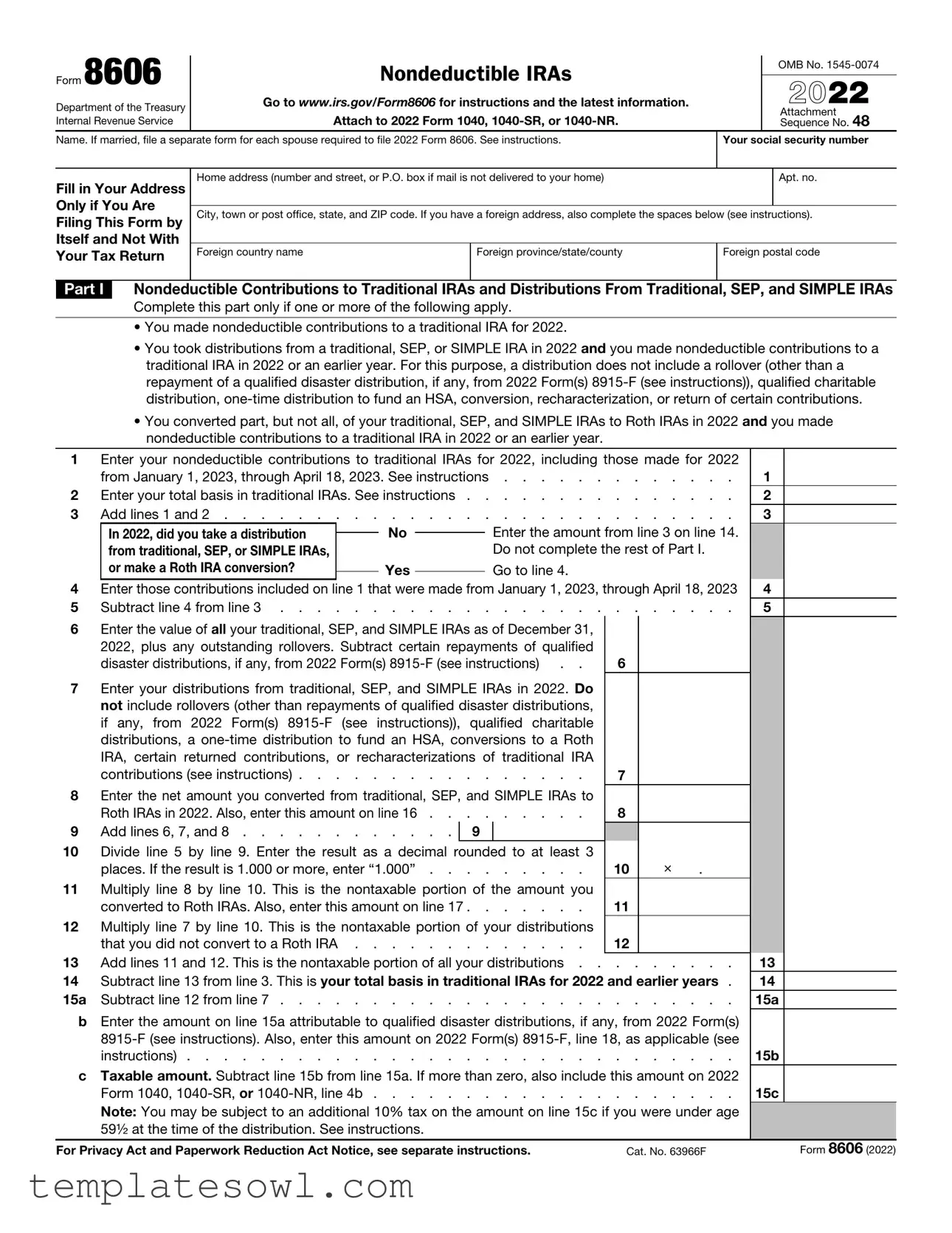

Fill Out Your 8606 Form

The IRS Form 8606 plays a crucial role in managing certain types of individual retirement accounts (IRAs), particularly when it comes to nondeductible contributions and conversions to Roth IRAs. Taxpayers must fill out this form if they have made nondeductible contributions to traditional IRAs, taken distributions from these accounts, or converted any portion of their traditional, SEP, or SIMPLE IRAs to Roth IRAs in the applicable tax year. For those who qualify, the form allows for the reporting of both the nondeductible contributions made and the taxable amounts resulting from distributions or conversions. Importantly, it ensures that individuals accurately track their basis in traditional IRAs and avoid double taxation on their contributions. Married individuals filing separately must submit a separate Form 8606 for each spouse. This form is typically filed alongside the IRS Form 1040, 1040-SR, or 1040-NR, making its timely and accurate completion essential for compliant tax reporting. Understanding the nuances of Form 8606 can help taxpayers effectively manage their retirement savings and minimize potential tax liabilities.

