Fill Out Your Af 594 Form

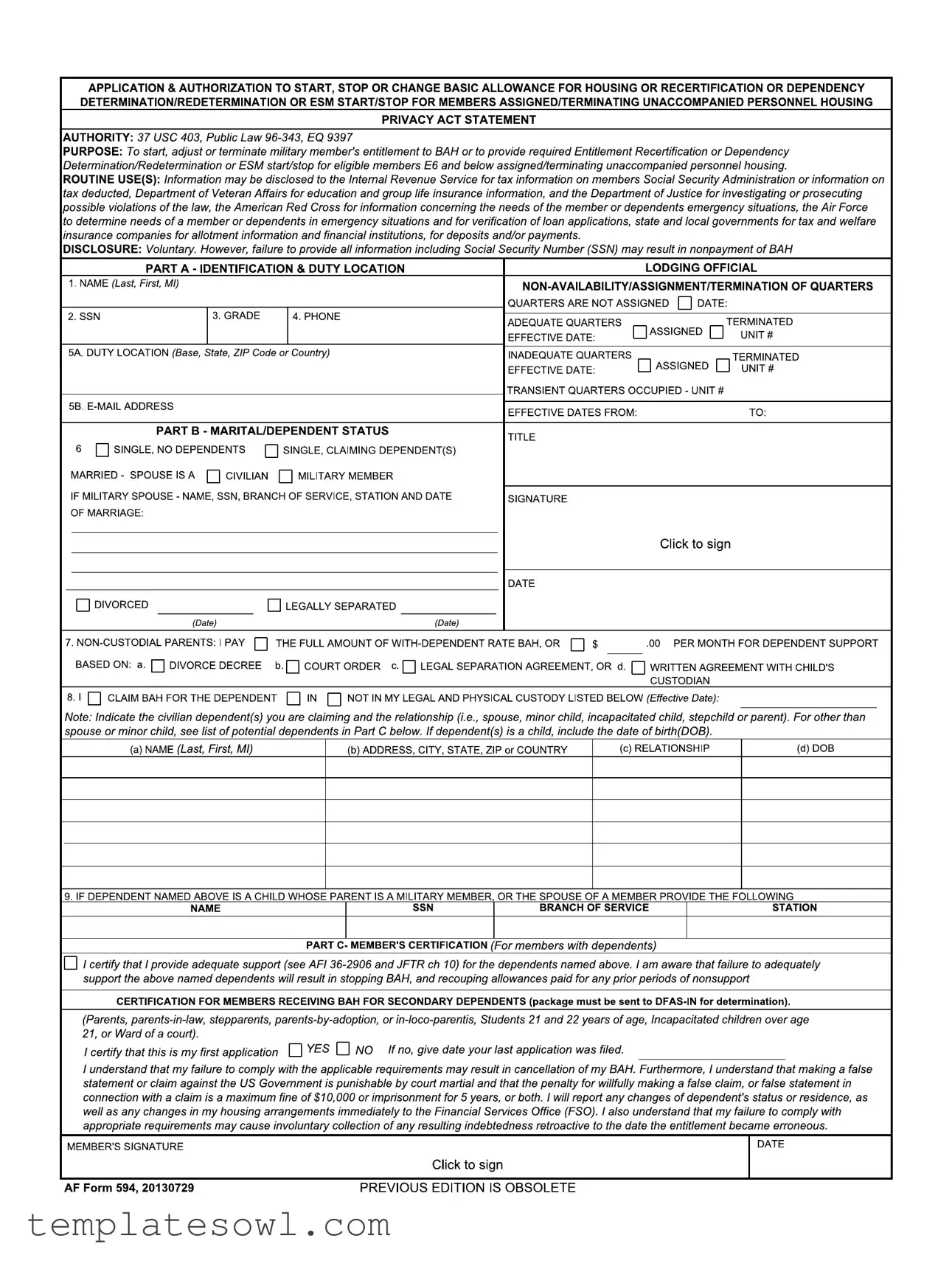

The AF Form 594 plays a crucial role in managing the Basic Allowance for Housing (BAH) for military personnel. This application and authorization form is essential for starting, stopping, or changing a service member's BAH entitlement, particularly for those assigned to unaccompanied personnel housing. It also addresses enrollment for dependency determinations and recertifications for eligible members, specifically those in the E6 grade and below. Information collected through this form is often shared with various governmental agencies, including the IRS, Department of Veterans Affairs, and Department of Justice, to support member benefits and comply with tax regulations. The form requires personal identification, marital status, and details of dependents, as well as a certification that supports the claims made regarding dependent support. It incorporates a voluntary disclosure clause for sensitive information, stressing that incomplete submissions may lead to issues with BAH payments. Understanding the intricacies of the AF Form 594 is necessary for service members to ensure they manage their housing allowances effectively and meet the pertinent requirements set forth by military regulations.

Af 594 Example

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Application & Authorization to Start, Stop or Change Basic Allowance for Housing |

| Governing Authorities | 37 USC 403, Public Law 96-343, EQ 9397 |

| Purpose | To adjust BAH entitlements for military members as necessary. |

| Eligibility | Applicable for E6 and below assigned to unaccompanied personnel housing. |

| Disclosure | Submission is voluntary; failure to provide required information may affect BAH payments. |

| Routine Use of Information | Information may be shared with various government agencies for verification and compliance. |

| Part A | Focuses on member's identification and duty location. |

| Part B | Addresses marital and dependent status of the member. |

| Certification Requirement | Member must certify support for claimed dependents to maintain BAH eligibility. |

| Official Use Only | Contains sections for finance verification and approval actions. |

Guidelines on Utilizing Af 594

Filling out the AF 594 form is a straightforward process that helps you manage your Basic Allowance for Housing (BAH) and related dependency determinations. Before diving into the details, ensure that you have all relevant information handy, including personal details, dependency information, and any supporting documentation. With everything ready, let’s go through the steps to complete the form accurately.

- PART A – IDENTIFICATION & DUTY LOCATION:

- In the first section, write your full name in the format "Last, First, Middle Initial."

- Enter your Social Security Number (SSN) and grade (military rank).

