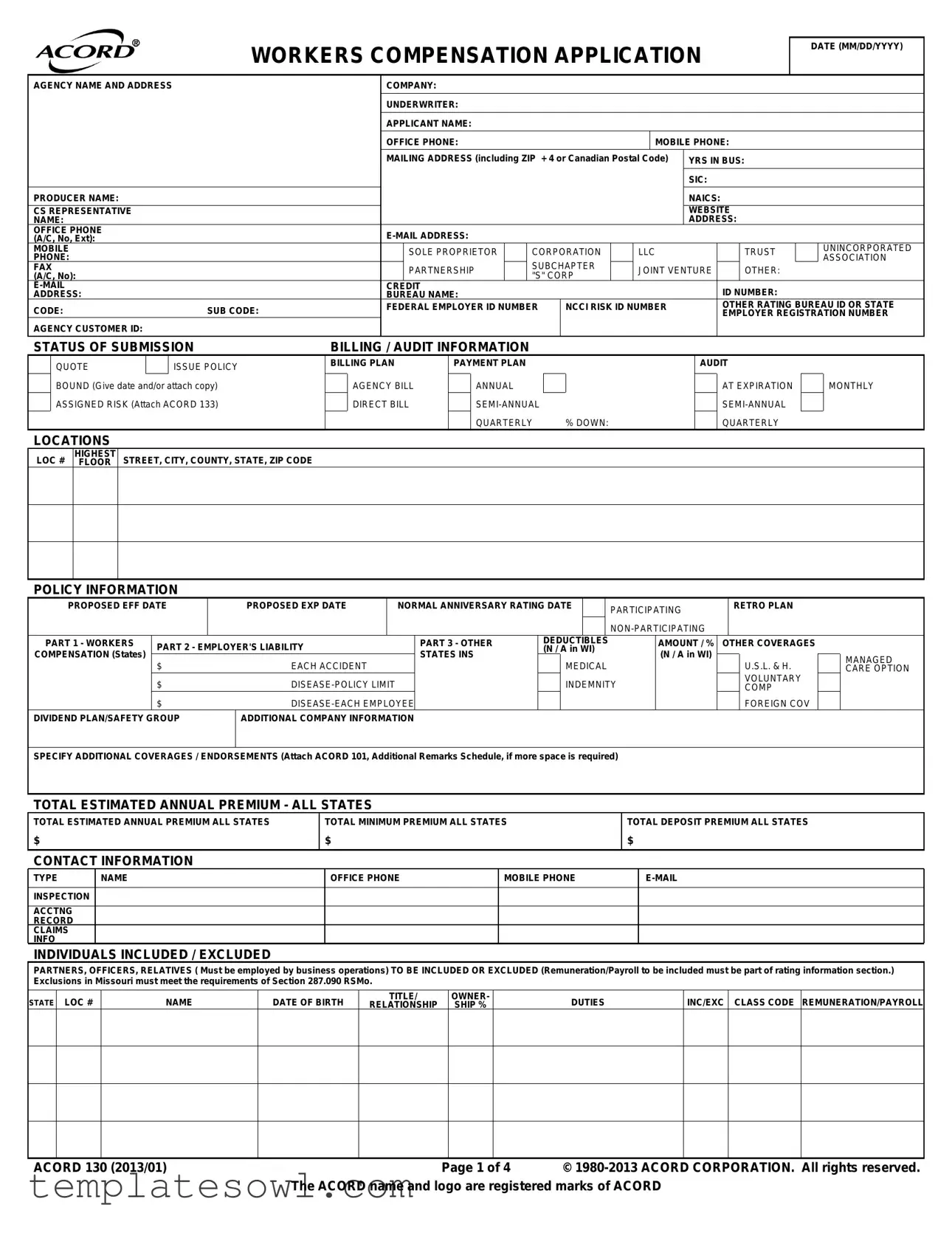

Fill Out Your Acord 130 Form

The Acord 130 form plays a crucial role in facilitating the application process for workers' compensation insurance. It gathers vital information from applicants to help insurance carriers assess risk accurately. This form requires the inclusion of key details, such as the applicant’s business name, type of entity, and contact information. It also asks for specifics on the years in business and relevant classifications, such as Standard Industrial Classification (SIC) and North American Industry Classification System (NAICS) codes. Additionally, the form requests details about the estimated payroll, the number of employees, and any claims history to evaluate past performance and determine eligibility. Beyond these elements, it addresses coverage needs by allowing applicants to specify desired limits and any additional endorsements that may apply. Understanding the comprehensive nature of the Acord 130 form can streamline the submission process, helping businesses obtain the necessary protection while ensuring compliance with underwriting requirements.

