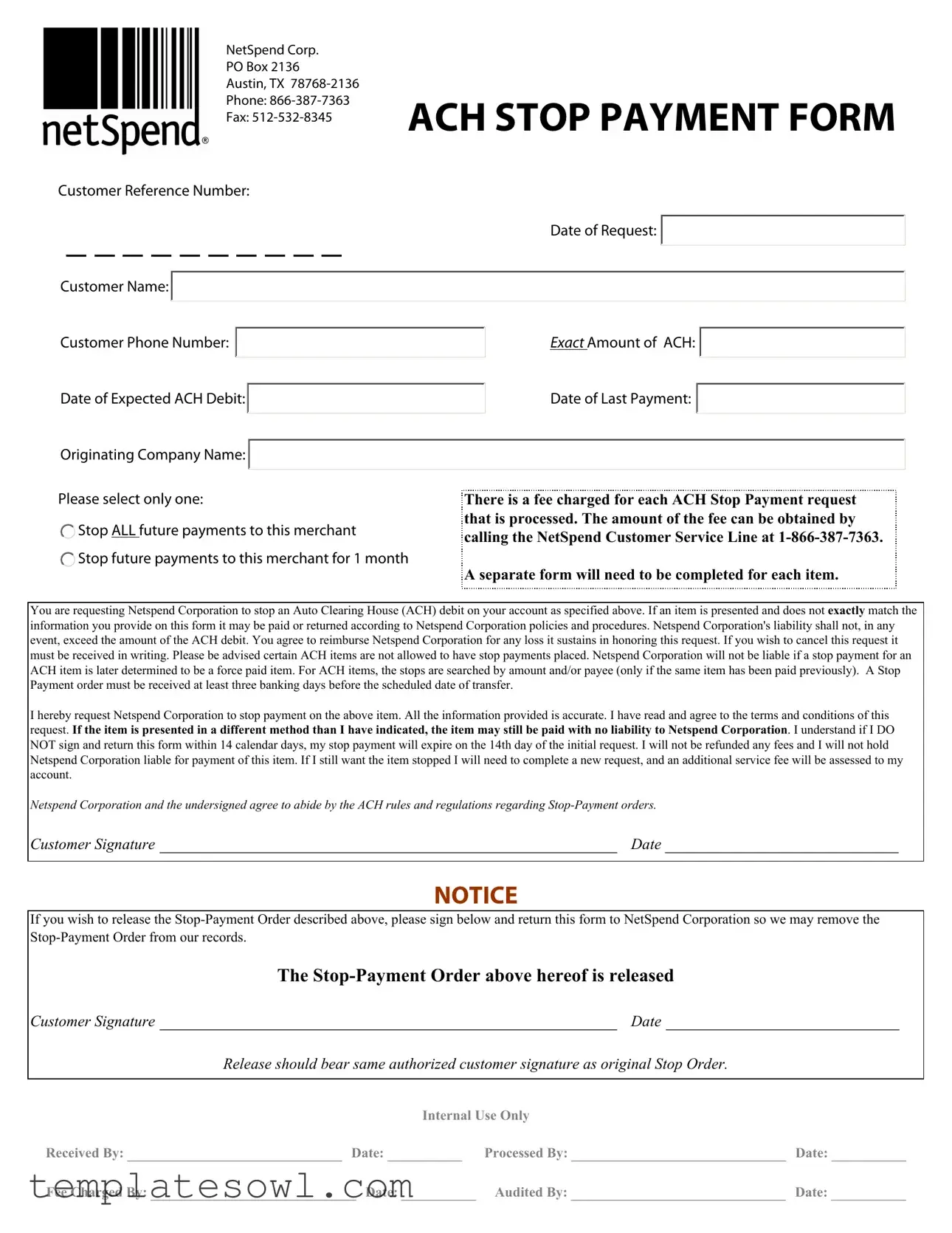

Fill Out Your Ach Stop Payment Form

The ACH Stop Payment form is a crucial tool for customers looking to halt a scheduled electronic transaction from their accounts. Designed for use with Automated Clearing House (ACH) debits, this form helps people manage and control their payments efficiently. When filling out the form, customers need to provide specific details, including their name, the exact amount of the ACH transaction, and the date it is expected to occur. The form also requires the name of the originator, or the company initiating the debit, to ensure clarity and accuracy. Customers have options on how to stop payments, such as ceasing all future transactions with a certain merchant or suspending payments for a temporary period. It's important to note that a fee is associated with each request for a stop payment, and this fee can vary. To effectively process the request, customers must submit the form at least three business days before the transaction's scheduled date. Understanding the implications of submitting this form, including the conditions under which it may not be honored, will empower consumers to make well-informed decisions regarding their financial transactions.