8606 Example

Form 8606 |

|

Nondeductible IRAs |

|

|

OMB No. |

|

|

|

|

|

|||

|

|

2022 |

||||

Department of the Treasury |

Go to www.irs.gov/Form8606 for instructions and the latest information. |

|

||||

|

|

Attach to 2022 Form 1040, |

|

|

Attachment |

|

Internal Revenue Service |

|

|

|

Sequence No. 48 |

||

Name. If married, file a separate form for each spouse required to file 2022 Form 8606. See instructions. |

Your social security number |

|||||

|

|

|

|

|

||

Fill in Your Address |

Home address (number and street, or P.O. box if mail is not delivered to your home) |

|

|

Apt. no. |

||

Only if You Are |

|

|

|

|

|

|

City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces below (see instructions). |

||||||

Filing This Form by |

||||||

Itself and Not With |

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

Foreign postal code |

||||

Your Tax Return |

||||||

Part I Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, SEP, and SIMPLE IRAs

Complete this part only if one or more of the following apply.

• You made nondeductible contributions to a traditional IRA for 2022.

• You took distributions from a traditional, SEP, or SIMPLE IRA in 2022 and you made nondeductible contributions to a traditional IRA in 2022 or an earlier year. For this purpose, a distribution does not include a rollover (other than a repayment of a qualified disaster distribution, if any, from 2022 Form(s)

• You converted part, but not all, of your traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2022 and you made nondeductible contributions to a traditional IRA in 2022 or an earlier year.

1 |

Enter your nondeductible contributions to traditional IRAs for 2022, including those made for 2022 |

|

|

|||||

|

from January 1, 2023, through April 18, 2023. See instructions |

. . . . . . . . . . . . . |

1 |

|

||||

2 |

Enter your total basis in traditional IRAs. See instructions . . |

. . . . . . . . . . . . . |

2 |

|

||||

3 |

Add lines 1 and 2 |

. . . . . . . . . . . . . |

3 |

|

||||

|

In 2022, did you take a distribution |

|

No |

|

|

Enter the amount from line 3 on line 14. |

|

|

|

|

|

|

|

||||

|

from traditional, SEP, or SIMPLE IRAs, |

|

|

|

|

Do not complete the rest of Part I. |

|

|

4 |

or make a Roth IRA conversion? |

|

Yes |

|

|

Go to line 4. |

|

|

|

|

|

|

|||||

Enter those contributions included on line 1 that were made from January 1, 2023, through April 18, 2023 |

4 |

|

||||||

5 |

Subtract line 4 from line 3 |

. . . . . . . . . . . . . |

5 |

|

||||

6Enter the value of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2022, plus any outstanding rollovers. Subtract certain repayments of qualified

disaster distributions, if any, from 2022 Form(s) |

6 |

7Enter your distributions from traditional, SEP, and SIMPLE IRAs in 2022. Do not include rollovers (other than repayments of qualified disaster distributions, if any, from 2022 Form(s)

IRA, certain returned contributions, or recharacterizations of traditional |

IRA |

|

contributions (see instructions) |

. |

7 |

8Enter the net amount you converted from traditional, SEP, and SIMPLE IRAs to

Roth IRAs in 2022. Also, enter this amount on line 16 . . |

. . . . . . . |

8 |

|

|

9 Add lines 6, 7, and 8 |

9 |

|

|

|

10Divide line 5 by line 9. Enter the result as a decimal rounded to at least 3

places. If the result is 1.000 or more, enter “1.000” |

10 |

× |

. |

11Multiply line 8 by line 10. This is the nontaxable portion of the amount you

converted to Roth IRAs. Also, enter this amount on line 17 |

11 |

12Multiply line 7 by line 10. This is the nontaxable portion of your distributions

|

that you did not convert to a Roth IRA |

12 |

|

|

13 |

Add lines 11 and 12. This is the nontaxable portion of all your distributions |

|

13 |

|

14 |

Subtract line 13 from line 3. This is your total basis in traditional IRAs for 2022 and earlier years . |

|

14 |

|

15a |

Subtract line 12 from line 7 |

15a |

||

bEnter the amount on line 15a attributable to qualified disaster distributions, if any, from 2022 Form(s)

instructions) |

15b |

cTaxable amount. Subtract line 15b from line 15a. If more than zero, also include this amount on 2022 Form 1040,

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 63966F |

Form 8606 (2022) |

Form 8606 (2022) |

Page 2 |

Part II 2022 Conversions From Traditional, SEP, or SIMPLE IRAs to Roth IRAs

Complete this part if you converted part or all of your traditional, SEP, and SIMPLE IRAs to a Roth IRA in 2022.

