Fill Out Your Ach Payment Enrollment Form

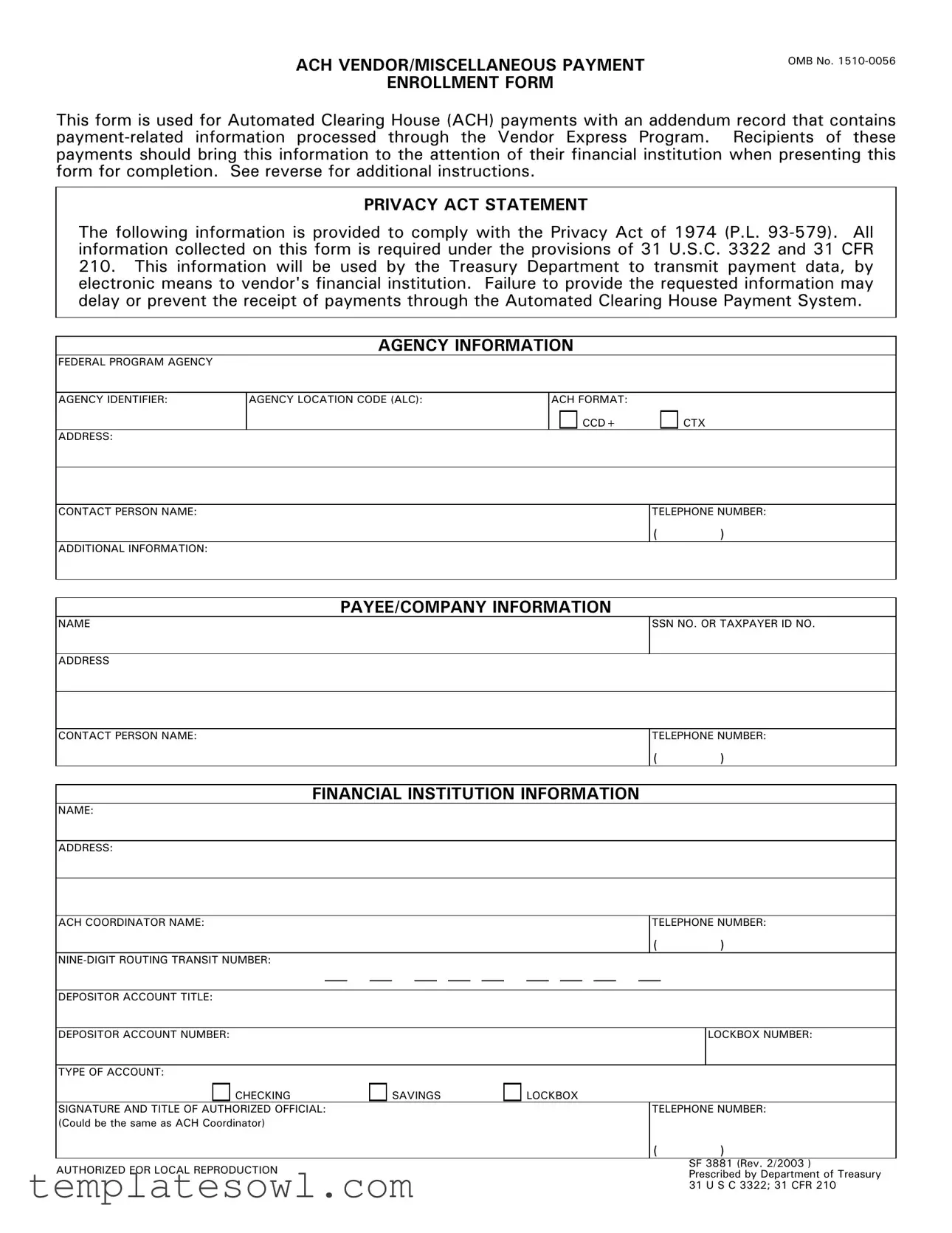

The ACH Payment Enrollment form is an essential tool for anyone looking to receive funds through the Automated Clearing House (ACH) payment system. This form is particularly relevant for individuals and organizations that participate in the Vendor Express Program, ensuring that payments are processed accurately and efficiently. Key sections of the form include agency information, payee/company details, and financial institution specifics. Each section must be filled out carefully, as it collects crucial data such as the agency name, contact information, and banking details. Payees need to provide their name, address, social security or taxpayer ID number, and verify their account information with the financial institution. Additionally, the form requires input from the financial institution, including the routing transit number and account title. Completing this form correctly is vital for avoiding any delays in payment processing. It's also important to keep privacy considerations in mind, as the details provided are subject to the Privacy Act of 1974. By understanding these components, recipients can facilitate smooth financial transactions and ensure prompt payment. Remember, making copies of the completed form is necessary, as it serves different stakeholders including the agency, payee, and financial institution.

Ach Payment Enrollment Example

ACH VENDOR/MISCELLANEOUS PAYMENT

ENROLLMENT FORM

OMB No.

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains

PRIVACY ACT STATEMENT

The following information is provided to comply with the Privacy Act of 1974 (P.L.

210.This information will be used by the Treasury Department to transmit payment data, by electronic means to vendor's financial institution. Failure to provide the requested information may delay or prevent the receipt of payments through the Automated Clearing House Payment System.

AGENCY INFORMATION

FEDERAL PROGRAM AGENCY

AGENCY IDENTIFIER: |

AGENCY LOCATION CODE (ALC): |

ACH FORMAT: |

CCD+ |

CTX |

ADDRESS:

CONTACT PERSON NAME:

ADDITIONAL INFORMATION:

TELEPHONE NUMBER:

()

PAYEE/COMPANY INFORMATION

NAME

ADDRESS

CONTACT PERSON NAME:

SSN NO. OR TAXPAYER ID NO.

TELEPHONE NUMBER:

()

FINANCIAL INSTITUTION INFORMATION

NAME:

ADDRESS:

ACH COORDINATOR NAME: |

TELEPHONE NUMBER: |

|

|

|

|

|

|

|

( |

) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPOSITOR ACCOUNT TITLE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPOSITOR ACCOUNT NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCKBOX NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF ACCOUNT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKING |

|

SAVINGS |

|

|

|

|

LOCKBOX |

|

|

|||||||||||

SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE NUMBER: |

|||

(Could be the same as ACH Coordinator) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||||||||||

