Fill Out Your Aarp Life Insurance Form

Understanding the AARP Life Insurance form is crucial for anyone involved in a life insurance policy, particularly for members of the Collegiate Alumni Trust. This form contains essential information for designating beneficiaries, which is a primary consideration when planning for the future. It outlines the group policyholder's details, including the policy number, insured individual’s name, and certificate number, setting the stage for a clear presentation of your wishes regarding life and accidental death benefits. Urgency is paramount; improper or incomplete designations can lead to unintended consequences, such as life insurance benefits being transferred to the state under unclaimed property laws. To avoid any complications, it’s vital to provide complete identifying information for all beneficiaries—this not only expedites claim payments, but it also ensures that your intended recipients are easily located posthumously. The form allows for multiple primary and contingent beneficiaries, with clear instructions to allocate shares; all percentages must sum to 100%. Thoughtful completion of this document signifies empowerment, ensuring that your loved ones receive the expected benefits without unnecessary delays or confusion. Remember, clear beneficiary designations and accurate information can mean the difference between a smooth claims process and a legal quagmire.

Aarp Life Insurance Example

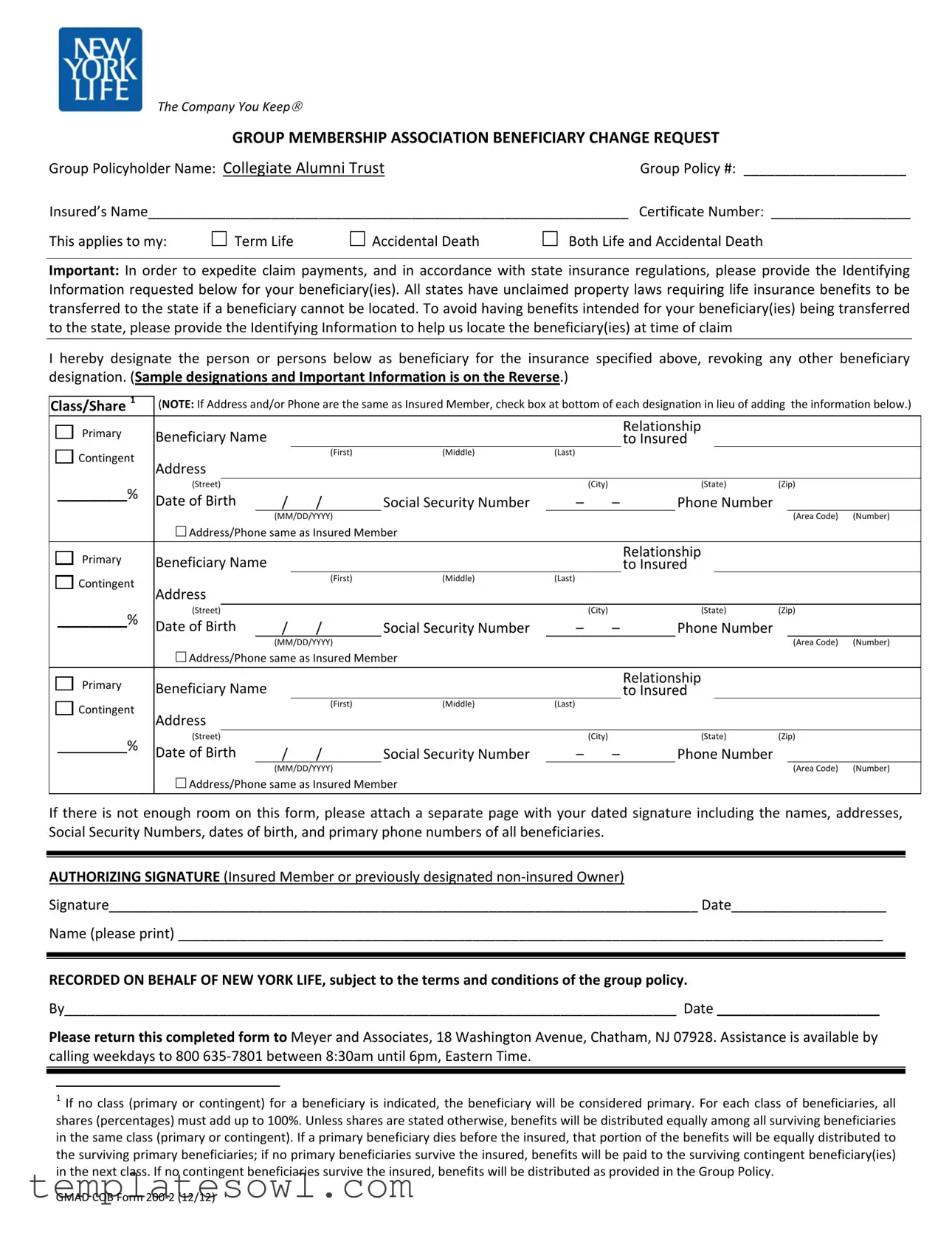

The Company You Keep®

GROUP MEMBERSHIP ASSOCIATION BENEFICIARY CHANGE REQUEST

Group Policyholder Name: Collegiate Alumni TrustGroup Policy #: _____________________

Insured’s Name______________________________________________________________ Certificate Number: __________________

This applieS to my: |

□ Term Life |

□ Accidental Death |

□ Both Life and Accidental Death |

Important: In order to expedite claim payments, and in accordance with state insurance regulations, please provide the Identifying Information requested below for your beneficiary(ies). All states have unclaimed property laws requiring life insurance benefits to be transferred to the state if a beneficiary cannot be located. To avoid having benefits intended for your beneficiary(ies) being transferred to the state, please provide the Identifying Information to help us locate the beneficiary(ies) at time of claim

I hereby designate the person or persons below as beneficiary for the insurance specified above, revoking any other beneficiary designation. (Sample designations and Important Information is on the Reverse.)

Class/Share 1 |

(NOTE: If Address and/or Phone are the same as Insured Member, check box at bottom of each designation in lieu of adding the information below.) |

|||||||||||||

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