16If you completed Part I, enter the amount from line 8. Otherwise, enter the net amount you converted

from traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2022 . . . . . . . . . . . . .

17If you completed Part I, enter the amount from line 11. Otherwise, enter your basis in the amount on

line 16 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

18Taxable amount. Subtract line 17 from line 16. If more than zero, also include this amount on 2022 Form 1040,

Part III Distributions From Roth IRAs

16

17

18

Complete this part only if you took a distribution from a Roth IRA in 2022. For this purpose, a distribution does not include a rollover (other than a repayment of a qualified disaster distribution (from 2022 Form(s)

19 |

Enter your total nonqualified distributions from Roth IRAs in 2022, including any qualified |

|

|

|||||||||

|

homebuyer distributions, and any qualified disaster distributions from 2022 Form(s) |

|

|

|||||||||

|

instructions) |

. . . . |

19 |

|

||||||||

20 |

Qualified |

|

|

|||||||||

|

by the total of all your prior qualified |

. . . . |

20 |

|

||||||||

21 |

Subtract line 20 from line 19. If zero or less, enter |

. . . . |

21 |

|

||||||||

22 |

Enter your basis in Roth IRA contributions (see instructions). If line 21 is zero, stop here . |

. . . . |

22 |

|

||||||||

23 |

Subtract line 22 from line 21. If zero or less, enter |

|

|

|||||||||

|

may be subject to an additional tax (see instructions) |

. . . . |

23 |

|

||||||||

24 |

Enter your basis in conversions from traditional, SEP, and SIMPLE IRAs and rollovers from qualified |

|

|

|||||||||

|

retirement plans to a Roth IRA. See instructions |

. . . . |

24 |

|

||||||||

25a |

Subtract line 24 from line 23. If zero or less, enter |

. . . . |

25a |

|

||||||||

b Enter the amount on line 25a attributable to qualified disaster distributions, if any, from 2022 Form(s) |

|

|

||||||||||

|

|

|

||||||||||

|

instructions) |

. . . . |

25b |

|

||||||||

c |

Taxable amount. Subtract line 25b from line 25a. If more than zero, also include this amount on 2022 |

|

|

|||||||||

|

Form 1040, |

. . . . |

25c |

|

||||||||

Sign Here Only if You |

Under penalties of perjury, I declare that I have examined this form, including accompanying attachments, and to the best of my knowledge and |

|||||||||||

Are Filing This Form |

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||

by Itself and Not With |

|

|

|

|

|

|

|

|

|

|

||

Your Tax Return |

|

|

|

|

|

|

|

|

|

|

||

|

Your signature |

|

|

|

|

Date |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

|

Print/Type preparer’s name |

Preparer’s signature |

Date |

|

|

|

Check |

if |

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

Firm’s name |

|

|

|

|

|

|

|

Firm’s EIN |

|

|||

Use Only |

|

|

|

|

|

|

|

|

||||

Firm’s address |

|

|

|

|

|

Phone no. |

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Form 8606 (2022) |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | Form 8606 is used to report nondeductible contributions to traditional IRAs and distributions from traditional, SEP, and SIMPLE IRAs. It ensures proper tracking of these contributions for tax purposes. |

| Filing Requirement | This form must be attached to Form 1040, 1040-SR, or 1040-NR. If you are married and both spouses must file, each must submit a separate Form 8606. |

| Contribution Reporting | Taxpayers must report nondeductible contributions made to traditional IRAs for the tax year 2022, as well as any conversions to Roth IRAs. |

| Nontaxable Portions | The form calculates the nontaxable portion of distributions from IRAs, helping taxpayers understand what amount is not subject to income tax. |

| State-Specific Laws | Some states may have additional laws regarding retirement contributions and distributions. It's advised to consult local regulations or a tax professional for state-specific forms and requirements. |

Guidelines on Utilizing 8606

Filling out Form 8606 can seem daunting, but breaking it down into manageable steps can simplify the process. Once filled out correctly, this form will be attached to your tax return. It is essential to gather all relevant financial information before you begin, ensuring accuracy as you work through each section.

