Fill Out Your Adp Fsa Claim Form

The ADP Flexible Spending Account (FSA) Claim Form is a crucial tool for individuals looking to reclaim their healthcare expenses efficiently. Designed specifically for healthcare-related expenses, this form offers a structured process for reimbursement requests. To begin, the individual must fill out the form by providing necessary details like their social security number, employee ID, and specific expense information. It is essential to itemize each expense separately, ensuring clarity and accuracy in claims. Attached documentation, such as itemized receipts and Explanation of Benefits (EOB), must provide a clear breakdown of the eligible expenses. The form emphasizes direct submission methods, highlighting that faxing is generally faster than mailing. Users can also choose to receive faster reimbursements through Direct Deposit, which can expedite the process significantly. It is critical to adhere to specific guidelines, such as using the appropriate coverage codes for medical, dental, or vision expenses, and avoiding common pitfalls, such as using red ink or submitting photocopies. For those needing clarification on eligible expenses or submission procedures, ADP provides resources online and through customer service. Understanding this form's intricacies will empower individuals to manage their healthcare expenses more effectively, ensuring they receive the benefits to which they are entitled.

Adp Fsa Claim Example

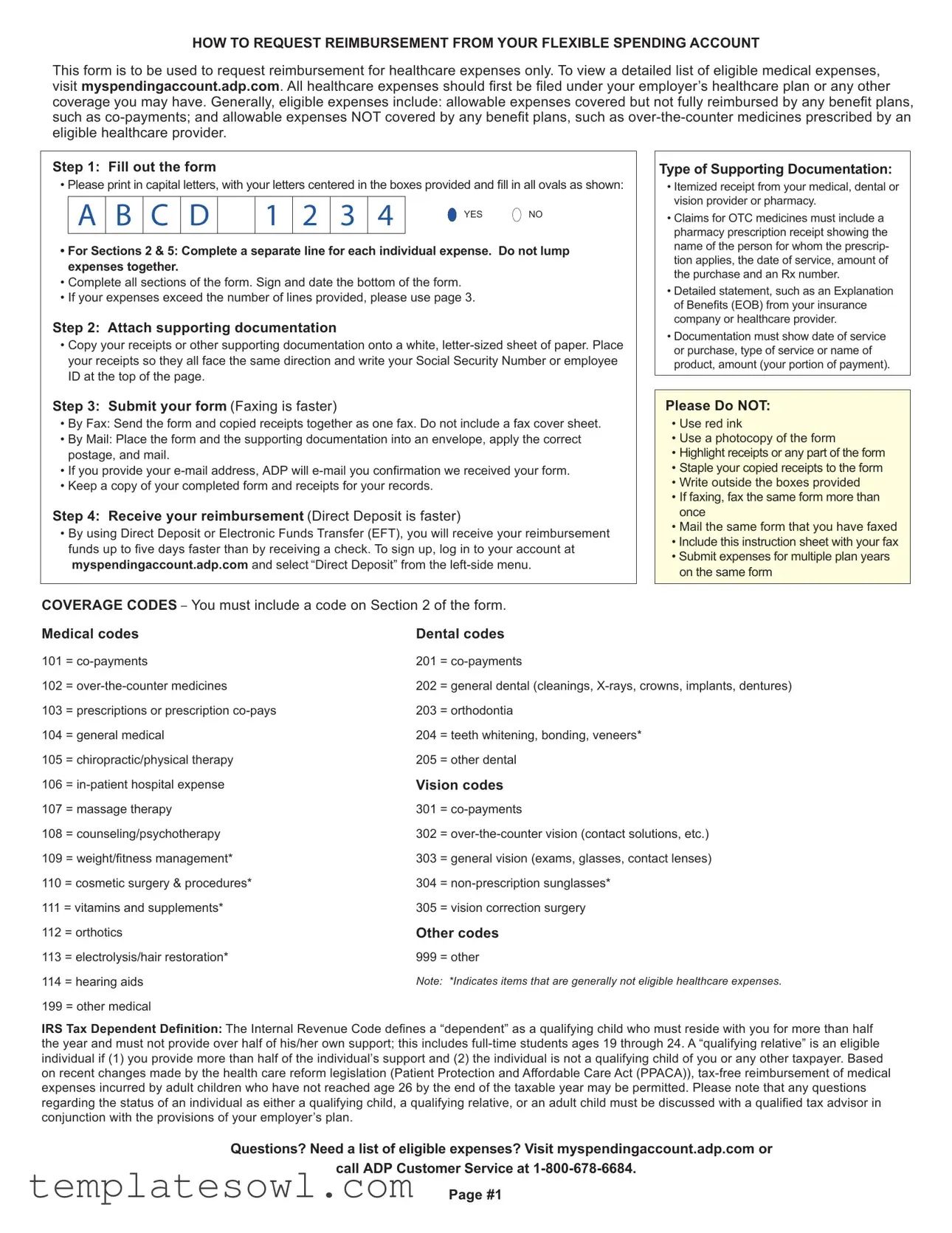

HOW TO REQUEST REIMBURSEMENT FROM YOUR FLEXIBLE SPENDING ACCOUNT

This form is to be used to request reimbursement for healthcare expenses only. To view a detailed list of eligible medical expenses, visit myspendingaccount.adp.com. All healthcare expenses should irst be iled under your employer’s healthcare plan or any other COVERAGE you may have. Generally, eligible expenses include: allowable expenses covered but not fully reimbursed by any beneit plans, such as

Step 1: Fill out the form

• Please print in capital letters, with your letters centered in the boxes provided and ill in all ovals as shown:

