Fill Out Your Ad 1026 Form

The AD 1026 form plays a critical role in the U.S. Department of Agriculture's (USDA) efforts to promote sustainable farming practices and protect natural resources. It is designed for producers who are seeking to certify their compliance with the Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) provisions. This form must be completed electronically for all agricultural operations and requires detailed information about the producer, including their name, tax identification number, and specific farming interests. Producers must attest to their understanding of conservation requirements and provide critical information about their land use practices. Notably, the form addresses important compliance questions related to past and intended farming activities on potentially problematic land. Certain exemptions may apply, permitting specific producers to bypass typical compliance protocols under certain conditions. Completing the AD 1026 accurately is essential, as non-compliance could lead to ineligibility for various USDA benefits, such as loans and premium subsidies for crop insurance. Understanding the implications of HELC and WC compliance may significantly impact a producer's operations and eligibility for federal assistance.

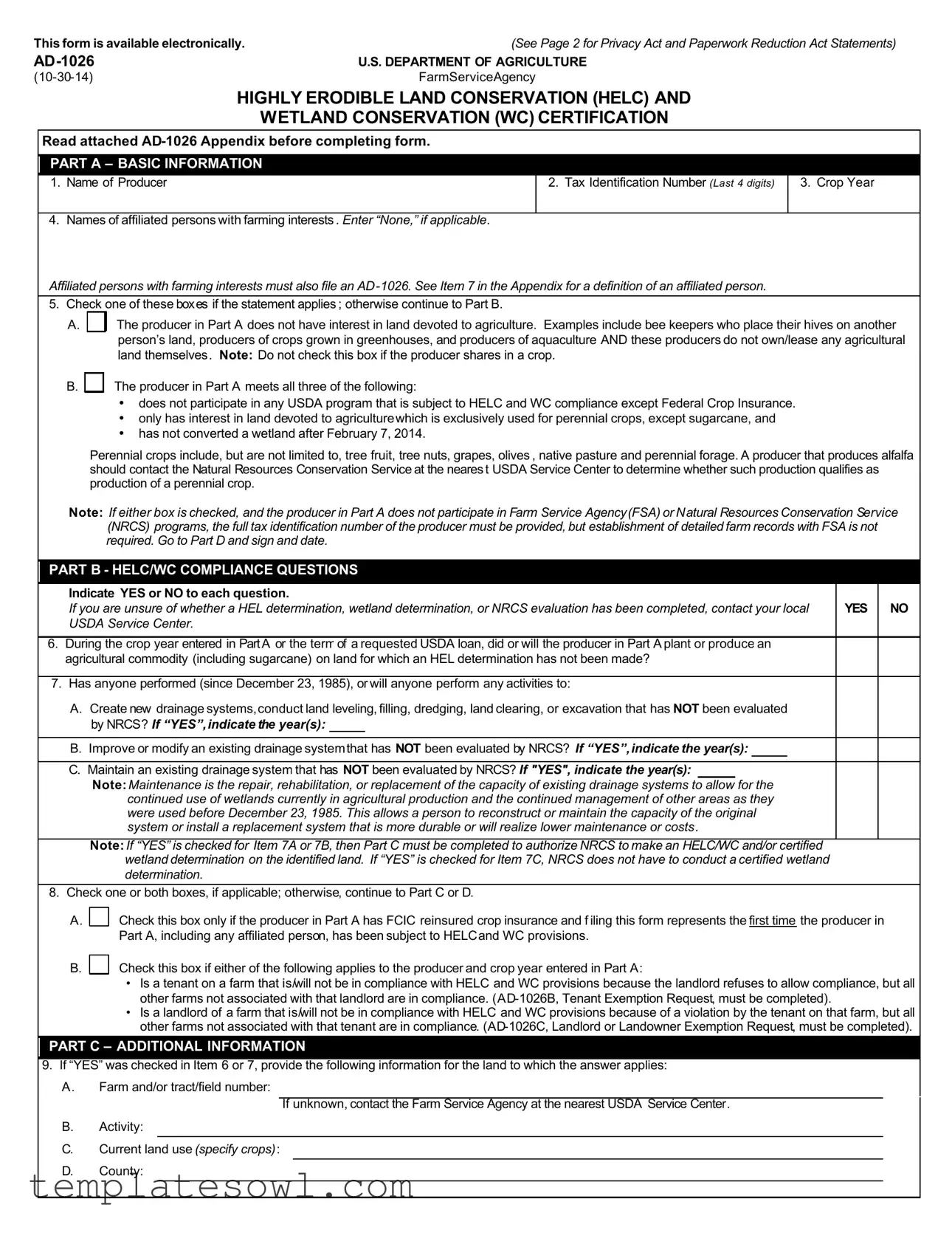

Ad 1026 Example

This form is available electronically.

(See Page 2 for Privacy Act and Paperwork Reduction Act Statements)

U.S. DEPARTMENT OF AGRICULTURE

FarmServiceAgency

HIGHLY ERODIBLE LAND CONSERVATION (HELC) AND

WETLAND CONSERVATION (WC) CERTIFICATION

Read attached

PART A – BASIC INFORMATION

1. Name of Producer

2. Tax Identification Number (Last 4 digits)

3. Crop Year

4. Names of affiliated persons with farming interests . Enter “None,” if applicable.

Affiliated persons with farming interests must also file an

5.Check one of these boxes if the statement applies; otherwise continue to Part B.

A.  The producer in Part A does not have interest in land devoted to agriculture. Examples include bee keepers who place their hives on another person’s land, producers of crops grown in greenhouses, and producers of aquaculture AND these producers do not own/lease any agricultural land themselves. Note: Do not check this box if the producer shares in a crop.

The producer in Part A does not have interest in land devoted to agriculture. Examples include bee keepers who place their hives on another person’s land, producers of crops grown in greenhouses, and producers of aquaculture AND these producers do not own/lease any agricultural land themselves. Note: Do not check this box if the producer shares in a crop.

