Fill Out Your Afcu 435 Form

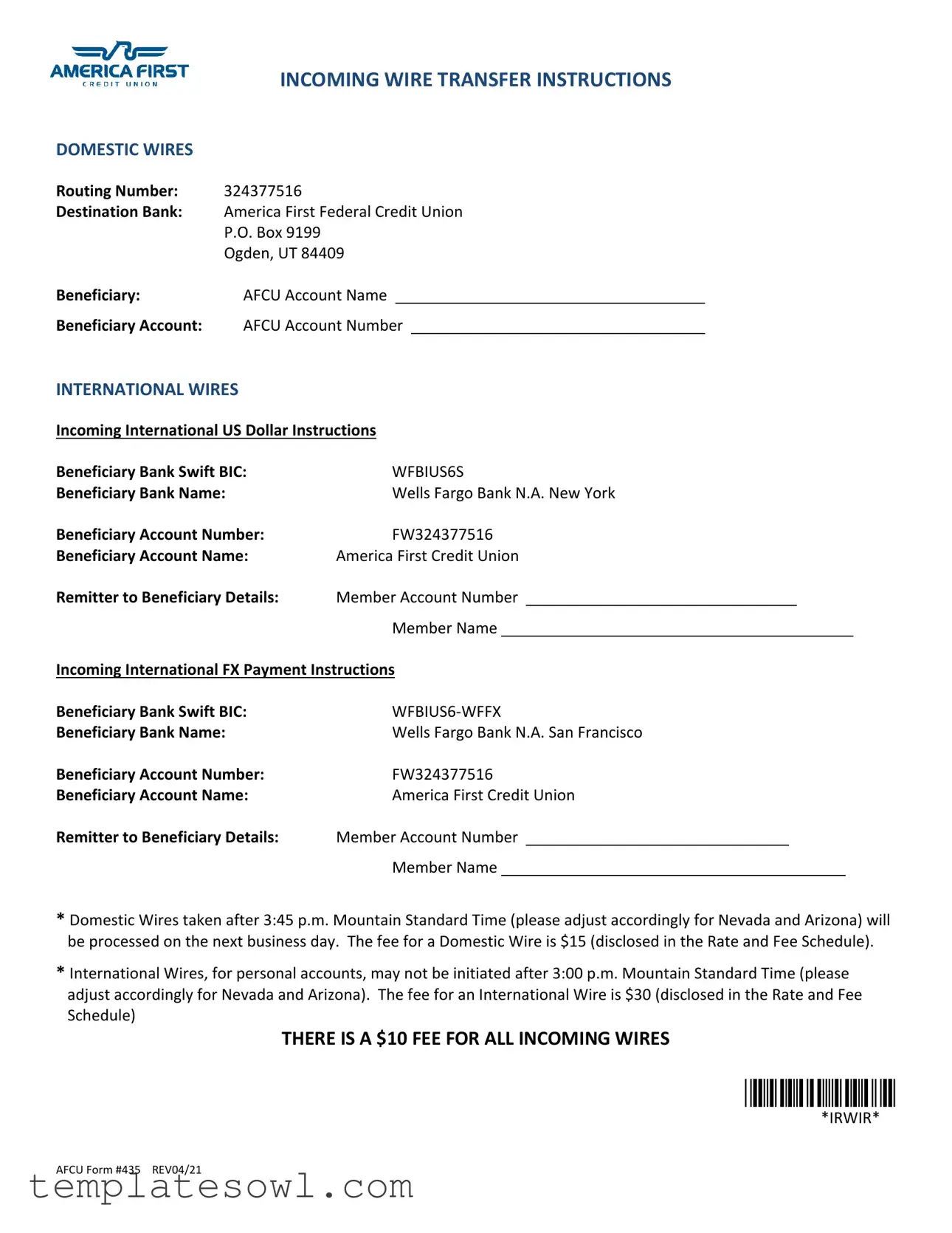

The AFCU 435 form is pivotal for members of America First Federal Credit Union who need to facilitate both domestic and international wire transfers. Designed with clarity, it outlines essential instructions that ensure the secure and efficient movement of funds. Members must take note of the specific routing number, 324377516, designated for domestic wires, as well as the beneficiary account details, which include the account name and number required for successful transfers. For international transactions, the AFCU 435 provides precise information regarding the beneficiary bank, including important Swift BIC codes necessary for processing payments. Notably, the form specifies cut-off times for initiating wire transfers, emphasizing that domestic wires initiated after 3:45 p.m. Mountain Standard Time will be processed the following business day, while international wires have an earlier deadline of 3:00 p.m. These transfers come with associated fees—a $15 charge for domestic wires and a $30 fee for international wires—enabling members to plan their transactions accordingly. Additionally, it is important to highlight that every incoming wire incurs a $10 fee, emphasizing the need for members to familiarize themselves with both the form and the associated costs involved with wire transfers.

