Fill Out Your Adm 399 Form

The ADM 399 form serves as an essential tool for individuals seeking refunds for various fees collected by the Department of Motor Vehicles (DMV) in California. This application specifically addresses requests for refunds related to vehicle or vessel registration, driver licenses, identification cards, and special certificates, among other payments. Refunds are warranted when fees were either paid in error or are not mandated by law—as outlined in California Vehicle Code §42231 and Revenue and Taxation Code §10901. To initiate the process, applicants must carefully read the instructions to ascertain eligibility and complete the form accurately. Key steps include submitting the application to the nearest DMV office or through mail, alongside necessary documentation that verifies the claim, such as copies of payment receipts or vehicle registration cards. It is crucial to note that not all requests are eligible for refunds; the DMV has specific criteria that must be met. This includes timing restrictions, such as submitting requests within three years of payment, and specific situations like refunds for duplicate items that were voluntarily requested. A well-prepared application can lead to expedited processing, with notifications typically sent within 30 days of the submission, allowing for clarity and communication throughout the refund process.

Adm 399 Example

APPLICATION FOR REFUND

A Public Service Agency

INSTRUCTIONS:

This application form (ADM 399) can be used to request refunds for vehicle/vessel registration, driver license, identification card, special certificate, financial responsibility, and other fees and/or penalties collected by the Department of Motor Vehicles (DMV). Refund is due when fees were paid in error or were not required to be paid to DMV as stated in California Vehicle Code §42231 and/or Revenue and Taxation Code §10901.

To apply for a refund of fees and/or penalties collected by DMV that were erroneous, excessive, or not due:

•Read the instructions thoroughly to determine if a refund of fees is due.

•Complete Application for Refund. See the instructions.

Submit the Application for Refund to the nearest DMV office or mail to: |

|

|

Registration |

Driver License/Identification Card |

Occupational Licensing |

Department of Motor Vehicles |

Department of Motor Vehicles |

Department of Motor Vehicles |

PO Box 942869, MS A235 |

PO Box 942890 |

Occupational Licensing Section |

Sacramento, CA |

Sacramento, CA |

PO Box 932342, MS L224 |

|

|

Sacramento, CA |

DMV will not honor refund requests that are:

•for registration fees:

–when they were paid prior to the sale of the vehicle.

–when the vehicle was operated after the new registration year.

–covering a portion of the year.

–wrecked after fees became due.

•for duplicate certificates and/or stickers when they were applied for voluntarily.

•for parking fees. Please contact the issuing agency or the court for the parking fee refund.

•for use tax. Please contact the California Department of Tax and Fee Administration for the use tax refund.

•received more than three years after the payment was made. This is due to the statute of limitations and the fact that DMV’s records are no longer available for verification.

•for all types of driver license and/or identification card applications unless the fee was collected in error.

Attach all applicable substantiation for your requested refund:

•Photocopy of the cancelled check (front and back) or credit card receipt showing proof of payment. If payment was made twice to DMV, please submit photocopies of both cancelled checks or credit card receipts.

•Photocopy of receipts issued by DMV.

•Vehicle registration card/stickers for the year fees are requested to be refunded.

•Photocopy of insurance Statement of Facts showing date of loss.

•Completed Certificate of

•Completed Notice of Transfer and Release of Liability (REG 138) providing the name and address of the purchaser and the date of sale.

•Completed Nonresident Military (NRM) Vehicle License Fee and Transportation Improvement Fee Exemption (REG 5045) form.

•Certificate of Title issued for the vehicle or vessel for which the fees are requested to be refunded (if a change or correction of vehicle or vessel description is also involved).

•Statement of Facts (REG 256) completed and signed authorizing DMV to issue the refund in your name (if you are other than the registered owner or selling dealer).

•Proof of medical condition which prevented issuance of a driver license.

NOTE: You will be notified of the disposition of your refund within 30 days from the date of receipt of the Application for Refund in Sacramento. You will be contacted by phone, email or surface mail if additional items or clarification is required. Please visit DMV’s Refund FAQs Webpage at https://www.dmv.ca.gov/ portal/dmv/detail/online/refund/refundfaqs for more details.

