Fill Out Your 8863 Credit Limit Worksheet Form

When it comes to preparing your taxes, understanding the forms you need is crucial, and the 8863 Credit Limit Worksheet plays an important role for many taxpayers. This worksheet helps you determine the correct amount to enter for education credits on your tax return. It starts with inputting specific figures from your completed Form 8863, with a focus on your qualified education expenses and any tax-free assistance you may have received. The process involves several simple calculations that guide you through subtracting adjustments from your total expenses to arrive at your adjusted qualified education expenses. You’ll also be instructed to complete a separate worksheet for each student if you’re claiming credits for multiple individuals. The aim is straightforward: ensure you're maximizing your tax credits efficiently while adhering to IRS guidelines. Completing the 8863 Credit Limit Worksheet accurately will help you figure out the correct amount to report on line 19 of Form 8863, potentially leading to significant savings on your tax bill.

8863 Credit Limit Worksheet Example

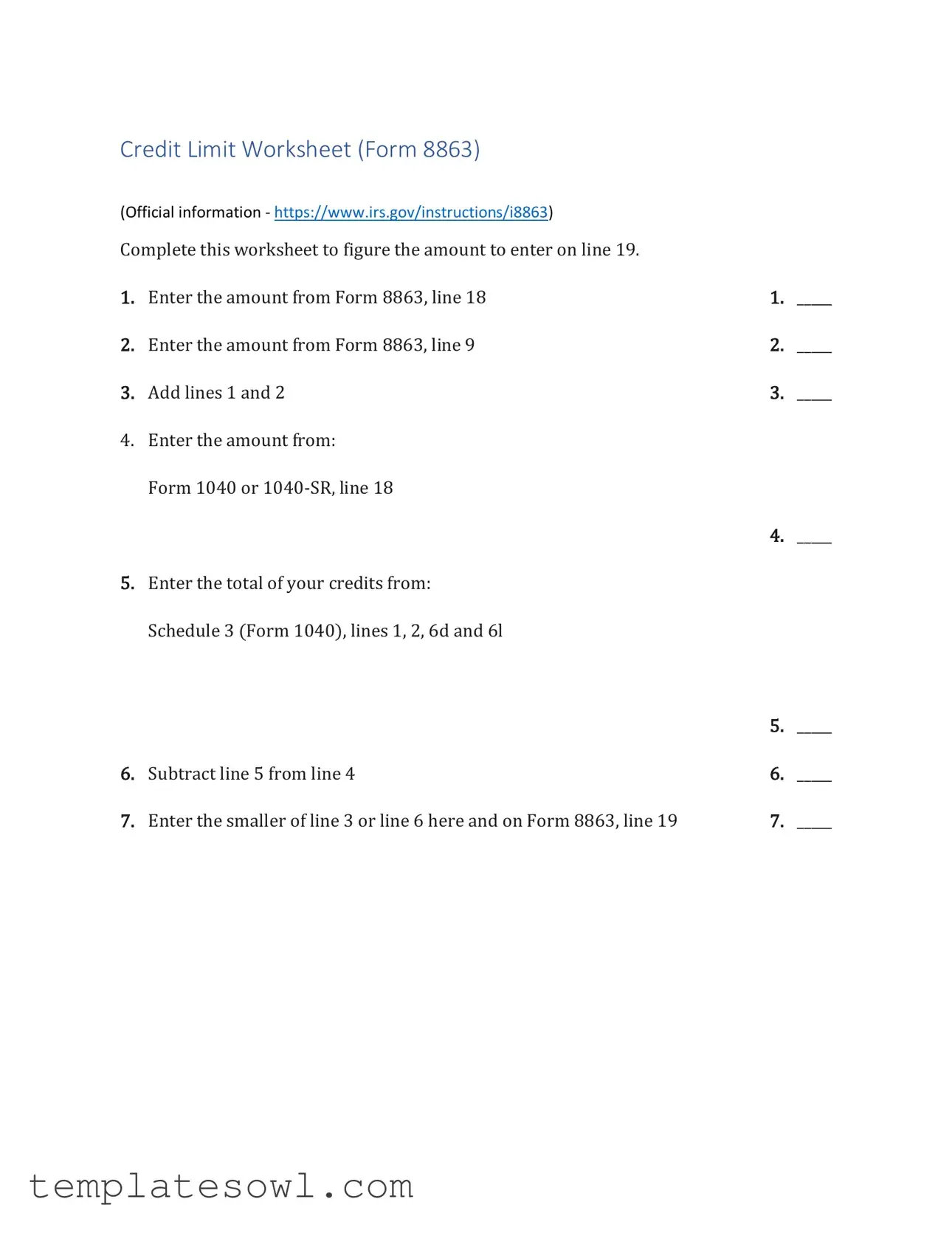

Credit Limit Worksheet (Form 8863)

