Fill Out Your 9465 Fs Form

The 9465 Form, officially known as the Installment Agreement Request, is a crucial document for taxpayers who find themselves unable to pay their taxes in full. This form provides an avenue for establishing a payment plan with the IRS, allowing taxpayers to spread their unpaid tax obligations over time. One of the key features of this form is its accessibility; individuals who owe $50,000 or less may even set up an installment agreement online without needing to file the form. The 9465 Form requires personal information, such as names, social security numbers, and addresses, along with detail about the tax dues, including the total amount owed and any other debts. Critical elements of the form include the proposed monthly payment amount, the preferred payment date, and options for direct debit or payroll deduction. Taxpayers must carefully fill out this form to ensure it accurately reflects their financial situation, as any discrepancies could delay the process. Completing Form 9465 is the first step towards regaining control over tax liabilities, helping individuals avoid penalties while moving towards a resolution of their tax debts.

9465 Fs Example

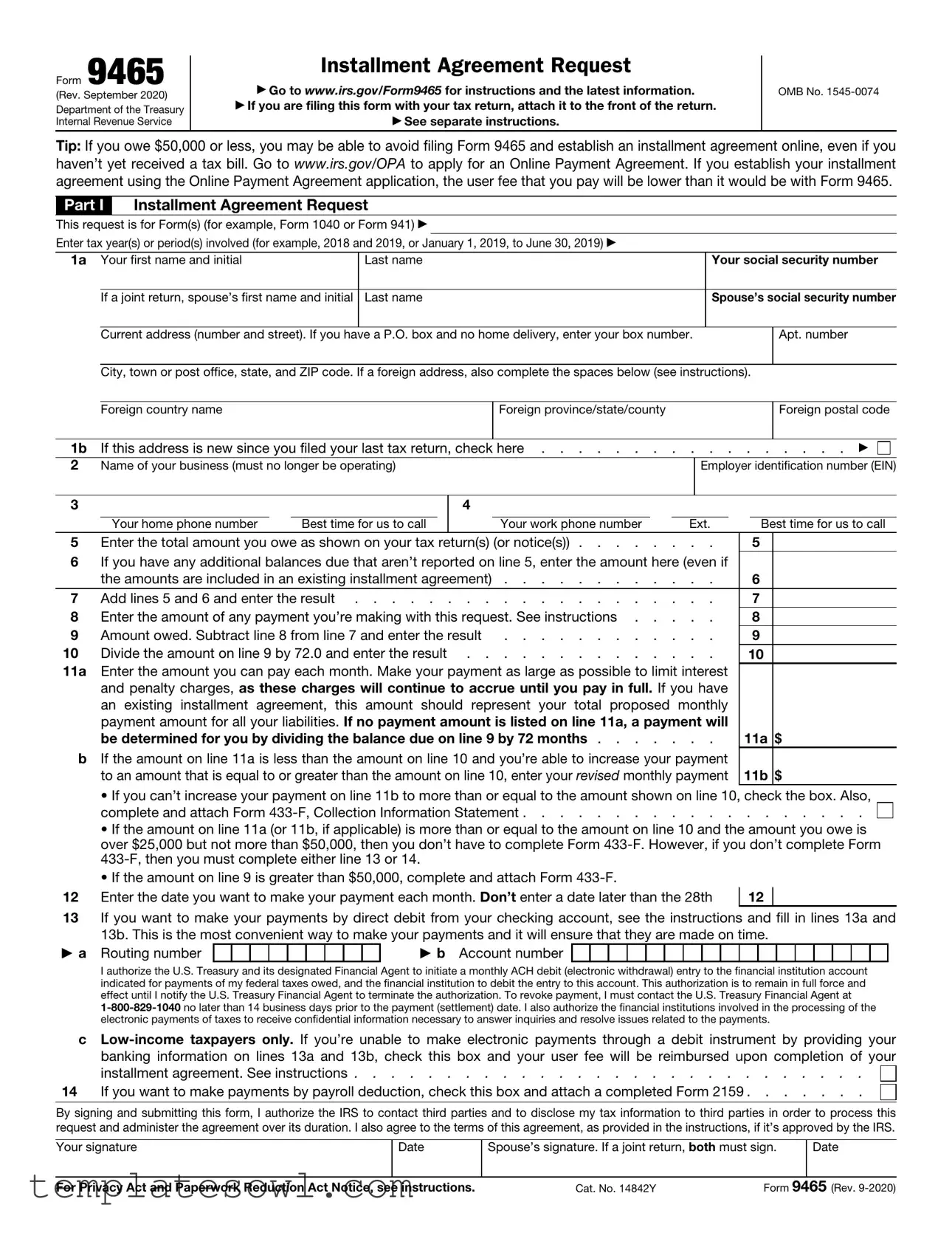

Form 9465

(Rev. September 2020)

Department of the Treasury

Internal Revenue Service

Installment Agreement Request

▶Go to www.irs.gov/Form9465 for instructions and the latest information.

▶If you are filing this form with your tax return, attach it to the front of the return.

▶See separate instructions.

OMB No.

Tip: If you owe $50,000 or less, you may be able to avoid filing Form 9465 and establish an installment agreement online, even if you haven’t yet received a tax bill. Go to www.irs.gov/OPA to apply for an Online Payment Agreement. If you establish your installment agreement using the Online Payment Agreement application, the user fee that you pay will be lower than it would be with Form 9465.

Part I |

Installment Agreement Request |

|

||

This request is for Form(s) (for example, Form 1040 or Form 941) ▶ |

|

|||

|

|

|

||

Enter tax year(s) or period(s) involved (for example, 2018 and 2019, or January 1, 2019, to June 30, 2019) ▶ |

|

|||

1a Your first name and initial |

Last name |

Your social security number |

||

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

Current address (number and street). If you have a P.O. box and no home delivery, enter your box number.

Apt. number

City, town or post office, state, and ZIP code. If a foreign address, also complete the spaces below (see instructions).

|

Foreign country name |

Foreign province/state/county |

Foreign postal code |

|

|

|

|

1b |

