Fill Out Your Ach Debit Authorization Agreement Form

The ACH Debit Authorization Agreement form is a crucial tool for individuals looking to streamline the transfer of funds from their accounts at other financial institutions to their BECU account. This form provides a straightforward way to establish recurring transfers, but it is necessary to complete it only if the other institution is unable to facilitate the setup directly. Users can indicate their specific intention by checking boxes to create a new authorization, modify an existing one, or cancel a previous agreement. The form requires essential account information, including the BECU account number and details of the financial institution from which funds will be debited. Clear directions guide users in specifying the amount to be debited—capped at $5,000 per month—as well as the desired date and frequency of these transactions. Keeping timing in mind, it is important that requests reach BECU with ample notice to prevent any processing delays. This form not only underscores the need for proper documentation but also ensures compliance with U.S. law governing automated transactions. Additional sections address what to do in case of changes or cancellations, demonstrating an understanding of both the user’s needs and the procedural requirements of automated clearing house transactions.

Ach Debit Authorization Agreement Example

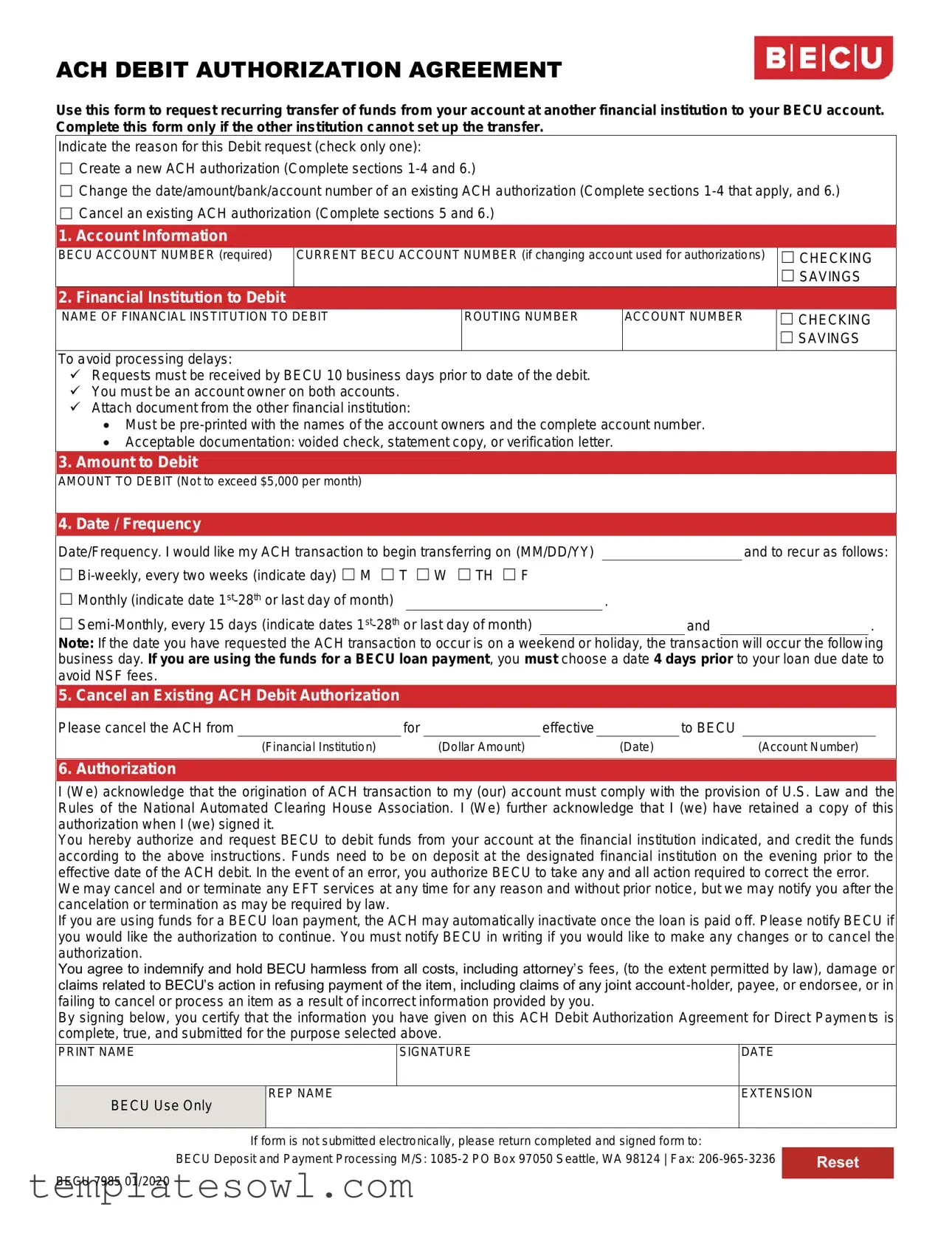

ACH DEBIT AUTHORIZATION AGREEMENT

Use this form to request recurring transfer of funds from your account at another financial institution to your BECU account. Complete this form only if the other institution cannot set up the transfer.

Indicate the reason for this Debit request (check only one):

☐Create a new ACH authorization (Complete sections

☐Change the date/amount/bank/account number of an existing ACH authorization (Complete sections

☐Cancel an existing ACH authorization (Complete sections 5 and 6.)

1. Account Information

BECU ACCOUNT NUMBER (required)

CURRENT BECU ACCOUNT NUMBER (if changing account used for authorizations)

☐CHECKING

☐SAVINGS

2. Financial Institution to Debit

NAME OF FINANCIAL INSTITUTION TO DEBIT

ROUTING NUMBER

ACCOUNT NUMBER

☐CHECKING

☐SAVINGS

To avoid processing delays:

Requests must be received by BECU 10 business days prior to date of the debit.

You must be an account owner on both accounts.

Attach document from the other financial institution:

Must be

