Fill Out Your Account Closing Form

When the time comes to close a bank account, whether due to a change in financial needs, relocation, or dissatisfaction with service, it's important to use the appropriate documentation to ensure the process runs smoothly. The Account Closing form serves as a formal request to your financial institution, allowing you to formally communicate your intentions regarding the closure of specific accounts, such as checking or savings. This form typically requires you to indicate which account(s) you wish to close by providing information such as the name on the account, the account number, and your current address for any remaining balance disbursement. Additionally, it includes a space for you to provide your contact information should the bank need to reach you for clarification or if any issues arise during the closure process. Signing this form confirms your request and provides the bank with the necessary authorization to proceed with the account closure. Such attention to detail can help prevent misunderstandings, ensuring that your funds are transferred correctly and promptly. Navigating the procedure intelligently can make a significant difference in your experience with closing an account.

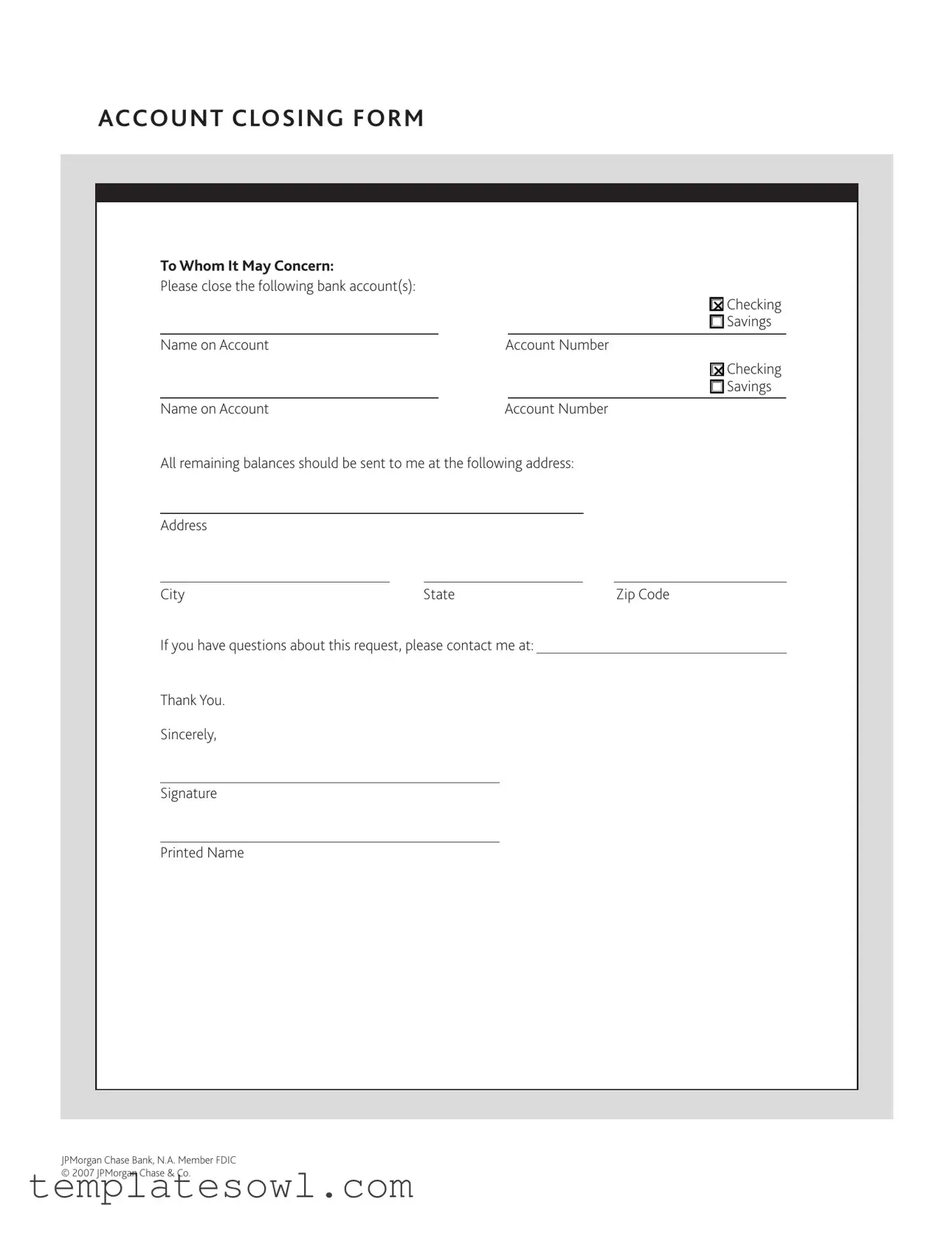

Account Closing Example

ACCOUNT CLOSING FORM

To Whom It May Concern: |

|

|

|

|

|

|

|

Please close the following bank account(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

oChecking |

|

|

|

|

|

|

|

oSavings |

|

|

|

|

|

|

|

|

Name on Account |

|

|

Account Number |

||||

|

|

|

|

|

|

|

oChecking |

|

|

|

|

|

|

|

oSavings |

|

|

|

|

|

|

|

|

Name on Account |

|

|

Account Number |

||||

All remaining balances should be sent to me at the following address: |

|||||||

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

|

|

Zip Code |

||

If you have questions about this request, please contact me at:

Thank You.

Sincerely,

Signature

Printed Name

JPMorgan Chase Bank, N.A. Member FDIC © 2007 JPMorgan Chase & Co.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Account Closing Form is used to officially request the closure of bank accounts. |

| Account Types | You can close both checking and savings accounts using this form. |

| Signature Requirement | A signature is necessary to validate the request for closing the account. |

| Remaining Balances | All remaining account balances will be transferred to the specified address. |

| Contact Information | Provide your contact information in case the bank has any questions about the request. |

| Timeframe | The closure may take several days to process after submission of the form. |

