Fill Out Your Aarp Claim Life Form

When faced with the loss of a loved one, the process of settling their affairs can feel overwhelming and emotionally draining. Amidst the grief, the AARP Claim Life form serves as a necessary tool for beneficiaries seeking to secure the proceeds from life insurance policies issued by New York Life Insurance Company. This user-friendly form is designed specifically to expedite the claims process, ensuring that individuals receive the financial support they need in a timely manner. The form outlines critical steps that beneficiaries must follow, such as providing details about the deceased, including their name, date of death, and insurance contract number, as well as filling out personal information about the beneficiary, including their Taxpayer Identification Number. New York Life aims for efficiency; claim payments are typically processed within ten business days of receiving all necessary documents, which include not only the completed claim form but also a certified death certificate. Beneficiaries have choices regarding how they would like to receive their proceeds, with options like a lump sum payment or a Continued Interest Account, the latter offering a way to manage funds while earning interest. A thorough understanding of these elements and the subsequent process can help beneficiaries navigate this challenging terrain with greater ease, allowing them to focus on healing during such a difficult time.

Aarp Claim Life Example

New York Life Insurance Company

AARP Operations

Claims Service

P.O. Box 30713 Tampa, FL

Dear Beneficiary:

Please accept our condolences on your recent loss. We understand this is a difficult time, and hope that we can alleviate any concerns you may have about your claim.

We are providing the enclosed Claim Form complete with

We have provided a Frequently Asked Questions section containing information that will assist you in completing the Claim Form.

We appreciate the trust placed in us and are proud to continue that tradition in service to you. If you have any questions, please call

Sincerely,

Monique

Monique

Corporate Vice President

*New York Life reserves the right to determine whether any insurance was in force at the time of death, as well as the beneficiary to whom proceeds may be payable.

NDCF2017V9A

HOW TO COMPLETE YOUR CLAIM FORM:

To facilitate the processing of your claim, please send us a fully completed Claim Form from each beneficiary, one certified death certificate and other documents that we may request. For additional Claim Forms, visit our website at nylaarp.com

No original documents will be returned.