Acceptable documentation: voided check, statement copy, or verification letter.

3.Amount to Debit

AMOUNT TO DEBIT (Not to exceed $5,000 per month)

4. Date / Frequency

Date/Frequency. I would like my ACH transaction to begin transferring on (MM/DD/YY) |

|

|

and to recur as follows: |

|

☐ |

|

|

|

|

☐ Monthly (indicate date |

|

|

. |

|

☐ |

|

and |

. |

|

Note: If the date you have requested the ACH transaction to occur is on a weekend or holiday, the transaction will occur the following business day. If you are using the funds for a BECU loan payment, you must choose a date 4 days prior to your loan due date to avoid NSF fees.

5. Cancel an Existing ACH Debit Authorization

Please cancel the ACH from |

for |

effective |

to BECU |

||||

|

(Financial Institution) |

|

(Dollar Amount) |

|

(Date) |

|

(Account Number) |

6. Authorization

I (We) acknowledge that the origination of ACH transaction to my (our) account must comply with the provision of U.S. Law and the Rules of the National Automated Clearing House Association. I (We) further acknowledge that I (we) have retained a copy of this authorization when I (we) signed it.

You hereby authorize and request BECU to debit funds from your account at the financial institution indicated, and credit the funds according to the above instructions. Funds need to be on deposit at the designated financial institution on the evening prior to the effective date of the ACH debit. In the event of an error, you authorize BECU to take any and all action required to correct the error.

We may cancel and or terminate any EFT services at any time for any reason and without prior notice, but we may notify you after the cancelation or termination as may be required by law.

If you are using funds for a BECU loan payment, the ACH may automatically inactivate once the loan is paid off. Please notify BECU if you would like the authorization to continue. You must notify BECU in writing if you would like to make any changes or to cancel the authorization.

You agree to indemnify and hold BECU harmless from all costs, including attorney’s fees, (to the extent permitted by law), damage or claims related to BECU’s action in refusing payment of the item, including claims of any joint account

By signing below, you certify that the information you have given on this ACH Debit Authorization Agreement for Direct Paymen ts is complete, true, and submitted for the purpose selected above.

