Fill Out Your Aaa Property Loss Worksheet Form

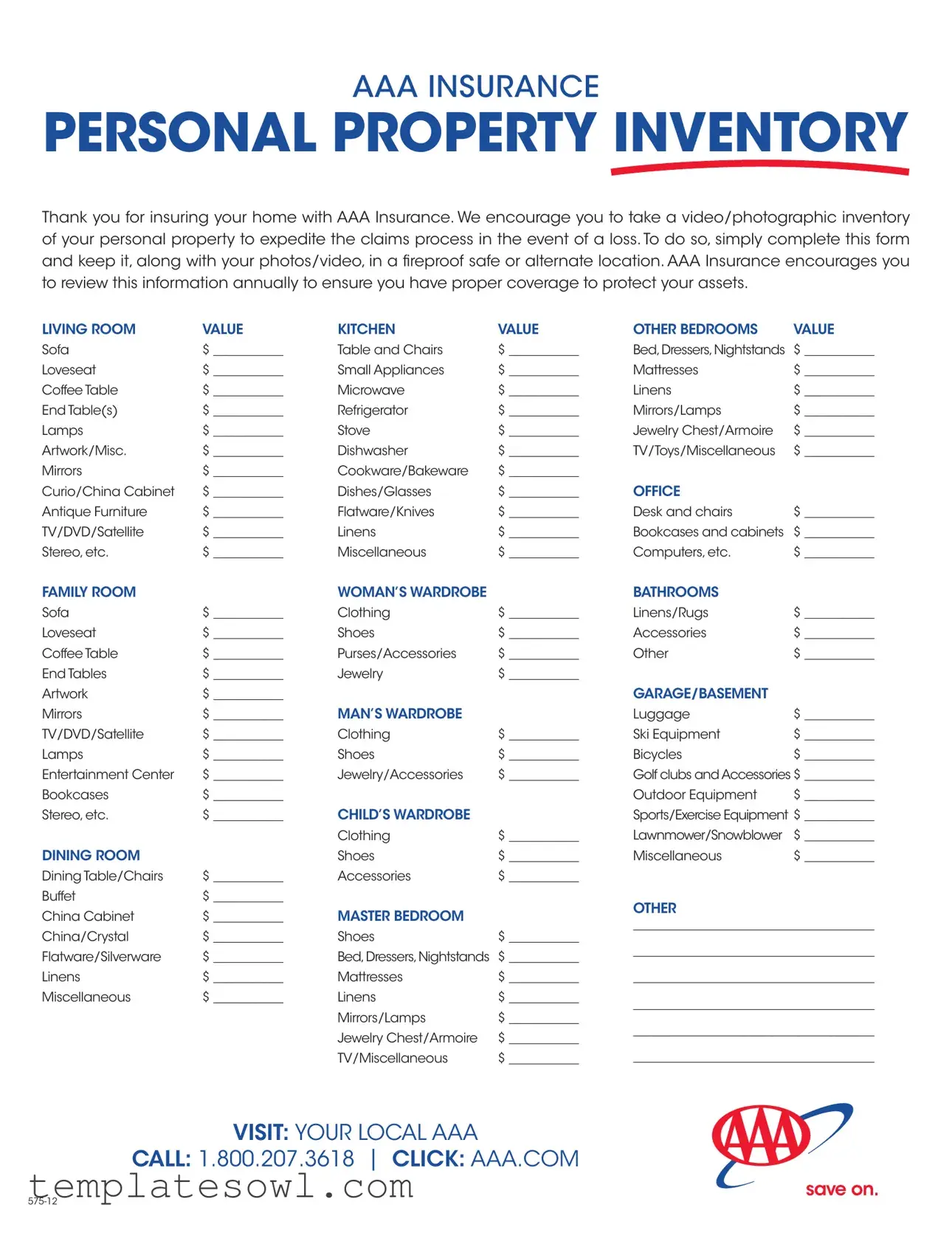

When it comes to safeguarding your personal belongings, the Aaa Property Loss Worksheet form stands out as an essential tool. This form allows you to create a detailed inventory of your household items, ensuring you are prepared for any unforeseen events that could lead to a property loss. It encourages you to document everything from your living room sofa to valuable jewelry, providing a structured approach to assess the value of your possessions. AAA Insurance stresses the importance of maintaining this inventory alongside photographs or videos, ideally stored in a fireproof safe, to expedite the claims process if necessary. Furthermore, this worksheet serves as a reminder to review your coverage annually, ensuring that all assets are appropriately protected. By filling out the various sections covering different rooms and categories, you can have a comprehensive overview of what you own, making managing your insurance claims more efficient should the need arise.