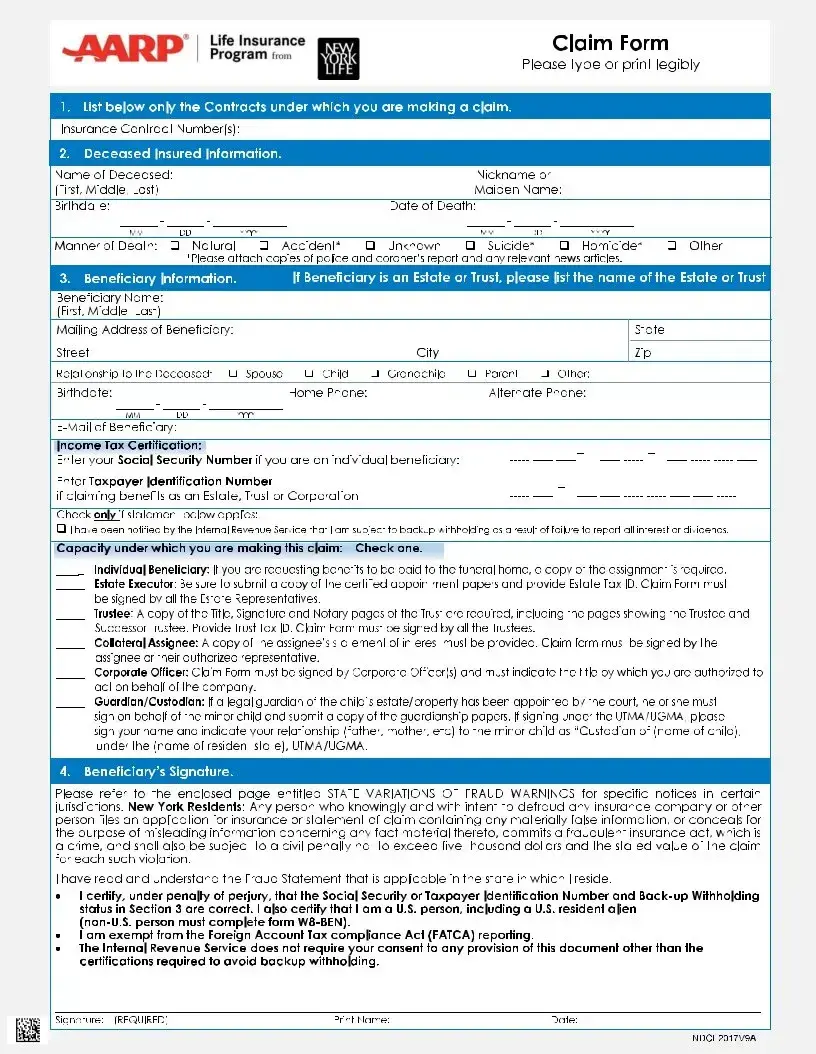

Section 1: List all the Contracts under which you are making a claim.

Section 2: Information about the deceased is necessary for purpose of identification and benefit determination.

Section 3: Beneficiary information and signature instructions:

Taxpayer Identification Number: Life insurance benefits are generally not subject to income tax. However, New York Life pays interest on the insurance proceeds from the date of death. Since the interest paid to you may be taxable, you should consult your tax advisor.

The Federal Government requires us, and all other financial institutions, to report interest we pay to you. Therefore, we are required to obtain your Social Security or other Taxpayer Identification Number, which you must certify under penalties of perjury. If you are applying for a tax number, the Federal Government requires us to withhold a portion of your interest as a deposit against the taxes that may be due.

Some persons may have been notified by the Internal Revenue Service that

report all their interest or dividends. If you have been so notified, and a backup withholding order has not been rescinded, you must check the Backup Withholding section right below your Income Tax Certification. We may contact you for more information if there are any questions about your Taxpayer Identification Number or back up withholding status, or if you are a

Section 4: Please sign the Claim Form in the same manner as you would normally sign your checks. Your signature may be used to verify instructions you give us in the future.

