Fill Out Your Additional Insured Vendors Form

The Additional Insured Vendors form is an important tool for businesses that wish to safeguard both themselves and their vendors in the event of claims related to bodily injury or property damage. This form serves as an endorsement to the Commercial General Liability policy, specifically addressing coverage that extends to vendors who sell or distribute a company's products. When completing the Schedule section of the form, it's essential to list the names of any additional insured persons or organizations involved. The coverage is particularly relevant when those products are involved in incidents that could lead to liability claims. However, it's important to understand the limitations of this coverage. For instance, the insurance offered will not be broader than what is stipulated in contracts or agreements with vendors. Additionally, specific exclusions apply, such as injuries arising from the vendor’s own negligence or certain product alterations not authorized by the original manufacturer. The form also sets clear limits on the extent of coverage provided based on existing agreements, ensuring that all parties involved have a clear understanding of the insurance landscape. By using the Additional Insured Vendors form, businesses can effectively navigate potential risks while maintaining strong relationships with their vendors.

Additional Insured Vendors Example

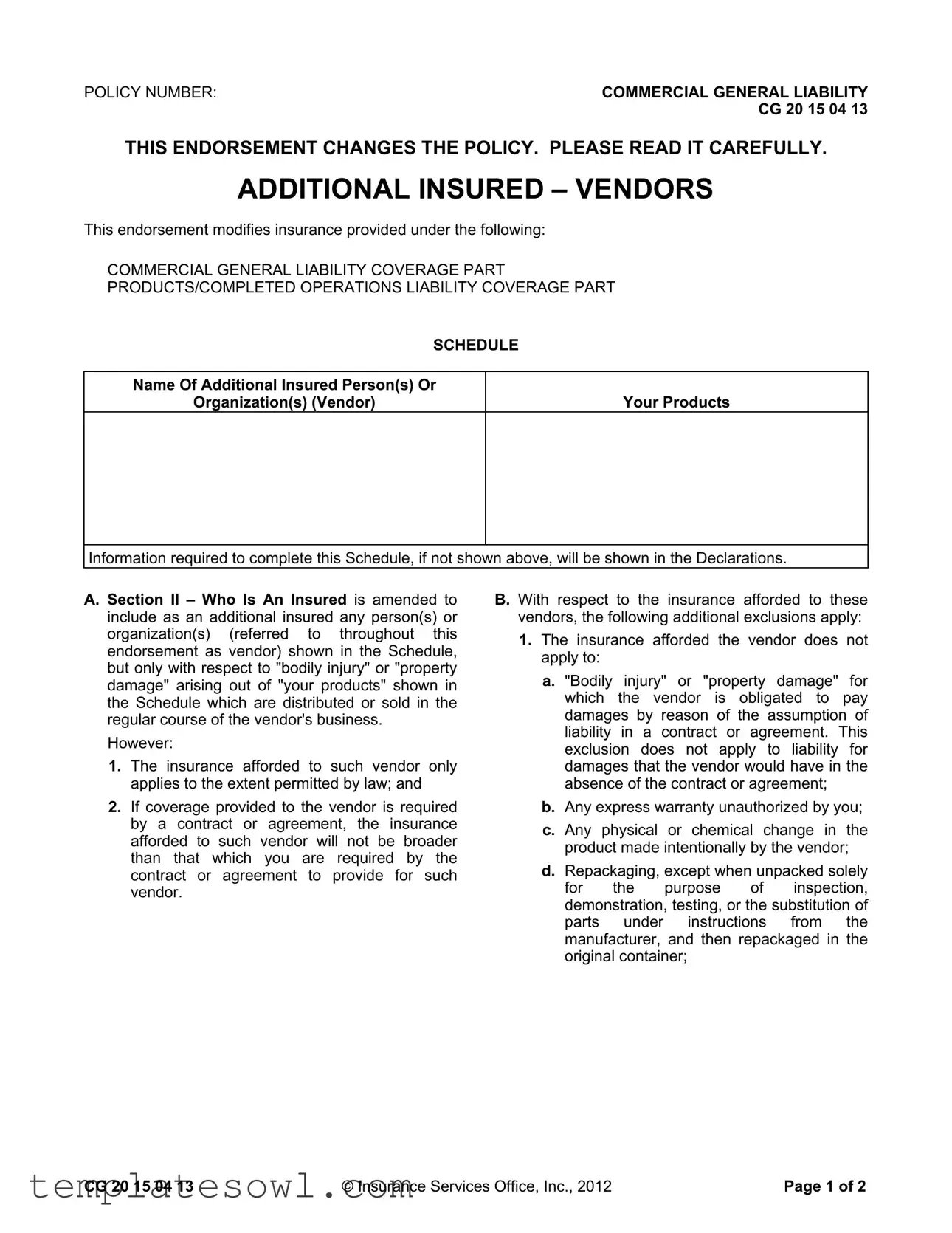

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 15 04 13 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – VENDORS

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s) Or

Organization(s) (Vendor)

Your Products

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured any person(s) or organization(s) (referred to throughout this endorsement as vendor) shown in the Schedule, but only with respect to "bodily injury" or "property damage" arising out of "your products" shown in the Schedule which are distributed or sold in the regular course of the vendor's business.

However:

1.The insurance afforded to such vendor only applies to the extent permitted by law; and

2.If coverage provided to the vendor is required by a contract or agreement, the insurance afforded to such vendor will not be broader than that which you are required by the contract or agreement to provide for such vendor.

B. With respect to the insurance afforded to these vendors, the following additional exclusions apply:

1.The insurance afforded the vendor does not apply to:

a."Bodily injury" or "property damage" for which the vendor is obligated to pay damages by reason of the assumption of liability in a contract or agreement. This exclusion does not apply to liability for damages that the vendor would have in the absence of the contract or agreement;

b.Any express warranty unauthorized by you;

c.Any physical or chemical change in the product made intentionally by the vendor;

d.Repackaging, except when unpacked solely for the purpose of inspection, demonstration, testing, or the substitution of parts under instructions from the manufacturer, and then repackaged in the original container;