| Governing Laws | The laws of the state where the account is held will govern the closing process. |

| Bank Affiliation | This form is specifically for accounts held at JPMorgan Chase Bank, N.A. |

| FDIC Membership | As a member of FDIC, JPMorgan Chase Bank ensures account holder protections. |

| Effective Date | This format is governed under the regulations established in 2007. |

Guidelines on Utilizing Account Closing

Once you have gathered the necessary information, you can proceed to fill out the Account Closing form. Ensure that all details are accurate to avoid any delays in processing your request. After submitting the form, the bank will begin the process of closing your account and will send any remaining balance to the address you provide.

- Start by selecting the type of account you wish to close by checking either the Checking or Savings box.

- Next, write the Name on Account exactly as it appears on your bank statements.

- Then, enter the Account Number for the account you are closing.

- If you are closing an additional account, repeat the previous two steps: check the type of account, input the name, and enter the account number.

- Provide an Address where you would like the remaining balance sent, ensuring that this is accurate.

- Add the City, State, and Zip Code for the address provided in the previous step.

- If applicable, write down your contact information in case the bank has any questions about your request.

- Sign the form in the Signature section to authorize the request.

- Lastly, print your name in the Printed Name section below your signature.

What You Should Know About This Form

What is the purpose of the Account Closing form?

The Account Closing form serves to formally request the closure of your bank accounts. It provides the bank with the necessary details, such as the account numbers and the type of accounts (checking or savings), to process your request efficiently. By using this form, you ensure that your closure request is documented and handled correctly.

Why do I need to specify the type of accounts I am closing?

It is important to specify whether you are closing a checking account, a savings account, or both. This clarity helps the bank to accurately identify which accounts need to be closed and avoids any potential confusion during the processing of your request.

What happens to the remaining balance in my account after it is closed?

Any remaining balance in your account will be sent to you at the address you provide on the form. Therefore, it is crucial to ensure that the address is correct and up to date. Miscommunication could delay the funds reaching you.

