Fill Out Your 668 W C Do Form

The IRS Form 668-W(c)(DO), also known as the Notice of Levy on Wages, Salary, and Other Income, is a significant document for both taxpayers and employers. Issued by the Internal Revenue Service (IRS), it serves as a formal notice when a taxpayer has failed to pay delinquent taxes. This notice instructs employers or other third parties to withhold a portion of a taxpayer's wages or other income to satisfy an outstanding tax debt. The document includes essential information such as the sender's notice date, the taxpayer's name and identifying number, the kind of tax owed, the applicable tax period, and the total amount due, which encompasses unpaid taxes, interest, and penalties. Importantly, the form delineates that this is not a bill for taxes due; rather, it is a directive to collect money owed. It clarifies what actions are required—primarily to turn over wages and future earnings until the levy is lifted. Also, the form explains exemptions that the taxpayer may claim to minimize the amount subject to levy. For employers and others receiving the notice, following the instructions to calculate exempt amounts is crucial for compliance. Understanding this form's implications can significantly impact financial operations for employers and ensure that taxpayers know their rights and obligations under the law.

668 W C Do Example

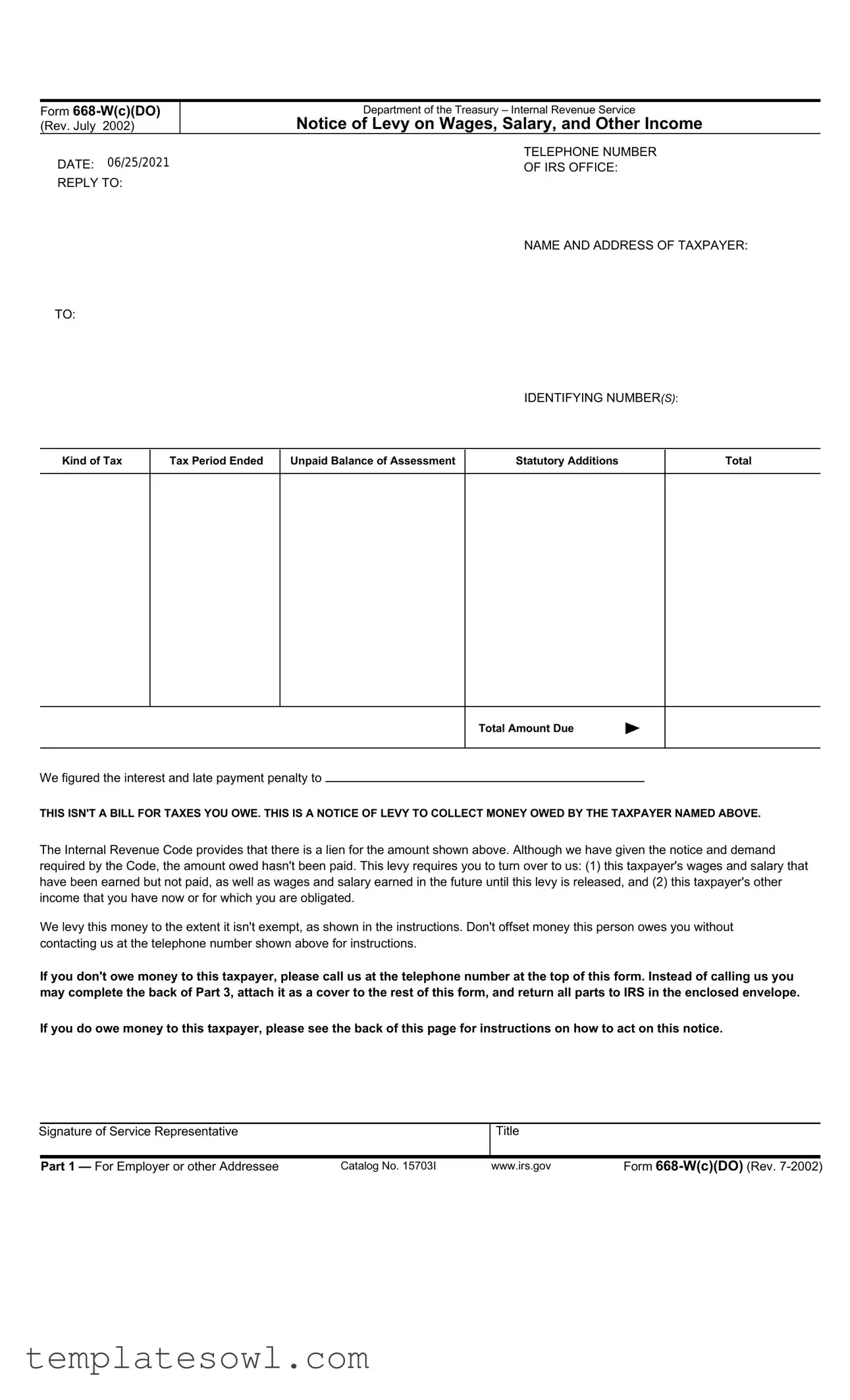

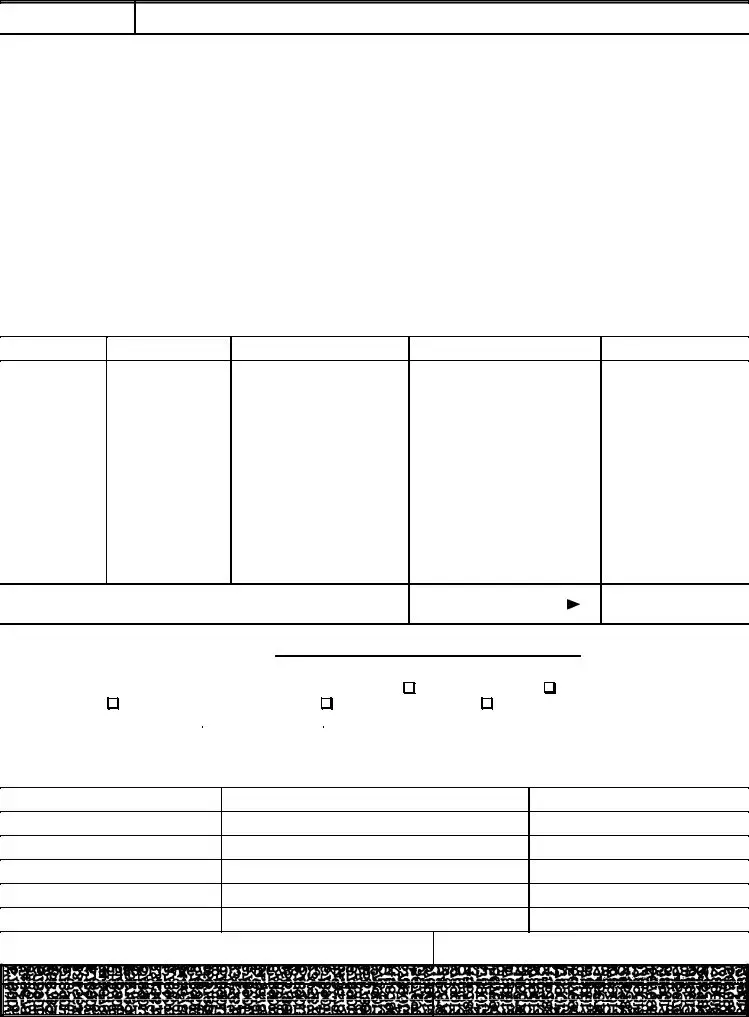

Form

(Rev. July 2002)

Department of the Treasury – Internal Revenue Service

Notice of Levy on Wages, Salary, and Other Income

DATE: 06/25/2021 |

TELEPHONE NUMBER |

OF IRS OFFICE: |

|

REPLY TO: |

|

|

NAME AND ADDRESS OF TAXPAYER: |

TO: |

|

|

IDENTIFYING NUMBER(S): |

Kind of Tax

Tax Period Ended

Unpaid Balance of Assessment

Statutory Additions

Total

Total Amount Due

We figured the interest and late payment penalty to

THIS ISN'T A BILL FOR TAXES YOU OWE. THIS IS A NOTICE OF LEVY TO COLLECT MONEY OWED BY THE TAXPAYER NAMED ABOVE.

