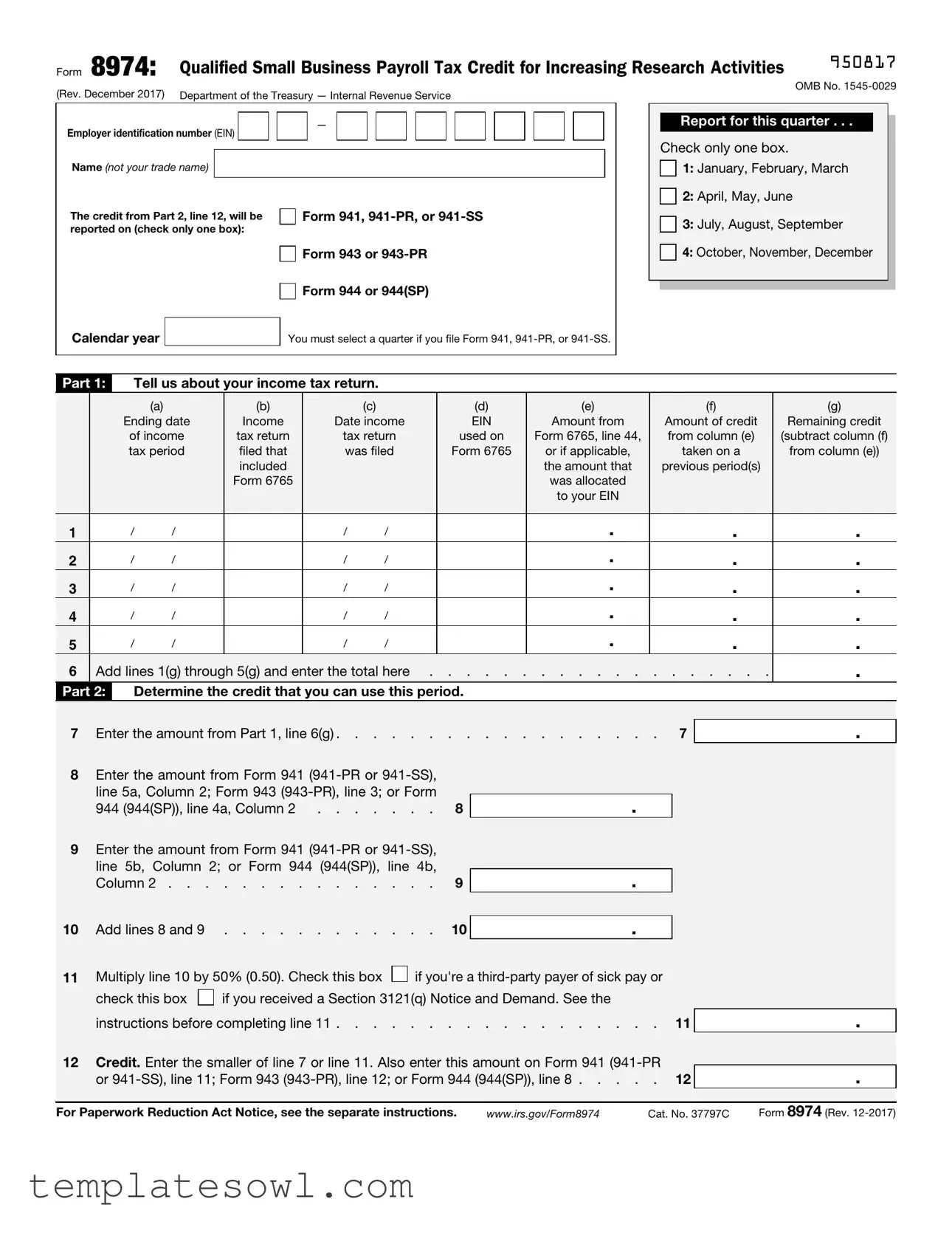

Fill Out Your 8974 Form

The 8974 form plays a vital role for businesses seeking to maximize their tax credits related to research activities. This form, officially named “Qualified Small Business Payroll Tax Credit for Increasing Research Activities,” helps small businesses claim a specific credit that directly affects their payroll expenses. Employers must fill out various sections, detailing their income tax return information and any previous credits claimed. Users of this form need to indicate which quarter they are reporting for, be it January through March or October through December. The form guides users through calculations to determine their potential payroll tax credit, ultimately allowing them to reduce their tax liabilities. By understanding how to properly complete Form 8974, employers can take full advantage of the benefits associated with research activity credits, thereby improving their overall financial health.