If this address is new since you filed your last tax return, check here |

. . . . . . . . . . ▶ |

||||||||||

2 |

Name of your business (must no longer be operating) |

|

|

|

|

|

Employer identification number (EIN) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your home phone number |

Best time for us to call |

Your work phone number |

Ext. |

Best time for us to call |

|||||||

5 |

Enter the total amount you owe as shown on your tax return(s) (or notice(s)) |

. . . |

|

5 |

||||||||

6 |

If you have any additional balances due that aren’t reported on line 5, enter the amount here (even if |

|

|

|

||||||||

|

the amounts are included in an existing installment agreement) |

. . . |

|

6 |

||||||||

7 |

Add lines 5 and 6 and enter the result |

. . . |

|

7 |

||||||||

8 |

Enter the amount of any payment you’re making with this request. See instructions . . |

. . . |

|

8 |

||||||||

9 |

Amount owed. Subtract line 8 from line 7 and enter the result |

. . . |

|

9 |

||||||||

10 |

Divide the amount on line 9 by 72.0 and enter the result |

. . . |

|

10 |

||||||||

11a |

Enter the amount you can pay each month. Make your payment as large as possible to limit interest |

|

|

|

||||||||

|

and penalty charges, as these charges will continue to accrue until you pay in full. If you have |

|

|

|

||||||||

|

an existing installment agreement, this amount should represent your total proposed monthly |

|

|

|

||||||||

|

payment amount for all your liabilities. If no payment amount is listed on line 11a, a payment will |

|

|

|

||||||||

|

be determined for you by dividing the balance due on line 9 by 72 months . . . . |

. . . |

|

11a $ |

||||||||

bIf the amount on line 11a is less than the amount on line 10 and you’re able to increase your payment

to an amount that is equal to or greater than the amount on line 10, enter your revised monthly payment 11b $

• If you can’t increase your payment on line 11b to more than or equal to the amount shown on line 10, check the box. Also, complete and attach Form

•If the amount on line 11a (or 11b, if applicable) is more than or equal to the amount on line 10 and the amount you owe is over $25,000 but not more than $50,000, then you don’t have to complete Form

•If the amount on line 9 is greater than $50,000, complete and attach Form

12 Enter the date you want to make your payment each month. Don’t enter a date later than the 28th |

12 |

|

13If you want to make your payments by direct debit from your checking account, see the instructions and fill in lines 13a and 13b. This is the most convenient way to make your payments and it will ensure that they are made on time.

