Fill Out Your Act 221 Disclosure Form

The Act 221 Disclosure Form plays a vital role in the resale process of condominiums and townhomes in Illinois, providing essential information that both sellers and buyers need to make informed decisions. This form, which must be filled out by an officer or managing agent of the condominium association, includes several key pieces of information about the unit and the overall association. It details the status of monthly assessments, indicating whether they are paid in full or if there are overdue sums. Importantly, it also informs potential buyers about any special assessments or charges that may affect their future investment. Additionally, the form raises awareness of anticipated capital expenditures and provides transparency regarding the association's reserve or replacement funds. Furthermore, the most recent approved budget of the association offers a snapshot of its financial health. Buyers should also take note of any pending lawsuits involving the association, as these could impact their ownership experience. Lastly, the form provides contact details for the insurance carrier associated with the unit owner's association, ensuring that all parties can address questions that may arise. With such detailed information, the Act 221 Disclosure Form serves as a crucial document in fostering transparency and protecting the interests of all involved in the real estate transaction.

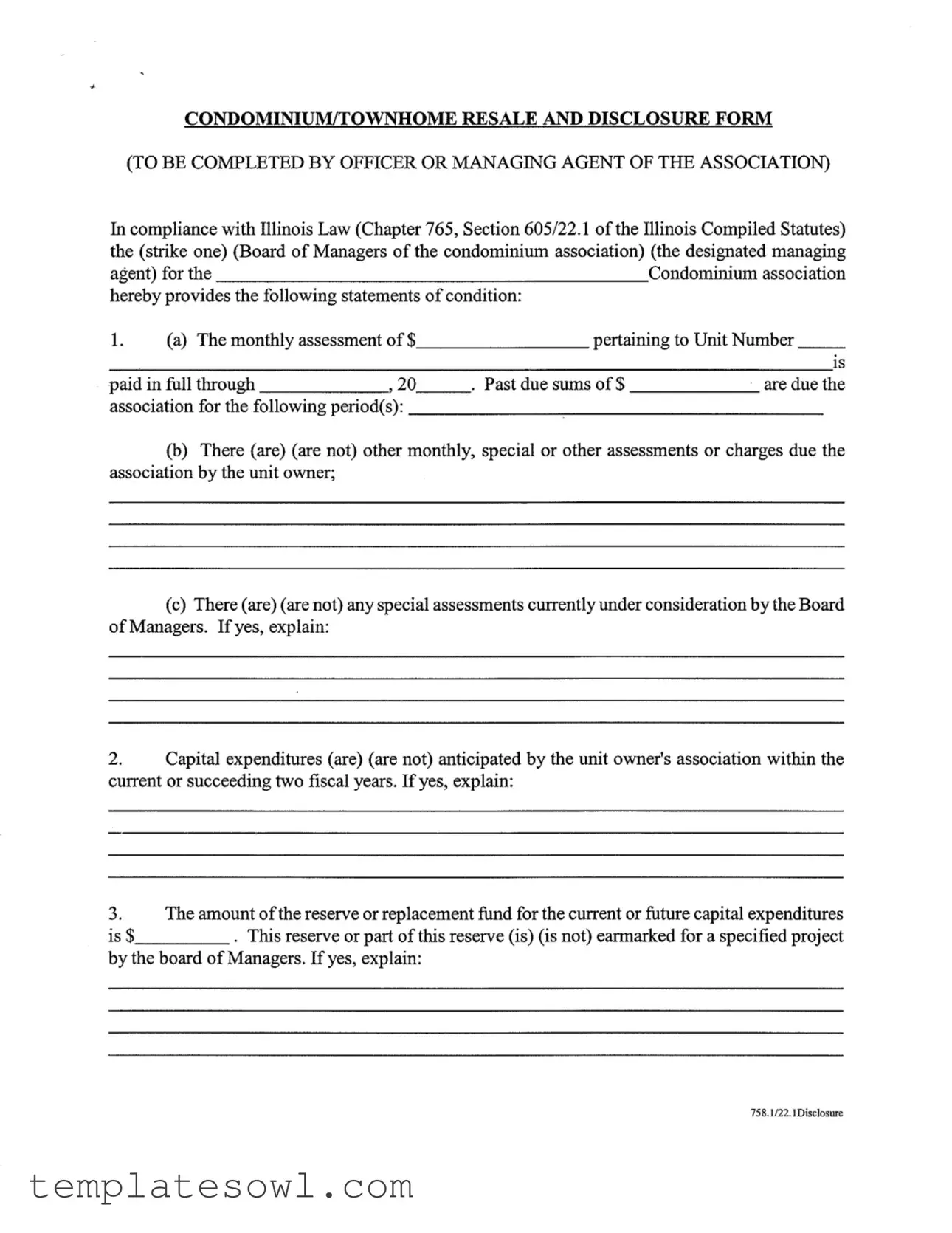

Act 221 Disclosure Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | This form complies with Illinois Law, specifically Chapter 765, Section 605/22.1 of the Illinois Compiled Statutes. |

| Purpose | The Act 221 Disclosure form provides necessary financial and legal information about a condominium or townhome association to prospective buyers. |

| Assessment Payments | The form includes information about whether the monthly assessments for the unit are paid in full and if there are any past due amounts. |

