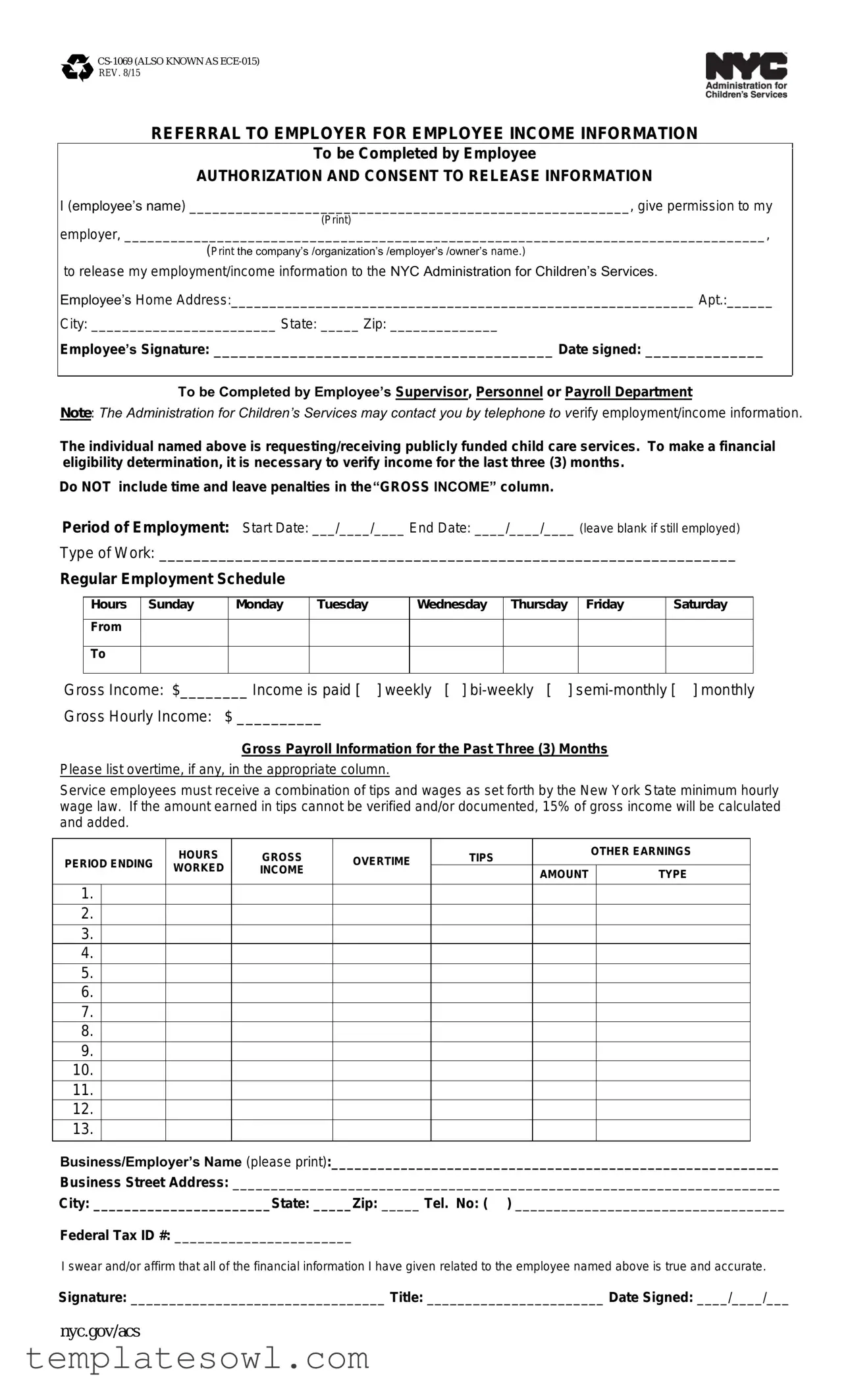

Fill Out Your Acd 1069 Form

The AC 1069 form, also known as the ECE-015, serves as an essential instrument in the verification of employee income, specifically for those involved in publicly funded child care services in New York City. Designed with a comprehensive layout, this form is divided into sections that require input from both the employee and the employer. Employees begin by authorizing their employers to disclose their employment and income details to the NYC Administration for Children's Services. Accurate completion of this form is crucial since it is used to assess financial eligibility for child care assistance. Employers must detail the employee's work schedule, type of employment, and gross income, which must exclude any penalties related to leave. Furthermore, the form encompasses requirements related to overtime and tips for service employees, ensuring that all income sources are accounted for. It demands signatures from both the employee and a representative from the employer's payroll or personnel department, validating the authenticity of the reported information. Ultimately, the AC 1069 form is a vital step in connecting eligible families with necessary child care services in the city.