8974 Example

Form |

8974: |

Qualified Small Business Payroll Tax Credit for Increasing Research Activities |

950817 |

|||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||

(Rev. December 2017) |

Department of the Treasury — Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OMB No. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer identification number (EIN) |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report for this quarter . . . |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check only one box. |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1: January, February, March |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2: April, May, June |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The credit from Part 2, line 12, will be |

|

|

|

Form 941, |

|

|

|

|

|

|

|

|

3: July, August, September |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

reported on (check only one box): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Form 943 or |

|

|

|

|

|

|

|

|

|

|

|

|

4: October, November, December |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Calendar year |

|

|

|

|

|

|

|

|

|

Form 944 or 944(SP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

You must select a quarter if you file Form 941, |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Part 1: |

Tell us about your income tax return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

(a) |

|

|

|

(b) |

|

|

|

(c) |

|

|

|

|

|

|

(d) |

|

|

|

(e) |

|

|

(f) |

|

(g) |

||||||||||||

|

|

Ending date |

|

|

Income |

|

|

Date income |

|

|

EIN |

|

Amount from |

|

Amount of credit |

|

Remaining credit |

|||||||||||||||||||||

|

|

of income |

|

tax return |

|

|

|

tax return |

|

|

used on |

|

Form 6765, line 44, |

|

from column (e) |

(subtract column (f) |

||||||||||||||||||||||

|

|

tax period |

|

|

filed that |

|

|

|

was filed |

|

Form 6765 |

|

or if applicable, |

|

|

taken on a |

|

from column (e)) |

||||||||||||||||||||

|

|

|

|

|

|

included |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the amount that |

|

previous period(s) |

|

|

|

|

|||||||||

|

|

|

|

|

Form 6765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

was allocated |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to your EIN |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1 |

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

. |

|

. |

|

|

||

2 |

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

. |

|

. |

|

|

||

3 |

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

. |

|

. |

|

|

||

4 |

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

. |

|

. |

|

|

||

5 |

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

. |

|

. |

|

|

||

6 |

Add lines 1(g) through 5(g) and enter the total here |

|

. |

|

|

|||||||||||||||||||||||||||||||||

Part 2: |

Determine the credit that you can use this period. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

7 Enter the amount from Part 1, line 6(g) . . . . . . . . . . . . . . . . . . 7

.

8 |

Enter the amount from Form 941 |

|

|

|

|

line 5a, Column 2; Form 943 |

|

|

|

|

944 (944(SP)), line 4a, Column 2 |

8 |

|

. |

9 |

Enter the amount from Form 941 |

|

|

|

|

line 5b, Column 2; or Form 944 (944(SP)), line 4b, |

|

|

|

|

Column 2 |

9 |

|

. |

|

|

|

|

|

10 |

Add lines 8 and 9 |

10 |

|

. |

11Multiply line 10 by 50% (0.50). Check this box

if you're a

if you're a

check this box

if you received a Section 3121(q) Notice and Demand. See the

if you received a Section 3121(q) Notice and Demand. See the

instructions before completing line 11 |

11 |

|

. |

12 Credit. Enter the smaller of line 7 or line 11. Also enter this amount on Form 941 |

|

|

|

or |

12 |

|

. |

For Paperwork Reduction Act Notice, see the separate instructions. |

www.irs.gov/Form8974 |

Cat. No. 37797C |

Form 8974 (Rev. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form 8974 is used by businesses to claim the Qualified Small Business Payroll Tax Credit for Increasing Research Activities. |

| Filing Frequency | This form is submitted quarterly along with specific payroll tax forms like Form 941 or Form 943. |

| Governing Laws | The credit is governed by federal tax laws, specifically regarding qualified research expenses under IRC Section 41. |

| Required Information | To complete the form, you need your Employer Identification Number (EIN), tax return information, and credit calculations from previous forms. |

| Part 1 Contents | Part 1 gathers information about your income tax returns, including income amounts and credits used, across different tax periods. |

| Credit Calculation | Part 2 requires details to determine the available credit for the period, which involves specific calculations of past amounts and percentages. |

| Submission Links | The final credit amount must be reported on your main payroll tax forms, such as Form 941 or Form 943, as indicated on line 12 of Form 8974. |

Guidelines on Utilizing 8974

Completing Form 8974 is an important step for businesses looking to claim a tax credit. Following these steps closely will ensure that all necessary information is accurately reported. Be prepared to enter details about your income tax return and calculate the credit you’re eligible for during the quarter.