(Official information - https://www.irs.gov/instructions/i8863) |

|

|

|

Complete this worksheet to figure the amount to enter on line 19. |

|

|

|

1. |

Enter the amount from Form 8863, line 18 |

1. |

_____ |

2. |

Enter the amount from Form 8863, line 9 |

2. |

_____ |

3. |

Add lines 1 and 2 |

3. |

_____ |

4.Enter the amount from:

Form 1040 or

4. _____

5.Enter the total of your credits from: Schedule 3 (Form 1040), lines 1, 2, 6d and 6l

|

|

5. |

_____ |

6. |

Subtract line 5 from line 4 |

6. |

_____ |

7. |

Enter the smaller of line 3 or line 6 here and on Form 8863, line 19 |

7. |

_____ |

Line 31

Complete a separate worksheet for each student for each academic period beginning or treated as beginning (see below) in 2022 for which you paid (or are treated as having paid) qualified education expenses in 2022.

1. |

Total qualified education expenses paid for or on behalf of the |

_____ |

|

|

student in 2022 for the academic period |

|

|

2. |

Less adjustments: |

|

|

|

a. |

_____ |

|

|

allocable to the academic period |

|

|

|

b. |

_____ |

|

|

(and before you file your 2022 tax return) allocable |

|

|

|

to the academic period |

|

|

|

c. Refunds of qualified education expenses paid in |

_____ |

|

|

2022 if the refund is received in 2022 or in 2023 |

|

|

|

before you file your 2022 tax return |

|

|

3. |

Total adjustments (add lines 2a, 2b, and 2c) |

|

_____ |

4. |

Adjusted qualified education expenses. Subtract line 3 from line |

_____ |

|

|

1. If zero or less, enter |

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 8863 Credit Limit Worksheet is used to calculate the amount for line 19 on Form 8863, which pertains to education credits. It ensures that taxpayers apply eligible credits correctly based on their qualified education expenses. |

| Required Information | This worksheet requires specific entries from Form 8863, including lines 9 and 18, as well as information from Form 1040 or 1040-SR. It's essential to gather this information before starting the worksheet. |

| Academic Period Requirement | Taxpayers must complete a separate worksheet for each student for each academic period in 2022. This ensures a clear record of expenses and adjustments applicable to each specific student. |

| Adjustments | The worksheet includes steps to account for any tax-free educational assistance or refunds related to qualified expenses. These adjustments are critical in accurately determining the adjusted qualified education expenses. |

| Final Output | At the end of the worksheet, taxpayers will arrive at the lesser of two amounts, which finalizes the figure they need to enter on Form 8863, line 19. This step is vital for ensuring compliance with IRS guidelines. |

Guidelines on Utilizing 8863 Credit Limit Worksheet

Once you have gathered all necessary information, you can begin filling out the 8863 Credit Limit Worksheet. This worksheet will help determine the correct amount to enter on your tax forms based on your qualifying education expenses and available credits.

- Enter the amount from Form 8863, line 18 in the first blank. _____

- In the second blank, input the amount from Form 8863, line 9. _____

- Add the amounts from lines 1 and 2. Write the total in the third blank. _____

- Next, enter the amount from Form 1040 or 1040-SR, line 18 in the fourth blank. _____

- Now, enter the total of your credits from Schedule 3 (Form 1040), lines 1, 2, 6d, and 6l in the fifth blank. _____

- Subtract the amount on line 5 from line 4. Write this result in line 6. _____

- Finally, enter the smaller amount from either line 3 or line 6 in the seventh blank. This is the figure to report on Form 8863, line 19. _____

For each student in your household who had qualified educational expenses in 2022, complete a separate worksheet. This helps ensure that each academic period is accurately accounted for in your credits.