Acd 1069 Example

REV. 8/15

REFERRAL TO EMPLOYER FOR EMPLOYEE INCOME INFORMATION

To be Completed by Employee

AUTHORIZATION AND CONSENT TO RELEASE INFORMATION

I (employee’s name) _________________________________________________________, give permission to my

(Print)

employer, ___________________________________________________________________________________,

(Print the company’s /organization’s /employer’s /owner’s name.)

to release my employment/income information to the NYC Administration for Children’s Services.

Employee’s Home Address:____________________________________________________________ Apt.:______

City: ________________________ State: _____ Zip: ______________

Employee’s Signature: ________________________________________ Date signed: ______________

To be Completed by Employee’s Supervisor, Personnel or Payroll Department

Note: The Administration for Children’s Services may contact you by telephone to verify employment/income information.

The individual named above is requesting/receiving publicly funded child care services. To make a financial eligibility determination, it is necessary to verify income for the last three (3) months.

Do NOT include time and leave penalties in the “GROSS INCOME” column.

Period of Employment: Start Date: ___/____/____ End Date: ____/____/____ (leave blank if still employed)

Type of Work: ____________________________________________________________________

Regular Employment Schedule

|

Hours |

Sunday |

Monday |

Tuesday |

|

Wednesday |

Thursday |

|

Friday |

Saturday |

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Income: $________ Income is paid [ |

] weekly [ ] |

] |

||||||||

Gross Hourly Income: $ __________ |

|

|

|

|

|

|

||||

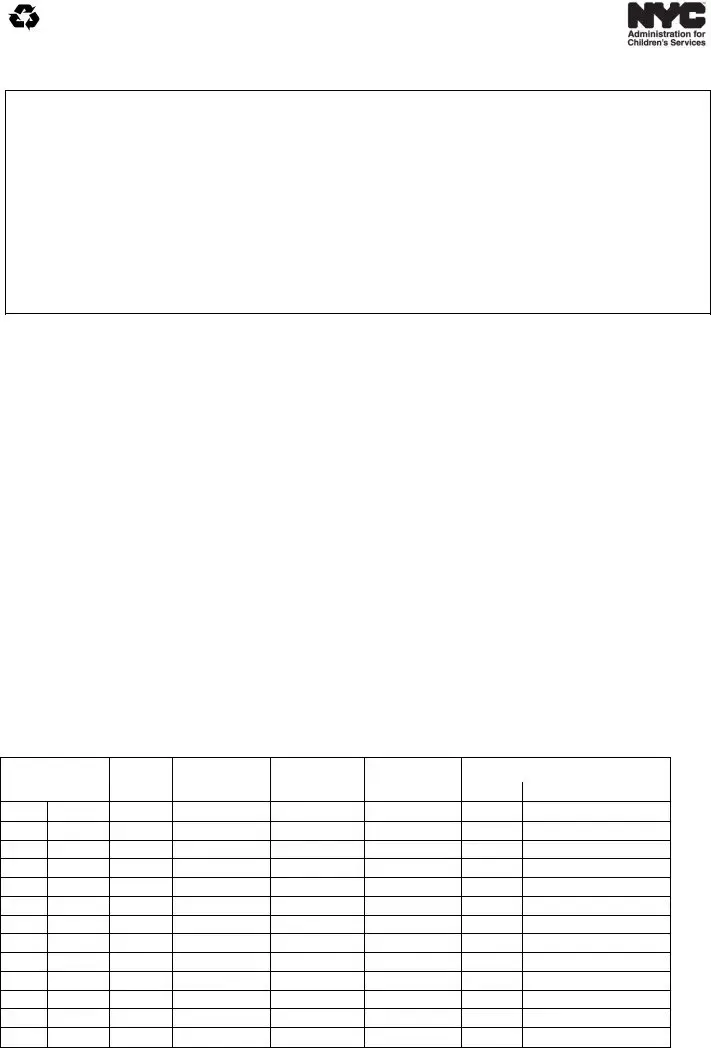

Gross Payroll Information for the Past Three (3) Months

Please list overtime, if any, in the appropriate column.

