Fill Out Your Acd 31075 Tax Registration Update Form

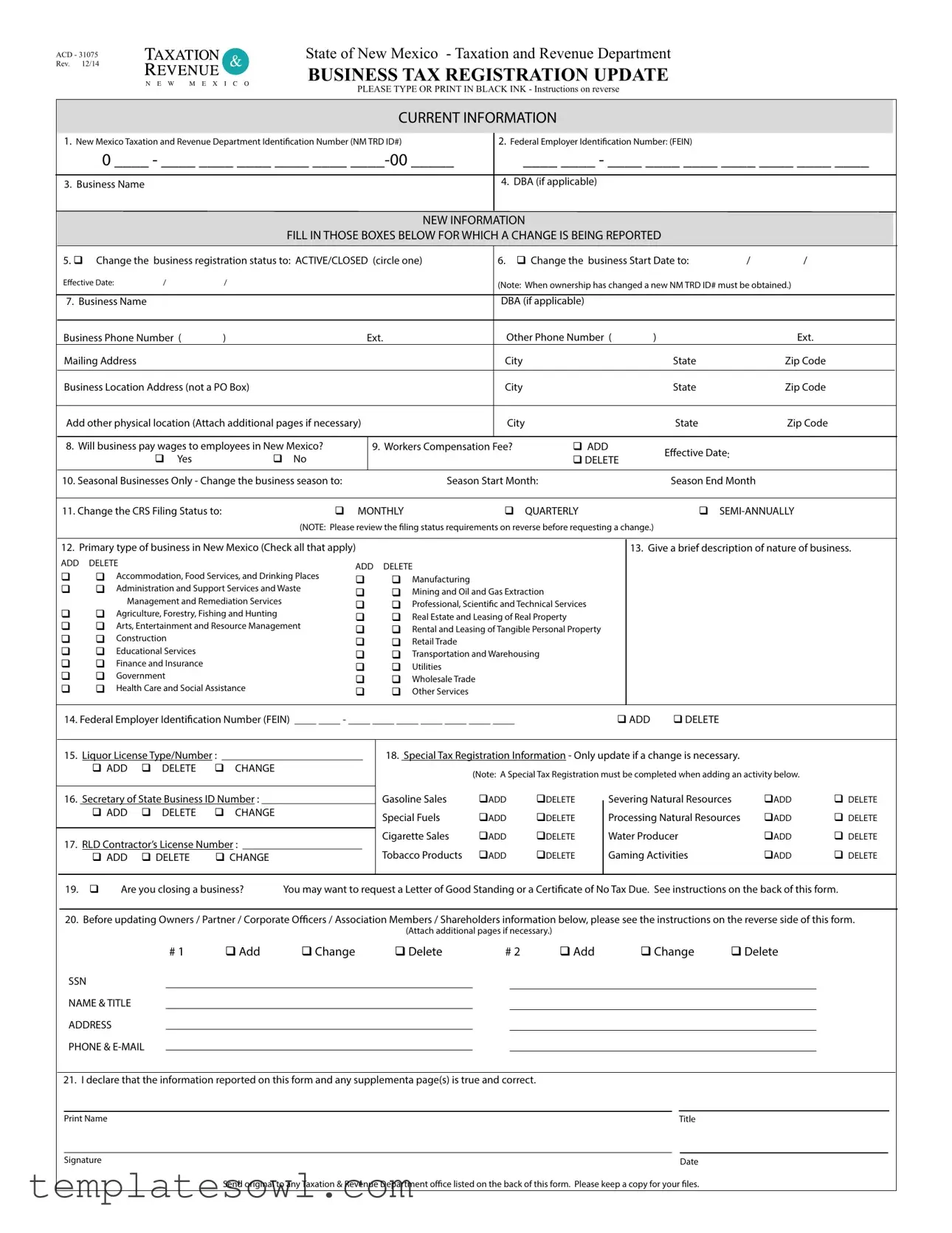

The ACD 31075 Tax Registration Update form is a crucial tool for businesses operating in New Mexico, facilitating necessary changes to their tax registration information. This form allows business owners to update their current and new information effectively, including their business name, registration status, and physical addresses. Additionally, it provides options to report changes in business activities, employee wages, and filing statuses. Specific features include sections for federal and state identification numbers, liquor licenses, and workers’ compensation details. The form also addresses seasonal business operations and special tax registration needs. By completing this form accurately, businesses ensure compliance with state regulations while maintaining up-to-date records with the New Mexico Taxation and Revenue Department. Accurate reporting on this form is essential, as it helps to avoid potential penalties and facilitates smoother business operations.

Acd 31075 Tax Registration Update Example

ACD - 31075

State of New Mexico - Taxation and Revenue Department

Rev. 12/14 |

|

|

|

|

|

|

|

BUSINESS TAX REGISTRATION UPDATE |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

N |

E |

W M E |

X I |

C O |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE TYPE OR PRINT IN BLACK INK - Instructions on reverse |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

1. New Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#) |

|

|

2. Federal Employer Identiication Number: (FEIN) |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

0 ____ - ____ ____ ____ ____ ____ |

|

|

|

____ ____ - ____ ____ ____ ____ ____ ____ ____ |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

3. Business Name |

|

|

|

|

|

|

|

|

|

|

|

4. DBA (if applicable) |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW INFORMATION |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

FILL IN THOSE BOXES BELOW FOR WHICH A CHANGE IS BEING REPORTED |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

5. q |

Change the business registration status to: ACTIVE/CLOSED (circle one) |

|

6. q Change the business Start Date to: |

/ |

/ |

|

|

|

||||||||||||||||||||||

|