B.  The producer in Part A meets all three of the following:

The producer in Part A meets all three of the following:

·does not participate in any USDA program that is subject to HELC and WC compliance except Federal Crop Insurance.

·only has interest in land devoted to agriculturewhich is exclusively used for perennial crops, except sugarcane, and

·has not converted a wetland after February 7, 2014.

Perennial crops include, but are not limited to, tree fruit, tree nuts, grapes, olives, native pasture and perennial forage. A producer that produces alfalfa should contact the Natural Resources Conservation Service at the nearest USDA Service Center to determine whether such production qualifies as production of a perennial crop.

Note: If either box is checked, and the producer in Part A does not participate in Farm Service Agency(FSA) or Natural Resources Conservation Service (NRCS) programs, the full tax identification number of the producer must be provided, but establishment of detailed farm records with FSA is not required. Go to Part D and sign and date.

PART B - HELC/WC COMPLIANCE QUESTIONS

Indicate YES or NO to each question. |

|

If you are unsure of whether a HEL determination, wetland determination, or NRCS evaluation has been completed, contact your local |

YES NO |

USDA Service Center. |

|

6.During the crop year entered in PartA or the term of a requested USDA loan, did or will the producer in Part A plant or produce an agricultural commodity (including sugarcane) on land for which an HEL determination has not been made?

7.Has anyone performed (since December 23, 1985), or will anyone perform any activities to:

A.Create new drainage systems,conduct land leveling, filling, dredging, land clearing, or excavation that has NOT been evaluated by NRCS? If “YES”,indicate the year(s):

B.Improve or modify an existing drainage systemthat has NOT been evaluated by NRCS? If “YES”,indicate the year(s):

C. Maintain an existing drainage system that has NOT been evaluated by NRCS? If "YES", indicate the year(s):

Note:Maintenance is the repair, rehabilitation, or replacement of the capacity of existing drainage systems to allow for the continued use of wetlands currently in agricultural production and the continued management of other areas as they were used before December 23, 1985. This allows a person to reconstruct or maintain the capacity of the original system or install a replacement system that is more durable or will realize lower maintenance or costs.

