Price: _______________ |

Parcel Number: |

Purchase Date: _______________ |

FTB 4905 PIT CI (REV

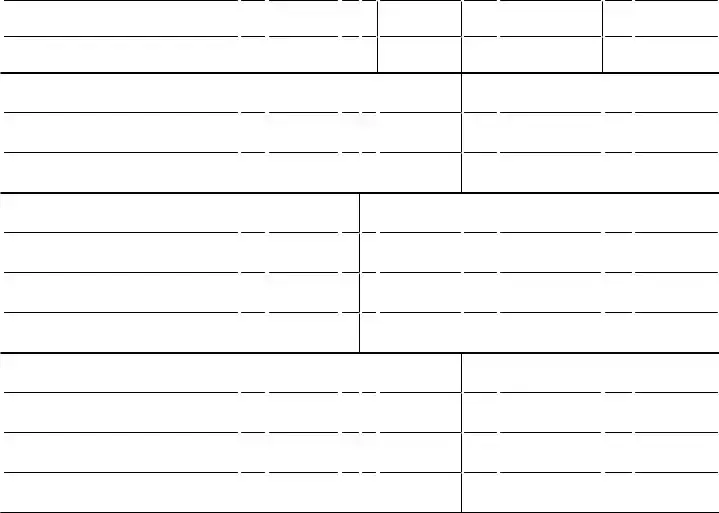

Section 3 – General Financial Information (continued)

C) Physical address and description: (Single family dwelling,

Parcel Number:

Mortgage lender’s name and address:

How is title held: ____________________________

Purchase Price: _______________

Purchase Date: _______________

Charge cards and lines of credit. Attach additional pages if needed.

Type of |

Name and Address of |

Minimum Monthly |

Credit Limit |

Credit |

Amount Owed |

|

Account |

Creditor Grantor |

Payment |

Availability |

|||

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Payments.

Enter total of payments on line 61,

Section 5 of this application. . . . . . . . . . . . . . . . . .

Total Owed.

Enter total owed on line 22, Section 4 of this application. . .

Provide the following information relating to you and your spouse/RDP’s financial condition. If you check “Yes”, provide dates, explanation, and documentation.

Court proceedings |

mNo mYes |

|

Repossessions |

mNo mYes |

|

Anticipated increase in income |

mNo mYes |

|

Bankruptcies/receiverships |

mNo mYes |

|

Recent transfer of assets |

mNo mYes |

|

Beneficiary to trust, estate, profit sharing, etc. . |

mNo |

mYes |

Last California income tax return filed |

Year |

_____ |

Total exemptions you claim from return: |

___________ |

|

Adjusted gross income from return: |

___________ |

|

List any vehicles, equipment, or property sold, given away, or repossessed during the past five years.

DescriptionValue (Year, make, model of vehicle, or property address)

FTB 4905 PIT C1 (REV

Section 4 – Asset and Liability Analysis

Immediate assets

1. Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Bank accounts/balance (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Vehicles/available equity (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Loan/cash surrender value of life insurance (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Securities (from Section 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Safe deposit box value of contents (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Immediate Assets . . . . . . . . . . . .

Real property (from Section 3)

|

Address or Location |

Current Market |

Mortgage |

Equity |

|

Value |

Payoff Amount |

||

|

|

|

||

7. |

A) |

|

|

|

8. |

B) |

|

|

|

9. |

C) |

|

|

|

Total Equity . . . . . . . . . . . . . . . . . . . . . .

Other assets

10. Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Judgements/settlements receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Aircraft, watercraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Interest in trusts, e.g., trustee, trustor, beneficiary, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Interest in estates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Interest in business entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Other Assets. . . . . . . . . . . . . . . . .

21. Sum Total of Assets (Immediate, Equity, and Other). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Current liabilities including judgements, notes and other charge accounts. Do not include vehicle or home loans.

22. Total owed for lines of credit (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23. Taxes owed to IRS (provide a copy of recent notices) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24. Other liabilities _____________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25. Other liabilities _____________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26. Other liabilities _____________________________________. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27. Other liabilities _____________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Liabilities . . . . . . . . . . . . . . . . . .

