Fill Out Your Aarp Medicare Supplement Form

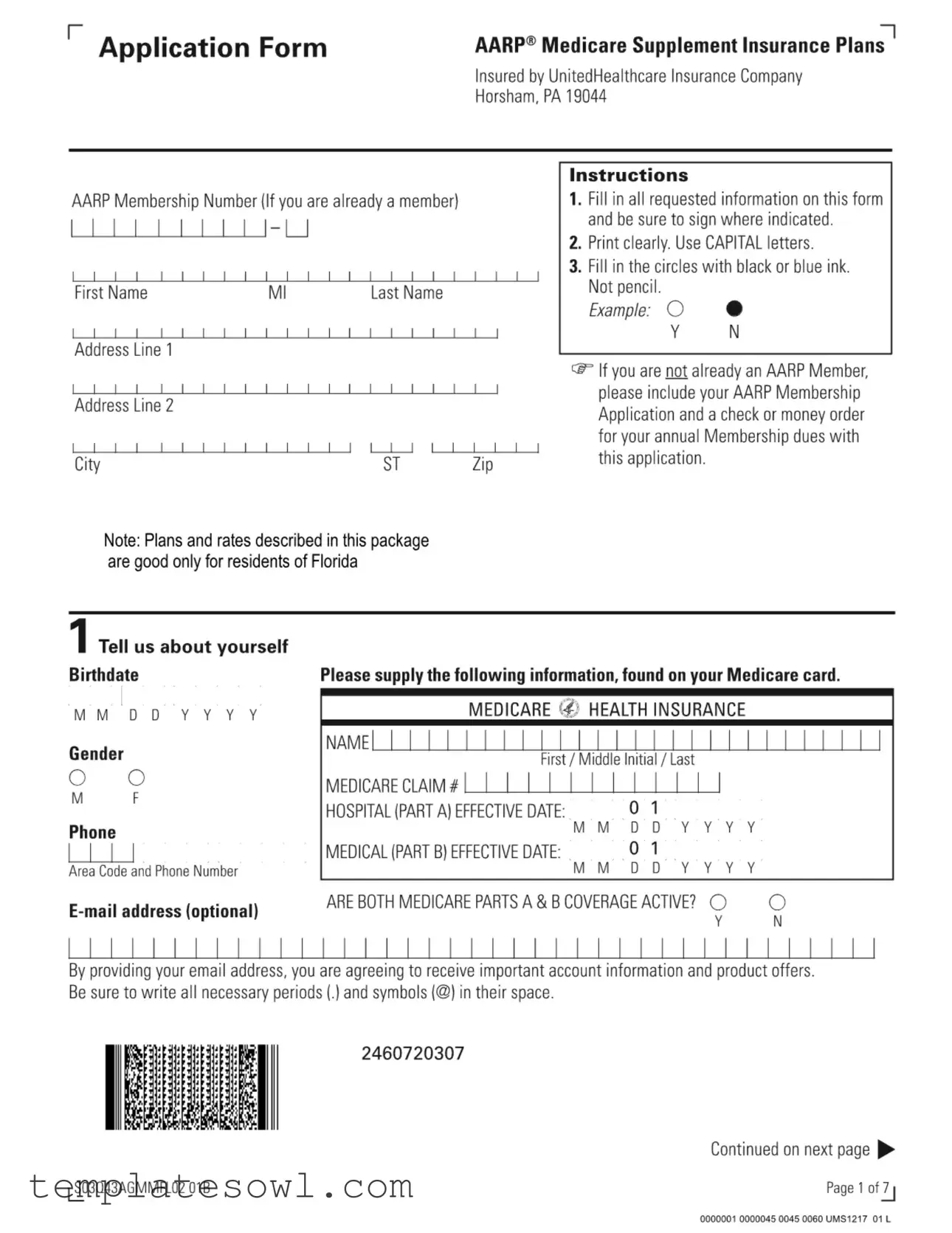

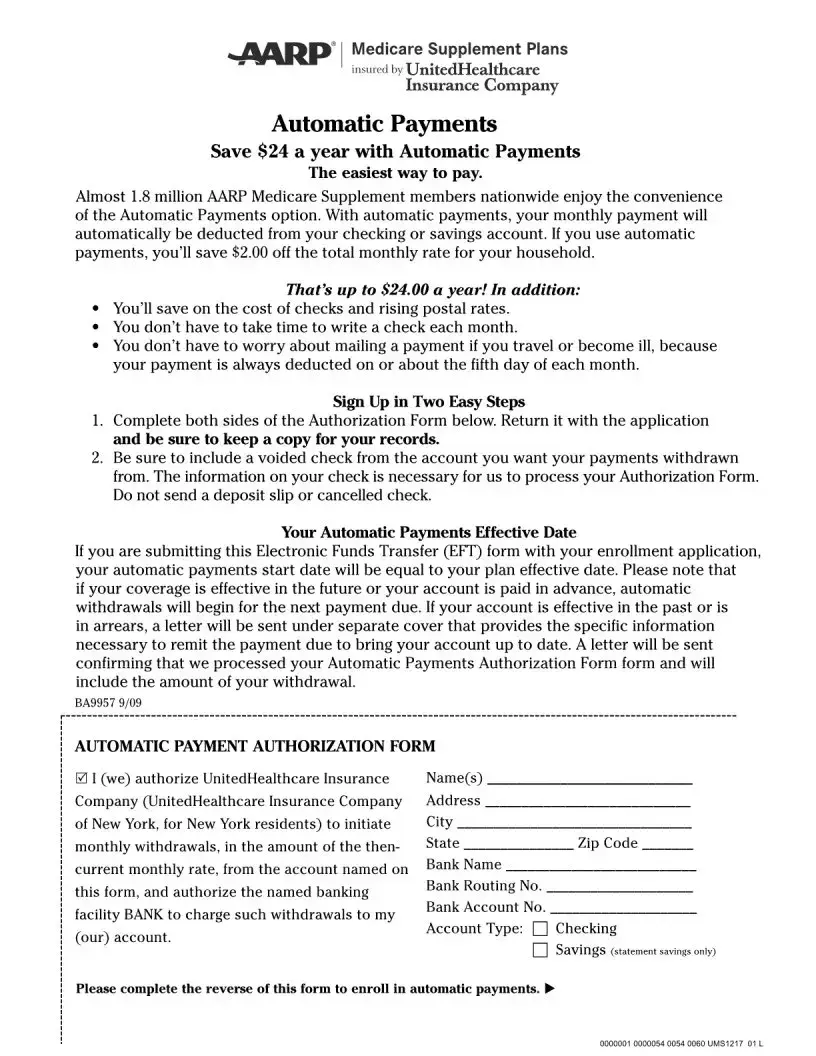

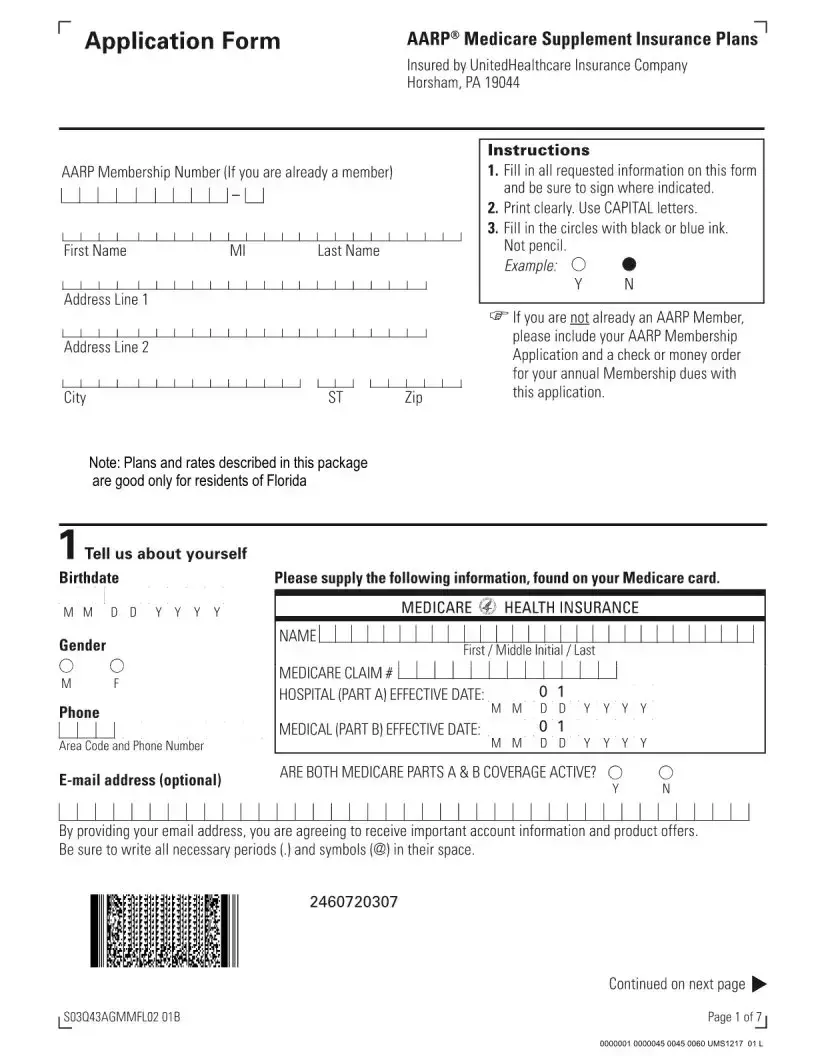

The AARP Medicare Supplement form is an essential tool for individuals seeking additional coverage alongside their Medicare benefits. This comprehensive application outlines the necessary steps to enroll in AARP’s Medicare Supplement Insurance Plans, which are insured by UnitedHealthcare Insurance Company. To get started, applicants must fill in their personal details, including their AARP membership number, contact information, and Medicare card information. Clear instructions guide users on how to complete the form accurately, emphasizing the importance of using capital letters and submitting the application with the appropriate membership dues if not already a member. Additionally, the form assesses eligibility through a series of straightforward questions about age, Medicare