The Internal Revenue Code provides that there is a lien for the amount shown above. Although we have given the notice and demand required by the Code, the amount owed hasn't been paid. This levy requires you to turn over to us: (1) this taxpayer's wages and salary that have been earned but not paid, as well as wages and salary earned in the future until this levy is released, and (2) this taxpayer's other income that you have now or for which you are obligated.

We levy this money to the extent it isn't exempt, as shown in the instructions. Don't offset money this person owes you without contacting us at the telephone number shown above for instructions.

If you don't owe money to this taxpayer, please call us at the telephone number at the top of this form. Instead of calling us you may complete the back of Part 3, attach it as a cover to the rest of this form, and return all parts to IRS in the enclosed envelope.

If you do owe money to this taxpayer, please see the back of this page for instructions on how to act on this notice.

Signature of Service Representative

Title

Part 1 — For Employer or other Addressee |

Catalog No. 15703I |

www.irs.gov |

Form |

IF MONEY IS DUE THIS TAXPAYER

Give the taxpayer Parts 2, 3, 4 and 5, as soon as you receive this levy. Part of the taxpayer's wages, salary, or other income is exempt from levy. To claim exemptions, the taxpayer must complete and sign the Statement of Exemptions and Filing Status on Parts 3, 4, and 5 and return Parts 3 and 4 to you within 3 work days after you receive this levy. The taxpayer's instructions for completing the Statement of Exemptions and Filing Status are on the back of Part 5.

Send us the taxpayer's take home pay minus the exempt amount which is described below, on the same dates that payments are made, or are due, to the taxpayer. Unless we tell you that a deduction should not be allowed, allow the taxpayer's payroll deductions which were in effect when you received this levy in determining the take home pay. Do not allow the taxpayer to take new voluntary payroll deductions while this levy is in effect. The method of payment to the taxpayer, for example, direct deposit, has no bearing on take home pay. Direct deposit is not considered a payroll deduction.

When you send us your check, complete the back of Part 3 of this form, attach it to the check, and mail them to us in the enclosed envelope. Make your check payable to United States Treasury. Please write on the check (not on a detachable stub) the taxpayer's name, identifying number(s), kind of tax, and tax periods shown on Part 1, and the words “LEVY PROCEEDS.”

This levy remains in effect for all wages and salary for personal services until we send you a release of levy. Wages and salary include fees, commissions, and bonuses. If more than one payment is necessary to satisfy the levy, send additional payments to the Internal Revenue Service address shown on your copy of this levy, and make out your check as described above.

This levy remains in effect for benefit and retirement income if the taxpayer has a current fixed right to future payments, until we send you a release of levy.

For income other than wages and salary, and benefit and retirement income as described above, this levy is effective only for funds you owe the taxpayer now. We may issue another levy if necessary. However, this levy attaches to all obligations you owe the taxpayer at the time you receive it, even though you plan to make the payment at a later date.

INSTRUCTIONS FOR FIGURING THE AMOUNT EXEMPT FROM THIS LEVY

There are three steps in figuring the amount exempt from this levy.

1.When you receive the completed Parts 3 and 4 from the taxpayer, use item 1 of the enclosed table (Publication 1494) to figure how much wages, salary, or other income is exempt from this levy. Find the correct block on the table using the taxpayer's filing status, number of personal exemptions claimed, and pay period. Be sure you allow one exemption for the taxpayer, in addition to one for each person listed on Parts 3 and 4, unless, “I cannot claim myself as an exemption,” is written next to the taxpayer's signature. If no Social Security Number is provided for a personal exemption, do not allow that exemption, unless “Less than six months old” is written in the space for that person's Social Security Number. If you don't receive the completed Parts 3 and 4, then the exempt amount is what would be exempt if the taxpayer had returned them indicating married filing separate and only the taxpayer is claimed as a personal exemption. Don't use the information on the taxpayer's Form

2.If the taxpayer, or the taxpayer's spouse, is at least 65 years old and/or blind, an additional amount is exempt from this levy. To claim this, the taxpayer counts one for each of the following: (a) the taxpayer is 65 or older, (b) the taxpayer is blind, (c) the taxpayer's spouse is 65 or older, and (d) the taxpayer's spouse is blind. Then, this total (up to 4) is entered next to “ADDITIONAL STANDARD DEDUCTION” on the Statement of Exemptions and Filing Status. If the taxpayer has entered a number in this space, use item 2 of the enclosed table to figure the additional amount exempt from this levy.

3.The amount the taxpayer needs to pay support, established by a court or an administrative order, for minor children is also exempt from the levy, but the court or administrative order must have been made before the date of this levy. These children can't be claimed as personal exemptions on Parts 3, 4, and 5.

If the taxpayer's exemptions, filing status, or eligibility for additional standard deduction change while this levy is in effect, the taxpayer may give you a new statement to change the amount that is exempt. You can get more forms from an IRS office. If you are sending payments for this levy next year, the amount that is exempt doesn't change merely because the amount that all taxpayers can deduct for exemptions, filing status, and additional standard deductions on individual income tax returns changes for the new year. However, if the taxpayer asks you to recompute the exempt amount in the new year by submitting a new Statement of Exemptions and Filing Status, even though there may be no change from the prior statement, you may use the new year's exemption table. This change applies to levies you already have as well as this one. If you are asked to recompute the exempt amount and you don't have the new year's exemption table, you may order one by calling