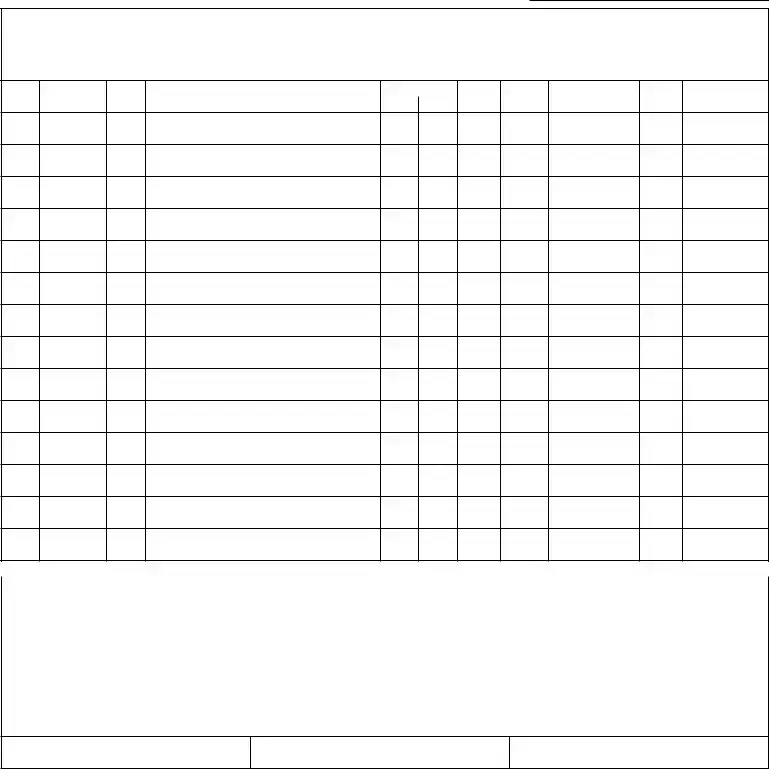

Acord 130 Example

WORKERS COMPENSATION APPLICATION |

DATE (MM/DD/YYYY) |

|

|

|

|

AGENCY NAME AND ADDRESS |

|

|

|

|

COMPANY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDERWRITER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICE PHONE: |

|

|

|

|

|

|

|

|

|

|

MOBILE PHONE: |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS (including ZIP + 4 or Canadian Postal Code) |

YRS IN BUS: |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIC: |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRODUCER NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAICS: |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

CS REPRESENTATIVE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEBSITE |

|

|

|

||||||||||||

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS: |

|

|

|

||||||||

OFFICE PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(A/C, No, Ext): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MOBILE |

|

|

|

|

|

|

|

|

|

|

|

|

|

SOLE PROPRIETOR |

|

|

CORPORATION |

|

LLC |

|

|

|

|

|

TRUST |

|

|

|

UNINCORPORATED |

||||||||||||||

PHONE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSOCIATION |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBCHAPTER |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

FAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

PARTNERSHIP |

|

|

|

JOINT VENTURE |

|

|

|

OTHER: |

|

|

|

||||||||||||||||||

(A/C, No): |

|

|

|

|

|

|

|

|

|

|

|

|

|

"S" CORP |

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ID NUMBER: |

|

|

|

|||||||||||||

ADDRESS: |

|

|

|

|

|

|

|

|

|

|

BUREAU NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

CODE: |

|

|

|

|

|

|

SUB CODE: |

|

|

FEDERAL EMPLOYER ID NUMBER |

|

|

NCCI RISK ID NUMBER |

|

|

|

OTHER RATING BUREAU ID OR STATE |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER REGISTRATION NUMBER |

|||||||||||||

AGENCY CUSTOMER ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

STATUS OF SUBMISSION |

|

BILLING / AUDIT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

QUOTE |

|

|

|

ISSUE POLICY |

|

BILLING PLAN |

|

PAYMENT PLAN |

|

|

|

|

|

|

|

|

|

|

|

|

AUDIT |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

BOUND (Give date and/or attach copy) |

|

|

AGENCY BILL |

|

|

ANNUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AT EXPIRATION |

|

|

MONTHLY |

||||||||||||||||||

|

ASSIGNED RISK (Attach ACORD 133) |

|

|

DIRECT BILL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUARTERLY |

|

|

% DOWN: |

|

|

|

|

|

|

|

QUARTERLY |

|

|

|

||||||||||

LOCATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

LOC # |

HIGHEST |

|

STREET, CITY, COUNTY, STATE, ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

FLOOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

POLICY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

PROPOSED EFF DATE |

|

|

PROPOSED EXP DATE |

|

|

NORMAL ANNIVERSARY RATING DATE |

|

|

PARTICIPATING |

|

|

|

|

RETRO PLAN |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

PART 1 - WORKERS |

PART 2 - EMPLOYER'S LIABILITY |

|

|

|

|

|

PART 3 - OTHER |

|

|

DEDUCTIBLES |

|

|

|

|

AMOUNT / % |

OTHER COVERAGES |

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

(N / A in WI) |

|

|

|

|

|

|

||||||||||||||||||||||||||||||

COMPENSATION (States) |

|

|

|

|

|

STATES INS |

|

|

|

|

|

(N / A in WI) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

$ |

|

|

|

EACH ACCIDENT |

|

|

|

|

|

MEDICAL |

|

|

|

|

|

|

U.S.L. & H. |

|

|

MANAGED |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARE OPTION |

|||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

INDEMNITY |

|

|

|

|

|

|

|

|

VOLUNTARY |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMP |

|

|

|

|||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN COV |

|

|

|

||||||||

DIVIDEND PLAN/SAFETY GROUP |

|

ADDITIONAL COMPANY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIFY ADDITIONAL COVERAGES / ENDORSEMENTS (Attach ACORD 101, Additional Remarks Schedule, if more space is required)

TOTAL ESTIMATED ANNUAL PREMIUM - ALL STATES

TOTAL ESTIMATED ANNUAL PREMIUM ALL STATES |

TOTAL MINIMUM PREMIUM ALL STATES |

TOTAL DEPOSIT PREMIUM ALL STATES |

$ |

$ |

$ |

|

|

|

CONTACT INFORMATION

TYPE |

NAME |

OFFICE PHONE |

MOBILE PHONE |

|

|

|

|

|

|

INSPECTION |

|

|

|

|

|

|

|

|

|

ACCTNG |

|

|

|

|

RECORD |

|

|

|

|

CLAIMS |

|

|

|

|

INFO |

|

|

|

|

INDIVIDUALS INCLUDED / EXCLUDED

PARTNERS, OFFICERS, RELATIVES ( Must be employed by business operations) TO BE INCLUDED OR EXCLUDED (Remuneration/Payroll to be included must be part of rating information section.) Exclusions in Missouri must meet the requirements of Section 287.090 RSMo.

STATE |

LOC # |

NAME |

DATE OF BIRTH |

TITLE/ |

OWNER- |

DUTIES |

INC/EXC |

CLASS CODE |

REMUNERATION/PAYROLL |

RELATIONSHIP |

SHIP % |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACORD 130 (2013/01) |

Page 1 of 4 |

© |

|

The ACORD name and logo are registered marks of ACORD |

|

STATE RATING SHEET # |

|

OF |

|

SHEETS |

AGENCY CUSTOMER ID: |

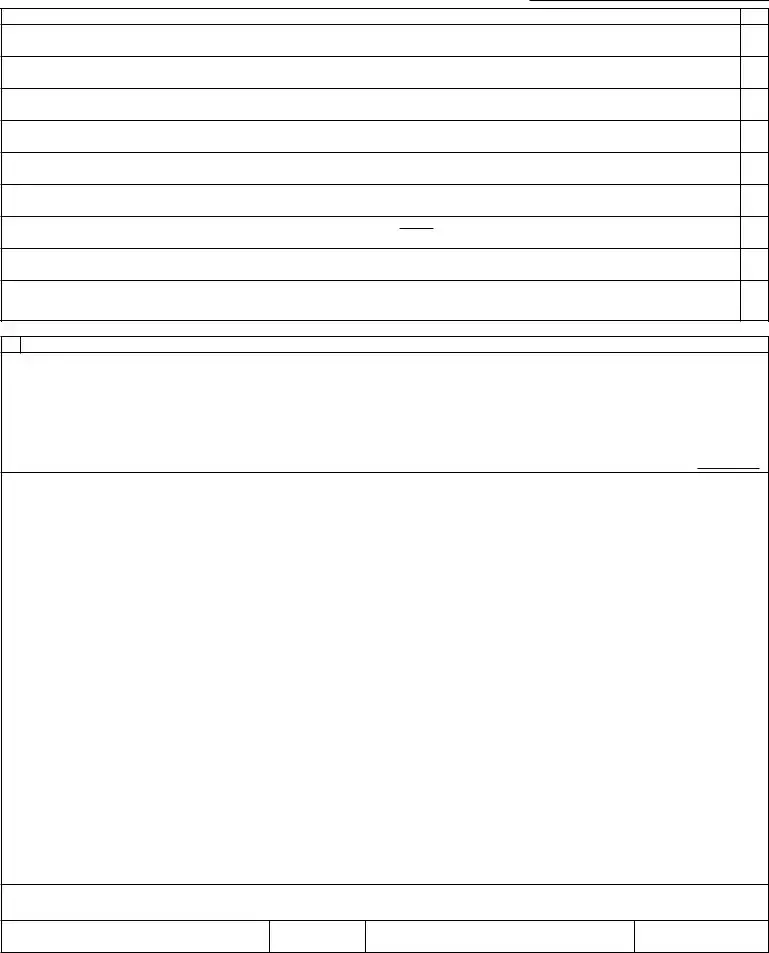

STATE RATING WORKSHEET

FOR MULTIPLE STATES, ATTACH AN ADDITIONAL PAGE 2 OF THIS FORM RATING INFORMATION - STATE:

LOC # CLASS CODE

DESCR

CODE

CATEGORIES, DUTIES, CLASSIFICATIONS

# EMPLOYEES

FULL PART

TIME TIME

SIC

NAICS

ESTIMATED ANNUAL

REMUNERATION/

PAYROLL

ESTIMATED

RATE ANNUAL MANUAL PREMIUM

PREMIUM

STATE: |

FACTOR |

FACTORED PREMIUM |

|

FACTOR |

FACTORED PREMIUM |

TOTAL |

N / A |

$ |

|

|

$ |

INCREASED LIMITS |

|

$ |

SCHEDULE RATING * |

|

$ |

DEDUCTIBLE * |

|

$ |

CCPAP |

|

$ |

|

|

$ |

STANDARD PREMIUM |

|

$ |

EXPERIENCE OR MERIT |

|

$ |

PREMIUM DISCOUNT |

|

$ |

MODIFICATION |

|

|

|||

|

|

$ |

EXPENSE CONSTANT |

N / A |

$ |

ASSIGNED RISK SURCHARGE * |

|

$ |

TAXES / ASSESSMENTS * |

N / A |

$ |

ARAP * |

|

$ |

|

|

$ |

* N / A in Wisconsin |

|

|

|

|

|

TOTAL ESTIMATED ANNUAL PREMIUM

$

MINIMUM PREMIUM

$

DEPOSIT PREMIUM

$

REMARKS (ACORD 101, Additional Remarks Schedule, may be attached if more space is required)

|

|

ACORD 130 (2013/01) |

Page 2 of 4 |

PRIOR CARRIER INFORMATION / LOSS HISTORY

AGENCY CUSTOMER ID:

PROVIDE INFORMATION FOR THE PAST 5 YEARS AND USE THE REMARKS SECTION FOR LOSS DETAILS |

|

|

|

LOSS RUN ATTACHED |

|

||

YEAR |

CARRIER & POLICY NUMBER |

ANNUAL PREMIUM |

MOD |

# CLAIMS |

AMOUNT PAID |

RESERVE |

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

|

POL #: |

|

|

|

|

|

|

|

CO: |

|

|

|

|

|

|

POL #:

NATURE OF BUSINESS / DESCRIPTION OF OPERATIONS

GIVE COMMENTS AND DESCRIPTIONS OF BUSINESS, OPERATIONS AND PRODUCTS: MANUFACTURING - RAW MATERIALS, PROCESSES, PRODUCT, EQUIPMENT; CONTRACTOR - TYPE OF WORK,

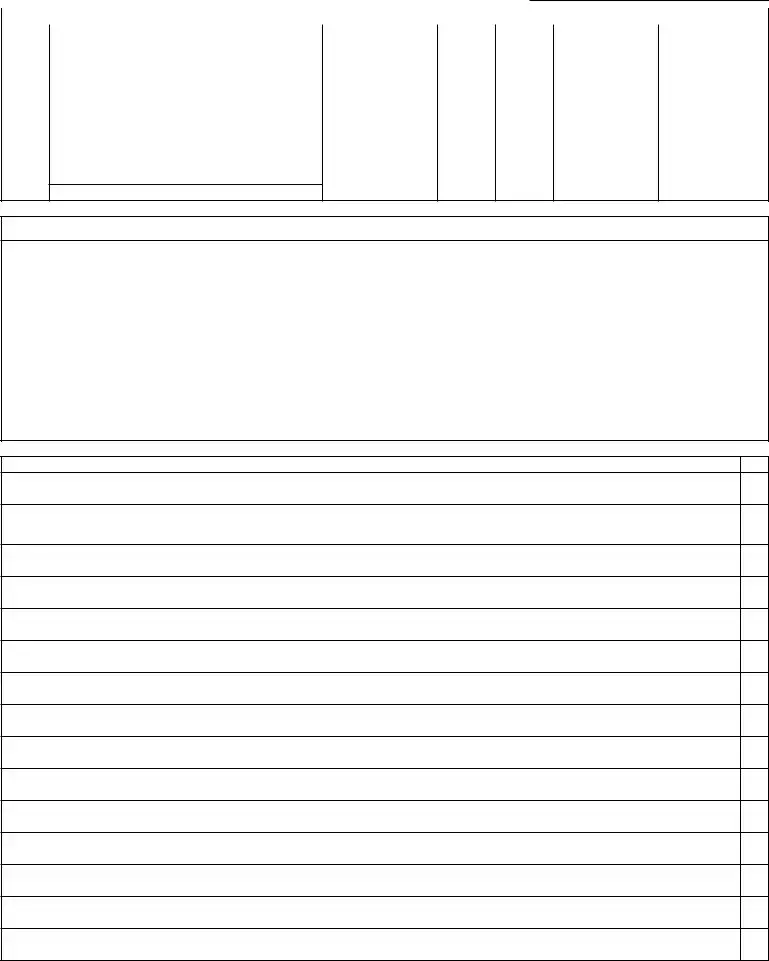

GENERAL INFORMATION

EXPLAIN ALL "YES" RESPONSES

1.DOES APPLICANT OWN, OPERATE OR LEASE AIRCRAFT / WATERCRAFT?