- Provide your contact phone number and email address.

- Specify your duty location including the base name, state, ZIP code, or country.

- Indicate whether quarters have been assigned and provide effective dates if applicable.

- PART B – MARITAL/DEPENDENT STATUS:

- Circle your marital status and indicate if you have any dependents.

- If you are married, provide details about your spouse, including name, SSN, branch of military service, and the date of marriage.

- Report if you are claiming BAH for a dependent; if yes, list their details, including relationship and date of birth.

- PART C – MEMBER'S CERTIFICATION:

- Sign and date the certification section to confirm that you are providing adequate support for your dependents.

- Check whether this application is your first, and if not, include the date of your last application.

- Read the statements regarding compliance and false claims, acknowledging your understanding and responsibilities.

- ADDITIONAL INFORMATION:

- Complete any official use sections if applicable. Be sure to double-check any required boxes for starting, changing, or stopping benefits.

- Finally, ensure all sections are filled out correctly before submitting.

What You Should Know About This Form

What is the purpose of the AF 594 form?

The AF 594 form is used by military personnel to start, stop, or change their Basic Allowance for Housing (BAH). It also serves for recertification of entitlement or dependency determination for members assigned or terminating unaccompanied personnel housing. This form helps ensure individuals receive the appropriate housing benefits according to their current situation.

Who needs to fill out the AF 594 form?

Military members, particularly those in the E-6 grade and below, are typically required to complete the AF 594 form when there are changes to their housing situations, marital status, or dependent claims. This includes members who are transitioning to or from unaccompanied housing, as well as those seeking to update their BAH based on changes in family status.

What information is required on the AF 594 form?

The form requires key personal information such as the individual's name, Social Security Number, grade, and contact information. It also collects details about the member's marital and dependent status, including the names and relationships of dependents, if applicable. Information regarding custody arrangements and financial support for dependents may also need to be disclosed.

What happens if I do not provide my Social Security Number (SSN) on the AF 594 form?

Filling out the AF 594 form is voluntary, but failing to provide essential information, including your Social Security Number, may result in nonpayment of your Basic Allowance for Housing. It is crucial to provide complete and accurate information to avoid delays or issues with your housing allowance.

How is the information on the AF 594 form used?