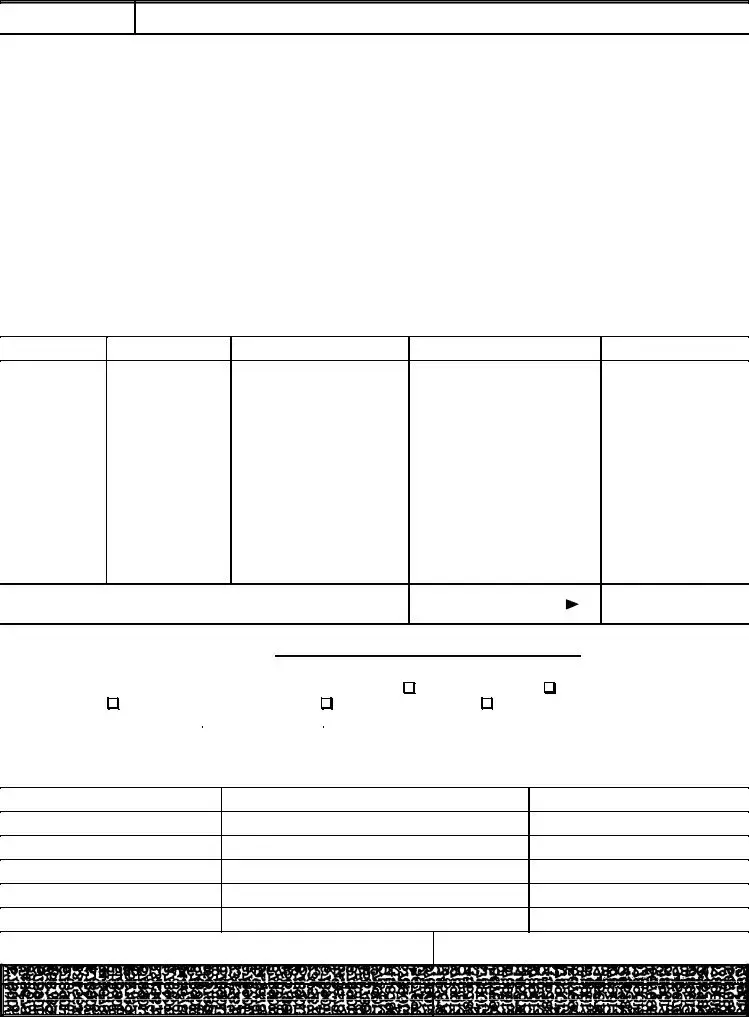

Form

Form

(Rev. July 2002)

Department of the Treasury – Internal Revenue Service

Notice of Levy on Wages, Salary, and Other Income

|

TELEPHONE NUMBER |

DATE: |

OF IRS OFFICE: |

REPLY TO: |

|

|

NAME AND ADDRESS OF TAXPAYER: |

TO: |

|

|

IDENTIFYING NUMBER(S): |

Kind of Tax

Tax Period Ended |

Unpaid Balance of Assessment |

|

|

Statutory Additions

Total

Total Amount Due

We figured the interest and late payment penalty to

Although we asked you to pay the amount you owe, it is still not paid.

This is your copy of a Notice of Levy we have sent to collect the unpaid amount. We will send other levies if we don't get sufficient funds to pay the total amount you owe.

This levy requires the person who received it to turn over to us: your wages and salary that have been earned but not paid, as well as wages and salary earned in the future until the levy is released; and (2) your other income that the person has now or is obligated to pay you. This money is levied to the extent it isn't exempt, as explained on the back of Part 5 of this form.

If you decide to pay the amount you owe now, please bring a guaranteed payment (cash, cashier's check, or money order) to the nearest IRS office with this form, so we can tell the person who received this levy not to send us your money. Make checks and money orders payable to United States Treasury. If you mail your payment instead of bringing it to us, we may not have time to stop the person who received this levy from sending us your money.

If you have any questions or want to arrange payment before other levies are issued, please call or write us. If you write to us, please include your telephone number and the best time for us to call you.

Please see the back of Part 5 for instructions.

Signature of Service Representative

Title

Part 2 — For Taxpayer |

Catalog No. 15703I |

www.irs.gov |

Form |

Excerpts from the Internal Revenue Code

Sec. 6331. LEVY AND DISTRAINT.

(b)Seizure and Sale of

(c)Successive

(e)Continuing Levy on Salary and

Sec. 6332. SURRENDER OF PROPERTY SUBJECT TO LEVY.

(a)Requirement.– Except as otherwise provided in this section, any person in possession of (or obligated with respect to) property or rights to property subject to levy upon which a levy has been made shall, upon demand of the Secretary, surrender such property or rights (or discharge such obligation) to the Secretary, except such part of the property or rights as is, at the time of such demand, subject to an attachment or execution under any judicial process.

(d)Enforcement of Levy.

(1)Extent of personal

(2)Penalty for

(e)Effect of honoring

Sec. 6333. PRODUCTION OF BOOKS.

If a levy has been made or is about to be made on any property, or right to property, any person having custody or control of any books or records, containing evidence or statements relating to the property or right to property subject to levy, shall, upon demand of the Secretary exhibit such books or records to the Secretary.

Sec. 6334. PROPERTY EXEMPT FROM LEVY.

(a)

(4)Unemployment

respect to his unemployment (including any portion thereof payable with respect to dependents) under an unemployment compensation law of the United States, of any State, or of the District of Columbia or of the Commonwealth of Puerto Rico.

(6)Certain annuity and pension

(7)Workmen's compensation.– Any amount payable to an individual as workmen's compensation (including any portion thereof payable with respect to dependents) under a workmen's compensation law of the United States, any State, the District of Columbia, or the Commonwealth of Puerto Rico.

(8)Judgments for support of minor

(9)Minimum exemption for wages, salary and other

(10)Certain

(A)subchapter II, III, IV, V, or VI of chapter 11 of such title 38, or

(B)Chapter 13, 21, 23, 31, 32, 34, 35, 37, or 39 of such title 38.

(11)Certain public assistance

(A)title IV or title XVI (relating to supplemental security income for the aged,

blind, and disabled) of the Social Security Act, or

(B)State or local government public assistance or public welfare programs for which eligibility is determined by a needs or income test.

(12)Assistance Under Job Training Partnership

(d)Exempt Amount of Wages, Salary, or Other Income.–

(1)Individuals on weekly

(2)Exempt

(A) the sum of–

(I) the standard deduction, and

(II) the aggregate amount of the deductions for personal exemptions allowed the taxpayer under section 151 in the taxable year in which such levy occurs, divided by

(B) 52.

Unless the taxpayer submits to the Secretary a written and properly verified statement specifying the facts necessary to determine the proper amount under subparagraph (A), subparagraph (A) shall be applied as if the taxpayer were a married individual filing a separate return with only 1 personal exemption.

(3)Individuals on basis other than

Sec. 6343. AUTHORITY TO RELEASE LEVY AND RETURN PROPERTY.

(a)Release of Levy and Notice of Release.–

(1)In

(A)the liability for which such levy was made is satisfied or becomes unenforceable by reason of lapse of time,

(B)release of such levy will facilitate the collection of such liability,

(C)the taxpayer has entered into an agreement under section 6159 to satisfy such liability by means of installment payments, unless such agreement provides otherwise.

(D)the Secretary has determined that such levy is creating an economic hardship due to the financial condition of the taxpayer, or

(E)the fair market value of the property exceeds such liability and release of the levy on a part of such property could be made without hindering the collection of such liability.

For purposes of subparagraph (C), the Secretary is not required to release such levy if such release would jeopardize the secured creditor status of the Secretary.

(2)Expedited determination on certain business

(3)Subsequent

(b)Return of

(1)the specific property levied upon,

(2)an amount of money equal to the amount of money levied upon, or

(3)an amount of money equal to the amount of money received by the United States from a sale of such property.

Property may be returned at any time. An amount equal to the amount of money levied upon or received from such sale may be returned at any time before the expiration of 9 months from the date of such levy. For purposes of paragraph (3), if property is declared purchased by the United States at a sale pursuant to section 6335(e) (relating to manner and conditions of sale), the United States shall be treated as having received an amount of money equal to the minimum price determined pursuant to such section or (if larger) the amount received by the United States from the resale of such property.