- Record the total qualified education expenses paid for or on behalf of the student for the academic period in the first blank. _____

- In the less adjustments section, first enter any tax-free educational assistance received in 2022 that is allocable to the academic period. _____

- Then enter any tax-free educational assistance received in 2023 that is also allocable to the academic period. _____

- Next, include any refunds of qualified education expenses paid in 2022 if the refund is received in 2022 or in 2023 before filing your tax return. _____

- Add lines 2a, 2b, and 2c to find the total adjustments. Enter this amount. _____

- Finally, subtract the total adjustments from line 1. Enter the result. If this amount is zero or less, record -0-. _____

What You Should Know About This Form

What is Form 8863 Credit Limit Worksheet?

The Credit Limit Worksheet (Form 8863) is a tool used to determine the amount of credit available for education-related expenses. It specifically helps taxpayers calculate the educational credits they can claim on their tax return and ultimately how much they can enter on Form 8863, line 19.

Who needs to complete this worksheet?

If you have incurred qualified education expenses for a student during the 2022 academic period, you will need to complete this worksheet. This applies to each student individually, meaning if you have multiple students, a separate worksheet must be filled out for each one.

What information do I need before starting the worksheet?

Before beginning, gather your Form 8863 amounts, including lines 18 and 9. Additionally, you need your Form 1040 or 1040-SR line 18, and details from Schedule 3 (Form 1040) lines 1, 2, 6d, and 6l. It is also essential to know the total qualified education expenses paid in 2022, along with any adjustments for tax-free assistance or refunds received.

How do I calculate adjusted qualified education expenses?

To calculate adjusted qualified education expenses, start with the total amount paid for or on behalf of the student in 2022. Then make any necessary adjustments, which include tax-free educational assistance or refunds. Add up these adjustments and subtract this total from the initial qualified expenses. If the result is zero or less, enter -0-.

What should I do if I have tax-free educational assistance?

Tax-free educational assistance received in both 2022 and 2023, as well as any refunds related to qualified education expenses, must be considered when completing the worksheet. This information adjusts the total qualified education expenses down, ensuring the credits are correctly calculated.

How do I enter the final results on Form 8863?

Once calculations are complete, you will need to compare line 3 (the total from entries related to qualified expenses) and line 6 (the total credits from Schedule 3). The smaller number of the two becomes the amount entered on Form 8863, line 19. This step is crucial as it determines the eligible credit amount for your tax return.

Can I file multiple worksheets if I have more than one student?

Yes, a separate worksheet must be completed for each student for every academic period in which qualified education expenses were paid. Ensure that each worksheet is filled out accurately for each respective student to maximize potential credit claims.

What happens if my calculations lead to a negative amount?

If the adjusted qualified education expenses calculation leads to a negative amount, you should enter -0-. This indicates that there are no eligible expenses left to claim credits against.

Where can I find the official instructions for the Credit Limit Worksheet?

Official instructions for the Credit Limit Worksheet can be accessed on the IRS website at irs.gov/instructions/i8863. This site provides detailed guidance to help navigate the worksheet and understand requirements.

Are there any deadlines for completing this worksheet?

It is essential to complete the worksheet and incorporate the results into your tax return by the filing deadline. For most taxpayers, this means by April 15 of the following year. Late submissions could impact potential credits.

Common mistakes

Filling out the Credit Limit Worksheet on Form 8863 can be a vital step for anyone seeking education-related tax credits. However, several common mistakes can lead to inaccuracies that might affect the final outcome. Recognizing these pitfalls is essential for a smooth completion of the form.

One significant error arises from incorrectly entering line amounts. Each line of the worksheet requires precise attention, particularly lines 1 and 2, which involve transferring figures from other parts of Form 8863. If these amounts are entered mistakenly or omitted, the calculations that follow will be compromised, leading to incorrect credit claims.

Another frequent oversight occurs when taxpayers fail to acknowledge the total credits from Schedule 3. Line 5 requires a careful addition of various credits, including those from lines 1, 2, 6d, and 6l of Schedule 3. Neglecting to calculate this total can result in an inflated credit limit. Taxpayers may want to take additional time to ensure all relevant credits are secured to avoid future discrepancies.

Moreover, not properly calculating adjustments can mislead users. Adjustments on line 3 require specific amounts associated with educational assistance or refunds. Ignoring past aid received or refunds processed can lead to an incorrect evaluation of adjusted qualified education expenses, ultimately skewing the result on line 4.