The information collected on the AF 594 is shared with various government entities as needed, such as the Internal Revenue Service and Department of Veterans Affairs. The data helps in determining eligibility for housing benefits, processing tax information, and verifying loan applications. The privacy of the information is protected under the Privacy Act.

What should I do if my dependent status or housing situation changes after submitting the AF 594 form?

If there are any changes to your dependent status, residence, or housing arrangements, you must report these immediately to the Financial Services Office (FSO). Prompt reporting is vital as it may affect your BAH and prevent potential overpayments or legal consequences stemming from inaccurate claims.

Common mistakes

Filling out the AF 594 form can be a straightforward process, but mistakes are common. One of the most frequent errors occurs when individuals fail to provide their full name as required. If the name is incomplete or does not match official documents, it can delay processing. Make sure to double-check that your name is accurate and spelled correctly; this simple step can save you time and energy.

Another mistake frequently made involves not including the Social Security Number (SSN). The AF 594 specifically states that omitting the SSN may result in nonpayment of Basic Allowance for Housing (BAH). Therefore, it's crucial to enter your SSN in the designated area. Taking a moment to ensure all information is provided can help avoid frustrating hold-ups in your benefits.

Many people also overlook filling out their marital and dependent status accurately. Section Part B includes essential questions that can directly impact your entitlement. Misclassifying your status—like claiming dependents incorrectly or missing out on important details—can lead to serious issues later. Carefully reviewing your answers ensures compliance and clarity, assisting the officials in processing your claim swiftly.

Additionally, not updating effective dates can create confusion. Members often forget to include effective dates when reporting changes in quarters or marital status. The effective date is crucial for calculating how benefits apply to your situation. Be thorough and precise: adding these dates can prevent unnecessary complications in future transactions.

Lastly, consider the significance of signatures and certifying the information provided. Incomplete signatures can result in immediate denial of the application. Ensure that all required signatures are in place before submitting the form. This small yet vital step can help facilitate a smooth approval process.

Documents used along the form

The AF 594 form is essential for military members needing to manage their Basic Allowance for Housing (BAH) and related dependent determinations. When completing this form, you might also need several other documents. Each of these documents serves different purposes, and understanding them can simplify the process.

- DD Form 1172-2: This is the application for a Uniformed Services Identification Card and DEERS Enrollment. It is necessary for proving eligibility for benefits for dependents, including healthcare and BAH.

- DA Form 3685: This document is the "Application for Change to Family Member Status." It is used when family circumstances change, affecting dependency status and entitlement to BAH.

- AF Form 1333: Known as the "Record of Emergency Data," this form captures necessary information about military members’ beneficiaries. It’s crucial for ensuring proper communications and support in times of emergency.

- Commander's Support Statement: This document, often written by a commanding officer, supports an application for special housing considerations, such as eligibility for BAH based on unique situations.

- Marriage Certificate: Often needed to verify marital status when applying for BAH with dependents. Original or certified copies are typically required.

- Court Orders and Agreements: Such documents can include divorce decrees or support agreements that establish the financial responsibilities towards dependents, which are critical in determining BAH eligibility.

Having these documents ready when filling out the AF 594 form can help streamline your application process. By understanding what each document is for, you can avoid potential delays and ensure a smoother experience.

Similar forms

The AF 594 form is used for various military housing benefits and related authorizations. Several documents share similar purposes and functions, aimed at managing similar processes. Below are eight documents analogous to the AF 594 form:

- DA Form 4187 (Personnel Action Request): This form is used by Army personnel to request changes in status, including duty assignments and housing adjustments.

- DD Form 137-3 (Dependency Application/Certification): This document helps military members establish or recertify eligibility for dependent allowances, similar to dependency considerations in AF 594.

- DD Form 214 (Certificate of Release or Discharge from Active Duty): This document summarizes a military member’s service, affecting eligibility for benefits like Basic Allowance for Housing (BAH).

- AF Form 102 (Application for Appointment): Used for officer appointments, this form includes applicant information and dependent status, similar to the identification details required in AF 594.

- VA Form 22-5490 (Application for Survivors' and Dependents' Educational Assistance): This document assesses eligibility for benefits based on dependency status, paralleling the AF 594's focus on dependents.