coverage, and tobacco usage. Applicants will need to indicate their chosen plan and desired effective date while also providing information about any previous health coverage and current medical status. Understanding the requirements and questions involved in this process ensures that individuals can navigate their healthcare options more effectively.

Aarp Medicare Supplement Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Requirements | To apply for AARP Medicare Supplement, applicants must be AARP members, at least 50 years old, and enrolled in Medicare Parts A and B. |

| Guaranteed Acceptance | Applicants who have turned 65 in the last six months, or have enrolled in Medicare Part B within the last six months, obtain guaranteed acceptance. |

| Health Questions | Applicants must answer health questions, specifically about recent medical advice or treatment, to determine eligibility for coverage. |

| Effective Date | The coverage becomes effective on the first day of the month after the application and premium are approved unless a future date is requested. |

| State-Specific Information | This plan and rates are valid only for residents of Florida, governed by Florida Statutes Title XXXVII, Chapter 627. |

Guidelines on Utilizing Aarp Medicare Supplement

After completing the AARP Medicare Supplement form, you'll need to review your answers to ensure they are accurate and complete. Once finalized, submit your application to initiate the enrollment process for the Medicare Supplement plan you desire. Be prepared to provide any additional documents if required.

- Gather required information: You will need your AARP Membership Number, personal details including your name, address, and contact information, as well as your Medicare information.

- Print clearly: Use CAPITAL letters throughout the form and avoid using pencil. Make sure to fill in the circles with black or blue ink.