- Start by filling in your name, social security number, and home address at the top of the form.

- If you're married and need to submit a separate form for your spouse, prepare their information as well.

- In Part I, only complete this section if you made nondeductible contributions to traditional IRAs in 2022 or if you took distributions from any IRAs.

- On line 1, enter the total amount of your nondeductible contributions to traditional IRAs for 2022.

- On line 2, indicate your total basis in traditional IRAs.

- Add the amounts from lines 1 and 2, and put the total on line 3.

- Answer whether you took any distributions from your traditional, SEP, or SIMPLE IRAs in 2022. If you did not, enter the amount from line 3 on line 14 and do not continue.

- If you did take distributions, enter any contributions made between January 1, 2023, and April 18, 2023, on line 4.

- Subtract line 4 from line 3 and record the result on line 5.

- On line 6, enter the total value of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2022.

- Record the distributions from your IRAs for the year on line 7.

- Enter the net amount converted to Roth IRAs in 2022 on line 8.

- Add lines 6, 7, and 8 together, and write the sum on line 9.

- Divide line 5 by line 9. Round the result to at least three decimal places and enter it on line 10.

- Multiply line 8 by line 10 to find the nontaxable portion of your Roth IRA conversion. Enter this amount on line 11.

- Multiply line 7 by line 10 to calculate the nontaxable portion of your distributions not converted to Roth IRAs. Enter this on line 12.

- Add lines 11 and 12 together for the total nontaxable portion, and enter the result on line 13.

- Subtract line 13 from line 3 to determine your total basis in traditional IRAs for this year and enter that amount on line 14.

- Complete line 15 by subtracting line 12 from line 7 to find the taxable amount.

- If applicable, fill out lines in Part II for any conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

- In Part III, if you took a distribution from Roth IRAs in 2022, fill out the relevant lines.

- Finally, remember to sign and date the form at the bottom, certifying it is accurate to the best of your knowledge.

What You Should Know About This Form

What is Form 8606 and who needs to file it?

Form 8606 is used to report nondeductible contributions to traditional Individual Retirement Accounts (IRAs) and any distributions from traditional, SEP, or SIMPLE IRAs. If you made nondeductible contributions to a traditional IRA during the tax year or if you took any distributions from these accounts and made contributions in the same year or in the past, you will need to file this form. Additionally, if you converted any of your traditional IRAs to Roth IRAs, this form is also required to calculate the taxable and nontaxable portions of your conversion.

What information should I gather to complete Form 8606?

To fill out Form 8606, you will need details about your contributions, distributions, and account values. Specifically, gather the amounts of your nondeductible contributions to traditional IRAs, the total basis in your traditional IRAs, the value of all your traditional, SEP, and SIMPLE IRAs at the end of the year, and any distributions taken during the year. For conversions to Roth IRAs, be prepared to provide the amounts converted and your basis in those conversions.

Can I file Form 8606 by itself, or do I need to attach it to my tax return?

You should attach Form 8606 to your main tax return, which is typically Form 1040, 1040-SR, or 1040-NR, when you file for the year. It is essential to include this form if you have made nondeductible contributions or conversions to ensure your tax return is accurate. In some cases, if you are filing only this form without a main tax return, follow the specific instructions provided by the IRS to ensure proper submission.

What happens if I fail to file Form 8606 when required?

Not filing Form 8606 when necessary may lead to tax penalties. The IRS may impose a $50 penalty for the failure to file this form, and you may miss the opportunity to properly report your tax basis in traditional IRAs. In some cases, this could result in paying taxes on money that should be tax-free. Filing the form ensures that you accurately report your contributions and distributions, protecting your retirement savings. It's important to comply with all filing requirements for your financial well-being.

Common mistakes

Filling out Form 8606 can be a daunting task for many, particularly when it comes to tracking nondeductible IRAs and Roth IRA conversions. However, a few common mistakes often plague this process.

One significant error arises when individuals fail to keep track of their nondeductible contributions. If a taxpayer neglects to report any nondeductible contributions made during the year, it can lead to incorrect tax calculations. This oversight not only affects potential taxes owed but could also jeopardize future benefits associated with their retirement accounts.

Another common pitfall occurs when taxpayers wrongly assume that all IRA distributions are taxable. In reality, only a portion of an IRA distribution may be subject to taxation, especially for those who have made nondeductible contributions. It's vital to differentiate between amounts contributed and earnings on those funds. Misunderstanding this distinction can lead to overseeing a portion of earnings that are indeed taxable.