Efective Date: |

|

|

/ |

|

/ |

|

|

|

|

|

|

|

(Note: When ownership has changed a new NM TRD ID# must be obtained.) |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

7. Business Name |

|

|

|

|

|

|

|

|

|

|

|

DBA (if applicable) |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Business Phone Number ( |

) |

|

|

|

Ext. |

|

|

Other Phone Number ( |

) |

|

|

|

Ext. |

|

|

|||||||||||||||

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

Zip Code |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Business Location Address (not a PO Box) |

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

Zip Code |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Add other physical location (Attach additional pages if necessary) |

|

|

|

|

City |

|

|

|

State |

|

Zip Code |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

8. Will business pay wages to employees in New Mexico? |

|

9. Workers Compensation Fee? |

q ADD |

|

|

Efective Date: |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

q |

Yes |

|

q |

No |

|

|

|

|

|

|

|

q DELETE |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

10. Seasonal Businesses Only - Change the business season to: |

|

|

|

Season Start Month: |

|

|

Season End Month |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

11. Change the CRS Filing Status to: |

|

q MONTHLY |

|

|

q |

QUARTERLY |

|

|

|

|

q |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

(NOTE: Please review the iling status requirements on reverse before requesting a change.) |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

12. Primary type of business in New Mexico (Check all that apply) |

|

|

|

|

|

|

|

|

|

|

13. Give a brief description of nature of business. |

|||||||||||||||||||

|

ADD |

DELETE |

|

|

|

|

|

|

|

ADD DELETE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

q |

q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Accommodation, Food Services, and Drinking Places |

q |

|

q |

Manufacturing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

q |

q |

Administration and Support Services and Waste |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

q |

|

q Mining and Oil and Gas Extraction |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