PRINT NAME |

|

SIGNATURE |

DATE |

|

|

|

|

|

REP NAME |

EXTENSION |

|

BECU Use Only

If form is not submitted electronically, please return completed and signed form to:

BECU Deposit and Payment Processing M/S: |

Reset |

|

BECU 7985 01/2020

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form allows individuals to request a recurring transfer of funds from their account at another financial institution to their BECU account. |

| Condition for Use | It should be completed only if the other financial institution is unable to set up the transfer. |

| Request Types | Three types of requests can be made: creating a new authorization, changing an existing authorization, or canceling an existing authorization. |

| Documentation Required | To avoid delays, a pre-printed document (like a voided check or account statement) from the other financial institution must be attached. |

| Maximum Debit Amount | The amount to be debited cannot exceed $5,000 per month. |

| Submission Timeline | Requests must be submitted to BECU at least 10 business days prior to the intended debit date. |

| Governing Laws | This form is governed by U.S. law and the rules set by the National Automated Clearing House Association (NACHA). |

Guidelines on Utilizing Ach Debit Authorization Agreement

After filling out the ACH Debit Authorization Agreement form, you can expect it to be processed by the financial institution. Make sure you provide accurate information to avoid any delays. Depending on the request type, additional documentation may be necessary.

- Choose the Request Type: Indicate if you want to create, change, or cancel an ACH authorization by checking the appropriate box.

- Fill in Account Information: Provide your BECU account number. If you are changing the account, include the current BECU account number and select the account type (checking or savings).

- Enter Financial Institution Details: Write the name of the financial institution you want to debit. Include the routing number, account number, and indicate the account type.

- Specify the Amount to Debit: Fill in the amount you wish to debit, ensuring it does not exceed $5,000 per month.

- Set Date and Frequency: Choose the start date for the transaction and how often it should recur (bi-weekly, monthly, or semi-monthly). Provide the specific days if applicable.

- If Canceling an Existing Authorization: Fill in the details about the ACH you want to cancel, including the effective date, financial institution, dollar amount, and account number.

- Complete Authorization Section: Sign and date the form, and provide your printed name. Include the representative's name and extension if required.

- Submit the Form: If the form is not sent electronically, return it to BECU at the specified address or fax it to the provided number.

What You Should Know About This Form

What is the ACH Debit Authorization Agreement form used for?

The ACH Debit Authorization Agreement form is a tool that allows individuals to initiate recurring transfers of funds from an account at another financial institution to their BECU account. It is especially useful when the other institution is unable to set up the transfer on its own.

How do I complete the form if I want to create a new ACH authorization?

If you wish to create a new ACH authorization, you will need to complete sections 1 through 4 and section 6 of the form. This will include providing your BECU account number, the name and details of the financial institution from which funds will be debited, the amount to be debited, and the date or frequency of the transfer. Ensure that you also attach the necessary documentation from the other financial institution.

What documentation is required to process this request?

To avoid delays in processing, you must attach a document from the other financial institution. This document should be pre-printed with the names of the account owners and the complete account number. Acceptable forms of documentation include a voided check, a copy of a bank statement, or a verification letter from the institution.

What is the maximum amount I can debit from my account each month?

The form stipulates that the amount debited cannot exceed $5,000 per month. This limit is important to consider as you plan your recurring transactions.

How much notice do I need to give before debiting my account?

Requests for debits must be received by BECU a minimum of 10 business days prior to the intended date of the debit. This helps ensure that there is enough time for the transaction to be processed smoothly.

Can I cancel an existing ACH authorization, and if so, how?

Yes, you can cancel an existing ACH authorization. To do this, you will need to complete section 5 of the form, specifying the relevant details such as the financial institution, effective date of cancellation, dollar amount, and account number. Make sure to submit this request in writing as directed by the form.

What happens if I fail to provide accurate information on the form?

In the event that incorrect information is provided, you agree to indemnify and hold BECU harmless from all costs, including attorney’s fees, and damage or claims that may arise. It's vital to review the information for correctness before submitting the form to avoid any complications with your account.