- Gather Your Documents: Collect your income tax returns, Form 6765, and any other necessary documentation that contains your employer identification number (EIN) and financial details.

- Identify the Quarter: Determine which quarter you are reporting for and check the appropriate box on the form.

- Complete Part 1: In Part 1, provide information about your income tax return. Fill out the ending date, date income was filed, income account (EIN), amount from Form 6765, and the remaining credit information for each applicable line (1 - 5).

- Calculate Total Credit: Add lines 1(g) through 5(g) from Part 1 and enter the total in line 6 of Part 1.

- Fill Out Part 2: Start Part 2 by entering the amount from line 6 in line 7. Next, complete lines 8 and 9 with the amounts from the relevant forms (Form 941, 943, or 944).

- Add Lines 8 and 9: Compute the total and enter it in line 10.

- Complete Line 11: Multiply the amount from line 10 by 50% (0.50). Consider any applicable checkboxes for third-party sick pay or notices received.

- Determine Your Credit: Enter the smaller amount from line 7 or line 11 in line 12. Ensure you record this amount on the relevant Form 941, 943, or 944.

- Review and Validate: Double-check all entries for accuracy. Cross-reference your calculations and ensure that all required boxes are checked.

- Submit the Form: Once completed, file the form as per IRS submission guidelines, either electronically or via mail.

What You Should Know About This Form

What is Form 8974 used for?

Form 8974 is utilized to claim the Qualified Small Business Payroll Tax Credit for Increasing Research Activities. This form helps eligible small businesses receive a payroll tax credit by reporting their research and development activities effectively. Businesses can offset their payroll taxes with this credit, ultimately lowering their tax liability.

Who should file Form 8974?

Small businesses that have conducted qualified research activities can file Form 8974. To qualify, the business needs to have a valid employer identification number (EIN) and should be able to demonstrate its eligibility for the research credit. Additionally, the form is specifically for businesses that plan to use the credit to reduce their payroll taxes on forms like 941, 943, or 944.

When is Form 8974 due?

The due date for Form 8974 coincides with the quarterly payroll tax returns it supports. For example, if a business files Form 941, which is typically due on the last day of the month following the end of a quarter, then Form 8974 must be filed by that same deadline. Businesses should be aware of their specific filing periods and ensure that they submit this form in a timely manner to avoid any penalties or issues in tax credit processing.

How do I complete Form 8974?

Filling out Form 8974 involves entering details from your income tax return and other relevant payroll forms. Start by providing your employer identification number and select the appropriate quarter of the tax period. Then, fill in the requested information about income tax returns and credits as outlined in the form. The calculations of the credits that can be claimed are also detailed on the form, requiring you to refer to Form 6765 to ensure proper amounts are reported. Accurate completion is essential for a successful tax credit claim.

What happens if I make a mistake on Form 8974?

If a mistake is made on Form 8974, it is important to correct it as soon as possible. Depending on the nature of the error, you may need to file a corrected form or amend your payroll tax return. This could impact the amount of credits you are entitled to, and thus timely correction is crucial. If unsure, consulting with a tax professional or the IRS can provide guidance on the best course of action to rectify any errors.

Common mistakes

When filling out Form 8974, several common mistakes can lead to delays or rejections. One frequent error is failing to select the appropriate quarter for the report. Each taxpayer must check only one box corresponding to the quarter in which the credit is claimed. Without this step, the form cannot be processed correctly.

Another mistake involves inaccuracies in reporting the Employer Identification Number (EIN). This number must be valid and match the one on the taxpayer's income tax return. Errors in the EIN can cause confusion and may impede the review process.