Management and Remediation Services |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

q |

|

q Professional, Scientiic and Technical Services |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

q |

q |

Agriculture, Forestry, Fishing and Hunting |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

q |

|

q Real Estate and Leasing of Real Property |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

q |

q |

Arts, Entertainment and Resource Management |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

q |

|

q Rental and Leasing of Tangible Personal Property |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

q |

q |

Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

q |

|

q |

Retail Trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

q |

q |

Educational Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

q |

|

q |

Transportation and Warehousing |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

q |

q |

Finance and Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

q |

|

q |

Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

q |

q |

Government |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

q |

|

q |

Wholesale Trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

q |

q |

Health Care and Social Assistance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

q |

|

q |

Other Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

14. Federal Employer Identiication Number (FEIN) ____ ____ - ____ ____ ____ ____ ____ ____ ____ |

|

|

|

q ADD |

|

q DELETE |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

15. Liquor License Type/Number : __________________________ |

|

18. Special Tax Registration Information - Only update if a change is necessary. |

|

|

|

|

|||||||||||||||||||||||

|

|

|

q ADD |

q |

DELETE |

q |

CHANGE |

|

|

|

|

|

(Note: A Special Tax Registration must be completed when adding an activity below. |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Gasoline Sales |

qADD |

qDELETE |

|

|

Severing Natural Resources |

qADD |

q DELETE |

||||||||||||||||||||

|

|

16. Secretary of State Business ID Number : _____________________ |

|

|

|||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

|

|

|

q ADD |

q |

DELETE |

q |

CHANGE |

|

|

|

Special Fuels |

qADD |

qDELETE |

|

|

Processing Natural Resources |

qADD |

q DELETE |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cigarette Sales |

qADD |

qDELETE |

|

|

Water Producer |

|

qADD |

q DELETE |

|||||||||

|

|

17. RLD Contractor’s License Number : ______________________ |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

qADD |

qDELETE |

|

|

|

|

|

|

|

|

qADD |

q DELETE |

|||||||||||||||

|

|

|

q ADD |

q DELETE |

q CHANGE |

|

|

|

Tobacco Products |

|

|

Gaming Activities |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

19. |

q |

Are you closing a business? |

You may want to request a Letter of Good Standing or a Certiicate of No Tax Due. See instructions on the back of this form. |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

20. Before updating Owners / Partner / Corporate Oicers / Association Members / Shareholders information below, please see the instructions on the reverse side of this form. |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Attach additional pages if necessary.) |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

# 1 |

q Add |

q Change |

|

|

q Delete |

# 2 |

q Add |

|

q Change |

q Delete |

|

|

|||||||||||

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME & TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. I declare that the information reported on this form and any supplementa page(s) is true and correct. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Send original to any Taxation & Revenue Department oice listed on the back of this form. Please keep a copy for your iles. |

|

|

|

|

|

|||||||||||||||||

ACD - 31075

Rev. 12/14

This business tax registration update is to be used for the following tax programs: Gross Receipts, Compensating, Withholding, Workers Compensation Fee, Gasoline, Special Fuels, Cigarette, Tobacco Products, Severance, Resource, Water Producers and Gaming Activities. All attachments must contain the business name and New

Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#). Should you need assistance completing this update, please contact the department at one of the ofices listed below.

COMPLETE ONLY THE AREAS TO BE UPDATED OR CHANGED – If the ownership of a proprietorship has changed, a new NM TRD ID# is required (i.e. A proprietorship has now become a corporation; a different family member is now taking ownership of the family business, etc). If the owner- ship of a partnership has changed (i.e. a partner is no longer involved or you wish to add a partner) a new NM TRD ID# is required.

CURRENT INFORMATION

1.Provide the New Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#)

2.Provide the Federal Employer Identiication Number (FEIN) if applicable. If the FEIN has changed as a result of an ownership change, a new NM TRD ID# is required.

3.Provide the current business name and name the business is Doing Business As (DBA) (as it appears on Taxation and Revenue Department records before the change is made).

NEW INFORMATION

4.Enter the name you are DOING BUSINESS AS if applicable.

5.Change the business registration status to ACTIVE or CLOSED. Circle one. Provide an effective date for the status change.

6.Change the Business Start Date if the date originally indicated is incorrect and no business activity has occurred.

7.Change as needed the Business Name, DBA, Business Phone Number and Extension, Other Phone Number, Mailing Address, Business Location Address and add any other physical locations. (Attach additional pages if necessary). Complete ONLY items that have changes.