(d)RETURN OF PROPERTY IN CERTAIN

(1)any property has been levied upon, and

(2)the Secretary determines that–

(A)the levy on such property was premature or otherwise not in accordance with administrative procedures of the Secretary,

(B)the taxpayer has entered into an agreement under section 6159 to satisfy the tax liability for which the levy was imposed by means of installment payments, unless such agreement provides otherwise,

(C)the return of such property will facilitate the collection of the tax liability, or

(D)with the consent of the taxpayer or the National Taxpayer Advocate, the return of such property would be in the best interest of the taxpayer (as determined by the National Taxpayer Advocate) and the United States,

the provisions of subsection (b) shall apply in the same manner as if such property had been wrongly levied upon, except that no interest shall be allowed under subsection (c).

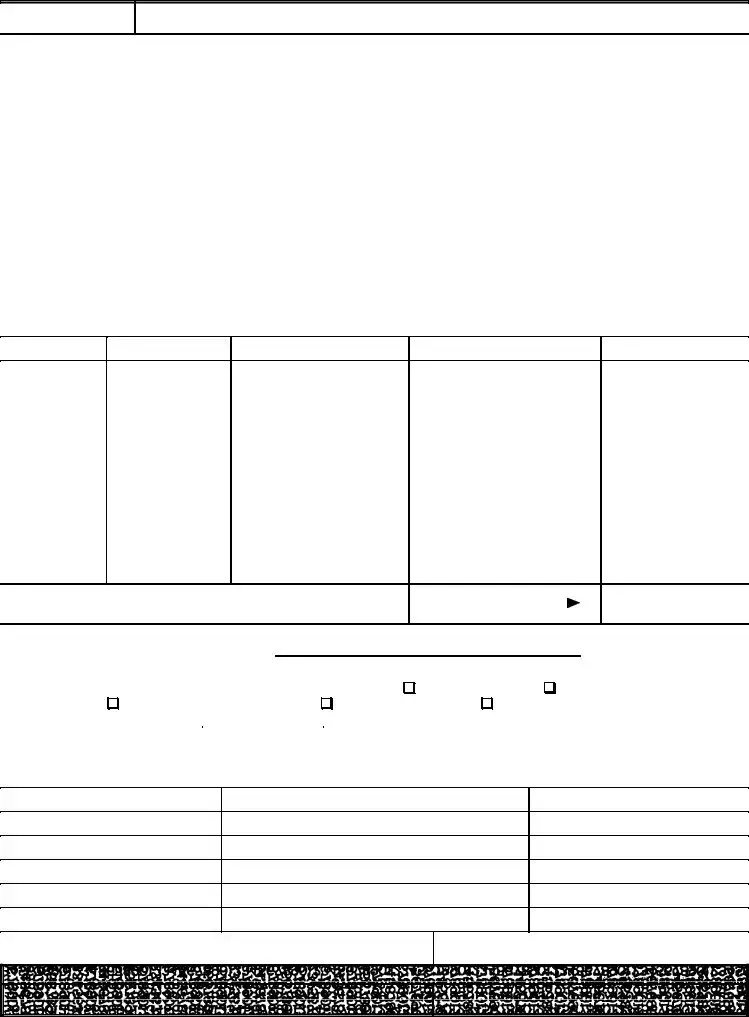

Form

Form

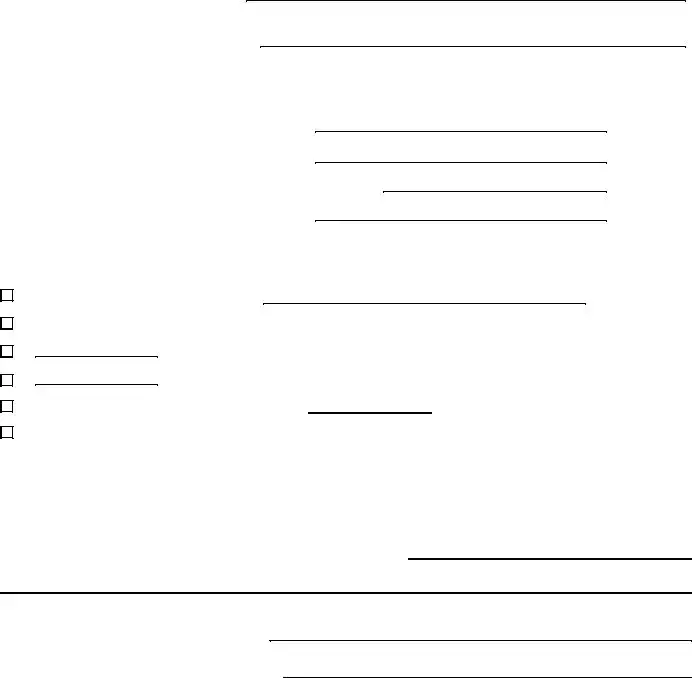

(Rev. July 2002)

Department of the Treasury – Internal Revenue Service

Notice of Levy on Wages, Salary, and Other Income

|

TELEPHONE NUMBER |

DATE: |

OF IRS OFFICE: |

REPLY TO: |

|

|

NAME AND ADDRESS OF TAXPAYER: |

TO: |

|

|

IDENTIFYING NUMBER(S): |

Kind of Tax

Tax Period Ended

Unpaid Balance of Assessment

Statutory Additions

Total

Employer or Other Addressee: Please complete the back of this page.

Total Amount Due

We figured the interest and late payment penalty to

Statement of Exemptions and Filing Status (To be completed by taxpayer; instructions are on the back of Part 5)

My filing status for my income tax return is (check one): |

|

|

|

Single; |

|

|

|

Married Filing a Joint Return; |

|||

|

|

|

|

|

|

||||||

|

|

Married Filing a Separate Return; |

|

Head of Household; or |

|

Qualifying Widow(er) with dependent child |

|||||

|

|

|

|||||||||

ADDITIONAL STANDARD DEDUCTION: |

|

(Enter amount only if you or your spouse is at least 65 and/or blind.) |

|||||||||

I certify that I can claim the people named below as personal exemptions on my income tax return and that none are claimed on another Notice of Levy. No one I have listed is my minor child to whom (as required by court or administrative order) I make support payments that are already exempt from levy. I understand the information I have provided may be verified by the Internal Revenue Service. Under penalties of perjury, I declare that this statement of exemptions and filing status is true.

Name (Last, First, Middle Initial)

Relationship (Husband, Wife, Son, Daughter, etc.)

Social Security Number (SSN)

Taxpayer's Signature

Date

Part 3 — Return to IRS |

Form |

PLEASE REMOVE THIS PAGE BEFORE COMPLETING IT.

TAXPAYER'S NAME(S)

IDENTIFYING NUMBER(S)

(as shown on the front)

SECTION 1.— Levy Acknowledgment

Signature of person responding

Printed name of person responding

Your telephone number |

( |

) |

Date and time this levy received

SECTION 2.— Levy Results (Check all applicable boxes.)

Check attached in the amount of $

Additional checks will be sent:

(weekly,

approximate amount of each payment

Taxpayer no longer employed here, as of(date). Remarks

SECTION 3.— Additional Information (Please complete this section if this levy does not attach any funds.)

Taxpayer's latest address, if different from the one on this levy.