A |

B |

C |

D |

|

1 |

2 |

3 |

4 |

YES NO |

|

|

|

|

|

|

|

|

|

|

•For Sections 2 & 5: Complete a separate line for each individual expense. Do not lump expenses together.

•Complete all sections of the form. Sign and date the bottom of the form.

•If your expenses exceed the number of lines provided, please use page 3.

Step 2: Attach supporting documentation

•Copy your receipts or other supporting documentation onto a white,

Step 3: Submit your form (Faxing is faster)

•By Fax: Send the form and copied receipts together as one fax. Do not include a fax cover sheet.

•By Mail: Place the form and the supporting documentation into an envelope, apply the correct postage, and mail.

•If you provide your

•Keep a copy of your completed form and receipts for your records.

Step 4: Receive your reimbursement (Direct Deposit is faster)

•By using Direct Deposit or Electronic Funds Transfer (EFT), you will receive your reimbursement funds up to ive days faster than by receiving a check. To sign up, log in to your account at myspendingaccount.adp.com and select “Direct Deposit” from the

Type of Supporting Documentation:

•Itemized receipt from your medical, dental or vision provider or pharmacy.

•Claims for OTC medicines must include a pharmacy prescription receipt showing the name of the person for whom the prescrip- tion applies, the date of service, amount of the purchase and an Rx number.

•Detailed statement, such as an Explanation of Beneits (EOB) from your insurance company or healthcare provider.

•Documentation must show date of service or purchase, type of service or name of product, amount (your portion of payment).

Please Do NOT:

•Use red ink

•Use a photocopy of the form

•Highlight receipts or any part of the form

•Staple your copied receipts to the form

•Write outside the boxes provided

•If faxing, fax the same form more than once

•Mail the same form that you have faxed

•Include this instruction sheet with your fax

•Submit expenses for multiple plan years on the same form

COVERAGE CODES – You must include a code on Section 2 of the form.

