Fill Out Your 51A126 Form

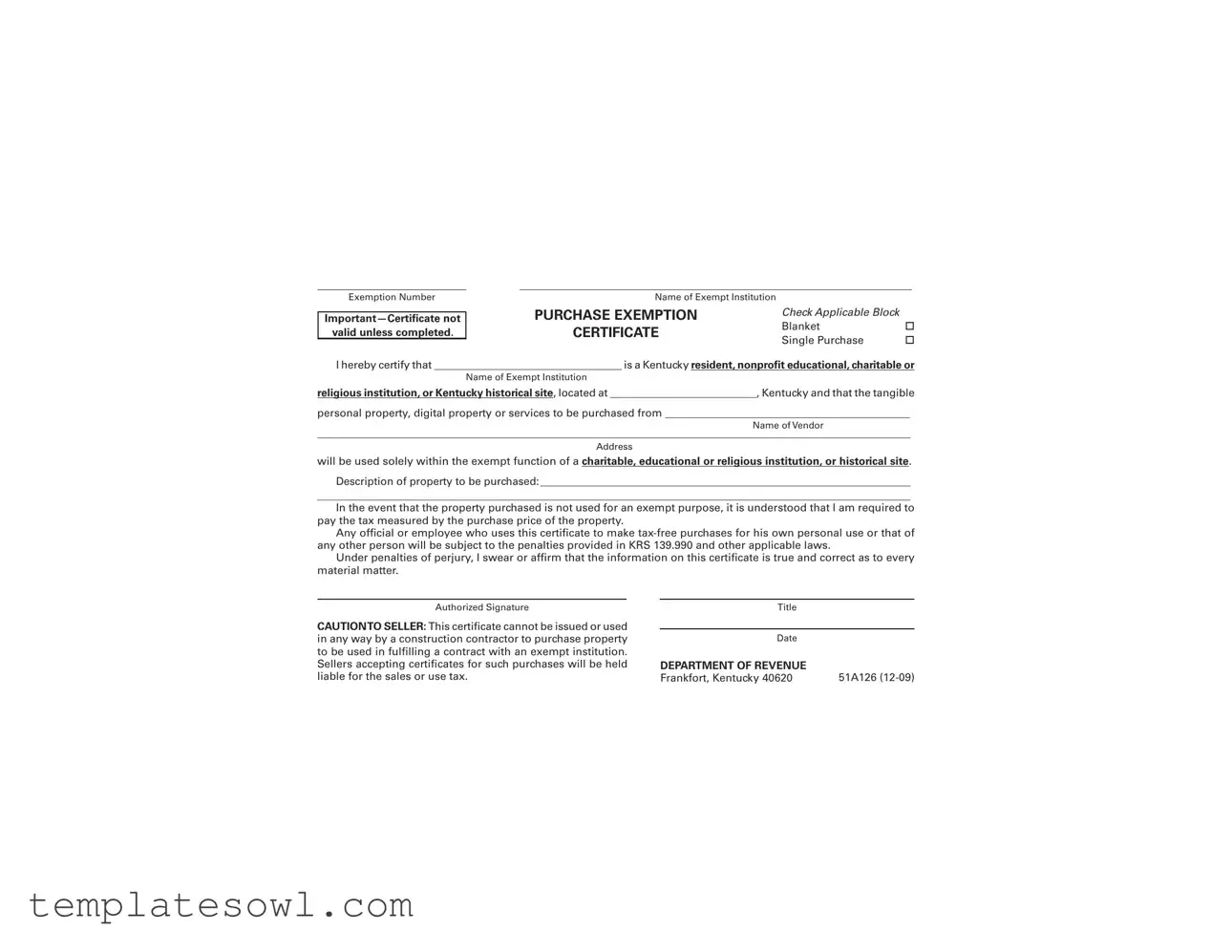

The 51A126 form serves as a crucial document in Kentucky for individuals and organizations seeking to make tax-exempt purchases on behalf of exempt institutions, such as nonprofit educational, charitable, or religious entities. By completing this form, the authorized representative certifies that the institution in question is a valid Kentucky-based entity and details the nature of the property or services to be acquired. The form requires key information including the name and address of both the exempt institution and the vendor, as well as a description of the items being purchased. It establishes that the tangible and digital goods will be used solely for an exempt purpose. Users must understand that if the purchased property is not utilized for its intended exempt function, they will be liable for the relevant sales tax. Additionally, the 51A126 warns that misuse of this certificate for personal gain could result in serious penalties. The requirement for an authorized signature and the cautionary note for sellers underline the importance of compliance with state regulations.