▶a Routing number

▶b Account number

I authorize the U.S. Treasury and its designated Financial Agent to initiate a monthly ACH debit (electronic withdrawal) entry to the financial institution account indicated for payments of my federal taxes owed, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke payment, I must contact the U.S. Treasury Financial Agent at

c

installment agreement. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 If you want to make payments by payroll deduction, check this box and attach a completed Form 2159 . . . . . . .

By signing and submitting this form, I authorize the IRS to contact third parties and to disclose my tax information to third parties in order to process this request and administer the agreement over its duration. I also agree to the terms of this agreement, as provided in the instructions, if it’s approved by the IRS.

Your signature |

Date |

Spouse’s signature. If a joint return, both must sign. |

Date |

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 14842Y |

Form 9465 (Rev. |

||

Form 9465 (Rev. |

Page 2 |

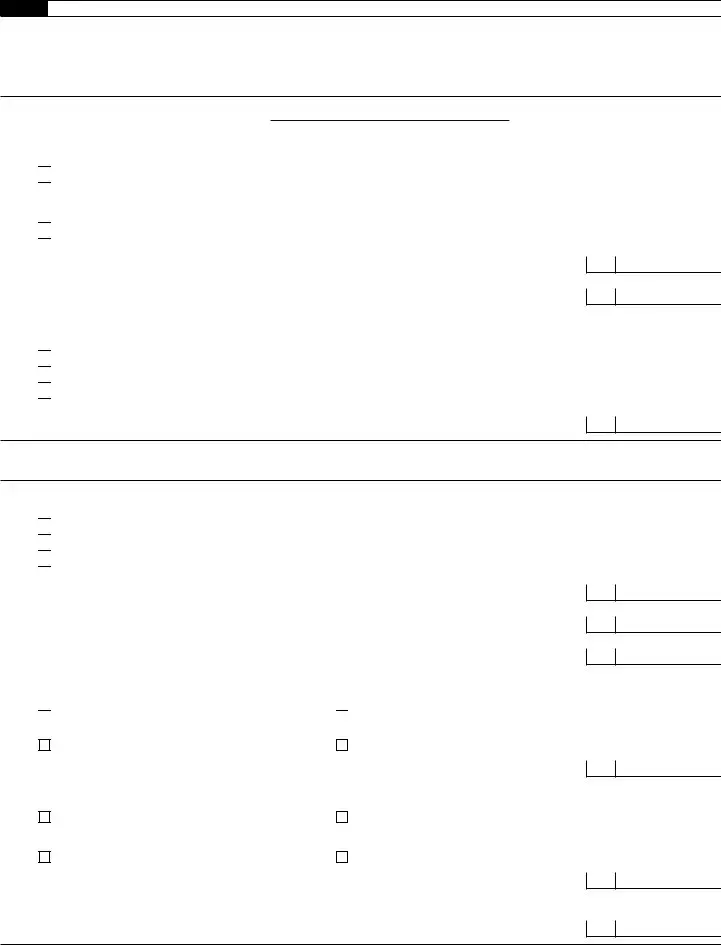

Part II Additional Information

Complete this Part only if all three conditions below apply:

1.You defaulted on an installment agreement in the past 12 months;

2.You owe more than $25,000 but not more than $50,000; and

3.The amount on line 11a (or 11b, if applicable) is less than line 10.

Note: If you owe more than $50,000, also complete and attach Form

15In which county is your primary residence?

16a Marital status:

Single. Skip question 16b and go to question 17.

Single. Skip question 16b and go to question 17.

Married. Go to question 16b.

Married. Go to question 16b.

bDo you share household expenses with your spouse?  Yes.

Yes.

No.

No.

17How many dependents will you be able to claim on this year’s tax return?. . . . . . . . .

18 How many people in your household are 65 or older? . . . . . . . . . . . . . . .

19How often are you paid?  Once a week.