ADM 399 (REV. 6/2020) WWW

|

Clear Form |

|

|

|

|

APPLICATION FOR REFUND

A Public Service Agency

INSTRUCTIONS (continued)

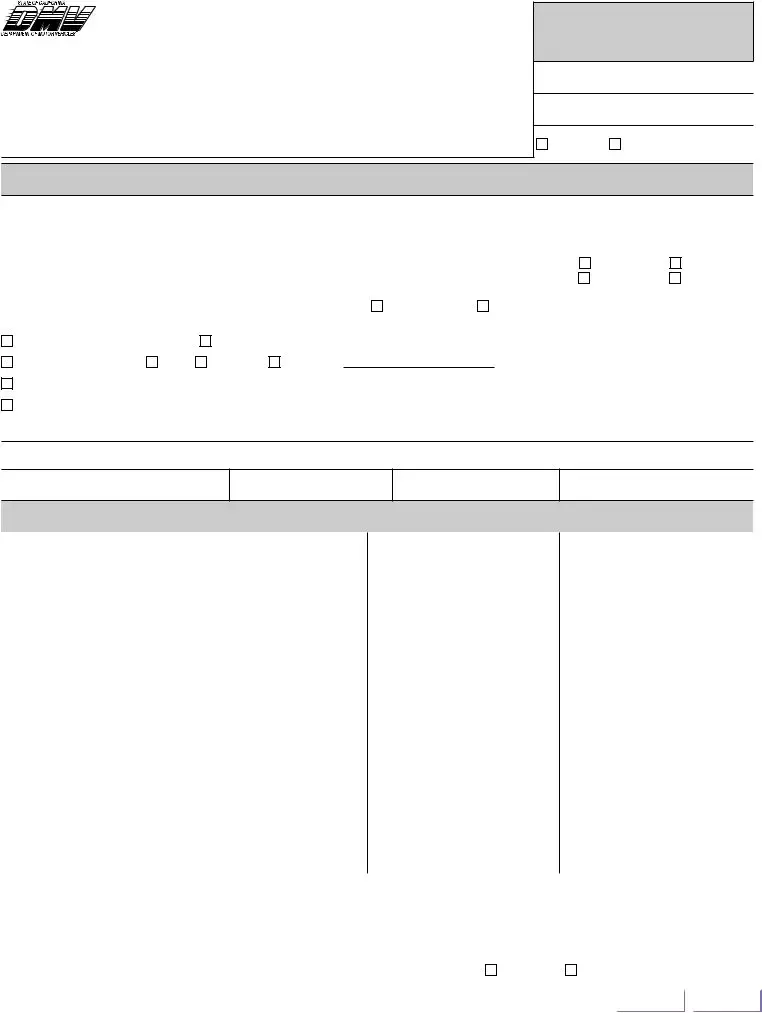

How to complete Application for Refund:

•“Item” corresponds to the numbers shown on the Application for Refund.

•“Item Description” is the same as indicated on the application form.

•“What to Enter” clarifies the information required to be completed by the applicant.

ITEM |

ITEM DESCRIPTION |

WHAT TO ENTER |

1 |

Name or Company Name |

Name (last, first, and middle initial) of the individual(s) and/or company that is |

|

|

entitled to the refund. Refund is issued back to the original form of payment. |

|

|

For credit card refunds, the refund is issued back to the credit card holder. If the |

|

|

refund needs to be issued to a different person, a completed Statement of Facts |

|

|

(REG 256) is needed. |

2 |

Mailing Address |

Show complete mailing address. (For an “in care of” (C/O) address, enter the |

|

|

C/O name first on the mailing address line, followed by the mailing address.) |

3 |

City, State, and Zip Code |

Show complete city name, state, and zip code. |

4VIN/HIN (Last 3 Characters) Refund of registration fees only: show the last three characters of the vehicle identification number or vessel hull identification number.