||||

|

|

|

|

|

to Insured |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

||||

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

||||

|

|

|

|

|

||||||||||

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|||||

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

||||

|

|

|

|

|

to Insured |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

||||

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

||||

|

|

|

|

|

||||||||||

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|||||

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

||||

|

|

|

|

|

to Insured |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

||||

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

||||

|

|

|

|

|

||||||||||

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|||||

If there is not enough room on this form, please attach a separate page with your dated signature including the names, addresses, Social Security Numbers, dates of birth, and primary phone numbers of all beneficiaries.

AUTHORIZING SIGNATURE (Insured Member or previously designated non‐insured Owner)

Signature____________________________________________________________________________ Date____________________

Name (please print) ___________________________________________________________________________________________

RECORDED ON BEHALF OF NEW YORK LIFE, subject to the terms and conditions of the group policy.

By_______________________________________________________________________________ Date _____________________

Please return this completed form to Meyer and Associates, 18 Washington Avenue, Chatham, NJ 07928. Assistance is available by calling weekdays to 800 635‐7801 between 8:30am until 6pm, Eastern Time.

1If no class (primary or contingent) for a beneficiary is indicated, the beneficiary will be considered primary. For each class of beneficiaries, all shares (percentages) must add up to 100%. Unless shares are stated otherwise, benefits will be distributed equally among all surviving beneficiaries in the same class (primary or contingent). If a primary beneficiary dies before the insured, that portion of the benefits will be equally distributed to the surviving primary beneficiaries; if no primary beneficiaries survive the insured, benefits will be paid to the surviving contingent beneficiary(ies) in the next class. If no contingent beneficiaries survive the insured, benefits will be distributed as provided in the Group Policy.

GMAD COB Form 200‐2 (12/12)

SAMPLES OF BENEFICIARY DESIGNATIONS: Below are examples of some common beneficiary designations that may be helpful as you complete this form.

1. Specific unequal shares (NOTE: Insert “Per Stirpes” after % to have any Benefits due any deceased beneficiary payable to his/her descendents)