8.Check Yes or No. Every employer, including employers of some agricultural workers, who withhold a portion of an employee’s wages for payment of federal income tax, must withhold NM income tax..

9.Check the box to Add or Delete the Workers’ Compensation Fee status. Provide an effective date when you become (or plan to become) a covered employer or are no longer subject to the fee. For more information contact the Workers’ Compensation Administration at (505)

10.Seasonal Businesses only – When the business is engaged in business activity outside the Business Season, the entity is no longer a Seasonal Business. Indicate the new Business Season for a seasonal business only.

11.Request to change the CRS iling Status to Monthly, Quarterly, or

a)Monthly – due by the 25th of the following month if combined taxes due average more than $200 per month or if you wish to ile monthly regardless of the amount due. Monthly periods are from the 1st of each month to the last day of each month.

b)Quarterly- due by the 25th of the month following the end of the quarter if combined taxes due for the quarter are less than $600 or an average of less than $200 per month in the quarter. Quarters are January 1st - March 31st; April 1st – June 30th ; July 1st – September 30th ; October 1st – December 31st.

c)Semiannual due by the 25th of the month following the end of the

12.Add or Delete the business activity in which the business is engaged. More than one business activity can be selected. Please describe all business activities that are "added". If you are unsure as to your entity's business classiication, please contact one of ofices listed below.

13.Briely describe the nature of the type(s) of business in which you will be engaging. The lack of information may affect the type of NTTC for which you qualify.

14.Add or Delete the Federal Employer Identiication Number (FEIN), issued by the Internal Revenue Service. If the FEIN has changed as a result of an owner ship change, a new NM TRD ID# is required.

15.Liquor License Type/Number. - Add, Delete or Change the Liquor License Type/No. issued by the Alcohol and Gaming Division of the Regulation and Licensing

Department.

16.Secretary of State Business Number. – Add, Delete or Change the Business Number issued by the Secretary of State.

17.RLD Contractor's License Number. – Add, Delete, or Change the License Number issued by the Construction Industries Division of the Regulation and Licensing

Department.

18.Special Tax Registration information – Add or Delete an activity, which qualiies for Special Tax purposes. A Special Tax Registration form must be com pleted when adding an activity. Taxpayers selling, leasing, or transferring a liquor license should request a letter of no objection from the Taxation & Revenue

Department.

19.Check this box if you are closing a business. Proprietorships may want to request a Letter of Good Standing from the Department to verify that there are no outstanding liabilities or

20.You may update an owner’s or partner’s address, telephone number, or

21.he registration update should be signed by an Owner, Partner, Corporate Oicer, Association Member, Shareholder, or authorized representative.

Return this form and all attachments to one of the ofices listed below.

Taxation & Revenue Department |

Taxation & Revenue Department |

Taxation & Revenue Department |

Manuel Lujan Sr. Building |

2540 El Paseo, Bldg #2 |

400 N. Pennsylvania Ste.200 |

1200 South St. Francis Dr. |

PO Box 607 |

PO Box 1557 |

PO Box 5374 |

Las Cruces, NM |

Roswell, NM |

Santa Fe, NM |

(575) |

(575) |

(505) |

|

Taxation & Revenue Department |

Taxation & Revenue Department |

5301 Central NE |

3501 E. Main St., Suite N |

PO Box 8485 |

PO Box 479 |

Albuquerque, NM |

Farmington, NM |

(505) |

(505) |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Form | The ACD 31075 form is used to report changes related to business tax registration in New Mexico, including changes to business status, name, address, and tax filing status. |

| State Requirements | This form complies with New Mexico Statutes Section 7-1-10, which mandates tax registration updates reflecting any business changes to the New Mexico Taxation and Revenue Department. |

| Submission Instructions | Completed forms must be sent to any Taxation & Revenue Department office listed on the back of the form. It is crucial to keep a copy for your records. |

| Signature Requirement | The form must be signed by an owner, partner, corporate officer, association member, or authorized representative to validate the information provided. |

Guidelines on Utilizing Acd 31075 Tax Registration Update

Once you have completed the ACD 31075 Tax Registration Update form, the next step involves sending the original document to the appropriate office of the New Mexico Taxation and Revenue Department. It's essential to keep a copy for your records and ensure that your information is accurate and up to date.