CG 20 15 04 13 |

© Insurance Services Office, Inc., 2012 |

Page 1 of 2 |

e. Any failure to make such inspections, adjustments, tests or servicing as the vendor has agreed to make or normally undertakes to make in the usual course of business, in connection with the distribution or sale of the products;

f. Demonstration, installation, servicing or repair operations, except such operations performed at the vendor's premises in connection with the sale of the product;

g.Products which, after distribution or sale by you, have been labeled or relabeled or used as a container, part or ingredient of any other thing or substance by or for the vendor; or

h."Bodily injury" or "property damage" arising out of the sole negligence of the vendor for its own acts or omissions or those of its employees or anyone else acting on its behalf. However, this exclusion does not apply to:

(1)The exceptions contained in Sub- paragraphs d. or f.; or

(2)Such inspections, adjustments, tests or servicing as the vendor has agreed to make or normally undertakes to make in the usual course of business, in connection with the distribution or sale of the products.

2.This insurance does not apply to any insured person or organization, from whom you have acquired such products, or any ingredient, part or container, entering into, accompanying or containing such products.

C.With respect to the insurance afforded to these vendors, the following is added to Section III – Limits Of Insurance:

If coverage provided to the vendor is required by a contract or agreement, the most we will pay on behalf of the vendor is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable Limits of Insurance shown in the Declarations;

whichever is less.

This endorsement shall not increase the applicable Limits of Insurance shown in the Declarations.

Page 2 of 2 |

© Insurance Services Office, Inc., 2012 |

CG 20 15 04 13 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Policy Number | The form is associated with the policy number CG 20 15 04 13. |

| Coverage Scope | This endorsement provides additional insured status to vendors for "bodily injury" or "property damage" arising out of "your products". |

| Limitations of Coverage | Vendors are only covered to the extent permitted by law and limitations defined in a contract or agreement. |

| Exclusions | Coverage excludes liability due to contract assumptions, unauthorized warranties, physical changes, and negligence of the vendor. |

| Contractual Limits | The maximum amount payable for vendors is either based on contract requirements or existing limits in the policy, whichever is less. |

| Declarations Reference | Details necessary for proper coverage must be referenced in the Declarations section of the policy. |

Guidelines on Utilizing Additional Insured Vendors

Completing the Additional Insured Vendors form requires careful attention to detail. This process ensures that the necessary information is accurately captured, allowing for proper coverage under the policy.