- Fill in personal information: Enter your first name, middle initial, last name, birthdate, gender, and phone number. Include your Medicare information such as your Medicare claim number and effective dates for Parts A and B.

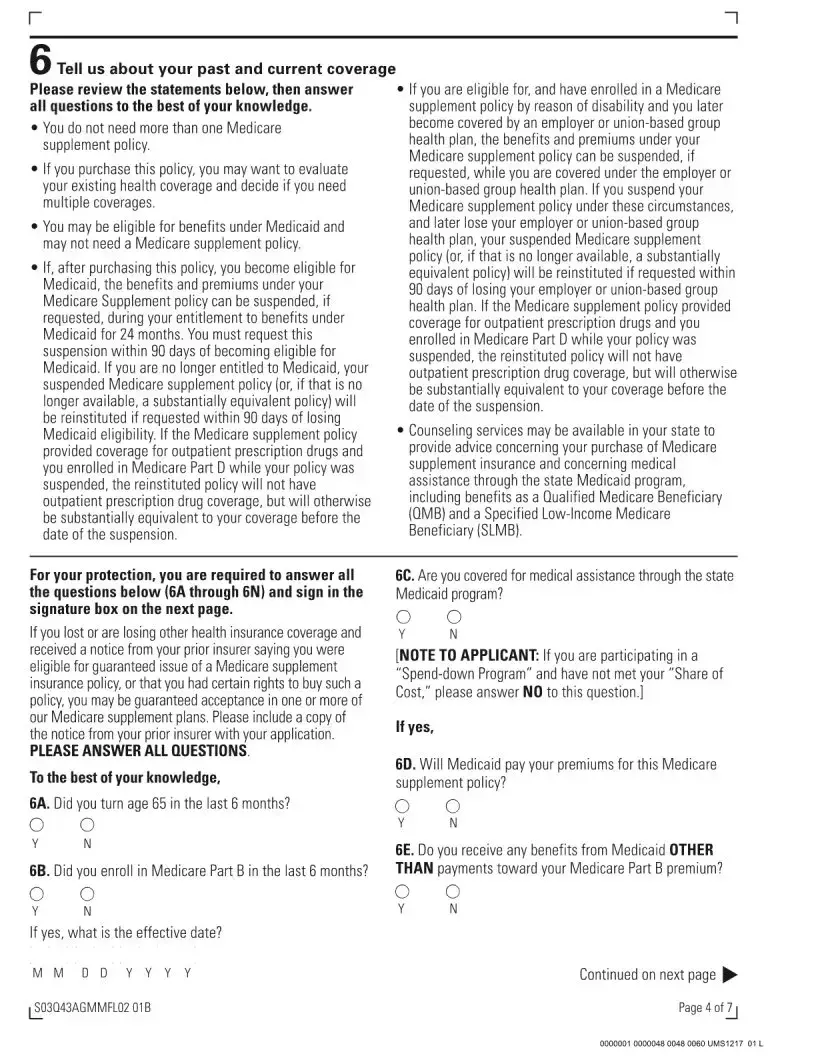

- Indicate tobacco use: If you have used tobacco in the past year, darken the corresponding circle.

- Select your plan: Choose your desired Medicare Supplement plan from the options provided and specify an effective date for your coverage.

- Answer health questions: Respond to the health-related questions to determine eligibility for guaranteed acceptance. Your answers here are crucial, so be attentive.

- Current and past coverage: Provide details on any previous health insurance coverage, and whether you plan to replace it.

- Review and sign: Before submitting, double-check all your entries for completeness. Lastly, sign where indicated on the form.

What You Should Know About This Form

1. What is the AARP Medicare Supplement Insurance Plan?

The AARP Medicare Supplement Insurance Plans help cover costs that Medicare may not pay for, such as deductibles, copayments, and coinsurance. These plans are underwritten by UnitedHealthcare Insurance Company and are designed to provide additional financial support for those enrolled in Medicare Parts A and B. They come with various plan options, allowing members to select coverage that best fits their healthcare needs.