Taxpayer's telephone number ( )

Name and address of taxpayer's employer: (if different from addressee)

Other information you believe may help us:

Form

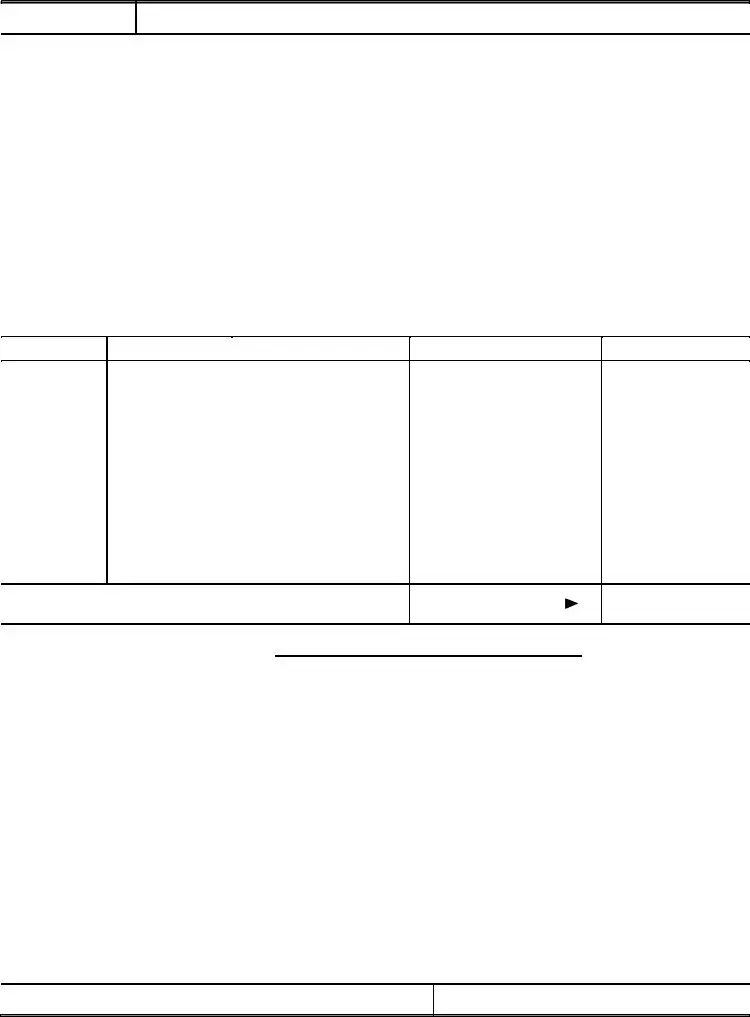

Form

(Rev. July 2002)

Department of the Treasury – Internal Revenue Service

Notice of Levy on Wages, Salary, and Other Income

|

TELEPHONE NUMBER |

DATE: |

OF IRS OFFICE: |

REPLY TO: |

|

|

NAME AND ADDRESS OF TAXPAYER: |

TO: |

|

|

IDENTIFYING NUMBER(S): |

Kind of Tax

Tax Period Ended

Unpaid Balance of Assessment

Statutory Additions

Total

Total Amount Due

We figured the interest and late payment penalty to

Statement of Exemptions and Filing Status (To be completed by taxpayer; instructions are on the back of Part 5)

My filing status for my income tax return is (check one): |

|

|

|

Single; |

|

|

|

Married Filing a Joint Return; |

|||

|

|

|

|

|

|

||||||

|

|

Married Filing a Separate Return; |

|

Head of Household; or |

|

Qualifying Widow(er) with dependent child |

|||||

|

|

|

|||||||||

ADDITIONAL STANDARD DEDUCTION: |

|

(Enter amount only if you or your spouse is at least 65 and/or blind.) |

|||||||||

I certify that I can claim the people named below as personal exemptions on my income tax return and that none are claimed on another Notice of Levy. No one I have listed is my minor child to whom (as required by court or administrative order) I make support payments that are already exempt from levy. I understand the information I have provided may be verified by the Internal Revenue Service. Under penalties of perjury, I declare that this statement of exemptions and filing status is true.

Name (Last, First, Middle Initial)

Relationship (Husband, Wife, Son, Daughter, etc.)

Social Security Number (SSN)

Taxpayer's Signature

Date

Part 4 — For Employer or other Addressee to keep after Taxpayer completes |

Form |

Excerpts from the Internal Revenue Code

Sec. 6331. LEVY AND DISTRAINT.

(b)Seizure and Sale of

(c)Successive

(e)Continuing Levy on Salary and

Sec. 6332. SURRENDER OF PROPERTY SUBJECT TO LEVY.

(a)Requirement.– Except as otherwise provided in this section, any person in possession of (or obligated with respect to) property or rights to property subject to levy upon which a levy has been made shall, upon demand of the Secretary, surrender such property or rights (or discharge such obligation) to the Secretary, except such part of the property or rights as is, at the time of such demand, subject to an attachment or execution under any judicial process.

(d)Enforcement of Levy.

(1)Extent of personal

(2)Penalty for

(e)Effect of honoring

Sec. 6333. PRODUCTION OF BOOKS.

If a levy has been made or is about to be made on any property, or right to property, any person having custody or control of any books or records, containing evidence or statements relating to the property or right to property subject to levy, shall, upon demand of the Secretary exhibit such books or records to the Secretary.

Sec. 6334. PROPERTY EXEMPT FROM LEVY.

(a)

(4)Unemployment

respect to his unemployment (including any portion thereof payable with respect to dependents) under an unemployment compensation law of the United States, of any State, or of the District of Columbia or of the Commonwealth of Puerto Rico.

(6)Certain annuity and pension

(7)Workmen's compensation.– Any amount payable to an individual as workmen's compensation (including any portion thereof payable with respect to dependents) under a workmen's compensation law of the United States, any State, the District of Columbia, or the Commonwealth of Puerto Rico.

(8)Judgments for support of minor

(9)Minimum exemption for wages, salary and other

(10)Certain

(A)subchapter II, III, IV, V, or VI of chapter 11 of such title 38, or

(B)Chapter 13, 21, 23, 31, 32, 34, 35, 37, or 39 of such title 38.

(11)Certain public assistance

(A)title IV or title XVI (relating to supplemental security income for the aged,

blind, and disabled) of the Social Security Act, or

(B)State or local government public assistance or public welfare programs for which eligibility is determined by a needs or income test.

(12)Assistance Under Job Training Partnership

(d)Exempt Amount of Wages, Salary, or Other Income.–

(1)Individuals on weekly

(2)Exempt

(A) the sum of–

(I) the standard deduction, and

(II) the aggregate amount of the deductions for personal exemptions allowed the taxpayer under section 151 in the taxable year in which such levy occurs, divided by

(B) 52.

Unless the taxpayer submits to the Secretary a written and properly verified statement specifying the facts necessary to determine the proper amount under subparagraph (A), subparagraph (A) shall be applied as if the taxpayer were a married individual filing a separate return with only 1 personal exemption.

(3)Individuals on basis other than

Sec. 6343. AUTHORITY TO RELEASE LEVY AND RETURN PROPERTY.

(a)Release of Levy and Notice of Release.–

(1)In

(A)the liability for which such levy was made is satisfied or becomes unenforceable by reason of lapse of time,

(B)release of such levy will facilitate the collection of such liability,

(C)the taxpayer has entered into an agreement under section 6159 to satisfy such liability by means of installment payments, unless such agreement provides otherwise.