| Pending Assessments | It asks whether there are any other assessments or charges due and if there are any special assessments currently under consideration. |

| Capital Expenditures | The disclosure outlines whether there are anticipated capital expenditures within the next two fiscal years and any associated project details. |

| Insurance Information | The form requires the name, address, contact person, and telephone number of the insurance carrier for the unit owner's association. |

Guidelines on Utilizing Act 221 Disclosure

Completing the Act 221 Disclosure form requires careful attention to detail to ensure that all necessary information is accurately provided. After filling out this form, it will be submitted to the appropriate parties involved in the condominium or townhome resale process, allowing them to assess various conditions about the property.

- Identify the Condominium Association: Begin by specifying whether the Board of Managers or the designated managing agent is completing the form.

- Fill in the Unit Information: Enter the unit number and state that the monthly assessment is fully paid through the specified date.

- Disclose Past Due Sums: Indicate any past due sums owed to the association and specify the time periods for these dues.

- Assess Additional Charges: State whether there are any additional monthly, special, or other assessments due from the unit owner.

- Provide Special Assessments Status: Note if there are any special assessments under consideration by the Board of Managers. If so, briefly explain.

- Detail Capital Expenditures: Confirm if any capital expenditures are anticipated within the next two fiscal years. Provide an explanation if applicable.

- Reserve Fund Information: State the amount of the reserve or replacement fund for current or future capital expenditures. Note whether part of this reserve is earmarked for a specific project, offering further details if necessary.