51A126 Example

Exemption Number

valid unless completed.

Name of Exempt Institution |

|

|

PURCHASE EXEMPTION |

Check Applicable Block |

|

CERTIFICATE |

Blanket |

|

Single Purchase |

||

|

I hereby certify that ___________________________________ is a Kentucky resident, nonprofit educational, charitable or

Name of Exempt Institution

religious institution, or Kentucky historical site, located at ___________________________, Kentucky and that the tangible

personal property, digital property or services to be purchased from _____________________________________________

Name of Vendor

_____________________________________________________________________________________________________________

Address

will be used solely within the exempt function of a charitable, educational or religious institution, or historical site.

Description of property to be purchased: ____________________________________________________________________

_____________________________________________________________________________________________________________

In the event that the property purchased is not used for an exempt purpose, it is understood that I am required to pay the tax measured by the purchase price of the property.

Any official or employee who uses this certificate to make

Under penalties of perjury, I swear or affirm that the information on this certificate is true and correct as to every material matter.

Authorized Signature

CAUTIONTO SELLER: This certificate cannot be issued or used in any way by a construction contractor to purchase property to be used in fulfilling a contract with an exempt institution. Sellers accepting certificates for such purchases will be held liable for the sales or use tax.

Title

Date |

|

DEPARTMENT OF REVENUE |

|

Frankfort, Kentucky 40620 |

51A126 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The 51A126 form certifies tax exemption for certain purchases made by nonprofit educational, charitable, or religious institutions in Kentucky. |

| Applicable Law | This form is governed by KRS 139.990 and other applicable Kentucky laws regarding sales and use tax. |

| Conditions of Use | The certificate is only valid when completed correctly and must be used solely for exempt purposes. Misuse can lead to penalties. |

| Restrictions | Construction contractors cannot use this certificate for their purchases intended for contract fulfillment with exempt institutions. |

Guidelines on Utilizing 51A126

Once you have gathered your information, filling out the 51A126 form is straightforward. Follow these steps carefully to ensure accuracy and compliance.

- Obtain the 51A126 form, either online or at a local revenue office.

- Enter the Exemption Number at the top of the form.

- Provide the Name of Exempt Institution in the designated space.

- Check the applicable block for either Blanket or Single Purchase.

- In the next section, fill in the name of the exempt institution again, confirming that it is a Kentucky resident, nonprofit educational, charitable, or religious institution, or a Kentucky historical site.

- List the Address of the exempt institution.

- Next, provide the Name of Vendor, from whom the purchase will be made.

- Include the Address of the vendor in the specified line.

- Detail the Description of Property to be purchased, ensuring clarity and specificity.

- Read the statement about the use of purchased property and ensure you understand it.

- Sign and date the form in the Authorized Signature section, affirming the accuracy of your provided information.

After completing the form, retain a copy for your records. Submit the original to the vendor when making your tax-exempt purchase. Follow any additional protocols provided by the vendor to ensure the transaction proceeds smoothly.

What You Should Know About This Form

What is the purpose of the 51A126 form?

The 51A126 form serves as a certificate of exemption for certain nonprofit organizations in Kentucky. It allows qualified institutions to purchase tangible personal property, digital property, or services without paying sales tax, given that these items will be used solely for their exempt purposes, such as educational, charitable, or religious activities.

Who can use the 51A126 form?

This form can be utilized by Kentucky residents who are part of a nonprofit educational institution, charitable organization, religious institution, or a Kentucky historical site. It's important that these entities meet specific qualifications to ensure they are eligible for tax exemptions on their purchases.

Is the 51A126 form valid for all types of purchases?

No, the 51A126 form is not valid for all purchases. It is specifically designed for items that will be directly used in fulfilling the exempt functions of the institution. Additionally, construction contractors are prohibited from using this exemption form for materials purchased in relation to contracts with exempt institutions.

What happens if the purchased property is not used for an exempt purpose?

If the property purchased is ultimately not used for an exempt purpose, the institution must pay the tax based on the purchase price of the property. This requirement emphasizes the importance of using the purchased items solely for their intended exempt functions.