(D)the Secretary has determined that such levy is creating an economic hardship due to the financial condition of the taxpayer, or

(E)the fair market value of the property exceeds such liability and release of the levy on a part of such property could be made without hindering the collection of such liability.

For purposes of subparagraph (C), the Secretary is not required to release such levy if such release would jeopardize the secured creditor status of the Secretary.

(2)Expedited determination on certain business

(3)Subsequent

(b)Return of

(1)the specific property levied upon,

(2)an amount of money equal to the amount of money levied upon, or

(3)an amount of money equal to the amount of money received by the United States from a sale of such property.

Property may be returned at any time. An amount equal to the amount of money levied upon or received from such sale may be returned at any time before the expiration of 9 months from the date of such levy. For purposes of paragraph (3), if property is declared purchased by the United States at a sale pursuant to section 6335(e) (relating to manner and conditions of sale), the United States shall be treated as having received an amount of money equal to the minimum price determined pursuant to such section or (if larger) the amount received by the United States from the resale of such property.

(d)RETURN OF PROPERTY IN CERTAIN

(1)any property has been levied upon, and

(2)the Secretary determines that–

(A)the levy on such property was premature or otherwise not in accordance with administrative procedures of the Secretary,

(B)the taxpayer has entered into an agreement under section 6159 to satisfy the tax liability for which the levy was imposed by means of installment payments, unless such agreement provides otherwise,

(C)the return of such property will facilitate the collection of the tax liability, or

(D)with the consent of the taxpayer or the National Taxpayer Advocate, the return of such property would be in the best interest of the taxpayer (as determined by the National Taxpayer Advocate) and the United States,

the provisions of subsection (b) shall apply in the same manner as if such property had been wrongly levied upon, except that no interest shall be allowed under subsection (c).

Form

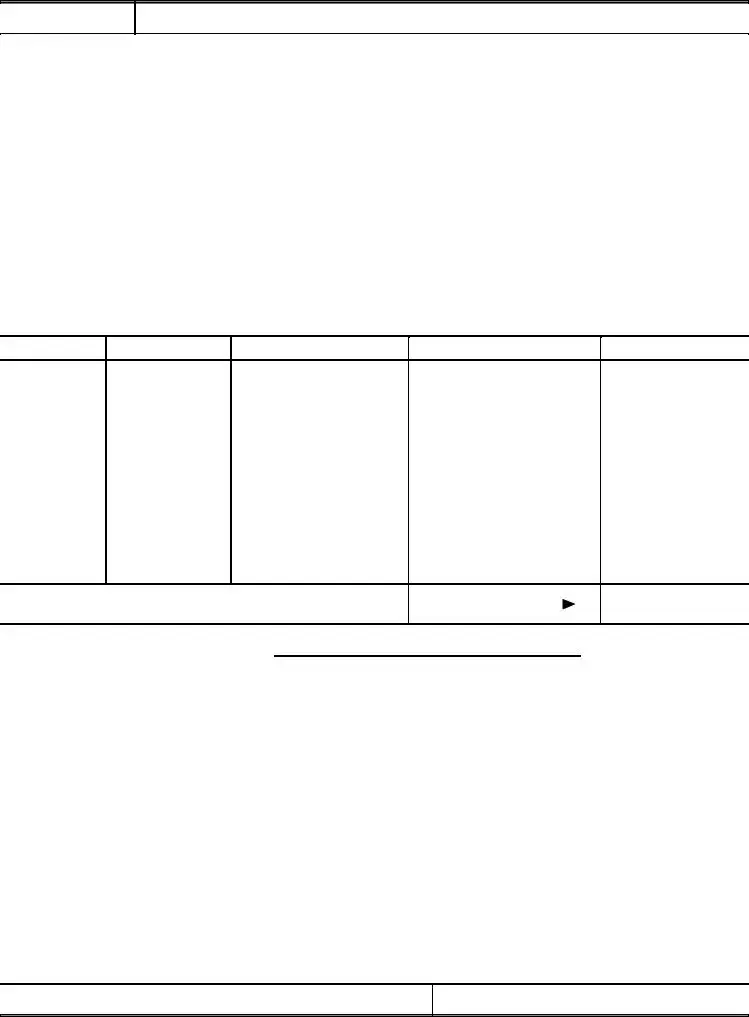

Form

(Rev. July 2002)

Department of the Treasury – Internal Revenue Service

Notice of Levy on Wages, Salary, and Other Income

|

TELEPHONE NUMBER |

DATE: |

OF IRS OFFICE: |

REPLY TO: |

|

|

NAME AND ADDRESS OF TAXPAYER: |

TO: |

|

|

IDENTIFYING NUMBER(S): |

Kind of Tax

Tax Period Ended

Unpaid Balance of Assessment

Statutory Additions

Total

Total Amount Due

We figured the interest and late payment penalty to

Statement of Exemptions and Filing Status (To be completed by taxpayer; instructions are on the back of Part 5)

My filing status for my income tax return is (check one): |

|

|

|

Single; |

|

|

|

Married Filing a Joint Return; |

|||

|

|

|

|

|

|

||||||

|

|

Married Filing a Separate Return; |

|

Head of Household; or |

|

Qualifying Widow(er) with dependent child |

|||||

|

|

|

|||||||||

ADDITIONAL STANDARD DEDUCTION: |

|

(Enter amount only if you or your spouse is at least 65 and/or blind.) |

|||||||||

I certify that I can claim the people named below as personal exemptions on my income tax return and that none are claimed on another Notice of Levy. No one I have listed is my minor child to whom (as required by court or administrative order) I make support payments that are already exempt from levy. I understand the information I have provided may be verified by the Internal Revenue Service. Under penalties of perjury, I declare that this statement of exemptions and filing status is true.

Name (Last, First, Middle Initial)

Relationship (Husband, Wife, Son, Daughter, etc.)

Social Security Number (SSN)

Taxpayer's Signature

Date

Part 5 — For Taxpayer to keep |

Form |

Instructions to the Taxpayer

A levy was served on the person named on the front of this form. The information you provide on this form will be used by that person to figure the amount of your income that is exempt from levy.

Please complete Parts 3, 4, and 5. First, indicate your filing status by checking one of the five blocks on the Statement of Exemptions and Filing Status. Then, list each person that you can claim as an exemption on your income tax return not claimed on another Notice of Levy on Wages, Salary, and Other Income. Include each person's relationship to you and Social Security Number. If the person is less than six months old and does not have a number yet, write “Less than six months old” in the Social Security Number column. If you are claimed as a dependent by someone else, write “I can't claim an exemption for myself” next to your signature on the statement. Be sure to complete, sign and date all copies of the statement.

The amount of your income that is exempt from this levy each week can be figured by adding the standard deduction you can claim on your income tax return and the amount you claim on it for exemptions. Then, this total is divided by 52.

If you or your spouse is at least 65 years old and/or blind, you can claim the additional standard deduction which increases the amount exempt from this levy.

Count one for each of the following: (a) you are 65 or older, (b) you are blind, (c) your spouse is 65 or older, and (d) your spouse is blind. Enter this total (up to 4) to the right of “ADDITIONAL STANDARD DEDUCTION” on Parts 3, 4, and 5.

Also, if you are required by a court or administrative order (made before the date of this levy) to support your minor children, then the amount needed to pay the support established by a court or administrative order is also exempt from the levy, and these minor children can't be listed as exemptions.