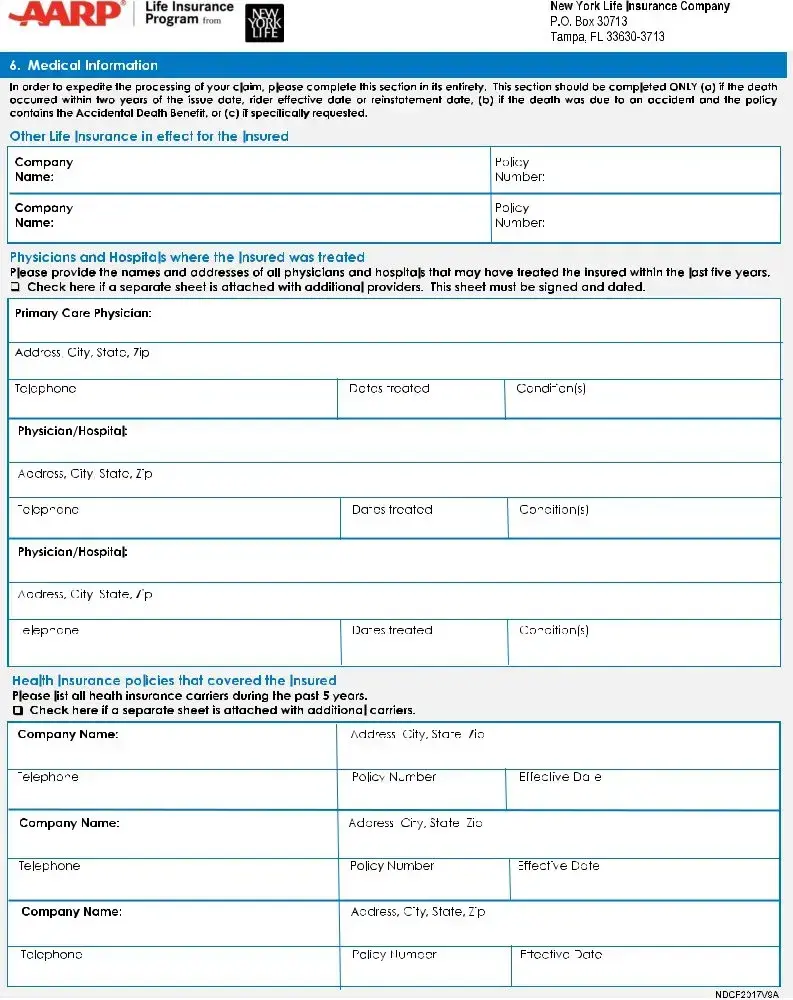

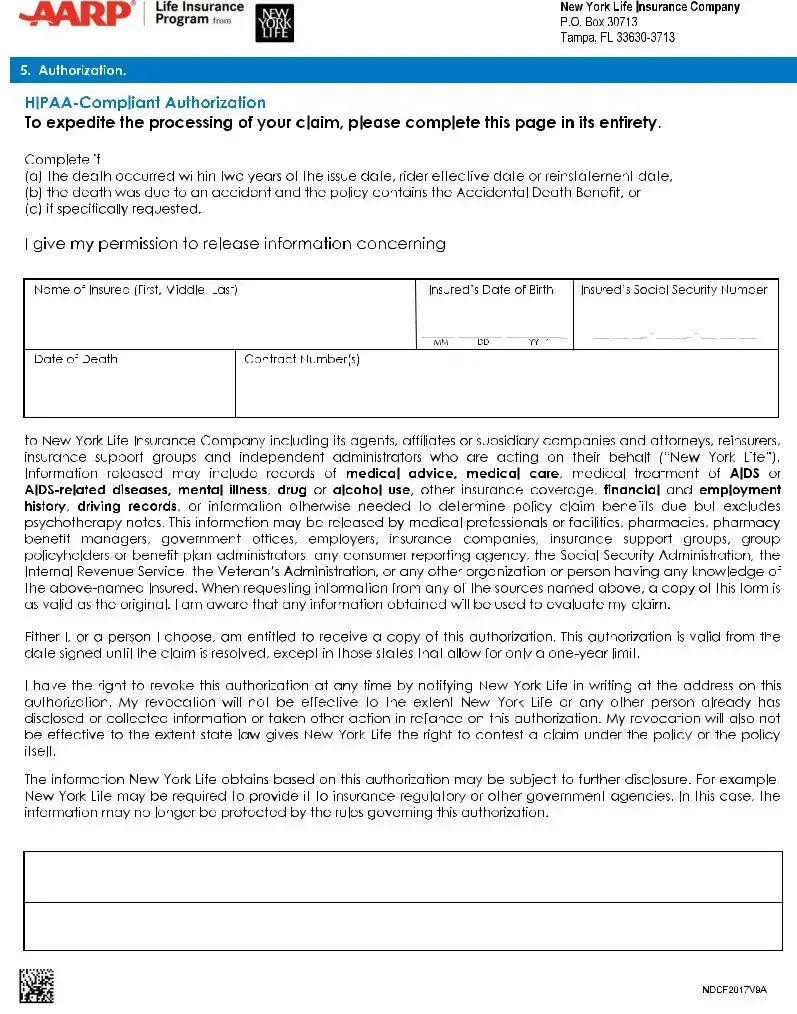

Sections In order to expedite the processing of your claim, please complete the Authorization 5 and 6: and Medical Information sections if all or any portion of the insurance coverage is

less than two years old at the time of death.

Illinois Interest Statement:

If the contract was issued in Illinois, you will be paid 10% interest, from the date of death, if your claim is not paid within 31 days of receipt of the necessary proofs needed to settle the claim.