Additionally, when it comes to calculating the basis of traditional IRAs, individuals sometimes forget to include distributions taken in previous years. This is crucial, especially if they rolled over funds back into IRAs. Such an omission can lead to inflated taxable amounts, which may cause unwanted surprises come tax time.

An often overlooked mistake is not considering the implications of Roth IRA conversions. Those who convert traditional IRAs to Roth IRAs must track their basis accurately. If the basis is incorrect, it can distort the calculation of the nontaxable portion of distributions and conversions, leading to potential tax liabilities that one might be unaware of.

Many also experience confusion regarding deadlines. Taxpayers sometimes make contributions after the filing deadline, mistakenly believing these late contributions can still be counted for the previous tax year. While there are exceptions for contributions made early in the year, understanding the nuances of these deadlines is imperative to avoid errors.

Finally, many people neglect to sign and date their form before submission. Although this may seem minor, failure to sign can result in the IRS disregarding the entire form. Ensure that every detail, including signatures, is in order before sending it off. These mistakes, while commonly made, can have lasting repercussions. By paying attention to these details and understanding each requirement, taxpayers can navigate the complexities of Form 8606 with confidence.

Documents used along the form

When completing Form 8606 for reporting nondeductible contributions to IRAs and conversions to Roth IRAs, you may also need to provide or reference other forms and documents. These forms help clarify various aspects of your tax situation and ensure accurate reporting. Below is a list of key forms and documents that are often used alongside Form 8606.

- Form 1040: This is the standard individual income tax return form. You will attach Form 8606 to your Form 1040, as it captures your overall tax information for the year.

- Form 1040-SR: Specifically designed for seniors aged 65 and older, this simplified version of the Form 1040 can also be used to report your income and taxes, along with Form 8606.

- Form 1040-NR: For non-resident aliens, this form is used during tax filing. If you're a non-resident with nondeductible IRA contributions, Form 8606 will be attached to your Form 1040-NR.

- Form 8915-F: Used to report qualified disaster-related distributions and repayments to your retirement accounts, this form may impact your calculations on Form 8606.

- Form 5498: This form reports contributions to traditional and Roth IRAs. It provides additional details on contributions made throughout the year, which may affect figures entered on Form 8606.

- Form 1099-R: Issued for distributions from pensions, annuities, and IRAs, this form provides crucial information on distributions that you will need to reference when completing Form 8606.

- Form 8606 Instructions: The IRS instructions for Form 8606 provide detailed guidance on how to fill out the form correctly, helping ensure that you meet all requirements.

- Financial Statements: Statements from your IRA provider may also be necessary to track contributions, conversions, and distributions accurately and to provide supporting documentation with your tax return.

Having these forms and documents on hand can simplify the tax filing process and ensure accurate reporting of your IRA contributions and distributions. It is beneficial to review them carefully to avoid any oversights that could lead to complications with the IRS.

Similar forms

- Form 1040: This is the standard individual income tax return form used to report income and calculate taxes owed. Similar to Form 8606, it is submitted as part of the taxpayer’s annual filing and can include information related to IRAs.

- Form 1040-SR: Designed for senior taxpayers, this form maintains similarities with Form 8606, especially in capturing retirement distributions and contributions. It provides a straightforward format for those who are 65 or older while addressing similar IRA complexities.

- Form 1040-NR: Non-resident aliens use this form to report their income. Like Form 8606, it serves to account for IRA activity but is tailored for individuals without U.S. residence who have U.S. source income.

- Form 8606-B: This form is specifically for reporting Roth IRAs and is similar to Form 8606 regarding distributions and conversions. It helps track the nontaxable portions of Roth IRA distributions.

- Form 5498: This document reports contributions to IRAs and the fair market value of those accounts. Form 5498 complements Form 8606 by providing evidence of IRA contributions for the tax year.

- Form 1099-R: Used for reporting distributions from pensions, annuities, retirement plans, and IRAs, this form is similar to Form 8606 in that it details amounts distributed from retirement accounts, further clarifying tax implications.

- Form 8915-F: This form is applicable for disaster-related distributions, paralleling Form 8606 in its focus on reporting specific types of IRA distributions. Both forms require detailed documentation about the nature of the distributions.

- Form 5329: Taxpayers utilize this form to report additional taxes on IRAs and other qualified plans. It helps in addressing penalties related to early withdrawals, connecting with the reporting nature of Form 8606.