FTB 4905 PIT CI (REV

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Title | The FTB 4905 form is officially titled "Offer in Compromise for Individuals." |

| Purpose of the Form | This form allows individuals to propose a reduced payment for their California income tax liabilities. |

| Eligibility Criteria | Individuals with limited income or assets, unable to pay their tax liability now or in the foreseeable future, may be eligible for an Offer in Compromise. |

| Required Documentation | Applicants must submit various documents, including proof of income, expenses, bank statements, and any applicable legal documents. |

| Application Processing | FTB processes the application only after verifying that all required tax returns have been filed. |

| Collaboration with IRS | Applicants must include any IRS OIC application and acceptance letters, if applicable. |

| Collection Activity | Submitting an offer does not stop ongoing collection efforts. Continued collection may occur until approval is granted. |

| Governing Laws | The process and criteria for Offers in Compromise are governed by the California Revenue and Taxation Code. |

Guidelines on Utilizing 4905 Ftb

Completing the FTB 4905 form requires careful preparation and attention to detail. Every section of the application must be filled out thoroughly to ensure a complete submission. Gathering all necessary supporting documents ahead of time will help streamline the process and avoid delays.

- Obtain the FTB 4905 form from the Franchise Tax Board's website or local office.

- Read the instructions included with the form carefully to ensure you understand the requirements.

- Fill out Section 1, providing your personal information such as your name, address, and Social Security number.

- Complete Section 2 by detailing your employment or business income information over the required time period.

- Provide your financial situation in Section 3, ensuring to include all sources of income and debts.

- Analyze your assets and liabilities in Section 4, listing everything you own and owe.

- Document your monthly household income and expenses in Section 5. Be precise with your figures.

- Summarize your income for the past three years in Section 6. This summary will provide context for your current financial situation.

- Explain the basis for your offer in Section 7, highlighting any significant financial hardships.

- Identify the source of funds in Section 8 that you propose to use for settling your tax liabilities.

- Enter your proposed offer amount in Section 9, making sure it reflects the lowest amount you can realistically pay.

- Sign and date the Statement of Agreement in Section 10, confirming all statements provided are true and complete.

- Gather required supporting documents as outlined in the checklist included with the form.

- Mail the completed application and supporting documentation to the address indicated on the form.

What You Should Know About This Form

What is the FTB 4905 form?

The FTB 4905 form, officially titled "Offer in Compromise for Individuals," is used by California residents to request a reduction in their tax liability. If you find it challenging to pay your full tax amount due to financial hardship or other valid reasons, this form allows you to propose a lesser amount for settlement. It serves as an opportunity for individuals to alleviate tax burdens when they cannot pay the full amount now or in the foreseeable future.

Who is eligible to file an Offer in Compromise using the FTB 4905 form?

Eligibility for an Offer in Compromise generally applies to individuals who lack the income and assets necessary to pay their tax liabilities. Factors considered include your current financial situation, future income potential, asset equity, expenses, and the likelihood of changing circumstances. If you believe you fit within these parameters, you might be eligible to file the form.

What documentation must be submitted with the FTB 4905 form?

When submitting the FTB 4905 form, it's crucial to include specific documents to avoid delays. Required items include verification of income for the past three months, documentation of expenses for the last three months, bank statements, investment account statements, current lease agreements, real property information, IRS OIC application details, legal documents, and any necessary medical information. Always submit copies and indicate any items that don’t apply to your situation.

Will submitting an Offer in Compromise stop collection activities?

Submitting the FTB 4905 form does not automatically halt collection efforts by the Franchise Tax Board. If the tax authority believes that delaying collection might hinder their ability to collect the taxes owed, they may continue their collection activities. It's important to remember that interest, fees, and penalties will continue to accrue until an agreement is reached or the tax is paid.

When should I submit the payment for my Offer in Compromise?

Do not send your offer amount with your application. You will only need to submit the payment when the Franchise Tax Board requests it. When you receive their request, ensure that you pay the required amount by cashier’s check or money order. Following proper procedures helps ensure that your application is processed smoothly.

What happens once my Offer in Compromise is approved?

If your Offer in Compromise application is approved, you may need to enter into a collateral agreement. This agreement often stipulates that if your earnings increase significantly during the five years following approval, you may need to pay back a portion—or all—of the original tax liability. This is a precaution to protect the state's interests while providing relief from immediate tax burdens.

Is it necessary to file all tax returns before submitting the FTB 4905?

Yes, it is mandatory that you file all required tax returns before your Offer in Compromise application can be processed. If you do not have any filing requirements, you should note this on your application. Having your tax returns filed demonstrates that you are compliant with tax laws and increases your chances of having your offer approved.

How does the Franchise Tax Board evaluate my Offer in Compromise?