Service employees must receive a combination of tips and wages as set forth by the New York State minimum hourly wage law. If the amount earned in tips cannot be verified and/or documented, 15% of gross income will be calculated and added.

PERIOD ENDING |

HOURS |

GROSS |

OVERTIME |

TIPS |

OTHER EARNINGS |

|

|

||||||

WORKED |

INCOME |

|

|

|||

AMOUNT |

TYPE |

|||||

|

|

|||||

|

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Business/Employer’s Name (please print):__________________________________________________________

Business Street Address: _______________________________________________________________________

City: _______________________State: _____Zip: _____ Tel. No: ( ) ___________________________________

Federal Tax ID #: _______________________

I swear and/or affirm that all of the financial information I have given related to the employee named above is true and accurate.

Signature: _________________________________ Title: _______________________ Date Signed: ____/____/___

nyc.gov/acs

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The ACd 1069 form is officially titled “Referral to Employer for Employee Income Information.” |

| Purpose | This form is used to authorize the release of employment and income information from an employer to the NYC Administration for Children’s Services. |

| Period of Information | The form requests income information for the last three months to determine financial eligibility for publicly funded child care services. |

| Governing Law | This form operates under New York State laws regarding child care services and employment verification. |

Guidelines on Utilizing Acd 1069

Completing the ACd 1069 form requires careful attention to detail. This form facilitates the communication between an employee and their employer regarding the employee’s income information. Below are the steps to accurately fill out the form.

- Begin by printing the employee's name in the space provided.

- Print the name of the employer or the company in the designated area.

- Fill in the employee's home address, including the apartment number, city, state, and zip code.

- The employee should sign in the space labeled "Employee’s Signature" and date the form.

- Next, the supervisor or personnel department will fill out the employment information. Write down the period of employment including the start and end dates.

- Specify the type of work performed by the employee in the provided space.

- Complete the regular employment schedule by indicating the hours worked for each day of the week.

- Detail the gross income earned and indicate how often the income is paid: weekly, bi-weekly, semi-monthly, or monthly.

- For gross hourly income, write down the amount earned per hour.

- Document the gross payroll information for the past three months. Include hours worked for each pay period, gross income, overtime, tips, and any other earnings.

- In the section labeled "Business/Employer’s Name," print the name of the business or employer.

- Fill in the business's street address, city, state, and zip code.

- Provide a telephone number for the business in the designated area.

- Enter the employer’s federal tax ID number.

- The employer representative should sign and provide their title and the date of signing.

After completing the form, ensure that all information is accurate and clear to avoid delays in processing. Submitting this form promptly will assist in facilitating the benefits you are entitled to receive.

What You Should Know About This Form

What is the purpose of the AC 1069 form?

The AC 1069 form, also known as ECE-015, is used to collect employment and income information from an employee who is requesting or receiving publicly funded child care services. This information helps the NYC Administration for Children’s Services determine the financial eligibility of the employee for assistance.

Who needs to complete the AC 1069 form?

The form must be completed by the employee requesting assistance and their employer. The employee provides their consent for the employer to release relevant employment and income details. This process ensures the necessary information is gathered to evaluate the employee's eligibility for child care services.

What information is required from the employee?

The employee must provide their name, address, and signature on the form. They need to state the employer’s name and employment details as well. This includes the period of employment, type of work, salary information, and gross income for the past three months. These details are essential for the verification process.

What does an employer need to complete on the form?

The employer or their representative must fill out details regarding the employee’s gross income, employment schedule, and hours worked over the last three months. Additionally, the employer must provide accurate information regarding tips and other earnings if applicable. Their signature attests to the truthfulness of this information.

How is gross income calculated?

Gross income includes the total earnings before deductions. It does not factor in unpaid leave or penalties. Employers should list overtime separately and include tips as required by New York State minimum wage laws. If tips cannot be verified, 15% of the gross income will be added as an estimate.