Afcu 435 Example

|

INCOMING WIRE TRANSFER INSTRUCTIONS |

||

DOMESTIC WIRES |

|

|

|

Routing Number: |

324377516 |

|

|

Destination Bank: |

America First Federal Credit Union |

||

|

P.O. Box 9199 |

||

|

Ogden, UT 84409 |

||

Beneficiary: |

AFCU Account Name |

|

|

Beneficiary Account: |

AFCU Account Number |

|

|

INTERNATIONAL WIRES

Incoming International US Dollar Instructions

Beneficiary Bank Swift BIC: |

WFBIUS6S |

|

|

|||

Beneficiary Bank Name: |

Wells Fargo Bank N.A. New York |

|

|

|||

Beneficiary Account Number: |

FW324377516 |

|

|

|||

Beneficiary Account Name: |

America First Credit Union |

|

|

|||

Remitter to Beneficiary Details: |

Member Account Number |

|

|

|

||

|

Member Name |

|

|

|

||

Incoming International FX Payment Instructions |

|

|

||||

Beneficiary Bank Swift BIC: |

|

|

||||

Beneficiary Bank Name: |

Wells Fargo Bank N.A. San Francisco |

|

|

|||

Beneficiary Account Number: |

FW324377516 |

|

|

|||

Beneficiary Account Name: |

America First Credit Union |

|

|

|||

Remitter to Beneficiary Details: |

Member Account Number |

|

|

|

|

|

|

Member Name |

|

|

|

||

*Domestic Wires taken after 3:45 p.m. Mountain Standard Time (please adjust accordingly for Nevada and Arizona) will be processed on the next business day. The fee for a Domestic Wire is $15 (disclosed in the Rate and Fee Schedule).

*International Wires, for personal accounts, may not be initiated after 3:00 p.m. Mountain Standard Time (please adjust accordingly for Nevada and Arizona). The fee for an International Wire is $30 (disclosed in the Rate and Fee Schedule)

THERE IS A $10 FEE FOR ALL INCOMING WIRES

*IRWIR*

*IRWIR*

AFCU Form #435 REV04/21

Form Characteristics

| Fact Name | Description |

|---|---|

| Routing Number | The routing number for domestic wire transfers is 324377516. |

| Domestic Wire Fee | A fee of $15 applies for domestic wire transfers, as outlined in the Rate and Fee Schedule. |

| International Wire Deadline | International wire transfers must be initiated before 3:00 p.m. Mountain Standard Time. |

| Incoming Wire Fee | There is a $10 fee for all incoming wires, regardless of the type. |

Guidelines on Utilizing Afcu 435

Completing the AFCU 435 form is a straightforward process that requires careful attention to detail. The form is used for wire transfers to ensure that all necessary information is accurately provided. Following these steps will facilitate a smooth transaction.

- Gather all relevant information, including your account details and those of the destination bank.

- Locate the section for domestic wire transfers. Fill in the following details:

- Routing Number: Enter 324377516.

- Destination Bank: Enter America First Federal Credit Union.

- Beneficiary Account Name: Enter your AFCU Account Name.

- Beneficiary Account Number: Enter your AFCU Account Number.

- Next, proceed to the section for international wire transfers, if applicable. Enter the required information:

- Beneficiary Bank Swift BIC: Enter WFBIUS6S for USD transfers or WFBIUS6-WFFX for FX payments.

- Beneficiary Bank Name: Enter Wells Fargo Bank N.A. (either New York or San Francisco based on your transfer type).

- Beneficiary Account Number: Enter FW324377516.

- Beneficiary Account Name: Enter America First Credit Union.

- Remitter Account Number: Enter your Member Account Number.

- Remitter Name: Enter your name as it appears on the account.

- Be aware of the deadlines for processing. Domestic wires initiated after 3:45 p.m. MST will be processed the following business day. International wires have a cutoff of 3:00 p.m. MST.

- Review all information entered to ensure accuracy and completeness.

- Submit the completed form according to your bank's instructions, keeping in mind the associated fees for each type of wire transfer.

What You Should Know About This Form

What is the AFCU 435 form?