5Registered Owner or License Registered owner’s name or licensed person’s name if different from the

Name |

Applicant. Include the registered owner’s or the licensed person’s address in the |

|

blank space under #11 “Other”. |

6License or License Plate Refund of driver license fees: show the license number (Including identification

|

Number |

card, driver license, motorcycle license, commercial driver license, special |

|

|

certificate, occupational license, or financial responsibility, etc.) |

|

|

Refund of registration fees: show the vehicle license plate number, vessel |

|

|

registration number, one trip permit number, commercial requester account |

|

|

number, or IRP fleet number, etc. |

6a |

Registration |

Mark an “X” in the “Registration” box if refund is for vehicle/vessel related fees. |

|

Driver/ID |

Mark an “X” in the “Driver/ID” box if refund is for driver license or identification |

|

Occupational |

card related fees. |

|

Misc. |

Mark an “X” in the “Occupational” box if refund is for occupational license fees. |

|

|

For all others, mark an “X” in the “Misc.” box. |

7 |

Date Fees Were Paid |

Enter the date the fees to be refunded were originally paid. |

8 |

Office Where |

Enter the name of the DMV office, business partner, or location of the Auto Club |

|

Fees Were Paid |

where the fees to be refunded were originally paid. |

9 |

Payment Method |

Mark an “X” in the box of your original payment method. |

10Refund Amount Requested Enter the amount of refund that you are requesting, including dollars and cents.

11 |

Reason for Refund |

Mark an “X” in the appropriate box. Mark an “X” in the “Other” box if the reason |

|

|

for refund is not listed. Write a brief statement justifying the refund request. |

|

|

If applicant is not the registered owner’s or the licensed person’s include the |

|

|

registered owner’s or licensed person’s address under “Other”. |

12 |

Signature of Applicant |

Your signature. |

|

|

|

|

13 |

Date |

Enter the date the Application for Refund is signed. |

||||

14 |

Daytime Telephone Number |

Your daytime area code and telephone number. |

||||

15 |

Email Address |

Your email address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clear Form |

|

|

|

|

|

|

|

|

|

ADM 399 (REV. 6/2020) WWW

A Public Service Agency

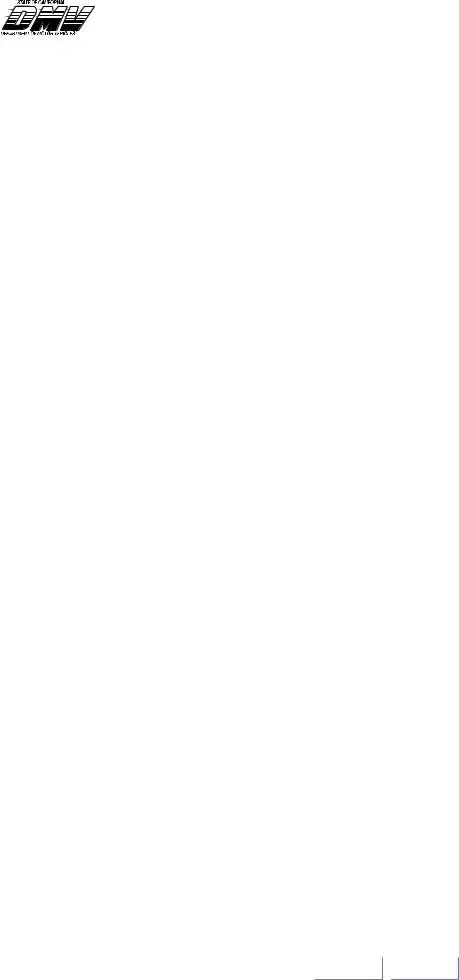

APPLICATION FOR REFUND

DMV USE ONLY

RECEIVED AND DESTROYED STICKER NO. HERE

YEAR ______

WARRANT NO. (ACCOUNTING USE ONLY)

