Fill Out Your 501C3 Application Form

The 501(c)(3) Application form is an essential tool for organizations seeking charitable contributions from foundations and donors. When completing this form, organizations must confirm their eligibility as a federally recognized nonprofit entity. Certain criteria must be met, including that the organization has not received funds from the Foundation in the past year. The form requires applicants to outline the purpose of the grant, categorizing it into areas such as health and human services, education, or arts and culture. It also prompts organizations to disclose their diversity by providing insight into the percentage of their membership representing minority groups. Notably, applicants need to identify the geographical area served and methods for measuring the project’s effectiveness. Additionally, financial transparency is crucial; organizations must list already secured funding sources, their board of directors’ financial participation, and the amount of funding requested. To ensure a smooth application process, organizations must attach their 501(c)(3) tax exemption status letter and other relevant documentation. This comprehensive form not only streamlines the application process but also helps foundations assess the impact and reach of the nonprofit's initiatives.

501C3 Application Example

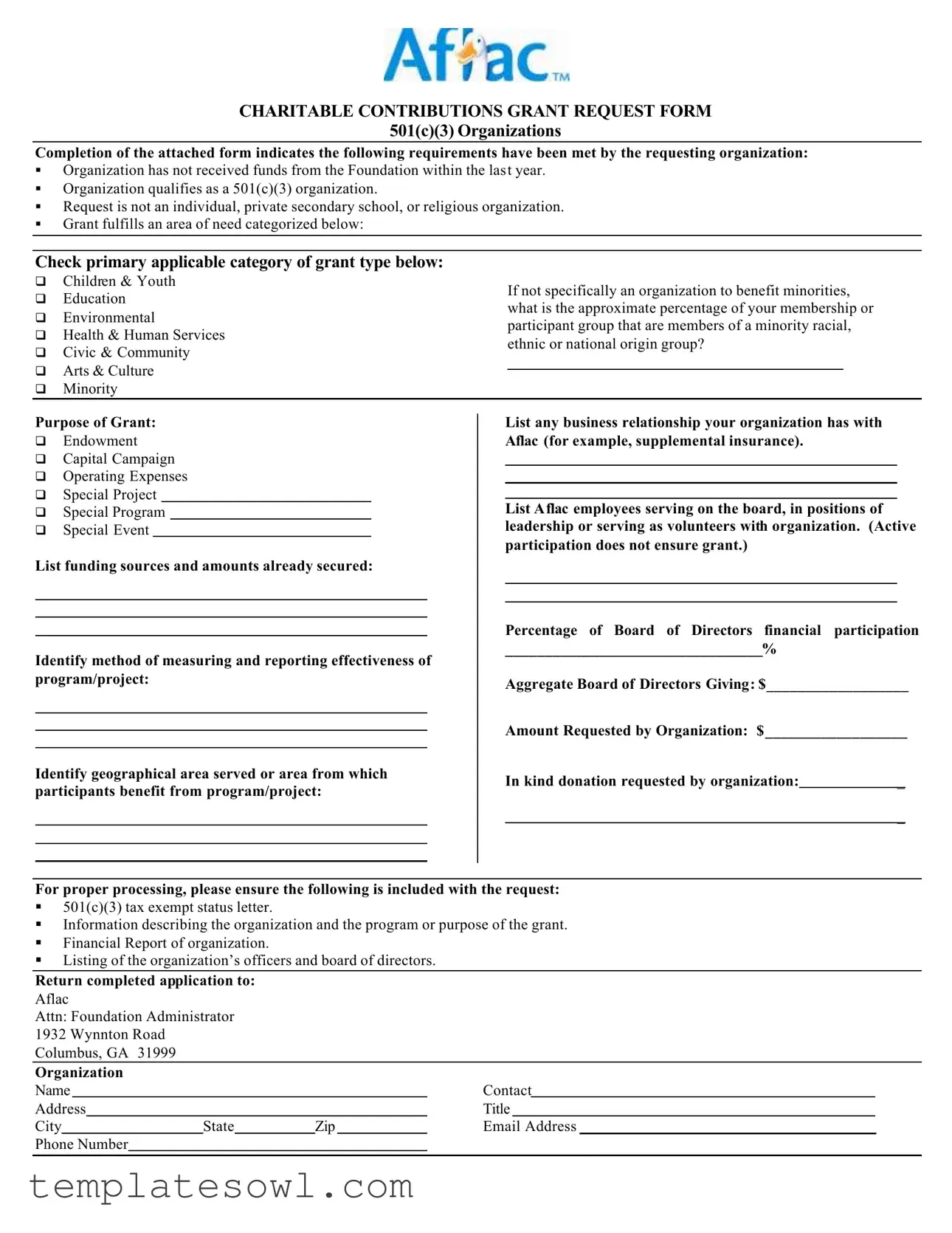

CHARITABLE CONTRIBUTIONS GRANT REQUEST FORM

501(c)(3) Organizations

Completion of the attached form indicates the following requirements have been met by the requesting organization:

§Organization has not received funds from the Foundation within the last year.

§Organization qualifies as a 501(c)(3) organization.

§Request is not an individual, private secondary school, or religious organization.

§Grant fulfills an area of need categorized below:

Check primary applicable category of grant type below:

qChildren & Youth

qEducation

qEnvironmental

qHealth & Human Services

qCivic & Community

qArts & Culture

qMinority

If not specifically an organization to benefit minorities, what is the approximate percentage of your membership or participant group that are members of a minority racial, ethnic or national origin group?

Purpose of Grant:

qEndowment

qCapital Campaign

qOperating Expenses

qSpecial Project

qSpecial Program

qSpecial Event

List funding sources and amounts already secured:

Identify method of measuring and reporting effectiveness of program/project:

Identify geographical area served or area from which participants benefit from program/project:

List any business relationship your organization has with Aflac (for example, supplemental insurance).

List Aflac employees serving on the board, in positions of leadership or serving as volunteers with organization. (Active participation does not ensure grant.)

Percentage of Board of Directors financial participation