Ach Stop Payment Example

|

NetSpend Corp. |

|

|

|

|

|

|||

|

PO Box 2136 |

|

|

|

|

|

|||

|

Austin, TX |

|

|

|

|

|

|||

|

Phone: |

ACH STOP PAYMENT FORM |

|||||||

|

Fax: |

||||||||

|

|

|

|

|

|

||||

Customer Reference Number: |

|

|

|

|

|

||||

_ _ _ _ _ _ _ _ _ _ |

|

Date of Request: |

|

|

|

||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Customer Phone Number: |

|

|

|

|

EXACT Amount of ACH: |

|

|||

|

|

|

|

|

|

|

|

||

Date of Expected ACH Debit: |

|

|

|

Date of Last Payment: |

|

|

|||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Originating Company Name: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Please select only one:

Stop ALL future payments to this merchant

Stop ALL future payments to this merchant

Stop future payments to this merchant for 1 month

Stop future payments to this merchant for 1 month

There is a fee charged for each ACH Stop Payment request that is processed. The amount of the fee can be obtained by calling the NetSpend Customer Service Line at

A separate form will need to be completed for each item.

You are requesting Netspend Corporation to stop an Auto Clearing House (ACH) debit on your account as specified above. If an item is presented and does not exactly match the information you provide on this form it may be paid or returned according to Netspend Corporation policies and procedures. Netspend Corporation's liability shall not, in any event, exceed the amount of the ACH debit. You agree to reimburse Netspend Corporation for any loss it sustains in honoring this request. If you wish to cancel this request it must be received in writing. Please be advised certain ACH items are not allowed to have stop payments placed. Netspend Corporation will not be liable if a stop payment for an ACH item is later determined to be a force paid item. For ACH items, the stops are searched by amount and/or payee (only if the same item has been paid previously). A Stop Payment order must be received at least three banking days before the scheduled date of transfer.

I hereby request Netspend Corporation to stop payment on the above item. All the information provided is accurate. I have read and agree to the terms and conditions of this request. If the item is presented in a different method than I have indicated, the item may still be paid with no liability to Netspend Corporation. I understand if I DO NOT sign and return this form within 14 calendar days, my stop payment will expire on the 14th day of the initial request. I will not be refunded any fees and I will not hold Netspend Corporation liable for payment of this item. If I still want the item stopped I will need to complete a new request, and an additional service fee will be assessed to my account.

Netspend Corporation and the undersigned agree to abide by the ACH rules and regulations regarding

Customer Signature _________________________________________________ Date _________________________

NOTICE

If you wish to release the

The

Customer Signature _________________________________________________ Date _________________________

Release should bear same authorized customer signature as original Stop Order.

Internal Use Only

Received By: _______________________ Date: ________ |

Processed By: _______________________ |

Date: ________ |

Fee Charged By: ______________________ Date: ________ |

Audited By: _______________________ |

Date: ________ |

Terms

Automated Clearing House (ACH) - The ACH Network is a nationwide

ACH payments include, but are not limited to:

*Direct Deposit of payroll, Social Security and other government benefits, and tax refunds; *Direct Payment of consumer bills such as loans, utility bills and insurance premiums;

*Federal, state and local tax payments

Customer Name - Name listed on the ACH and the name should appear on the NetSpend account.

Customer Reference Number - This is a number obtained from Netspend and is used to locate your account on their system.

Date of Request - Date customer completed form.

Originating Company Name - Name of company sending the ACH to Netspend. Any individual, corporation or other entity that initiates entries into the Automated Clearing House (ACH) Network.

Written Statement of Unauthorized Debit (WSUD) form - A sworn Statement by a customer declaring that a particular ACH transaction was unauthorized, improper or that authorization for the transaction has been revoked.

Frequently Asked Questions

What happens if the ACH is not stopped in time or shows up on my account?

If the ACH appears on your account, please fill out a WSUPP form. The form may be obtained by calling the NetSpend Customer Service Line at

Will I still be charged a fee for the Stop Payment request if the ACH is not stopped?

Yes. The fee is intended to pay for the processing of the form. This is not a guarantee that the payment will be stopped. NetSpend

will take reasonable measures to ensure that the payment does not post to the account.

When will the Stop Payment fee be removed from my account?

The Stop Payment fee will be obtained when you first communicate to NetSpend your request to stop a payment.

Can I stop payment on any ACH?