The Franchise Tax Board evaluates offers based on various factors, including your ability to pay, the amount of equity you hold in assets, your current and anticipated future income, and your living expenses. Additionally, they consider the potential for changes in your financial situation. The goal is to determine whether the offered amount represents the maximum that can be reasonably collected.

What if my financial situation changes after I submit my application?

If your financial status changes after submitting the FTB 4905 form, it is important to communicate this to the Franchise Tax Board. Changes can affect your eligibility and the evaluation of your offer. Depending on the nature of the changes, your offer may need adjustments or reconsideration, so maintaining transparency can benefit your case.

Where do I send my completed FTB 4905 form?

Your completed and signed application should be mailed to the specified address on the FTB 4905 form. Typically, this is the Franchise Tax Board’s Offer in Compromise group. If you have any questions while completing your form or about the submission process, you can reach out to the FTB directly at the contact number provided on the application.

Common mistakes

Filling out the FTB 4905 form can be straightforward, but many people make mistakes that could delay the process or even lead to denial. One common error is failing to provide complete personal information. Incomplete sections regarding your name, address, and other identification details can result in an application's return. Providing accurate and thorough information helps ensure your offer is considered promptly.

Another significant mistake is not including the required supporting documentation. Each application requires various documents, such as income verification and bank statements. When applicants skip this step or submit documents that are outdated or incomplete, the Franchise Tax Board may deem the application insufficient. It’s crucial to check the checklist provided in the form to ensure all necessary items are included.

A third mistake involves misunderstanding eligibility guidelines. Some individuals believe they qualify for an Offer in Compromise without fully meeting the requirements, such as having no means to pay their tax liabilities. Misjudging one's financial status can lead to inappropriate offers, which may end in rejection. Careful consideration of your current and future financial situation is essential before submission.

Lastly, submitting the offer amount prematurely is a frequent oversight. Applicants must wait until they receive a request from FTB for the payment. Submitting the funds before that point can complicate the process or even lead to unnecessary delays. Patience and attention to instructions can significantly impact the outcome of an application.

Documents used along the form

The FTB 4905 form, also known as the Offer in Compromise application for individuals, requires accompanying documents to ensure a comprehensive review. Each document serves a purpose in validating a taxpayer's financial situation, ensuring an accurate determination of eligibility. Below is a list of key documents commonly submitted alongside the FTB 4905 form.

- Verification of Income: Submit complete pay stubs for the past three months or financial statements covering two years for self-employed individuals. This shows all potential income sources.

- Verification of Expenses: Provide billing statements from the last three months, including credit card statements and personal loan documents, to back up claimed monthly expenses.

- Bank Information: Include complete bank statements for both savings and checking accounts from the last six months, or twelve months for self-employed individuals. This helps assess overall liquidity.

- Securities: Investment account statements should display the value of stocks, bonds, mutual funds, and any retirement accounts. This provides insight into available assets.

- Current Lease or Rental Agreements: This document shows any current housing costs or obligations, necessary for evaluating financial commitments.

- Real Property Information: Provide mortgage and escrow statements for properties owned or disposed of within the last five years. This helps assess property value.

- IRS Information: Submission of any IRS Offer in Compromise application or acceptance letters assists in understanding prior tax obligations.

- Legal Documents: Include marital settlement agreements, divorce decrees, and bankruptcy documents, if applicable. These documents clarify financial responsibilities stemming from legal proceedings.

Assembling this documentation accurately can significantly impact the outcome of the Offer in Compromise process. Ensure that all included documents are clear and complete to facilitate a smoother review by the Franchise Tax Board.

Similar forms

The FTB 4905 form, which is used for the Offer in Compromise (OIC) in California, shares similarities with several other financial and tax-related documents. Below are six documents that it closely resembles, along with a brief explanation of how they are similar:

- IRS Offer in Compromise (Form 656): Like the FTB 4905, this IRS form allows individuals to settle their federal tax debts for less than the full amount owed, based on their ability to pay.

- Form 1040 (U.S. Individual Income Tax Return): This form collects personal and financial information, similar to the FTB 4905, which also requires detailed financial disclosures to evaluate an individual's tax situation.

- Form 433-A (OIC): This is a financial statement that individuals must complete and submit alongside the IRS’s Offer in Compromise, much like the financial information required in the FTB 4905.

- Bankruptcy Petition (Form B101): When individuals file for bankruptcy, they must disclose their financial situation including income, expenses, and assets, paralleling the financial transparency required in the FTB 4905.