Please send your fully completed Claim Form and one certified death certificate, along with any additional requested documentation to:

Regular Mail |

Express Mail: |

New York Life Insurance /AARP Operations |

New York Life Insurance /AARP Operations |

ATTN: Claims Department |

ATTN: Claims Department |

PO Box 30713 |

5505 W. Cypress Street |

Tampa, FL |

Tampa, FL 33607 |

FREQUENTLY ASKED QUESTIONS:

How do I obtain a certified death certificate, and how do I know the death certificate I receive is certified?

Most funeral homes will provide the family of the deceased with several certified death certificates. You may also contact the Vital Records Division in the state of the deceased for this document. Certified death certificates contain the signature of an appropriate officer of the county, city or state and will have either a raised seal or a multicolored signature seal from the county, city or state of issuance. If the manner of death is pending on the death certificate we receive, we will require an additional death certificate listing the final manner of death.

The designated beneficiary is deceased, what do we do?

Please provide a copy of the certified death certificate for the deceased beneficiary.

What is a funeral home assignment?

A funeral home assignment is a binding contract between a contract owner or beneficiary and the funeral home. This will allow us to direct payment of all, or a portion of the proceeds, to the funeral home. The funeral home assignment must be signed by the beneficiary and must be received in our office prior to the settlement of the claim. We are obligated to honor the assignment and pay the funeral home accordingly. In

What is an incontestable claim?

date; reinstatement date; or the effective date of any rider.

What is a contestable claim?

Aclaim is

: the insurance date; reinstatement date; or effective date of any rider. On contestable claims, the HIPAA Compliant Authorization section must be signed.

: the insurance date; reinstatement date; or effective date of any rider. On contestable claims, the HIPAA Compliant Authorization section must be signed.

What if the beneficiary is a minor?

Please complete Section 3 of the Claim F

property/estate. If a legal guardian has not been established for the property/estate of the minor child, payment may be considered under the Uniform Transfers to Minors Act, (UTMA), or the Uniform Gifts to Minors Act, (UGMA) subject to state guidelines. Please contact our office for further information. Note: The

Are life insurance proceeds subject to taxation?

Any interest paid on death proceeds is subject to federal and state taxation. We will not withhold income tax from interest unless you have advised us that you are subject to backup withholding or if the taxable portion of all payments for the year is less than $200.00. Interest is paid on most claims from the date of death until the date the claim is paid. The Social Security Number or Tax Identification Number is required to report interest payments to the Internal Revenue Service.

What is IRS Tax Form

Forms

What is FATCA?

The Foreign Account Tax Compliance Act, (FATCA), is a United States law designed to combat tax evasion by U.S. persons/entities. Provisions to the law include expansive withholding and information reporting rules aimed at ensuring U.S. persons and entities with financial assets outside the U.S. are paying U.S. taxes.

What if the insured was confined in a skilled nursing home for 180 consecutive days prior to his/her death?

Additional benefits may be available and their eligibility is outlined in the Contract Provisions. Contact New York Life for specific information.

Please Print Name:

Signature |

Relationship to Insured* |

Date |

X

*Authorized Representative must provide proper documentation, such as Estate representation documents.

This Page Intentionally Left Blank

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The AARP Claim Life Form helps beneficiaries submit claims for life insurance benefits efficiently. |

| Timely Payments | Most claim payments are issued within ten business days after the completed form and other required documents are received. |

| Payment Options | Beneficiaries can choose between a Continued Interest Account and a Lump Sum Payment if the amount is $5,000 or more. |

| Continued Interest Account Details | This account allows beneficiaries to access their funds while earning interest, offering flexibility during a difficult time. |

| Tax Information | Life insurance benefits are typically not taxable, but interest earned may be taxable. Consulting a tax advisor is advised. |

| Importance of Information | Accurate information about the deceased and the beneficiary is crucial for swift claims processing. |