What should employees do if their circumstances change?

If an employee's employment situation changes—such as a job loss or a significant change in income—they should inform the NYC Administration for Children’s Services immediately. Timely reporting is crucial as it may impact eligibility for ongoing child care services.

Where can I find more information about the AC 1069 form?

Additional information about the AC 1069 form can be found on the NYC Administration for Children’s Services website at nyc.gov/acs. This resource offers guidance on the form, eligibility criteria, and the application process for child care services.

Common mistakes

Filling out the ACD 1069 form can be a straightforward process, yet many people stumble upon common pitfalls that can complicate their application. One of the most frequently made mistakes is failing to provide accurate and complete personal information. An employee’s name and employer’s name must be printed clearly. Omissions or errors not only delay the process but could also lead to an outright rejection of the application.

Another mistake involves neglecting to include the employee's home address. This section is vital, as it helps to establish the employee's identity and is necessary for the administration's records. Sometimes individuals rush through filling out the form and may leave address fields blank, which can cause confusion later on in the verification process.

Inaccuracies in reporting the period of employment can also create issues. It is essential to enter both a start date and, if applicable, an end date. If someone is still employed, the form should have that section left blank. Misrepresenting employment duration can mislead the reviewing agency regarding income and eligibility, which can have further consequences.

Many tend to miscalculate or omit gross income figures entirely. It is crucial to indicate the exact gross income and to remember that this figure should not include time and leave penalties, as noted in the instructions. Mistakes in this section can result in incorrect eligibility determinations.

Another common error is failing to check the frequency of income payment. Whether income is paid weekly, bi-weekly, semi-monthly, or monthly should be indicated, and this choice impacts how income is assessed. Neglecting to fill this part out accurately can muddy the understanding of an employee’s financial situation.

The section detailing gross payroll information for the past three months is also often filled out incorrectly. Employees sometimes either forget to complete this or do not provide the necessary details about overtime and other earnings. If additional payments like tips apply, accurately reporting these amounts is essential to ensure a fair evaluation for child care services.

Employees may also overlook the need for the business or employer’s name and contact details, including the federal tax ID number. This information allows the administration to contact the employer directly for verification and ensures a smoother process. Failing to include these details can lead to unnecessary delays.

Finally, a signature is a non-negotiable requirement, and some forget to sign or date the form. A missing signature signals that the employee has not authorized the release of their information, which can halt the application process altogether. Moreover, the title of the person completing the form for the employer must be provided; without this, the verification process may stall.

Documents used along the form

When filling out the ACD 1069 form, various other documents and forms may be required to complete the application process. These additional documents provide essential information and support the verification of employment and income for individuals applying for publicly funded services. Below is a brief overview of common forms that may be used alongside the ACD 1069.

- Pay Stubs: Pay stubs serve as proof of income. They usually detail the employee's earnings for a specific pay period, including deductions for taxes, health insurance, and retirement contributions.

- W-2 Forms: Issued by employers, W-2 forms summarize an employee’s yearly earnings and taxes withheld. They are crucial for understanding overall income for the prior year.

- Tax Returns: Personal tax returns, such as the 1040 form, reflect a person's total income for the previous year. They help evaluate a household's financial situation and are often required for income verification.

- Employment Verification Letter: An employment verification letter from the employer confirms an employee’s job status, salary, and length of employment, providing context for the income reported.

- Direct Deposit Authorization Form: This form shows the employee's bank information for direct deposit of earnings. It can be used to verify the employee’s banking relationship and regularity of income.

- Previous Year’s IRS Form 1099: For independent contractors or freelancers, 1099 forms detail earnings from non-employment sources. They are important for confirming income from multiple jobs.

- Self-Employment Income Documentation: For those who are self-employed, providing records such as profit and loss statements or invoices may be necessary to assess their income accurately.

- Social Security Benefit Statements (SSA-1099): For individuals receiving social security, this form shows the total benefits received during the year, assisting in evaluating additional sources of income.

- Child Support Payment Records: Any documents that show income from child support can provide clarity on additional financial resources supporting a household.

- Bank Statements: Recent bank statements can give a broader view of an individual’s financial situation, including regular deposits and expenditures, offering insight into income stability.