- Locate the form titled Additional Insured – Vendors.

- Find the section labeled POLICY NUMBER and fill in the specific policy number as indicated on your documentation.

- In the Name Of Additional Insured Person(s) Or Organization(s) (Vendor) field, enter the legal name of the vendor you are adding as an additional insured.

- If there are additional products involved, provide Your Products information as required in the designated area.

- Review Section A to ensure adherence to the conditions outlined concerning "bodily injury" or "property damage" linked to the vendor’s activities.

- Consult Section B for any exclusions that might apply and confirm they align with the terms of your agreement with the vendor.

- Finally, assess the limits of insurance specified in Section C and ensure they meet contractual requirements for the vendor.

- Sign and date the form to verify the information provided is accurate and complete.

What You Should Know About This Form

What is the purpose of the Additional Insured Vendors form?

The Additional Insured Vendors form allows businesses to include specific vendors as additional insureds under their commercial general liability insurance policy. This inclusion provides vendors coverage for bodily injury or property damage related to your products that they distribute or sell, subject to certain limitations and exclusives.

Who is considered an additional insured under this form?

An additional insured under this form is any person or organization specified in the schedule section of the endorsement. This additional insured status applies strictly in scenarios where bodily injury or property damage arises out of your products as listed in the schedule and is related to the vendor’s typical business operations.

Under what conditions does the coverage apply?

The coverage applies only to the extent permitted by law. Additionally, if a contract or agreement requires coverage for the vendor, the insurance provided will not exceed the scope dictated by that contract or agreement.

Are there specific exclusions listed in the endorsement?

Yes, several exclusions apply. Notably, coverage does not extend to bodily injury or property damage for which the vendor is liable due to assumed contractual obligations. Other exclusions include any unauthorized warranties by the vendor, changes to products, repackaging issues, and negligence solely attributed to the vendor.

What happens in case of a product being labeled or relabeled by the vendor?

Insurance coverage does not apply to products that, after being distributed or sold by you, have been relabeled or used as components in other products by the vendor. This restriction seeks to prevent issues arising from alterations made after the initial sale.

How does this endorsement affect insurance limits?

The endorsement does not increase the overall limits of insurance shown in your declarations. If coverage is required by contract, the maximum payout for the vendor will be the lower of the contract-required amount or the applicable limits in your policy declarations.

Can vendors expect coverage for their own negligence?

Not typically. Coverage does not apply to bodily injury or property damage arising solely from the vendor's own negligence. However, specific activities, such as inspections and servicing that the vendor is contractually bound to perform, may still be covered under certain conditions.

Is the vendor required to be named on the policy for coverage to apply?

Yes, vendors must be explicitly named in the schedule section of the endorsement for the additional insured status to take effect. Coverage does not automatically extend to all vendors without proper documentation in the insurance policy.

What should businesses do if they have additional questions about the form?

Businesses should consult with their insurance agents or legal advisors to clarify specific points regarding the Additional Insured Vendors form. Understanding the nuances of coverage and exclusions is essential for effective risk management.

Common mistakes

When filling out the Additional Insured Vendors form, individuals can encounter various common mistakes that can jeopardize insurance coverage. One frequent error is neglecting to list the full name of the additional insured. Providing an incomplete name or an abbreviation can lead to confusion or disputes when a claim arises, as it may not match the legal entity recognized in contracts.

Another common issue arises from failing to specify the scope of coverage. The form is designed to limit coverage to specific incidents related to the vendor's operations. If the description of the vendor’s activities is too vague, it could limit the effectiveness of the coverage in case of a claim.