Note:If “YES” is checked for Item 7A or 7B, then Part C must be completed to authorize NRCS to make an HELC/WC and/or certified wetland determination on the identified land. If “YES” is checked for Item 7C, NRCS does not have to conduct a certified wetland determination.

8. Check one or both boxes, if applicable; otherwise, continue to Part C or D.

A.

B.

Check this box only if the producer in Part A has FCIC reinsured crop insurance and filing this form represents the first time the producer in Part A, including any affiliated person, has been subject to HELCand WC provisions.

Check this box if either of the following applies to the producer and crop year entered in Part A:

•Is a tenant on a farm that is/will not be in compliance with HELC and WC provisions because the landlord refuses to allow compliance, but all other farms not associated with that landlord are in compliance.

•Is a landlord of a farm that is/will not be in compliance with HELC and WC provisions because of a violation by the tenant on that farm, but all other farms not associated with that tenant are in compliance.

PART C – ADDITIONAL INFORMATION

9. If “YES” was checked in Item 6 or 7, provide the following information for the land to which the answer applies:

A.Farm and/or tract/field number:

If unknown, contact the Farm Service Agency at the nearest USDA Service Center.

B. Activity:

B. Activity:

C. Current land use (specify crops):

C. Current land use (specify crops):

D. County:

D. County:

Page 2 of 2 |

PART D – CERTIFICATION OF COMPLIANCE

Ihave received and readthe

continuous and will remain in effect unless revoked or a violation is determined. I further understand and agree that:

· all applicable payments must be refunded if a determination of ineligibility is made for a violation of HELC or WC provisions.

· NRCS may verify whether a HELC violation or WC has occurred.

· a revised Form

understand that failure to revise Form

· affiliatedpersons are also subject to compliance with HELC and WC provisions and their failure to comply or file Form

Producer’s Certification:

I hereby certify that the information on this form is true and correct to the best of my knowledge.

10A. Producer’s Signature (By) |

10B. Title/Relationship (If Signing in Representative Capacity) |

10C. Date |

|

|

|

FOR FSA USE ONLY(for referral to NRCS) |

11A. Signature of FSA Representative |

11B. Date |

|

|

|

Sign and date if NRCS determination is needed. |

|

|

|

|

|

IMPORTANT: If youare unsure about the applicability of HELCand WCprovisionsto your land, contact your local USDA Service Center for details concerningthe location of anyhighly erodible land or wetlandand anyrestrictions applyingto your landaccording to NRCS determinations before plantingan agricultural commodity or performingany drainage or manipulation. Failure to certify and properly revise your compliancecertification when applicable may: (1) affect your eligibility for USDA program benefits, including whether you qualify for reinstatement of benefits through the Good Faith process; and (2)result in other consequences.

NOTE: |

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this |

|

form is 7 CFR Part 12, the Food Security Act of 1985 (Pub. L. |

||

|

||

|

compliance with HELC and WC provisions and to determine producer eligibility to participate in and receive benefits under programs administered by USDA agencies. |

|

|

The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have |

|

|

been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for |

|

|

||

|

requested information will result in a determination of producer ineligibility to participate in and receive benefits under programs administered by USDA agencies. |

|

|

This information collection is exempted from the Paperwork Reduction Act as specified in the Agricultural Act of 2014 (Pub. L. |

|

|

and Administration). The provisions of appropriate criminal and civil fraud, privacy, and other statutes may be applicable to the information provided. RETURN |

|

|

THIS COMPLETED FORM |

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited basis will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the address below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202)

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866)

This form is available electronically.

U.S. DEPARTMENT OF AGRICULTURE |

|

FarmServiceAgency |

|

|

APPENDIX TO FORM |

|

HIGHLY ERODIBLE LAND CONSERVATION (HELC) AND |

|

WETLAND CONSERVATION (WC) CERTIFICATION |

1.Overview

The following conditions of eligibility are required for a producer to receive any U.S. Department of Agriculture (USDA) loans or other program benefits that are subject to the highly erodible land conservation (HELC) and wetland conservation (WC) provisions. Unless an exemption has been granted by USDA, the producer agrees to all of the following on all farms in which the producer, and any affiliated person to the producer (as specified in 7 CFR Part 12), has an interest:

·NOT to plant or produce an agriculturalcommodity on highly erodible land or fields unless being farmed in accordance with a conservation plan or system approved by the Natural Resources Conservation Service.