- Financial Disclosure Form for Loan Applications: This form requires detailed personal financial information, akin to the income and expense analyses found within the FTB 4905.

- State Tax Adjustment Application Forms: Certain states have forms similar to the FTB 4905 that allow taxpayers to negotiate their state tax liabilities based on financial hardship, mirroring the purpose and method of the FTB 4905 process.

Dos and Don'ts

When filling out the FTB 4905 form, it's important to follow specific guidelines to ensure proper processing. Below is a list of dos and don'ts.

- Do accurately complete all sections of the form.

- Do provide all required documentation as outlined in the checklist.

- Do check your personal information for accuracy before submission.

- Do submit clear copies of all required documents.

- Do indicate any items that are not applicable (N/A).

- Don't submit the offer amount until requested.

- Don't leave any sections blank; fill out everything applicable.

- Don't forget to file all your tax returns prior to submitting the offer.

- Don't assume submission will halt collection activity; understand collection processes remain active.

Misconceptions

1. Misconception: An Offer in Compromise (OIC) is automatically approved.

Many believe that submitting an OIC guarantees approval. In reality, each application is scrutinized thoroughly. Approval depends on various factors such as ability to pay, equity in assets, and future income prospects.

2. Misconception: You can submit your offer anytime.

Individuals often assume they can submit their offer whenever they choose. However, do not send the offer amount until requested by the Franchise Tax Board (FTB). Timing is critical in processing your application.

3. Misconception: Only people with no income can apply.

Another common belief is that only those with zero income qualify for an OIC. In fact, the program is available for individuals who cannot pay their tax liabilities now or in the foreseeable future, even if they have some income.

4. Misconception: You do not need to file tax returns before applying.

Some mistakenly think they can submit an OIC without having filed all required tax returns. It is crucial to file all necessary tax returns because the FTB won't process the application otherwise. If no filing requirement exists, indicate this on your application.

5. Misconception: Collecting taxes halts once an OIC is submitted.

People often believe submitting an offer will immediately stop all collection activities. This is incorrect. Collection actions may continue if delaying these actions jeopardizes the FTB's ability to collect the tax owed. Interest, fees, and penalties will also still accrue.

6. Misconception: All debts can be settled through an OIC.

Not all tax liabilities are eligible for an OIC. This program specifically targets individual income tax liabilities recognized as nondisputed. Verify your eligibility based on the nature of your tax debt.

7. Misconception: A collateral agreement is optional.

Lastly, some may think collateral agreements are not necessary. In cases where an individual has the potential for significant income increases, entering into a collateral agreement may indeed be required. This helps ensure the FTB can recover unpaid taxes if income exceeds expectations after acceptance of the OIC.

Key takeaways

1. Understanding Eligibility: To qualify for an Offer in Compromise (OIC), you must lack the income, assets, or means to settle your tax liability now or in the foreseeable future. Eligibility is crucial as it determines whether your application will be considered.

2. Preparing Required Documentation: Complete all necessary documents for your application. This includes filing all tax returns. If you do not have a filing requirement, it should be noted on your application.

3. Importance of Supporting Information: Provide comprehensive supporting documentation with your application. Incomplete submissions can lead to delays or rejection of your application.

4. Factors for Approval: The Franchise Tax Board (FTB) assesses various factors during the evaluation of your OIC. Key considerations include your ability to pay, equity in assets, current income, and future expenses.

5. Required Payment Process: Do not send your offer amount until specifically requested by the FTB. When requested, use a cashier’s check or money order for submission.

6. Collection Activity Status: Note that submitting an offer does not automatically halt collection activities. The FTB may continue collection efforts if they believe it jeopardizes their ability to collect the owed tax.

7. Collateral Agreement: Upon approval of your offer, a collateral agreement may be necessary. This is particularly applicable if you have significant potential for increased earnings.

8. Frequently Asked Questions: Review the 'Frequently Asked Questions' section to better understand the OIC process. This section offers valuable insights and clarifications that can assist you throughout your application journey.

Browse Other Templates

ID Card Loss Report,CAC Theft Notification,Security Incident Report,Government ID Replacement Form,Lost CAC Documentation,Incident Report for Stolen ID,Military ID Incident Notification,CAC Card Loss Declaration,Identification Card Misplacement Repor - The report becomes part of the individual’s personnel file for future reference.

Stanley-brown Safety Plan - It’s essential to recognize personal values that contribute meaning and purpose to life.