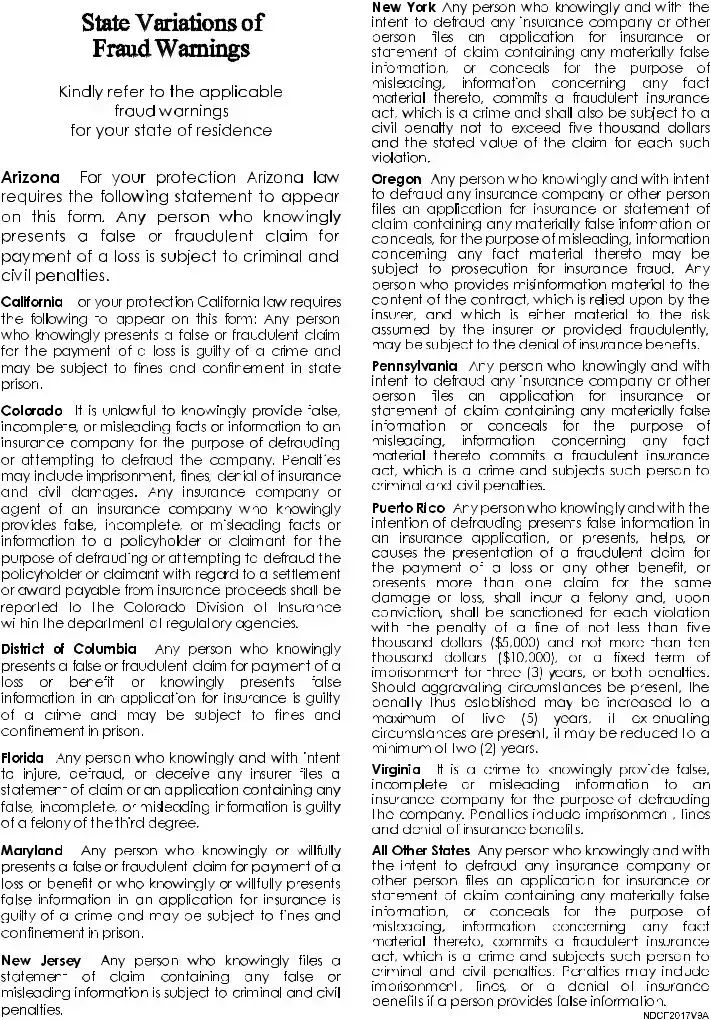

| State-Specific Regulations | Fraud warnings vary by state as per local laws, highlighting the importance of truthfulness in claims. |

| Contact Information | For questions, beneficiaries can reach out to New York Life at 1-800-695-5165 during business hours. |

Guidelines on Utilizing Aarp Claim Life

Please follow these steps carefully to complete the AARP Claim Life form. Each instruction is essential to ensure a smooth and efficient claims process. After submitting the form along with the necessary documents, you can expect a decision and potential payment from New York Life Insurance Company within ten business days.

- Begin by filling out Section 1 with information about the deceased. Include the name, date of death, and insurance contract number.

- In Section 2, enter your details as the beneficiary. This includes your name, address, contact numbers, Social Security or Taxpayer Identification Number, and date of birth. If you are the executor or legal representative, indicate your capacity.

- If the claim amount is $5,000 or higher, choose your payment option in Section 3. You can opt for either the Continued Interest Account or Lump Sum Payment.

- Sign the Claim Form in Section 4. Ensure your signature matches the one on your checks. This signature verifies your future instructions.

- Complete Section 5 if the deceased’s insurance coverage is less than two years old. This section requires medical information and authorization.

- Review the entire form for completeness and accuracy. Make sure no sections are left blank.

- Attach the certified death certificate and any additional documentation required by New York Life Insurance Company.

- Submit the completed Claim Form and supporting documents to the address provided by New York Life Insurance Company.

What You Should Know About This Form

What is the AARP Claim Life form used for?