Losing track of individual students’ records is another notable error. As the worksheet specifies, one must complete a separate worksheet for each student attending school in 2022. Failing to do so not only complicates the filing process but also increases the risk of overlooking eligible education expenses.

A common blunder can be seen when individuals forget to check for zero or negative outcomes. Line 4 must be scrutinized closely, as it calls for an adjusted total. If this line results in zero or less, it should be documented as -0- on line 5. This requirement is often overlooked, potentially affecting the tax credits available.

Lastly, submitting incomplete worksheets remains a prevalent mistake. Individuals should ensure their worksheets are thoroughly filled out. Missing any required information can not only delay the processing of tax returns but also result in disallowed credits. Careful review and verification of all entries prior to submission can mitigate this risk.

Documents used along the form

The Tax Credit Limit Worksheet (Form 8863) is vital for calculating education-related tax credits. However, several other forms and documents can accompany it to ensure that you accurately report your expenses and maximize your potential tax benefits. Below is a list of these important documents, each playing a crucial role in the overall tax preparation process.

- Form 8863: Education Credits - This form is necessary for claiming education credits. It helps taxpayers apply for the American Opportunity Credit and the Lifetime Learning Credit.

- Form 1040: U.S. Individual Income Tax Return - This is the primary form used by individuals to file their annual income tax returns, reporting income and calculating tax due or refund owed.

- Schedule 3 (Form 1040): Additional Credits and Payments - Use this form to report nonrefundable andrefundable credits that reduce your tax liability, effectively summarizing credits you may be eligible for before final calculation.

- Form 1098-T: Tuition Statement - Educational institutions issue this form to report qualified tuition and related expenses, which can be crucial in determining eligibility for education-related tax credits.

- Form W-2: Wage and Tax Statement - Employers provide this form to report an employee's annual wages and the taxes withheld. It serves as a vital document to establish income for tax calculations.

- Form 8862: Information to Claim Earned Income Credit After Disallowance - If your Earned Income Credit was denied in the past, this form is required to claim the credit again, reminding the IRS of your eligibility.

- Form 4506-T: Request for Transcript of Tax Return - This form allows taxpayers to request a transcript of their tax return information, useful for verifying past income and expenses related to education credits.

- Schedule A (Form 1040): Itemized Deductions - Taxpayers who choose to itemize their deductions use this form to detail eligible expenses, which can also include educational expenses if applicable.

- Form 8862: Claim for Refund and Request for Change in Address - If you move and want the IRS to send your refund to your new address, use this form alongside your tax return filings.

Navigating the world of tax documents can be overwhelming. Utilizing the right forms in tandem with the Credit Limit Worksheet can significantly impact your tax results. By being informed and organized, you can take the necessary steps to effectively manage your education-related tax credits and entitlements.

Similar forms

The Form 8863 Credit Limit Worksheet serves a vital role in determining education credits on your tax return. It operates in a unique way, yet it shares similarities with several other official documents. Below is a list of ten documents that are comparable to the 8863 worksheet, along with an explanation of how they relate.

- Form 1040: This is the standard individual income tax return. Like the 8863 worksheet, it captures crucial financial information that affects tax credits and liabilities. Both forms require detailed entries about income and taxable events.

- Schedule A (Form 1040): This form outlines itemized deductions. Similar to the 8863 worksheet, it assists taxpayers in calculating potential deductions that can ultimately reduce tax bills.

- Schedule 3 (Form 1040): Used for reporting additional credits and payments, this schedule is closely tied to the 8863 worksheet, as both documents help track and claim available tax benefits.

- Form 8862: This is used to claim certain credits after disallowance. Both forms require the taxpayer to provide detailed information to justify eligibility for tax credits.

- Form 8867: This form ensures due diligence when claiming certain tax credits. Like the 8863 worksheet, it demands a thorough review of qualifying criteria and documentation.

- Form 8880: This is used to claim a Credit for Qualified Retirement Savings Contributions. It shares the characteristic of needing to determine eligibility based on specific criteria, paralleling the process found in the 8863 worksheet.

- Form 8889: This form pertains to Health Savings Accounts. Much like the 8863 worksheet, it calculates amounts that can impact tax credits based on various contributions and distributions.

- Form 8917: This form claims the Tuition and Fees Deduction. Both documents assist taxpayers in identifying educational expenses, emphasizing qualified expenditures essential for credit calculations.