Once a week.

Once every 2 weeks.

Once every 2 weeks.

Once a month.

Once a month.

Twice a month.

Twice a month.

17

18

20 What is your net income per pay period (take home pay)? . . . . . . . . . . . . . .

20$

Note: Complete lines 21 and 22 only if you have a spouse and meet certain conditions (see instructions). If you don’t have a spouse, go to line 23.

21How often is your spouse paid?  Once a week.

Once a week.

Once every 2 weeks.

Once every 2 weeks.

Once a month.

Once a month.

Twice a month.

Twice a month.

22What is your spouse’s net income per pay period (take home pay)? . . . . . . . . . . .

23 How many vehicles do you own? . . . . . . . . . . . . . . . . . . . . . .

24 How many car payments do you have each month? . . . . . . . . . . . . . . . . . . .

22$

23

24

25a Do you have health insurance?  Yes. Go to question 25b.

Yes. Go to question 25b.

No. Skip question 25b and go to question 26a.

No. Skip question 25b and go to question 26a.

bAre your health insurance premiums deducted from your paycheck?

Yes. Skip question 25c and go to question 26a. |

No. Go to question 25c. |

cHow much are your monthly health insurance premiums? . . . . . . . . . . . . . .

26a Do you make |

|

Yes. Go to question 26b. |

No. Go to question 27. |

25c $

bAre your

Yes. Go to question 27. |

No. Go to question 26c. |

c How much are your

26c $

27Not including any

27

$

Form 9465 (Rev.

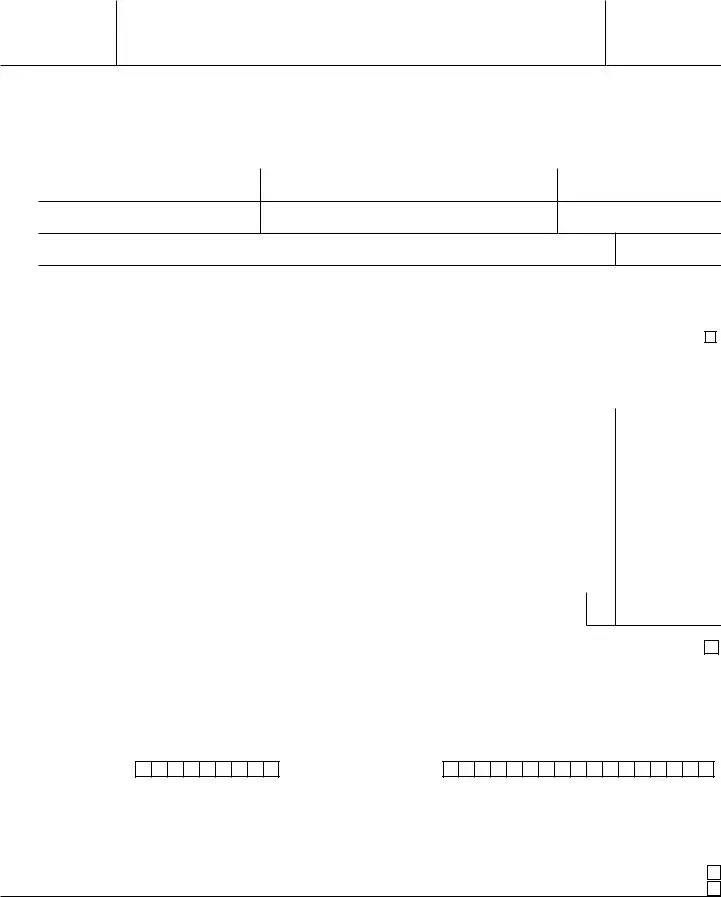

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | Form 9465 is used to request an installment agreement to pay outstanding tax liabilities over time. |

| Eligibility | Taxpayers with owing amounts of $50,000 or less may apply for an online payment agreement to simplify the process. |

| Filing Instructions | Attach Form 9465 to the front of your tax return if submitted together, or file it separately. |

| Payments | Taxpayers can choose to make monthly payments, and should aim to keep these payments as high as possible to reduce penalties. |

| Direct Debit Option | Paying by direct debit is recommended for convenience and to ensure timely payments. |

| Form Validity | The form's current revision is September 2020, which reflects the most recent updates from the IRS. |

| Privacy Notice | By signing the form, taxpayers authorize the IRS to contact third parties regarding their tax information. |

| State-Specific Law | No state-specific law governs this federal form; it adheres to federal tax regulations. |

Guidelines on Utilizing 9465 Fs

Completing Form 9465 is an important step if you need to set up an installment agreement with the IRS. After gathering the required information, follow these steps to fill out the form accurately.