AUTHORIZED FOR LOCAL REPRODUCTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SF 3881 (Rev. 2/2003 ) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prescribed by Department of Treasury |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 U S C 3322; 31 CFR 210 |

|

Instructions for Completing SF 3881 Form

Make three copies of form after completing. Copy 1 is the Agency Copy; copy 2 is the Payee/Company Copy; and copy 3 is the Financial Institution Copy.

1.Agency Information Section - Federal agency prints or types the name and address of the Federal program agency originating the vendor/miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency. Also, the appropriate box for ACH format is checked.

2.Payee/Company Information Section - Payee prints or types the name of the payee/company and address that will receive ACH vendor/miscellaneous payments, social security or taxpayer ID number, and contact person name and telephone number of the payee/company. Payee also verifies depositor account number, account title, and type of account entered by your financial institution in the Financial Institution Information Section.

3.Financial Institution Information Section - Financial institution prints or types the name and address of the payee/company's financial institution who will receive the ACH payment, ACH coordinator name and telephone number,

Burden Estimate Statement

The estimated average burden associated with this collection of information is 15 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Financial Management Service, Facilities Management Division, Property and Supply Branch, Room

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is designed for individuals and businesses to enroll in the Automated Clearing House (ACH) payment system, facilitating electronic payments through the Vendor Express Program. |

| Privacy Compliance | The form adheres to the Privacy Act of 1974, ensuring that all collected information is handled appropriately and only used for specified payment purposes. |

| Governing Laws | Compliance with federal regulations under 31 U.S.C. 3322 and 31 CFR 210 is mandatory, ensuring payments are processed lawfully. |

| Completion Instructions | Users are instructed to make three copies of the completed form: one for the agency, one for the payee/company, and one for the financial institution. |

| Time Estimate | The estimated time to complete the form is approximately 15 minutes, depending on individual circumstances. |

| Financial Institution Role | The financial institution plays a crucial role by processing the ACH payments and ensuring all required information is accurate. |

| Contact Information | Each section of the form requires contact information, ensuring clear communication between all parties involved in the payment process. |

Guidelines on Utilizing Ach Payment Enrollment

Completing the ACH Payment Enrollment form accurately is essential for ensuring your payments are processed correctly. Once you've filled out the form, you'll need to submit it to your financial institution. They will help you finalize the enrollment and start receiving payments via ACH.