2. How do I apply for an AARP Medicare Supplement Insurance Plan?

To apply, you need to fill out the AARP Medicare Supplement application form. Make sure to provide all requested information, including your personal details and Medicare information. Once completed, sign and submit the form along with your first month's premium and, if applicable, your AARP membership dues. Remember to print clearly and use black or blue ink only.

3. What are the eligibility requirements for enrollment?

To enroll in an AARP Medicare Supplement Insurance Plan, you must be an AARP member, aged 50 or older, and currently enrolled in both Medicare Parts A and B. Additionally, your acceptance is guaranteed if you have turned 65 or enrolled in Medicare Part B within the last six months, or if you have lost other health insurance coverage.

4. When will my coverage become effective?

Your coverage will typically start on the first day of the month following the approval of your application and the receipt of your premium. If you wish to delay the start of your coverage, you can indicate a specific date on the application form for a later effective date.

5. What if I have a pre-existing condition?

If you have a pre-existing condition, your eligibility may depend on your answers to health questions on the application form. It is essential to answer these questions accurately. If you do not meet the guaranteed acceptance criteria and have certain health issues, you may not be eligible for the plan at that time. However, you can apply again if your health improves.

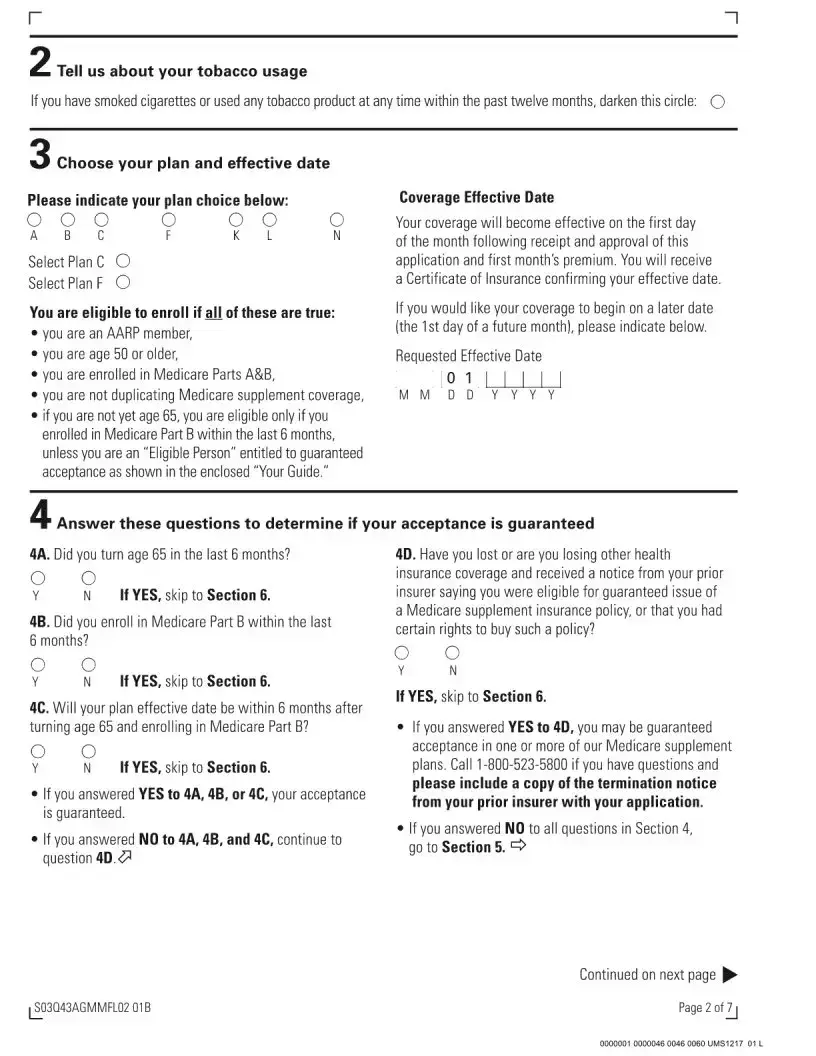

6. Can I keep my Medicare supplement policy if I become eligible for Medicaid?

Yes, if you become eligible for Medicaid after purchasing an AARP Medicare Supplement policy, you can request to suspend your policy. This suspension can occur for up to 24 months. After that period or if you lose Medicaid eligibility, you can reinstate the policy by making a request within 90 days.

7. Is there a waiting period for benefits?

For individuals who are guaranteed acceptance, there’s usually no waiting period for benefits. If you do not qualify for guaranteed acceptance and have health issues, a waiting period may apply. It's advisable to check specific plan details as they can vary.

8. What happens if I want to change my plan later?

You have the option to change your plan within certain time frames, such as during the Medicare Open Enrollment Period. However, switching plans can depend on your current health status and enrollment guidelines, so a new application may be necessary. Keep in mind that not all plans guarantee acceptance based on health status.

9. Are there any restrictions on tobacco use?