Medical codes |

Dental codes |

||

101 |

= |

201 |

= |

102 |

= |

202 |

= general dental (cleanings, |

103 |

= prescriptions or prescription |

203 |

= orthodontia |

104 |

= general medical |

204 |

= teeth whitening, bonding, veneers* |

105 |

= chiropractic/physical therapy |

205 |

= other dental |

106 |

= |

Vision codes |

|

107 |

= massage therapy |

301 |

= |

108 |

= counseling/psychotherapy |

302 |

= |

109 |

= weight/itness management* |

303 |

= general vision (exams, glasses, contact lenses) |

110 |

= cosmetic surgery & procedures* |

304 |

= |

111 = vitamins and supplements* |

305 |

= vision correction surgery |

|

112 |

= orthotics |

Other codes |

|

113 |

= electrolysis/hair restoration* |

999 |

= other |

114 |

= hearing aids |

Note: *Indicates items that are generally not eligible healthcare expenses. |

|

199 |

= other medical |

|

|

IRS Tax Dependent Deinition: The Internal Revenue Code deines a “dependent” as a qualifying child who must reside with you for more than half the year and must not provide over half of his/her own support; this includes

Questions? Need a list of eligible expenses? Visit myspendingaccount.adp.com or call ADP Customer Service at

Page #1

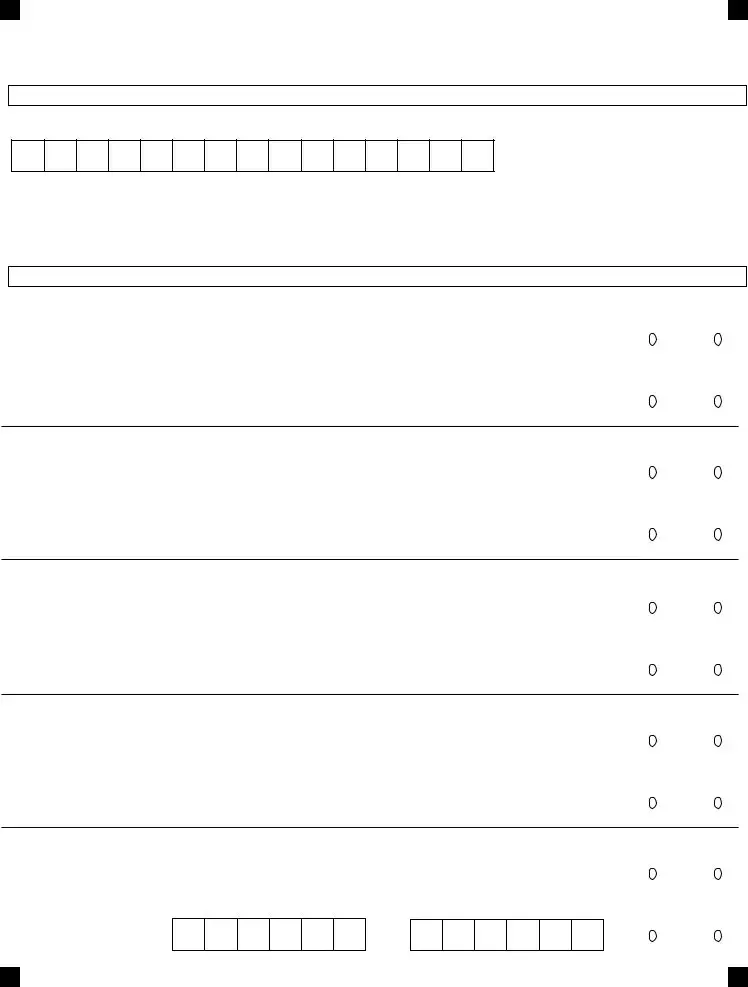

REIMBURSEMENT FORM – HEALTHCARE EXPENSES

Use only CAPITAL LETTERS, completely fill in ovals,

and don’t use red ink.

FAX TO:

For additional expenses, please use next page.