What penalties apply if the certificate is misused?

Any official or employee who misuses the 51A126 form to make tax-free purchases for personal use can face penalties. KRS 139.990 outlines the penalties that may be enforced, which can include fines or other legal consequences for violating the regulations regarding tax exemption certificates.

How should the 51A126 form be completed?

To complete the 51A126 form, the institution must fill in their name and address, as well as the name and address of the vendor. The description of the property to be purchased must also be included. The form requires an authorized signature to validate the claim, signifying that the information provided is true and correct.

Where can I find the 51A126 form?

The 51A126 form is available through the Kentucky Department of Revenue's website. You can download and print the form from there, as well as access guidelines for completing it accurately. It's important to ensure that you're using the most recent version to avoid any issues with your exemption claims.

Common mistakes

When it comes to completing the 51A126 form, many individuals overlook crucial details that could lead to complications down the line. One common mistake involves failing to provide the correct name of the exempt institution. This not only hinders the processing of the form but may also cause the exemption to be denied. Always ensure that the legal name of the institution is clearly stated and accurately filled in.

Another frequent error is related to the selection of the exemption type. The form allows for either a blanket or single purchase exemption. Many individuals either neglect to check the appropriate box or mistakenly select both options. This can cause confusion and result in delays. Clearly marking the correct option is crucial for the form’s validity.

In addition to choosing the correct exemption type, it's vital to fill out the address of the vendor accurately. Many compilers of the form might leave this section incomplete or enter incorrect details. This oversight can result in complications if the vendor or the Department of Revenue needs to verify information. Double-checking the vendor’s address helps prevent unnecessary issues.

Furthermore, people often provide an insufficient description of the property to be purchased. A vague description might lead to misunderstandings regarding whether the purchase qualifies for exemption. It is highly recommended that individuals provide a detailed and specific description of the items or services being purchased to avoid any ambiguity.

A very important aspect that sometimes gets overlooked involves the declaration of intended use. The form specifies that the property must be used solely for the exempt function of the organization. Failure to acknowledge this responsibility places both the buyer and seller at risk of penalties. It's essential to remember and confirm that the property will be used correctly.

Lastly, some individuals neglect to complete the authorized signature section with both their title and the date. This might seem minor, but without a proper signature, the entire certificate is invalidated. Confirming that all necessary sections are filled out accurately ensures that the form is complete and valid for submission.

Documents used along the form

The 51A126 form is often used by exempt institutions in Kentucky to certify their tax-exempt status when making purchases. Along with this form, several other documents may also be utilized in similar contexts. Below is a list of these forms and documents, each described briefly.

- Form ST-1: This is a general Sales Tax Exemption Certificate for nonprofit organizations. It confirms that the organization is exempt from sales tax for purchases related to its mission.

- Form ST-2: This form serves as a New York State Exempt Purchase Certificate. Nonprofit organizations use it to make tax-exempt purchases within New York.

- Form ST-5: A New York Resale Certificate, this document is used by businesses to purchase goods intended for resale without paying sales tax upfront.

- Form 990: This is the IRS Return of Organization Exempt from Income Tax. Charitable organizations use it to report their financial information and confirm their tax-exempt status.

- Form 401: Issued by certain states, this form is an Application for a Sales Tax Exemption Certificate specifically for schools and educational institutions.

- Form 501: This document is used in some jurisdictions to apply for nonprofit status, which can provide eligibility for sales tax exemptions.

- Invoices or Receipts: Detailed invoices or receipts provide proof of purchase. They often include essential details necessary for record-keeping and tax reporting.

These documents help ensure that organizations comply with tax regulations while benefiting from their exempt status. Proper use and understanding of each is crucial for maintaining eligibility and avoiding penalties.

Similar forms

- Form ST-5: This form is a sales tax exemption certificate used by exempt organizations, similar to the 51A126 form. It certifies that the purchaser is an exempt entity and allows for tax-free purchases based on that exemption.

- Form ST-4: This certificate also serves as a resale certificate, allowing the purchaser to buy goods tax-free if those goods are intended for resale. It parallels the 51A126 in its function for exempt purchases.

- Form ST-587: Used by certain governmental entities, this form acts as a certification for tax exemption. Like the 51A126, it confirms that purchases are made for a specific purpose exempt from sales tax.