Many individuals neglect to verify the ending date of their income tax return. The date must align with the tax period being claimed. Incorrect dates can lead to discrepancies that complicate the credit allocation process.

Completing Part 1 incorrectly is a common issue. Taxpayers must provide detailed information about their income tax return, including the amounts from Form 6765. Skipping or miscalculating these amounts results in incomplete or inaccurate information that can derail the claim.

A major pitfall lies in misunderstanding how to determine the credit for the period. Taxpayers must diligently follow the instructions to correctly calculate credits from prior periods. Mistakes in this calculation can lead to overestimations or underestimations of the credit being claimed.

Some applicants overlook the importance of checking the boxes relevant to their tax scenario. For example, if a third-party payer of sick pay applies, this box must be checked. Ignoring such indicators may lead to processing complications or disqualification from the tax credit.

Furthermore, individuals often enter the wrong figures for lines 8 and 9, which are critical to calculating the total credit accurately. Entering figures from the wrong tax forms can significantly alter the outcome, leading to problems in the credit calculation.

Failing to double-check the final credit amount before submission is a mistake that can be easily avoided. Individuals need to ensure that line 12, which states the smaller of line 7 or line 11, is accurate. This is the amount that will be entered on other relevant forms, and any error here could result in funding discrepancies.

Lastly, not reviewing the instructions provided by the IRS is a fundamental oversight. These instructions contain essential guidance that can prevent many of the mistakes mentioned. Taking the time to understand the requirements can minimize errors and ensure a smoother filing process.

Documents used along the form

The IRS Form 8974 is used to claim the Qualified Small Business Payroll Tax Credit for Increasing Research Activities. When filing this form, several other documents are commonly needed to provide complete and accurate information. Below is a list of these documents, along with brief descriptions of each one.

- Form 941: This is the employer's quarterly federal tax return. It reports wages, tips, and other compensation paid to employees, along with the federal income tax withheld and the employer and employee portions of Social Security and Medicare taxes.

- Form 943: This form is used by employers who pay agricultural workers. It helps report annual Federal income tax withheld and agricultural wages paid to employees.

- Form 944: Intended for smaller businesses, this annual form is filed to report payroll taxes. It simplifies the process for employers with a low payroll obligation.

- Form 6765: This form is related to the credit for increasing research activities. Businesses need to provide details about their qualified research expenses and calculate the credit available.

- Form 941-PR: This is the equivalent of Form 941 but specifically designed for Puerto Rican employers. It is used to report wages and payroll taxes for employees working in Puerto Rico.

- Form 941-SS: Similar to Form 941-PR, this is a special version for employers in U.S. territories. It is used to report Federal insurance contributions for employees in these areas.

- Form 943-PR: This form is a version of Form 943, specifically for agricultural employers in Puerto Rico to report payroll taxes.

- Form 944(SP): The Spanish version of Form 944, it serves the same purpose for businesses filing in Spanish-speaking territories within the U.S.

Gathering these documents before completing the 8974 form will ensure a smoother filing process and compliance with IRS requirements. Being organized helps prevent errors and potential delays in claiming your tax credits.

Similar forms

- Form 6765: Credit for Increasing Research Activities - This document is used to claim the same research activities credit featured in Form 8974. While Form 8974 specifies how much of the credit can be applied to payroll taxes, Form 6765 documents the research expenses that necessitate the credit in the first place.

- Form 941: Employer's Quarterly Federal Tax Return - Form 941 is crucial for reporting income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. Like Form 8974, it also ties into the payroll tax credit, as the amounts reported determine eligibility and the basis for calculating credits.

- Form 943: Employer's Annual Federal Tax Return for Agricultural Employees - Similar to Form 941, this document is for agricultural employers to report wages and calculate taxes owed. Form 8974 works alongside it, allowing agricultural employers to highlight their eligibility for payroll tax credits linked to research activities.

- Form 944: Employer's Annual Federal Tax Return - Form 944 is an annual return that some small businesses use instead of Form 941. It reports employee wages and tax withheld. Form 8974 interacts with Form 944 by helping businesses claim the appropriate credits for payroll taxes paid.

- Form 941-PR: Planilla Para La Declaracion Trimestral de Una Persona o Entidad - This form is the Spanish-language equivalent of Form 941, designed for employers in Puerto Rico. It serves a similar function as Form 8974, ensuring that claims for payroll credits are reported properly for eligible employers in that region.