- Start with Part I. Indicate the form or forms (like Form 1040) for which you are requesting the installment agreement.

- List the tax year(s) or period(s) involved (e.g., 2018 and 2019).

- Provide your first and last name, social security number, and if applicable, your spouse's information.

- Enter your current address. If it’s a P.O. box, make sure to include it correctly.

- If your address has changed, check the appropriate box.

- If applicable, include the name and Employer Identification Number (EIN) of your business.

- Fill in your home and work phone numbers, along with the best times to call.

- Enter the total amount owed as displayed on your tax return(s).

- If you have additional amounts due, include that on the specified line.

- Add the two amounts together and enter the result.

- Input any payment you are making now.

- Subtract your current payment from the total amount owed and enter the result.

- Divide the amount owed by 72 and write down that figure.

- Indicate the largest monthly payment you can afford.

- If you can pay an amount greater than or equal to the divided amount, enter that; otherwise, check the box for the revised payment.

- Choose the date you want to make your payments each month (no later than the 28th).

- If you choose direct debit, fill in your bank routing and account numbers.

- If applicable, indicate if you are unable to make electronic payments and provide the required information.

- If you wish to make payments through payroll deduction, check the box and attach Form 2159.

- Sign and date the form, and ensure your spouse also signs if a joint return.

- Complete Part II only if specific conditions apply about previous agreements or amounts owed.

What You Should Know About This Form

What is Form 9465?

Form 9465 is an IRS form used by individuals who owe taxes and wish to request an installment agreement. This allows taxpayers to pay off their tax liabilities in smaller, more manageable monthly payments over time. The form should be filed if a taxpayer cannot pay the full amount owed at once and would like to set up a payment plan with the IRS.

Who needs to fill out Form 9465?

If you owe taxes and cannot pay the full amount by the due date, you may need to fill out Form 9465. It's particularly relevant for individuals who owe $50,000 or less. However, if your tax debt exceeds this amount, additional forms or requirements may also apply.

How can I submit Form 9465?

You can submit Form 9465 in a couple of ways. If you are filing your tax return, simply attach the form to your return. Alternatively, if you are not filing a return, you can mail the completed form separately to the address specified for payment plans in the IRS directions.

Is there a fee to set up an installment agreement?

Yes, there is usually a user fee for establishing an installment agreement. However, if you owe $50,000 or less and set up your agreement online, the fee may be reduced. For those facing financial hardship, a reimbursement of the user fee may be possible upon completing the installment agreement.

How do I determine my monthly payment amount?

Your monthly payment amount is typically calculated by dividing the total amount owed by the number of months in which you plan to pay off the debt. This number should be listed on line 10 of the form. Make sure to propose the largest payment you can manage to minimize interest and penalties.

What if I am unable to pay the proposed monthly payment?

If you cannot afford the payment stated on the form, you may indicate this by checking the appropriate box. You'll then need to fill out and attach Form 433-F, which provides the IRS with detailed information about your financial situation—helping them assess your payment capabilities.

When will I need to start making payments?

Payments should begin the following month after the IRS accepts your installment agreement. On Form 9465, you will specify the date on which you wish to make payments each month, ensuring it falls on or before the 28th day of the month.

Can I change my payment date after submitting the form?

Once your installment agreement is approved, changing the payment date may be more complicated. You would need to contact the IRS directly to discuss any required adjustments. It's advisable to keep that original date unless absolutely necessary to change it.