The AFCU 435 form provides instructions for incoming wire transfers to America First Federal Credit Union (AFCU). It outlines the necessary routing numbers and details for both domestic and international wire transfers to ensure funds are properly directed to the beneficiary's account.

How do I use the AFCU 435 form for domestic wires?

To initiate a domestic wire transfer, provide the routing number 324377516, along with the beneficiary account name and account number found on the form. Ensure the transfer is completed before 3:45 p.m. Mountain Standard Time for same-day processing. After this time, the wire transfer will process on the next business day.

What are the fees associated with domestic wire transfers?

A fee of $15 applies for each domestic wire transfer. This fee can be found in the Rate and Fee Schedule provided by AFCU. Make sure to review these fees prior to completing a transfer.

What do I need to provide for international wire transfers?

For international wire transfers, you must include the appropriate Swift BIC number and beneficiary account details. This includes Wells Fargo Bank’s Swift BIC for incoming international payments, WFBIUS6S for New York and WFBIUS6-WFFX for San Francisco. The beneficiary account number and account name are also required for successful processing.

What is the cutoff time for sending international wires?

International wire transfers must be initiated by 3:00 p.m. Mountain Standard Time. If the transfer is completed after this time, it will be processed on the next business day. Adjust for local times in Nevada and Arizona as necessary.

How much do international wire transfers cost?

The fee for international wire transfers for personal accounts is $30. As with domestic wires, you can find this fee in the Rate and Fee Schedule issued by AFCU.

Is there a fee for incoming wire transfers?

Yes, there is a $10 fee for all incoming wire transfers. This fee applies regardless of whether the wire is domestic or international and can be verified in the Rate and Fee Schedule.

Where should I send my completed AFCU 435 form?

The AFCU 435 form is not a document that needs to be sent. Rather, you should use the information on the form to complete the wire transfer through your financial institution. Ensure that all details are accurate to prevent any delays in your wire transfer.

Who can I contact for further assistance regarding wire transfers?

If you have further questions or need assistance, consider contacting America First Federal Credit Union directly. Their customer service team can provide guidance and support related to wire transfers and the use of the AFCU 435 form.

Common mistakes

Filling out the AFCU 435 form can seem straightforward, but many people make key mistakes that can lead to delays or complications. One common error is leaving out crucial information, especially in the beneficiary section. Each field is essential, and any omission such as the AFCU Account Name or AFCU Account Number may result in the wire transfer not going through. Ensuring that all details are filled in completely is vital for a smooth process.

Another frequent mistake is incorrectly inputting the routing number. The routing number for America First Federal Credit Union must be accurate, as this number directs the funds to the correct institution. Writing an incorrect number can cause serious delays or lead to the funds being sent to the wrong financial institution. It’s always a good idea to double-check the routing number provided.

Many individuals also overlook the specifications concerning the timing of their wire transfer. If a domestic wire is submitted after 3:45 p.m. Mountain Standard Time, for example, it will not be processed until the next business day. Similarly, international wires cannot be initiated after 3:00 p.m. Mountain Standard Time. Failing to recognize these cut-off times can be frustrating and may lead to unexpected delays. Planning ahead can save time and stress.

Moreover, miscalculating fees associated with wire transfers can be another pitfall. It's important to remember that domestic wire transfers incur a $15 fee, while international transfers may cost $30. Being aware of these charges helps avoid confusion and ensures that there are no surprises when the transaction is processed.

Lastly, many people forget to review their completed forms before submission. Taking a moment to read over the entire form can catch minor mistakes that could affect the transaction. Verification helps in confirming that all entered details are correct and complete. Trusting the process different clients undergo can prevent errors, allowing for a smoother transaction experience.

Documents used along the form

When working with the AFCU 435 form, several related documents may be necessary for a smoother transaction process. Each of these documents provides crucial information or serves an important role in facilitating wire transfers, either domestic or international. Below is a list of commonly used forms and documents that often accompany the AFCU 435.

- Wire Transfer Request Form: This form outlines the specifics of the wire transfer, including the amount to be transferred, the sender's and recipient's details, and the reason for the transfer. It serves as the primary authorization document for processing the wire.

- Rate and Fee Schedule: This document details the costs associated with various wire transfer services. It outlines fees for domestic and international wires, helping individuals understand their financial obligations before conducting a transfer.

- Account Verification Documents: These are forms such as statements or identification proofs that confirm the authenticity of both the sender's and recipient's accounts. This verification protects all parties involved in the transaction.

- International Wire Transfer Instructions: If conducting an international transfer, this document gives detailed instructions needed for sending funds internationally. It includes specific banking codes and requirements unique to each country, ensuring the transfer goes smoothly.