Yes. Simply notify NetSpend, either orally or in writing, at least three business days before the scheduled payment date. If you call NetSpend, you may also be required to provide a written request within 14 days. As a courtesy, you may also want to inform the Originating Company that you are stopping a payment. Keep in mind this only stops one payment, until the request is received in writing. If you want to revoke your authorization for all future payments, you need to contact the Originating Company.

Can I stop multiple payments from multiple companies with one form?

No. Due to record keeping purposes, you must fill out one form for each merchant and/or dollar amount. A Stop Payment fee will be assessed for each request.

Form Characteristics

| Fact Name | Description |

|---|---|

| Request Submission | To successfully request a stop payment, the form must be submitted at least three banking days before the scheduled debit date. |

| Fee Information | Each ACH stop payment request incurs a fee, which can be confirmed by contacting NetSpend at 1-866-387-7363. |

| Payment Limits | You can either stop all future payments or halt payments for a single month, but a separate form is needed for each request. |

| Liability Disclaimer | NetSpend Corporation's liability is limited to the amount of the ACH debit and may not cover instances where the information provided does not match exactly. |

| Cancellation Policy | Requests to cancel must be received in writing. If a request is not signed and returned within 14 days, the stop payment expires. |

| ACH Governing Laws | The ACH stop payment process is governed by NACHA Operating Rules, supported by the Federal Reserve and Electronic Payments Network. |

Guidelines on Utilizing Ach Stop Payment

Using the ACH Stop Payment form is a straightforward process. This form allows you to request that NetSpend stop a specific ACH debit from your account. It’s essential to provide accurate information to ensure your stop payment request is processed correctly. Follow the steps outlined below to fill out the form correctly and avoid any issues.

- Gather your information: Collect details such as your Customer Reference Number, Customer Name, Customer Phone Number, and the Originating Company Name.

- Complete the form: Fill in the Date of Request. Provide the EXACT Amount of ACH and the Date of Expected ACH Debit.

- Specify the last payment date: Enter the Date of Last Payment that was made for this ACH debit.

- Select your request: Choose whether you want to stop ALL future payments to this merchant or just for 1 month.

- Sign and date the form: At the bottom of the form, sign where indicated and write the date.

- FAX or mail the form: Send the completed form to NetSpend Corporation at the fax number or address provided.

After submitting the form, remember to monitor your account for confirmation that the stop payment has been processed. If it’s not stopped in time, further action, such as filling out a WSUPP form, may be needed. Stay informed about the fees associated with this request as well, since there’s a charge for processing each stop payment.

What You Should Know About This Form

What happens if the ACH is not stopped in time or shows up on my account?

If the ACH appears on your account despite your request, it’s important to act quickly. You should fill out a Written Statement of Unauthorized Debit (WSUD) form. This form is available by contacting the NetSpend Customer Service Line at 1-866-387-7363. Taking this step helps ensure that the issue is properly documented and addressed.

Will I still be charged a fee for the Stop Payment request if the ACH is not stopped?

Yes, you will still incur a fee for submitting the Stop Payment request even if the ACH is not successfully stopped. The fee covers the processing of your request and does not guarantee that the payment will be blocked. Nevertheless, NetSpend will make reasonable efforts to prevent the payment from posting to your account.

When will the Stop Payment fee be removed from my account?

The Stop Payment fee will typically be deducted from your account as soon as you communicate your request to stop a payment to NetSpend. Make sure to keep track of this in your transaction history.

Can I stop payment on any ACH?

You can request a stop payment for any ACH transaction, but the request must be communicated to NetSpend at least three business days before the scheduled payment date. If you make the request over the phone, a written follow-up may be necessary within 14 days. Additionally, it's courteous to inform the Originating Company, although this is not a requirement.

Can I stop multiple payments from multiple companies with one form?

No, each Stop Payment request must be submitted on a separate form. This helps maintain accurate records and ensures that each request is processed correctly. Additionally, a fee will be charged for each Stop Payment request submitted.

What information do I need to complete the ACH Stop Payment form?

To fill out the form, you’ll need to provide your Customer Reference Number, the exact amount of the ACH, and details including the date of the expected debit and the name of the originating company. Make sure all the information is accurate to help facilitate the process.

How long does it take for a Stop Payment request to process?

A Stop Payment request must be received at least three banking days before the scheduled date of the ACH transaction. This time frame allows NetSpend to appropriately process your request and take action to block the payment.

What happens if I want to cancel my Stop Payment request?

If you decide to cancel your Stop Payment request, you must provide the cancellation in writing. This ensures that your request is properly documented and eliminates any confusion about your intentions.

What risks are associated with placing a Stop Payment order?