2.DO / HAVE PAST, PRESENT OR DISCONTINUED OPERATIONS INVOLVE(D) STORING, TREATING, DISCHARGING, APPLYING, DISPOSING, OR TRANSPORTING OF HAZARDOUS MATERIAL? (e.g. landfills, wastes, fuel tanks, etc)

3.ANY WORK PERFORMED UNDERGROUND OR ABOVE 15 FEET?

4.ANY WORK PERFORMED ON BARGES, VESSELS, DOCKS, BRIDGE OVER WATER?

5.IS APPLICANT ENGAGED IN ANY OTHER TYPE OF BUSINESS?

6.ARE

7.ANY WORK SUBLET WITHOUT CERTIFICATES OF INSURANCE? (If "YES", payroll for this work must be included in the State Rating Worksheet on Page 2)

8.IS A WRITTEN SAFETY PROGRAM IN OPERATION?

9.ANY GROUP TRANSPORTATION PROVIDED?

10.ANY EMPLOYEES UNDER 16 OR OVER 60 YEARS OF AGE?

11.ANY SEASONAL EMPLOYEES?

12.IS THERE ANY VOLUNTEER OR DONATED LABOR? (If "YES", please specify)

13.ANY EMPLOYEES WITH PHYSICAL HANDICAPS?

14.DO EMPLOYEES TRAVEL OUT OF STATE? (If "YES", indicate state(s) of travel and frequency)

15.ARE ATHLETIC TEAMS SPONSORED?

Y / N

ACORD 130 (2013/01) |

Page 3 of 4 |

GENERAL INFORMATION (continued)

AGENCY CUSTOMER ID:

EXPLAIN ALL "YES" RESPONSES

16.ARE PHYSICALS REQUIRED AFTER OFFERS OF EMPLOYMENT ARE MADE?

17.ANY OTHER INSURANCE WITH THIS INSURER?

18.ANY PRIOR COVERAGE DECLINED / CANCELLED /

19.ARE EMPLOYEE HEALTH PLANS PROVIDED?

20.DO ANY EMPLOYEES PERFORM WORK FOR OTHER BUSINESSES OR SUBSIDIARIES?

21.DO YOU LEASE EMPLOYEES TO OR FROM OTHER EMPLOYERS?

22.DO ANY EMPLOYEES PREDOMINANTLY WORK AT HOME? If "YES", # of Employees:

23.ANY TAX LIENS OR BANKRUPTCY WITHIN THE LAST FIVE (5) YEARS? (If "YES", please specify)

24.ANY UNDISPUTED AND UNPAID WORKERS COMPENSATION PREMIUM DUE FROM YOU OR ANY COMMONLY MANAGED OR OWNED ENTERPRISES? IF YES, EXPLAIN INCLUDING ENTITY NAME(S) AND POLICY NUMBER(S).

Y / N

SIGNATURE

Copy of the Notice of Information Practices (Privacy) has been given to the applicant. (Not required in all states, contact your agent or broker for your state's requirements.)

PERSONAL INFORMATION ABOUT YOU, INCLUDING INFORMATION FROM A CREDIT OR OTHER INVESTIGATIVE REPORT, MAY BE COLLECTED FROM PERSONS OTHER THAN YOU IN CONNECTION WITH THIS APPLICATION FOR INSURANCE AND SUBSEQUENT AMENDMENTS AND RENEWALS. SUCH INFORMATION AS WELL AS OTHER PERSONAL AND PRIVILEGED INFORMATION COLLECTED BY US OR OUR AGENTS MAY IN CERTAIN CIRCUMSTANCES BE DISCLOSED TO THIRD PARTIES WITHOUT YOUR AUTHORIZATION. CREDIT SCORING INFORMATION MAY BE USED TO HELP DETERMINE EITHER YOUR ELIGIBILITY FOR INSURANCE OR THE PREMIUM YOU WILL BE CHARGED. WE MAY USE A THIRD PARTY IN CONNECTION WITH THE DEVELOPMENT OF YOUR SCORE. YOU MAY HAVE THE RIGHT TO REVIEW YOUR PERSONAL INFORMATION IN OUR FILES AND REQUEST CORRECTION OF ANY INACCURACIES. YOU MAY ALSO HAVE THE RIGHT TO REQUEST IN WRITING THAT WE CONSIDER EXTRAORDINARY LIFE CIRCUMSTANCES IN CONNECTION WITH THE DEVELOPMENT OF YOUR CREDIT SCORE. THESE RIGHTS MAY BE LIMITED IN SOME STATES. PLEASE CONTACT YOUR AGENT OR BROKER TO LEARN HOW THESE RIGHTS MAY APPLY IN YOUR STATE OR FOR INSTRUCTIONS ON HOW TO SUBMIT A REQUEST TO US FOR A MORE DETAILED DESCRIPTION OF YOUR RIGHTS AND OUR PRACTICES REGARDING PERSONAL INFORMATION.