The application includes questions regarding tobacco usage. If you have used any tobacco product within the last twelve months, it could influence your eligibility or premiums. It's essential to fill out this section accurately to avoid potential issues.

10. Where can I find more information about these plans?

For more information about AARP Medicare Supplement Insurance Plans, you can visit the AARP website or contact their customer service. Additionally, reviewing the "Your Guide" document provided with your application can offer more detailed insights into each plan and the benefits they include.

Common mistakes

Filling out the AARP Medicare Supplement form can be a straightforward process, but several common mistakes can lead to problems. One frequent error is incomplete information. Applicants sometimes skip required fields or fail to provide all necessary details. Each section of the form must be completed accurately to avoid delays in processing. If any part is left blank, the application may be returned, causing frustration and potential loss of coverage.

Another mistake often seen is the use of inappropriate writing tools. The form specifies using black or blue ink only, and applicants who use pencil may find their applications rejected. Additionally, writing in a manner that is unclear can hinder the review process. Printing clearly in capital letters is emphasized for a reason—illegibility can cause critical information to be misinterpreted, leading to errors in enrollment.

Timing is crucial when completing the application. A common oversight involves inaccurate effective dates. Applicants are required to indicate the effective date for their coverage, and failure to provide this information or marking it incorrectly might result in delayed coverage start dates or, in some cases, rejection of the application. It’s also essential to ensure that all related application materials, like membership dues for AARP, are included if not already a member.

Lastly, misunderstanding the eligibility criteria can lead to complications. Applicants sometimes misinterpret the questions related to Medicare Part B enrollment and recent health insurance coverage. If an applicant answers these questions inaccurately, it could affect their eligibility for guaranteed acceptance. Taking ample time to understand the requirements before submitting the application is vital for a smooth process.

Documents used along the form

When applying for AARP Medicare Supplement Insurance, several supporting documents and forms may be required to ensure a smooth application process. Each of these documents plays a critical role in verifying eligibility, coverage details, and other related information.

