Fill Out Your Ach Vendor Payment Form

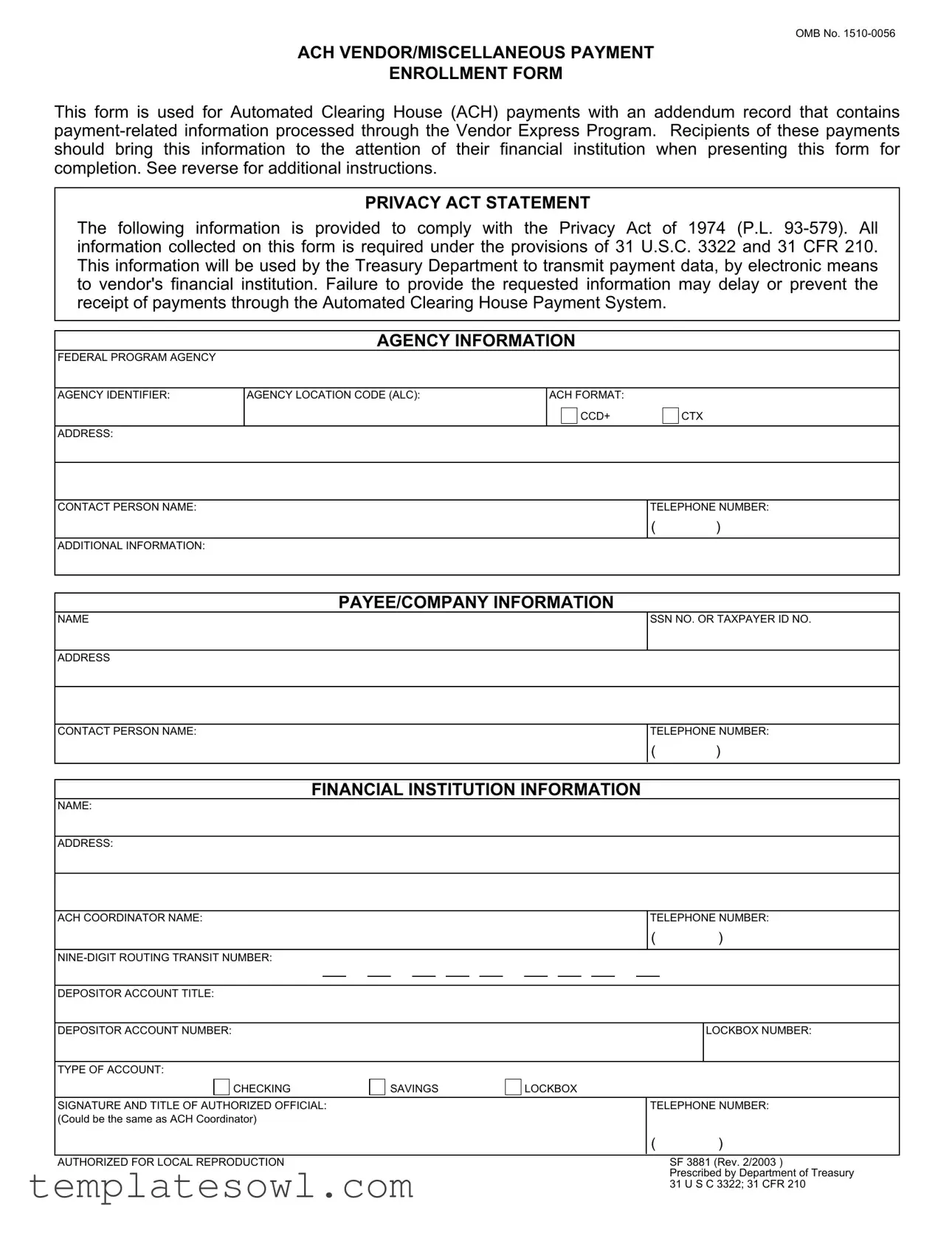

The ACH Vendor Payment form plays a crucial role in facilitating seamless financial transactions between vendors and federal agencies. Designed specifically for Automated Clearing House (ACH) payments through the Vendor Express Program, this form includes an addendum record that captures essential payment-related information. Vendors must ensure that their financial institutions are informed when completing this form to prevent any mishaps or delays. Importantly, the form adheres to the stipulations outlined in the Privacy Act of 1974, demanding accurate information under 31 U.S.C. 3322 and 31 CFR 210 to ensure timely processing of payments. Each section of the form, including agency information, payee details, and financial institution specifics, requires careful attention. This approach ensures all data is correctly provided, from agency identifiers to the depositor account information. Simplifying administrative processes, this form emphasizes accuracy and collaboration between all parties involved. Completing this form not only helps maintain efficient payment routes but also secures the necessary financial details to prevent interruptions in service. With a straightforward structure and clear instructions, this form ultimately streamlines payment operations for federal programs.