_________________________________%

Aggregate Board of Directors Giving: $__________________

Amount Requested by Organization: $__________________

In kind donation requested by organization: |

_ |

|

_ |

For proper processing, please ensure the following is included with the request:

§501(c)(3) tax exempt status letter.

§Information describing the organization and the program or purpose of the grant.

§Financial Report of organization.

§Listing of the organization’s officers and board of directors.

Return completed application to:

Aflac

Attn: Foundation Administrator

1932 Wynnton Road

Columbus, GA 31999

Organization |

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

Contact |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

Title |

|

|

||||

City |

|

State |

|

Zip |

|

Email Address ______________________________________ |

||||||

Phone Number |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Requirements | Organizations must meet specific criteria, including being a 501(c)(3) nonprofit and not having received funds from the Foundation in the past year. |

| Grant Categories | Grants are categorized into several areas such as Children & Youth, Education, Health & Human Services, and more. Applicants must specify the primary category for their grant request. |

| Funding Source Disclosure | Organizations must list any funding sources already secured, along with their amounts, to demonstrate the financial viability of the project. |

| Measurement of Effectiveness | Each organization is required to identify methods for measuring and reporting the effectiveness of their program or project, ensuring accountability for the funds requested. |

| Business Relationships | The application requires disclosure of any business relationship the organization has with Aflac, including board members or volunteers associated with the company. |

| Compliance Documentation | Applicants must submit a 501(c)(3) tax-exempt status letter, a financial report, and information on officers and board members as part of their application for proper processing. |

Guidelines on Utilizing 501C3 Application

Completing the 501(c)(3) Application form is a significant step for organizations seeking grants. By following these detailed steps, applicants can provide the necessary information and documentation to support their request. It’s important to ensure that all parts of the application are filled out accurately and completely, as this promotes a smoother review process.

- Gather essential documents, including your 501(c)(3) tax exempt status letter, a financial report, and a list of your organization’s officers and board of directors.

- Begin with the organization name, including the contact address, city, state, and zip code. Indicate the title of the contact person and provide their email and phone number.

- Check the box that confirms your organization has not received funds from the Foundation within the last year.