(Not applicable in AZ, CA, DE, KS, MA, MN, ND, NY, OR, VA, or WV. Specific ACORD 38s are available for applicants in these states.)

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects that person to criminal and civil penalties (In Oregon, the aforementioned actions may constitute a fraudulent insurance act which may be a crime and may subject the person to penalties). (In New York, the civil penalty is not to exceed five thousand dollars ($5,000) and the stated value of the claim for each such violation). (Not applicable in AL, AR, AZ, CO, DC, FL, KS, LA, ME, MD, MN, NM, OK, PR, RI, TN, VA, VT, WA and WV).

Applicable in AL, AR, AZ, DC, LA, MD, NM, RI and WV: Any person who knowingly (or willfully in MD) presents a false or fraudulent claim for payment of a loss or benefit or who knowingly (or willfully in MD) presents false information in an application for insurance is guilty of a crime and may be subject to fines or confinement in prison.

Applicable in Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company, Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the department of regulatory agencies.

Applicable in Florida and Oklahoma: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony (In FL, a person is guilty of a felony of the third degree).

Applicable in Kansas: Any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or belief that it will be presented to or by an insurer, purported insurer, broker or any agent thereof, any written statement as part of, or in support of, an application for the issuance of, or the rating of an insurance policy for personal or commercial insurance, or a claim for payment or other benefit pursuant to an insurance policy for commercial or personal insurance which such person knows to contain materially false information concerning any fact material thereto; or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act.

Applicable in Maine, Tennessee, Virginia and Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Applicable in Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

Applicable in Utah: Any person who knowingly presents false or fraudulent underwriting information, files or causes to be filed a false or fraudulent claim for disability compensation or medical benefits, or submits a false or fraudulent report or billing for health care fees or other professional services is guilty of a crime and may be subject to fines and confinement in state prison.

THE UNDERSIGNED IS AN AUTHORIZED REPRESENTATIVE OF THE APPLICANT AND REPRESENTS THAT REASONABLE INQUIRY HAS BEEN MADE TO OBTAIN THE ANSWERS TO QUESTIONS ON THIS APPLICATION. HE/SHE REPRESENTS THAT THE ANSWERS ARE TRUE, CORRECT AND COMPLETE TO THE BEST OF HIS/HER KNOWLEDGE.

APPLICANT'S SIGNATURE (Must be Officer, Owner or Partner)

DATE

PRODUCER'S SIGNATURE

NATIONAL PRODUCER NUMBER

ACORD 130 (2013/01) |

Page 4 of 4 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ACORD 130 form is used to apply for workers' compensation insurance. |

| Submission Date | The form requires a specified application date, formatted as MM/DD/YYYY. |

| Applicant Information | Key details, such as the applicant's name, address, and contact numbers, must be included on the form. |

| Business Structure | The applicant selects their business structure, which may include sole proprietor, corporation, LLC, partnership, and others. |

| Coverage Sections | The form has multiple sections addressing workers' compensation, employer's liability, and other coverages. |

| State-Specific Laws | Each state has different laws governing workers' compensation. Ensure to reference local laws when filling out the form. |

| Estimated Premiums | Applicants are required to provide estimated annual premiums for various coverage types. |

| Exclusions | Information about individuals included or excluded from coverage must be provided, with specific regulations varying by state. |

| Fraud Warnings | The form includes warnings about the consequences of submitting false information, which can lead to criminal penalties. |

Guidelines on Utilizing Acord 130

Filling out the ACORD 130 form requires careful attention to detail to ensure accuracy and completeness. This application is an important step in obtaining workers' compensation insurance. Below are the steps to assist in the process of filling out the form effectively.

- Begin by entering the date of application in the format MM/DD/YYYY.

- Provide the agency name and address including any necessary contact details.

- Fill in the company name and the name of the underwriter.

- Input the applicant’s name along with office and mobile phone numbers.

- Complete the mailing address, ensuring to include the ZIP + 4 or Canadian postal code.

- Indicate the number of years in business and provide the relevant SIC and NAICS codes.

- List the producer name and the CS representative’s website if applicable.

- Include the agency customer ID and federal employer ID number, as well as any relevant NCCI risk ID numbers.

- Indicate the status of submission by selecting one of the options for billing or audit information.

- Provide details about locations and their corresponding numbers, along with the highest street address including city, county, state, and ZIP code.

- State the policy information such as proposed effective and expiration dates, anniversary rating date, and any additional coverage options.

- Complete the additional company information, specifying any coverage or endorsements needed.

- Enter the total estimated annual premium and relevant financial details, such as minimum and deposit premiums.

- Provide contact information for individuals involved in the process and list any included or excluded individuals such as partners or officers.