XHXCXRX

SECTION1:YOURINFORMATION

SOCIAL SECURITY NUMBER OR EMPLOYEE ID (NO DASHES) |

COMPANY NAME |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE LAST NAME |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE HOME ZIP CODE |

FOR ADP ONLY |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE EMAIL |

|

DAYTIME PHONE # (AREA CODE FIRST, NO DASHES) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION2:YOURHEALTHCAREEXPENSES

EXPENSE 1 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

||||||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YES |

NO |

EOB ATTACHED? |

|

YES |

NO |

EXPENSE 2 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

|

|

|

||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YES |

NO |

EOB ATTACHED? |

|

YES |

NO |

EXPENSE 3 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

|||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YESNO

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

EOB ATTACHED? |

YESNO

SECTION3:CERTIFICATIONPleasereadCertificationStatementthoroughlybeforesigning.

I hereby certify that: |

|

|

• I have read and understand the instructions on page one. |

FAX: |

|

• The information contained within this form is correct. |

||

• I have not received reimbursement previously for these expenses from my Healthcare Account or any other plan |

MAIL: ADP Spending Accounts |

|

and will not seek reimbursement by any other plan. |

||

PO Box 34700 |

||

• Any expenses submitted on behalf of a dependent, qualifying relative or adult child are in accordance with the IRS |

||

Louisville, KY 40232 |

||

Definitions of dependents, the guidelines for adult dependent children, or my employer's plan. |

||

PHONE: |

||

I understand that: |

•Reimbursement is not a guarantee that this payment is tax free.

•Healthcare expenses reimbursed through this account cannot be used as a deduction on my personal income tax return.

I hereby authorize release of payment through my Healthcare Account. I hereby authorize ADP or its representatives to obtain necessary information from all physicians, hospitals, medical service providers, pharmacists, employers, and all other agencies or organizations (this includes other insurers) to consider claim for reimbursement under

my Healthcare Account. |

|

|

|

|

|

|

|

|

Date(MMDDYY) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XHXCXRX |

EmployeeSignature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

USE AN ORIGINAL FORM (NOT A PHOTOCOPY)

Page#2

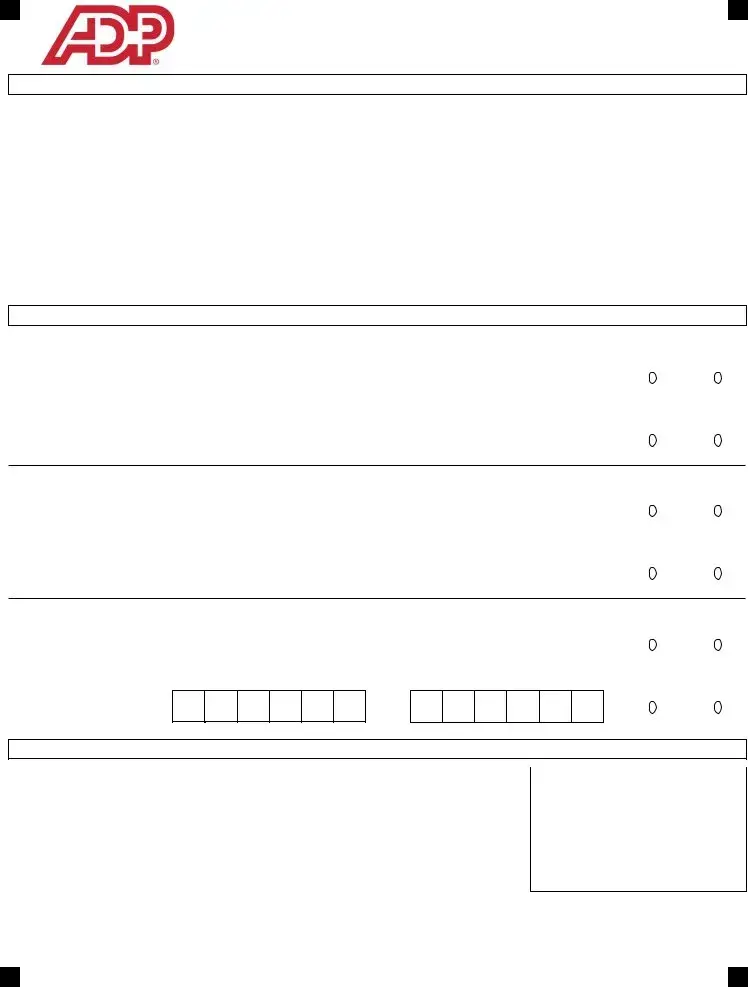

USETHISPAGEFORADDITIONALHEALTHCAREEXPENSES.