Aaa Property Loss Worksheet Example

AAA INSURANCE

PERSONAL PROPERTY INVENTORY

Thank you for insuring your home with AAA Insurance. We encourage you to take a video/photographic inventory of your personal property to expedite the claims process in the event of a loss. To do so, simply complete this form and keep it, along with your photos/video, in a fireproof safe or alternate location. AAA Insurance encourages you to review this information annually to ensure you have proper coverage to protect your assets.

LIVING ROOM |

VALUE |

KITCHEN |

VALUE |

OTHER BEDROOMS |

VALUE |

|

Sofa |

$ ___________ |

Table and Chairs |

$ ___________ |

Bed, Dressers, Nightstands |

$ ___________ |

|

Loveseat |

$ ___________ |

Small Appliances |

$ ___________ |

Mattresses |

$ ___________ |

|

Coffee Table |

$ ___________ |

Microwave |

$ ___________ |

Linens |

$ ___________ |

|

End Table(s) |

$ ___________ |

Refrigerator |

$ ___________ |

Mirrors/Lamps |

$ ___________ |

|

Lamps |

$ ___________ |

Stove |

$ ___________ |

Jewelry Chest/Armoire |

$ ___________ |

|

Artwork/Misc. |

$ ___________ |

Dishwasher |

$ ___________ |

TV/Toys/Miscellaneous |

$ ___________ |

|

Mirrors |

$ ___________ |

Cookware/Bakeware |

$ ___________ |

|

|

|

Curio/China Cabinet |

$ ___________ |

Dishes/Glasses |

$ ___________ |

OFFICE |

|

|

Antique Furniture |

$ ___________ |

Flatware/Knives |

$ ___________ |

Desk and chairs |

$ ___________ |

|

TV/DVD/Satellite |

$ ___________ |

Linens |

$ ___________ |

Bookcases and cabinets |

$ ___________ |

|

Stereo, etc. |

$ ___________ |

Miscellaneous |

$ ___________ |

Computers, etc. |

$ ___________ |

|

FAMILY ROOM |

|

WOMAN’S WARDROBE |

|

BATHROOMS |

|

|

Sofa |

$ ___________ |

Clothing |

$ ___________ |

Linens/Rugs |

$ ___________ |

|

Loveseat |

$ ___________ |

Shoes |

$ ___________ |

Accessories |

$ ___________ |

|

Coffee Table |

$ ___________ |

Purses/Accessories |

$ ___________ |

Other |

$ ___________ |

|

End Tables |

$ ___________ |

Jewelry |

$ ___________ |

|

|

|

Artwork |

$ ___________ |

|

|

GARAGE/BASEMENT |

|

|

Mirrors |

$ ___________ |

MAN’S WARDROBE |

|

Luggage |

$ ___________ |

|

TV/DVD/Satellite |

$ ___________ |

Clothing |

$ ___________ |

Ski Equipment |

$ ___________ |

|

Lamps |

$ ___________ |

Shoes |

$ ___________ |

Bicycles |

$ ___________ |

|

Entertainment Center |

$ ___________ |

Jewelry/Accessories |

$ ___________ |

Golf clubs and Accessories $ ___________ |

||

Bookcases |

$ ___________ |

|

|

Outdoor Equipment |

$ ___________ |

|

Stereo, etc. |

$ ___________ |

CHILD’S WARDROBE |

|

Sports/Exercise Equipment $ ___________ |

||

|

|

Clothing |

$ ___________ |

Lawnmower/Snowblower |

$ ___________ |

|

DINING ROOM |

|

Shoes |

$ ___________ |

Miscellaneous |

$ ___________ |

|

Dining Table/Chairs |

$ ___________ |

Accessories |

$ ___________ |

|

|

|

Buffet |

$ ___________ |

|

|

OTHER |

|

|

China Cabinet |

$ ___________ |

MASTER BEDROOM |

|

|

||

|

______________________________________ |

|||||

China/Crystal |

$ ___________ |

Shoes |

$ ___________ |

|||

______________________________________ |

||||||

Flatware/Silverware |

$ ___________ |

Bed, Dressers, Nightstands |

$ ___________ |

|||

|

|

|||||

Linens |

$ ___________ |

Mattresses |

$ ___________ |

______________________________________ |

||

Miscellaneous |

$ ___________ |

Linens |

$ ___________ |

______________________________________ |

||

|

|

Mirrors/Lamps |

$ ___________ |

|||

|

|

______________________________________ |

||||

|

|

Jewelry Chest/Armoire |

$ ___________ |

|||

|

|

|

|

|||

|

|

TV/Miscellaneous |