Common mistakes

Completing the ACH Debit Authorization Agreement form can be straightforward, but there are common mistakes that individuals make which may delay the process. One frequent error is failing to provide the required information in the Account Information section. The form specifically requires the BECU account number, which is mandatory. Omitting this detail can result in the form being returned and the request unprocessed.

Another mistake arises from incorrectly checking the appropriate request type at the beginning of the form. Applicants must only select one option: creating a new authorization, changing an existing one, or canceling an authorization. Checking multiple boxes can lead to confusion and delay in processing, as BECU will need clarification before proceeding.

Individuals also often overlook the need to attach the proper documentation from the other financial institution. The attached document must be pre-printed with the account owner's names and full account number. Commonly accepted documents include voided checks, bank statements, or verification letters. Failing to include this documentation can delay the processing of the request.

Finally, many applicants do not take into account the timing of their request. The form states that the submission must be received by BECU at least ten business days before the desired debit date. Ignoring this timeline can result in processing delays or missed transactions, leading to potential issues with payments. Therefore, it's essential to plan ahead and submit the form within the designated timeframe.

Documents used along the form

When applying for an ACH Debit Authorization Agreement, several other forms and documents may be necessary to complete your request efficiently. Understanding these can help streamline your process and ensure all requirements are met.

- Voided Check: This is a check from your financial institution that has been marked as "void." It shows your account number and the bank's routing number. You will need to attach this to verify the account you want debited.

- Account Statement: A recent statement from your financial institution can serve as evidence of your account details. It should include your name and the account number. This is useful for confirming account ownership.

- Verification Letter: If you cannot provide a voided check or statement, a letter from your bank can also confirm your account details. It should be issued on the bank's letterhead and contain the necessary information about your account.

- Change Request Form: If you are modifying an existing ACH authorization, this form will detail what changes you wish to make, such as changing the account or the amount being debited.

- Cancellation Form: This document is needed if you want to cancel an existing ACH authorization. It provides the necessary information for processing your request and ensures that no further debits occur.

By preparing these forms and documents in advance, you can make the ACH Debit Authorization process smoother. Gathering all necessary information helps avoid delays and enhances the accuracy of your transactions.

Similar forms

EFT Authorization Form: This document is used to authorize electronic funds transfers, similar to the ACH Debit Authorization Agreement. It provides a clear method for clients to permit withdrawals from their accounts for various payments.

Direct Deposit Authorization Form: Like the ACH Debit Authorization Agreement, this form allows individuals to authorize automatic deposits into their bank accounts. Both forms help manage recurring financial transactions and ensure timely payments.

Recurring Payment Authorization Form: This form is specifically designed for setting up recurring payments. It functions similarly to the ACH Debit Agreement by enabling users to schedule regular payments from their accounts.

Cancelling Direct Debit Authorization: In cases where individuals wish to stop automatic transfers, this document helps them request the cancellation, just like the section in the ACH form dedicated to canceling existing authorizations.

Bank Transfer Authorization Form: This document allows customers to authorize transfers from one bank account to another. It shares similarities with the ACH form in managing inter-bank transactions.

Payment Agreement Form: Similar to the ACH Debit Authorization Agreement, this form outlines terms for making regular payments, ensuring both parties are clear on the payment schedule.

Loan Payment Authorization Form: This form is specifically for authorizing automatic loan payments from an account, mirroring the ACH Debit Authorization Agreement's function for payments related to loans.

Service Agreement Form: This document details the terms of service and payment obligations between two parties, akin to how the ACH form stipulates the responsibilities regarding payment transfers.

Credit Card Payment Authorization Form: This form allows customers to authorize the recurring charges of a credit card payment, similar in purpose to the ACH agreement but specifically tailored for credit card transactions.

Automatic Bill Payment Authorization Form: This document is used for setting up automatic payments for recurring bills, which serves a function that closely resembles the ACH Debit Authorization Agreement’s intent to facilitate regular transfers.