BHBABDB

SECTION4:YOURINFORMATION(ABBREVIATED)

SOCIAL SECURITY NUMBER OR EMPLOYEE ID (NO DASHES)

EMPLOYEE LAST NAME |

EMPLOYEE HOME ZIP CODE |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION5:YOURADDITIONALHEALTHCAREEXPENSES

EXPENSE 4 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

||||||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YES |

NO |

EOB ATTACHED? |

|

YES |

NO |

EXPENSE 5 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

||||||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YES |

NO |

EOB ATTACHED? |

|

YES |

NO |

EXPENSE 6 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

||||||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YES |

NO |

EOB ATTACHED? |

|

YES |

NO |

EXPENSE 7 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

||||||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YES |

NO |

EOB ATTACHED? |

|

YES |

NO |

EXPENSE 8 |

DATES OF SERVICE (MMDDYY) |

REQUESTED AMOUNT (DOLLARS . CENTS) |

|||||||||||||||||

COVERAGE CODE (SEE PAGE 1) |

FROM |

||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED BY INSURANCE?

YESNO

TO |

PATIENT DATE OF BIRTH (MMDDYY ) |

EOB ATTACHED? |

YESNO

USE AN ORIGINAL FORM (NOT A PHOTOCOPY) |

BHBABDB |

Page#3

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is specifically designed for requesting reimbursement of healthcare expenses only. |

| Eligible Expenses | Eligible expenses include co-payments and expenses not fully reimbursed by any benefit plans. |

| Submission Steps | Complete the form, attach required documentation, and submit via fax or mail. |

| Documentation Requirements | Receipts should be itemized and must include essential information like date of service and amounts. |

| Direct Deposit | Using Direct Deposit allows for faster reimbursement than receiving a check. |

| Restrictions | Do not highlight receipts, use red ink, or submit more than one form for the same expenses. |

| IRS Definition of Dependent | IRS defines a “dependent” as a qualifying child or a qualifying relative who meets specific criteria. |

Guidelines on Utilizing Adp Fsa Claim

Filling out the ADP FSA Claim form involves several straightforward steps. Completing this form accurately will help ensure a smooth reimbursement process for your eligible healthcare expenses.

- Fill out the form: Use all capital letters and write clearly inside the designated boxes. Ensure you complete all sections and provide details for each individual expense on separate lines. If more space is needed, refer to page 3 of the form.

- Attach supporting documentation: Gather your receipts or other relevant documents. Copy them onto a plain, letter-sized sheet of paper, ensuring they all face the same direction. Write your Social Security Number or employee ID at the top.

- Submit your form: You can choose to submit by fax or mail. If faxing, send the form and copied receipts without a cover sheet. For mail, place everything in an envelope with proper postage. If you provide your email address, ADP will send you a confirmation upon receipt. Remember to keep a copy for your records.

- Receive your reimbursement: Opt for Direct Deposit or Electronic Funds Transfer (EFT) for faster reimbursement, which can be quicker than receiving a check. Log in to your account on myspendingaccount.adp.com to enroll in Direct Deposit.

Finally, carefully review your form before submitting it to avoid any delays in your reimbursement. For any uncertainties regarding eligible expenses or your claim status, you can visit myspendingaccount.adp.com or contact ADP Customer Service directly.

What You Should Know About This Form

What is the purpose of the ADP FSA Claim Form?