DATE DMV RECEIVED REFUND REQUEST

BUSINESS INDICATOR

B |

I |

SECTION 1 — APPLICANT INFORMATION

1. NAME (LAST, FIRST, MI) OR COMPANY NAME

2. MAILING ADDRESS |

|

|

|

|

3. CITY |

|

|

|

STATE |

ZIP CODE |

|||

|

|

|

|

|

|

|

|

|

|

|

|||

4. VIN/HIN (LAST 3 CHARACTERS) |

|

5. REGISTERED OWNER OR LICENSE NAME |

6. LICENSE OR LICENSE PLATE NUMBER |

6A. |

REGISTRATION |

DRIVER/ID |

|||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

OCCUPATIONAL |

MISC. |

|

|

7. DATE FEES WERE PAID (MM/DD/YYYY) |

8. OFFICE WHERE FEES WERE PAID |

9. PAYMENT METHOD |

|

|

10. REFUND AMOUNT REQUESTED |

|||||||

|

|

|

|

|

|

|

CREDIT/DEBIT |

CASH/CHECK |

|

|

|

|

|

|

11. A REFUND OF FEES IS BEING REQUESTED |

BECAUSE: |

|

|

|

|

|

|

|

|

|

||

|

Vehicle/vessel left California |

last operated in California on |

|

|

. |

|

|

|

|

||||

|

DATE |

|

|

|

|

|

|||||||

|

Vehicle/vessel was |

sold |

wrecked |

stolen on |

|

. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

DL/ID/OL Refund Reason

DATE

Other (please explain briefly).

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

12. SIGNATURE OF APPLICANT

13. DATE

14. DAYTIME TELEPHONE NUMBER |

15. EMAIL ADDRESS |

( )

FOR DMV USE ONLY

SUB M FEE CLEARANCE INFO |

REPORTING UNIT NUMBER TYPE LICENSE TOTAL REFUND |

|

FEE CODES + |

REFUND |

FEE CODES + |

REFUND |

FEE CODES + |

|

REFUND |

FEE CODES + |

|

REFUND |

|

|||||

|

Waiver/County |

AMOUNT |

Waiver/County |

AMOUNT |

Waiver/County |

|

AMOUNT |

Waiver/County |

|

AMOUNT |

||||||

|

(008) |

|

(088) |

|

060 |

|

|

VL2 - |

|

|

|

|

|

|||

AA - |

|

AQ63 - |

|

|

|

|

|

|

|

|

||||||

|

(031) |

|

(089) |

|

154 |

|

|

VPC |

|

|

|

|

|

|||

AO - |

|

AQ64 - |

|

|

|

|

|

|

|

|

||||||

|

(069) |

|

(093) |

|

316 |

|

|

|

|

|

|

|

|

|

||

AZ - |

|

AN - |

|

|

|

|

|

|

|

|

|

|

||||

|

(074) |

|

(094) |

|

501 |

|

|

|

|

|

|

|

|

|

||

AD - |

|

AU - |

|

|

|

|

|

|

|

|

|

|

||||

|

(075) |

|

(095) |

|

502 |

|

|

|

|

|

|

|

|

|

||

AL - |

|

AI - |

|

|

|

|

|

|

|

|

|

|

||||

|

(076) |

|

001 |

|

|

503 |

|

|

|

|

|

|

|

|

|

|

AJ - |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(083) |

|

002 |

|

|

50L |

|

|

|

|

|

|

|

|

|

|

AT - |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(084) |

|

003 |

|

|

AQ1 |

|

|

|

|

|

|

|

|

|

|

AB - |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(085) |

|

00L - |

|

AR1 |

|

|

|

|

|

|

|

|

|

||

AQ - |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

(086) |

|

014 |

|

|

AR0 |

|

|

|

|

|

|

|

|

|

|

AS - |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(087) |

|

039 |

|

|

EF0 |

|

|

|

|

|

|

|

|

|

|

AV - |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

DMV APPROVALS (LEGIBLE SIGNATURE REQUIRED) |

|

|

|

|

|

|

|

||||

|

TECHNICIAN NAME |

|

|

TECHNICIAN SIGNATURE |

|

TECHNICIAN TELEPHONE NUMBER |

DATE |

|

|

|

|

|||||

|

|

|

|

|

X |

|

|

( |

) |

|

|

|

|

|

|

|

|

MANAGER NAME |

|

|

MANAGER SIGNATURE |

|

MANAGER TELEPHONE NUMBER |

DATE |

|

|

|

|

|||||

|

|

|

|

|

X |

|

|

( |

) |

|

|

|

|

|

|

|

|

Z96 # |

|

|

|

|

|

|

CREDIT CARD COMPANY NAME |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

ELAVON |

FIRST DATA |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADM 399 (REV. 6/2020) WWW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Clear Form |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The ADM 399 form is used to request refunds for various fees collected by the DMV. |