- Form 943-PR: Planilla Para La Declaracion Annual de Una Persona o Entidad - Like Form 943, this is the Spanish equivalent for agricultural employers in Puerto Rico. Form 8974 overlaps with it by providing a way to claim payroll credits based on qualifying research activities, specifically for businesses operating in Puerto Rico.

Dos and Don'ts

Filling out Form 8974 can be straightforward if you keep a few things in mind. Here’s a list of what you should and shouldn't do.

- Do read the instructions carefully before starting. Understanding the requirements will save you time.

- Don’t rush through the form. Take your time to ensure accuracy.

- Do double-check your employer identification number (EIN). An incorrect EIN can lead to delays.

- Don’t leave any fields blank unless instructed. Every section matters for your tax credit calculation.

- Do keep copies of all documents for your records. This is important for future reference.

- Don’t forget to select the correct quarter. You must choose one if you file Form 941, 941-PR, or 941-SS.

- Do verify that the amounts from previous forms match. Discrepancies could trigger questions from the IRS.

Misconceptions

There are several misconceptions about Form 8974, which can create confusion for those seeking to understand its purpose and requirements. Below are six common misunderstandings explained in simple terms.

- Form 8974 applies only to certain businesses. Many people believe that only specific types of businesses can use Form 8974. In reality, this form is available to a broader range of qualified small businesses that engage in research activities and meet the necessary criteria.

- Form 8974 must be filed separately from other payroll forms. Some people think they need to submit Form 8974 as a standalone document. However, the credit calculated on this form is reported directly on your payroll tax returns, such as Form 941 or Form 943.

- The form is only for businesses that are involved in scientific research. While Form 8974 is often associated with research tax credits, it is not limited to traditional scientific research. It covers a variety of activities that qualify under the IRS guidelines for research and development.

- The credit claimed is only available for one tax period. There is a belief that the credit can only be claimed once. On the contrary, if eligible, businesses can claim this credit for multiple tax periods as long as they qualify.

- Completing Form 8974 requires extensive accounting knowledge. Some may think that a deep understanding of complex accounting practices is essential for filling out this form. In fact, the form is designed to be straightforward, making it accessible for business owners and their accountants alike.

- Filing Form 8974 guarantees a credit. Many assume that submitting the form guarantees receiving the credit. However, eligibility requirements must be met, and the actual credit amount is subject to evaluation based on the business's specific activities and payroll taxes.

Understanding these misconceptions can help businesses better navigate the process of claiming the Qualified Small Business Payroll Tax Credit more effectively.

Key takeaways

Here are some key takeaways when filling out and using Form 8974:

- Understand the purpose: Form 8974 is crucial for claiming the Qualified Small Business Payroll Tax Credit, which incentivizes research activities.

- Choose the correct quarter: You must select the quarter you are claiming the credit for. This applies if you file Forms 941, 941-PR, or 941-SS.

- Input accurate details: Fill in the employer identification number (EIN) and ensure the business name is correct, as this information is essential for processing your claim.

- Complete Part 1 carefully: Be precise when entering the dates, income amounts, and credits. Each entry affects your total credit eligibility.

- Calculate credits correctly: Ensure you closely follow the instructions for determining the amount of credit you can use during the period.

- Check the credit amount: The final credit you can claim is the lesser of the amounts calculated in lines 7 and 11; make sure this is accurately transferred to your relevant tax form.

- Pay attention to deadlines: Timely filing is critical. Submit Form 8974 alongside your payroll tax forms to avoid potential penalties.

- Consult the instructions: Always review the specific IRS guidelines for Form 8974 to ensure compliance and maximization of your tax credit.

Filling out Form 8974 may seem complex, but taking it step by step can simplify the process. Keep these key pointers in mind to enhance accuracy and efficiency in claiming your credit.

Browse Other Templates

Sodexolink Electronic Pay/direct Deposit - You can easily manage up to three different accounts with this form.

Hand Hygiene Compliance in Healthcare Workers - Observers are encouraged to document any relevant contextual information during the session.

Secondary Dependent Navy - The form requires detailed income reporting for the child to assess dependency status.