- AF Form 2100 (Application for a Family Housing Assignment): This form is used to apply for military housing and includes details about family members, like the AF 594.

- DA Form 5888 (Family Member Deployment Screening): This document screens family member support when military personnel deploy, addressing dependent needs like the AF 594 that handles similar concerns for housing.

- AF Form 357 (Family Care Plan): This form outlines care arrangements for dependents while a service member is away, connecting to AF 594's focus on dependency information.

Dos and Don'ts

When completing the AF 594 form, it is essential to ensure accuracy and compliance with the required guidelines. The following list provides a set of do's and don'ts to assist in the proper submission of this document.

- Ensure that all personal information, including Social Security Number (SSN), is correctly filled out to avoid any nonpayment issues for the Basic Allowance for Housing (BAH).

- Verify that you have indicated your current duty location, including complete address details such as base, state, ZIP code, or country.

- Clearly specify your marital and dependent status, providing accurate details for each dependent if applicable.

- Make sure to sign and date the form to validate the information provided.

- Review the form carefully before submission to ensure all necessary sections have been completed.

- Submit the form to the appropriate office as indicated, ensuring any required accompanying documentation is included.

- Avoid leaving any required fields blank; incomplete forms may lead to delays or rejections.

- Do not provide inaccurate or misleading information, as this can result in penalties for false claims against the government.

- Refrain from submitting the form without reviewing it for clarity and completeness.

- Do not forget to inform the Financial Services Office (FSO) of any changes in dependent status or housing arrangements after submission.

- Make sure not to send the form without the correct method of delivery based on the receiving office's guidelines.

- Do not ignore the Privacy Act statement; understand how your information may be shared and used.

Misconceptions

The AF 594 form is often misunderstood. Below are ten common misconceptions, along with clarifications.

- This form is only for officers. The AF 594 form is applicable to all military members, including enlisted personnel.

- Filing this form is mandatory for all members. Submission of the form is not required in every situation. It is needed only for specific changes related to Basic Allowance for Housing (BAH) or other entitlements.

- You cannot change your information once submitted. Members can update or correct their information by submitting a new form.

- The AF 594 guarantees BAH approval. While the form is necessary to initiate changes, approval is not automatic and is subject to review.

- This form is only for members living off base. It is also relevant for members assigned to unaccompanied housing or those needing to update their BAH while in base housing.

- The information is not shared. Personal information may be disclosed to various government agencies as part of standard operating procedures.

- You can claim BAH for any dependent. Only legally recognized dependents can be claimed on the form. Be sure to follow the specific eligibility criteria.

- Your Social Security Number (SSN) is not needed. Providing your SSN is mandatory. Failure to do so may lead to a delay or denial of BAH payments.

- Once approved, you will always receive BAH. Approval is contingent on continuous eligibility. Changes in marital status or dependent custody can affect entitlements.

- Submitting the AF 594 is the end of the process. Members must remain proactive. Any changes in dependent status or living arrangements should be reported promptly to the Financial Services Office (FSO).

Key takeaways

When filling out the AF 594 form, clarity and accuracy are essential. This form is used by military members to start, stop, or change their Basic Allowance for Housing (BAH). Understanding its key components will facilitate smoother processing.

- Identification Information Is Critical. Ensure that you provide complete and accurate details in Part A. This includes your name, Social Security Number, and duty location. Missing or incorrect information can lead to delays or nonpayment of benefits.

- Marital and Dependent Status Must Be Clearly Stated. In Part B, indicate your relationship status and any dependents you're claiming. This section is vital for determining eligibility for specific BAH rates. Any discrepancies in this section could result in complications.

- Dependency Certification Requirements. Complete the member's certification to confirm that you provide support for your dependents. A lack of information about support can result in the suspension of BAH and possible recoupment of funds already disbursed.

- Voluntary Disclosure Obligations. While providing information is voluntary, failing to submit your Social Security Number and other critical details may hinder your BAH entitlement. Be aware that incomplete submissions have consequences.

Browse Other Templates

Explore Rate Authorization Form - The guest's name must be filled in to associate charges correctly.

Cbu Transcript Request - For urgent requests, consider using courier services.