- In the Agency Information Section, print or type the following details:

- Name and address of the Federal program agency.

- Agency identifier.

- Agency location code.

- The contact person’s name.

- Telephone number of the agency.

- Check the appropriate box for ACH format.

- Move on to the Payee/Company Information Section and provide:

- Name of the payee or company.

- Address of the payee or company.

- Contact person's name.

- Social Security Number or Taxpayer ID Number.

- Telephone number of the payee or company.

- Verify the depositor account number, account title, and type of account.

- In the Financial Institution Information Section, fill in:

- Name and address of the financial institution.

- Name and telephone number of the ACH coordinator.

- Nine-digit routing transit number.

- Depositor (payee/company) account title and account number.

- Check the box for the type of account.

- Signature, title, and telephone number of the authorized official from the financial institution.

- After completing the form, make three copies:

- Copy 1 for the Agency.

- Copy 2 for the Payee/Company.

- Copy 3 for the Financial Institution.

What You Should Know About This Form

What is the ACH Payment Enrollment Form used for?

The ACH Payment Enrollment Form is designed for individuals and businesses to set up Automated Clearing House (ACH) payments. It allows the federal treasury to transfer payments electronically to recipients through the Vendor Express Program. This form makes the payment process smoother and quicker for everyone involved.

What information do I need to provide on the form?

You will need to provide your agency information, payee or company information, and details about your financial institution. This includes names, addresses, telephone numbers, account numbers, and the nine-digit routing number of your bank.

Do I need to complete the form in a certain way?

Yes, it’s important to follow the instructions carefully. Print or type the information clearly and complete all required sections. Ensure that the details about your financial institution, including the account type, are accurate to avoid complications.

What should I do after I complete the form?

After completing the form, make three copies. One copy is for your agency, one is for your records, and the last one goes to your financial institution. Each copy is important for confirming the information you provided.

What happens if I don’t provide all the required information?

If you fail to fill out any of the required information, it may delay or even prevent you from receiving payments through the ACH system. It's crucial to provide complete and accurate information to avoid any disruption in payments.

Can I use this form for personal payments?

This form is specifically intended for vendor or miscellaneous payments processed through federal programs. Personal payments do not fall under this program and require different handling.

Is my personal information safe when I provide it on this form?

The form includes a Privacy Act Statement that explains how your information will be used and protected. The data collected is used solely for processing payments and is subject to strict privacy regulations.

Who should I contact if I have questions while filling out the form?

If you have questions, it’s best to reach out to the contact person listed in the agency information section of the form. They can provide the most relevant assistance based on your specific situation.

What is the estimated time to complete the form?

On average, it takes about 15 minutes to complete the ACH Payment Enrollment Form. However, this can vary based on individual circumstances, such as the complexity of the information required.

Where can I submit the completed form?

You should submit the completed form to the appropriate agency that is managing your payments. Each agency may have specific protocols for submission, so it’s advisable to follow their guidelines closely.

Common mistakes

Completing the ACH Payment Enrollment form can be a straightforward process, but there are common errors that individuals often make, which can lead to delays or misunderstandings. Understanding these mistakes is crucial for ensuring that payments are processed efficiently.

One frequent error occurs during the Agency Information section. Individuals often fail to provide accurate or complete agency identifiers or location codes. Each agency has specific identifiers that facilitate proper payment processing. Leaving these fields blank or entering incorrect data can result in significant processing delays and confusion concerning the source of the payment.

Another mistake is in the Payee/Company Information section, where individuals sometimes neglect to verify their social security or taxpayer identification numbers. This information is foundational to establishing identity and ensuring compliance with tax regulations. Failure to provide correct identification numbers may not only delay payments but could also lead to complications with tax filings later on.