$ ___________ |

______________________________________ |

||

VISIT: YOUR LOCAL AAA

CALL: 1.800.207.3618 | CLICK: AAA.COM

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Aaa Property Loss Worksheet helps homeowners document their personal property for insurance purposes. |

| Encouragement of Inventory | AAA Insurance recommends taking a video or photographic inventory of possessions to streamline claims. |

| Storage Guidelines | Keeping the worksheet and any accompanying photos in a fireproof safe is advised for safety. |

| Annual Review | Policyholders should review their inventory list annually to ensure adequate coverage of their assets. |

| Room Categorization | The worksheet organizes items by room, such as living room, kitchen, bedrooms, and garage. |

| Valuation Space | Each item listed has a designated space for policyholders to enter its value. |

| Legal Compliance | In some states, homeowners must maintain an accurate inventory for compliance with insurance laws. |

| Accessibility | The form can typically be accessed online through the AAA Insurance website. |

| Contact Information | Aaa Insurance provides contact details for support via phone or website for further assistance. |

Guidelines on Utilizing Aaa Property Loss Worksheet

The Aaa Property Loss Worksheet is designed to help individuals organize and document their personal property. This step-by-step guide will assist in successfully completing the form, allowing for efficient tracking and management of belongings in the event of a loss. Once you finish filling out the form, store it safely with any photos or videos of your property to facilitate the claims process.

- Begin by gathering items from each room in your home that need to be listed.

- On the form, locate the section labeled for the specific room you are working on, such as Living Room or Kitchen.

- For each item listed in the section, write down the value next to the corresponding item description. The format is as follows: Item Name $ ___________.

- Continue this process for each room, ensuring that all personal property is accounted for.

- When you reach categories that apply to more specific areas, like Master Bedroom or Woman’s Wardrobe, follow the same pattern to record the values.

- As you fill out the form, double-check for accuracy and completeness to ensure no items are overlooked.

- Once finished, review the entire worksheet for clarity and correctness.

- Store the completed form in a fireproof safe or another secure location along with any visual documentation of your items.

What You Should Know About This Form

What is the purpose of the AAA Property Loss Worksheet form?

The AAA Property Loss Worksheet form is designed to help homeowners organize and keep track of their personal property. By cataloging items in various rooms, individuals can quickly reference this list in the event of a loss. It aids in expediting the claims process with insurance companies by providing a clear inventory of belongings. Additionally, the form encourages homeowners to take photographs or videos of their items, creating a complete record of their property that can be stored safely.

How should I store the completed worksheet and supporting materials?

Upon finishing the worksheet, it is crucial to secure it in a safe location. AAA Insurance recommends keeping the form together with any photographs or videos in a fireproof safe. Alternatively, you may store these items in a different secure place within your home, ensuring they are protected from potential disasters. The goal is to make sure these records are easily accessible when needed, especially during the stress of dealing with an insurance claim.

How often should I update my property inventory?