Common mistakes

When filling out Form 9465, many individuals make common mistakes that can delay or derail their request. One significant error occurs when applicants fail to provide accurate personal information. For instance, mixing up names or social security numbers can trigger unnecessary complications. Always double-check that each name and number corresponds accurately to what appears on official documents.

Another frequent mistake is neglecting to include all outstanding tax liabilities. On line 5, if you only report part of the amount owed, it may lead to misunderstandings about your financial situation. Ensure that any additional balances due are reported under line 6. Not including these figures can cause the IRS to reject your request.

Improper calculations can also cause significant problems. When you add must enter your total amount owed in line 7, make sure it includes everything from lines 5 and 6. If you skip this step or miscalculate, the amounts you report on subsequent lines can be incorrect, leading to delays in processing your request.

Many applicants forget to specify a desirable payment date on line 12. Failing to establish a specific date may result in the IRS setting one for you, potentially not aligning with your financial situation. Choosing the right date helps ensure you can make timely payments without incurring additional fees.

Direct debit authorizations on lines 13a and 13b often trip people up as well. Participants sometimes overlook these lines or provide incorrect banking information. If you intend to make payments via direct debit, ensure that your routing and account numbers are accurate to avoid issues with withdrawals.

Lastly, applicants sometimes neglect to sign the form. Both signatures are necessary if it's a joint tax return. A missing signature can result in outright rejection of the application. Remember that your authorization signifies acceptance of the payment terms outlined by the IRS.

Documents used along the form

When individuals or businesses are unable to pay their tax liabilities in full, they may request an installment agreement through Form 9465. This form allows taxpayers to propose a plan for paying off their tax debts over time. In conjunction with Form 9465, several additional documents may be necessary. Each form plays a specific role in the process of securing an installment agreement with the IRS.

- Form 433-F, Collection Information Statement: This document provides the IRS with a comprehensive overview of a taxpayer's financial situation. It includes details on income, expenses, assets, and liabilities, and is often required if the amount owed exceeds certain thresholds or if the taxpayer has had previous defaults on installment agreements.

- Form 1040, U.S. Individual Income Tax Return: This is the standard tax form used by individuals to file their annual income tax returns. A copy of the most recent Form 1040 may need to be included with Form 9465 to establish income levels and overall financial responsibility.

- Form 2159, Payroll Deduction Agreement: If a taxpayer chooses to make payments through payroll deductions, this form must be completed. It allows the IRS to deduct payments directly from the taxpayer's paycheck, ensuring that payments are made consistently and on time.

- Form 9465 (if applicable): A duplicate or additional copy of Form 9465 may be needed if the taxpayer is applying for multiple agreements or wishes to clarify specific points regarding their request for an installment plan.

- Form SS-4, Application for Employer Identification Number: For businesses, this form is essential if they are applying for an installment agreement related to business taxes. It provides the IRS with the necessary identification of the business entity.

Each of these documents serves a unique purpose in facilitating the payment plan process and ensuring compliance with IRS requirements. Keeping accurate records and submitting the appropriate forms can help taxpayers navigate their obligations more effectively.

Similar forms

- Form 433-F (Collection Information Statement): This form is often completed if you owe more than $50,000 and need to provide detailed financial information to the IRS. Similar to Form 9465, it assesses your ability to pay.

- Form 9465-B (Installment Agreement Request): This form is used for streamlined installment agreements for taxpayers owing less than a specified amount. Both forms serve to request an installment payment plan for tax debts.

- Form 12153 (Request for a Collection Due Process or Equivalent Hearing): This form is filed to request a hearing regarding IRS collection actions. Like Form 9465, it provides a way for taxpayers to address their tax liabilities, though it’s more about disputing them.

- Form 1040 (U.S. Individual Income Tax Return): When filing your annual income tax return, Form 1040 may indicate how much you owe and could lead to an installment agreement request using Form 9465 to pay your tax debt.

- Form 8822 (Change of Address): This form is used to inform the IRS of a new address. Keeping your address current is crucial for communication regarding your installment agreement and any notices about your tax liability.

- Form 2159 (Payroll Deduction Agreement): This form allows you to set up a payment plan through payroll deductions. It complements Form 9465, providing another method to pay tax debts over time.