- Confirm your organization's eligibility by checking that it qualifies as a 501(c)(3) organization.

- Indicate that the request is not for an individual, private secondary school, or religious organization.

- Select the primary category of need that your grant addresses by checking one of the options: Children & Youth, Education, Environmental, Health & Human Services, Civic & Community, Arts & Culture, or Minority.

- If applicable, provide the approximate percentage of your participant group that belong to a minority group.

- Clearly state the purpose of the grant by checking a relevant option such as Endowment, Capital Campaign, Operating Expenses, Special Project, Special Program, or Special Event.

- List any secured funding sources along with the amounts already secured.

- Describe the method your organization will use to measure and report the effectiveness of the program or project.

- Identify the geographical area served by your program or project.

- Disclose any business relationships with Aflac, including details of any Aflac employees who serve on your board or volunteer.

- Indicate the financial participation percentage of your Board of Directors.

- Provide the aggregate giving amount from the Board of Directors.

- Specify the amount requested by your organization and detail any in-kind donations requested.

- Ensure all accompanying documents are included with the application before submission.

Return the completed application with all necessary documents to Aflac, addressed to the Foundation Administrator at their Columbus, GA office. Make sure to double-check your submissions to ensure accuracy and completeness.

What You Should Know About This Form

What is the purpose of the 501(c)(3) Application form?

The 501(c)(3) Application form is used by organizations seeking grants from foundations. It confirms that the organization meets the necessary requirements to receive funding. These requirements include being recognized as a 501(c)(3) organization and outlining the purpose of the grant request.

What types of organizations can apply for grants using this form?

What areas of need does the application cover?

The application covers several categories, including Children & Youth, Education, Environmental, Health & Human Services, Civic & Community, Arts & Culture, and Minority groups. Organizations must select the primary category that aligns with their project.

What information is required to complete the application?

How does the application define a minority organization?

If an organization does not primarily serve minorities, it must indicate the approximate percentage of its membership or participants who are from minority racial, ethnic, or national origin groups. This helps the foundation understand the community impact.

Can organizations request in-kind donations?

Yes, organizations can request in-kind donations. The application requires details about the specific items or services being requested in addition to any monetary amounts sought.

Where should the completed application be sent?

The completed application should be sent to Aflac, addressed to the Foundation Administrator at 1932 Wynnton Road, Columbus, GA 31999. It is vital to ensure that all required documents accompany the application to avoid delays.

Is there any financial participation requirement for board members?

The application asks for the percentage of financial participation from the Board of Directors and the total amount contributed. This information is useful for understanding the board's commitment to the organization’s funding efforts.

Common mistakes

When completing the 501(c)(3) application form, many individuals make common mistakes that can lead to delays or denials in their grant requests. One frequent error is failing to provide adequate proof of the organization's 501(c)(3) tax-exempt status. This letter is crucial for establishing eligibility and must be included with the application.

Another typical mistake is not clearly articulating the purpose of the grant. Without a detailed explanation of how the funds will be used, reviewers may find it difficult to assess the alignment with their grant-making goals. It's essential to specify whether the request is for an endowment, capital campaign, operating expenses, special project, special program, or special event.

Many applicants overlook the significance of detailing the geographical area served by the program or project. This information helps establish the impact of the organization's efforts. If the area of benefit is not well defined, it can raise questions about the organization's outreach and effectiveness.

Additionally, applicants often fail to list all funding sources that have been secured for the project. Providing this information demonstrates fiscal responsibility and the organization’s ability to attract support from various channels, which can influence funding decisions positively.

In some cases, applicants neglect to mention any business relationships with Aflac. If the organization has connections with Aflac employees or maintains any business relationships, these must be properly disclosed. Transparency in these details can help avoid potential conflicts of interest.

A common oversight involves not including the financial report of the organization. This document is necessary for the Foundation to assess the organization's financial health and sustainability. Failure to provide this report can result in immediate disqualification.

Another mistake is leaving out the list of officers and board of directors. This information is crucial for understanding the governance of the organization. A complete list helps the reviewers gauge the leadership's stability and commitment to the cause.