| Applicable Fees | This form can be used for vehicle/vessel registration, driver licenses, identification cards, and more. |

| Governing Laws | California Vehicle Code §42231 and Revenue and Taxation Code §10901 govern the refund process. |

| Eligibility Criteria | Refund requests are valid when fees were paid in error or were not needed. |

| Submission Methods | Applications can be submitted in person at DMV offices or mailed to designated DMV addresses. |

| Refund Exclusions | Requests for duplicate certificates, parking fees, and use tax are not eligible for refunds through this application. |

| Documentation Required | Applicants must attach proof of payment, such as canceled checks or credit card receipts. |

| Processing Time | Applicants will be notified within 30 days about the status of their refund request. |

| Statute of Limitations | Refund requests must be made within three years from the date of payment. |

| Online Resources | Additional information can be found on DMV’s Refund FAQs webpage. |

Guidelines on Utilizing Adm 399

The ADM 399 form is essential for requesting refunds from the DMV in California. To ensure success in your application, follow each step carefully to provide the needed information. This guide simplifies the process of completing the form, ensuring clarity and effectiveness.

- Download and print the ADM 399 form.

- In Item 1, enter your full name or company name as it appears on the payment method.

- Provide your mailing address in Item 2.

- Fill in Item 3 with your city, state, and zip code.

- If requesting a registration fee refund, fill in Item 4 with the last three characters of the VIN or HIN.

- In Item 5, enter the name of the registered owner or licensed person, including their address in section 11 if it differs from yours.

- For Item 6, provide the correct license or license plate number based on the type of refund you’re requesting.

- Mark the appropriate box in Item 6a to indicate the type of refund.

- Fill in Item 7 with the date the fees were originally paid.

- In Item 8, state the name of the DMV office where the fees were paid.

- Mark the box that corresponds with your payment method in Item 9.

- Enter the total amount you are requesting as a refund in Item 10.

- Indicate the reason for the refund in Item 11 and provide any necessary details.

- Sign and date the form in Items 12 and 13.

- Provide your daytime telephone number in Item 14.

- Lastly, include your email address in Item 15.

Once you've completed the form, gather any required documents before submitting. You may visit your local DMV office or mail the form to the appropriate address provided in the instructions. Keep an eye out for communication from the DMV about the status of your refund request.

What You Should Know About This Form

What is the purpose of the ADM 399 form?

The ADM 399 form is used to request refunds for various fees collected by the Department of Motor Vehicles (DMV). This includes refunds for vehicle or vessel registration, driver licenses, identification cards, special certificates, and other penalties. A refund may be due if fees were overpaid or paid in error.

How do I determine if I am eligible for a refund?

You may be eligible for a refund if you have paid fees that were not required or were made in error, as outlined in California Vehicle Code §42231 and Revenue and Taxation Code §10901. It’s important to read the instructions carefully to assess your eligibility before completing the form.

What should I include with my refund application?

When submitting your application, attach all relevant documentation. This might include proof of payment, like cancelled checks or credit card receipts. Additionally, include any DMV-issued receipts, a Vehicle Registration card, and forms substantiating your request for a refund.

What types of fees are not eligible for a refund?

DMV will not approve refund requests for registration fees paid before vehicle sale, for duplicate certificates obtained voluntarily, or for parking fees. Additionally, requests received more than three years after payment cannot be honored due to limitations on records.

How do I submit the ADM 399 form?

You can submit your completed form to the nearest DMV office, or you can mail it to the appropriate DMV divisions as specified in the instructions. Ensure that you send it to the correct address, depending on the type of refund you are requesting.

How long will it take to receive my refund?

You will receive notification about the decision regarding your refund within 30 days of the DMV receiving your application. If further information is needed, DMV staff will reach out to you via phone, email, or mail.