People often forget to check for compliance with contractual obligations. Coverage afforded to the vendor should not exceed what is specified in the contract. If a party extends a broader insurance coverage than what was agreed upon, it can lead to complications and challenges in claims processing.

Inaccurate policy numbers present another risk. Entering the wrong policy number can result in lost time verifying coverage later. It is crucial to double-check the policy number to ensure it directly corresponds to the relevant coverage.

Another mistake involves misunderstanding the exclusions listed in the endorsement. Many people overlook these exclusions, which detail specific scenarios where the insurance would not apply. A clear understanding of these exclusions can prevent surprises when attempting to file a claim.

A failure to review the schedule is also common. Insurance forms often have a section that lists important details, such as the type of products the coverage applies to. Omitting product information or not detailing the various products can leave gaps in coverage.

Some individuals neglect to update the form with any changes in operations or vendors. It's essential to amend the Additional Insured Vendors form when there are changes to ensure that all parties maintain the necessary coverage levels. This oversight can lead to significant issues, especially if a claim arises connected to an unreported vendor.

Entering incorrect addresses for vendors can create complications as well. Accurate addresses ensure that all parties can be easily contacted in case of claims or audits. Mistakes in this area can result in delays and problems with claim processing.

Moreover, many people fail to retain a copy of the completed form for their records. Keeping documentation of what has been submitted is vital for tracking what coverage exists and can aid in resolving potential disputes over coverage amounts.

Lastly, misunderstandings about the nature of “your products” can lead to problems. It is crucial to maintain clarity on what is being covered under the additional insured status to avoid claims being denied due to misinterpretation of what constitutes the covered products. Awareness of these common mistakes can significantly enhance the accuracy and effectiveness of the Additional Insured Vendors form.

Documents used along the form

When dealing with insurance matters, especially regarding liability, it’s crucial to understand various forms and documents often used alongside the Additional Insured Vendors form. Each document plays a vital role in clarifying responsibilities and coverage, ensuring that all parties involved are adequately protected. Below are some common forms that complement the Additional Insured Vendors form.

- Certificate of Insurance (COI): This document proves that a business holds specific insurance coverage. A COI typically outlines the types of coverage, policy limits, and the name of the insured party. It serves as a confirmation to vendors or clients that the necessary insurance is in place.

- Indemnity Agreement: An indemnity agreement is a contract where one party agrees to compensate another for certain damages or losses. This document often outlines the conditions under which indemnification occurs and can address liabilities that the Additional Insured Vendors form does not cover.

- Contractor Agreement: A contractor agreement delineates the terms of the relationship between a vendor and the contractor who might be engaging their services. This document often includes clauses about insurance requirements, the scope of work, and responsibilities for liabilities, tying back to the coverage provided in the Additional Insured Vendors form.

- Exclusions Schedule: This schedule specifies which events or situations are not covered under an insurance policy. A thorough understanding of the exclusions helps clarify the limitations of coverage provided by the Additional Insured Vendors form, emphasizing any risks that may remain.

Being aware of these documents will not only safeguard your interests but also strengthen your business relationships. Ensure that you have all relevant forms in check to minimize exposure to risk and liability. It’s advisable to consult with a professional to navigate these documents effectively and ensure compliance with all legal obligations.

Similar forms

The Additional Insured Vendors form serves as a vital document in the realm of liability coverage for vendors. Its primary focus is on extending insurance protection to vendors who distribute or sell products in the regular course of their business. There are several other documents that share similarities with the Additional Insured Vendors form in terms of purpose, coverage, and integration within insurance practices. Here is a list of those similar documents:

- Certificate of Insurance: This document provides proof of insurance coverage but does not confer additional insured status unless explicitly stated. It is commonly used in contractual agreements to verify that adequate coverage exists.

- Additional Insured Endorsement: Similar to the Additional Insured Vendors form, this endorsement extends coverage to designated entities. However, it can be more broad, encompassing various types of liability beyond just vendors.

- Waiver of Subrogation: This document protects the vendor by preventing the insurance company from pursuing recovery from a third party who may be liable for a loss, similar to how additional insured status provides protection against claims related to the covered products.