·NOT to plant or produce an agriculturalcommodity on a wetland that was converted after December 23, 1985.

·NOT to have converted a wetland after November 28, 1990, for the purpose, or to have the effect, of making the production of an agricultural commodity possible on such converted wetland.

·NOT to convert a wetland by draining, dredging, filling, leveling, removing woody vegetation, or any other activity that results in impairing or reducing the flow and circulation of water in a way that would allow the planting of an agricultural commodity.

·NOT to use proceeds from any Farm Service Agency farm loan, insured or guaranteed, or any USDA financial assistance program, in such a way that might result in negative impacts to a wetland, except for those projects evaluated and approved by Natural Resources Conservation Service.

2.Statutory and Regulatory Authority

The Food Security Act of 1985, as amended, requires producers participating in most programs administered by the Farm Service Agency (FSA), Natural Resources Conservation Service (NRCS), and the Risk Management Agency (RMA) to comply with HELC and WC provisions on all land owned or farmed that is considered highly erodible or a wetland unless USDA determines an exemption applies. Producers participating in these programs, and any individualor entity considered to be an affiliated person of a participating producer, are subject to these provisions. The regulations covering these provisions are set forth at 7 CFR Part 12; all such provisions, whether or not explicitly stated herein, shall apply.

3.Explanation of Terms

Agriculturalcommodity is any crop planted and produced by annual tilling of the soil, including tilling by

Highly erodible land is any land that has an erodibility index of 8 or more. Highly erodible fields are fields where either:

·33.33 percent or more of the total field acreage is identified as soil map units that are highly erodible; or

·50 or more acres in such field are identified as soil map units that are highly erodible.

Perennial crop is any crop that is planted once and produces crops over multiple years. Go to

www.nrcs.usda.gov/compliance for a list of perennial and annual crops.

Wetland is an area that:

·has a predominance of hydric soils (wet soils);

·is inundated or saturated by surface or groundwater (hydrology) at a frequency and duration sufficient to support a prevalence of hydrophytic (water tolerant) vegetation typically adapted for life in saturated soil conditions; and

·under normal circumstances supports a prevalence of such vegetation, except that this term does not include lands in Alaska identified as having a high potential for agricultural development and a predominance of permafrost soils.

Page 2 of 3 |

4. NRCS and FSA Determinations

When making HELC and WC compliance determinations:

·NRCS makes technical determinations; these include:

§For HELC compliance:

§whether land is considered highly erodible;

§establishing conservation plans or systems; and

§whether highly erodible fields are being farmed in accordance with a conservation plan or system approved by NRCS.

§For WC compliance:

§whether land is a wetland and if certain technical exemptions apply, such as prior converted;

§whether a wetland conversion has occurred.

·FSA’s responsibilities include:

·making eligibility determinations, such as who is ineligible based upon NRCS technical determinations of

·acting on requests for application of certain eligibility exemptions, such as the good faith relief exemption.

·maintaining the official USDA records of highly erodible land and wetland determinations. The determinations are recorded both within the geographic information system and the automated farm and tract records maintained by FSA; however, it is important to know that determinations may not include all of a producer’s land. If a producer is uncertain of the highly erodible land and wetland determinations applicable to any of the producer’s land, the producer should contact the appropriate USDA Service Center for assistance.

5.HELC and WC

Producers who are not in compliance with HELC and WC provisions are not eligible to receive benefits for most programs administered by FSA and NRCS. If a producer received program benefits and is later found to be

In particular, unless exemptions apply, a producer participating in FSA and NRCS programs must: not plant or produce an agricultural commodity on a highly erodible field unless such production is in compliance with a conservation plan or system approved by NRCS; not have planted or produced an agricultural commodity on a wetland converted after December 23, 1985; and, after November 28, 1990, must not have converted a wetland for the purpose, or to have the effect, of making the production of an agricultural commodity possible on such converted wetland.