- Beneficiary Information Form: This form captures vital information about the beneficiary of the wire transfer, including their account information and contact details. It is essential for ensuring the funds reach the correct destination without issues.

Using these documents in conjunction with the AFCU 435 form can streamline the wire transfer process and provide clarity. Make sure all information is accurate to avoid any complications during the transfer.

Similar forms

- Form W-9: This form is used to provide your taxpayer identification number (TIN) to the bank or other financial entity. It’s crucial for compliance with IRS regulations, similar to how the AFCU 435 facilitates clear communication about incoming wire transfers.

- Form 1040: The individual income tax return requires thorough and accurate reporting of financial information. Like the AFCU 435, it needs precise details, ensuring that all transactions and accounts are documented correctly.

- ACH Authorization Form: This document authorizes automatic debits or credits through the Automated Clearing House. Both forms ensure proper management of financial transactions through accurate account information.

- Wire Transfer Request Form: This form also contains instructions for sending and receiving wire transfers. Its purpose and structure are similar to the AFCU 435 in guiding the processing of funds.

- Deposit Slip: This is used to deposit money into an account, requiring account details similar to those requested in the AFCU 435 for incoming wires.

- Loan Application: This document gathers necessary financial information for processing a loan. Like the AFCU 435, it demands precise details to facilitate transactions efficiently.

- Beneficiary Designation Form: This form allows account holders to designate beneficiaries for accounts. It serves a similar purpose in ensuring that all necessary information about the account is collected properly.

Dos and Don'ts

When filling out the AFCU 435 form, attention to detail is crucial. Here are some important do's and don'ts.

- Do ensure that you provide the correct routing number: 324377516. This is essential for domestic wires.

- Do double-check the beneficiary account details. Make sure the beneficiary account name and number are accurate to prevent any delays.

- Do submit your domestic wire requests before 3:45 p.m. Mountain Standard Time to ensure they are processed on the same day.

- Do keep in mind that incoming international wires require specific Swift BIC codes, so be sure to include them correctly.

- Don't submit international wire requests after 3:00 p.m. Mountain Standard Time, as they will be processed the next business day.

- Don't forget to check the fee structure. Domestic wires incur a fee of $15, while international wires dive into a $30 fee.

- Don't skip the section for remitter details. Including your member account number and name helps streamline the process.

- Don't overlook the $10 fee for all incoming wires. Accounting for this in your total will save you from surprises.

Misconceptions

- Misconception: All wire transfers are free. Many individuals believe that incoming wire transfers do not incur any fees. However, the AFCU 435 form clearly states that there is a $10 fee for all incoming wires.

- Misconception: Domestic wire transfers are processed immediately. Some might think that all domestic wire transfers are completed in real-time. In fact, domestic wires submitted after 3:45 p.m. Mountain Standard Time will be processed the next business day.

- Misconception: There is no time limit for initiating international wire transfers. Contrary to this belief, international wires for personal accounts may not be initiated after 3:00 p.m. Mountain Standard Time, ensuring that customers are aware of the timing constraints.

- Misconception: Only one fee applies to international wire transfers. Many assume that a single fee covers both types of international wire transfers. The AFCU 435 form specifies different fees: $30 for standard international wires and details for foreign exchange payments, each with specific instructions.

Key takeaways

When dealing with the AFCU 435 form for wire transfers, there are several important points to remember. Here are key takeaways to help guide you through the process:

- Routing Number: For domestic wire transfers, use the routing number 324377516, ensuring the funds are directed to America First Federal Credit Union.

- Timing Matters: Domestic wire transfers sent after 3:45 p.m. Mountain Standard Time will be processed the next business day, so plan accordingly.

- Fees: Be aware that there is a $15 fee for domestic wires and a $30 fee for international wires for personal accounts.

- International Transfers: For international wires, ensure you have the correct Swift BIC. For transfers in US dollars, use WFBIUS6S, and for FX payments, use WFBIUS6-WFFX.

- Beneficiary Information: Clearly specify the account name and number for the beneficiary. This information helps to ensure a smooth transfer without delays.

- Incoming Wires Fee: Any incoming wire transfer will incur a $10 fee, which is important to keep in mind when receiving funds.

Understanding these elements will not only help streamline the process but also ensure that your wire transfers go off without a hitch.

Browse Other Templates

Seller Disclosure Statement Washington State - This form is essential for the transfer of residential properties, including houses, condominiums, and manufactured homes.

Wi Wt-7 - Other informational returns also need to be included for a complete reconciliation of withheld taxes.