- Indemnification Agreement: Often included in contracts, this agreement requires one party to compensate another for certain losses, aligning with the purpose of protecting vendors from certain liabilities outlined in the Additional Insured Vendors form.

- General Liability Insurance Policy: This policy typically provides broad protection against various claims, similar to how the Additional Insured Vendors form extends liability coverage specifically focused on vendor-related injuries or damages.

- Contractual Liability Insurance: This type of insurance covers liabilities assumed in contracts, echoing the restrictions placed on coverage for vendors mentioned in the Additional Insured Vendors form.

- Products Liability Insurance: This specific coverage is essential for businesses that manufacture or sell products, reflecting the core theme of the Additional Insured Vendors form that focuses on liabilities arising from the vendor’s products.

- Professional Liability Insurance: While typically associated with professional services, this policy resembles the vendor coverage by protecting against claims stemming from professional negligence, much like how the Additional Insured form addresses product-related claims.

Understanding these documents and their similarities to the Additional Insured Vendors form can elucidate the protections afforded to vendors and enhance the clarity around liability coverage in various business transactions.

Dos and Don'ts

When filling out the Additional Insured Vendors form, keep the following points in mind:

- Do ensure that the policy number is accurate and matches your existing insurance documentation.

- Do clearly list all names of additional insured persons or organizations in the designated area.

- Do verify that any products listed are relevant to the business activities of the vendor.

- Don't assume coverage applies without confirming if the vendor is included in the policy's schedule.

- Don't provide information about other forms of insurance that do not pertain to this endorsement.

- Don't overlook the exclusions that may apply to the specific vendor you are listing.

- Don't sign the form until you've reviewed all details for accuracy.

Misconceptions

Misconceptions about the Additional Insured Vendors form can lead to misunderstandings regarding coverage and responsibilities. Here are eight common misconceptions:

- All vendors are automatically covered. The form only covers specific vendors listed in the schedule. Coverage is limited to those mentioned by name.

- This form provides blanket coverage for all liabilities. The coverage applies solely to bodily injury or property damage arising from the contractor's products. It does not cover all types of claims.

- The coverage is as broad as any vendor contract. The insurance coverage will not exceed the limits specified in any contract. The form does not automatically provide additional coverage beyond what is agreed upon.

- Vendors are protected against all negligence claims. The form explicitly excludes coverage for bodily injury or property damage arising from the vendor's own negligence.

- This endorsement covers product modifications made by vendors. Any physical or chemical changes made by the vendor to a product are excluded from coverage unless specifically authorized.

- The insurance covers all business activities of the vendor. Coverage is limited to activities related to the distribution or sale of the products listed. Other business activities are not included.

- The limits of insurance can be exceeded. The policy expressly states that the limits of insurance shown in the declarations will not be increased by this endorsement.

- The form covers liability incurred through vendor contracts. If a vendor assumes liability through a contract, coverage will not apply for that liability unless it would exist independently of the contract.

Understanding these misconceptions can help in appropriately managing expectations and ensuring compliance with insurance requirements.

Key takeaways

Understanding the Additional Insured Vendors form is crucial for proper coverage. Here are some key takeaways:

- Policy Number: Always note the policy number on the form. This ensures clarity and accuracy.

- Definition of Additional Insured: Only those named in the schedule qualify as additional insureds. This is limited to "bodily injury" or "property damage" from your products.

- Coverage Limits: The coverage for additional insured vendors is limited by law and by any existing contracts.

- Exclusions to Keep in Mind: The insurance does not cover vendor obligations from contracts or agreements. Be aware of what is excluded.

- Contractual Obligations: If coverage is mandated by a contract, it cannot exceed what is required by that contract.

- Claims and Liability: Liability arising from a vendor’s own negligence is excluded, except for certain specified exceptions.

Browse Other Templates

Self Employment Sworn Statement - Download the CSF 35 to kick-start your self-employment documentation journey.

Rent Letter Sample - It's essential to handle your late rent payment quickly.

Allegheny County Dog License Online - Organizing your documentation in advance can simplify the application process.