|

Class/Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|||||

|

|

|

John |

J. |

|

Smith |

to Insured |

Brother |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

Address |

|

|

|

|

(First) |

(Middle) |

|

(Last) |

|

99999‐1111 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

15 Bay Ridge Boulevard |

Smithville |

AK |

|

|

|||||||||||

__60%___ |

|

|

(Street) |

|

|

|

|

|

(City) |

|

(State) |

(Zip) |

|||||||

|

Per stirpes |

Date of Birth |

|

11 / 15 / 1974 |

|

Social Security Number |

123 – 45 – 6789 |

Phone Number |

(111) 234‐5678 |

||||||||||

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|||

|

|

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|||||

|

|

|

Antoinette |

Dubois |

|

Jones |

to Insured |

Sister |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

|

|

|

|

|

(First) |

(Middle) |

|

(Last) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Address |

2201‐1870 Southwest Third Avenue |

|

|

Ocean City |

KS |

11111‐2222 |

||||||||||

|

|

|

|

|

|

||||||||||||||

__40%___ |

|

|

(Street) |

|

|

|

|

|

(City) |

|

(State) |

(Zip) |

|||||||

|

Per stirpes |

Date of Birth |

|

5 / |

7 / 1979 |

|

Social Security Number |

987 – 65 – 4321 |

Phone Number |

|

(999) 876‐5432 |

||||||||

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|||

|

|

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|

||||||

2. Trust as Beneficiary:

“John Smith and Mary Jones as Trustees of the Jones Family Trust under the Trust document dated December 1, 2012.” [Please provide Identifying Information for all Trustees.]

3.Minor Beneficiary ‐ Uniform Transfers/Gifts to Minors Act (UTMA/UGMA) Designation:

“[Name of Adult] as Custodian for [Name of Minor] under [Insured Member’s or Minor’s State of Residence] Uniform Transfers/Gifts to Minors Act.” [Please provide Identifying Information for the minor and adult Custodian.]

NOTICE REGARDING DESIGNATING A MINOR BENEFICIARY

Unless a UTMA/UGMA designation is used, or there is an existing court appointed guardian of the minor’s estate who can make financial decisions for the minor, a claims payment to a minor may be delayed until a surviving parent, relative, or other interested party obtains a court appointment as financial guardian of the minor’s estate, for the purpose of receiving the proceeds on behalf of the child.

NOTICE REGARDING TESTAMENTARY TRUST UNDER LAST WILL AND TESTAMENT AS BENEFICIARY

The following is understood and agreed when naming a Testamentary Trust under the Last Will and Testament as beneficiary of a specified decedent (Insured Member or non‐insured owner).

Proceeds shall be paid to the named contingent beneficiary if the decedent dies intestate (without a Last Will and Testament), or with a Last Will and Testament but (1) it does not create a Trust and name a Trustee or (2) no court proceeding has been started to probate the Last Will and Testament or no Trustee qualifies and claims the proceeds within 12 months (18 in Mississippi, New York, Texas; 6 months in Florida and North Carolina) after the decedent’s death. If the named contingent beneficiary is not living, and no further beneficiary is named, payment shall be made in accordance with the Group Policy.

New York Life is not obligated to inquire about the terms of any Trust affecting this policy or its proceeds, and shall not be held responsible for knowing the terms of any such Trust.

Payment to and receipt by said Trustee(s) or any successor Trustee(s), or payment to and receipt by the contingent beneficiary or insured’s estate shall constitute a full discharge and releases the New York Life Insurance Company to the extent of such payment. The full discharge and release of the New York Life Insurance Company’s obligation for payment applies to all persons and fiduciaries having any interest in such proceeds.

NOTICE REGARDING NON‐INSURED OWNER

A non‐insured owner who wishes to name a person other than themselves as beneficiary should do so only after receiving advice from their Counsel as to the possible tax consequences in light of existing decisional law to the effect that, when the proceeds are paid to someone other than the non‐insured owner, the proceeds constitute a taxable gift from the owner to the beneficiary at the time of the insured’s death.

*Per Stirpes means that any interest in a life insurance policy that a deceased beneficiary would have, if living, will be shared equally by all living children of that deceased beneficiary.

GMAD COB Form 200‐2 (12/12)

Form Characteristics

| Fact Name | Description |

|---|---|

| Group Membership Association | The AARP Life Insurance form is associated with the Group Membership Association, promoting benefits for its members. |

| Policyholder Name | The form is designated for the Collegiate Alumni Trust as the Group Policyholder. |

| Types of Coverage | Members can select from Term Life, Accidental Death, or both types of life insurance coverage for beneficiaries. |

| Beneficiary Information | To ensure timely claims processing, beneficiaries’ identifying information is required, adhering to state insurance rules. |

| Claim Considerations | If a beneficiary cannot be located, life insurance benefits may be transferred to the state, as required by unclaimed property laws. |

| Designating Beneficiaries | The form allows the insured to revoke previous beneficiary designations and specify new beneficiaries along with their shares. |

| Distribution of Benefits | In cases where the primary beneficiary passes before the insured, benefits will rely on the structure of surviving primary and contingent beneficiaries. |

| Special Designations | Designations can include trusts, minors, or specific relationships, requiring additional identifying information where necessary. |

| Returning the Form | The completed form must be sent to Meyer and Associates in Chatham, NJ, with a dedicated assistance line for inquiries. |