The Financial Institution Information section is also prone to errors. Users may enter incorrect routing numbers or account numbers. The nine-digit routing transit number is critical for directing the funds to the correct bank. A simple typographical error in this number can send funds to the wrong institution, creating a challenging situation for all parties involved.

Many individuals also skip detailing the Account Title and type. This oversight is significant because financial institutions are required to match payments to the correct account type, whether checking or savings. Not specifying the correct type can lead to funds being held or returned, further complicating the payment process.

Providing an Authorized Official's Signature is another critical requirement that can be overlooked. Some individuals may fill out the form but not sign it, believing that the completion is sufficient. The signature verifies that the information provided has been reviewed and is accurate, and without it, the submission may be deemed invalid.

Additionally, there can be confusion around the copies of the form. Individuals sometimes fail to make the required three copies as instructed. Each party involved (the agency, the payee, and the financial institution) must have a copy for their records. Not following this protocol can lead to misunderstandings regarding who is responsible for processing the payment.

Incorrectly listing the Contact Person information is another common oversight. Some people either do not provide a contact name or give a name that is not directly associated with the transaction. An accurate contact person is essential for communication regarding the payments, and lacking this information can lead to misdirected inquiries or delays in addressing issues.

Lastly, individuals often misinterpret the instructions provided on the form, especially when it comes to self-explanatory fields. Carefully reading and following the instructions is vital for successful completion. Ignoring the directions can result in half-completed sections, critical information being omitted, or the form being filled out incorrectly.

Avoiding these common mistakes when completing the ACH Payment Enrollment form is key to ensuring timely and accurate payments. Attention to detail can streamline the process, reduce the risk of errors, and foster a more effective interaction with financial institutions.

Documents used along the form

The ACH Payment Enrollment form is a crucial document utilized for managing Automated Clearing House payments. However, several other forms and documents often accompany it to ensure efficient processing and compliance. Here is a list of key documents frequently used alongside the ACH Payment Enrollment form:

- IRS Form W-9: This form is used to provide the correct Taxpayer Identification Number (TIN) to the requester. It is essential for tax reporting purposes and helps the IRS track earnings for tax compliance.

- Authorization Agreement for Direct Deposit (Form SF-1199A): This form is used by individuals and businesses to authorize direct deposit of federal payments. It ensures funds are deposited directly into a specified bank account.

- Invoice Form: An invoice is a document issued by a vendor that lists the goods or services provided. It includes the amount owed and payment terms, serving as a request for payment.

- Vendor Information Form: This form collects essential details about a vendor or supplier, including contact information and tax identification. It is essential for registration and payment processing.

- Payment Request Form: This document is used to formally request payment for services rendered or goods provided. It outlines the specifics of the transaction and is often required for approval from an agency.

- Certificate of Insurance: Vendors sometimes provide this document to prove insurance coverage. It protects the paying agency from liability and ensures compliance with contractual obligations.

- ACH Credit Authorization Form: This authorization is specifically for allowing an organization to initiate ACH credit transactions. It must be signed by the account holder and is necessary for direct deposit setups.

Utilizing these related documents alongside the ACH Payment Enrollment form will promote a streamlined payment process and ensure compliance with federal regulations. Each document serves a distinct purpose in the payment cycle and fosters effective communication between involved parties.

Similar forms

- W-9 Form - Similar to the ACH Payment Enrollment form, the W-9 collects important information such as the taxpayer's name, address, and taxpayer identification number. This ensures the IRS has accurate records for taxpayer information.

- Direct Deposit Authorization Form - Like the ACH form, this document authorizes a financial institution to deposit funds directly into a bank account. Both require detailed banking information and information about the individual or organization receiving funds.

- Vendor Registration Form - This form is used by businesses to register as vendors for payment processing. Similar to the ACH Payment Enrollment form, it gathers relevant company and banking information needed to process payments.

- Payroll Authorization Form - This form allows employees to authorize their employer to pay wages electronically through direct deposits, similar to how the ACH form facilitates vendor payments electronically.