Dos and Don'ts

Filling out Form 8606, which deals with nondeductible IRAs, can be a crucial step in managing your retirement accounts accurately. Here are some essential dos and don’ts to ensure you complete the form correctly.

- Do keep your records organized. Gather all necessary documents before you start. This includes contributions, distributions, and any previous forms related to your IRAs.

- Do provide accurate information. Each line must reflect true and precise numbers to avoid issues down the road. Mistakes can lead to complications with the IRS.

- Do sign and date the form. It’s a simple step, but it’s often overlooked. A signature confirms your commitment to the integrity of your filing.

- Don’t skip lines. If a line does not apply to you, it’s better to indicate “0” rather than leaving it blank. This reduces the chance of confusion later.

- Don’t forget about deadlines. Make sure to submit the form along with your tax return by the designated date to avoid penalties.

- Don’t hesitate to seek help. If you’re unsure about any part of the process, consider consulting a tax professional. It’s better to ask than to guess and potentially make a costly error.

Taking these steps will help you navigate the complexities of Form 8606 with greater ease and accuracy.

Misconceptions

Here are nine common misconceptions about Form 8606, which is used for reporting nondeductible contributions to IRAs and other related transactions.

- Form 8606 is only for high-income earners. This form is required for anyone who makes nondeductible contributions to a traditional IRA, regardless of their income level.

- You don’t need to file Form 8606 if you have a tax professional. Even if you have someone preparing your taxes, you are still responsible for including Form 8606 if it applies to you.

- Form 8606 is only needed when converting to a Roth IRA. While it's important for conversions, this form is also necessary for any nondeductible contributions and certain distributions from traditional IRAs.

- Nondeductible contributions do not affect taxes. Nondeductible contributions are not taxed upon withdrawal, but failing to report them can lead to tax liabilities on distributions.

- You can skip Form 8606 if you have not made any contributions in a given year. If you took distributions or converted funds, you still need to file the form, even if there are no new contributions.

- Form 8606 is only relevant for retirement age individuals. Anyone contributing to a traditional IRA or taking distributions should be aware of this form, regardless of age.

- All IRA contributions are fully deductible. Only contributions to traditional IRAs may be deductible, and many factors can limit or eliminate this deduction.

- Filing Form 8606 takes too much time and is complicated. Although it requires attention to detail, the form is straightforward, and instructions are readily available to assist.

- You can ignore the form if you forget to file it. Ignoring Form 8606 can lead to penalties or may complicate your tax situation in future years.

Understanding these misconceptions can help you navigate your tax responsibilities better and ensure compliance with IRS regulations related to IRAs.

Key takeaways

Form 8606 is essential for taxpayers who make nondeductible contributions to traditional IRAs or take distributions from their IRAs. Here are some key takeaways to consider when using this form:

- Purpose of the Form: It primarily documents nondeductible contributions to IRAs and distributions from traditional, SEP, or SIMPLE IRAs.

- Filing Requirements: Every taxpayer who makes nondeductible contributions must complete this form, even if they are filing separately as a married couple.

- Tax Year Specific: The current version of Form 8606 is for the tax year 2022, and it must be filed alongside your 2022 Form 1040, 1040-SR, or 1040-NR.

- Reporting Nondeductible Contributions: Enter your nondeductible contributions for the year, including contributions made for the previous year up until the tax deadline.

- Tracking Basis: Keeping track of your basis in traditional IRAs is crucial. This helps determine your tax liabilities when you take distributions or convert funds.

- Conversions to Roth IRAs: If you convert your traditional IRA funds to a Roth IRA, you need to report the amounts on this form, as not all funds may be taxable.

- Distributions Reporting: When reporting distributions from your IRAs, only include certain types of distributions, excluding rollovers and qualified charitable distributions.

- Taxable Amounts: Your taxable amounts can be calculated using the information reported on the form, notably distinguishing between taxable and nontaxable portions of distributions.

- Sign and Date: Ensure you sign and date the form accurately. This certification attests that the provided information is correct to the best of your knowledge.

Completing Form 8606 correctly is vital to ensuring accurate tax reporting and avoiding potential penalties. Thoroughly review each section, and if you ever feel uncertain, consult a tax professional for guidance.

Browse Other Templates

Nafta Certificate of Origin Canada - Using "Same" indicates you are both producer and exporter.

Sellers Permit Florida - Applicants must specify the category under which they seek to qualify for the permit.