- Fill out the state rating sheet for each location and provide loss history for the past five years.

- Answer all general information questions honestly, particularly those related to operations, safety programs, and employee details.

- Sign the application as the authorized representative of the applicant, including the date of signing.

- Ensure the producer also signs and includes their national producer number to finalize the application.

What You Should Know About This Form

What is the Acord 130 form used for?

The Acord 130 form is a Workers Compensation Application. Businesses use it to apply for workers' compensation insurance coverage. This form collects essential information about the company, including details of operations, employee classifications, and estimated payroll. All this data helps insurance companies assess the risk of providing coverage and determine appropriate premiums.

What information do I need to provide on the Acord 130 form?

When completing the Acord 130 form, you’ll need to fill in several details. This includes the business name, contact information, and the nature of its operations. You'll also be asked to specify the number of employees, their classifications, and payroll estimates. Don’t forget to mention prior coverage and any loss history for the past five years. Accurate and complete information will help ensure a smoother application process.

Who should complete the Acord 130 form?

The Acord 130 form should be completed by an authorized representative of the business, typically an officer, owner, or partner. These individuals are responsible for the accuracy of the information provided. Errors or omissions may lead to complications in obtaining coverage, so it’s beneficial to gather all necessary details before filling it out.

How often do I need to submit the Acord 130 form?

The submission of the Acord 130 form primarily occurs when applying for workers' compensation insurance or renewing an existing policy. If there are significant changes in your business, such as alterations in employee roles, payroll fluctuations, or shifts in operations, it may be required to update the form even outside regular renewal periods. Keeping the information current helps maintain the accuracy of your insurance coverage.

Common mistakes

Filling out the Acord 130 form can seem straightforward, but many people make mistakes that may lead to complications with their workers' compensation insurance. One common error is not providing the correct contact information. All phone numbers, email addresses, and names should be accurate. A simple typo can delay communication and processing.

Another frequent mistake involves the estimated annual premium. Users often underestimate or overestimate this figure. Providing the correct premium is vital, as it directly affects the coverage and budget. Clarity in this section helps ensure accurate premium calculations.

Omitting necessary details about additional coverages or endorsements is another area where applicants err. Many do not take the time to fully explain or attach the required documents. If additional coverages apply, they need to be clearly specified. Failure to do so can result in unanticipated gaps in coverage.

Many also overlook the importance of including a detailed loss history. This should cover at least the past five years. Complete and honest representation of previous claims helps insurers assess risk accurately. Additionally, details about claim amounts and reserves should not be glossed over.

Some applicants mistakenly assume that inclusion or exclusion of specific employees is optional. However, declaring individuals included or excluded, particularly partners and officers, is crucial for accurate payroll calculations. Not doing so can lead to misclassification of risk and improper premium calculations.

Another mistake occurs in the section regarding business operations. Failing to describe the nature of the business properly can raise red flags for underwriters. Thoroughly explaining operations helps in understanding the associated risks and ensuring the right coverage is selected.

Lastly, confusion often arises regarding yes/no questions in the general information section. Inconsistent or incomplete answers can cause unnecessary delays. Respondents should read these questions carefully and provide honest, comprehensive answers. This practice aids in a smoother application process.

Documents used along the form

When completing the ACORD 130 form for a workers' compensation application, several other documents may be required to provide comprehensive information. These documents help ensure that the insurer has all necessary details to assess risk and coverage accurately.

- ACORD 133: This form is used for Assigned Risk applications. It provides additional details regarding the employer's qualifications for the Assigned Risk Pool.

- ACORD 101: This is the Additional Remarks Schedule. It allows applicants to provide extra information or comments that cannot be accommodated in the main form.

- ACORD 125: This form is a standard commercial insurance application. If other types of coverage are being sought alongside workers' compensation, this form may be needed.

- Loss Runs: Loss history reports for the past 5 years. Insurers use these reports to evaluate any claims or incidents that have occurred with your business.

- State-Specific Workers' Compensation Form: Many states require specific forms or endorsements for workers' compensation insurance. These forms collect data unique to the state's regulations.

- Employee Classification Worksheet: This document lists employee classifications and payroll figures. It ensures accurate payroll reporting for premium calculations.

- Safety Program Documentation: A safety program outline may be necessary to demonstrate efforts in maintaining employee safety and compliance with state and federal safety regulations.

- Certificate of Insurance (COI): If you are requesting workers' compensation as a subcontractor, this certificate verifies existing coverage from your primary insurer.

- Business Description Document: A detailed explanation of business operations, including risk factors, helps the insurer assess liability and coverage requirements uniquely associated with your industry.

Filing these documents along with the ACORD 130 form can expedite the review process and lessen the likelihood of delays in receiving coverage. Ensure all paperwork is accurate, complete, and submitted promptly to facilitate a smooth application process.

Similar forms

- ACORD 125 - Commercial Insurance Application: Similar in that it gathers essential information from the applicant, including business details and proposed coverages. It serves as a comprehensive application form for various types of commercial insurance.