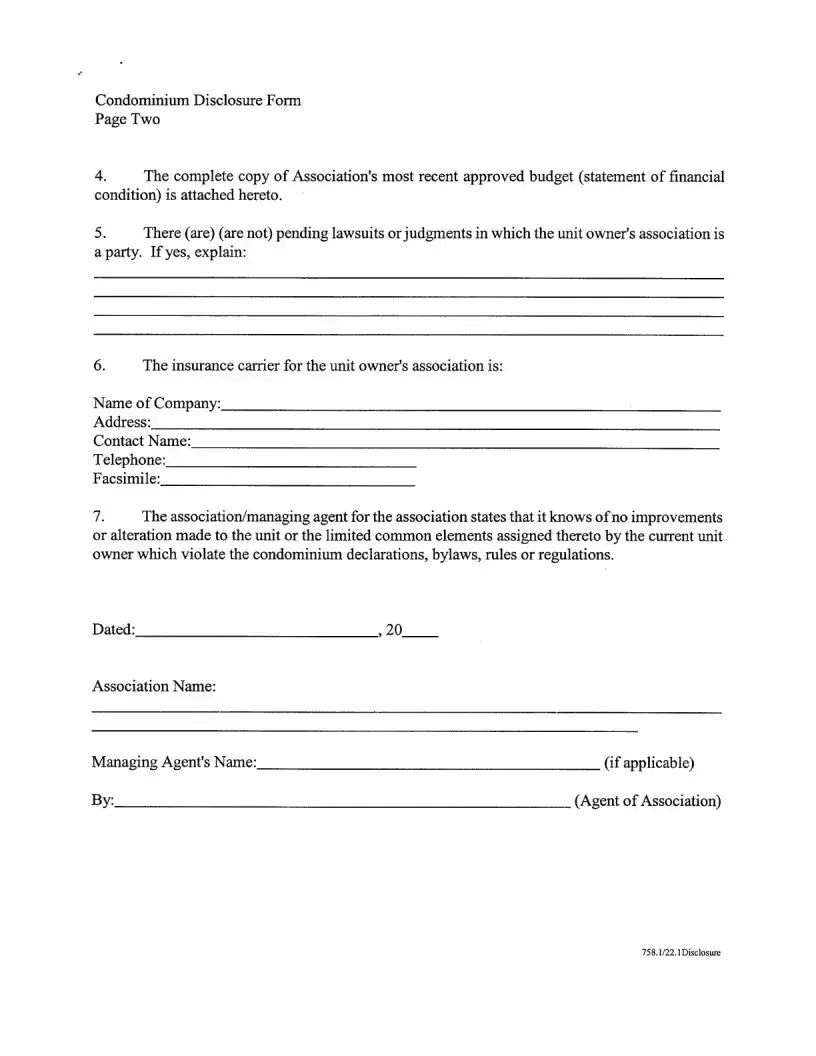

- Attach Latest Budget: Ensure the most recent approved budget or statement of financial condition is attached as required.

- Disclose Lawsuits: Indicate if there are any pending lawsuits or judgments involving the association, offering explanations if there are.

- Document Insurance Carrier: Complete the section with the name, address, contact name, telephone number, and facsimile number of the insurance carrier for the unit owner's association.

- Confirm Compliance with Regulations: State that, to the best of your knowledge, no improvements or alterations were made that violate the condominium declarations, bylaws, rules, or regulations.

- Complete Signature Section: Fill in the name of the association, the managing agent (if applicable), and sign the form as the authorized agent of the association.

What You Should Know About This Form

What is the purpose of the Act 221 Disclosure form?

The Act 221 Disclosure form is designed to ensure that potential buyers of a condominium or townhome receive vital information about the property and the associated homeowners' association. This form provides details about financial assessments, potential capital expenditures, and any ongoing legal matters that may affect the property. Its goal is to promote transparency, allowing buyers to make informed decisions.

Who fills out the Act 221 Disclosure form?

This form must be completed by an officer or managing agent of the homeowners' association. This means it could be a member of the board of managers or a designated managing agent responsible for overseeing the day-to-day operations of the association. Their role is to ensure accurate and up-to-date information is provided to prospective buyers.

What kind of financial information is disclosed?

The form covers several financial aspects, including current monthly assessments paid by the unit owner and any past due sums. It also indicates whether there are any special assessments or additional charges due. Furthermore, it reveals whether any special assessments are being considered by the Board of Managers, which could impact future costs for residents.

How does the form address future financial obligations?

In addition to current financial obligations, the form looks ahead. It outlines anticipated capital expenditures for the current and following two fiscal years. This foresight allows potential buyers to understand any upcoming costs that could influence their financial planning when purchasing a unit.

What is the significance of the reserve or replacement fund mentioned in the form?

The reserve or replacement fund is critical for the long-term maintenance and improvements of the property. The form indicates the amount set aside for future capital projects and specifies if these reserves are earmarked for particular projects. Understanding these funds helps buyers evaluate the financial health of the association and the property's maintenance strategy.

Are there any legal concerns addressed in the disclosure?

The form requires the disclosure of any pending lawsuits or judgments involving the homeowners' association. This information is crucial, as ongoing legal issues could have financial implications for current and future residents. Having clarity here helps ensure buyers know what they might be getting into.

What insurance information is provided?

The form includes details about the insurance carrier for the unit owner's association, including the company name, contact information, and other relevant details. This information is vital for understanding the coverage the association has in place, which can affect residents' safety and liability concerns.

What should I do if I have further questions after reviewing the disclosure?

If you have any questions or need clarification after reviewing the Act 221 Disclosure form, it is recommended to reach out directly to the managing agent or the board of managers of the association. They can provide additional insights and address any specific concerns you may have regarding the condominium's operations and status.

Common mistakes

Completing the Act 221 Disclosure form is crucial for ensuring transparency in condominium transactions. Yet, many individuals make common mistakes that can lead to misunderstandings or even legal issues. Awareness of these pitfalls is essential.

One frequent mistake is failing to provide complete and accurate information regarding monthly assessments. It is vital to indicate whether the assessments for the unit are paid in full and to specify any past due amounts. Omitting this information may mislead potential buyers about their financial obligations.