Dos and Don'ts

When filling out the ACH Debit Authorization Agreement form, there are important dos and don'ts to ensure that the process goes smoothly. Here’s a helpful list:

- Do ensure that all required fields are filled out completely. Missing information can lead to delays.

- Do attach the necessary documentation from the other financial institution, such as a voided check or bank statement.

- Do verify that you are an account owner on both the BECU account and the account you wish to debit.

- Do submit your request at least 10 business days prior to the expected debit date to avoid any processing issues.

- Don’t provide incomplete account information; this includes the account number and routing number of the financial institution.

- Don’t forget to keep a copy of the signed authorization for your records, as this is important for your reference.

Misconceptions

Understanding the ACH Debit Authorization Agreement is essential for individuals and businesses looking to manage their finances effectively. Misconceptions can lead to confusion and delays, so let’s clarify seven common myths about this agreement:

- It's Just a Simple Form. Many people believe that the ACH Debit Authorization Agreement is a one-page, simplistic form. In reality, it requires accurate details about multiple factors such as the amounts, dates, and account information. Impressively filling out the form correctly can save time and prevent future processing issues.

- Only the Receiving Institution Can Cancel It. Some individuals think that only the financial institution receiving the funds can initiate a cancellation. However, you— as the account holder—can also request to cancel your authorization at any time, ensuring you maintain control over your transactions.

- Once Submitted, It's Set in Stone. A common belief is that once the form is submitted, it cannot be altered. In fact, you can change the date, amount, or bank account number by completing the necessary sections of the form. Flexibility is built into the process.

- Funds Must Be in the Account Before Submission. People often worry they must have the funds in their account at the time they submit the ACH authorization. Yet, the requirement is that funds must be available in the account the evening before the scheduled transaction date. This provides a buffer for planning.

- There Are No Limits on Amounts. Some assume that there are no restrictions on how much can be debited through the ACH. This is misleading. The agreement explicitly states that no more than $5,000 per month can be deducted. Knowing this limit is crucial for budgeting.

- All Financial Institutions Are the Same. Another misconception is that all banks must handle ACH authorizations similarly. This is not the case; practices and requirements may vary. Always check with your specific financial institution for their unique guidelines.

- Once a Loan Is Paid Off, the Authorization Remains Active. Many assume that their ACH authorization for a loan payment continues indefinitely. Wrong. If the loan is paid off, the ACH authorization may automatically inactivate. It is imperative to inform your financial institution if you wish to continue any authority after loan termination.

By dispelling these misconceptions, individuals can navigate the ACH process with confidence. An informed approach promotes better financial management and ensures that your transactions are as smooth as possible.

Key takeaways

Here are some key takeaways about filling out and using the ACH Debit Authorization Agreement form:

- This form is used to set up recurring transfers of funds from another financial institution to your BECU account.

- Before filling out the form, ensure that the other financial institution cannot set up the transfer on your behalf.

- Clearly indicate the purpose of your request by selecting one option: creating a new authorization, changing an existing one, or canceling an existing authorization.

- Complete necessary sections based on the action you are taking. Sections 1-4 and 6 are generally required for new and changing requests, while section 5 and 6 are needed for cancellations.

- You must provide accurate account information, which includes your BECU account number and details about the financial institution you wish to debit.

- All requests must be submitted at least 10 business days prior to the intended debit date to avoid possible delays.

- You must be an account owner on both the BECU account and the account being debited.

- Attach the required documentation, such as a voided check or bank statement, which must include both the account holders' names and the complete account number.

- Specify the amount you wish to debit, ensuring that it does not exceed $5,000 per month.

- If the payment date falls on a weekend or holiday, be aware that the transaction will take place on the next business day.

Understanding these points will help ensure a smoother process when dealing with the ACH Debit Authorization Agreement.

Browse Other Templates

Usaa Insurance Claims Process - You can arrange for vehicle towing if needed, either from the scene or a storage location.

Prudential Lancing - Report interest income accurately to avoid penalties from the IRS.