- ACORD 133 - Workers' Compensation Assigned Risk Application: Related through its focus on workers' compensation. This form specifically addresses applicants in assigned risk pools, necessitating additional documentation of exposures and risks.

- ACORD 126 - Businessowners Policy Application: This form is also a type of application that reviews an applicant's entire business for coverage eligibility. Both forms require extensive information about the business operations and risks.

- ACORD 101 - Additional Remarks Schedule: Used to provide extra space for the applicant to offer additional details or comments regarding their application. This is often attached to forms like ACORD 130 for further clarifications.

- ACORD 25 - Certificate of Liability Insurance: Though it functions differently, it also relates to insurance verification. ACORD 25 documents coverage details and limits for a specific period, indicating the insured status similar to information found in ACORD 130.

- ACORD 140 - Commercial General Liability Application: Like ACORD 130, this form collects detailed operational information to assess risk before underwriting a policy, particularly for general liability insurance.

- ACORD 46 - Evidence of Property Insurance: Serves the purpose of confirming insurance coverage for property. While it serves a different insurance aspect, it parallels the purpose of validating insurance protection provided in ACORD 130.

- ACORD 27 - Certificate of Errors and Omissions Insurance: This document serves as evidence of coverage specific to errors and omissions liability insurance. It provides similar coverage documentation as found in the ACORD 130.

- ACORD 2 - General Information for Property and Casualty Insurance: It requests fundamental details for a range of insurance products. Both this form and Acord 130 seek critical insights into the applicant’s operations.

- ACORD 90 - Personal Auto Policy Application: Shares the intent of gathering detailed information from applicants. It focuses on personal auto needs, yet both need thorough information for underwriting their respective coverages.

Dos and Don'ts

- DO: Fill in all sections of the Acord 130 form completely. Partial submissions can lead to delays in processing.

- DO: Double-check the proposed effective and expiration dates to avoid gaps in coverage.

- DO: Provide accurate payroll information for all employees to ensure correct premium calculations.

- DO: Keep a copy of the form for your records once submitted.

- DON'T: Omit details regarding employees, especially regarding those who may be included or excluded from coverage.

- DON'T: Leave out any prior loss history information, as this can impact your application’s eligibility.

Misconceptions

There are many misconceptions about the ACORD 130 form. Below are some of the most common misunderstandings and clarifications regarding them.

- Misconception 1: The ACORD 130 form is only for large businesses.

- Misconception 2: Completing the ACORD 130 form is optional.

- Misconception 3: The ACORD 130 form is the same as a general insurance policy.

- Misconception 4: You can't make changes after submitting the ACORD 130 form.

- Misconception 5: All states use the same information on the ACORD 130 form.

- Misconception 6: Employees under 16 and over 60 are automatically excluded from coverage.

- Misconception 7: You can skip the section on loss history if there are none.

- Misconception 8: The form guarantees approval for workers' compensation insurance.

- Misconception 9: The ACORD 130 does not require any personal information.

This form is used by businesses of all sizes to apply for workers' compensation insurance. Small businesses often need it just as much as larger ones.

The form is necessary for obtaining workers' compensation insurance. Insurance companies usually require applicants to submit this document to process their requests.

The ACORD 130 form serves as an application and is not a policy itself. It provides information needed to assess risk and determine coverage.

Adjustments may be made, but you should contact your insurance agent or broker as soon as possible to discuss necessary changes.

Each state has different regulations and requirements, so information may vary. It is crucial to include accurate state-specific details.

While there are special considerations for young and older workers, exclusion from coverage is not automatic. Each case needs to be evaluated individually.

It's always best to provide this section even if there is no loss history. Transparency helps with the assessment process.

Completing the form does not guarantee approval. Each application is reviewed, and decisions are based on multiple factors.

The form does ask for personal and business information, including contact details, which are vital for accurate processing and communication.

Key takeaways

- The Acord 130 form is essential for applying for workers compensation insurance.

- Ensure all fields are filled out accurately, including the applicant’s name, contact information, and business details.

- Indicate the type of business structure (e.g., corporation, LLC, partnership) clearly.

- List all relevant employees, including their specific job duties and remuneration.

- Be transparent about any claims history over the past five years.

- Provide detailed descriptions of your business operations.

- Submit the form through the correct agency and be aware of their submission deadlines.

- Keep a copy of the completed form for your records to reference in future audits.

- Consider additional endorsements or coverage options that may be appropriate for your business needs.

- Understanding the billing and payment plan options is crucial for managing insurance costs effectively.

Browse Other Templates

Payless Trinidad Vacancies - Utilize the Payless Application form to apply for your desired job position.

What Happens If You Lose a Lawsuit and Can't Pay in California - It is crucial to fill out the form accurately to avoid delays in payments approval.

Wisconsin Annual Report Form - By submitting, members affirm the amendments were adopted correctly.