The ADP FSA Claim Form is specifically designed for individuals looking to request reimbursement for healthcare expenses through their Flexible Spending Account (FSA). It is crucial to first submit these expenses to any other available coverage you may have, like your employer’s healthcare plan, before using this form. The form helps streamline the process of getting reimbursed for eligible medical costs such as co-payments, and expenses that aren't fully covered by other insurance plans, like over-the-counter medications prescribed by a healthcare provider.

How do I fill out the claim form correctly?

Filling out the claim form requires careful attention to detail. Begin by using capital letters for clarity. Each section must be fully completed, with separate lines for individual expenses in Sections 2 and 5—you shouldn’t group expenses together. Make sure you accurately indicate whether the expense was covered by insurance. Don’t forget to sign and date the bottom when you're finished. If you have more expenses than there are lines available, simply use additional pages provided in the form. Lastly, be sure to keep a copy of everything for your records.

What documents do I need to attach to my claim?

When submitting your claim, it's important to attach proper documentation to support your request. This typically includes itemized receipts from medical or dental providers, or pharmacy receipts, which should detail the services provided, the date of service, and the amount paid. For over-the-counter medications, attach a pharmacy prescription receipt showing the patient’s name and other relevant details. Documentation must clearly show the date and type of service or product purchased. Keep in mind that failure to provide adequate documentation can delay or deny your reimbursement request.

What is the quickest way to submit my form and receive reimbursement?

For the fastest results, submitting your claim by fax is advised. Make sure to send the form and supporting documents together without a cover sheet. However, if choosing to mail, ensure everything is well-organized in an envelope with the correct postage. Utilizing Direct Deposit or Electronic Funds Transfer (EFT) can also expedite the process, as reimbursements through these methods are generally received up to five days faster than by check. To enroll in Direct Deposit, log in to your account at myspendingaccount.adp.com and navigate to the “Direct Deposit” option.

Common mistakes

Filling out the ADP FSA Claim form can seem straightforward, but there are common mistakes that can hinder the reimbursement process. One frequent error is failing to fill out all sections of the form. It's important to complete every section and to be thorough. Leaving out information may lead to delays or rejections. Each healthcare expense must be listed separately as well. If multiple expenses are grouped together, it may cause confusion and require resubmission.

Another common mistake involves the documentation that needs to accompany the claim. It's essential to use original receipts and to ensure they are clear and itemized. Many people incorrectly photocopy their receipts or forget to attach the necessary details, such as the name of the individual receiving the service or the service dates. This documentation is vital for your claim to be considered and processed correctly.

Additionally, some claimants neglect to use the correct reimbursement codes within the designated sections of the form. Each type of healthcare expense has specific coverage codes that must be included. If the wrong code is used, it could result in a denial or delay in processing the reimbursement. Double-checking the codes against the form's instructions can help prevent this issue.

Lastly, many individuals overlook the submission method. While mailing the form is an option, it’s often slower. Using fax or submitting online can expedite the process significantly. Data shows that faxes tend to be processed more quickly, and including a cover sheet can also be unnecessary and may cause delays. Following the instructions closely for submission will ensure a smoother reimbursements experience.

Documents used along the form

The ADP FSA Claim Form is a vital document for requesting reimbursement from a Flexible Spending Account (FSA) for healthcare expenses. To ensure smooth processing, various accompanying documents may also be necessary. Below are a few common forms and documents that are typically used alongside the ADP FSA Claim Form.

- Itemized Receipt: This is a detailed list of the services or products received, showing the exact amount paid. It must include the name of the provider, the date of service, and a breakdown of the expenses.

- Explanation of Benefits (EOB): Issued by insurance companies, this document outlines what medical services have been covered and what remains the patient's responsibility. It provides insight into the payments made on behalf of the patient.

- Prescription Receipt: For over-the-counter (OTC) medications qualifying for reimbursement, this receipt must show that a prescription was written by an eligible healthcare provider. It should detail the patient's name, date, and purchase amount.