Keep Parts 2 and 5 for your records. Give Parts 3 and 4 to your employer within 3 work days after you receive them. If you do not give the completed statement to your employer, then your exempt amount will be figured as if your filing status is married filing separate with only one exemption, plus the amount for paying child support established by a court or administrative order. If you subsequently submit a Statement of Exemptions and Filing Status to your employer, your exempt amount will be adjusted to correspond to your statement.

If the number of your exemptions or your filing status change while this levy is in effect, please file another Statement of Exemptions and Filing Status with the person on whom this levy was served. You can get more forms from an Internal Revenue Service office.

In addition, if this levy is still in effect next year and if the standard deduction and amount deductible for personal exemptions change in the new year for all taxpayers, you may submit a new Statement of Exemptions and Filing Status, even though there may be no change from the prior statement. Submitting a new Statement of Exemptions and Filing Status will allow your employer to use the new year's exemption table (Publication 1494).

The information you provide is submitted under penalties of perjury and may be verified by the Internal Revenue Service.

Form

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | This form serves as a Notice of Levy on wages, salary, and other income owed to a taxpayer. |

| Governing Law | The levy is governed by Section 6331 of the Internal Revenue Code. |

| Effective Date | The current version of the form was revised in July 2002. |

| Notice of Levy | The form notifies the recipient that they are required to turn over certain amounts to the IRS specified in the notice. |

| Exempt Amount | Some portions of wages or income are exempt from levy as detailed in the form’s instructions. |

| Office Contact | A specific IRS office telephone number is provided for inquiries related to the levy. |

| Compliance Requirement | Failure to comply with the levy can result in personal liability for the individual or entity receiving the notice. |

| Form Distribution | Parts of the form must be given to the taxpayer immediately upon receipt of the levy notice. |

Guidelines on Utilizing 668 W C Do

Following the outline provided, use the steps below to complete the Form 668 W C Do. It is important to fill out this form accurately and promptly, as it pertains to a notice of levy requiring the collection of tax debts.

- Obtain the form: Download or print Form 668-W(c)(DO) from the IRS website.

- Fill in the date: Enter the date the form is being completed in the designated space.

- Contact information of IRS office: Provide the telephone number and address as indicated on the form.

- Complete taxpayer information: Write the name and address of the taxpayer who owes taxes, including their identifying number if available.

- Specify tax information: Indicate the kind of tax, the tax period ended, unpaid balance, statutory additions, and the total amount due.

- Distribute Parts: Give Parts 2, 3, 4, and 5 of the form to the taxpayer as soon as the levy is received. Ensure the taxpayer understands their responsibilities regarding exemptions.

- Wait for the taxpayer's response: The taxpayer must complete Parts 3 and 4 regarding exemptions within 3 business days after receiving the levy. Look for their completed forms.

- Calculate exempt amounts: Utilize the information provided in Parts 3 and 4 and apply it to the table from Publication 1494 to figure the exempt amounts from the levy.

- Make payments: Send the taxpayer's net earnings after exempt amounts to the IRS according to the instructions provided in the form.

- Maintain records: Keep a copy of the completed forms and any payments sent to the IRS for your records.

Once the form is completed, follow the outlined steps diligently. It is important to adhere to the required timelines and procedures to avoid complications with the IRS or potential penalties.

What You Should Know About This Form

What is Form 668-W(c)(DO)?

Form 668-W(c)(DO) is a document issued by the Internal Revenue Service (IRS) that serves as a Notice of Levy on wages, salary, and other income. It is not a bill for taxes owed but acts as a formal notification that the IRS is collecting outstanding taxes from an individual’s wages or other sources of income. The form specifies the unpaid balance due and provides instructions on how to respond to the levy.

Who receives Form 668-W(c)(DO)?

This form is typically sent to employers or other entities obligated to pay income to a taxpayer. The IRS advises these parties to withhold the taxpayer's wages or income to satisfy the tax debt indicated on the form. The taxpayer will also receive a copy for their records and awareness of the situation.

What should I do if I receive this form as an employer?

If you receive Form 668-W(c)(DO), you must follow the instructions provided. You need to withhold the specified amount from the taxpayer's wages or income, as detailed in the levy notice. Make sure to send the withheld funds to the IRS as directed by the form. You should also inform the taxpayer about the levy, as they may need to claim exemptions or adjust their payments going forward.

Can a taxpayer claim exemptions from the levy?

Yes, taxpayers may claim certain exemptions from the levy. To do this, they must complete the Statement of Exemptions and Filing Status, which is part of the form. The guidelines for determining exempt amounts are outlined in the instructions provided with the levy notice. The exemptions may account for personal exemptions, additional standard deductions for age or blindness, and support payments for minor children that have been established by court order.

How long is the levy in effect?

The levy remains in effect until the IRS releases it. This could be after the tax debt is paid, if a payment arrangement is made, or if certain qualifying conditions are met, such as economic hardship. Employers and other entities are required to honor this levy on all future payments to the taxpayer until they receive a notification from the IRS indicating the levy has been lifted.

What happens if I do not comply with the levy?

Failure to comply with the levy can lead to personal liability for the amount not remitted to the IRS. This could mean you are responsible for paying the IRS what the taxpayer owes, along with potential penalties. The IRS has the authority to enforce the levy, which may include further legal actions against you for noncompliance.

What information do I need to send with the payment to the IRS?

When sending payments to the IRS as a result of a levy, employers must include specific information on the check. This includes the taxpayer’s name, identifying number(s), type of tax, the tax periods involved, and the note “LEVY PROCEEDS.” Additionally, ensure that the payment is made out to the United States Treasury. Following these instructions helps ensure proper application of the payment against the taxpayer's debt.

Common mistakes

Filling out the Form 668-W(c)(DO) can be a daunting process. One common mistake occurs when individuals fail to provide their correct identifying numbers, particularly Social Security Numbers (SSNs). Providing an incorrect or missing SSN can lead to delays and complications in processing the levy. It is vital to double-check this information before submitting the form to ensure it aligns with the IRS records.

Another error often seen is misunderstanding the exemptions related to the taxpayer's income. Many people incorrectly assume exemptions automatically apply without completing the required Statement of Exemptions and Filing Status accurately. It's crucial to carefully follow the instructions and submit the necessary documentation in Parts 3 and 4, as failing to do so means the taxpayer may not benefit from the exemptions they are entitled to claim.

Additionally, individuals sometimes overlook the importance of timely responses. Once the levy is received, it requires action within a set period, typically three work days. Delaying this response can result in the employer or other payees being obligated to forward the taxpayer's income without accounting for potential exemptions. Adhering to the timeline is essential to ensure that the taxpayer retains some control over their finances.

Moreover, it is common for taxpayers to miscalculate their exempt amounts. For instance, when determining the exempt amount based on dependents and filing status, errors can arise. Individuals may forget to include all eligible exemptions or misinterpret the guidelines leading to incorrect calculations. It is advisable to take the time to review the specific exemption categories outlined in the IRS guidelines to ensure accurate reporting.

An additional frequent pitfall pertains to ongoing income reporting. Those completing the form may not understand that the levy applies not only to current wages but also to future payments. Thus, it is crucial that employers understand their obligation extends beyond merely submitting a one-time payment but rather involves a continuous obligation as long as the levy is in effect. This misunderstanding can lead to confusion and potential non-compliance with IRS directives.