Gathering these documents alongside the ACD 1069 form can ensure a smoother process for verifying eligibility. Understanding what each document entails and why it is required alleviates any concerns you may have regarding the application process. Being prepared with the necessary information can be a vital step toward obtaining the services needed.

Similar forms

-

W-2 Form: Similar to the Acd 1069 form, the W-2 form provides information about an employee's wages and the taxes withheld from those wages. This form is issued by employers every year and helps employees report their income to the IRS. Both documents require accurate income reporting for verification purposes.

-

1040 Tax Return: The 1040 tax return is a personal income tax form used by U.S. citizens and residents to report their annual income. Like the Acd 1069 form, it includes detailed income information which is essential for determining eligibility for various programs or benefits.

-

Pay Stub: A pay stub outlines an employee's earnings for a specific pay period, including gross income and deductions. This document is often necessary for income verification in situations like loan applications, similar to the verification process in the Acd 1069 form.

-

Employment Verification Letter: This letter, typically provided by an employer, confirms an employee's job and income details. It serves a similar purpose to the Acd 1069 form as both documents help verify someone’s employment status and financial situation.

-

Form 4506-T: This form, used to request a transcript of a tax return, is important for verifying income when applying for loans or benefits. It complements the Acd 1069 form in that both involve providing financial information necessary for confirming eligibility for government services.

Dos and Don'ts

When filling out the Acd 1069 form, follow these guidelines to ensure accuracy and compliance.

- Do provide complete and accurate information about the employee’s name and employer.

- Do verify the employment dates and include them correctly.

- Do include all sources of income, including overtime and tips, as required.

- Do confirm that the signature on the form is from the right authority.

- Do double-check all financial figures before submission.

- Don't leave any required fields blank unless specified.

- Don't include penalties in the gross income calculations.

- Don't make assumptions about the income types; provide documentation if necessary.

- Don't ignore the need for a business signature and contact information.

- Don't forget to date the form upon completion.

Misconceptions

Understanding the Acd 1069 form can be tricky, leading to some common misconceptions. Here are four of those misunderstandings explained:

- It’s only for new employees. Many believe the Acd 1069 form applies only to new employees. In reality, it is used to verify income for existing employees who are receiving publicly funded child care services, regardless of when they started working.

- Employer information is optional. Some people think that providing employer information on the form is optional. Actually, it is essential. The form needs accurate employer details to ensure the NYC Administration for Children’s Services can verify employment and income effectively.

- Gross income must include every type of payment. There’s a common belief that all forms of payment should be included in gross income. However, the form specifically states not to include time and leave penalties in the gross income column, simplifying the reporting process.

- The form is only for hourly employees. Many assume the Acd 1069 is applicable only to employees paid by the hour. In fact, it is designed for all types of payment structures, including those on salary or commission, as long as the employee meets the requirements for publicly funded child care services.

Clearing up these misconceptions helps ensure that the form is completed accurately, facilitating a smoother process for both employees and employers.

Key takeaways

Filling out and using the AC-1069 form is an important process for employees seeking publicly funded childcare services. Here are some key takeaways:

- Employee Consent: The employee must grant permission for their employer to release employment and income information.

- Accurate Personal Information: Ensure that the employee's name and employer's name are printed clearly to avoid confusion.

- Home Address Importance: Complete the home address section thoroughly. This allows for proper identification and communication.

- Signature Requirement: The employee must sign and date the form, confirming the consent given for their information to be released.

- Verification of Employment: Employers may be contacted by the Administration for Children’s Services for verification of the provided income details.

- Income Details: Include gross income without time and leave penalties. This reflects the employee’s actual earnings accurately.

- Regular Work Schedule: Ensure to fill out the employee’s work schedule. This aids in understanding their employment status.

- Reporting Income: List all income types correctly, including overtime and tips, as required by New York State minimum wage law.

- Employer's Affirmation: The employer must also sign the form, affirming that the financial information provided is true and accurate.

Filling out this form carefully helps ensure that the necessary financial information is provided for childcare assistance. Follow the guidelines closely to avoid delays in the process.

Browse Other Templates

Et117 - The validated release of lien must be filed with the local county clerk.

Documents Needed for a Va Loan - Funding fee exemption status must be indicated for VA funding regulations.

Form of Invoice - Examinations conducted after specific dates can be reimbursed under this program.