- Enter your New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) in the first box.

- Provide your Federal Employer Identification Number (FEIN) if applicable.

- Fill in your current business name and "Doing Business As" (DBA) if you have one.

- Specify if there is a change in your business registration status. Circle either ACTIVE or CLOSED, and provide an effective date for the change.

- Select whether you want to change the business start date, and input the new date if necessary.

- Update your business name, DBA, business phone number, other phone number, mailing address, and business location address as applicable. Add any other physical locations on an additional page if needed.

- Indicate whether your business will pay wages to employees in New Mexico by checking Yes or No.

- Decide on the Workers’ Compensation Fee status. Check the box to ADD or DELETE, and supply an effective date for the change.

- For seasonal businesses only, enter the new season start and end months.

- Change your CRS Filing Status to monthly, quarterly, or semi-annually based on the requirements outlined.

- Select the primary type of business activities by checking all applicable boxes.

- Provide a brief description of your business activities.

- If there’s a change in your FEIN, indicate whether to ADD or DELETE it.

- Update your Liquor License Type/Number if applicable by indicating whether to ADD, DELETE, or CHANGE it.

- Change your Secretary of State Business ID Number if necessary, marking it as ADD, DELETE, or CHANGE.

- If relevant, update the RLD Contractor's License Number following the same ADD, DELETE, or CHANGE format.

- If adding or changing special tax registration information, mark it as ADD, DELETE, or CHANGE.

- Check if you are closing a business and consider requesting a Letter of Good Standing or Certificate of No Tax Due.

- Update information for Owners, Partners, Corporate Officers, or Association Members. Specify whether to Add, Change, or Delete each individual.

- Sign and date the form, ensuring it is completed by an authorized representative of the business.

- Send the original form to one of the Taxation and Revenue Department offices listed on the back of the form. Keep a copy for your records.

What You Should Know About This Form

What is the purpose of the ACD 31075 Tax Registration Update form?

The ACD 31075 form is used by businesses in New Mexico to update their tax registration information. Changes may involve the business's registration status, name, contact details, or tax filing status. This ensures that the Taxation and Revenue Department has current and accurate information on file for all businesses operating in New Mexico.

Who needs to fill out this form?

Any business that needs to report changes to its tax registration should complete this form. This includes businesses that have changed ownership, altered their operational status (like becoming active or closing), or updated their contact information. It's essential for business owners, partners, corporate officers, and authorized representatives to ensure the information is accurate and up-to-date.

What information do I need to provide on the form?

You will need to provide your New Mexico Taxation and Revenue Department Identification Number, your Federal Employer Identification Number (if applicable), and your current business name. Additionally, you'll need to fill in any changed details, such as phone numbers, addresses, business activity types, and filing status. Make sure to only fill out the sections that reflect the changes being reported.

What happens if ownership of the business changes?

If the business ownership changes, it’s necessary to obtain a new New Mexico Taxation and Revenue Department Identification Number. The form allows you to indicate such changes clearly, ensuring that the correct tax responsibilities are assigned to the new owner. After a change in ownership, a new NM TRD ID# must be secured for accurate tax processing.

Can I submit this form online?

As of now, the ACD 31075 form must be submitted in hard copy to the Taxation and Revenue Department. You should send the completed form and any required attachments to the nearest department office listed on the back of the form. Keeping a copy for your records is important, in case you need to reference it in the future.

What if I am closing my business?

Businesses that are closing should check the box on the form to indicate this status. It is also recommended to request a Letter of Good Standing or a Certificate of No Tax Due before closure. These documents confirm that there are no outstanding tax liabilities. This step is crucial for avoiding complications that might arise after the business is no longer active.