While placing a Stop Payment order can protect you from unauthorized transactions, it’s important to understand that if the information you provide does not precisely match the ACH item, it may still be paid. NetSpend is not liable for any discrepancies that may arise, so providing accurate details is crucial.

Common mistakes

Filling out the ACH Stop Payment form accurately is essential to ensure that your request is processed without issues. Many individuals inadvertently make mistakes that can delay or complicate the stop payment process. One common error is failing to specify the exact amount of the ACH debit. If the amount provided does not match the actual debit, the stop payment order may be disregarded. As a result, the transaction could still occur, leaving the individual responsible for any unwanted payments.

Another frequent misstep is neglecting to provide the customer's reference number. This number is crucial for NetSpend Corp. to locate and process your request efficiently. Without this identifier, further delays in handling the request may arise. Furthermore, individuals sometimes overlook the requirement to sign and date the form. If the signature is missing, the request may be rendered invalid, and customers will remain exposed to unauthorized transactions.

Many people also fail to confirm the originating company name accurately. Providing incorrect information here could lead to confusion or failure to stop the intended payments. Additionally, some customers select the option to stop all future payments to a merchant but do not realize they also need to specify a timeline. Whether opting for an indefinite stop or a one-month stop, individuals must make their intentions clear on the form.

Poor communication regarding the status of the stop payment request can lead to misunderstandings. If individuals do not proactively inform the originating company about their decision to stop payment, they risk continuing charges. Moreover, forgetting to include the date of the last payment is another common mistake. It is critical to provide this information to ensure that the stopping of payments is effectively executed from the right point forward.

Another error often made is misinterpreting the time frame for submitting the stop payment request. It is important to submit the form at least three banking days before the scheduled ACH debit to avoid complications. If a request is submitted late, it may not be honored, resulting in additional problems for the customer.

Additionally, some individuals misunderstand the implications of the stop payment fee. Many believe that the fee is contingent upon success in preventing the payment, but it is charged regardless of the outcome. This misunderstanding can lead to frustration later on. Lastly, forgetting to read and accept the terms and conditions when filling out the ACH Stop Payment form can lead to unintentional agreement lapses. A complete understanding of the terms helps individuals recognize their rights and obligations throughout the process.

Documents used along the form

When dealing with ACH stop payments, you may find it necessary to prepare additional documents. These documents assist in the process, clarify your intentions, and ensure you have all necessary information documented. Here’s a list of some common forms that frequently accompany an ACH Stop Payment form:

- Written Statement of Unauthorized Debit (WSUD): This form is used when a customer claims that a specific ACH transaction was not authorized. It serves as a formal declaration that may help in disputing the charge.

- ACH Revocation of Authorization: This document allows a customer to officially revoke their permission for future ACH transactions from a specific originator. It is often necessary for terminating recurring payments.

- Bank Statement: A record of your recent transactions that can help verify unauthorized charges or provide context to the stop payment request. Having this handy can clarify discrepancies.

- Customer Authorization Form: Some companies may require this form to make sure you have authorized interaction with your account regarding adjustments and stop payments.

- Payment Declaration Form: This form can be used to detail the nature of the disputed payment, including specifics like the date, amount, and source of the ACH debit in question.

- Service Agreement: If it applies, this document outlines the terms between you and the originating company regarding their services, which might affect how payments can be stopped.

- ACH Dispute Form: Used to formally declare a dispute on an ACH transaction, this document often serves as a precursor to further claims or investigations.

- Transfer Request Form: If you plan to transfer funds between accounts due to an unauthorized ACH debit, filling out this request form can facilitate a smooth transaction.

- Fee Agreement: This outlines any fees associated with the stop payment or other related actions. It’s important to understand potential charges you might incur.

- Follow-Up Communication Template: A prepared letter that can be sent to the originating company or financial institution to inform them of the stop payment and any claims you have made.

Incorporating these documents can simplify your experience with ACH transactions. Being thorough helps ensure that proper steps are taken in managing your finances. Always keep copies of any forms submitted for your personal records. Taking these precautionary measures allows you to effectively handle issues related to ACH payments, and it helps foster clearer communication with your financial institutions.

Similar forms

- Written Statement of Unauthorized Debit (WSUD): Similar to the ACH Stop Payment form, this document serves as a declaration by the customer. It states that a specific ACH transaction was not authorized or that permission for the transaction has been revoked.

- Stop Payment Order: This document formally requests a bank to prevent payment on a check or debit that has not yet cleared. Like the ACH Stop Payment form, it requires specific transaction details and must be submitted in advance of the payment being processed.