Can I close my account immediately after submitting the form?

No, the closure is not necessarily instantaneous. After submitting your Account Closing form, the bank needs time to process your request. This process could take a few days, depending on the bank's policies and procedures. Money owed or upcoming transactions should be settled before closure is finalized.

Do I need to sign the Account Closing form?

Yes, your signature is required. Signing the form serves as your official consent for the bank to close the account(s). This step protects you and the bank by preventing unauthorized requests for account closures.

Whom should I contact if I have questions regarding my account closure request?

If you have questions, you should contact the customer service department of your bank. The form includes a section where you can provide your contact information to ensure the bank can reach you with any questions they might have about the closure request.

Is there any fee for closing my account?

Typically, banks do not charge a fee for closing an account, but this can vary by institution. It's advisable to check your bank's policy regarding account closures and any potential penalties, especially if the account is being closed before a specified period or under a promotional agreement.

Common mistakes

When filling out the Account Closing form, one common mistake is leaving out essential personal information. For example, individuals often forget to include their address, which is necessary for the bank to send any remaining balances. Without a complete address, the bank might be unable to process the request thoroughly, leading to delays or complications.

Another frequent error is marking the wrong type of account for closure. Whether it’s a checking or savings account, selecting the wrong option can result in unnecessary frustrations. It is crucial to double-check the account type and information before submission. This ensures that you are closing the specific account you intend to close.

People sometimes neglect to specify their account numbers. Leaving the account numbers blank can create confusion within the bank, prompting additional verification steps. Complete and accurate details help expedite the closure process, making it smoother and faster.

Additionally, forgetting to sign the form can halt the entire procedure. A signature verifies the request, affirming that the account holder truly wants to close the account. Without a signature, the bank cannot proceed, which might lead to a longer wait to finalize the closure.

Finally, many individuals fail to provide a contact number or email, which can be critical if the bank needs further clarification. Without a way to reach you, the process can stall. Including this information allows for prompt communication, should any issues arise during the account closure process.

Documents used along the form

When closing a bank account, it’s important to have all necessary forms and documents ready to ensure a smooth process. Apart from the Account Closing Form, you may need several other documents to facilitate the closing and ensure all procedures are followed correctly. Here’s a brief overview of some key documents you might encounter.

- Identity Verification Form - This document serves to confirm your identity. It may require you to provide personal information, such as your Social Security number or driver's license number, to prevent fraud.

- Account Transfer Form - If you are moving your funds to a different account, this form allows you to transfer the balance. It includes both your old and new account details.

- Final Transaction Statement - This document summarizes your account activity and any remaining balance. It’s essential for your records and helps ensure you don’t miss any outstanding transactions.

- Fee Waiver Request Form - If you are closing an account with a remaining balance, you might need to ensure any applicable fees are waived. This form formally requests a waiver of any closing fees.

- Direct Deposit/Cancellation Request - Use this form to cancel any direct deposits tied to your account. It helps to stop future deposits from being made after the account is closed.

- Credit Card Closure Form - In case you have credit cards associated with your bank account, this form allows you to close those accounts and ensures you are not charged any further fees.

- Joint Account Closure Form - If there is more than one person on the account, this document ensures that all account holders agree to the closure and that each person’s signature is collected.

Making sure you have these documents in order can streamline the account closure process. Each form plays a specific role in protecting your interests and ensuring a hassle-free experience. Having them handy will make the transition smoother.

Similar forms

The Account Closing form serves a specific function, allowing individuals to formally request the closure of their bank accounts. It shares similarities with several other documents that also serve to communicate important financial intentions or requests. Below are four documents that are similar to the Account Closing form, along with a brief explanation of their similarities:

- Withdrawal Request Form: Both documents allow individuals to request the movement of funds. Just as the Account Closing form directs the bank to send remaining balances to a specified address, a Withdrawal Request Form instructs the bank to release funds to the account holder, ensuring a clear transfer of money.