Common mistakes

Filling out the ACD 31075 Tax Registration Update form can be challenging. One common mistake is not carefully reviewing the New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#). Omitting or entering this number incorrectly can delay the processing of your form. Each business must ensure that this number is accurate, as it uniquely identifies the business's tax records.

Another frequent error is failing to provide the Federal Employer Identification Number (FEIN) if applicable. If the FEIN has changed due to ownership changes, a new NM TRD ID# is also required. Businesses often overlook this requirement, risking disqualification for certain tax privileges.

Many people incorrectly assume that all sections need to be filled out. However, the instructions explicitly state that only the areas requiring updates or changes should be completed. This oversight leads to cluttered forms, making it harder for tax officials to process the application efficiently.

Next, the Business Start Date may not be updated correctly. If a business has had previous activity or if the start date is written incorrectly, the update will not reflect true business operations. Additionally, failing to circle the business registration status—ACTIVE or CLOSED—can result in the application being returned for correction.

Another notable mistake is not providing a clear description of the nature of the business. This section is crucial, as it helps define the appropriate tax obligations. Insufficient or vague descriptions may lead to complications in compliance and tax assessment.

Lastly, individuals sometimes forget to sign the form. The declaration at the end must be completed by an Owner, Partner, or Corporate Officer to validate the information. An unsigned form is often considered incomplete, leading to further delays.

Documents used along the form

The Acd 31075 Tax Registration Update form is an essential document for businesses in New Mexico that need to update their tax registration details. Along with this form, several other documents are commonly involved in the tax registration process. Each document plays a specific role in facilitating compliance with state regulations.

- Letter of Good Standing: This document verifies that a business has no outstanding tax liabilities or unfiled reports. It is often requested when closing a business.

- Certificate of No Tax Due: Used by businesses to confirm that they are not liable for any taxes owed. This certificate can protect purchasers from assuming the previous owner's tax debts.

- Federal Employer Identification Number (FEIN): This number, issued by the IRS, is required for businesses to manage federal tax obligations. It may need to be updated if there is a change in ownership.

- Liquor License Application: Required for businesses selling alcohol, this application ensures compliance with state regulations regarding the sale of liquor.

- Special Tax Registration Form: This form is necessary when adding activities that require special tax classifications, ensuring that relevant tax obligations are met.

- Contractor’s License: Businesses engaged in construction must have this license, which is issued by the Regulation and Licensing Department and might need updates if ownership changes.

- Secretary of State Business ID Number: This identification number is essential for business registration and may need updating alongside tax registration details.

- Operational Permits: Depending on the type of business, various operational permits may be required. These permits ensure that businesses comply with local regulations.

These documents provide vital information and verification to support the tax registration process. Ensuring all necessary forms and documents are accurately completed and submitted can help maintain compliance and avoid potential issues in the future.

Similar forms

The ACD 31075 Tax Registration Update form is a key document for informing the New Mexico Taxation and Revenue Department about changes in a business's tax registration details. Several other documents serve similar functions across different states, agencies, or business contexts. Here’s a rundown of ten documents that are comparable to the ACD 31075:

- IRS Form 8822: This form is used to notify the IRS of a change of address. Like the ACD 31075, it ensures government records are up-to-date, maintaining accurate information for tax purposes.

- New Mexico CRS Transfer Request: When a business steps away from its Gross Receipts Tax account, it utilizes this form to transfer its account details. This is somewhat akin to updating registrations, as it allows for smoother transitions.

- State Business Entity Registration Form: Similar to the ACD 31075, this form is used when a business is initially registered in the state or when significant changes need to be reported, like ownership or structure.

- Employer Identification Number (EIN) Application (Form SS-4): This IRS form is essential for obtaining an EIN. The process is similar, as both forms deal with critical business identifiers required for taxation.