- Form 1098-T: This is a Tuition Statement from educational institutions. It is similar as it tracks qualified education expenses, feeding essential information into the 8863 worksheet for determining education credits.

- Form 8888: This enables taxpayers to request a split refund. While it is less directly related, it does also involve calculations that result from entries on the primary tax forms, similar to how the 8863 worksheet operates in tax computation.

Each of these documents aims to clarify and streamline the process of claiming tax credits and deductions, ensuring that taxpayers accurately report their financial information and maintain compliance with tax regulations.

Dos and Don'ts

When filling out the 8863 Credit Limit Worksheet form, there are important dos and don'ts to keep in mind. Following these guidelines can help ensure accuracy and avoid unnecessary complications.

- Do carefully read each instruction before starting the worksheet.

- Do double-check the amounts you enter from the Form 8863, particularly lines 18 and 9.

- Do complete a separate worksheet for each student if you have multiple students.

- Don't forget to account for any tax-free educational assistance received in both 2022 and 2023.

- Don't leave any lines blank; if certain amounts are not applicable, be sure to indicate them with a zero.

Understanding these key points can streamline the process and help avoid mistakes. Be thorough and pay attention to the details!

Misconceptions

Understanding the 8863 Credit Limit Worksheet is crucial for students and families seeking to claim education credits. Here are six common misconceptions about this form that should be clarified:

-

Misconception 1: The 8863 form is only for college students.

This is not true. The form applies to any qualified education expenses paid for eligible students, including those in vocational or other post-secondary educational programs.

-

Misconception 2: You can complete the worksheet at any time before filing taxes.

Actually, the worksheet needs to be completed before you file your taxes to ensure the correct amount is entered on Form 8863. It helps in accurately calculating your education credits.

-

Misconception 3: All education expenses qualify for the credit.

This is misleading. Only qualified education expenses that meet IRS requirements can be counted. Familiarize yourself with what qualifies, such as tuition and fees, but not all related costs.

-

Misconception 4: It's necessary to fill out a separate worksheet for each subject taken.

You only need to complete a separate worksheet for each student’s academic period, not for each class. This simplifies the process, allowing you to group subjects under the same student.

-

Misconception 5: Tax-free assistance reduces the amount you can claim.

While it's true that tax-free assistance must be accounted for, it can reduce your qualified expenses, meaning you may end up with a smaller amount to claim. This ensures you're only claiming what you’ve truly paid.

-

Misconception 6: You must attach the worksheet to your tax return.

This misconception is common. You do not need to file the worksheet with your taxes, but you should keep it for your records in case the IRS requires it in the future.

Clarifying these misconceptions can help you navigate the process more easily. Be sure to gather all necessary documents and information before you begin.

Key takeaways

When filling out the 8863 Credit Limit Worksheet, there are several important points to keep in mind.

- Understand its Purpose: The worksheet helps you determine the amount to report on line 19 of Form 8863. Accurately reporting your qualifications is crucial for claiming educational tax credits.

- Gather Necessary Information: Before you start, collect your 8863 form data. You'll need amounts from lines 18 and 9 specifically, as they are essential for your calculations.

- Calculate Carefully: Begin by adding the amounts from lines 1 and 2, then proceed with the rest of the calculations. Precision matters; errors can lead to claim denials.

- Document Your Credits: You must also account for credits listed on Schedule 3 of Form 1040. These inputs significantly affect your overall eligibility for the educational credits.

- Focus on Adjustments: Be mindful of any tax-free educational assistance or refunds. Subtract these amounts properly to ensure that your reported qualified education expenses are accurate.

- Create a Worksheet for Each Student: If you have multiple students, prepare a separate worksheet for each one. This prevents any confusion and helps maintain clear records for each academic period.

- Review Your Results: After all calculations, enter the smaller amount of line 3 or line 6 onto Form 8863, line 19. Double-check your math to be certain that you are claiming the correct credit.

Browse Other Templates

Dhsh - You must provide gross income amounts before any deductions are made.

Us Veteran - Clarify any uncertainties by providing a complete description of the services for which you are claiming reimbursement.

Single Family Asset Management Application,HUD Payee Registration Form,SAMS Payee Enrollment Sheet,Housing and Urban Development Payee Form,Acquired Asset Payee Application,Single Family Property Payee Record,HUD Single Family Vendor Registration,Pay - This form is part of HUD’s commitment to promoting minority business participation.