Guidelines on Utilizing Aarp Life Insurance

Completing the AARP Life Insurance form is an important step in managing your insurance policy and ensuring that your beneficiaries are properly designated. By following the steps outlined below, you can fill out the form accurately, which helps to expedite any future claims your beneficiaries may need to make. Here's how to get started.

- Start with the Group Policyholder Name. Write “Collegiate Alumni Trust” in the designated space.

- Fill in the Group Policy # using the number provided to you.

- Enter the Insured’s Name in the space provided. Make sure to include the first, middle, and last name.

- Input the Certificate Number exactly as shown on your insurance documents.

- Indicate whether your request applies to Term Life, Accidental Death, or Both Life and Accidental Death by checking the appropriate box.

- List your first beneficiary under Primary Beneficiary Name. Include their relationship to the insured, address, date of birth, and social security number.

- Optionally, specify the % share for the first beneficiary. If the address and phone number are the same as the insured member, check the box.

- Repeat step 6 for any additional primary beneficiaries, ensuring that all shares add up to 100%.

- If needed, list contingent beneficiaries similar to the primary beneficiaries by entering their names, relationship, and relevant identifying information.

- Complete the AUTHORIZING SIGNATURE section using your signature. Include the date of signature and print your name below.

- Carefully review all information for accuracy. An error could delay the processing of the form.

- Return the completed form to the address provided: Meyer and Associates, 18 Washington Avenue, Chatham, NJ 07928.

- If you have any questions, don't hesitate to call the assistance line at 800-635-7801 during business hours.

What You Should Know About This Form

What is the purpose of the AARP Life Insurance Beneficiary Change Request form?

The AARP Life Insurance Beneficiary Change Request form is designed to facilitate the designation of beneficiaries for your life and accidental death insurance policies. By completing this form, policyholders can specify who will receive the insurance benefits upon their death, ensuring that their intentions are clearly outlined. It also helps expedite claims payments and ensures compliance with state regulations regarding unclaimed property.

Who can be designated as a beneficiary on this form?

Beneficiaries can include individuals, trusts, or even estates. Common examples are family members, such as spouses, children, or siblings. It’s important to provide necessary identifying information, including their names, relationships to the insured, and contact details, to prevent issues in locating them when a claim arises.

What information is required for each beneficiary?

For each beneficiary, the form requires their name, relationship to the insured, address, date of birth, social security number, and phone number. This information assists the insurance company in accurately identifying the beneficiary at the time of the claim, thereby helping to prevent benefits from being transferred to the state in case of unclaimed benefits.

What happens if I do not complete the beneficiary designations correctly?

If the designations are incomplete or inaccurate, there may be delays in processing the claims or difficulties in determining who should receive the benefits. Additionally, if no class (primary or contingent) is indicated for a beneficiary, that beneficiary will automatically be considered primary, which may not align with your intentions.

Can I specify different shares or percentages for multiple beneficiaries?

Yes, you can specify different shares for beneficiaries. However, the total percentages must add up to 100%. If this requirement is not met, it may cause complications in the distribution of benefits. If you're unsure how to allocate shares, consider consulting with a financial advisor for advice.

What should I do if I want to change my beneficiaries in the future?

To change your beneficiaries, you will need to complete a new AARP Life Insurance Beneficiary Change Request form, revoking any previous designations. Ensure that all new designations are clear and complete to avoid confusion. Keep records of all forms submitted for future reference.

Is there any specific consideration when naming a minor as a beneficiary?

If you wish to name a minor as a beneficiary, it's strongly recommended to use a Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA) designation. Without this, there may be delays in the claims process until a guardian is appointed. This can create additional complications and hinder the timely distribution of benefits intended for the minor.

How should I submit this completed form?

Once you have completed the AARP Life Insurance Beneficiary Change Request form, you should return it to Meyer and Associates at the specified address. For assistance or clarification while filling out the form, you can contact the provided phone number during business hours. This will help ensure that your form is submitted correctly and processed without delays.