The AARP Claim Life form is a document for beneficiaries to initiate the claims process following the death of an insured individual. It serves to collect essential information about the deceased and the beneficiary to ensure the accurate and efficient processing of the claim by New York Life Insurance Company. It streamlines the submission of necessary documents, such as the death certificate, and outlines payment options for beneficiaries.

How long will it take to process my claim?

New York Life Insurance Company aims to process claims quickly. Generally, beneficiaries can expect to receive payment within ten business days after the company receives the completed Claim Form and any required documentation, including the death certificate. Efficient submission of all necessary documents will help expedite the process.

What payment options do I have for the claim proceeds?

Beneficiaries entitled to $5,000 or more can choose between two payment options: a Continued Interest Account or a Lump Sum Payment. The Continued Interest Account allows beneficiaries to maintain access to their funds while earning interest, whereas the Lump Sum Payment is a straightforward one-time payment by check.

What is a Continued Interest Account?

A Continued Interest Account is an interest-bearing account designed for beneficiaries who prefer to leave their funds on deposit. This account provides immediate access to the full amount at any time through checks, without incurring penalties. It allows beneficiaries time to consider their options during a challenging period while ensuring their funds remain secure and earn interest.

What information is required to complete the Claim Form?

To complete the Claim Form, beneficiaries must provide information about the deceased, including the insurance contract number, date of death, and cause of death. Beneficiaries must also supply their personal details, such as mailing address, Social Security Number, and relationship to the deceased. If applicable, additional documentation, such as death certificates or guardianship papers, may be needed.

How do I ensure my tax information is correctly submitted?

The Claim Form requires beneficiaries to provide their Social Security or Taxpayer Identification Number for tax purposes. It is important to certify the accuracy of this information, as tax implications may arise from any interest paid on the insurance proceeds. Consulting a tax advisor is advisable for understanding potential tax liabilities associated with the claim.

Can claims be made by an executor or administrator?

Yes, claims can be submitted by an executor or administrator of the deceased's estate. The individual making the claim must sign the Claim Form and include a copy of the appointment papers to demonstrate their authority. This ensures that the claim proceeds are directed appropriately in accordance with estate laws.

What happens if I provide false information on the Claim Form?

Providing false information on the Claim Form may lead to serious consequences. Most states impose criminal and civil penalties for knowingly submitting fraudulent claims. This can result in fines, imprisonment, or denial of insurance benefits. It is crucial to ensure that all information provided is accurate and truthful to avoid such repercussions.

Common mistakes

Filling out the AARP Claim Life form can be a challenging task, especially during such a difficult time. It’s essential to navigate the process correctly to avoid delays in receiving benefits. Here are ten common mistakes people make when completing the form.

First and foremost, many people forget to include the insurance contract number. This number is crucial for identifying the specific policy linked to the deceased. Without it, New York Life Insurance Company may struggle to process the claim efficiently.

Another mistake involves incomplete information about the deceased. While it might seem straightforward, every section must be filled out accurately. Providing all previously known names of the deceased is particularly vital for proper identification.

Beneficiary errors are prevalent as well. Some individuals neglect to include their taxpayer identification number. This number is needed for tax reporting purposes, even if life insurance benefits themselves are typically not taxable. Each beneficiary must ensure that they provide this information to facilitate a smooth claims process.

A number of individuals also mistakenly skip the section that asks for a signature. A missing signature can halt the entire process. It’s advisable to sign the form exactly as one would normally sign a check as the signature will be used to verify future instructions.

Many claimants make the mistake of not choosing a settlement option. If no choice is made, the company will automatically issue a lump sum payment. It is crucial for beneficiaries to understand their options, such as the Continued Interest Account, to make informed decisions based on their financial needs.

Some people fail to read the instructions carefully, which can lead to filling out the form incorrectly. Each section has essential information that is required to process the claim adeptly, and overlooking these details can cause unnecessary delays.

Submitting inappropriate supporting documents is a frequent issue. Claimants must attach the correct death certificate and any other necessary documents, such as police reports in cases of unnatural deaths. Missing or incorrect documents can lead to processing delays.