A producer who violates HELC or WC provisions is ineligible for applicable FSA and NRCS benefits for the year(s) in violation. A planting violation, whether on highly erodible land or a converted wetland, results in ineligibility for benefits for the year(s) when the planting occurred. A wetland conversion violation results in ineligibility beginning with the year in

which the conversion occurred and continuing for subsequent years, unless the converted wetland is restored or mitigated before January 1st of the subsequent year.

6.HELC and WC

Producers obtaining federally reinsured crop insurance will not be eligible for any premium subsidy paid by the Federal Crop Insurance Corporation (FCIC) for any policy or plan of insurance if the producer:

·has not filed a completed Form

·is not in compliance with HELC and WC provisions.

Unless an exemption applies, a producer must:

·not plant or produce an agricultural commodity on a highly erodible field, unless such production is in compliance with a conservation plan approved by NRCS;

·not plant or produce an agricultural commodity on a wetland converted after February 7, 2014; and

·not have converted a wetland for the purpose, or to have the effect, of making the production of an agricultural commodity possible on such converted wetland after February 7, 2014.

Page 3 of 3 |

A producer is ineligible for any premium subsidy paid by FCIC on all policies and plans of insurance for the reinsurance year (July 1 – June 30) following the reinsurance year of a final determination of a violation of HELC or WC provisions, including all administrative appeals, unless specific exemptions apply. Further, a producer will be ineligible for any premium subsidy paid by FCIC on all policies and plans of insurance for a reinsurance year if they do not have a completed Form

7. Affiliated Persons

Any affiliated person of a producer requesting benefits subject to HELC and WC provisions must also be in compliance with those provisions. Ineligibility of a producer will also apply to affiliated persons of that producer. If an affiliated person has a farming interest (as owner, operator, or other producer on any farm), the affiliated person must also file Form

Use this table to determine affiliated persons who must be in compliance with HELC and WC provisions and file Form

IF the producer requesting |

THEN affiliated persons with farming interests who must be in compliance with HELC and WC |

benefits is a (an) . . . |

provisions and file Form |

|

|

individual |

spouses or minor children with separate farming interests, or who receive benefits under their |

|

individual ID number. |

NOTE: For a minor, parents |

|

estates, trusts, partnerships, and joint ventures in which the individual filing, or the individual’s spouse or |

|

or guardians shall be listed |

minor children have an interest. |

as affiliated persons . |

|

corporations in which the individual filing or the individual's spouse or minor children have more than |

|

|

20% interest. |

|

|

general partnership |

first level members of the entity. |

limited partnership |

|

limited liabilitycompany |

|

joint venture |

|

estate |

|

irrevocable or revocable trust |

|

Indian tribal venture or group |

|

|

|

|

first level shareholders with more than 20% interest in the corporation. |

corporation with stockholders |

Note: First level shareholders of a corporation with 20% interest or less in the corporation are not |

|

|

|

considered affiliated persons of the corporation. |

IMPORTANT NOTICE:

Signature on Form

NOTE: |

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on |

|

this form is 7 CFR Part 12, the Food Security Act of 1985 (Pub. L. |

|

compliance with HELC and WC provisions and to determine producer eligibility to participate in and receive benefits under programs administered by USDA |

|

agencies. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental |

|

entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of |

|

Records Notice for |

|

However, failure to furnish the requested information will result in a determi nation of producer ineligibility to participate in and receive benefits under programs |

|

administered by USDA agencies. |

|

This information collection is exempted from the Paperwork Reduction Act as specified in the Agricultural Act of 2014 (Pub. L. |

|

Administration). The provisions of appropriate criminal and civil fraud, privacy, and other statutes may be applicable to the information provided. RETURN THE |

|

COMPLETED FORM |

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited basis will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the address below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202)

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any

USDA office, or call (866)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The AD-1026 form certifies compliance with Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) provisions set by the USDA. |

| Eligibility Criteria | To be eligible for certain USDA benefits, producers must adhere to specific criteria regarding their farming practices on highly erodible lands and wetlands. |

| Regulating Authorities | This form is governed by the Food Security Act of 1985, which outlines requirements related to HELC and WC provisions. |

| Required Signatures | Producers must sign the form to certify their understanding and compliance with all provisions detailed in the appendix of the AD-1026. |

| Affiliated Persons | Anyone with a farming interest associated with the producer must also file the AD-1026 form for compliance to be considered valid. |

| Submission Instructions | Completed forms should be returned to the local county Farm Service Agency (FSA) office for processing. |

Guidelines on Utilizing Ad 1026

The completion of the AD-1026 form is a critical step for producers involved in agricultural activities within the U.S. Department of Agriculture's framework. Following these detailed steps ensures that producers provide the necessary information in a clear and compliant manner.