Another common error involves neglecting to address whether there are any pending special assessments. Indicating "there are not" when, in fact, there are special assessments currently under consideration can have serious repercussions. Buyers deserve to know about any potential financial obligations that may arise after the purchase.

Misunderstanding the status of capital expenditures is also a mistake. Individuals often leave this section blank or fail to clarify whether such expenditures are anticipated. This lack of information can create uncertainty for potential buyers regarding the future financial health of the association.

Many mistakenly overlook the importance of including detailed explanations where required. For example, if there are pending lawsuits or judgments, simply stating their existence without further context can lead to confusion or mistrust. Providing thorough explanations fosters better communication and trust.

Additionally, the insurance information provided is sometimes incomplete. It is essential to list the name of the insurance carrier, along with contact details. Failure to do so may leave buyers without critical information during their due diligence process.

Furthermore, disregarding the importance of the association's budget is another misstep. The complete copy of the most recent approved budget must be attached to the form. Skipping this can hinder prospective buyers from assessing the financial stability and operational efficiency of the association.

Finally, errors frequently occur in confirming compliance with the condominium declarations, bylaws, and regulations. It is imperative to accurately state whether there have been any improvements or alterations made that run contrary to these guidelines. This highlights the importance of maintaining good relations within the community and adhering to established rules.

In summary, being diligent while filling out the Act 221 Disclosure form is critical. By avoiding these common mistakes, individuals can ensure a smoother transaction process and maintain clarity for all parties involved.

Documents used along the form

The Act 221 Disclosure form provides essential information regarding the financial and legal status of a condominium or townhome association. However, several other documents often accompany this form to ensure both buyers and sellers are fully informed about the property and its management. Below is a list of commonly used forms and documents.

- Condominium Bylaws: This document outlines the rules and regulations governing the operation of the condominium association. It addresses everything from the management structure to residents' rights and obligations. Buyers should review these bylaws to understand the community's governing framework.

- Declaration of Condominium: The declaration details the property’s legal description and defines the common elements, individual units, and shared responsibilities among owners. It establishes the legal basis for the condominium and is critical for potential buyers to consider.

- Financial Statements: Recent financial statements provide insight into the association's financial health. They typically include income statements, balance sheets, and budgets, which help owners gauge the stability of their investment.

- Meeting Minutes: Minutes from recent board meetings can reveal important discussions and decisions affecting the condominium association. Reviewing these can inform potential buyers about community engagement and ongoing issues or upcoming projects.

- Disclosure of Special Assessments: This document outlines any special assessments levied on unit owners for unexpected costs or major repairs. Understanding these potential financial obligations is crucial for anyone considering a purchase.

Encompassing these documents, the Act 221 Disclosure form serves as part of a comprehensive suite of information to guide potential buyers in making well-informed decisions. Having all relevant documents available fosters transparency and helps ensure a smooth transaction process.

Similar forms

The Act 221 Disclosure form serves to provide potential buyers with vital information about a condominium association. Several other documents share similar purposes and elements, ensuring transparency and informed decision-making. Below is a list of these documents:

- Seller’s Disclosure Statement: This document discloses information about the condition of a property being sold. It highlights any known issues, such as structural problems or zoning violations, similar to how the Act 221 form addresses financial and structural conditions of the condominium.

- Property Condition Disclosure Statement: Often used during real estate transactions, this statement outlines the condition of various systems in the property, such as plumbing or electrical. Like the Act 221 form, it informs the buyer about existing issues that might affect their purchase decision.

- Community Association Disclosure Packet: This packet includes essential details about the community association, including rules, regulations, and financial health. It echoes the intent of the Act 221 form by providing potential owners with material facts about governance and finances.

- Final Walkthrough Checklist: Although generally used in the final stages of a home purchase, this checklist allows buyers to assess the condition of the property closely. Its similarity lies in its objective to ensure buyers are fully informed before finalizing their purchase, similar to the protective nature of the Act 221 form.

- Illinois Residential Real Property Disclosure Act Form: This statewide form provides exhaustive details about residential property issues. It is akin to the Act 221 form as both serve to promote transparency in real estate transactions.

- Bylaws of the Condominium Association: These governing documents outline the rules and regulations of the association. Additionally, they provide insights into the rights and responsibilities of unit owners, paralleling the financial and operational insights found in the Act 221 Disclosure form.