- Form ST-13: This form provides a method for claiming exemption from the payment of sales tax for property purchased by certain nonprofit organizations. It shares similar requirements and purposes with the 51A126.

- Form ST-1: This form is known as the sales tax registration application. While it differs in function, both the ST-1 and 51A126 are essential for nonprofit organizations to establish their exemption status.

- Form ST-10: This form serves as an exemption certificate for purchases made by specific organizations dealing with educational purposes. It functions similarly to the 51A126 in asserting tax-exempt status.

- Form ST-2: This is a tax exemption certificate specifically for manufacturing equipment. Similar to the 51A126, it is used by eligible entities to purchase goods tax-free under specific conditions.

Dos and Don'ts

When filling out the 51A126 form, it is important to follow certain guidelines to ensure accuracy and validity. Here are six things to consider:

- Do ensure that all sections are completed accurately, including the name of the exempt institution and the address.

- Do check the appropriate box for the type of exemption being claimed, whether blanket or single purchase.

- Do provide a detailed description of the property or services to be purchased.

- Do sign and date the form, confirming that the provided information is true and correct.

- Don't use the form for personal purchases; it must be solely for the exempt institution's use.

- Don't attempt to use this certificate if you are a construction contractor for purchases related to contract fulfillment.

Misconceptions

Understanding the 51A126 form is crucial for organizations seeking tax exemptions in Kentucky. However, several misconceptions often lead to confusion. Here are eight misconceptions clarified:

- Anyone can use the 51A126 form for personal purchases. The form is strictly for authorized representatives of qualified nonprofit organizations. Personal use is prohibited.

- All organizations automatically qualify for the exemption. Only Kentucky residents who meet specific nonprofit criteria can use the form to claim exemptions.

- This form is only for purchases of tangible goods. The 51A126 also applies to digital property and services related to the exempt organization's mission.

- Using this form guarantees tax-free purchases. Tax-free status is contingent upon the intended use of the items purchased. Misuse can lead to liability for taxes.

- Construction contractors can use the 51A126 form. Contractors are not permitted to use this form for purchases related to fulfilling contracts with exempt institutions.

- The seller is not responsible for verifying the form. Sellers must carefully check the form. Accepting it without due diligence could result in liability for unpaid taxes.

- Filing this form is optional for exempt organizations. While it might seem optional, accurate completion is essential for compliance and to avoid penalties.

- Misrepresentation on the form has no severe consequences. Providing false information can lead to significant penalties under Kentucky law, including fines.

This information aims to help avoid misunderstandings about the 51A126 form. Clarity on these points can aid organizations in successfully navigating the exemption process.

Key takeaways

When filling out and utilizing the 51A126 form, there are several important considerations to keep in mind. Below are key takeaways that can guide you through the process.

- Complete all required fields: Ensure that each section of the form is filled out completely, including the name of the exempt institution and the vendor.

- Specify the exemption type: Clearly indicate whether the purchase is for a blanket exemption or a single purchase.

- Certify eligibility: Confirm that the institution qualifies as a Kentucky resident, nonprofit, educational, charitable, or religious entity.

- Detail the property: Provide a thorough description of the tangible personal property, digital property, or services to be purchased.

- Understand the purpose: Acknowledge that the purchased items must be used solely for the exempt function of the organization.

- Know the consequences: Be aware that failure to use the property as intended will result in the obligation to pay applicable taxes.

- Follow legal guidelines: Avoid using the certificate for personal purchases, as it may lead to penalties under KRS 139.990 and other laws.

- Ensure authorized signature: An authorized individual must sign the form; otherwise, the exemption may not be recognized.

- Avoid construction uses: Understand that construction contractors cannot use this certificate for property related to contracts with exempt institutions.

- Retain copies: Keep copies of the completed forms and associated documents for your records to ensure compliance and for future reference.

By adhering to these guidelines, you can effectively navigate the requirements of the 51A126 form and ensure that your organization benefits appropriately from its exempt status.

Browse Other Templates

Minnesota Repossession Laws - This document is a key resource for secured parties looking to establish ownership legally.

Fbi Background Check for Visa - Timeframes for processing can vary based on the FBI's workload.

Whats a Net Listing - Element of flexibility exists for adding additional terms or conditions specific to individual listings.