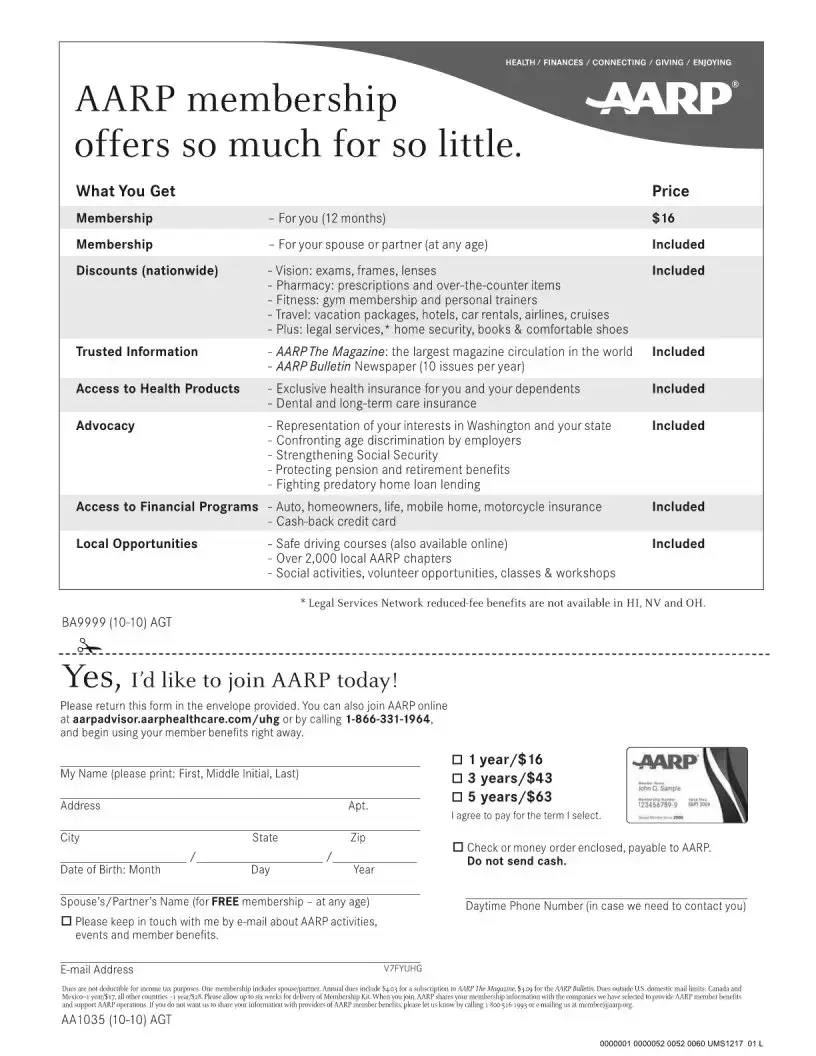

- AARP Membership Application: Required if the applicant is not currently a member of AARP. This form allows individuals to join AARP and provides their membership number, essential for the Medicare Supplement application.

- Medicare Card: A copy or details from the Medicare card helps establish eligibility for Medicare Parts A and B. It includes crucial information such as the Medicare claim number and effective dates of coverage.

- Certificate of Insurance: Once the application is approved, this document confirms the effective date of the Medicare Supplement policy. It serves as proof of the coverage.

- Prior Insurance Documents: These include termination letters or notices from previous insurers. They provide proof of prior coverage and may help in qualifying for guaranteed acceptance in a new Medicare Supplement plan.

- Health History Questionnaire: Applicants may need to answer health questions to determine eligibility for coverage. This form assesses any pre-existing conditions or recent medical treatments.

- Medicaid Eligibility Documents: If applicable, documents verifying eligibility for Medicaid can impact the Medicare Supplement application. They inform about potential premium payment coverage under Medicaid.

- Payment Information: A method of payment, such as a check or credit card information, may also be required to cover the first month’s premium for the supplement policy.

- Authorization Forms: If an applicant is working with a representative or agent, signed authorization may be required to allow the agent to act on behalf of the applicant during the application process.

Gathering these documents in advance can streamline the application process and help ensure a seamless transition to Medicare Supplement coverage. Being well-prepared enhances the likelihood of obtaining the desired benefits without delay.

Similar forms

Here are six documents that the AARP Medicare Supplement form is similar to, along with how they connect:

- Medicare Enrollment Application: Like the AARP Medicare Supplement form, this application gathers personal details, Medicare information, and requires a signature to process an enrollment for Medicare benefits.