- Provide your name in the space designated for the producer's name.

- Enter the last four digits of your Tax Identification Number.

- Specify the crop year related to the certification.

- List the names of any affiliated persons with farming interests. If there are none, write "None."

- Check one of the boxes in Part A to indicate whether the producer has interest in land devoted to agriculture or meets specific conditions related to their agricultural practices. If neither box applies, proceed to Part B.

- Answer the compliance questions in Part B by indicating "YES" or "NO" for each question related to HELC and WC activities.

- If "YES" is selected for questions 6 or 7, provide additional information about the land related to those questions, including farm or tract/field number, activity performed, current land use, and county in Part C.

- In Part D, read the certification statement carefully. Sign and date the form. If signing in a representative capacity, please include your title or relationship to the producer.

- If applicable, a representative from FSA will sign and date the form for internal use.

After completing the form, ensure that it is returned to your county Farm Service Agency office. It is important to check the form for accuracy and completeness before submission to avoid any potential issues regarding eligibility for USDA program benefits.

What You Should Know About This Form

What is the purpose of the AD-1026 form?

The AD-1026 form is used for certifying compliance with highly erodible land conservation (HELC) and wetland conservation (WC) provisions. Producers must submit this form to participate in USDA programs, ensuring they adhere to conservation requirements on agricultural land.

Who needs to complete the AD-1026 form?

Any producer participating in USDA programs that involve agricultural land must complete this form. Additionally, affiliated persons with farming interests must also file the form. This includes individuals such as spouses, minor children, or those with significant ownership in a farming entity.

What happens if a producer is found non-compliant with HELC and WC provisions?

If a producer fails to comply with HELC and WC provisions, they may lose eligibility for certain USDA program benefits. This non-compliance can lead to a requirement to refund benefits received, and penalties may also be imposed.

How can I determine if my land is considered highly erodible or a wetland?

To determine if your land is classified as highly erodible or as a wetland, you should contact your local USDA Service Center. They can provide specific evaluations and determinations based on soil and hydrology assessments relevant to your property.

Can producers receive exemptions from complying with HELC and WC provisions?

Yes, producers may be eligible for exemptions under certain conditions. However, these exemptions must be formally granted by USDA, and producers are responsible for understanding their compliance obligations to avoid potential penalties.

What information do I need to provide when completing the AD-1026 form?

When filling out the AD-1026 form, you must provide basic information, including your name, tax identification number, crop year, and details regarding any affiliated persons. You will also respond to compliance questions regarding HEL and WC provisions.

Where do I submit the completed AD-1026 form?

The completed AD-1026 form should be submitted to your local county Farm Service Agency (FSA) office. It is essential to ensure that the form is filled out accurately to maintain eligibility for USDA programs.

Common mistakes

Completing the AD-1026 form can be a crucial step for producers, as it certifies compliance with Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) provisions. However, there are several common mistakes that individuals often make while filling out this important document that can affect eligibility for various USDA program benefits.

One prevalent error is failing to provide accurate names of affiliated persons with farming interests. Many producers overlook this section or mistakenly write "None" when there are indeed affiliated individuals involved in the farming operation. It is essential to identify all individuals who have a stake in the farming activities, as their compliance also impacts the benefits available to the producer.

Another frequent issue arises in the selection of the correct compliance statements under Part A of the form. Producers might check the wrong box regarding their interests in agricultural land. It is vital to fully understand the definitions provided in the appendix. For example, checking the box indicating no interest in agricultural land while actually sharing in a crop can lead to serious compliance issues later on.