- Additional Healthcare Expense Form: This form may be required if multiple expenses exceed the lines available on the main claim form. It allows for additional expenses to be documented and submitted for reimbursement.

Gathering these documents ensures that the reimbursement process goes as smoothly as possible. It is important to review each requirement carefully to avoid any delays. When all materials are organized and correct, submitting for reimbursement can be a straightforward process.

Similar forms

Flexible Spending Account (FSA) Enrollment Form: Similar to the claim form, this document is used in the FSA process, specifically for enrolling in the program. It requires participants to provide personal information, selected plan options, and acknowledgment of program requirements.

Health Reimbursement Arrangement (HRA) Claim Form: This form serves a similar purpose by requesting reimbursement for qualifying medical expenses. Much like the FSA claim form, it necessitates detailed documentation of healthcare costs incurred by the employee.

Dependent Care FSA Claim Form: This document is designed for claiming expenses related to dependent care. It parallels the ADP FSA claim form in terms of submission requirements, including the need for itemized receipts and a detailed description of services.

Insurance Claim Form: Often used in conjunction with health insurance plans, this form requests reimbursement for medical services rendered. Like the ADP FSA claim form, it requires comprehensive information about the service utilized, dates, and amounts paid.

Dos and Don'ts

The following is a list of important actions to take and avoid when filling out the ADP FSA Claim form:

- Do: Use capital letters when completing the form.

- Do: Fill in all sections carefully and completely.

- Do: Attach supporting documentation on a separate sheet of white paper.

- Do: Keep a copy of your form and receipts for your records.

- Do: Use the correct coverage codes for your healthcare expenses.

- Don't: Use red ink on the form.

- Don't: Submit a photocopy of the form.

- Don't: Highlight any part of the form or receipts.

- Don't: Staple your receipts to the form.

- Don't: Fax the same form more than once or mail it after faxing.

Misconceptions

- Misconception: The ADP FSA Claim Form can be used for non-healthcare expenses. This form is specifically intended for requesting reimbursement for healthcare expenses only. If you submit claims for non-healthcare costs, they will be rejected.

- Misconception: You can lump multiple expenses together on the form. Each individual expense must be entered on a separate line. Combining expenses may result in a delay or denial of your reimbursement.

- Misconception: Receipts do not need to be itemized. You must provide itemized receipts or documentation that clearly details the date of service, type of service, and amount paid. Claims without appropriate documentation may not be processed.

- Misconception: You can fax the same claim form multiple times. If you fax your claim, do not send the same form again. Doing so can lead to confusion and potential denial of your claim.

- Misconception: All items purchased with FSA funds are eligible for reimbursement. Not every item qualifies for reimbursement. Check your eligible expenses carefully. Items marked with an asterisk (*) in the instructions are generally not eligible.

- Misconception: You do not need to keep copies of your submitted forms and receipts. It is important to keep copies for your records. This helps you track your claims and is beneficial if any issues arise.

Key takeaways

Here are some important points to remember when filling out and using the ADP FSA Claim form:

- This form is only for healthcare expenses. Always check myspendingaccount.adp.com for a list of eligible expenses.

- Before you submit your claim, ensure you have filed your expenses with your employer’s healthcare plan.

- Fill in all sections of the form completely, and use capital letters. Sign and date at the bottom.

- Attach all necessary documentation. Use a white, letter-sized sheet for your receipts, and include your Social Security Number or employee ID at the top.

- Submit your claim by faxing it for faster processing, or by mailing it. If you fax, do not include a cover sheet.

- Using Direct Deposit will speed up how quickly you get your reimbursement. Sign up through your account on myspendingaccount.adp.com.

- Keep copies of everything you submit for your own records. This includes the completed form and receipts.

Browse Other Templates

Kcb Bank Loan Application Form Pdf - Each director's signature must be provided, affirming their agreement with the application.

Georgia Driver Manual - Remember to check the payment methods accepted before sending the request.