Confusion surrounding backup withholding can also create hurdles in the claims process. If a beneficiary has been notified by the IRS regarding this issue, it’s crucial to highlight it on the form. This avoids unexpected tax withholding on the interest earned during the claims process.

Finally, many people neglect to follow up after submission. Even if the form has been correctly filled out, checking in with New York Life Insurance Company ensures that it was received and is being processed. This simple action can alleviate any worries and clarify the next steps.

By remaining aware of these common pitfalls, beneficiaries can significantly enhance their chances of a smooth and speedy claims process. Understanding each component and taking the time to double-check can make all the difference during this challenging time.

Documents used along the form

The process of claiming life insurance benefits is often accompanied by several important forms and documents. These papers help establish the necessary details for processing the claim efficiently and accurately. Below is a list of common documents that may be required alongside the AARP Claim Life form.

- Certified Death Certificate: This official document confirms the death of the insured individual. A certified copy is typically required to validate the claim and is usually needed by the insurance company to establish entitlement to the benefits.

- Taxpayer Identification Number Certification: Beneficiaries must provide their social security numbers or other taxpayer identification numbers. This information is necessary for tax reporting purposes, especially if interest is earned on insurance proceeds.

- Executor or Administrator Appointment Papers: If the claim is being made through an estate, the executor or administrator must submit proof of their legal authority. This may include court documents that confirm their appointment to handle the deceased's affairs.

- Assignment Papers (if applicable): If benefits have been assigned to a funeral home or financial institution, relevant assignment documentation must accompany the claim. This ensures proper distribution of funds according to the deceased's wishes.

- Guardianship Papers (for minors): If the beneficiary is a minor, guardianship documentation is crucial. It proves the guardian’s legal authority to act on behalf of the child in receiving the insurance proceeds.

- Medical Information and Authorization Form: This form is required if the insurance policy was issued within a specific timeframe prior to the insured's death. It allows the insurance company to obtain necessary medical information to assess the claim.

These documents are vital in allowing a smooth claim process. Providing accurate and complete information can significantly reduce delays and ensure that beneficiaries receive their due benefits in a timely manner.

Similar forms

-

Life Insurance Claim Form: This document shares similarities with the AARP Claim Life form since it also serves the purpose of reporting a claim on a life insurance policy. Like the AARP form, it typically requires information about the deceased and the beneficiary to ensure the proper distribution of benefits. Both documents aim to expedite the claims process and require appropriate supporting documents, such as a death certificate.

-

Insurance Beneficiary Designation Form: This form designates who will receive benefits from a life insurance policy upon the policyholder’s death. It is similar in structure, requiring personal information and possibly the deceased's details. Like the AARP Claim Life form, it must be completed accurately to facilitate the swift distribution of funds.

-

Last Will and Testament: A will delineates how a person's assets, including life insurance proceeds, should be distributed after death. Both the will and the AARP form call for accurate identification of beneficiaries. They serve as fundamental documents that guide the legal transfer of assets, providing clarity and support for the grieving family.

-

Trust Distribution Form: This document facilitates the distribution of assets held in a trust after the death of a trustee or family member. Similar to the AARP Claim Life form, the trust distribution form ensures that funds are directed to designated beneficiaries, necessitating documentation of the deceased and the trust status.

-

Funeral Payment Agreement: This agreement outlines the payment responsibilities for funeral expenses. It functions similarly to the AARP form in that it may require a beneficiary's acknowledgement and consent, ensuring that the cost of the deceased's arrangements can be covered by life insurance proceeds.

-

Social Security Death Benefit Form: This document allows beneficiaries to apply for death benefits from the Social Security Administration. Its purpose aligns with the AARP Claim Life form as it provides financial assistance after a loss. Both documents involve filing specific evidence of the death and beneficiary information to ensure timely payment.