What if I submitted my application but haven’t heard back?

If you haven’t received an update within the outlined timeframe, it is advisable to contact the DMV for the status of your application. Be ready to provide any necessary details to expedite the inquiry.

Can someone else submit the refund request on my behalf?

Yes, someone else can submit the request, but they must complete a Statement of Facts (REG 256) authorizing DMV to issue the refund to them. Make sure to follow this requirement to avoid delays in processing your application.

Common mistakes

Submitting the ADM 399 form can feel overwhelming. Many individuals make mistakes that can delay or deny their refund requests. One common error is not providing complete and accurate contact information. Applicants often forget to include their mailing address or fill out the city, state, and zip code sections correctly. This can lead to complications in processing the refund, as the DMV needs this information to contact the applicant.

Another mistake involves the refund amount requested. People sometimes enter an incorrect amount, forgetting to include cents or miscalculating the total. Ensuring this figure is accurate is crucial because it directly affects the outcome of the application. If an error is made, it may require resubmission of the form, resulting in further delays.

Filling out the section related to the reason for the refund can also trip applicants up. Many tend to either select the wrong option or fail to provide a clear, concise justification for the request. Marking “Other” without a proper explanation is particularly problematic. The DMV requires a brief statement justifying the refund request to assess its validity.

Additionally, applicants often overlook the requirement for documentation. Failing to attach all necessary substantiation, such as a photocopy of the original payment proof, can lead to a rejection of the application. It's not enough to simply fill out the form; all supporting documents must also be included for successful processing.

The signature of the applicant is another common point of failure. Some individuals forget to sign the application, while others may fail to date it properly. Both are critical for the DMV to consider the application valid. An unsigned or undated form is essentially incomplete.

Identifying the correct DMV office where fees were paid often poses challenges, leading to further errors. Some applicants mistakenly list an incorrect location, which could impact the processing of their refund. It's important to double-check the location before submission.

Finally, individuals sometimes misinterpret the instructions regarding the method of payment or miss marking their chosen payment method altogether. This oversight can cause confusion and delay as the DMV relies on this information to process the refund accurately. Each of these mistakes can complicate the application process, making thoroughness and attention to detail essential when completing the ADM 399 form.

Documents used along the form

When filing the ADM 399 form to request a refund from the DMV, you may need several other documents to support your application. Each piece of documentation plays a crucial role in helping to clarify your request and ensure that the process goes smoothly.

- Certificate of Title (REG 227): This document serves as proof of ownership of a vehicle or vessel and may be necessary if the refund request relates to a change or correction in the vehicle's description.

- Statement of Facts (REG 256): Use this form to provide additional details about your refund request, especially if you are not the registered owner but are making the request on their behalf.

- Notice of Transfer and Release of Liability (REG 138): This form must be submitted when a vehicle is sold. It provides DMV with the buyer's details and the sale date, helping establish that the seller is no longer responsible for the vehicle.

- Nonresident Military (NRM) Vehicle License Fee Exemption (REG 5045): If you are a member of the military and meet certain criteria, this form can help you claim an exemption from specific fees.

- Certificate of Non-Operation (REG 102): If the vehicle was not operated during the registration period, this form establishes that and can support your refund request.

- Photocopies of Payment Evidence: Include photocopies of canceled checks or credit card receipts to demonstrate proof of payment. Submitting these documents can expedite the review process.

Having the necessary documents ready can significantly streamline your refund request with the DMV. It's important to ensure all files are correctly completed and submitted alongside the ADM 399 form to avoid delays in processing.

Similar forms

- Form REG 102: This form is used to certify non-operation or planned non-operation of a vehicle. Like the ADM 399, it is geared towards managing vehicle records and helps in requesting refunds or exemptions in registration fees.

- Form REG 138: This document is the Notice of Transfer and Release of Liability. It is crucial for reporting the sale of a vehicle, ensuring the previous owner is not held liable for future actions. Similar to ADM 399, it provides a means for individuals to correct records with the DMV.

- Form REG 5045: This is a Nonresident Military Vehicle License Fee and Transportation Improvement Fee Exemption form. It helps service members request refunds or exemptions related to vehicle registration fees, just like the ADM 399 facilitates the refund process.