When answering the compliance questions in Part B, producers sometimes answer "Yes" or "No" without adequate reflection on their situation. This can lead to unintended misrepresentation of activities related to land usage. Producers should take the time to consider their practices carefully, such as planting on highly erodible land or conducting activities that were not evaluated by the Natural Resources Conservation Service (NRCS).

Omitting required information from Part C can also be detrimental. If a producer answers “Yes” to any of the questions in Item 6 or 7, they must provide detailed information about the land in question, including farm numbers and current land use. Failing to include this information can delay processing and may result in ineligibility for anticipated benefits.

Producers may also neglect to review and sign the Certification of Compliance in Part D properly. This section is crucial because it signifies understanding and agreement to the certification terms. Not signing or dating the form can render it invalid, resulting in a lost opportunity for those benefits.

Finally, another common mistake involves missing the deadline to revise the form when operational changes occur. If there are modifications in farming practices that affect compliance, producers must file a revised AD-1026. Failing to do so can lead to complications, including potential penalties or ineligibilities, which can significantly impact financial assistance opportunities.

By being aware of these mistakes and taking steps to address them, producers can better navigate the AD-1026 form process and ensure they remain compliant with USDA guidelines. Ensuring accurate information not only benefits individual producers but also supports broader agricultural goals of sustainability and conservation.

Documents used along the form

When completing the AD-1026 form for Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) Certification, there are several other documents that might be required or beneficial to include along with it. Understanding each form and its purpose can help streamline your process and ensure compliance.

- AD-1026B, Tenant Exemption Request: This form is for tenants who believe they should be exempt from compliance because their landlord will not allow necessary conservation practices. Filing this is essential for those who wish to request an exemption based on these conditions.

- AD-1026C, Landlord or Landowner Exemption Request: Landlords can use this form if they find themselves in a situation where they are unable to comply due to violations caused by their tenants. This ensures they can seek appropriate exemptions.

- NRCS Conservation Plans: A conservation plan tailored by the Natural Resources Conservation Service ensures land is managed in a way that meets HELC/WC requirements. This plan is crucial for farmers working on highly erodible lands.

- Form FSA-578, Report of Acreage: This form is necessary to report the acreage of all crops, which assists the Farm Service Agency in making compliance determinations. Accurate reporting can prevent potential penalties.

- Form AD-2047, Customer Data Worksheet: This document collects vital information about farming operations and helps establish a customer profile with the USDA. It can expedite processing and eligibility determinations.

- Form AD-1006, Payment Eligibility Statement: To ensure you're eligible for various USDA payments, this form may need to be filed. It confirms your compliance with payment eligibility requirements.

- FSA Agricultural Benefit Programs Enrollment Forms: Numerous USDA programs require enrollment forms specific to each benefit. Completing these forms is necessary to access program benefits that can aid your farming operation.

- NRCS Wetland Determination Documentation: Documentation that determines whether specific land qualifies as wetland is crucial. This assessment directly affects compliance with wetland conservation regulations.

- Environmental Quality Incentives Program (EQIP) Application: If seeking financial assistance for conservation practices, filing for EQIP will provide funding options that align with HELC and WC standards.

These documents often play vital roles in navigating the requirements that come with the AD-1026 form. Ensuring you have everything in order can help you avoid complications and stay eligible for important farm-related benefits.

Similar forms

- AD-1026B (Tenant Exemption Request): Similar to the AD-1026, this document allows producers who are tenants and may not comply with HELC and WC provisions due to landlords' restrictions to request exemption. It focuses on tenant-landlord relationships and compliance nuances.

- AD-1026C (Landlord or Landowner Exemption Request): This document complements the AD-1026 by addressing situations where landlords face compliance issues due to tenant violations. It serves as a request for exemption specific to the landlord's perspective.

- Form CCC-941 (Average Adjusted Gross Income Certification): This form is linked to USDA program eligibility, similar to AD-1026, as it requires producers to certify their adjusted gross income, which is often a factor in determining compliance for benefits.

- Form FSA-848 (Request for Farm Loan Assistance): Just like the AD-1026, this form is essential for farmers seeking loans from the USDA. Both documents assess eligibility requirements based on compliance with specific regulations.