Ach Vendor Payment Example

OMB No.

ACH VENDOR/MISCELLANEOUS PAYMENT

ENROLLMENT FORM

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains

PRIVACY ACT STATEMENT

The following information is provided to comply with the Privacy Act of 1974 (P.L.

AGENCY INFORMATION

FEDERAL PROGRAM AGENCY

AGENCY IDENTIFIER: |

AGENCY LOCATION CODE (ALC): |

ACH FORMAT: |

|

|

||

|

|

|

|

CCD+ |

|

CTX |

|

|

|

|

|

||

|

|

|

|

|

|

|

ADDRESS: |

|

|

|

|

|

|

CONTACT PERSON NAME:

ADDITIONAL INFORMATION:

TELEPHONE NUMBER:

( )

PAYEE/COMPANY INFORMATION

NAME

ADDRESS

CONTACT PERSON NAME:

SSN NO. OR TAXPAYER ID NO.

TELEPHONE NUMBER:

( )

FINANCIAL INSTITUTION INFORMATION

NAME:

ADDRESS:

ACH COORDINATOR NAME:

TELEPHONE NUMBER:

( )

DEPOSITOR ACCOUNT TITLE:

DEPOSITOR ACCOUNT NUMBER: |

|

|

|

|

|

LOCKBOX NUMBER: |

||

|

|

|

|

|

|

|

|

|

TYPE OF ACCOUNT: |

|

|

|

|

|

|

||

|

|

CHECKING |

|

SAVINGS |

|

LOCKBOX |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: |

|

|

|

|

TELEPHONE NUMBER: |

|||

(Could be the same as ACH Coordinator) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

( |

) |

AUTHORIZED FOR LOCAL REPRODUCTION |

SF 3881 (Rev. 2/2003 ) |

|

Prescribed by Department of Treasury |

|

31 U S C 3322; 31 CFR 210 |

Instructions for Completing SF 3881 Form

Make three copies of form after completing. Copy 1 is the Agency Copy; copy 2 is the Payee/ Company Copy; and copy 3 is the Financial Institution Copy.

1.Agency Information Section - Federal agency prints or types the name and address of the Federal program agency originating the vendor/miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency. Also, the appropriate box for ACH format is checked.

2.Payee/Company Information Section - Payee prints or types the name of the payee/company and address that will receive ACH vendor/miscellaneous payments, social security or taxpayer ID number, and contact person name and telephone number of the payee/company. Payee also verifies depositor account number, account title, and type of account entered by your financial institution in the Financial Institution Information Section.

3.Financial Institution Information Section - Financial institution prints or types the name and address of the payee/company's financial institution who will receive the ACH payment, ACH coordinator name and telephone number,

Burden Estimate Statement

The estimated average burden associated with this collection of information is 15 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Financial Management Service, Facilities Management Division, Property and Supply Branch, Room

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form enables vendors to enroll for Automated Clearing House (ACH) payments, ensuring efficient electronic transactions. |

| Privacy Compliance | The information collected complies with the Privacy Act of 1974, ensuring your data is handled with care and respect. |

| Governing Law | It falls under the provisions of 31 U.S.C. 3322 and 31 CFR 210, mandating specific processing guidelines for payments. |

| Required Information | Information such as SSN or Taxpayer ID, financial institution details, and account numbers are mandatory for processing. |

| Estimated Completion Time | On average, it takes about 15 minutes to complete this form, depending on personal circumstances. |

| Distribution of Copies | After filling out the form, make three copies for the agency, payee, and financial institution, ensuring everyone has the necessary documentation. |

Guidelines on Utilizing Ach Vendor Payment

After you have gathered all the necessary information, filling out the ACH Vendor Payment form will be a straightforward process. Make sure you have the required details of your agency, payee, and financial institution on hand. The next steps will guide you through completing the form accurately, ensuring timely processing of your ACH payments.

- Agency Information Section: Begin by entering the name and address of the federal program agency that is initiating the payment. Include the agency identifier and agency location code. Additionally, fill in the contact person's name and telephone number. Don't forget to check the box for the appropriate ACH format.