- Form REG 256: The Statement of Facts allows an individual to authorize a refund to someone other than the registered owner. Like ADM 399, it gathers necessary information to process requests accurately for various situations involving refunds.

- Form DL 44: This is the application for a driver’s license. While it’s primarily used to apply for a new license, it shares a purpose with ADM 399 in managing driver fees, ensuring that the reasons for payments are accurately processed.

- Form ID 440: This form is used to issue identification cards. Similar to ADM 399, it entails the payment of fees and ensures that transactions with the DMV are accurately reflected and managed.

- Form REG 342: This is a General Request form that allows individuals to inquire about their vehicle status or make payments. Like the ADM 399, it facilitates communication with the DMV regarding refunds and other requests related to fees.

Dos and Don'ts

When filling out the ADM 399 form, here are some important dos and don'ts:

- Do: Read the instructions thoroughly to ensure you qualify for a refund.

- Do: Provide complete and accurate information on all required fields.

- Do: Include any necessary documentation to support your refund request.

- Do: Submit the form to the correct DMV office or mail it to the appropriate address.

- Don't: Submit a refund request if the payment was made more than three years ago.

- Don't: Apply for a refund of fees that were paid voluntarily.

- Don't: Expect a refund unless you attach substantiating documents.

- Don't: Skip any fields; incomplete applications may be rejected.

Misconceptions

- Only DMV staff can file the ADM 399 form. Any individual or business eligible for a refund can submit the application, not just DMV employees.

- The ADM 399 form can be used for any type of refund. This form is specific to fees paid to the DMV. For other types of refunds, different processes may apply.

- All refund requests will be granted. Refunds are only issued for eligible circumstances outlined in the instructions. Requests for registration fees under certain conditions may be denied.

- If I submit the form, I'll receive my refund immediately. After submission, it typically takes up to 30 days to process the request and notify the applicant.

- I can request a refund even if I missed the three-year limitation. Requests received after three years from the payment date cannot be processed due to statute limitations.

- It’s okay to submit any documentation I find relevant. The application has specific documentation requirements. Failing to attach the correct proof can delay or deny the request.

- Refunds are offered for duplicate certificate fees. The DMV does not refund fees for duplicate certificates or stickers if they were applied for voluntarily.

- I can request a refund for parking fees using the ADM 399 form. Parking fees must be addressed through the issuing agency or court, not through the DMV.

- Filing the application is all I need to do for a refund. Accurate completion of the application and submission of required documents is necessary to receive the refund.

- The DMV will contact me only if they need more information. They will inform applicants of the status of their refund or request additional information as needed.

Key takeaways

Here are some important points to consider when filling out and using the ADM 399 form:

- Understand the purpose: This form is specifically designed to request refunds for various DMV fees, including vehicle registration and driver license fees.

- Eligibility matters: A refund request can only be made if fees were paid in error or weren't required, as defined by the relevant California codes.

- Complete the form accurately: Fill out all required fields carefully to avoid delays. Double-check the information before submitting.

- Submission options: You can submit the application in person at your nearest DMV office or mail it to the specified DMV addresses.

- Time limits: Refund requests must be made within three years of payment due to the statute of limitations.

- Required documentation: Include necessary documents like proof of payment, vehicle registration cards, and any other applicable forms when submitting your application.

- Be aware of unqualified requests: Certain requests, such as for duplicate certificates or parking fees, will not be honored. Review the invalid request section to understand what’s excluded.

- Notification timeline: You will receive a notification regarding your refund within 30 days after your application is received, so keep an eye on your preferred contact method.

- Signature matters: Don’t forget to sign your application. An unsigned form may lead to rejection or delay.

- Contact DMV for questions: If you're unsure about any part of the process, don’t hesitate to reach out to the DMV for clarity. They can help guide you through any confusion.

Browse Other Templates

Secondary Dependent Navy - This form is an integral step in maintaining the welfare of dependents of military personnel.

Dot Medical Card Online - Submitting the CDL 7 form is essential for operational compliance with federal regulations.