Many applicants also forget to measure and report on the effectiveness of the program or project. Including a clear method for measuring success is vital. It not only highlights the organization’s accountability but also assures funders that their investment will have a meaningful impact.

Lastly, some submissions come with incomplete contact information. It is important that all fields designated for contact details – including the organization name, address, title, email address, and phone number – are filled out accurately. Missing or incorrect information can create barriers to communication that complicate the review process.

Documents used along the form

When submitting a 501(c)(3) application, several supporting documents may enhance the application process and provide additional context about the organization. Each document serves a distinct purpose and helps demonstrate compliance with the necessary requirements for tax-exempt status.

- 501(c)(3) Tax Exempt Status Letter: This letter is issued by the IRS and confirms that an organization qualifies as a tax-exempt entity under section 501(c)(3) of the Internal Revenue Code. It is a crucial document that establishes the organization’s eligibility for grants and donations.

- Organizational Description: A detailed description of the organization and its mission, including its purpose, activities, and intended beneficiaries. This document helps funders understand the organization's goals and impact.

- Financial Report: A comprehensive report detailing the organization’s financial status. It typically includes income statements, balance sheets, and cash flow statements, which provide transparency regarding the organization’s fiscal health.

- List of Officers and Board of Directors: This document includes the names and positions of individuals who serve on the organization’s board. It helps establish governance and accountability within the organization.

- Program Budget: A detailed budget outlining all anticipated income and expenses related to the proposed program. This budget serves to illustrate the financial planning and management of the project or program for which funding is requested.

- Proof of Funding Sources: Documentation that lists any current or secured funding sources, along with the amounts. This information demonstrates the organization's ability to leverage additional funding for projects and programs.

- Evaluation Plan: This document outlines methods for measuring the effectiveness of the proposed project or program. It highlights how the organization intends to assess its impact and report back to funders.

Inclusion of these documents can significantly strengthen an application for 501(c)(3) status. Each provides essential evidence of the organization’s capabilities, goals, and financial stability, enabling potential funders to make informed decisions regarding support and collaboration.

Similar forms

The 501(c)(3) Application form is important for organizations seeking tax-exempt status in the United States. Several other documents share similarities with this application, each serving a distinct purpose while containing comparable elements. Here are seven documents that are similar to the 501(c)(3) Application form:

- IRS Form 1023: This is the primary application for obtaining recognition as a tax-exempt entity under 501(c)(3). It requires organizations to provide details about their mission, governance, and financial outlook, much like the information required in the 501(c)(3) Application form.

- Charitable Registration Application: Many states require organizations to register before soliciting donations. This application asks for information related to organizational structure and intent to serve a defined purpose, paralleling the requirements found in the 501(c)(3) Application.

- Grant Proposal: When seeking funding from various foundations, organizations must submit detailed project descriptions and budgetary needs. Like the 501(c)(3) Application, these proposals require clarity regarding the intended impact and effectiveness metrics.

- Annual Information Return (Form 990): Organizations must file this form to maintain their tax-exempt status, providing transparency on finances and operations. Similar to the 501(c)(3) Application, it seeks to demonstrate accountability and effective use of resources.

- Nonprofit Bylaws: These documents outline the governance structure and operating procedures of an organization. Much like the 501(c)(3) Application, bylaws require information about leadership roles and responsibilities within the organization.

- Funding Request Letters: When organizations reach out to individuals, corporations, or foundations for support, these letters often share essential organizational details and project goals. They, too, emphasize the organization’s mission, aligning closely with the intent of the 501(c)(3) Application.

- Donor Agreement: This document stipulates the conditions and expectations surrounding donations. Like the 501(c)(3) Application, it serves to safeguard the interests of both the donor and the organization while ensuring compliance with regulatory standards.

Each of these documents contributes to the framework within which nonprofit organizations operate, managing transparency, accountability, and compliance with applicable regulations.

Dos and Don'ts

When filling out the 501(c)(3) Application form, it’s important to follow certain guidelines to increase the chances of a successful submission. Here are some helpful tips on what to do and what to avoid:

- Do complete all required sections thoroughly.

- Do include your 501(c)(3) tax-exempt status letter.