These documents aim to protect buyers and promote transparent transactions, each contributing uniquely to the overall understanding of the property in question.

Dos and Don'ts

When filling out the Act 221 Disclosure form, here are seven important dos and don'ts:

- Do: Provide accurate and complete information about monthly assessments.

- Do: Clearly indicate any outstanding balances owed by the unit owner.

- Do: Mention any anticipated capital expenditures for the association.

- Do: Attach the most recent approved budget of the association.

- Do: Disclose any pending lawsuits involving the owner's association.

- Do: List the insurance carrier details clearly, including contact information.

- Do: Confirm whether any alterations violate condominium rules.

- Don't: Leave any sections blank; all areas need attention.

- Don't: Exaggerate or misrepresent the financial status of the association.

- Don't: Ignore past due assessments; all financial issues should be addressed.

- Don't: Withhold information about lawsuits or judgments.

- Don't: Forget to verify the insurance details and their accuracy.

- Don't: Skip over the review of modifications to the unit or common elements.

- Don't: Sign the form without ensuring all information is correct and complete.

Misconceptions

Understanding the Act 221 Disclosure form is crucial for anyone involved in the condo or townhome market. However, several misconceptions often cloud its purpose and functionality. Here are six common misunderstandings and clarifications about the form.

- It is optional to provide this form. Many believe that the Act 221 Disclosure form is optional. In reality, Illinois law mandates its use when selling a condominium or townhome, ensuring potential buyers have essential information before making a decision.

- All financial details are provided in the form. Some think the form outlines every financial aspect of the association. While it does include critical financial information like assessments and pending budgets, it serves as a snapshot, not a comprehensive financial statement.

- The form guarantees there are no issues with the property. Many assume that absence of noted problems in the form indicates a trouble-free property. This is misleading. The form reflects the current knowledge of the association and does not account for undisclosed issues or future concerns.

- The form only pertains to financial matters. A common misconception is that the form focuses solely on financial assessments. In truth, it covers various aspects, including potential lawsuits, insurance details, and overall property condition, giving a fuller picture of the association's status.

- It is the same for all condominiums and townhomes. Some people think the form is uniform across all properties. In reality, while the general structure appears similar, specific details will vary depending on each association's unique circumstances and situations.

- Buyers do not need to worry about the form until closing. Lastly, it is a common belief that the form's details can be ignored until the closing process. Potential buyers should review this document well in advance. Understanding the information helps in making informed decisions and negotiations.

Clarifying these misconceptions can significantly enhance a buyer's understanding of their potential investment and the responsibilities that come with it.

Key takeaways

Understanding the Act 221 Disclosure form is crucial for anyone involved in condominium or townhome transactions in Illinois. Below are key takeaways to consider when filling out and using this important document:

- Purpose of the Form: The Act 221 Disclosure form serves to inform potential buyers about the financial status and any pending legal issues concerning the condominium association.

- Completing the Form: Either the Board of Managers or the designated managing agent must fill out and sign the form to ensure its validity.

- Assessments: Disclosure of the current status of monthly assessments is mandatory, including any overdue amounts. Be clear about any special assessments as well.

- Capital Expenditures: Identify any anticipated capital expenditures within the current or following two fiscal years. Lack of this information may lead to misunderstandings about future financial obligations.

- Reserve Funds: Clearly specify the amount in the reserve or replacement fund. Indicate whether these funds are earmarked for specific projects, as this can greatly affect buyer decisions.

- Financial Documentation: Attach a complete copy of the association’s most recent approved budget. This transparency aids buyers in evaluating the financial health of the association.

- Pending Legal Issues: If there are any lawsuits or judgments involving the association, this must be disclosed. Buyers need to be aware of any ongoing legal challenges.

- Insurance Information: Provide detailed information about the insurance carrier for the association, including the company name, address, and contact details. This is essential for understanding risk management practices.

These takeaways encapsulate important elements that contribute to a comprehensive understanding of the Act 221 Disclosure form. Completing this form accurately can help foster transparency and trust in real estate transactions.

Browse Other Templates

Nc Mvr-180 - Vehicles over ten years old are exempt from this disclosure until specified dates.

New Jersey Lemon Law Used Car - Be aware that contested claims can lengthen the dispute resolution timeline.

54244 640p - Employers need to note their response date next to their signature on the form.