- Change of Address Form: This form is used to notify a bank of a change in the account holder's address. Similar to how the Account Closing form requests that remaining balances be sent to a new address, the Change of Address form provides necessary updates to ensure all future correspondences go to the right location.

- Account Transfer Request Form: Individuals may use this document to transfer their funds from one account to another within the same bank. Like the Account Closing form, which specifies account details needing closure, the Account Transfer Request Form outlines which accounts are being affected and directs where the funds should be sent.

- Authorization Letter for Account Actions: An authorization letter may be submitted when someone else is handling financial matters on behalf of the account holder. This document, akin to the Account Closing form, specifies clear instructions and identifies the accounts involved, making it easy for the bank to process the request.

Dos and Don'ts

When filling out the Account Closing form, keep these important tips in mind:

- Do: Clearly state which account you want to close.

- Do: Fill in your account number accurately to avoid delays.

- Do: Provide a complete mailing address for the remaining balance.

- Do: Include your signature for verification purposes.

- Do: Check your information before submitting the form.

- Don't: Forget to specify the type of account (Checking or Savings).

- Don't: Leave any sections of the form blank.

- Don't: Use an outdated address; make sure it’s current.

- Don't: Assume the bank knows which account to close without clarification.

- Don't: Ignore follow-up if you do not receive confirmation.

Misconceptions

Misconceptions About the Account Closing Form

- All accounts will close immediately upon submission. Many believe that once they submit the form, their account will be closed instantly. However, processing can take a few days, especially if there are outstanding transactions.

- You must have a zero balance to close an account. Some think they must transfer all funds out first. In fact, banks typically allow you to close an account even if a small balance remains, but it's best to double-check policies.

- Only physical forms are accepted. Many assume they can't close an account online or via mobile banking. However, many banks offer digital options to submit closure requests without needing a physical form.

- Closing the account will not affect credit scores. Closing a bank account can impact your credit indirectly. It may affect your credit utilization if you had overdraft protection or linked credit products.

- All banks require a long notice period. It is a common belief that banks need 30 days' notice to process account closures. In general, most banks can process requests much faster.

- You can’t close the account if it's negative. Some people think they can’t close a negatively funded account. In reality, a bank will typically allow you to close an account, but you may need to settle any overdraft first.

- A signature is unnecessary if the account holder is deceased. Often, there is a misconception that personal accounts can be automatically closed without documentation. Executors may be required to provide legal documentation to close accounts of deceased individuals.

- All banks process the Account Closing Form the same way. Many believe that the process is universal across all banking institutions. However, procedures can vary significantly, and it's important to check with your specific bank for their guidelines.

Understanding these misconceptions can help make the account closing process smoother and less stressful. If you have any concerns or questions, reach out to your bank for clarity. They are there to assist you.

Key takeaways

Filling out the Account Closing form can seem daunting at first, but breaking it down into manageable parts can make the process smoother. Here are some key takeaways to keep in mind:

- Specify the Account Type: Clearly indicate whether you are closing a checking or savings account. Make sure to check the corresponding box for each account you wish to close.

- Provide Accurate Details: Include the name on the account and the account number. Double-check these details to avoid any processing delays.

- Account Balances: Specify where you would like any remaining funds to be sent. Fill in your address completely, including city, state, and zip code.

- Contact Information: If there are questions or issues regarding your request, ensure you provide your contact details. This helps the bank to reach you promptly if necessary.

- Sign and Print Name: Don’t forget to sign the form and print your name. A signature is essential for validating your request and completing the process.

By adhering to these points, you can navigate the process of closing your account with confidence. Make sure to keep a copy of the completed form for your records!

Browse Other Templates

How Long Does It Take to Get 3000 Clinical Hours - Both applicant and supervisor must sign the verification section of the form.

Dmr Form - Future urban developments are expected to align closely with these guidelines.

E-1 Visa Usa Requirements - Member data is recorded by the SSS for future reference and verification.