It is wise to review and update your property inventory at least once a year. This is to ensure that your coverage accurately reflects your current property value. People often acquire new possessions or dispose of older ones, and changes might affect your insurance needs. Annual reviews can help maintain proper protection for your assets and enable you to make adjustments to your coverage as necessary.

Can I include valuables like jewelry or collectibles in the worksheet?

Yes, absolutely! The AAA Property Loss Worksheet form allows for the inclusion of valuable items such as jewelry, collectibles, and artwork. It’s important to list these items separately, providing an estimate of their value. This detailed documentation can help ensure that these possessions are covered under your insurance policy. Having an accurate inventory can also streamline the claims process should you experience a loss.

Common mistakes

Filling out the AAA Property Loss Worksheet is a crucial step in safeguarding one’s personal belongings. However, certain common mistakes may hinder the effectiveness of this process. Being aware of these pitfalls can assist individuals in completing the form accurately and thereby streamline future claims.

One frequent mistake is failing to provide accurate or specific values for each item listed. It is important for individuals to take the time to research and determine the replacement cost of their possessions. Rounding off the value or estimating may lead to inadequate coverage. Providing precise values not only reflects the true worth of an item but also ensures that a claim is settled fairly in the event of a loss.

Another common error involves neglecting to account for all personal property within the home. Often, people overlook items in less frequented areas, such as basements or attics. All items, regardless of their location, should be included in the inventory. This will ensure a comprehensive assessment of losses should they occur, avoiding potential disputes during the claims process.

Furthermore, many individuals omit taking photographs or videos of their possessions. Visual documentation is invaluable and serves as proof of ownership and condition. Omitting this step can significantly complicate claims. It is advisable to store these images alongside the completed worksheet in a safe location to ensure easy access when needed.

Lastly, incomplete or unreadable forms pose a significant challenge for claims adjusters. Individuals should take care to fill out every required field clearly and legibly. A form that is difficult to understand may delay the claims process, leaving individuals without the support they need during challenging times. Attention to detail is crucial in ensuring the worksheet is informative and useful.

A deeper understanding of these common errors can empower individuals to fill out the AAA Property Loss Worksheet effectively. By valuing items accurately, accounting for all possessions, providing visual documentation, and ensuring clarity in their submissions, they can facilitate a more efficient claims process when incidents arise.

Documents used along the form

The AAA Property Loss Worksheet complements several other important forms and documents that assist in managing and documenting property loss. Each of these documents plays a vital role in the claims process and helps ensure proper coverage. Below is a list of these forms along with a brief description of each.

- Property Damage Claim Form: This form is used to formally report damages to your property due to an incident. It provides details about the damage and is submitted to your insurance company.

- Personal Property Inventory List: A detailed list of all personal items owned. This helps in validating claims and shows proof of ownership. It can include descriptions and values.

- Loss Notice: This document serves as an initial notification to your insurance company about any loss or damage. It typically includes a description of the incident.

- Estimate for Repairs: This is a quote from a contractor or service provider outlining the costs to repair or replace damaged property. It supports your claim for reimbursement.

- Photos of Damages: Visual documentation of the damage helps support your claim. Having clear, dated images can be beneficial during the assessment process.

- Witness Statements: If others witnessed the incident, their statements can provide additional context and support your account of what occurred.

- Supplementary Claim Forms: Sometimes, additional information is required by the insurance company. These forms gather further details about your claim.

- Insurance Policy Document: Your policy outlines the coverage, terms, and conditions of your insurance. It’s crucial to review this document when making a claim.

- Proof of Loss Form: This document is used to finalize your claim. It includes all pertinent details and must be signed under oath, affirming the loss claimed.

- Claims Denial Letter: If a claim is denied, this letter explains the reasons. Understanding these reasons is essential if you plan to appeal the decision.

Having these forms and documents organized and ready can greatly improve the efficiency of the claims process. It is always advisable to keep them in a secure location, ensuring easy access when needed. This preparation can make a significant difference when facing unexpected property losses.