- Medicaid Application: This document also requests personal information and health coverage details. Both forms assess eligibility based on prior insurance coverage and potential financial assistance.

- Health Insurance Marketplace Application: Similar to the AARP form, this application helps determine eligibility for specific health plans, requiring detailed personal data and information about existing coverage.

- Long-Term Care Insurance Application: Like the Medicare Supplement form, it includes health questions that aim to assess suitability for coverage and requires personal and contact information for the applicant.

- Life Insurance Application: This document also requires comprehensive personal information, health status inquiries, and assessments related to prior and current insurance coverage, much like the AARP form.

- Critical Illness Insurance Application: Similar in nature, this application requests health history and personal data to determine eligibility and involves the need for the applicant's consent, just like the AARP Medicare Supplement form.

Dos and Don'ts

Filling out the AARP Medicare Supplement form requires careful attention to detail. Here are eight essential dos and don’ts to ensure your application is processed smoothly:

- Do fill in all requested information completely.

- Do print clearly using CAPITAL letters for legibility.

- Do use black or blue ink to fill in the circles.

- Do include your AARP Membership Application and dues if you're not a member.

- Don’t use pencil, as it may not be readable.

- Don’t leave any sections blank; every question must be answered to the best of your knowledge.

- Don’t provide false information, as it could jeopardize your coverage.

- Don’t forget to sign the form where indicated, as this confirms your application is valid.

Misconceptions

- Misconception: You must be a member of AARP to apply for Medicare Supplement Insurance. Many believe membership is mandatory. However, you can enroll in a Medicare Supplement plan if you apply for AARP membership simultaneously.

- Misconception: All AARP Medicare Supplement plans are the same. Each plan has different benefits and coverage levels. It’s vital to compare details to find the option best suited to your needs.

- Misconception: If you are under 65, you cannot apply for a Medicare Supplement plan. Individuals under 65 may qualify if they enrolled in Medicare Part B in the last six months or meet other criteria for guaranteed acceptance.

- Misconception: You can have multiple Medicare Supplement plans. Holding more than one Medicare Supplement policy is not allowed. If you purchase a new plan, consider reviewing and possibly canceling your current coverage.

- Misconception: You can fill out the application in any writing style. It's essential to print clearly and use CAPITAL letters when filling out the application. Any deviation may delay processing.

- Misconception: The application must be submitted only in person. You can mail or use other delivery methods to send the completed application. Delivery methods often depend on the specific insurance provider.

- Misconception: Your coverage begins immediately after applying. Coverage starts on the first day of the month following the approval of your application and receipt of the first premium payment.

- Misconception: Past health issues disqualify you from all plans. While certain health conditions may affect eligibility, guaranteed acceptance is often available under specific circumstances. Always check if you meet the required conditions for guarantee acceptance.

Key takeaways

When filling out and using the AARP Medicare Supplement form, keep the following key points in mind:

- Complete All Sections: Ensure all requested information is filled in completely. Incomplete forms can lead to delays in processing.

- Clear and Proper Formatting: Use capital letters and print clearly. Fill in the circles with black or blue ink—do not use pencil.

- Eligibility Requirements: Verify your eligibility. You must be at least 50 years old, enrolled in Medicare Parts A and B, and not duplicating coverage.

- Guaranteed Acceptance: If you recently turned 65 or enrolled in Medicare Part B, you may have guaranteed acceptance. A quick review of questions will help determine this.

- Health Status Declaration: Answer all health questions honestly. If you do not meet the guaranteed acceptance criteria and have health concerns, your application may be denied.

Following these guidelines can streamline the application process and help you secure the coverage you need.

Browse Other Templates

Maintenance Agreements - All owners agree to bear equal costs for maintenance, ensuring fairness in shared usage.

Baseball Evaluation Sheets - Document results to evaluate seasonal player performance.

Dl 44 Form for Minors - The form must be submitted to the DMV for processing to ensure the cancellation takes effect.