Furthermore, individuals often fail to seek assistance when needed. Many assume they must navigate the complexities of the tax levy alone. Seeking guidance from a tax professional or directly from the IRS can provide clarity and ensure that the form is filled out correctly. Taking this step can prevent costly mistakes that could exacerbate the situation.

Another area of confusion lies in understanding the limitations of exemptions that apply to certain types of income. For example, unemployment benefits and retirement payments have specific guidelines that may not be immediately clear to many. Failure to account for these specifics can result in further financial issues for the taxpayer. Reviewing the IRS exemptions thoroughly can help individuals avoid this trap.

Lastly, some may neglect to keep a copy of the completed levy form for their records. This can result in complications in future interactions with the IRS or when discussing the matter with financial institutions. Keeping comprehensive records is essential when dealing with such important documentation, as it provides a safeguard if the matter arises again.

Documents used along the form

The IRS Form 668-W(c)(DO) is a notice of levy, specifically focusing on collecting unpaid taxes through the garnishment of wages and other income. Along with this notice, several other forms and documents are frequently involved in the process of tax collection and compliance. Below is a list of these forms, complete with brief explanations of their purposes.

- Form 668-W - This is the main levy notice that instructs the employer or payer about the amount to withhold from the taxpayer's earnings. It guides the employer on how to proceed with the levy attached to the taxpayer's wages.

- Form 843 - This is used to claim a refund or request an abatement of certain taxes, penalties, or interest. If a taxpayer believes they have been wrongfully levied or if a mistake has occurred, this form can initiate the process to get their funds back.

- Form 1040 - The standard individual income tax return that taxpayers file annually. This document provides comprehensive details about the taxpayer's income, deductions, and tax liability, which helps determine whether the levy is warranted.

- Form 1040-X - This form is for amending a previously filed tax return. If a taxpayer finds errors on their original return that could affect their liability, this form updates their records and potentially refutes the basis for a levy.

- Form W-4 - This is the Employee's Withholding Certificate used by employees to set their federal income tax withholding. While not directly related to levies, updated withholding information can affect a taxpayer's take-home pay and may relate to exempt amounts owed in response to a levy.

- Form 941 - This form is used by employers to report employment taxes and withholdings. The IRS might review these forms to confirm the accuracy of amounts withheld under a levy.

- Publication 1494 - This IRS publication outlines the Federal Exempt Amount for tax levies and is referenced when figuring out exemptions for wage levies, guiding employers in understanding what amounts are exempt.

- Form 4579 - This form is used to provide additional information and documentation if a taxpayer is facing potential levy action, especially if they believe they owe less than indicated or do not owe at all.

Understanding these forms can empower both employers and taxpayers in handling tax levies effectively. Properly managing the levy process and understanding one's rights and responsibilities is crucial to avoid unnecessary complications and ensure compliance with tax laws.

Similar forms

The Form 668 W C Do serves a specific function within tax collection procedures, particularly in relation to levies on wages and income. Here are five documents that share similarities with this form, highlighting their purposes and connections:

- Form 668-W(c)(S) - This is another version of the Notice of Levy specifically for certain types of unearned income such as dividends and interest. Just like the 668 W C Do, it informs third parties of the IRS's intent to collect owed taxes through the levying of earnings.

- Form 668-A - Often referred to as the "Notice of Levy," this form includes details for seizing assets other than wages, such as bank accounts or property. Both forms notify the recipient of the levy but focus on different sources of income or asset types.

- Form 13327 - Known as the “Notice of Federal Tax Lien,” this document indicates the IRS's legal claim against property when taxes are unpaid. While the 668 W C Do is about collecting income directly, this form serves as a public record indicating the federal government's claim to a taxpayer's property.

- Form 1040 - This is the standard individual income tax return form. While the 668 W C Do is a tool for collecting unpaid tax liabilities, the 1040 is used to report income, deductions, and credits, which are essential for establishing any tax obligations at all.

- Form 8379 - Also known as the “Injured Spouse Allocation,” this form allows a spouse to claim their portion of a tax refund that may have been intercepted to pay for the other spouse’s tax debt. Like the 668 W C Do, it addresses situations related to tax liabilities, helping to protect the financial interests of a taxpayer when one spouse has tax debts.

Dos and Don'ts

Things You Should Do:

- Read the entire form carefully before you start filling it out.

- Ensure that the taxpayer’s name and identifying number are accurate.

- Provide complete and honest information to avoid penalties.

- Contact the IRS for clarity if any part of the form is unclear.

- Return the completed Parts 3, 4, and 5 to the appropriate address within the required time frame.

- Include necessary documentation when requested by the IRS.

- Keep copies of all documents for your records.

Things You Shouldn't Do:

- Do not ignore the instructions provided on the form.

- Never alter information that has already been submitted.

- Avoid making assumptions about exemptions without proper documentation.

- Do not delay sending the form back to the IRS.

Misconceptions

- Misconception 1: The Form 668 W C Do is a bill for taxes owed.

- Misconception 2: All income from the taxpayer is subject to levy.

- Misconception 3: The taxpayer can ignore this notice.

- Misconception 4: The recipient of the levy can deduct payments owed to the taxpayer.

- Misconception 5: The IRS will immediately withdraw the levy once payment is made.

- Misconception 6: Any funds owed to a taxpayer can be withheld indefinitely.

- Misconception 7: The taxpayer's filing status does not affect the exempt amount.

This form is not a bill. It serves as a notice of levy to collect unpaid taxes. The IRS has already demanded payment, and this document indicates further action to secure funds owed.

Not all income is subject to the levy. Specific exemptions exist for certain types of income, such as unemployment benefits, pension payments, and child support.

Recipients cannot offset any payments owed to the taxpayer against the amounts to be levied without first consulting the IRS.

The IRS will release the levy only when certain conditions are met, including full payment of the owed taxes or hardship circumstances evaluated by the IRS.

While the levy remains in effect until released, it only applies to income due at the time of the levy. Future payments require a new notice or levy.

The taxpayer's filing status and exemptions significantly influence the amount exempt from the levy. Proper documentation must be provided to claim these exemptions.

Key takeaways

Form 668-W(c)(DO) serves as a Notice of Levy issued by the IRS, aimed at collecting unpaid taxes from a taxpayer’s wages or other income. It is crucial for recipients to understand that this is not a bill, but a formal request for the payment of owed funds.

Employers or third parties receiving this notice must act promptly. They are required to provide the taxpayer with Parts 2, 3, 4, and 5 of the form upon receipt in order to account for exemptions and ensure proper handling of the levy.

The taxpayer can claim exemptions from the levy by submitting a Statement of Exemptions and Filing Status. This statement must be filled out and returned within three workdays of receiving the levy to ensure that the correct net amount is remitted to the IRS.

It is essential for the person handling the levy to maintain accurate payment records. They must document the taxpayer’s take-home pay after exempt amounts have been deducted and forward the remaining funds to the IRS on schedule, preventing any penalties for non-compliance.

Browse Other Templates

Wordly Wise 3000 Book 5 Test Booklet Pdf - Enables the reproduction of designated pages for instructional use only.

Boys Night Out Permission Slip - The form also cheekily suggests financial repercussions, common in long-term relationships.