Similar forms

- Personal Property Inventory List: Similar to the AAA Property Loss Worksheet, a personal property inventory list serves to document the items owned by an individual. This list typically includes details such as descriptions, values, and locations of items, helping to streamline the claims process when a loss occurs.

- Homeowners Insurance Policy: A homeowners insurance policy outlines the coverage provided for personal property, akin to how the AAA Property Loss Worksheet highlights specific items and their values. Together, they help ensure that a homeowner understands what is protected under their insurance.

- Contents Schedule: A contents schedule, often used in personal property insurance, details items owned by a policyholder. It shares similarities with the AAA form by providing an organized look at the possessions covered, assisting in claims where individual item values are crucial.

- Inventory Management App: An inventory management app allows users to record and track their personal belongings digitally. Like the AAA Property Loss Worksheet, such apps facilitate the documentation of valuable items and can aid significantly during insurance claims, as they may store images and item details efficiently.

Dos and Don'ts

When filling out the AAA Property Loss Worksheet form, there are clear guidelines that can help ensure accuracy and completeness. Here is a list of important dos and don’ts to keep in mind.

- Do take a video or photographic inventory of your personal property.

- Do use clear and specific descriptions for each item listed.

- Do keep the completed form in a safe location.

- Do review the inventory annually to update values and items.

- Do include the purchase date and value for each item whenever possible.

- Don't overlook items that may hold significant value, such as jewelry or antiques.

- Don't rush through the form; take your time to ensure completeness.

- Don't use vague terms to describe items; be as specific as possible.

- Don't forget to check all rooms and storage areas for items.

- Don't neglect to share the inventory and any photos with your household members.

Misconceptions

Misconception 1: The Aaa Property Loss Worksheet is only for major items.

Many people believe that the worksheet is only necessary for large or valuable belongings. However, every item in your home contributes to your total assets. Including smaller items helps ensure a comprehensive inventory that can expedite a claim in case of a loss.

Misconception 2: Completing the worksheet is a one-time task.

Some individuals think that once they complete the form, they do not need to revisit it. In reality, it is advisable to review and update the inventory annually. This ensures that any new purchases or changes in asset value are accounted for, keeping your coverage accurate.

Misconception 3: I don’t need to take photos or videos if I have the worksheet filled out.

While the form lists all your personal property, having photographic or video evidence greatly enhances the claims process. Visual documentation provides irrefutable proof of what you owned and its condition, making it easier to substantiate your claim.

Misconception 4: The worksheet is only useful in the event of a total loss.

People often think that the worksheet only matters if there’s a complete loss of property, such as a house fire. In fact, it can be beneficial in situations of theft, vandalism, or damage. Being prepared can save time and stress, regardless of the nature of the loss.

Key takeaways

Filling out the AAA Property Loss Worksheet is an essential step in protecting your personal belongings. Here are seven key takeaways to consider:

- Inventory Preparation: Taking a video or photographic inventory of your personal property helps simplify the claims process, should a loss occur.

- Safe Storage: Keep the completed worksheet and all photos or videos in a fireproof safe or another secure location.

- Annual Review: It's advisable to review and update your inventory annually to ensure that you have adequate coverage for your assets.

- Room-by-Room Organization: The worksheet categorizes items by room, making it easier to assess the value of belongings in specific areas of your home.

- Value Assessment: Provide an accurate value for each item as this will assist in the claims process and ensure proper reimbursement.

- Items to Include: Don't forget to include all types of personal items, from furniture to jewelry, to create a comprehensive inventory.

- Accessible Contact Information: For further assistance, AAA provides resources such as a local office and a contact number to facilitate support.

Browse Other Templates

Florida Loss Declaration,Insurance Claim Proof Statement,Insured Property Damage Affidavit,Loss Verification Form,Claim Support Affidavit,Statement of Loss Evidence,Affidavit of Property Damage,Proof of Insurance Loss Statement,Insurance Loss Submiss - The Florida Proof of Loss form serves as a formal declaration for losses under a specific insurance policy.

Savrx Prior Authorization - Be sure to check the box if you prefer brand name medications for your prescriptions.

Common App Step by Step - Describe your racial or ethnic identity based on the categories provided.