- ACH Debit Authorization Form - This document is used to authorize recurring payments through the ACH network. Like the ACH Payment Enrollment form, it requires banking information and consent for automated payments to be processed.

Dos and Don'ts

When filling out the ACH Payment Enrollment form, certain practices can enhance accuracy and efficiency. Here are ten things you should do, and ten things you should avoid.

- Do: Read all instructions carefully before starting the form.

- Do: Use clear and legible handwriting if filling out the form by hand.

- Do: Verify all information, especially account numbers and routing numbers.

- Do: Provide complete and accurate contact information for both the payee and financial institution.

- Do: Double-check that you have selected the correct type of account (checking or savings).

- Do: Have a knowledgeable representative from your financial institution available for questions.

- Do: Make three copies of the completed form: one for the agency, one for your company, and one for the financial institution.

- Do: Keep your copy in a secure location for future reference.

- Do: Use the correct Social Security Number or Taxpayer ID Number.

- Do: Sign and date the form where indicated.

- Don't: Skip any sections of the form; incomplete forms will delay processing.

- Don't: Use white-out or other correction tools on the form.

- Don't: Provide outdated or incorrect contact information.

- Don't: Forget to check the box for the ACH format.

- Don't: Assume that your financial institution knows all relevant details without confirmation.

- Don't: Submit the form without making necessary copies.

- Don't: Leave any fields blank unless specified as optional.

- Don't: Use abbreviations that may lead to confusion.

- Don't: Wait until the last minute to complete the form, as errors may arise.

- Don't: Ignore the privacy statement; understand how your information will be used.

Misconceptions

Understanding the ACH Payment Enrollment form is crucial for ensuring timely and accurate payments. Yet, there are several misconceptions that can lead to confusion. Here are five common misunderstandings:

- Misconception 1: The form is optional for ACH payments.

- Misconception 2: The form requires multiple signatures on behalf of the payee.

- Misconception 3: You must have a business account to enroll in ACH payments.

- Misconception 4: Errors in the form will automatically result in rejection.

- Misconception 5: The information provided is not protected under the Privacy Act.

In reality, the ACH Payment Enrollment form is a necessary document for individuals or businesses who wish to receive payments electronically. Failing to complete this form may prevent or delay your payment.

This is not true. Only one authorized official's signature is needed on the form. This simplifies the process significantly.

While many businesses use ACH for payments, individuals with personal accounts can also complete the enrollment. The form is not restricted to business accounts.

While accuracy is vital, minor mistakes might not lead to outright rejection. However, it is essential to correct any errors promptly to prevent delays in payment processing.

This belief is incorrect. The form is designed to comply with the Privacy Act of 1974, meaning that all information collected is safeguarded and used exclusively for the intended purpose of processing payments.

Clarifying these misconceptions can help ensure a smoother enrollment process and more reliable receipt of payments. Awareness diminishes uncertainty, allowing for a more straightforward experience with electronic payments.

Key takeaways

Below are key takeaways regarding the ACH Payment Enrollment form:

- The ACH Payment Enrollment form is used for receiving payments electronically through the Vendor Express Program.

- Provide accurate information to avoid delays in payment processing.

- You must notify your financial institution when presenting the form for completion.

- The form requires details like agency information, payee/company information, and financial institution information.

- Ensure the depositor account number and account title match what your financial institution has on record.

- The completed form must be duplicated for different parties: one for the agency, one for the payee/company, and one for the financial institution.

- Inaccurate or incomplete information may prevent successful transactions.

- It typically takes about 15 minutes to complete the form, but this may vary.

Browse Other Templates

Homeowners Mediation Request Form,Lot Rental Dispute Mediation Form,Mobile Home Park Mediation Petition,Homeowners Association Mediation Application,Petition for Lot Rental Review,Dispute Mediation Request for Homeowners,Notice of Mediation for Homeo - Homeowners can file the form after a committee meeting with the park owner.

Fed Benefits Dental - It’s important to specify what type of request you are making: new enrollment, change, or cancellation.

Can You Get a Moving Permit Online - This short-term permit helps move vehicles during special circumstances without the hassle of regular registration.