- State Business License Application: This document is used to apply for or update a business license. It serves a parallel purpose by ensuring businesses comply with state regulations.

- New Mexico Letter of Good Standing: Requesting this letter can confirm that a business is in good standing with the state, similar to the confirmation aspect of updating tax registration records.

- IRS Form 941: This quarterly report form outlines federal income tax withheld from employee wages. It complements the ACD 31075 by dealing with payroll taxation specifics.

- Certificate of No Tax Due: For closing a business, this certificate ensures there are no outstanding tax liabilities, mirroring the ACD 31075's role in reporting status changes accurately.

- Business Change of Ownership Notification: This is similar in purpose to the ACD 31075, as it updates the relevant authorities about new ownership or structure within the business.

- State Unemployment Tax Application: This form registers a business for unemployment taxes, which is essential for employers. The significance of keeping tax-related documents current aligns with the goals of the ACD 31075.

Each of these documents serves a unique role in ensuring that a business remains compliant and transparent to state and federal authorities, just like the ACD 31075 form does for New Mexico businesses.

Dos and Don'ts

Do's:

- Provide the New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) correctly.

- Fill in any sections that have changes without skipping relevant fields.

- Circle the correct option for business registration status (ACTIVE or CLOSED).

- Double-check that all business contact details are accurate before submission.

- Sign and date the form at the bottom before sending it to the department.

Don'ts:

- Do not leave any required fields blank.

- Avoid using ink colors other than black when filling out the form.

- Do not submit without keeping a copy of the filled-out form for your records.

- Do not forget to review whether new NM TRD ID# is needed due to ownership changes.

- Never submit attachments that do not contain the business name and NM TRD ID#.

Misconceptions

Understanding tax forms can often lead to confusion. Here are seven misconceptions about the ACD 31075 Tax Registration Update form:

- It is only for new businesses. The ACD 31075 form is not exclusive to new businesses. Existing businesses must also use it to report changes in registration status, ownership, or other important information.

- Only sole proprietors need to complete this form. This form is applicable to all types of businesses, including corporations, partnerships, and limited liability companies. Any entity operating in New Mexico must report updates as necessary.

- Filing the form is optional for all businesses. Businesses that experience changes in ownership, registration status, or other critical data are required to file this form. Failure to do so can lead to penalties.

- The form can be submitted electronically. Currently, the ACD 31075 form must be submitted in hard copy by mail or in person. There is no electronic submission option available.

- Just completing the form means changes will take effect immediately. Changes reported on the form will become effective based on the effective date provided. It may take additional time for the New Mexico Taxation and Revenue Department to process the changes.

- Individuals can report changes on behalf of the business without authorization. The form must be signed by an owner, partner, corporate officer, or authorized representative to be valid. Unauthorized submissions may be rejected.

- Only one copy of the form is needed. Businesses should retain a copy of the submitted ACD 31075 form for their records. It is essential to have documentation of changes for future reference or audits.

Key takeaways

Here are some key takeaways about filling out and using the ACD 31075 Tax Registration Update form:

- Accuracy is crucial. Ensure that all information provided is complete and correct to avoid delays.

- Any changes in ownership or business status require careful attention. A new New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) may be needed.

- Circle either "ACTIVE" or "CLOSED" to indicate the current registration status of the business.

- Specify the effective date of any changes. This helps to clarify when changes take effect for accounting purposes.

- It is necessary to provide a Federal Employer Identification Number (FEIN) if applicable. A change in FEIN requires a new NM TRD ID#.

- Submit the form to one of the Taxation & Revenue Department offices listed on the form. Retain a copy for your records.

- For any additional assistance, contacting the department directly is recommended.

Browse Other Templates

Aramp Army - The form restricts the use of personal devices or software on government computers to prevent security breaches.

How to Get Transcripts From College - Choose a delivery method for your transcripts at the end of the form.

Subpoena Duces Tecum California - Attorneys must provide their contact information on the form for any inquiries from the witness.