- Payee/Company Information Section: Print or type the name of the payee or company that will receive the ACH payments. Provide the address, social security number (SSN) or taxpayer ID number, and contact person’s name and telephone number. Verify that the depositor account number, account title, and account type have been accurately entered by your financial institution.

- Financial Institution Information Section: Here, enter the name and address of the financial institution that will receive the ACH payment. Include the name and telephone number of the ACH coordinator. Provide the nine-digit routing transit number, account title, and account number. Ensure the correct account type is checked, and secure the signature, title, and telephone number of the authorized official at the financial institution.

Once the form is completed, make three copies for your records: one for the agency, one for the payee/company, and one for the financial institution. Keeping these copies will help you track the process and address any potential issues that arise.

What You Should Know About This Form

What is the purpose of the ACH Vendor Payment form?

The ACH Vendor Payment form is designed to facilitate Automated Clearing House (ACH) transactions. Specifically, it allows for electronic payments processed through the Vendor Express Program. By completing this form, vendors ensure that their payment-related information is correctly transmitted to their financial institutions, allowing for timely and efficient payment processing.

Who needs to complete the ACH Vendor Payment form?

This form must be completed by vendors or payees who wish to receive payments via ACH. It is essential for any individual or organization that expects to participate in the Vendor Express Program and desires a streamlined method for receiving funds electronically.

What information is required on the form?

The form requires several key pieces of information. This includes details about the federal program agency initiating the payment, as well as the payee or company’s name, address, and taxpayer information. Additionally, information from the financial institution must be included, such as the routing transit number, account title, and a signature from an authorized official of the bank.

What should be done if information is missing or incorrect?

If any information is missing or incorrectly filled out, it is crucial to address this before submission. Incorrect or incomplete information may result in delays or prevent the successful processing of payments. Vendors should verify all details, especially those from their financial institution, to ensure accuracy.

Is there any privacy consideration for submitting the form?

Yes, the ACH Vendor Payment form adheres to the Privacy Act of 1974, which mandates the protection of the personal information collected. The form collects information necessary for processing payments and is shared only with the Treasury Department and the vendor's financial institution, ensuring that sensitive data is handled appropriately.

What should I do after completing the form?

Once the form is completed, it is important to make copies. Three copies should be made: one for the agency, one for the payee or company, and one for the financial institution. This ensures that all parties have the necessary documentation to reference during the payment process.

Common mistakes

Completing the ACH Vendor Payment form can be straightforward, but many individuals make critical mistakes that can lead to delays in payment processing. One of the most common errors occurs in the agency information section. People often fail to print or type the name of the agency correctly or skip essential details like the agency identifier and location code. This missing information can create confusion and potential roadblocks in processing payments.

Another mistake involves the payee/company information section. It is crucial to provide an accurate social security number or taxpayer ID number. Many individuals mistakenly enter incorrect numbers or neglect to verify their accuracy. This oversight can lead to significant delays, as the Treasury Department relies on this information to process payments properly.

In the financial institution information section, another frequent error is the incorrect entry of the nine-digit routing transit number. Some individuals may overlook confirming this number with their financial institution. Without the correct routing number, payments may not reach the intended destination, which adds more complications to an already cumbersome process.

Individuals also often miss checking the appropriate type of account box. Whether it's checking or savings, this detail must be accurately indicated on the form. Failing to do so can cause processing delays, as financial institutions may need additional time to clarify the account type.

Lastly, one of the most notable mistakes is neglecting the signature of the authorized official. It is critical that this part is completed correctly. A missing signature can invalidate the entire form, resulting in further delays and frustration. Taking the time to ensure all sections are adequately filled out will help avoid unnecessary complications and ensure prompt payments.

Documents used along the form

The ACH Vendor Payment form plays a crucial role in ensuring that payments are processed efficiently through the Automated Clearing House system. However, it often works in conjunction with other key documents that help facilitate the payment process. Here are some commonly used forms and documents that you might encounter.

- W-9 Form: This form is used by a business to provide their taxpayer identification information to another party, typically for tax reporting purposes. It helps the requester to accurately report payments made to the vendor.

- Invoice: A detailed document issued by a vendor requesting payment for goods or services rendered. The invoice specifies the amount owed, what the payment is for, and may include payment terms.

- Vendor Registration Form: This document collects necessary information about a vendor, such as contact details and banking information, for onboarding purposes. It's crucial for ensuring that vendors are set up correctly in the payment system.

- Payment Authorization Form: This form is used to authorize payments to vendors. It typically requires signatures from designated personnel to validate the expenditure.