- Check Cancellation Request: This form is used when a customer wants to cancel a check that has been issued. Similar to the ACH Stop Payment form, details about the check and the reason for cancellation are necessary.

- Debit Card Dispute Form: This document allows customers to dispute specific transactions made with their debit cards. As with the ACH Stop Payment, it involves providing transaction details and can require a follow-up process.

- Credit Card Dispute Form: Customers use this form to contest unauthorized credit card charges. It is similar in function to the ACH Stop Payment form as it requires a specific mention of the disputed charge and relevant transaction information.

- Recurring Payment Authorization Revocation: This form allows customers to cancel their agreement for ongoing payments. Just like the ACH Stop Payment, it must be submitted before the next scheduled payment occurs to be effective.

- Account Closure Request: When customers choose to close their account, they must complete this form. It resembles the ACH Stop Payment form in that it requires accurate information and intent to prevent further transactions.

- Refund Request Form: This document is used to request a refund for a transaction. Much like the ACH Stop Payment, it necessitates providing details about the original transaction for processing.

Dos and Don'ts

It is essential to take care when filling out the ACH Stop Payment form to ensure the process goes smoothly. Here are nine important do's and don'ts to consider:

- Do ensure all information is accurate, including the customer name and reference number.

- Do specify whether you want to stop all future payments or just one for a month.

- Do submit the request at least three banking days before the scheduled debit date.

- Do read and understand the terms and conditions before signing the form.

- Do contact NetSpend for any questions regarding fees associated with the stop payment request.

- Don't wait until the last minute to submit your request; delays may lead to processed payments.

- Don't assume that a stop payment applies to all future transactions without proper indication.

- Don't fill out one form for multiple payments or merchants; each request requires a separate form.

- Don't cancel your request verbally; a written request is necessary to make any changes.

Misconceptions

Understanding the ACH Stop Payment Form is crucial for effectively managing your electronic transactions. Here are nine common misconceptions regarding the form, along with explanations to clarify the facts.

- I can stop any ACH payment at any time. Many believe that stopping a payment is simple; however, a request must be made at least three banking days before the scheduled debit.

- Filing a Stop Payment guarantees that the payment will not go through. Submitting the form is not a guarantee that the payment will be stopped. Payments may still post if they don’t match the provided information exactly.

- One form covers multiple payments. Each payment, even from different companies, requires a separate ACH Stop Payment form. This is important for accurate record-keeping.

- Stopping a payment is free. Many assume there is no cost associated with this process. In fact, there is a fee for each Stop Payment request, so users should be prepared for this expense.

- I can cancel my Stop Payment request verbally. To cancel a Stop Payment order, you must submit a written request. Verbal communication is not sufficient for cancellation.

- My Stop Payment request lasts indefinitely. If the form is not signed and returned within 14 calendar days, the request will expire. After this period, a new request must be submitted.

- I will be refunded if the payment doesn’t stop. No refunds are provided for Stop Payment fees, even if the payment is not successfully halted.

- NetSpend is liable for any unauthorized payments. If a Stop Payment request does not comply with the rules or if an item was not properly stopped, NetSpend’s liability is limited, and it's not responsible for force paid items.

- All ACH transactions can have Stop Payment requests. Certain items may not allow for stop payments. Awareness of these restrictions is essential when submitting a request.

By dispelling these misconceptions, users can approach the ACH Stop Payment process with a clearer understanding and better prepare themselves for its limitations and requirements.

Key takeaways

When filling out the ACH Stop Payment form, here are four key takeaways to keep in mind:

- Complete Information: Ensure all fields are correctly filled, including your Customer Reference Number, Customer Name, and the exact amount of the ACH. Accurate information is crucial for processing your request.

- Timing is Essential: Submit the Stop Payment request at least three banking days before the scheduled ACH debit date to ensure it is processed in time. Delays may result in the payment being completed.

- Separate Requests Required: If you need to stop multiple ACH payments, you must fill out a separate form for each one. Each request incurs a service fee, so plan accordingly.

- Understanding Liability: Be aware that NetSpend Corporation’s liability is limited. If the information provided does not match the actual ACH item, they may still process the payment without liability for any losses incurred.

Browse Other Templates

City of Massillon - Documenting any changes in employee status or payroll can simplify future filings.

LLC Statutory Agent Withdrawal Form,Statutory Agent Resignation Notice,LLC Agent Departure Document,Arizona Statutory Agent Termination Form,Agent Resignation Filing,LLC Agent Notice of Resignation,Statutory Agent Exit Form,Arizona LLC Statutory Agen - Resignations must be communicated to all relevant parties for legal clarity.