Dos and Don'ts

When filling out the AARP Claim Life form, there are several important actions to take and avoid. Maintaining accuracy and clarity can help streamline the claims process during a challenging time. Here is a list of nine things to keep in mind:

- Do read the entire form carefully before you begin filling it out to understand what is required.

- Don't leave any sections blank. Every question is important for processing your claim.

- Do provide accurate information about the deceased, including names, dates of birth, and the insurance contract number.

- Don't falsify or omit information. Doing so can lead to delays or denial of your claim.

- Do ensure your signature matches the name listed on the form to alleviate confusion during verification.

- Don't forget to provide a certified death certificate or other necessary documents, as these are critical for processing.

- Do select your payment option clearly to avoid automatic processing as a lump sum if that's not your preference.

- Don't ignore the fraud warnings included on the form; they are provided for your protection.

- Do contact the claims department if you have any questions or uncertainties regarding the form or process.

Following these guidelines will help ensure that your claim is processed smoothly and efficiently, allowing you to focus on what matters most during this difficult time.

Misconceptions

Misconceptions about the AARP Claim Life Form can lead to unnecessary stress during an already difficult time. Here are nine common misunderstandings, along with clarifications to ensure beneficiaries can navigate the process smoothly.

- Claim Forms are always confusing. Many beneficiaries feel overwhelmed by the paperwork. However, the AARP Claim Life Form is designed to be straightforward, with step-by-step instructions to guide you through each section.

- Submitting a claim takes a long time. While processing claims can vary, New York Life Insurance Company typically processes claims quickly. Most payments are often sent within ten business days once all necessary documents are received.

- I must choose a lump sum payment. Beneficiaries with claims of $5,000 or more can opt for a Continued Interest Account instead. This account allows you to access funds easily while earning interest, offering greater flexibility during a trying time.

- The Continued Interest Account is not secure. This account is backed by the financial strength of New York Life. While funds aren’t insured by the FDIC, state guaranty associations offer protection in the unlikely event of an insurer's insolvency.

- I can ignore tax implications. Life insurance benefits aren’t taxable, but the interest accrued from these proceeds may be. Consulting with a tax professional ensures that you are aware of any potential tax liabilities.

- Incorrect information isn’t a big deal. Providing accurate information is crucial. Any discrepancies, particularly with Social Security or taxpayer identification numbers, may delay processing or lead to complications.

- It's okay to submit the claim without a death certificate. A certified death certificate is mandatory to process any claim. Make sure to include it with your documentation to avoid any delays.

- If I'm an executor, I do not have to sign the form. Executors must sign the claim form and include relevant appointment papers to confirm their authority to act on behalf of the estate.

- Once the claim is submitted, I cannot interact with it. You can inquire about your claim status and make changes at any time. Contact New York Life directly for assistance and updates regarding your submission.

By clearing up these misconceptions, beneficiaries can focus on what truly matters: honoring their loved ones while managing their claims effectively.

Key takeaways

When filling out and using the AARP Claim Life form, consider the following key takeaways:

- Understand the Requirements: Each beneficiary must submit a fully completed Claim Form, a certified death certificate, and any other necessary documents for processing the claim.

- Choose Payment Options Wisely: Beneficiaries receiving $5,000 or more can opt for a Continued Interest Account or a lump sum payment by check. The Continued Interest Account allows access to funds while earning interest.

- Double-Check Beneficiary Information: Ensure all information regarding the deceased and the beneficiary is accurate, including the insurance contract number and taxpayer identification information.

- Be Aware of Tax Implications: While life insurance benefits are usually not taxable, interest earned on those payments may be. Consult a tax advisor for clarity.

- Contact for Assistance: If questions arise, beneficiaries can reach New York Life’s claims department at 1-800-695-5165 for support during this challenging time.

Browse Other Templates

Oklahoma Llc - The company provides indemnification for members against various legal proceedings.

Vanguard Ira Distribution Form - Timely submissions are critical, especially if time-sensitive changes are needed.

Sc Controlled Substance Application - It simplifies the tracking of waste tires throughout their lifecycle.