- ACH Payment Notification: After an ACH transaction is initiated, this notification informs the vendor of the payment details. It acts as a record for both the payer and payee, detailing the amount and transaction date.

- Direct Deposit Authorization Form: This form gives a financial institution permission to deposit funds directly into a recipient's bank account. It is often required for setting up recurring payments.

- Proof of Insurance Certificate: Depending on the nature of the transaction, vendors might need to provide proof of insurance, ensuring that they are compliant with risk management policies before payment can be processed.

Understanding these supplementary documents can help streamline the payment process for vendors, ensuring timely and accurate transactions. By keeping these forms organized and readily available, businesses can enhance their financial interactions.

Similar forms

Invoice Submission Form: This document is used to request payment for goods or services provided, similar to how the ACH Vendor Payment form initiates payments electronically.

Purchase Order (PO): A purchase order outlines the agreement between the buyer and seller, much like the ACH form details the vendor and payment information before processing transactions.

Direct Deposit Authorization Form: This form allows employees or vendors to authorize direct deposits, which is the primary function of the ACH Vendor Payment form for vendors.

W-9 Form: Used to provide taxpayer identification information, the W-9 is often needed alongside the ACH form to ensure accurate payment processing.

Payment Request Form: This form is used within organizations to initiate payments, much like the ACH form requests automated payments from financial institutions.

Taxpayer Identification Number (TIN) Certification: This is a formal record to certify identity, similar to how the ACH form collects personal and banking information for payment processing.

Service Agreement: A contract that outlines the terms of service, this document is analogous to the ACH form, which stipulates the payment conditions for services rendered.

Reimbursement Request Form: Used for claiming expenses, this form operates similarly to the ACH Vendor Payment form as it also seeks to facilitate the transfer of funds.

Dos and Don'ts

- Do verify the correct agency information is included.

- Do ensure all sections are filled out completely.

- Do check the accuracy of the financial institution's details.

- Do confirm the depositor account number and title.

- Do make three copies of the completed form for records.

- Don't leave any required fields blank.

- Don't forget to include a contact telephone number.

Misconceptions

Below are some common misconceptions about the ACH Vendor Payment form, along with clarifications to help you better understand its purpose and use.

- It is optional to provide all information on the form. Many people believe that certain fields can be left blank. However, all information is necessary and helps ensure timely payment processing.

- All information is kept private and secure. While the form complies with the Privacy Act, it is important to understand that some necessary data will be shared with financial institutions to process payments.

- The form can be submitted casually through email. This misunderstanding can lead to delays. The form must be presented to the financial institution in person for completion.

- Filling out the form is a lengthy process. In reality, it typically takes about 15 minutes to complete, depending on individual circumstances.

- Only personal bank accounts can be used for payments. This form can accommodate various account types, including business accounts, as long as the correct details are provided.

- Signature from the financial institution is not essential. A valid signature from an authorized official is required to ensure the information is verified and accurate.

- There is no need for copies of the completed form. In fact, you should make three copies: one for the agency, one for the payee/company, and another for the financial institution for their records.

Key takeaways

When filling out and using the ACH Vendor Payment form, several key points ensure a smooth process. Understanding these points can lead to effective and timely payments.

- The purpose of the form: This form is specifically designed for Automated Clearing House (ACH) payments, which allows for electronic transfers of funds.

- Privacy concerns: Information collected is regulated under the Privacy Act of 1974. It's important to remember that all required details are necessary for processing payments.

- Accuracy matters: Ensure that all information, including names, addresses, and account numbers, is accurate to avoid any delays or issues in processing payments.

- Required copies: After completing the form, make three copies: one for the agency, one for the payee/company, and one for the financial institution. This ensures that everyone involved has the necessary documentation.

- Agency Information section: This section must be completed by the federal agency. It includes details such as agency name, address, and ACH format. Accuracy in this section is crucial for proper identification.

- Payee/Company Information section: The payee must confirm their details, including social security or taxpayer ID numbers. This confirms their eligibility to receive payments.

- Financial Institution Information section: Ensure that your financial institution fills out this portion correctly. It encompasses vital banking details necessary for processing payments.

- Signature required: An authorized official's signature is essential before submission. This adds a layer of verification to the information provided and authorizes transactions.

Following these key takeaways helps in effectively utilizing the ACH Vendor Payment form, ensuring a hassle-free payment experience.

Browse Other Templates

Oklahoma Tax Refund Status - You can submit requests and track notices through your OkTAP account.

Scaled Score to Standard Score - Stringent adherence to these scores can help manage expectations in various professional settings.