- Form 8606 (Nondeductible IRAs): This form tracks nondeductible contributions to IRAs, which could impact your overall tax liability. Understanding your total tax situation can help when deciding to submit Form 9465.

- Form 2220 (Underpayment of Estimated Tax by Individuals, Estates, and Trusts): This form addresses penalties for underpayment. It can be relevant if you end up owing more than expected, potentially leading you to seek an installment agreement with Form 9465.

- Form 1040-X (Amended U.S. Individual Income Tax Return): When you amend your tax return, you might change what you owe. You could then use Form 9465 if the amended return results in a balance due that you cannot pay all at once.

Dos and Don'ts

When filling out Form 9465, it’s essential to ensure that all information is provided accurately to facilitate the installment agreement process with the IRS. Below is a list of things you should and shouldn’t do while completing this form.

- Do carefully read all instructions provided for the form.

- Do provide accurate personal and financial information.

- Do sign and date the form before submission.

- Do check the box if you have a new address since your last tax return.

- Do calculate your monthly payment to minimize interest and penalties.

- Don’t leave any required fields blank.

- Don’t enter a payment date later than the 28th of the month.

- Don’t forget to attach any additional required forms if necessary.

- Don’t misrepresent your financial situation or payment ability.

- Don’t wait until the last minute to submit the form; early submission is recommended.

By following these guidelines, you can help ensure a smoother experience when filing your request for an installment agreement.

Misconceptions

- Form 9465 is only for individuals with tax bills. Many believe that Form 9465 is only needed after receiving a tax bill. However, if you owe $50,000 or less, you can establish an installment agreement online before receiving a bill.

- Filing Form 9465 guarantees approval of the installment agreement. Submitting Form 9465 does not automatically result in an approved installment agreement. The IRS reviews all requests and may require additional information.

- Form 9465 is only necessary for those with large debts. Some people think Form 9465 is only for individuals with significant tax debts. In reality, this form can be used for any amount owed, even small balances.

- You cannot change your payment amount after submitting Form 9465. Individuals often feel they are locked into the payment amount they provide on the form. However, you can request changes if your financial situation changes.

- Filing Form 9465 is the only way to set up an installment plan. Many forget that they can apply for an Online Payment Agreement instead of filing Form 9465. This can be a quicker and often more cost-effective option.

- The IRS won’t contact me if my payment amount is too low. It’s a misconception that the IRS will overlook low payment amounts. In fact, if the proposed monthly payment is insufficient, the IRS may contact you or deny the request.

- Form 9465 must be filed with every tax return. Not all tax returns require Form 9465. You only need to file it if you have tax owed for an installment agreement.

- There is no cost associated with submitting Form 9465. While many believe there are no fees for filing, there are specific user fees associated with establishing an installment agreement, which can be higher than fees associated with applying online.

Key takeaways

When filling out Form 9465, which is used to request an installment agreement with the IRS, consider the following key points:

- Eligibility: If you owe $50,000 or less, you may qualify to set up an installment agreement online. This can save you time and reduce user fees.

- Filing Process: Attach Form 9465 to the front of your tax return if you are submitting it together. Otherwise, you can file it separately.

- Payment Amount: Determine your monthly payment as accurately as possible. Aim to pay more than the calculated minimum to reduce interest and penalties.

- Required Attachments: If your owed amount exceeds $50,000, complete and attach Form 433-F along with your application for the agreement.

- Direct Debit Option: Consider selecting the direct debit option for convenience. This ensures timely payments, preventing potential late fees.

- Additional Documentation: Complete additional sections only if you have a spouse or if you previously defaulted on an installment agreement.

- Signature Requirement: Ensure both you and your spouse (if applicable) sign the form. This is a crucial step in processing your request.

Completing Form 9465 accurately is essential for an efficient resolution of your tax obligations. Pay attention to the details to avoid unnecessary complications later on.

Browse Other Templates

Louisiana Wage - Underpayments must include interest and penalty calculations.

Boeing Advantage+ Health Plan - Keep copies of the completed form for your records before sending it in.

Exxonmobil Foundation - Teams of employees can apply for grants after completing a joint project of at least 20 hours.