- Form AD-2047 (Customer Data Worksheet): This document collects essential producer data and aligns with the AD-1026 in ensuring that producers have submitted accurate information to access USDA programs and benefits.

- Form NRCS-CPA-1200 (Conservation Program Application): Closely related to the AD-1026, this application is used for conservation programs administered by the NRCS. It emphasizes compliance with HELC and WC standards similar to those required in the AD-1026.

- Form AD-1153 (Certification of Eligibility): Like the AD-1026, this certification is a formal attestation of eligibility to participate in specific USDA programs, requiring producers to affirm their compliance with relevant agricultural laws.

Dos and Don'ts

When filling out the Ad 1026 form, attention to detail is crucial. Here are some important things to consider:

- Ensure that you have the correct crop year information ready before starting the form.

- Provide the full names and tax identification numbers of any affiliated persons involved.

- Read the attached AD-1026 Appendix to understand all eligibility requirements.

- Make sure to check the appropriate box in Part A based on your farming interests and land use.

- Double-check your entries for accuracy and completeness before submitting the form.

Conversely, here are some things to avoid:

- Do not leave any sections blank; all applicable fields must be completed.

- Avoid checking boxes that do not apply to your situation.

- Do not submit without ensuring that all affiliated persons, if applicable, have also filled out the AD-1026 form.

- Refrain from ignoring compliance training regarding HELC and WC provisions before signing the form.

- Do not delay submission. Adhere to deadlines to ensure eligibility for USDA program benefits.

Misconceptions

- Misconception 1: Form AD-1026 is only for large farming operations.

- Misconception 2: Only landowners need to complete the form.

- Misconception 3: The form can be filed at any time.

- Misconception 4: Checking the wrong box on the form isn't a big deal.

- Misconception 5: Completing the form is a one-time requirement.

In reality, Form AD-1026 applies to all producers with an interest in agricultural land, regardless of the size of their operation. Anyone engaged in farming activities must file this form if they are part of USDA programs subject to HELC and WC compliance.

This is incorrect. The form must also be completed by tenants and anyone else affiliated with farming interests. All parties involved in agricultural operations must certify compliance with HELC and WC provisions.

It's essential to file Form AD-1026 before planting any agricultural commodities or making alterations to the land. Timely submission is crucial to ensure compliance and eligibility for USDA benefits.

Incorrectly checking a box can lead to significant repercussions, including loss of eligibility for USDA program benefits or penalties for non-compliance. Producers must ensure that the information provided is accurate and truthful to avoid complications.

This is not true. Form AD-1026 must be revised and updated whenever there are changes in operations or activities related to compliance with HELC and WC provisions. Continuous compliance is required to maintain eligibility for benefits.

Key takeaways

When dealing with the AD-1026 form, it is essential to understand several key aspects to ensure compliance and avoid eligibility issues with USDA programs.

- Electronic Availability: The AD-1026 form can be accessed and filled out electronically, making the process more convenient for producers.

- Certification of Compliance: Signing the form certifies that the producer complies with Highly Erodible Land Conservation and Wetland Conservation provisions. The certification remains in effect until revoked or a violation is determined.

- Affiliated Persons: All affiliated persons with farming interests must also complete the AD-1026 form. This includes individual family members, partners, and corporate entities that share farming interests.

- Consequences of Non-Compliance: Failure to comply with HELC and WC provisions can result in loss of eligibility for USDA program benefits. Refunds for previously received benefits may also be required for violations.

- Communication with USDA: If there is uncertainty about compliance or the status of highly erodible land or wetlands, producers should contact their local USDA Service Center for assistance.

Understanding these points can significantly impact the successful use of the AD-1026 form and ensure eligibility for important USDA programs.

Browse Other Templates

Kyc Update Federal Bank - The form is directed to the manager of The Federal Bank for proper processing.

Form Dr 0104 - Understanding your income sources can help clarify questions that might arise during the completion of the 104PN.

Form 886-h-eic - Divorced, separated, or parents living apart must submit specific legal documents regarding custody.