Common mistakes

Filling out the AARP Life Insurance form can seem straightforward, but many errors can lead to complications down the road. One common mistake involves neglecting to provide complete information for beneficiaries. Beneficiaries require specific identifying details, like full names, addresses, and Social Security numbers. Omitting even one piece of information can delay claim payments or even result in benefits being transferred to the state.

Another frequent error is inaccurately filling out the percentage shares for primary and contingent beneficiaries. All shares must add up to 100%. If they don’t, the insurance company may distribute the benefits in a way that does not align with the insured’s wishes. Double-check the math before submitting the form.

Some individuals forget to indicate their relationship to each beneficiary. This is a critical detail that should not be overlooked. Without this information, the insurance company may face challenges when processing claims. It is essential to ensure the relationship is clear.

Also, it is important to be diligent about including up-to-date contact information. Many users fail to provide accurate phone numbers or other contact details. This oversight can complicate communication with the insurance company when it comes time to process a claim.

Some filers misunderstand the use of contingent beneficiaries. Many believe that identifying only primary beneficiaries is sufficient. However, a contingent beneficiary serves as a backup. If the primary beneficiary cannot receive the benefit, it will proceed to the contingent. Not specifying this can lead to confusion later on.

People also sometimes neglect to sign and date the form. This is a simple but crucial step. A signature indicates agreement and intent, and without it, the form will likely be deemed incomplete, delaying any claims that may need to be processed.

In addition, failing to use clear and legible handwriting can create issues. Insurance companies require clarity to avoid misinterpretation of the information provided. If the text is difficult to read, it is likely to be mishandled, leading to potential problems when the need for claiming arises.

Some individuals make the mistake of thinking that the form can be processed regardless of the order of the beneficiaries listed. It's vital to remember that the order does matter. If a beneficiary listed as primary dies before the insured, the insurance provider will need to reference the next primary beneficiary to facilitate the claim.

Lastly, many people overlook the importance of including alternate addresses or phone numbers in cases where the primary information may change. Life circumstances can shift unexpectedly, and having an additional contact method can streamline communication when claims need to be processed.

Documents used along the form

The AARP Life Insurance form is often accompanied by several other important documents that facilitate the insurance process or manage the benefits after a claim. Understanding these documents can enhance clarity and efficiency when addressing life insurance needs.

- Beneficiary Designation Form: This document allows policyholders to specify who will receive benefits upon their death. It includes crucial details such as names, relationships, and contact information for the beneficiaries.

- Claim Form: To initiate a claim, this form is required. It typically includes sections for the insured's information, the policy number, and details regarding the claim being filed.

- Policyholder Information Form: This form collects essential data about the policyholder, including contact details and relationship to the insured. It ensures the insurance company has accurate records.

- Health Questionnaire: Necessary for underwriting, this document requests medical history and relevant health information to assess the risk associated with the insurance application.

- Authorization for Release of Information: This form gives the insurance company permission to access medical records or other personal information needed to process claims or applications.

- Change of Beneficiary Form: If the policyholder wishes to update their beneficiaries, this document provides the structure for making new designations or removing individuals from the beneficiary list.

- Notice of Policy Cancellation: Should a policy be canceled, this notice communicates the cancellation and any rights or obligations of the policyholder and beneficiaries.

- Annual Policy Statement: This document summarizes the policy's current status, including coverages, premiums paid, and potential benefits. It serves as an overview for the policyholder to review their insurance standing.

These additional documents work in tandem with the AARP Life Insurance form, creating a comprehensive approach to managing life insurance and ensuring beneficiaries are cared for as intended. Each document plays a specific role, streamlining the process and safeguarding the interests of the insured and their loved ones.

Similar forms

Life Insurance Policy: Like the AARP Life Insurance form, a standard life insurance policy includes essential information about the insured, beneficiaries, and the terms of the coverage. Both documents require the policyholder to designate beneficiaries to ensure the intended parties receive benefits upon the insured's death.

Beneficiary Designation Form: This document is similar to the AARP form in that it allows policyholders to specify who will receive benefits. Both forms necessitate details such as names, relationships, and contact information of the beneficiaries for proper identification during claims.

Accidental Death Insurance Form: An accidental death insurance form outlines similar information to the AARP Life Insurance form, focusing specifically on benefits if death occurs due to an accident. Both types of coverage often require beneficiary details and a signature for validation.