- Do provide a detailed purpose for the grant request.

- Do specify how you will measure the program’s effectiveness.

- Do ensure all contact information is accurate and up-to-date.

- Don't forget to disclose any business relationship with Aflac.

- Don't submit your application without the necessary financial report.

- Don't leave any questions unanswered or vague.

- Don't fail to state the amount you are requesting clearly.

- Don't send the application without reviewing it for errors.

Following these guidelines can streamline the application process and help your organization secure the necessary funding.

Misconceptions

Understanding the 501(c)(3) application form can be challenging for many organizations. Misconceptions often lead to confusion and missteps in the application process. Here are ten common misconceptions explained in detail.

- Only religious organizations qualify for 501(c)(3) status. Many believe that 501(c)(3) status is exclusively for religious groups. In reality, this status is available to a variety of organizations that operate for charitable, educational, and scientific purposes, among others.

- All donations to a 501(c)(3) are automatically tax-deductible. While most contributions are tax-deductible, there are specific conditions that must be met. For example, donations must be made to qualified 501(c)(3) organizations. Additionally, there may be limitations on certain types of gifts, such as property.

- If an organization has a 501(c)(3) status, it can engage in unlimited political activity. This is not true. 501(c)(3) organizations are strictly prohibited from participating in political campaigns or substantial lobbying activities. Engaging in these activities can jeopardize their tax-exempt status.

- Filing the 501(c)(3) application is a one-time event. Organizations often think that once they secure their 501(c)(3) status, they are finished. However, it is important to maintain compliance with IRS regulations and file annual returns, such as Form 990, to retain that status.

- The application process is quick and easy. Many underestimate the time and effort involved in completing the 501(c)(3) application. It requires thorough documentation, financial statements, and a detailed description of the organization’s mission and activities.

- 501(c)(3) status guarantees funding from foundations. Organizations may believe that receiving 501(c)(3) status means they will automatically receive grant funding. In reality, it is only one of many factors that grantors consider when reviewing funding requests.

- All 501(c)(3) organizations can serve any purpose they desire. Organizations cannot arbitrarily choose their mission. To qualify, the purpose must align with the charitable, educational, or scientific criteria outlined by the IRS. Programs that do not fit these areas may be denied tax-exempt status.

- Submitting the application is the only requirement for obtaining grants. Organizations must also demonstrate a clear plan for measuring and reporting their effectiveness. Grant makers often look for specific metrics that show how funds will be used and the anticipated outcomes.

- Once the application is submitted, organizations cannot change their mission or activities. Organizations can adapt and change their mission after receiving 501(c)(3) status, but they must notify the IRS of significant changes. There is a process involved in amending their articles of incorporation or bylaws.

- The board of directors' financial contributions do not impact the application. Board financial participation is crucial. Grant makers often look for evidence that board members are invested in the organization’s mission. This commitment can enhance the credibility of the organization during the application process.

Being aware of these misconceptions can help organizations navigate the complexities of the 501(c)(3) application process more effectively. Proper understanding is essential for compliance and sustainability in achieving their charitable goals.

Key takeaways

Filing the 501(c)(3) Application form is a crucial step for organizations seeking grants. Here are some key points to keep in mind:

- Eligibility Requirements: Ensure your organization meets specific criteria, including being a registered 501(c)(3) entity that has not received funding from the Foundation in the past year.

- Purpose of Grant: Clearly define the purpose for which you are requesting funding. Options include endowment, capital campaigns, operating expenses, and more. A well-defined purpose aligns with funding priorities.

- Transparency in Funding: List all secured funding sources and amounts. Being open about your financial situation builds credibility and helps assess the viability of your request.

- Documentation Requirements: Include necessary documents such as your tax-exempt status letter, a description of the organization, and a financial report. Omitting these can result in delays or denial.

By focusing on these points, organizations can enhance their applications and improve chances of securing grants.

Browse Other Templates

How to Ask for Donations Examples - Your submission should highlight how the donation will benefit the community.

Baseball Tryout Evaluation Form - Document your 40-yard dash performance.

Credit Application Template for Business - Indicate the payment address for each vendor to ensure correct communication.