Trustee Designation Document: This document can name a trust as the beneficiary, much like the AARP form. Both require identifying information for trustees, ensuring proper management of the benefits for the beneficiaries named in the trust.

Power of Attorney Documents: While primarily focused on granting someone authority to act on another's behalf, power of attorney documents can often include beneficiary designations in financial matters, similar to the AARP form which designates beneficiaries for insurance benefits.

Will or Testamentary Trust: A will designates how assets, including insurance benefits, should be distributed upon death, similar to the beneficiary designations in the AARP Life Insurance form. Both documents address what happens to benefits after the insured's passing.

Uniform Transfers to Minors Act (UTMA) Document: This document manages assets for minors, paralleling how the AARP form allows for the designation of minor beneficiaries. Both forms emphasize the importance of a custodian managing benefits until the minor reaches adulthood.

Claims Submission Form: Claims forms require details about the insured and beneficiaries, similar to the AARP Life Insurance form. Both ensure that the insurance provider has enough information to process claims efficiently.

Dos and Don'ts

When filling out the AARP Life Insurance form, it's important to be thorough and accurate. Here are some guidelines to help you complete the form effectively.

- Do read the instructions carefully before starting. Ensure you understand what information is required.

- Do provide complete identifying information for all beneficiaries. This includes their full name, address, date of birth, and social security number.

- Do check the box for address and phone number if they are the same as the insured member. This can save time.

- Do ensure that the percentage shares for beneficiaries add up to 100%. Review your calculations for accuracy.

- Don't leave any required fields blank. Incomplete information can delay processing.

- Don't use vague terms when designating beneficiaries. Specify relationships clearly to avoid confusion.

- Don't forget to sign and date the form. An unsigned form will not be processed.

- Don't use abbreviations that might be unclear. Provide all details fully to ensure understanding.

By following these guidelines, you can help ensure that your application is processed smoothly and that your beneficiaries are correctly designated.

Misconceptions

Misconception 1: The AARP Life Insurance form is only for term life insurance.

This form can apply to more than just term life insurance. It covers both term life and accidental death insurance. Be sure to indicate which type of coverage you are requesting when filling out the form.

Misconception 2: Beneficiary information is not necessary for claims processing.

Providing identifying information for beneficiaries is crucial. Incomplete beneficiary details could lead to delays or the transfer of benefits to the state if beneficiaries cannot be located.

Misconception 3: If a primary beneficiary dies, the benefits go unclaimed.

If a primary beneficiary passes away before the insured, the benefits do not automatically go unclaimed. Instead, they will be distributed equally among surviving primary beneficiaries. If none remain, the benefits will go to contingent beneficiaries.

Misconception 4: You can name a minor as a beneficiary without any restrictions.

Naming a minor as a beneficiary without using a Uniform Transfers/Gifts to Minors Act (UTMA/UGMA) designation may cause payment delays. A court appointment may be necessary for any claims made on behalf of the minor until an adult custodian is established.

Key takeaways

The AARP Life Insurance form is an important document that ensures your beneficiaries receive their due benefits smoothly. Here are key takeaways to consider when filling it out and using it:

- Identify the Policy: Always start by clearly entering your Group Policyholder Name and Group Policy Number at the top of the form.

- Specify Coverage: Indicate whether the application applies to Term Life, Accidental Death, or both.

- Provide Beneficiary Information: Complete the identifying information for each beneficiary. This helps prevent unclaimed benefits from being transferred to the state.

- Use Correct percentages: For each beneficiary listed, ensure that their shares add up to 100%. If no shares are specified, benefits are divided equally among primary beneficiaries.

- Include Identification Details: Each beneficiary needs to provide their date of birth, social security number, and phone number for expedience during the claims process.

- Utilize Additional Pages if Necessary: If there isn’t enough room on the form, attach a separate page with complete information on your beneficiaries.

- Sign and Date: Make sure to sign and date the form before submitting it. This is crucial for validating the changes you are making.

- Seek Assistance: If any confusion arises while filling out the form, do not hesitate to call Meyer and Associates for clarification.

Completing the AARP Life Insurance form accurately is essential. Follow these takeaways to ensure that your beneficiaries receive their benefits without complications.

Browse Other Templates

Punchline Bridge to Algebra 2001 Marcy Mathworks Answer Key - This form encourages a growth mindset, as students learn from mistakes and correct their approach.

Brewster Ice Cream - Practice your change-making skills with our examples.